TCI's story was a classic American entrepreneurial tale, and it reflected the slapdash, bootstrap history of the cable industry itself. TCI was born in the scrubland of western Texas in 1952 when Bob Magness, a part-time rancher with a weakness for whisky and gambling, gleaned from a couple of hitchhikers a nifty investment idea that almost bankrupted him. He sought help from Malone, and by 1990, Malone had expanded TCI's reach and assets more than 10-fold, making nearly 500 acquisitions in that time, an average of one deal every two weeks. The structures of his deals were exotic, and his

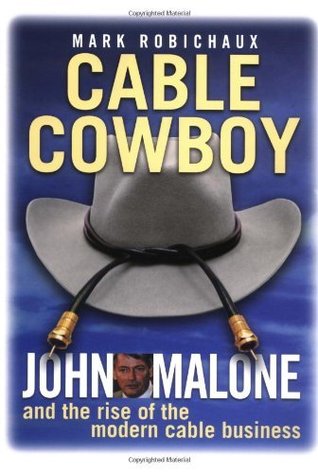

TCI's story was a classic American entrepreneurial tale, and it reflected the slapdash, bootstrap history of the cable industry itself. TCI was born in the scrubland of western Texas in 1952 when Bob Magness, a part-time rancher with a weakness for whisky and gambling, gleaned from a couple of hitchhikers a nifty investment idea that almost bankrupted him. He sought help from Malone, and by 1990, Malone had expanded TCI's reach and assets more than 10-fold, making nearly 500 acquisitions in that time, an average of one deal every two weeks. The structures of his deals were exotic, and his financial alchemy often befuddled Wall Street and investors. The flurry of complex mergers, acquisitions, stock dividends, and spin-offs clouded the picture of the company's true performance, which was phenomenal by the one measure that counts in almost all business: shareholder value. Despite its reputation as a risky play, through 1997, TCI outperformed every other stock in the market. A single share of TCI, purchased at the 1974 low of 75 cents, was worth $4,184 by the end of 1997-a 5,578-fold increase.' And in each of these deals, one outcome was certain: No one benefited more than Magness and Malone. Still, he saw no need to apologize for the creation of wealth. His shareholders got rich along with him. For Malone it was a noble, if not moral, achievement, the fruit of his enormous capacity to deduce and strategize. As Malone ascended to power, the cable television industry, too, had...

...more

This highlight has been truncated due to consecutive passage length restrictions.

The reason why there was so many acquisitions was that all the deals were smaller and regional ones. The internet was set to be a non-regional platform which raised upfront money.