My own preference—and you knew this was coming—is our third category: investment in productive assets, whether businesses, farms, or real estate. Ideally, these assets should have the ability in inflationary times to deliver output that will retain its purchasing-power value while requiring a minimum of new capital investment. Farms, real estate, and many businesses such as Coca-Cola, IBM, and our own See’s Candy meet that double-barreled test. Certain other companies—think of our regulated utilities, for example—fail it because inflation places heavy capital requirements on them. To earn

...more

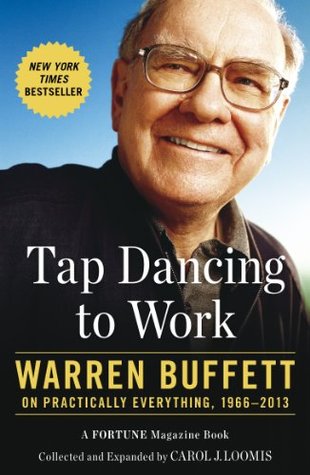

Welcome back. Just a moment while we sign you in to your Goodreads account.