More on this book

Community

Kindle Notes & Highlights

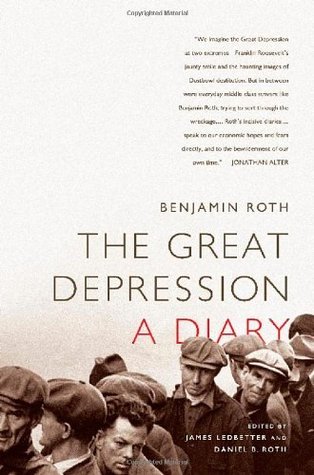

Benjamin Roth’s writing asks a central question, namely, how should an honest, prudent person create wealth, protect it, and build it over the course of a lifetime?

In the mid-thirties Roth begins to lay out an approach to investing based on controlling risk, maintaining liquidity, and protecting principle. Today, even casual investors are familiar with ways to describe the types of investment strategies toward which Roth gravitated: “value investing,” “buy and hold,” even “dollar-cost averaging.”

Here, for example, is an entry from May 1933: “Investigations are the order of the day. The Senate is investigating private banking and in particular J. P. Morgan & Co. Mr. Morgan was on the witness stand all day yesterday and today. The evidence shows that his firm made loans to many men now prominent in public affairs.” There is this on June 1, 1933: “In looking back over the 3 months since Roosevelt became President it seems that the U.S. has traveled a long way toward some form of socialism or managed economy.” And this in 1932: “It looks as though the Democrats will win because everybody

...more

For the first time in my personal business life I am witnessing a major financial crisis. I am anxious to learn the lessons of this depression. To the man past middle life it spells tragedy and disaster but to those of us in the middle thirties it may be a great school of experience out of which some worthwhile lesson may be salvaged.

It seems there should be no rush to buy bargains in a panic. The opportunities are many and the period is often protracted.

The farmers cannot sell their produce because men are not working and it has become popular for each family to have its own vegetable garden.

In normal times the average professional man makes just a living and lives up to the limit of his income because he must dress well, etc. In times of depression he not only fails to make a living but has no surplus capital to buy bargains in stocks and real estate. I see now how very important it is for the professional man to build up a surplus in normal times. A surplus capital of $2500 wisely invested during the depression might have meant financial security for the rest of his life. Without it he is at the mercy of the economic winds. His practice suffers and he has no chance of rising

...more

Many formerly rich families are living in the chauffeur quarters above the garage while the mansion stands closed.

The conclusion seems clear that savings and loan companies are not good places to deposit money even tho they pay a high rate of interest.

Everybody is talking about the depression and wondering where it will end.

There is no money in circulation and all business is at a standstill.

If a tooth aches they have it extracted but neglect all other dental services that might be expensive.

I did not bid on them because each carries future special tax assessments of $200. I suppose I will be sorry 10 years from now.

those Wickliffe lots had been purchased at $25 each in 1931 they would be worth less today than the original $25 investment plus accumulated taxes and interest for 10 years.

But the sheer volume of the needy in the first few years of the Depression tapped the normal capabilities of these organizations. In Youngstown the Allied Council, the local charity, handed out relief to 100 people in August 1931. By September 4 they handled 1,150 desperate calls.

Hold-ups and killings are becoming more frequent and it becomes dangerous to walk the streets after dark.

He became a prey to high pressure salesmen of worthless stocks, tried one business after the other, speculated in real estate and in many ways tried to make more money quickly. We discussed 7 or 8 other men to whom the same thing happened. Not one was able to hold his money. They

The closing of banks in Toledo and Warren received much publicity and distrust of all banks is growing like a cancer.

This is another example why a professional man should not invest in low-grade real estate. It takes almost full time to collect the rent, make the repairs, etc. The overhead is high and he is fortunate if he makes 6% clear over a period of years with nothing for his labor. Properties of this kind seldom have a speculative value.

Hard work, low wages and a period of accumulation are ahead of us.

It has become popular to wear old clothes—to brag about poverty and how much you lost in the 1929 crash. It is almost bad taste to give a big party or to drive a new car.

Above all, and I repeat it again and again—he must have liquid capital in time of depression to buy the bargains and then he must sell before the next crash. It is difficult if not impossible to do this but the conservative longtime investor who follows the general rule of buying stocks when they are selling far below their intrinsic value and nobody wants them, and of selling his stocks when people are bidding frantically for them at prices far above their intrinsic value—such an investor will pretty nearly hit the bull’s-eye.

1. The Community Chest will have an extra drive for funds. 2. The city will issue bonds. 3. All churches are acting as collectors of food, clothing, etc.

Banks are absolutely terrible in their insistence on payments on notes and mortgages. It is the old story of lending you an umbrella when the sun is shining and then demanding it back when it rains. If a depositor asks for his money he is regarded with suspicion—sometimes he is sent to one of the officials who wants to know why he wants the money—if they think he is hoarding it they try to shame him out of a withdrawal and only if he becomes unpleasant and insistent does he get his money. It is a good time not to owe money to a bank and many businesses are being ruined because the banks insist

...more

People who are ordinarily moderate predict freely that if things do not get better very soon we will have a revolution in the U.S.A. and some form of Communism or dictatorship.

Liquor became legal in 1933 but failed to help recovery. It stimulated the imbibers but not general businesses. Today we have 2 or 3 beer parlor lunchrooms in every block.

There is simply no money in circulation. This scarcity of money is what makes people think if more money were printed business would be better. This is a false and vicious theory.

Many investors would have been better to unload their real estate and stock investments during the first year of the depression rather than to have waited. They would at least have salvaged something rather than to have lost everything.

People lost all confidence in the old virtues of saving. They were willing to bet small amounts in the hope of getting large returns. They wanted something to occupy their minds and they wanted some gamble to buoy their hopes.

One financial writer says stocks are not too low—in fact too high—because future profits of industry will be lower on account of lower prices etc.—and that profits in the last 10 years of prosperity are not a good gauge.

Again and again I am forced to the conclusion that in prosperous times a man must be cautious and preserve his capital and be careful not to over-expand his business or to go too deeply in debt relying on a continuation of good business to pay the debt.

an attempt was made to reopen the city banks by urging depositors to buy new stock with 25% of their deposits and to agree to let the balance remain for an agreed period of 1 to 3 years.

I attended services at Rodef Sholom Temple last night and it was crowded. It seems true that religion and the church grow stronger in adversity.

They might possibly be criticized for not selling all their Sheet & Tube Common and Republic Common at boom prices in 1929 and switching to good bonds. Also they might be criticized for holding too much bank stock entirely or in one community. If Youngstown went bad, all their investments went bad.

Those who became “specialists” during the boom by taking a 3 months trip to Europe are now back in general practice. A good many doctors and dentists have given up their down-town office and are using their home. Same with lawyers. It is the old story of expanding too far and living too high.

Frequently some girl or man advertises that they will marry or “sell themself” to any person for a certain sum of money which they need very badly.

The war in China continues to rage and there is grave danger that U.S. will be dragged in.

3000 unemployed riot at Ford plant in Detroit and 4 are killed by police.

It now seems that the only person who could have evaded this panic would be a person who sold everything he had at the top of the boom and then invested everything in government bonds.

French premier shot and killed by a fanatic. Five people killed in Chicago communistic rioting. Community chest drive opens tomorrow with much greater needs and little chance of getting it. Dr. Philo [a Youngstown rabbi] chooses as his topic last night “If I Were Dictator of the U.S.” He makes numerous radical statements.

Those men who were wise enough to sell during the boom and then keep their funds liquid in the form of government bonds, etc. were not far-sighted or patient enough to wait almost three years to re-invest.

Patience, rather than boldness, seems to be required just now.

question whether it is not a wiser plan today for the purchase (of either stocks, bonds or a business) to actually wait until the turn has come before he does any buying.

Every investor should at all times have a reasonable portion of his holdings in liquid securities that can’t shrink much. In boom times everything should be sold and converted into government securities. When prices of more speculative stocks and bonds and businesses have reached bottom—then is the time to buy again.

For the past two months there has been a complete lull in business activity of all kind.

There is very little bankruptcy even because creditors have found it is useless to push their debtors.

I still think that right now the preferred stocks of good companies is a better investment than the common because the next few years may show small earnings on the common but if the company survives at all, the preferred will go back to par with cumulative dividends.

As far as I am personally concerned this depression has been a “postgraduate” course for me in economics and public finance. It has caused me to read widely of economic subjects and for the first time I am following, intelligently and with intense interest, the doings of Congress and the coming national election. This interest in books and economic subjects has been followed by history and biography.

If it weren’t for the suffering that it has caused I would say that the depression has brought with it a good many worthwhile results. Among other things library circulation has trebled and people are once again turning to home pleasures etc. and to simple living.

This in turn triggered the involvement of the federal army, who took to the streets of Washington with cavalry forces and tanks against World War I veterans with whom some of them had served.