Veterans Administration mortgages paid for nearly 5 million new homes. Prior to the Second World War, banks often demanded that buyers pay half in cash and imposed short loan periods, effectively restricting purchases to members of the upper middle class and upper class. With GI Bill interest rates capped at modest rates, and down payments waived for loans up to thirty years, the potential clientele broadened dramatically. The balance decisively tilted away from renting toward purchasing. Between 1945 and 1954, the United States added 13 million new homes to its housing stock. In 1946 and

...more

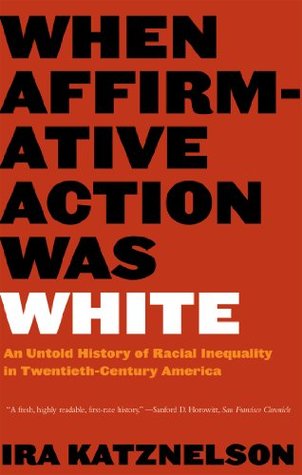

Welcome back. Just a moment while we sign you in to your Goodreads account.