Gea Elika's Blog, page 92

February 26, 2019

How to Keep from Going House Poor

For most people, becoming a homeowner is a great opportunity. You get to build equity, plan for the future and decorate your home however you wish. But if you buy before you’re ready – or buy too much – then you can end up house poor. First-time buyers are likely to encounter this term as they move through the home buying process. Even if you’re not familiar with the term, you’ll probably know someone who has experienced or is experiencing it. Do you know anyone who owns a 3-bedroom apartment but can’t pay their credit card bill? That’s what being house poor looks like. Read on to understand how people become house poor and what you can do to avoid it.

What is being house poor?

Being house poor is when a homeowner finds themselves spending a large amount of their income on housing expenses such as their mortgage, utility bills, homeowner’s insurance, and property taxes. Once all these expenses are paid, they have little left over to pay other financial obligations outside of homeownership. The usual benchmark by which someone can be called house poor is if they’re spending more than 30% of their income on housing expenses. For many people in NYC, they’re spending a lot more than that!

Whatever the exact benchmark, it’s a really bad situation to be in. It can happen when there’s a sudden drop in income or when there’s an unexpected life event or emergency. Others can create the situation by buying too much house or not being fully prepared for the costs of homeownership. If you find yourself on the road to going house poor, then you are facing serious financial risk. The best way to avoid it is to have a little patience and make sound financial decisions. Here’s how to do that.

1. Don’t buy more than you can afford

The easiest way to avoid becoming house poor is to stay within your budget when buying a home. The general rule is that you should pay no more than 30% of your monthly income on housing expenses. They key to doing this is not taking out more than you should on a mortgage. Keep in mind; your mortgage pre-approval is based on your gross income, not your take-home pay. Calculate what your monthly housing expenses will be and subtract that from your take-home pay. If what’s left isn’t enough to cover your current lifestyle then either reduce your lifestyle expenses or settle for a smaller home.

2. Build up your savings

A prime rule to follow (which many buyers don’t) is to make sure you have emergency savings left over after a home purchase. You never know when a medical emergency might strike or if you’ll suddenly lose your job. The situation needn’t even be as drastic as that. As a homeowner, you’re responsible for making all repairs. If your boiler breaks down in the dead of winter, you’ll want to have the funds needed for repairs. Aim to have at least 3-6 months’ worth of living expenses saved up before you sign that purchase contract.

3. Avoid lifestyle inflation

There’s nothing wrong with treating yourself a bit after a salary raise. Just watch that you don’t allow it to affect your ability to meet your monthly expenses. Try to reel yourself in and avoid overly increasing your lifestyle expenses. Instead, you should be putting that extra money into your savings account or using it to pay down the principle on your mortgage.

4. Be realistic about renovations

If you don’t mind fixing up a place for a reduced price, then look into buying a home as-is. Just be aware that the costs of renovations can quickly spiral out of control. Any estimates that private contractors give you for a job are just that: estimates. Further problems might be uncovered as the work progresses, leading to your savings drying up faster than you thought possible. Stay realistic about the size and scope of any renovations you might have to undertake. The same goes if you’ve already bought the property and want to make some upgrades. If you don’t have the funds to handle renovations (and leave savings left over), then it’s better to put them on hold or spread out your expenses over time.

The post How to Keep from Going House Poor appeared first on ELIKA insider.

What To Do With a Low Ball Offer

No matter the seller, a low ball offer stirs up feelings of frustration. The most common mistake sellers make when they get a low offer is how they respond to it. But a low ball offer is still an offer. That means there’s interest in your home. With the right strategy, sellers can turn a mediocre bid into a sale that satisfies them. Here’s what to keep in mind when a buyer submits a low ball offer.

Take the right approach:

Selling real estate is a business transaction. That means negotiations are an inevitable part of the process. Reminding yourself that this is business, not personal, is key. From that vantage point, you open yourself up to negotiations. Without a willingness to “do business” with potential buyers, you run the risk of letting a potentially good offer slip away.

Work with the offer, no matter what:

One of the biggest mistakes that sellers make is not responding to a low ball offer. This is not the way to handle the situation! You may feel like the buyer’s offer is ridiculously low. Even if it is, there’s always room for negotiation. The buyer may just be feeling gutsy and simply testing how serious you are about sticking to your asking price. So even if you are insulted by how low the offer is, proceed with a counter offer!

Stay calm:

Most people have an emotional attachment to their home. Maybe you lived there for a long time or raised your family there. Maybe selling your home is a last resort when facing financial hardship. In some cases, homeowners put a lot of work into their home. These factors make your home feel like it’s a part of you.

But to sell your home, you must let go of these emotional attachments. Having emotional attachments to your home makes sellers lose their cool when they get a low ball offer.

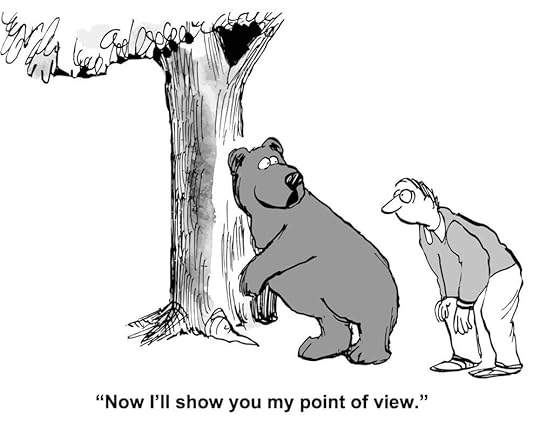

It’s normal to have an extreme reaction to a low ball offer. Some sellers counter with an offer that’s higher than their original asking price. This “I’ll show you” mentality doesn’t get you anywhere. As mentioned before, an offer is just an offer. It’s not a personal attack or insult to your home.

When you get a low ball offer, take a deep breath and keep an open mind. Remember that you’re doing business. The buyer putting forth a low bid has the potential to come up to a price that works for you. It doesn’t matter where the offer starts, but where it ends up!

Remember that you’re in control:

A low ball offer makes some sellers afraid that they can’t sell their home for their desired price. This isn’t the case. It’s important to remember that you don’t have to say yes to anything you don’t want to say yes to. At the end of the day, you determine the selling price of your home.

Reassess your asking price:

After receiving a low ball offer, it’s a good idea to analyze the market. Ensure that your home is priced competitively with current market values. You and your realtor probably did that already, but a comparative market analysis has a shelf life of just a couple months. The real estate market changes daily. Since prices go up and down, it’s possible that your home’s original list price is no longer competitive.

In some situations, you can ask your realtor to request a list of comparables from the buyer’s realtor. Why? Because it’s possible that the buyer’s agent doesn’t even have a list of comparables or familiarity with your specific neighborhood. If this is the case, it’s possible that the buyer’s realtor has given their client a skewed perspective of competitive/comparable prices.

Prepare for the counteroffer to your counteroffer:

Agreeing on a purchase price is a game of chess. Remaining patient, prepare for some back and forth.

One negotiation strategy to a low ball offer is countering with the lowest and final price you’re willing to accept. For the most part, this eliminates the back and forth right then and there.

Another negotiation strategy is countering the offer back to the full price. This shows the buyer that you are not “playing games.” You only want serious offers. Of course, this strategy potentially ends negotiations with the buyer on the spot.

Another counter offer option is to offer a slight price reduction—$5,000 to $10,000 for a $300,000 home, or $10,000 to $25,000 for a $1 million home, for example. It’s important to explain your reasoning. Your listing agent can present the buyer with a list of comparable properties. Then the buyer sees that your home is listed at a competitive price. Your realtor should also point out all of your home’s features and amenities. This backs up your asking price.

Create competition:

Setting your home’s list price slightly under that of comparable properties is one way to make your home stand out. This encourages reasonable offers right away. Another strategy to attract buyers is setting commission slightly above the going rate. This encourages agents to show your home.

Imposing a deadline for offer submissions is yet another way to send buyers the message that you’re serious and attract reasonable offers. In fact, according to The Wall Street Journal, home listings with published offer deadlines sometimes sell above their asking prices.

The post What To Do With a Low Ball Offer appeared first on ELIKA insider.

February 24, 2019

Buyers Can Leverage Home Inspections to Get a Better Deal

It goes without saying that home buyers always want to pay as little as possible for their home. Typically, the time to do that is during price negotiations. Depending on where you live, brokers can usually haggle the price down around1% or 2%. At this point, most buyers assume the price is set, and the deal is done. It’s not. There remains an additional opportunity to lower the price. Unbeknownst to most buyers, home inspections can sometimes be leveraged to squeeze additional price concessions out of sellers.

Home inspectors: tire-kickers of real estate

Almost every home gets inspected before closing. Most mortgage lenders require it. Licensed home inspectors examine the guts and bones of a property. They want to determine if there are any structural or operational flaws in the home.

Inspectors look for problems that may not be apparent to the untrained eye. For example, most check a building’s foundation, electrical system, plumbing, roof, and drainage. They pay particular attention to water. While it may be the staff of life, for buildings it’s often a cancer that can cause severe damage.

Who picks and pays for the home inspection?

Buyers usually pay for and choose the home inspector. According to the Department of Housing and Urban Development, a typical home inspection costs between $300 – $500. Most buyers rely on their real estate agent to recommend one.

However, this can be a problem. It’s in the agent’s interest to close the deal as quickly as possible. The last thing they want is for an inspector to uncover costly problems that can kill the deal. While the majority of agents are honest, this built-in conflict of interest exists.

Sherlock Holmes

Buyers need a home inspector who operates like Sherlock Holmes. Thoroughness, doggedness and a detective’s eye for detail are a must. Unfortunately, many home inspectors are anything but thorough, and only do a cursory examination.

It’s not unusual for an inspector to stroll through a house, clipboard in hand, checking this thing and that – never getting underneath the home’s veneer. A lazy home inspector – or an out of shape one – will avoid climbing on a roof or getting down on their hands and knees to check a crawl space.

Bumbling Inspector Cousteau

A large number of home inspectors working today are like the bumbling Inspector Cousteau; clueless, inept and terrible at their job. But unlike Cousteau, who in the end, inadvertently solves the case, these inspectors don’t. And they can cost home buyers lots of money.

It’s hard to believe, but 18 states do not require a license to become a home inspector. In states that do, many educational and training requirements are often spotty, at best.

One study illustrates this problem. Consumer’s Checkbook, an independent non-profit advocacy group that rates local services, did an undercover investigation of home inspectors. What they found was shocking. Twelve inspectors were told to inspect a three-bedroom home that had 28 known problems.

According to the study’s findings, none of the inspectors performed very well. They uncovered only 50% of the problems. And all of the home inspectors were licensed.

How to find a Holmes and avoid a Cousteau

It’s not easy finding a really good home inspector. But there are ways to do it:

-Read reviews on Yelp, Google and Angie’s List

Online reviews are a good source of reference for determining if a home inspector is good, so-so or just a lazy slob. Look for inspectors that have lots of reviews and good ones.

-Pick an inspector who wants you around

Red flags should go up if an inspector doesn’t want you around during the inspection. This doesn’t mean that he’s just an unsociable kind of guy. Instead, it probably means he wants no one around to watch him do a half ass job.

-Ask for a sample report

Compare inspection reports and see who is the most thorough. Granted, they probably give you their “best” example, but not always. Sometimes the inspectors think the average person has no idea what these should contain. Do your homework and find out beforehand.

-Find out what won’t be on the report

What’s excluded from a home inspection report is as important as what’s included.

-Finally, find out if they are licensed or a member of ASHI, NAHI or other professional groups

While this is certainly no guarantee of thoroughness and professionalism, a person without these credentials should be looked at with a critical eye.

Creepy bugs, fury mold, and leaky pipes can pay off big time

Once the report is finished by a top-notch home inspector, review the things that need repairing or replacement, assuming there are any (there usually are). Skip the little things. Tally up the cost. Get estimates from high-end service providers. This will inflate the repair bill and cover you if something unforeseen is uncovered.

Have your agent speak with the buyer’s agent. Say that for the deal to close, the price of the home must be reduced to cover these costs and more. You also want to be compensated for the “hassle factor.” Don’t be shy about asking a lot. Who wants workmen around hammering away in their newly bought house? In all likelihood, the buyer will acquiesce, particularly in this down market where buyers are hard to find.

This is one of the few times where unsightly mold, furry mildew, and small rodents can put money in your pocket.

The post Buyers Can Leverage Home Inspections to Get a Better Deal appeared first on ELIKA insider.

February 21, 2019

What To Do When You Can’t Pay Your Mortgage

Financial hardship happens. In January 2019, 435,421 homes were in some stage of foreclosure in the United States. In the event of economic hardship, here’s what to do to avoid foreclosure if you can’t keep up with your mortgage payments.

First, What Happens If You’re Late On a Payment?

If you miss a payment on your mortgage, your lender reports the late payment. The late payment is called a delinquency on your credit report. The delinquency remains on your report for seven years. Even missing a single mortgage payment negatively affects your credit score. The longer you go without bringing the account current, the greater the impact on your credit score.

If payments stop altogether, the loan becomes delinquent and goes into default. The default status continues for roughly 90 days. At this point, the lender usually reaches out to the homeowner about the balance of the loan. If the homeowner cannot pay, the lender may file a Notice of Foreclosure and file foreclosure documents in court.

This part of the process usually takes 120 days to nine months to complete. The homeowner can challenge this process in court.

What To Do When You Can’t Make the Payments

Act Fast: It’s hard to accept financial hardship when it happens. Denying your difficulties with money makes the situation worse. Luckily options are available to you. Time is of the essence when it comes to receiving support. Be proactive! When you wait to explore what could help you, you reduce the options that are available to you.

Contact the Consumer Financial Protection Bureau: Talk to a housing counselor about your options. Their professional expertise is extremely valuable. It’s also comforting to get their support before approaching your lender.

Contact Your Lender: Lenders want their money. But helping you keep your home is advantageous for them too. If the market is not strong, the lender stands to lose money when they repossess your home.

Prepare for your call with the following information:

Why you can’t pay the mortgage. (Do you have any documents to backup your reason for falling behind?)

How you have tried to resolve the problem.

Whether the situation is temporary or not.

Details about your income.

Changes you foresee in your financial situation in the short and long term.

Other financial issues that are stopping you from getting back on track.

What you would you like to see happen. (Do you want to keep your home? What type of payment arrangement is feasible for you?)

Tips:

Keep notes of all communications with your lender. This includes the date and time of contact, the nature of the contact (face-to-face, phone, email, fax, or regular mail), the name of the representative, and the outcome.

Follow up on any oral requests with a letter. Send your letter by certified mail, “return receipt requested,” which documents what the lender received. Keep copies of your letters and all enclosures.

Meet all deadlines.

Refinance: Refinancing your home is an option for some homeowners. This option is usually available if your credit is good. If your current loan has a high-interest rate, refinancing at a lower rate lowers your payments.Note: Refinancing often includes hefty fees for breaking your existing mortgage contract. Therefore it costs you more in interest over time. Refinancing is not usually an option for homeowners who have already overextended on their loan.

Loan Modification: This option is when a homeowner works with a lender to change the terms of their mortgage. The change is either temporary or permanent. It can affect the mortgage rate, the term, and/or the monthly payment. This option is similar to refinancing. But it’s only open to homeowners who can prove they’re facing great financial hardship.

There are different types of loan modification. Not all programs have the same impact on your credit score. For example, some programs referred to as loan modification are actually debt settlement plans. Debt settlement (see below) has a more negative impact on your credit score.

Debt Settlement: With debt settlement, the lender agrees to accept less than the full amount owed on the loan. As with any other type of debt, settling for less than what is owed reflects negatively on your credit report.

Forbearance: If your financial hardship is temporary, the forbearance option gives you the option to temporarily reduce or even suspend your mortgage payments for a period of time. Of course, the decision to use this option is up to the lender.

Rent Your Home: Most homeowners do not want to vacate their home. However, if it means being able to pay your mortgage, it’s not a bad option. Especially if the monthly rent you charge is more than your monthly mortgage payment.

Note: Before deciding to rent your home, know that your home will change from a primary residence to an investment property. This usually disqualifies you for any additional assistance from your lender. Also consider that you are responsible for things like home repairs, taxes, and insurance.

Sell Your Home: Sometimes the best way to avoid foreclosure is to sell your home. For homeowners who are already making late mortgage payments, there are two key options:

Short Sale: A short sale is when the bank agrees to let a homeowner sell the home for less than what is owed on the mortgage. It’s up to the lender to decide whether or not a short sale is in their best interest. If the lender doesn’t report the debt reduction to credit reporting agencies, a short sale is less damaging to your credit than a foreclosure.

Deed in Lieu of Foreclosure: In some cases, a lender allows a struggling homeowner to sign their deed over to the bank instead of foreclosing. You essentially turn the home over to the lender. The lender then sells the home to recoup what they’re owed.

Note: Both Deed in Lieu of Foreclosure and Short Sale have tax implications. Consult a HUD-certified housing counselor as well as a tax professional to determine the full implications of these options.

Declare Bankruptcy: Sometimes homeowners find themselves with no other choice but to declare bankruptcy. Bankruptcy has an extremely negative effect on your credit score. It makes it very hard to borrow money from a lender in the future. Personal bankruptcy can also affect your future employment options as many employers check candidates’ credit scores.

When an individual files Chapter 13 bankruptcy, it’s sometimes possible for them to keep their home. This is only an option if the homeowner has a solid plan to repay at least some of their debt. Unlike Chapter 7 bankruptcy, Chapter 13 requires that borrowers attempt to repay some of what they owe before the slate is wiped clean. Some homeowners in default stay in their homes for months or even years. Completing a foreclosure takes more than a year on average. If homeowners fight their eviction in court, they can stay even longer while the case works its way through the system.

Protect Yourself from Scammers: Unfortunately, there are tons of scammers out there looking to take advantage of struggling homeowners. Some signs of scams include

Unsolicited offers. Legitimate housing counselors do not send out solicitations.

Promises that sound too good to be true.

Upfront fees or requests for payments to be sent directly to them.

The post What To Do When You Can’t Pay Your Mortgage appeared first on ELIKA insider.

February 20, 2019

Mortgage Rates: What Goes Up Doesn’t Always Come Down

Mortgage Interest Rates Are Going Up Even Though, Right Now, They’re Going Down

Just a few short months ago, Wall Street forecasters almost unanimously stated that mortgage interest rates would go up. Virtually all real estate pundits agreed. You would have been hard-pressed to find a bookie to take a bet that rates would decline. Since the beginning of 2019, mortgage interest rates have dived. According to Freddie Mac, just last week, interest rates reached a 9-month low.

So, what’s up? And what does that mean for home buyers?

Market crash & free money

Starting with the 2008 financial crisis, and all the way through 2015, interest rates were hovering close to zero. The Treasury Department had their printing presses running overtime. Most importantly, the Federal Reserve Bank was practically giving money away. Their objective; kick-start economic activity and revive the battered housing market.

It worked. The U.S. economy is experiencing the longest economic expansion in recent history. Free money, in the guise of super-low interest rates, is becoming a thing of the past. As a result, home buyers are paying more in mortgage interest payments.

Which way the rate wind blows

In 2016, when mortgage rates averaged 3.44%, the Federal Reserve began to “normalize” rates. In other words, they increased them. Moreover, in 2018, the Federal Reserve raised rates four times. Beginning in October of that year, rates were 4.87%. The Chairman of the Federal Reserve stated that rates would continue their rapid ascent for the foreseeable future.

Recently, however, the Federal Reserve Bank did an abrupt about-face. Instead of increasing interest rates, it did nothing. Surprisingly, Janet Yellen, the former Fed Chairman, stated that interest rates might even go down. First, they’re up; then they’re down – what gives?

Confusion about what direction of interest rates will go is widespread. That confusion is most acutely felt by home buyers. The long-term impact on their wallet can’t be overstated. If a buyer waits, and rates go up, they may no longer be able to afford a home. However, if they buy immediately and rates go down, they’ll end up paying tens of thousands of dollars more for their home.

Big bucks at stake for home buyers

Most mortgage rate increases are small and by themselves don’t add much to the cost of buying a home. However, the cumulative effect of several small increases can stop a growing housing market in its tracks. It can also make buying a home unaffordable for tens of thousands of people.

Let’s say you are buying a $400,000 home at the 2016 rate of 3.44% (assuming a 20% down payment). A one percentage point increase adds almost $185 to a buyer’s monthly mortgage payment. That’s over $2,200 in additional payments per year. Over the life of a 30-year mortgage, the buyer ends up paying an additional $66,200. A person can buy a couple of mid-priced cars for that.

Up or down?

When forecasters made their predictions of higher rates in 2018, the global economy was in a very different place than it is today. Recent events, including December’s stock market rout, and the government shutdown, have all contributed to a slowing of the U.S. economy. Now, there’s even talk of a recession. When the economy appears to be going south, interest rates usually follow.

Many respected forecasters think the doom and gloom are overstated. There is, however, one thing most of the tea leaf readers agree on go.

Barring some unforeseen economic or political calamity, mortgage interest rates will probably keep going up, albeit slowly. The consensus is that there will be two .25% rate increases in 2019. This is based on a pronouncement by Jerome Powell, the Chairman of the Federal Reserve. Using our $400,000 home example, that’s about $100 a month in increased mortgage payments.

Where interest rates are heading: the canary in the coal mine

Nothing is etched in stone of course, particularly when it comes to interest rates. Fortunately, there is a canary in the coal mine forewarning the direction of interest rates. And it hinges at the moment on one thing. The U.S.-China trade talks. If a deal is cut, mortgage interest rates will probably climb. If the talks fail, the economic doomsayers will take center stage and rates will stay where they are or will fall.

Whatever happens, home buyers should view this transaction as a lifestyle decision as much as a financial one. If you need a larger house now, buy one. Don’t dither. Predicting the direction of interest rates is an inexact science. What goes up, may come down. Or maybe it won’t.

The post Mortgage Rates: What Goes Up Doesn’t Always Come Down appeared first on ELIKA insider.

February 19, 2019

How to Deal with Demanding Home Buyers

With the average sales price dropping across the city, and the number of listings rising, now is not a great time to be a seller in NYC. Dealing with demanding buyers is, unfortunately, a common part of selling a home. In slow markets like now, they can be especially prevalent. There’s the bargain hunter who thinks he can get everything with a lowball offer, the time waster who refuses to put an offer on paper, and the unrealistic dreamer who sets impossible deadlines. Such people are challenging but not impossible to work with. It just requires a cool head and a well thought out approach. Here’s how to deal with difficult buyers when selling your NYC home during a buyer’s market.

What to expect when selling your home

People tend to attach a lot of emotional value to a home, and if you’ve lived in yours for many years, then you should expect it to make you a little biased. This can cause problems when you run into difficult buyers. The first step should be to try and emotionally detach yourself from the home. Start out by finding the homes current market value through the use of a comparative market analysis (CMA). This will determine the right asking price for your home based on sales of comparable properties in your area. Next, depersonalize your home by removing most of your personal effects such as family portraits. This will also make it more appealing to potential buyers. Next, you’ll want to stage the home, so it looks it’s best for the open houses and private showings ahead.

As you meet different buyers and start negotiating towards a contract, keep in mind these negotiating tactics.

1. Say “No” and wait

If a buyer is playing hardball and refusing to budge on a concession or price point that is important to you then be prepared to say no. If you’re not getting a lot of offers, this can be difficult but is probably better in the long run. Say no and give your reasons for it. The buyer will see that they’ve hit a brick wall and may come back with a more reasonable offer if they’re interested in the home.

2. Make a counteroffer

Saying no to a buyer’s demands might work when there are multiple offers but what if you’ve only got one interested buyer? If a buyer’s first offer is too low, then be ready to meet them halfway with a counteroffer. For this to work in your favor, it is good practice to have some cushion space built into your original offer. This will allow you to scale back the price without going too far. From the buyer’s point, this looks good as it shows you’re willing to compromise and play fair in negotiations.

3. Take preventive measures

If a buyer doesn’t accept your counteroffer, then look for ways to mitigate your losses. Concessions and contingencies can be just as important as the price point so try to reduce them. If the buyer agrees to drop certain contingencies, then make sure you get it in writing.

4. Let your agent do all the talking

If things get very heated, then turn things over to your agent. They want to make a sale just as badly as you do, but because they don’t come with any emotional attachment to the home, they’ll be far better than you at keeping a level head.

The post How to Deal with Demanding Home Buyers appeared first on ELIKA insider.

February 18, 2019

Real Estate vs. Stocks: An Investing Primer

Real estate and stock investing are two fairly common ways to grow your wealth over time. Both present opportunities and challenges, with unique sets of potential rewards and risks. Of course, the two investments are not mutually exclusive, and there are benefits to pursuing both avenues.

However, as with any investment, it is useful to understand each one before diving in. Certainly, people invest because they hear about other people making a lot of money. However, this is not a good enough reason.

Real Estate

We have discussed New York City real estate investing. Many like real estate’s tangible quality. It is something physical, and people feel more connected to it.

Your cash flow benefits from the tax advantages you gain from deducting depreciation. Of course, depreciation is more than an accounting entry. As a good rule of thumb, you should plan to spend that much annually for maintenance expense. Nonetheless, the deduction shields part of your income.

There are different ways for investors to make money. One approach is to buy-and-hold. You collect rents, and your yield or cap rate is your net cash flow divided by your purchase price. Therefore, you need to watch how much you pay for the property and manage your monthly income and expenses. Historically, the city’s cap rate has been 3%-4%, but many people make their money through capital appreciation. In fact, this is a significant component of building wealth through real estate.

You can also buy a property intending to sell it quickly. Called flippers, these people generally seek a home that needs renovations. Then, after doing the needed repairs, they hope to turn a tidy, quick profit. The faster the turnaround, the better off you are since there are carrying costs that weigh on the investor’s return. This is a high-risk/high reward way to invest in real estate.

Advantages of real estate investing

There are several advantages to investing in real estate. In New York City, it has appreciated rapidly. This is no guarantee it will do so in the future, of course. But, with the city a financial and cultural hub, along with low crime rates, it is hard to bet against it. You can also leverage your purchase since lenders only require a down payment that is a fraction of the purchase price.

There is also the tax advantage we mentioned, along with the potential to push out any capital gains tax through a 1031 exchange.

Real estate investing provides some diversification benefits from the stock market. Although, in New York City, there historically has been a higher degree of correlation than in other parts of the country since the financial services’ industry comprises a fair amount of the city’s economy. It makes up about 10% of the employees and 30% of the workers’ earnings, with banking and securities companies accounting for the bulk of this amount.

Disadvantages of real estate investing

Investing in real estate is not for everyone, though. The main disadvantage is the lack of liquidity. This is particularly true during a downturn when buyers are scarce. Your property may sit on the market for a long time before you receive an offer.

Additionally, there are costs to consider. These include closing costs when you purchase and sell the property. Additionally, there are ongoing expenses to run and maintain your investment.

You can become actively involved in the day-to-day decision making. Otherwise, you must hire a management company/individual to take on the task. In either case, it is more work than merely investing in stocks.

Stocks

There are several ways to invest in the stock market. Generally, the easiest and cheapest is to invest in an index fund or exchange traded fund (ETF), such as one based on the S&P 500. Although the market is known for its volatility, if you are a long-term investor, this gets smoothed out.

For instance, assume you invested in the S&P 500 in 1996, in the middle of a strong bull market. Then, you sold your position in 2016. This would have generated an annual total return of 8.2%. This return was achieved as the late-1990s speculative bubble built and subsequently burst. Then, a recession ensued in the early part of the century. After this, there was another bull market that ended with the severe recession and bear market. Finally, we are in an upward movement.

Why stocks?

As mentioned previously, stocks have a solid long-term track record. Generally, equities are very liquid, making it easy to buy and sell. Additionally, you can build a diversified portfolio relatively easily and inexpensively, particularly through a mutual fund or ETF.

The disadvantages

There are a variety of ways to invest in the market, including via individual stocks, mutual funds, and exchange-traded funds (ETFs). There are a lot of different strategies that allow you to profit under various scenarios such as bull and bear markets. However, these are likely complex and risky. Most people investing in a company, industry sector, or overall market are expecting to make money from the price moving up. Hence, you are reliant on a host of factors, including the overall economy.

Investing in equities, particularly an individual company is inherently risky. This is particularly true in the short run. Those without the tolerance for short-term pain may find themselves selling at an inopportune time.

There are also costs to trading stocks, although many brokerages are cutting fees.

A compromise

For those that want to invest in real estate and own stock, you can purchase shares in a real estate investment trust (REIT). There are two broad types of REITs: an equity REIT and a mortgage REIT. The former typically invests in a specific property category. These include residential apartment buildings, commercial properties, student housing, and shopping malls, among other types of properties. A diversified REIT is when the company invests in more than one category. A mortgage REIT invests in mortgages and mortgage-backed securities.

By choosing an equity REIT to invest in real estate property, investors’ money gets pooled together. That way, there are greater resources to purchase the assets. This is ideal for someone who is either not inclined or faces time constraints to actively manage a property. It also allows for a diverse portfolio of holdings.

There are a variety of rules a company must adhere to qualify as a REIT. By doing so, the entity is exempt from taxation. One item includes generating at least 75% of the company’s income from real estate. Additionally, the company must pay out at least 90% of its taxable income in the form of dividends.

The post Real Estate vs. Stocks: An Investing Primer appeared first on ELIKA insider.

February 17, 2019

Do’s and Don’ts for Open Houses

There are many rules to follow when it comes to Open Houses. There are rules for the buyers, rules for the sellers, and of course rules for the agent to follow. Here are just a few of the Do’s and Don’ts to keep in mind when attending or hosting an Open House.

For the Buyer Do:

Do: Attend the viewing with your buyer’s agent. This way you have your representative there with you. Your agent most likely has attended countless Open Houses over their career, so any guesswork on your part can be avoided with your agent on hand. Since your agent will most likely be handling any negotiation for you, they’re your first line of defense. So, why not have them there up front? If your agent is not available to attend with you, put their name and phone number on the sign-in sheet, so then the listing broker does not assume you are unrepresented.

Do: Greet the broker immediately. If you don’t see one right away upon entrance, say hello and wait for an answer. Perhaps the agent is busy with another potential buyer, wait until they are free before going through the house on your own. If you’ve arrived at a super busy time, the broker should be aware of this and give group tours of the home if everyone is amenable to that.

Do: Be respectful and treat the home as you’d like other visitors to treat your own home. This can include asking about taking off your shoes to walk through the home, shutting doors gently, asking before turning on any lights or faucets and don’t go off in unknown areas alone. Also, if you’ve brought children along, keep them close at hand and well-behaved.

Do: Keep your ears open. While you’re here to ask your questions, you might hear some answers you didn’t know you needed by merely listening to other prospective buyers and their questions. You might also hear some additional information about the home you didn’t know.

For the Buyer Don’ts:

Don’t: Take photos or video without asking. Before you take out that phone camera to snap photos of the space, keep in mind that this home you’re viewing is, in fact, someone’s home. So, err on the side of caution and ask the homeowner or the agent if it’s OK to take photos/video. It’s also helpful to share your reasoning for footage with them—it will help put them at ease. Most likely, you’ll be given permission. But it’s always the best bet to ask first. You don’t want to be on anyone’s wrong side when it comes to a possible home purchase.

Don’t: Open any doors that are closed without asking the broker. There may be a personal reason the door to a room is closed. A broker will usually put a sign-up or tape across a door letting you know the designated area is off limits.

Don’t: Touch personal things in the home. While you’ll want to touch and feel as much as you can regarding the home’s foundation, again, keep in mind that this is someone’s home filled with personal belongings. You don’t want to be held accountable if anything breaks or disappears from the home during the Open House. You’ll be doing both the homeowner and yourself a favor by going in with a hands-off personal belongings policy.

Don’t: Use any disparaging or derogatory language about the appearance or condition of the home. Someone’s home is a reflection of themselves, and nobody wants to hear negativity. Any home furnishings and décor decisions are all up to opinion. And that opinion isn’t yours to make until you’re the homeowner yourself. So, keep it classy and save your opinions until you’re safely in the car and out of earshot of others who might be influenced by your remarks.

For the Seller Do:

Do: Make sure the home is clean, uncluttered and showcased in the best possible light. A surefire way to dissuade buyers is to present your home as messy or unmanageable. It’s a great excuse to clean and declutter anyway, so take advantage of the opportunity. You’ll also have less to pack when you start boxing up your belongings for moving day.

Do: Make yourself scarce during the viewing. While you’ll be curious and may be anxious about the Open House, it’s best that you let your agent handle the viewing without you there. They’re professionals, and they know what they’re doing to showcase your home to the right buyers.

Do: Spread the news to the neighbors. Let your neighbors know that you’re hosting an Open House, and make them aware of the date and time. They may know someone looking to buy a new home, and you’ll make them feel included in the process. It’s also nice to give them a heads-up as to why they might see strangers in the neighborhood that day.

For the Sellers Don’ts:

Don’t: Create any distractions in the home. There are some tricks that home sellers sometimes enlist to add to the appeal of the home: lit candles, fresh-baked cookies, fresh flowers. But some sellers go to the extreme and employ some unsuccessful, over-the-top tactics. Live entertainment is fun and can draw a crowd, but it can distract from the actual purpose of presenting the home to a serious buyer.

Don’t: Invite your friends to stop by. An Open House is not an invitation to a party. Again, the intention is to sell your home, and this is a serious business transaction that should be handled as such. Only invite those friends who have expressed serious interest in purchasing your home. And let your agent handle any interaction with them in regards to the price and sale. That age-old adage of mixing friends with business also applies to selling your home.

The post Do’s and Don’ts for Open Houses appeared first on ELIKA insider.

February 16, 2019

5 NYC Tenant Laws that landlords Don’t Want You to Know

Landlords can be tough in NYC and it’s not unknown for them to try and evict you for their own personal gain. Sometimes it can feel like the landlord is holding all the cards. Fortunately, that’s not the case thanks to a series of tenant laws in place to protect renters. But don’t expect your landlord to tell you about these. It’s in their interests to keep you ignorant so you’ll need to become aware of them yourself. Some of these are well known such as the right to livable housing. But the quirkier ones can be easily overlooked. Here are some of the stranger tenant laws on the books in NYC

1. There’s a way around the no pet’s clause in a lease

The no pet’s clause in a lease is a frequent bone of contention between tenants and landlords across the city. If your lease has one such clause then it’s helpful to know that, given the right circumstances, you can get around it quite easily. states that “In multiple dwellings in New York City and Westchester County, a no-pet lease clause is deemed waived where a tenant ‘openly and notoriously’ kept a pet for at least three months and the owner of the building or the owner’s agent had knowledge of this fact.”

The beauty of this is that even the most casual observations by the landlord’s workers of the pets accouterments can be used to argue that the landlord had knowledge of the pet. So if you see a maintenance worker walk by with a leash then you may just have to wait three months and you can get a dog.

2. You can take on a roommate without the landlord’s permission

Another interesting law relates to the question of roommates. Even if your landlord won’t allow you to have any there’s little they can do to stop you. Real estate Property Law 235(f), often referred to as the Roommate Law, holds that any residential lease entered into by a tenant allows them to share the apartment with their immediate family or one unrelated person. This is true even if the residential lease says otherwise.

3. It is very difficult to evict someone for repeated late payment

Technically speaking, repeatedly paying your rent more than a month late is grounds for being evicted. But in practice, it’s very hard to do so. In the court’s eyes, being repeatedly late on your payments only shows that there is no clear set of standards. So if you’re occasionally late on your payments then don’t let it worry you too much. This is not recommended as a personal policy but legally speaking you’re probably fine.

4. Elevators must have mirrors

Multiple Dwelling Law 51-b; NYC admin. Code 27-2042 holds that every self-service elevator in a multiple dwelling building must have mirrors. This is to allow anyone about to enter the elevator to check if anyone is already inside. There might not be much use to this but you’re welcome to try.

5. You are entitled to a fresh coat of paint every three years

Every NYC apartment (whether rent regulated or not) must be maintained according to the Housing Maintenance Code (HMC). This requires your landlord to ensure the lock on your front door works, that your windows aren’t broken, and a whole lot else. One section of the HMC even requires landlords to repaint your apartment once every three years. Landlords are responsible for fixing all wear and tear so if your apartment could use some sprucing up ask them to foot the bill for a paint job.

The post 5 NYC Tenant Laws that landlords Don’t Want You to Know appeared first on ELIKA insider.

February 14, 2019

6 Questions to Ask Your Realtor Before Buying

Buying a house is a huge decision—both emotionally and financially—and you want to be sure you feel comfortable committing to the house in question. Here are six questions to ask your realtor during the house hunting process before deciding to go all in on your future home.

1. Would you buy the home?

Flip the script on your real estate agent and ask if they would buy the house. If they don’t come back with a resounding yes, it’s worth going a little deeper and figuring out the reasons they wouldn’t. This isn’t to say that a “no” means completely canceling out the house, but if your realtor is worried about certain things, you’ll want to hear them out and listen to why they’re not immediately jumping on a purchase.

2. How long has the property been on the market?

Having a property that’s been on the market for an extended period could mean that there are some underlying issues with the house or that the seller has refused to negotiate on the asking price. Whatever the issue, ask your realtor why they think the house isn’t selling.

3. What’s the real estate market like in the area?

Realtors see a lot of growth and decline in their job. Throughout the home buying process, your agent should be aware of the growth and decline trends in the area and be intimately knowledgeable with the neighborhood you’re looking at. Ask your real estate agent about the community, especially if there’s any concern that the area may decrease in desirability.

For example, nobody wants to move into a neighborhood that’s dealing with a lot of foreclosures, especially if you’re planning on selling your home in the future. Consistent neighborhood improvement and small business activity can all point to a neighborhood’s potential growth. Your agent can give you advice on whether you’re making a solid investment based on any local housing market trends and economic factors that affect home values.

4. Are there any nuisances I should be aware of?

Even though your neighborhood may be quiet during the day, that might not always be the case in the evening. Traffic from nearby restaurants or stores could be an irritant, and adjacent road noise could be a constant cycle of noise. Even barking dogs next door can get on a person’s nerves. Be sure to ask your realtor and the seller about nuisances they’ve experienced or noticed.

5. Have there been any recent renovations to the house?

While renovations can make an old house or apartment look brand new, some renovations are done to cover up underlying problems. For example, a newly painted basement could mean that there’s mold or water damage. Ask about any renovations and what the purpose behind the improvement was. Sometimes, investors or an investment firm will buy a property, flip it, and then relist the home for profit. If this is the case, do your research and ask your real estate agent if that particular investor has a good reputation and track record when it comes to flipping homes.

6. Are there any seller’s disclosures?

While a home inspection will tell you what repairs need to be made, your seller legally has to disclose any problems with the home. Ask the seller of the house for all of the paperwork on major systems and appliances in the home. If the home comes with a home warranty, proper paperwork on all of the mechanical systems and appliances is critical. If you don’t have this paperwork and something breaks down, it’ll be difficult to determine if the systems are under warranty or what types of repairs and replacements need to be made.

The post 6 Questions to Ask Your Realtor Before Buying appeared first on ELIKA insider.