H.A. Larson's Blog, page 8

April 14, 2023

Why I Won't Fly with American Airlines Ever Again

It's no secret that I'm a miles traveler. This means when I fly, I typically fly using airline miles. Several years back, I acquired many miles through American Airlines (AA) by churning their branded credit card. I used the bulk of those miles to fly my daughter and myself roundtrip to Texas in March of 2021.

When it came time to make my annual trip to Portland (and Seattle, too, this time around) in the Fall of 2022 I didn't have enough miles to fly roundtrip with AA but I did have enough to fly one way. As the miles were going to expire, I wanted to use them. In addition to that, I no longer use the AA credit card because I find AA to be a subpar airline with a subpar flying experience. So, I booked my flight out using what remained of my AA miles. For my flight back home, I used my Delta miles. I love love love Delta Airlines - they are simply the best - so I wanted my trip home to be on my favorite airline.

I booked my flights pretty early in 2022 and as the date got closer, they made some changes to my connecting flight - fairly standard. Instead of a layover in Denver, American had me booked for not one, not two, but THREE layovers - Dallas, Salt Lake, and Seattle - before landing in Portland 16 hours after takeoff in Omaha. I was a bit alarmed, but I knew that one can usually call customer service and get a better route, which is exactly what I did. The customer service lady was incredibly nice and professional and fixed my flight - one 2.5-hour layover in Dallas. Perfect! It was just enough time to grab dinner and a bloody mary before my connecting flight.

The day of my trip arrives, I board in Omaha and all goes well, or as well as can be expected on an AA flight, until we were nearing Dallas. At that point, the pilot comes on over the intercom and tells us all two things:

1. There's bad weather over Dallas2. The plane is low on fuel

Because of these two things, the pilot informs us that we'll have to divert to Oklahoma City to refuel while we wait out the storm. I groaned because I knew this meant I would probably not be able to get that dinner and bloody mary I was looking forward to, but I understood the situation so instead focused on how I'd get what I wanted when I finally reached Portland.

We diverted to OKC and landed on the tarmac, where we sat...and sat....and sat some more. By the time we finally took off again and arrived in Dallas, I realized that there was going to be little time to catch my connecting flight to Portland. We finally land in DFW at a gate that was clear on the opposite side of the airport from my connecting flight. I start booking it across the airport but was graciously picked up by a guy who runs one of those airport shuttles that drives around. We get to my gate about 15 minutes before takeoff but the crew refuses to let me on. I argue with them because I know the industry standard of closing the plane doors 15 minutes before takeoff but since none of it was my fault and the plane hadn't taken off I felt they should let me on.

Instead, they direct me two gates over to where AA customer service is. I look over to see a ridiculously long line forming. Defeated, I join the line along with a couple who had been on my flight out and were also supposed to be on the same connecting flight. At some point, she noticed the connecting flight was delayed so goes back over to that gate to talk to the crew. She comes back and says that the crew said she could get on so she ran to go get her husband while I rushed back over there. Again, the crew says the flight is ready to take off and won't let me on. This is when I started seeing red flags.

I get back in line, at the back again, and wait for customer service. The couple returned, also rejected from boarding a plane they were told not more than a handful of minutes before that they could. Very frustrating, to say the least. They leave again to do who-knows-what and I end up chatting with the lady right behind me. She tells me she was on her way to Dallas (from a different location than Omaha) but was diverted to OKC because the plane was low on fuel and because there was bad weather over Dallas. She also missed her connecting flight. Interesting, another red flag.

I start talking to the woman in front of me. She came in from somewhere other than Omaha or the location of the woman behind me but had the same story. Diverted to OKC because of fuel and weather, and missed connecting flight. This meant one thing: American Airlines lied to all of us.

Now, if this wasn't bad enough, an AA customer service supervisor started walking the long line and talking to each of us briefly - to tell us that AA can't be responsible for passengers because of bad weather. WHAT?! As the words left his lips, I was thinking of how I was going to have to probably spend the night sleeping in an airport chair so I was ready to unload on him when someone came and whisked him away.

When I finally reached the customer service counter, the agent gave me a ticket for a flight the next morning and vouchers for a hotel (Hyatt Place, one of my favorites), transportation to and from the hotel (Hyatt has an airport shuttle so didn't need those), and for $12 of food in the airport. I wasn't happy to not be on a flight to Portland, but at least I wasn't going to spend the night sleeping in an airport chair.

On the way to the hotel, I told the shuttle driver about the events of the day and he said, "We had no bad weather in Dallas today." Call me shocked. I knew without a doubt that AA screwed us all over. I felt bad for the girl next to me in the shuttle because her checked luggage was on the connecting flight she was denied from. This is one of the main reasons I use a carry-on luggage set. I always have what I need with me at all times. At any rate, I got checked into the Hyatt then went downstairs where I finally got dinner and a bloody mary.

The next morning, after a fantastic continental breakfast, I took the shuttle back to the airport for (finally!) my connecting flight to Portland. My gate was nearby so I went to Starbucks (it was close to my gate) where I used my $12 voucher for snacks. No sooner had I returned to my gate and sat down than I got a notice that the gate for my connecting flight had been changed. Of fucking course it had and of course, it was a long haul across the airport.

Once again, I booked it across the airport, making it to my new connecting flight (that we were given barely any advance warning for) with about 25 minutes to spare - or 10 minutes if you consider the shutting of the door 15 minutes before takeoff where no one is allowed to board thereafter. A handful of hours later, I finally made it to Portland.

The original plan was to fly into Portland the day before I actually made it, meet up with my bestie Lisa (my reason for going to the PNW) at the airport, take the train downtown, stay in a nice hotel there, and get a drink or two before bed. We had train tickets for Seattle, leaving at noon the next day. We were set to arrive in Seattle around 3 pm.

Instead, AA screwed me and Lisa spent the night in the fancy hotel in downtown Portland alone while I stayed at the Hyatt Place in Dallas. We had to rebook our train tickets for later in the day, at an extra charge of $60 which was more than the original ticket and we didn't make it to Seattle until late in the evening.

How do I feel about it all? Well, yes, I was traveling with free miles and they did put me up in a nice hotel that had breakfast, along with transport and snacks, BUT...American Airlines lied to me, and everyone else flying into Dallas that day. They got me to my destination 24 hours behind schedule and caused me to spend extra money on a train ticket I didn't need to.

Make no mistake, American Airlines did this on PURPOSE. Why? I don't know. I'll never know because they will never tell us anything other than the story they presented to us in the first place. All this withstanding, they have other issues that make them not worth flying with anyway - uncomfortable seats, terrible snacks if any are offered at all, no in-flight entertainment except on the rare occasion, all for the same cost as better airlines - AND they treat their employees like shit. After my trip, I found a group on Facebook called "American Airlines Sucks" and the group is filled with stories just like mine. Lots and lots of them.

Luckily, I flew home on Delta. As expected, it went without a hitch, and I sat in a comfortable seat, had great snacks, and watched in-flight entertainment for the same amount of miles as I used for the nightmare above.

It's funny because having flown AA before, I knew they were pretty subpar, and I had a conversation in early 2022 with my friend Keith about how I just wanted to use up the AA miles and be done with them. He responded with, "There are airlines, and then there's Delta." He's not wrong. I still have about 4000 miles with AA, not enough to do anything with, and I'm glad. I'll never fly with American Airlines...ever again.

Published on April 14, 2023 12:51

April 11, 2023

Early Spring Hike

Good morning, friends. I had meant to get a post out quicker than this but life has been quite busy lately. I've been pulling extra duties at my job during the week, I've been out of town a handful of weekends in a row, and this past weekend I was super busy at home getting things done that desperately needed to get done.

One lovely Sunday, though, I did manage to squeak in a lovely, easy hike at one of my favorite local nature spots: Fontanelle Forest. For years, I would get an annual pass but over the past few years, I let it lapse. The Omaha Public Library came to the rescue as they have a wonderful program that lets anyone with a library card get a day pass to several places in the Metro area - one of them being Fontanelle Forest.

This was the first time in several months that I actually strapped on the old day pack and took a legit hike. Granted, it was an easy, short hike as I'm easing back into healthy habits after injury.

It was a perfect day with sunshine and a temperate climate. I first walked around their massive boardwalk.

The boardwalk winds around and down by the Missouri River. I could see hints of the passing winter as little ice pieces floated down the current.

In addition to the river, you can the tallest buildings of downtown Omaha as well as the Desert Dome at the Omaha Zoo.

After I had come full circle around the boardwalk, I went off onto one of the forest trails.

It wasn't as muddy as I thought it might be - it is Spring after all - but I also didn't go down into the valley where it undoubtedly was.

There's no better way to cap off a lovely Sunday afternoon outside than with a crisp hard cider. Glacial Till's new Cherry Vanilla variety is dangerously tasty.

I hope your week is going well and that you're planning some fun stuff to coincide with that great weather coming up. I have a few posts to get caught up on, but since I finally have some spare time coming up, I will be getting to those. Happy Spring!

Published on April 11, 2023 06:55

March 28, 2023

All My Best Financial Links in One Place

Over the years, I've written a bunch of blog posts dedicated to frugality. Whether I talked about it through my series "Basic Financial Fitness", general posts, or in my book The Urban Prepper , my goal throughout has been to empower people to survive and thrive in any situation on a low income.

I've been thinking quite a bit lately about the global financial situation and how it affects us low earners more than other people. To that end, I had thought about writing a detailed, long post about how to deal with this situation, but I realized that I already have - albeit in a handful of separate posts. I have posts on ways to cut down on bills in a large variety of ways, how to save money even when you think you can't, how to budget, and how to still live life & have adventures even when finances are minimal. Instead of writing a mini-book in blog form, I thought it would be a better idea to link these different posts here.

1. How to Survive a Recession

2. Frugal Living in my New Place

3. Saving Money and Being Less Wasteful

4. Saving More, Spending Less

5. Real Ways to Save Money

6. Having Fun with Little to No Money

7. Adopting a Smart Money Mindset

8. Making a Simple Budget

9. Why Saving Matter

10. Investing in the Future

11. Making More Money

12. Credit Card Churning

13. Planning the Perfect Staycation

14. I Stopped Using My Debit Card

15. Everything Costs More

You'll find good nuggets of information in all of these posts on how to save money for a rainy day, how to save money on food & bills, more advanced things like sinking funds & credit card churning, and how to have fun & live a life of adventure on the cheap. So, don't let the titles of some of these posts fool you, I've included them because they have good information. I hope by having all these links in one spot you can begin a journey to surviving and thriving on a low income. If you have any questions or tips to share that I haven't, comment below.

Published on March 28, 2023 08:33

March 23, 2023

It's Only Going to Get Worse

The writing is on the wall. Inflation is climbing and rents are climbing, but wages aren't. I don't see any relief in sight for quite some time. It's a time in our lives when we need to ponder, "Am I prepared?"

I'm not suggesting anyone become one of those doomsday-type preppers we all hear about, but there's no better time than now to start preparing as much as we can for tougher times ahead. How can you do that? Well, there are a few ways:

* Start saving money if you haven't already. Even if it's a dollar a week or five bucks a paycheck, save something. Every little bit helps whether you think it does or not.

* Cut spending where you can and save money on things you can. Cancel subscriptions that you don't need and unplug items you aren't using.

* Buy a little extra food and household supplies whenever you go to the store. Take it home and put it in your pantry, long-term storage, or wherever else you put things. I have items in my stockpile from 2020. What's significant about that? I bought them at 2020 prices. Things are expensive now, but I guarantee they will get more expensive.

Every little thing you can do now to save, prepare, and make changes is going to help, whether you believe it or not. I'm not saying things won't ever get better, but why struggle so hard until they do, because....things will get worse before they get better.

After I wrote this post for future publication, I happened across a Frontline episode on PBS - Age of Easy money - that talks about our financial situation, how it happened, and where it's going. It only echoed the things I've read and seen and made me realize that I'm accurate in what I can see happening. I suggest you watch it. It's available for free on YouTube.

Then, just yesterday, Jerome Powell, the Fed Chief, raised interest rates again. Indeed, things are going to get more expensive, so do your best to put yourself in a better position than you are today, if you haven't already.

Published on March 23, 2023 07:11

March 19, 2023

24ish Hours in Des Moines

The wanderlust has been striking pretty hard lately. So hard, in fact, that I recently started thinking about spending a Saturday night in either Sioux City or Des Moines - both of which are less than a 2-hour drive from Omaha. It happened, then, on a Friday morning I pulled the trigger and booked a hotel in Des Moines for the next night.

Now, you all know I dove head-first into the Iowa Beer and Wine Passports after having a fun year doing the Nebraska Wine Passport in 2021. It was such a fun thing to do on a partial or complete weekend and a great way to see the state I call home. Since a nice amount of the participants of said passports are located in the Des Moines area, my goal was the go to a few and spend the night, and that's exactly what I did - and I brought my friend Jayne along.

Our goal for the trip was to go to one winery and two breweries on the passports, and our first stop was at Covered Bridges Winery. The winery takes its name from the famous Bridges of Madison County. I thought about visiting a few of those this trip, but realized they would be much prettier to visit in the Spring or the Fall when the foliage is the best.

Like many wineries, this one is located out in the country amongst a bucolic setting. The inside was nice and spacious, with high ceilings.

And a picture window in which to get a good view of the rolling hills.

The wine was quite delicious, and there are plenty to choose from. Not surprisingly, the variety of grapes in Iowa are the same as the ones in Nebraska.

They also have charcuterie (standard for wineries) but they also had pub mix and deluxe chocolates for purchase. Jayne got two of the latter. Aren't those chocolates just pretty? Since I'm doing keto, I just had a bite of each of the three kinds of chocolate on offer.

After we visited Covered Bridges Winery, we made our way to Des Moines and checked into our hotel.

After a quick break to relax and refresh ourselves, we headed to our next stop, Exile Brewing Company. Exile is a bigger player, at least here in the Midwest, in the brewing world. You can, and I have, purchased their brews here in Omaha.

I got a big glass of their Tico Time, which is a tropical wheat ale, brewed with passion fruit and pink guava. It was both refreshing and delicious.

Exile is also a pub, so there were plenty of food offerings to choose from, so Jayne and I ordered dinner. I got the Black & Bleu burger (no bun, of course) and their fried brussel sprouts. I have to tell you, this was one of the best meals I've eaten out, ever. The burger was amazing and the brussel sprouts, omg, they were sooo incredibly delicious.

Happy and satiated, we headed for our last stop of the day, Fox Brewing Company. A small, innocuous place out in the boonies, this low-key brewery had some tasty brews.

We got shared a flight of all twelve beers of their on tap. My favorite was their Marzen. Lightly dark and refreshing, I could drink that brew all day. After the flight, I ordered one.

The next morning, nursing mild hangovers, the hotel's big continental breakfast, and a dip in their heated pool set us both right again. After that, we checked out and headed home.

This was a fun getaway for an evening that is close to home. I'm glad I started doing the Iowa Passport program. There are so many to choose from and, like the Nebraska Wine Passport program, it's a fun activity to do on a weekend. If you'd like to participate yourself, here's the link for the Iowa Tourism site. There are other passports you can choose from and ideas to plan a trip that includes things besides booze...although why would you want to skip that?

Have a great week, friends.

Published on March 19, 2023 09:32

March 9, 2023

Healthy Life: It's Damn Hard

Oooo, boy. The last time I posted one of these was in June of 2021. Yeah, gaining on two years now. What happened? Well, I'm not going to go over all of that again because what was happening then kept on happening if I'm being honest. Instead here's the link so you can refresh your memory.

As the new year rolled around, I decided that it was high time I got back on the wagon. I needed to. I had to. I'm not getting any younger and I have many things I still want to accomplish in life. This means I need to be healthy and well until I leave this earth.

The first thing I did, then, was go back to eating a keto diet. Back in 2018, I lost a bunch of weight by following keto and exercising quite a bit. After I stopped doing keto, all my old habits crept back in. At first, I maintained the weight I lost and then when 2020 hit, I started to gain. Fortunately, I didn't gain it all back but unfortunately, I gained a large chunk of it back. Le sigh.

After a few successful months of eating keto, I also hopped back on the intermittent fasting wagon. I ate that way for a long time and I feel better when I eat later in the day. Now, I'm not saying anyone else should do keto and/or intermittent fasting, but I will say that one should listen to their own body and do what works best for them. This is what works best for me.

Have I been successful yet? Well, yes, yes I have. I have refused to step on the scale because every time I do I am disappointed, but my clothes are getting bigger and I have more energy than I have had in a few years.

Because of my success and diligence over the past few months, I'm planning on gently getting back into hiking once Spring hits. Why not now? Well, if you all remember from previous posts I tore the meniscus in both knees trying to hike with a large pack using a body that was carrying too much weight and suffering from not being treated well. Are my knees healed? No, they will never be completely healed, but by eating in a way that keeps inflammation in my body away and getting rid of weight that exacerbates the issue, they can do what they're supposed to do.

After a few more months, then, of me being good to myself and shedding some more weight, I'll be ready to dust off my old day pack and start taking short hikes in my favorite spots again. Over time, I'll gradually get back to being the hiker I used to be.

It's been a while since I've attempted any real hiking since I got deathly sick on the AT last June. Which was just as well because I was incredibly out of shape. Barring that, I cannot leave this earth until I make it back to the AT again one day and accomplish what I set out to do in 2022.

Another bad habit I fell back into was drinking too much (I'm so predictable, eating and drinking all my feelings). Once again I've relegated drinking to something I do on the weekends. Maybe it's because I'm getting older, but drinking alone just isn't as fun as it once was. I've noticed over the past several months that I naturally only drink 3-4 times a month now. I'm also happier than I've ever been, and finally at the point I want to be in life. I think that helps a lot. I mean, when you don't need to escape anything, then you don't.

Above all else, I'm not critical of myself anymore. Much like life, this journey isn't a race either so I'm not treating it like one. I'm slowly, but surely, working toward the health and life that I desire.

So, that's where I am. I'll keep you posted on my progress.

Published on March 09, 2023 13:45

March 7, 2023

Twenty Years

Back in early January, I passed a milestone: my 20th year of living in Omaha.

In many ways, it feels like I've always lived here. Most of my adult life has happened in this city I call home. I moved here as a 31-year-old single mom, fresh out of a difficult life change. I needed a fresh start, a new place to call home, and Omaha was it.

I learned the streets of this town, first driving a mile here and there in straight lines so I could easily find my way back to my starting point.

In this manner, I found and frequented the Family Dollar and the thrift shop on 24th Street in South Omaha, in the heart of Little Mexico. It's the same place where I had my first authentic Mexican meal. I can still hear the music, the people talking in rapid-fire Spanish, and the aromas of that little cafe that also sold hand-made pinatas. I bought one for my son's 4th birthday party. None of those places are there anymore.

I lived with one of my best friends at the time in the suburb of Bellevue, then moved to my own apartment in the city proper with my ex-husband following a few months behind. There was a movie theatre, a bar & grill, and a frozen yogurt place down the road, while an old Kum & Go sat on the corner. There was a grocery store and a department store down another block and across the street. Everything we needed was a brief walk away. All of these places? Long gone.

Six and half years after I first moved to the area, I was now married with a daughter, and we moved our bigger family out of the two-bedroom apartment and into a three-bedroom rental house. It was our family home and our kids grew up there. The kids grew taller as each subsequent Halloween rolled by. The house got older, too, and lost the newness it had when we first moved in. We spent many nights on our back patio, sitting around a fire and consuming more drinks than were good for us. Our son grew up and moved out on his own, our marriage ended, and after twelve years of living in the house, we went our separate ways: my daughter and I into our own apartment, and my ex into his.

That was almost two years ago and yet I can still feel the renewed sense of hope and excitement at the prospect of new beginnings I had.

All of those years, all of those memories, and all of those places are a vivid part of the past twenty years of my life. I've never done so much yet feel like I've done so little.

Such is the passage of time. Our greatest, and most fleeting, of commodities.

I wonder what the next twenty years of my life will bring. I mean, I have a pretty good idea but if I've learned anything over the past twenty years, it's that nothing is a given. Things don't always work out the way you expect or hope, and that can be either a good thing or a bad thing...depending on the situation.

I guess I hope that life goes, to a large extent, the way I have imagined it in my head peppered with an occasional bad or good bump in the road.

Here's to the next twenty, friends.

Published on March 07, 2023 06:47

March 4, 2023

Trip to Seattle: Part Two

It might have taken four months, but damnit, I did it. I finally edited the rest of my photos and have prepared the second part of my trip to Seattle. Mind you, I took the trip back in September of last year but better late than never, right? There are a TON of photos in this post but I wasn't going to make a third post so I'll keep my commentary to a minimum and let the pictures do the talking. Let's go.

After we wandered around Pike's Market, we headed over to the Bainbridge Island Ferry to visit Bainbridge Island.

The ferry is huge, carrying both passengers and cars. On the passenger floor, there is plenty of seating as well as a dining station - which wasn't open on our trip.

As the ferry left Seattle, I took the opportunity to head to the stern of the boat to get a fantastic view of the city.

We sat at several different places on the ferry, trying to take in all the views from Puget Sound.

Although it was brisk on the deck, I went out for a little bit. While the destination was the island, taking the ferry was a cool experience within itself.

Looking out from the second story on the bow.

The ferry lands close to the main strip of Bainbridge Island.

Our first stop on the island was the Bainbridge Island Museum of Art.

While not as large as any major museum, it was more impressive than any other small museum I've been to.

After the museum, we headed farther down the main strip and happened upon Fletcher Bay Winery so, of course, we had to stop.

If I remember correctly (hey, it's been five months since the trip) I got the Blackberry/Raspberry fruit wine.

We made it to the main area of Winslow Way, which is the main strip closest to the Sound. The whole area reminded me of other touristy main streets, like Estes Park, CO, so I didn't take any pictures. Although, like Mackinac Island in the UP of Michigan, they also had their "World Famous Fudge" so I tried some. We moved closer to the Sound where the whole area is a park - Eagle Waterfront Park.

There's not much to it beyond some trails that follow along the shoreline, which we followed back to the Tacoma Ferry.

Back in Seattle.

Where I found a battered and discarded copy of Pink Floyd's Dark Side of the Moon album. Sacrilege!

The Space Needle was literally right outside our hotel window. With such limited time in Seattle, though, I didn't make it a point to visit - especially since it's a bit expensive.

Pike's Market, the Ferry, and Bainbridge Island were on my list of things to do while in the city, so our last day in Seattle, we did the things my friend Lisa wanted to do. Her first pick? The Seattle Aquarium.

Anenomes we could touch, which I did.

Big jellyfish.

I was excited to see seals, which you see from below...

...or above.

Small jellyfish.

I have to admit, I thought the Aquarium was a letdown. It costs $35 to get in and wasn't nearly as big nor had the variety of marine life I would have expected. The aquarium in the Omaha Zoo is just as big, has more in it, and costs the same...with the added bonus of being able to see the rest of the zoo as well. Lisa enjoyed it though and that's what mattered most.

As we wandered back towards the Market area from the Aquarium, we came across Old Stove Brewing Co. and I couldn't leave Seattle without trying some of their local brews.

I got a flight and enjoyed the views. The entire wall to my right here looks out over Puget Sound and opens up to the outside. It was warm enough outside for them to do so.

After filling up on beer, we hopped on the bus to Lisa's second pick, Washington Park. It's similar to Washington Park in Portland, which I went to in 2018, so it must be a PNW thing.

Stumbled upon this cool totem pole.

I read about it here.

Close up.

Goodbye Seattle, thanks for the memories!

I hope your weekend is shaping up to be a good one. I'm off for an overnight adventure that will include me working on the Iowa Wine and Beer Passports. I'll make sure to let you know how that goes.

Published on March 04, 2023 05:52

February 27, 2023

What Have I Been Up To Lately?

As I mentioned recently, life has begun again for me after a rough few years. Coming through it, things have definitely changed in my life - for the better. The main thing is that I resumed the life I had prior, the one I had envisioned for myself. One where I travel - near or far, get together with my friends more often, take care of myself, get outside as much as possible, and spend quality time with my family. To that end, I guess I've been making up for lost time. I've been busy, without a doubt.

In mid-December, I drove down south to Missouri to spend a weekend with my friend Audrey. She, her sister, and some of their friends get together once a month for game night and she had been wanting me to come down for it for quite some time. I was glad I could make it and had a lot of fun.

The following weekend was Christmas weekend. In years past, for many years in a row, I, my ex-husband, and our kids would spend a weekend in Platte River State Park sometime during the holidays. We'd rent the one cabin in either one of our two favorite pods that had a fireplace and just enjoy being out in the woods. We didn't do this for 2019, 2020, or 2021 - for obvious reasons - but resumed this year.

It was a blisteringly cold weekend so we hunkered down with food, gifts, and plenty of games.

I woke up to a beautiful sunrise coming in the window.

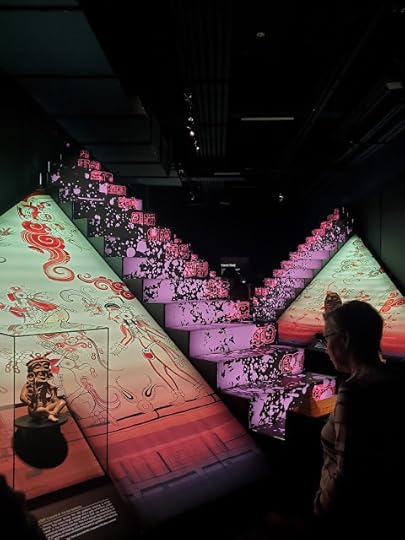

I started homeschooling my daughter in January, so we took a field trip to Kansas City to learn about the Maya. Union Station had an incredibly cool exhibit on the ancient tribe and we both found it fascinating.

The day after we returned home was NYE and I had a little get-together at my place to mark the occasion. Audrey even came up for the evening and she and I managed to make it up past midnight. We were pretty proud of ourselves.

In the middle of January, I made the short drive over to Lincoln to spend a long weekend with my son. He's 23 now and has his own apartment there (instead of the student share he's been doing the past few years) so I made a goal of getting up there once a month. We always have a lot of fun together and this visit was no different.

The next weekend saw bad weather and a trip up to my Dad's.

The weekend after that was the first weekend in February, which just so happens to be one of my best friend's birthdays. So I drove up north to spend the weekend with Amy and to celebrate her birthday, of course. On top of the Iowa Scenic Byways Passport I started last year, I also downloaded the Iowa Beer, Iowa Wine, and Iowa Distillery passports.

Our first Birthday stop was at Wise I Brew Co. in Le Mars, Iowa. These digital passports provide discounts for nearly every location on them, and we each got a dollar or two off our first drink.

I got The Cure Vol. 4, an absolutely stunning sour, while Amy got the Salty Sailor, a pleasant cider.

Next, we visited the Oscar Carl Vineyard just outside of Sioux City, Iowa. The passport discount was $2 off a wine flight. I picked Wiolet, Loesscato, and Jerry Wane. Delicious!

Our last stop of the evening was at Jackson Street Brewing where I got a glass of Roman Garden. I have to say, I enjoyed every drink we had this day - I think a true first in quite a long time.

The following weekend I finally got some big projects done around my place along with a good deep cleaning. It was exhausting but nice to get things taken care of, like the following.

I bought a couple of legit shelving units for my storage unit. My daughter and I put them together, cleared out the unit, cleaned things up, got rid of a bunch of things, then reorganized everything into a space that's tidy, not overcrowded, and where everything can be found easily.

To celebrate all my hard work, my friend Jayne and I headed down to Glenwood, Iowa, to cross another brewery off my Iowa Beer Passport, Keg Creek Brewing Co. They only had a couple of brews that I wanted to try, which worked perfectly with the $2.50 off two drinks coupon that came with the passport.

We ended the evening at a local bar where we sang karaoke. The same karaoke where I got covid from the microphone back in November of 2020. And guess what? I got sick again from the same damn microphone, only this time from the flu. I guess that's my sign to never sing karaoke there, ever again. That sickness put me down for the next two weeks and today is the first day I've felt largely okay in that time.

And that's what I've been up to lately. The weather is warming up again this week and there are some busy weekends coming up. I'm looking forward to it.

Until later, friends!

Published on February 27, 2023 12:43

February 10, 2023

Emergency Funds, Sinking Funds, and Side Hustles

Today, after years of saving, I finally have my six-month emergency fund (aka my BIG ER Fund) fully vested. For me, it's a huge accomplishment but, even more, a sense of relief that I have a security blanket should something happen. When I say it took me years to save it up, I do mean years. I've talked about it in length before, but I started in my 30s saving a mere $5 per paycheck upping the amount when I could over time. For the past few years, I've been adding a little over $250 a month to it.

What will I do with the extra money now? Well, now that I had to sign up for my own insurance again (I got a long period of insurance from my ex-spouse in my divorce settlement), a rent increase in May when my lease renews, and the cost of inflation, I will add that money back into my cash flow to make up the hits to my budget from these items.

In addition to my six-month emergency fund - which is split up between two high-yield online savings accounts - I have two other savings that I use to stave off ever dipping into my BIG ER Fund. One is my regular savings account at my everyday, local bank and the other is my checking account buffer (or CAB as I refer to it). I have a month's worth of expenses tucked into my regular savings account in case I need it. My CAB is a simple process by which I deduct $10 per paycheck from my checking account balance. It doesn't go anywhere but I pretend like it doesn't exist, although I do keep track of it on a ledger sheet.

These different types of ER funds I have are the three lines of defense I have against minor and major problems. Here's how it works:

1. CAB: If I have a monthly bill that's higher than my budgeted amount (looking at you, electricity bill) or I miscalculated what I might need, for example, I can pull from my CAB. I don't need to pay myself back for that, but rather I will just keep adding $10 to it each paycheck.

2. Regular Savings: If I have a bigger unexpected expense or need than my CAB can handle, I have a month's worth of expenses saved up in my regular savings account. If I do borrow from this I have to pay it back at a certain amount per paycheck.

3. Lastly, my BIG ER Fund is there strictly in case I lose my job. If I never lose my job, it will be used for retirement.

This past Fall, I finally figured out that I needed to be saving in advance for certain items and came across the concept of Sinking Funds. Sinking Funds, for those of you who don't know what they are, are monies you set aside for future purchases. My credit union allows me to open and nickname as many savings accounts as I want, so I set up five savings accounts in addition to my main savings account. They are:

Insurance and Phone Fund

I save a bunch of money by paying my car insurance six months in advance, my phone bill six months in advance, and my renter's insurance a year in advance. Instead of scrambling to come up with that large amount when the bill comes due, I calculated the cost per paycheck and put that amount in this sinking fund each time I get paid. When the bill comes due, it's paid automatically by one of my rewards credit cards and I pull the money from the sinking fund to pay the card off.

Clothing and Gifts Fund

I have a growing teenager who needs new clothes a few times a year. I also need clothing here and there and sometimes I need to buy a gift for some reason (mainly for Christmas) so I put money aside in this sinking fund each paycheck.

Car Fund

This is money to use for oil changes and new tires. I do have a new car under warranty, as a side note, so I don't have to save a large amount.

Health & Beauty

My face products and makeup cost a fair amount of money, more than my standard Household Supplies category can support, so I put a small amount in this sinking fund each time I get paid.

Travel Fund

Last, but surely not least, I put money in this sinking fund every payday...for obvious reasons.

Side hustles get talked about a lot on the internet. Trust me, I've watched and read lots of articles about side hustles, both positive and negative but they're not really something that I'm either keen on or can do...for various reasons.

However, I do *technically* have a couple of side hustles. The first one is babysitting. I babysit about 4 times a year for a family with three kids. They go to bed early and I make $5/kid/hour. It's not lucrative but does add a bit of spending money into my pot. The second one is credit card churning, something I've discussed a few times before. I made part-time job money without having to work the part-time job. Today, in fact, I just received a direct deposit (that went straight into my Travel Fund) for $224.55. If you're interested in credit card churning, check out this blog post I wrote or this one.

I hope you're inspired to make a few financial changes or shifts. If you have questions, shoot 'em in the comments below.

Published on February 10, 2023 14:39