Gea Elika's Blog, page 137

November 2, 2017

NYC: The Place to Invest in Real Estate

We have long touted New York City’s virtues, from the incredibly low crime rate to go along with the economic opportunity, museums, restaurants, and world-class events. Add in a public transportation system that runs 24/7. People continue flocking to New York, and the population grew to over 8.5 million as of July 2016, from about 8.2 million in 2010, according to a U.S. Census Bureau estimate.

The opportunities and ensuing population growth, which have been ongoing for some time, help explain why the city has favorable characteristics for real estate investors.

A resilient market

New York City prices have shown a remarkable ability to bounce back from the rough times a decade ago. In 2007, the average residential sale was about $731,500 ($42.7 billion total consideration, 58,393 transactions), based on data provided by the Real Estate Board of New York (REBNY). Residential sales are defined as one-to-three-family dwellings, condos, and co-ops. Two years later, at the low point in the cycle, this fell to an average $660,700, as both the consideration and number of units plummeted by 45% and 39%, respectively. Last year, after several years of steady improvements, the average climbed to nearly $959,000.

The first half of 2017 continued to be strong. The average sales price grew 3% year-over-year to $1.05 million in the second quarter. Meanwhile, the median price, which removes the effect of extreme prices, rose 8% to $630,000. Unit volume increased, too, 15% higher than a year ago.

Manhattan’s average condo price nearly doubled to over $3 million in the first quarter of 2017 compared to the first quarter of 2007. Co-op prices were more muted, with the average price rising to $1.18 million from $1.13 million. However, the average co-op price is skewed by the extreme prices at the high-end of the market.

The condo’s blended (studios to 4 bedrooms) average price per square rose nearly 41% to $1,724 compared to 2007’s level. For Manhattan co-ops, the blended average price per square foot was about 26% higher, reaching $1,263.

The first half of 2017 continued to be strong. The average sales price grew 3% year-over-year to $1.05 million in the second quarter. Meanwhile, the median price, which removes the effect of extreme prices, rose 8% to $630,000. Unit volume increased, too, 15% higher than a year ago.

Rentals

Rental income is an important and stable revenue source for investors. There is good news on this front, too. Through the summer, rents in Manhattan, Brooklyn, and Queens continued to push upward and reached record highs. Brooklyn and Queens experienced about a 1% increase, to about $2m500 and $2,000 and $2,500. Manhattan has been relatively stable but commands about $3,000 a month. There are also reports that landlords are offering fewer discounts and other concessions amid fewer vacancies.

A good climate

Demographics are favorable for New York City investors. Unemployment is low, at 5.1%, and the average weekly wage (thought the first quarter) was nearly $3,000, nearly triple the average for the entire country. It is tops in the country and grew about 7% from the prior year.

The city also attracts foreign buyers, widening the buyer pool. This helps support prices, particularly in a weaker economic climate. For instance, New York’s economy may be sluggish, but China’s may be doing very well. Chinese buyers may take the opportunity to purchase NYC real estate. New York’s regulations make it relatively easy for foreigners to purchase real estate, particularly compared to other world cities.

Final thoughts

While a recession can cause economic pain, the city has enough favorable characteristics to blunt the impact. During the last recession, which was severe, the market rebounded relatively quickly and resoundingly.

Before jumping in with both feet, though, remember the city is referred to as the “concrete jungle.” It is imperative to seek professionals to be your jungle guide.

The post NYC: The Place to Invest in Real Estate appeared first on - Elika Real Estate.

November 1, 2017

Breaking Down Los Angeles Property Taxes

The median home price in Los Angeles rose 7.5% from last year, and with that increase also comes an increase in L.A. property taxes. How much you pay in property tax is dictated by the cost of your home and the land on which it sits, but it’s also largely determined by where in Los Angeles you call home. California’s property tax assessments are necessary but also complex, paying for a whole host of services in the state.

Your property taxes cover public schooling, community colleges, fire and rescue, and other essential services. While property tax is a local tax, it does have an effect on state budgets. Because the largest recipient of property tax dollars is schools, your property taxes often reduce the state burden on those costs. Every homeowner at some point has complained about their property taxes, but understanding where the money goes may help set your mind at ease.

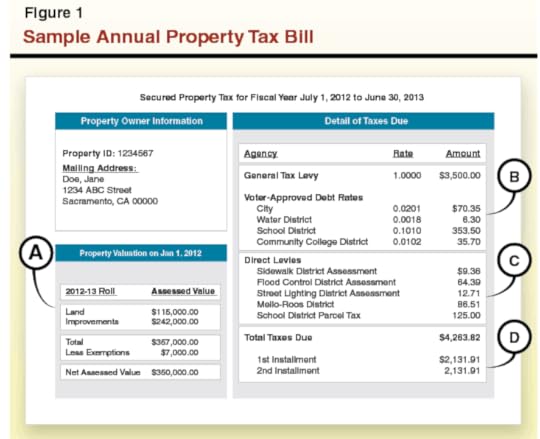

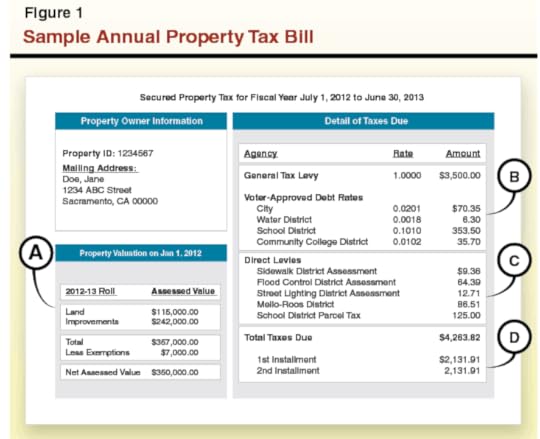

Image by Legislative Analyst’s Office

Image by Legislative Analyst’s Office

How Are Property Taxes Assessed in Los Angeles?

Property tax in Los Angeles begins with a 1 percent general property tax. Direct or special assessments, which are levied by your municipality, are then added to that amount. The average tax rate for Los Angeles is 1.16 percent of the value of your home. Proposition 13, passed in 1978, reduced the amount of taxes Californians pay in property tax by about 57 percent. While reducing the tax rate to 1 percent, it also established guidelines for existing homes, stating that taxes on homes, business, and farms could not increase more than 2 percent in a given year. There are only four conditions that allow for a reappraisal of property taxes.

A change in ownership

Completed new construction

New construction partially completed on the lien date

A decline in value

Reappraisals are determined by the Los Angeles County Office of the Assessor. It is this office that decides if a change in ownership or new construction merits a new assessment. If construction is done on an existing home or building, the Office of the Assessor can also determine if the work or addition has added value to the property. These assessments, made by the county, may be appealed if you feel they were made in error.

Who Pays the Most L.A. Property Taxes?

The city of Bell currently pays the second highest property taxes in the county. While the average in L.A. is 1.16 percent, the residents of Bell pay a whopping 1.55 percent. This has angered some residents whose local government officials also earn some of the highest salaries in the Los Angeles area.

While it would seem at first glance that areas within L.A. boasting the highest income, best schools and services, and largest homes would be paying the most, that is obviously not the case. Manhattan Beach, for example, was 79th out of 88 with some of the lowest property taxes in the county. Luckily, the LA times has broken down property taxes for all the county’s 88 cities.

See where you rank and ask yourself, are you paying too much? If so, then it may be time to move.

The post Breaking Down Los Angeles Property Taxes appeared first on - Elika Real Estate.

October 31, 2017

Final Walk-Through Pre-Closing Checklist – Be Prepared

The first step toward a successful walk-through is to make sure you come prepared so you can document the condition of the property. Bring a camera to take photos of any areas of the apartment that does not meet your standards and to keep a visual record of the condition. Have a pen and paper so you can take notes. Be sure to have a cell phone charger to check that all electrical outlets function. Also, bring a tape measure to ensure your furniture will fit in the elevator and through the halls and doorways.

In addition to being prepared with the right equipment, it’s also important to have a clear plan for what you’re going to check. Since an unorganized walkthrough is not going to be successful, we’ve simplified this process by putting together a comprehensive checklist.

By following each item on the checklist below, you’ll be able to get to everything that should be addressed during the walkthrough. That will give you peace of mind, as well as make this experience as efficient as possible.

Once you complete the walkthrough with your buyer’s agent or owner, be sure to let your attorney know if all is ok or if there are any issues that may require negotiating repairs or escrow at closing.

So without further ado, here’s everything you’ll need to check at walkthrough:

Walk-Through Checklist

GENERAL CHECKS

Check for any signs of an insect rodent infestation, such as droppings or chew marks.YESNO

Make sure home phone or cable jacks are available, and that they are functioning and accessible.YESNO

Check for floor creaks, noticeable cracks in plaster or drywall that might have been covered before the previous owner moved out, which could be signs of structural damage.YESNO

Turn on all light switches, the microwave, and the A/C unit at the same time to be sure a breaker doesn’t trip.YESNO

SAFETY CHECKS

Check to see that smoke and carbon monoxide detectors are working and in the appropriate areas, and ensure that fire extinguishers are in place.YESNO

Find the fire escape plan if your home is in an apartment building, and make sure you know where to go in the event of a fire or other emergency.YESNO

Check each electrical outlet by plugging in a cell phone charger or another electronic device.YESNO

DOOR AND WINDOW CHECKS

Check all windows and doors to make sure they operate properly.YESNO

Try all locks and doorknobs to ensure they are secure and not wobbly. If there is more than one type of lock, ask your building super for a key for each lock.YESNO

Be sure window screens function.YESNO

KITCHEN CHECKS

Turn on all the burners on the stove to make sure they light.YESNO

Open and close the oven door, and check that all racks are in the oven. Check the broiler and make sure it works.YESNO

Open and close the refrigerator doors and pull out every drawer. Check for any musty smells. If there is an ice-maker, check to see if it works. Make sure the fridge is chilly and the freezer is cold.YESNO

Check all other appliances (microwave, dishwasher, etc.) and make sure they are in good working order.YESNO

Examine tile for any scrapes, scuffs and cracks, and check the counter tops for any stains, burn marks or chips.YESNO

Open and close all the cupboard doors and drawers. Check for chips and dings.YESNO

BATHROOM CHECKS

Flush toilets to make sure the plumbing works properly. Look inside the tank to be certain the handle is sturdy.YESNO

Check for leaks under the sink by running every faucet. Look under the sink to make sure there are no drips, water discolorations or odors. Fill up the sinks to make sure they hold water and drain properly.YESNO

Make sure the shower-head works, and the water pressure is good. Test the hot water to ensure it heats up in a timely manner. Fill the tub with water to be sure that it drains well.YESNO

Open the medicine cabinet door to be certain it works well.YESNO

BEDROOM AND LIVING ROOM CHECKS

If the air conditioner is in the window, test it on low, medium, and high to be certain it cools. Listen for any strange sounds and be aware of any weird smells, which could be a sign that the filter needs to be changed.YESNO

Open and close the blinds to make sure they work properly.YESNO

Look for cracks and dents in the baseboards.YESNO

Check for stains in the carpet, chipped paint, peeling wallpaper, and large holes in the wall.YESNO

Make sure the fireplace (if there is one) is in working condition.YESNO

Once you and your broker have completed the walk-through, schedule any repairs, and make sure to sign a document detailing the agreed-upon condition of the property before going to closing.YESNO

The post Final Walk-Through Pre-Closing Checklist – Be Prepared appeared first on - Elika Real Estate.

Pre-Closing Final Walk-Through Checklist – Be Prepared

The first step toward a successful walk-through is to make sure you come prepared so you can document the condition of the property. Bring a camera to take photos of any areas of the apartment that does not meet your standards and to keep a visual record of the condition. Have a pen and paper so you can take notes. Be sure to have a cell phone charger to check that all electrical outlets function. Also, bring a tape measure to ensure your furniture will fit in the elevator and through the halls and doorways.

In addition to being prepared with the right equipment, it’s also important to have a clear plan for what you’re going to check. Since an unorganized walkthrough is not going to be successful, we’ve simplified this process by putting together a comprehensive checklist.

By following each item on the checklist below, you’ll be able to get to everything that should be addressed during the walkthrough. That will give you peace of mind, as well as make this experience as efficient as possible.

Once you complete the walkthrough with your buyer’s agent or owner, be sure to let your attorney know if all is ok or if there are any issues that may require negotiating repairs or escrow at closing.

So without further ado, here’s everything you’ll need to check at walkthrough:

Walk-Through Checklist

GENERAL CHECKS

Check for any signs of an insect rodent infestation, such as droppings or chew marks.YESNO

Make sure home phone or cable jacks are available, and that they are functioning and accessible.YESNO

Check for floor creaks, noticeable cracks in plaster or drywall that might have been covered before the previous owner moved out, which could be signs of structural damage.YESNO

Turn on all light switches, the microwave, and the A/C unit at the same time to be sure a breaker doesn’t trip.YESNO

SAFETY CHECKS

Check to see that smoke and carbon monoxide detectors are working and in the appropriate areas, and ensure that fire extinguishers are in place.YESNO

Find the fire escape plan if your home is in an apartment building, and make sure you know where to go in the event of a fire or other emergency.YESNO

Check each electrical outlet by plugging in a cell phone charger or another electronic device.YESNO

DOOR AND WINDOW CHECKS

Check all windows and doors to make sure they operate properly.YESNO

Try all locks and doorknobs to ensure they are secure and not wobbly. If there is more than one type of lock, ask your building super for a key for each lock.YESNO

Be sure window screens function.YESNO

KITCHEN CHECKS

Turn on all the burners on the stove to make sure they light.YESNO

Open and close the oven door, and check that all racks are in the oven. Check the broiler and make sure it works.YESNO

Open and close the refrigerator doors and pull out every drawer. Check for any musty smells. If there is an ice-maker, check to see if it works. Make sure the fridge is chilly and the freezer is cold.YESNO

Check all other appliances (microwave, dishwasher, etc.) and make sure they are in good working order.YESNO

Examine tile for any scrapes, scuffs and cracks, and check the counter tops for any stains, burn marks or chips.YESNO

Open and close all the cupboard doors and drawers. Check for chips and dings.YESNO

BATHROOM CHECKS

Flush toilets to make sure the plumbing works properly. Look inside the tank to be certain the handle is sturdy.YESNO

Check for leaks under the sink by running every faucet. Look under the sink to make sure there are no drips, water discolorations or odors. Fill up the sinks to make sure they hold water and drain properly.YESNO

Make sure the shower-head works, and the water pressure is good. Test the hot water to ensure it heats up in a timely manner. Fill the tub with water to be sure that it drains well.YESNO

Open the medicine cabinet door to be certain it works well.YESNO

BEDROOM AND LIVING ROOM CHECKS

If the air conditioner is in the window, test it on low, medium, and high to be certain it cools. Listen for any strange sounds and be aware of any weird smells, which could be a sign that the filter needs to be changed.YESNO

Open and close the blinds to make sure they work properly.YESNO

Look for cracks and dents in the baseboards.YESNO

Check for stains in the carpet, chipped paint, peeling wallpaper, and large holes in the wall.YESNO

Make sure the fireplace (if there is one) is in working condition.YESNO

Once you and your broker have completed the walk-through, schedule any repairs, and make sure to sign a document detailing the agreed-upon condition of the property before going to closing.YESNO

The post Pre-Closing Final Walk-Through Checklist – Be Prepared appeared first on - Elika Real Estate.

Pre-Closing WalkThrough Checklist – Be Prepared

The first step toward a successful walk-through is to make sure you come prepared so you can document the condition of the property. Bring a camera to take photos of any areas of the apartment that does not meet your standards and to keep a visual record of the condition. Have a pen and paper so you can take notes. Be sure to have a cell phone charger to check that all electrical outlets function. Also, bring a tape measure to ensure your furniture will fit in the elevator and through the halls and doorways.

In addition to being prepared with the right equipment, it’s also important to have a clear plan for what you’re going to check. Since an unorganized walkthrough is not going to be successful, we’ve simplified this process by putting together a comprehensive checklist.

By following each item on the checklist below, you’ll be able to get to everything that should be addressed during the walkthrough. That will give you peace of mind, as well as make this experience as efficient as possible.

Once you complete the walkthrough with your buyer’s agent or owner, be sure to let your attorney know if all is ok or if there are any issues that may require negotiating repairs or escrow at closing.

So without further ado, here’s everything you’ll need to check at walkthrough:

Walk-Through Checklist

GENERAL CHECKS

Check for any signs of an insect rodent infestation, such as droppings or chew marks.YESNO

Make sure home phone or cable jacks are available, and that they are functioning and accessible.YESNO

Check for floor creaks, noticeable cracks in plaster or drywall that might have been covered before the previous owner moved out, which could be signs of structural damage.YESNO

Turn on all light switches, the microwave, and the A/C unit at the same time to be sure a breaker doesn’t trip.YESNO

SAFETY CHECKS

Check to see that smoke and carbon monoxide detectors are working and in the appropriate areas, and ensure that fire extinguishers are in place.YESNO

Find the fire escape plan if your home is in an apartment building, and make sure you know where to go in the event of a fire or other emergency.YESNO

Check each electrical outlet by plugging in a cell phone charger or another electronic device.YESNO

DOOR AND WINDOW CHECKS

Check all windows and doors to make sure they operate properly.YESNO

Try all locks and doorknobs to ensure they are secure and not wobbly. If there is more than one type of lock, ask your building super for a key for each lock.YESNO

Be sure window screens function.YESNO

KITCHEN CHECKS

Turn on all the burners on the stove to make sure they light.YESNO

Open and close the oven door, and check that all racks are in the oven. Check the broiler and make sure it works.YESNO

Open and close the refrigerator doors and pull out every drawer. Check for any musty smells. If there is an ice-maker, check to see if it works. Make sure the fridge is chilly and the freezer is cold.YESNO

Check all other appliances (microwave, dishwasher, etc.) and make sure they are in good working order.YESNO

Examine tile for any scrapes, scuffs and cracks, and check the counter tops for any stains, burn marks or chips.YESNO

Open and close all the cupboard doors and drawers. Check for chips and dings.YESNO

BATHROOM CHECKS

Flush toilets to make sure the plumbing works properly. Look inside the tank to be certain the handle is sturdy.YESNO

Check for leaks under the sink by running every faucet. Look under the sink to make sure there are no drips, water discolorations or odors. Fill up the sinks to make sure they hold water and drain properly.YESNO

Make sure the shower-head works, and the water pressure is good. Test the hot water to ensure it heats up in a timely manner. Fill the tub with water to be sure that it drains well.YESNO

Open the medicine cabinet door to be certain it works well.YESNO

BEDROOM AND LIVING ROOM CHECKS

If the air conditioner is in the window, test it on low, medium, and high to be certain it cools. Listen for any strange sounds and be aware of any weird smells, which could be a sign that the filter needs to be changed.YESNO

Open and close the blinds to make sure they work properly.YESNO

Look for cracks and dents in the baseboards.YESNO

Check for stains in the carpet, chipped paint, peeling wallpaper, and large holes in the wall.YESNO

Make sure the fireplace (if there is one) is in working condition.YESNO

Once you and your broker have completed the walk-through, schedule any repairs, and make sure to sign a document detailing the agreed-upon condition of the property before going to closing.YESNO

The post Pre-Closing WalkThrough Checklist – Be Prepared appeared first on - Elika Real Estate.

October 30, 2017

To Rent or Buy in L.A.? Everything You Need to Know

Los Angeles has so much to offer, whether you’re here for the beautiful beaches or the excitement of L.A. nightlife. There are a million reasons to live here. But while there’s a lot to love about calling Los Angeles home, the cost of living is not one of them. The question for many is, can they afford it? Prices in recent years have risen considerably. LA Weekly recently made the sensational claim that “Living in L.A. is officially impossible.”

While that statement does have some truth to it, living in Los Angeles can be more affordable if you know how to stretch your dollars and get the most out of your money. Deciding whether to rent or buy in Los Angeles is a complicated matter. But in the end, the numbers don’t lie. If you can afford to, buying a home will save you money in the long run.

Image by Michael / Flickr

Buying is Still Cheaper Than Renting in Los Angeles

The median cost of a home in Los Angeles now sits at more than $630,000. That’s well over three times the national average of $200,000, according to CNBC. But just because L.A. housing prices are sky high doesn’t mean you should rent instead of buy. If you have good credit and enough cash squirreled away for the down payment, then buying a home is definitely cheaper in the long run.

Due to low-interest rates, buying a home is still 37.7% cheaper than renting a home in Los Angeles. Housing prices have soared in the last few years, but so have rental prices. At its lowest point in February of 2012, the median home price was $373,000. Rental units were consistently low between 2011 and 2013, averaging around $2,400. But median rent in the L.A. area has ballooned to $3,500, so as long as interest rates stay low, buying is still the cheaper option.

Who Should Rent a Home in Los Angeles

Even with soaring rent prices, not everyone can afford to buy a home in Los Angeles. In order to get favorable interest rates for a mortgage, you must have good credit. It’s also preferable to have 20 percent to put down on a house, although many loan programs allow for a down payment as low as 3.5 percent.

When it comes to affording the average rent, you’ll still need upfront cash. Take the average $3,500 price tag and consider that you’ll need first and last month’s rent upfront—that’s $7,000. Still, it’s considerably less than you’ll need for a down payment at any percentage.

There are, of course, other considerations that make renting more feasible. A lease likely only lasts for one year, whereas a mortgage will last much, much longer. Rental insurance is also much cheaper than homeowners insurance, averaging around $1,000 per year right now in Los Angeles.

It’s not always about money, however. L.A. is a rich and diverse place. Buying a home means staying in one place longer. If you want to get to know different neighborhoods within Los Angeles, there’s no better say than to live in them. Moving every year or so maybe a hassle for some, but for others, it may be the perfect opportunity to explore a new place and immerse yourself in a new community.

Whether you buy or rent is largely up to your circumstances and your disposition. You need to make the decision based not just on your financial circumstances but also your life and your lifestyle. Either way, Los Angeles is a great place to live and maybe impossible to leave.

The post To Rent or Buy in L.A.? Everything You Need to Know appeared first on - Elika Real Estate.

October 29, 2017

Understanding Real Estate Agency Types – NYS Agency Disclosure Form

You should understand the legal responsibilities your real estate agent has to you and the other parties in the transaction. If you are a Home Buyer ask your buyer’s agent to explain the type of agency relationship they have with you and with the brokerage company. In our article, we discuss the different agency types and their duties. New York State law requires the agent present you with the agency disclosure form provided below at your first meeting. Whether you are a home buyer, investor or seller it is important to understand duties owed to you.

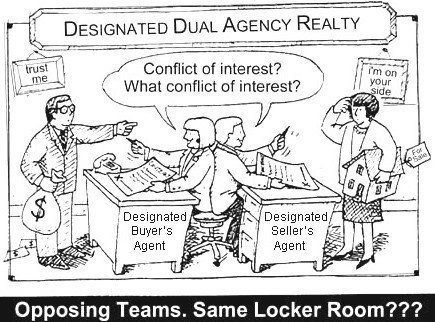

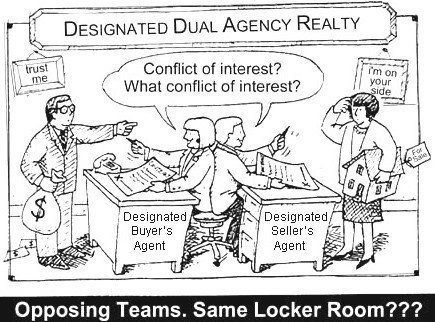

Image by Notorious-Rob.com

Image by Notorious-Rob.com

Seller’s Agent:

The seller hires a listing agent to represent him or her. The agent’s fiduciary responsibilities are to the seller alone. The agency relationship is created by the listing agreement.

Buyer’s Agent:

The buyer hires a buyer’s agent to represent them in a real estate transaction. The buyer’s agent owes fiduciary responsibility solely to the buyer. The buyer’s agent can work for a straight fee paid by the buyer, or receive payment from the seller via a commission split with the listing agent.

Broker’s Agent:

These agents work in cooperation with or at the behest of a listing agent or a buyer’s agent. Significantly, the broker’s agent does not work for the same firm as the listing/buyer’s agent with whom they are engaged. These agents don’t have a direct relationship with either buyer or seller.

Dual Agent:

Dual agency is a relationship that occurs when the brokerage firm represents both the buyer and the seller in the same real estate transaction. Dual agents have limited fiduciary responsibilities, and there is a potential for conflict of interest. Because of this, all parties in a dual agency relationship must give their informed consent. Disclosed dual agency, in which both the buyer and the seller are aware that a single agent is representing both of them, is legal in most states. Understand the perils of dual agency.

Dual Agent with Designated Sales Agent:

This is a brokerage practice that allows the managing broker to designate which agents in the brokerage will act as the agent for the seller and which will represent the buyer. Designated agency avoids many of the pitfalls associated with a dual-agency relationship. The designated agents give their clients full representation, with all the attendant fiduciary duties. The broker supervises both groups of agents.

The Importance of a Qualified Buyer’s Agent:

At Elika, we understand why different properties appeal to different buyers; so we know how to present you with properties that fit your lifestyle. We help with the deluge of paperwork also associated with buying a home. We help make sure that our clients understand the purchasing timeline. And by keeping our clients informed every step of the way, we keep the process relaxed. As we are familiar with New York neighborhoods and properties, we can also offer a professional, experienced point-of-view, which is valuable when applying, negotiating, and financing.

New York is one of the most culturally diverse cities in the world. With many beautiful neighborhoods to choose from, limitless food and entertainment options, and relatively stable property values, it is easy to see why people decide to buy New York Real Estate Unfortunately, it is also easy to make simple mistakes when purchasing in the city. Proper buyer’s representation from Elika is an essential tool that will eliminate the errors, and reduce your stress while getting the best possible real estate deal.

Designated Agency:

You might have heard the term “designated agency” in real estate circles. In a single real estate transaction, this term refers to the buyer’s agent and the seller’s agent working for the same brokerage firm. In this scenario, the buyer and the seller are denied true representation, and one firm earns the full commission.

Dual Agency:

Similar to the designated agency, dual agency defines the relationship between a single real estate broker who represents the buyer and seller in the same real estate transaction. In both dual agency and designated agency, the brokers who are employed by the same real estate firm are prohibited by law from negotiating for their clients (the buyer and seller), but instead, more focused on closing the transaction. What’s more, under these circumstances, brokers can be privy to confidential information from the buyer and seller that they would not have had access to otherwise. Even though legal in New York State, these types of agency are considered conflicts of interest, in that they do not provide undivided loyalty to the client. Instead, these relationships are profitable for the brokerage firm and discourage trust between the broker and their client.

For these reasons, when purchasing property in NYC, it’s best to work with an exclusive buyer’s agent, one with whom you can build a relationship. A knowledgeable, excellent buyer’s agent will negotiate on your behalf. Based on the Real Estate Board of New York’s co-brokering policies, either the seller pays the full commission (usually ranges from 4 to 6 percent) to the listing agent, or the commission is split 50/50 between the buyer’s agent and the broker who listed the property. Regardless of the listing price, legally, that amount of commission will be paid, so it’s probably a wise idea to take advantage of the expertise of a buyer’s agent and reap the benefits mentioned above.

NYS Real Estate Agency Disclosure

The post Understanding Real Estate Agency Types – NYS Agency Disclosure Form appeared first on - Elika Real Estate.

October 27, 2017

Los Angeles Closing Costs: What to Expect at a Real Estate Closing

Closing costs are a fact of life when purchasing or selling a home in Los Angeles. If you’re purchasing a home in L.A. you should expect closing costs to be between 2 percent to 5 percent. Sellers, on the other hand, can expect to pay between 5 percent and 10 percent in closing costs. While Hawaii has the highest closing costs in the country, California isn’t far behind. It’s not necessarily that the percentage points are higher, but if you consider that the median home price in Los Angeles is over $600,000, it’s not surprising at all.

Luckily, you won’t be caught off guard by the price tag when you close. In fact, you’ll receive a Good Faith Estimate (GFE) from your lender and paperwork explaining all of the final closing costs. This happens well before you actually close on your home. You can also understand what to expect in general so you can make an informed decision.

Closing Costs for Buyers in Los Angeles

While the seller pays a higher percentage of closing costs, as the buyer, you’ll face more line items. Unless you have negotiated with the seller to pick up some of your closing costs, these are some of the fees you can expect to pay.

The most expensive fee you can expect to pay at closing is likely to be the loan origination fee. This is a one-time fee the lender charges for processing your loan application, usually between 0.5 percent and 1 percent of the purchase price of the house. So a $500,000 home would likely incur up to a $5,000 loan origination fee.

While it’s not required by California law, your lender will likely require you to prepay homeowners insurance for a full year when closing on your new home. Surprisingly homeowners are not required to have insurance by the state, but considering that 5,700 buildings have burned in Northern California’s most recent fires, it’s easy to see why it’s a lender requirement.

Other fees you can expect to pay include an appraisal fee, bank processing fee, tax servicing fee, recording fee, notary fee, and title insurance. These are all smaller costs, but put them all together and they’ll quickly add up. When figuring out the cash you’ll need to close, be sure to consider all of these potential costs so you know the best way to negotiate your offer.

Closing Costs for Sellers in Los Angeles

While the loan origination fee is the largest one paid by the buyer, it’s not the largest overall closing cost. The commission on the sale of a home is the largest single expense in the entire process, and it’s paid by the seller. In Los Angeles, the average commission on the sale of a home is around 6 percent. While the commission is split between the buying and selling agents, the sellers pay the commission on the sale of the home at closing. On a $500,000 house, that comes to $30,000. Other fees paid by the seller may include any unpaid property taxes and homeowners association fees or dues.

What to Expect When Closing on a Home

Expect to sign a lot of documents when closing on a house, whether you’re buying or selling. Real estate transfer documents, such as the deed, bill of sale, and affidavit, will all need to be signed. Home loan documents also need to be signed at closing. These can include the mortgage, loan application, and loan estimate, among others. There’s a lot that goes into purchasing or selling a home whether you’re in Los Angeles, New York, or elsewhere. Having an idea of what to expect can make the experience less painful while minimizing surprises.

The post Los Angeles Closing Costs: What to Expect at a Real Estate Closing appeared first on - Elika Real Estate.

5 Signs your House is Haunted – Happy Halloween

Signs your House is Haunted:

Signs your House is Haunted:The Match Test – If you light a candle and it flickers blue, there is a ghost present!

Strange Feelings – If the house feels very depressing, or the atmosphere in the house feels very thick and heavy.

Unusual Smells – Some ghosts are accompanied by a terrible stench. Usually, these are negative, nasty ghosts.

Pets Act Paranoid – If it’s an unfriendly ghost, dogs will growl or cower for no apparent reason.

Weird Sounds – Often there are raps or knocks on the walls in a series of threes – like three, six or nin raps. People hear walking, like footsteps.

Protect your house from Ghouls!

The post 5 Signs your House is Haunted – Happy Halloween appeared first on - Elika Real Estate.

October 26, 2017

Tips to Buying a New York City Investment Property

If you want to earn some serious cash, New York City offers a unique opportunity for property investors. There are a lot of renters to go along with the plethora of condos. If you are interested in going down this path, we offer some tips on how to make this a profitable venture.

The market dynamics

Approximately 45% of New York City Housing consists of rental units, according to the U.S. Census Bureau’s American Community Survey, presented by the National Multifamily Housing Council. This is the highest among cities in the United States. For instance. Los Angeles had 39% or its housing devoted to rental, while San Francisco’s was 37%.

Other sources estimate about 67% of Manhattan’s housing stock are rentals.

While there is a ready source of demand, the economy is performing well. In August, the city’s unemployment rate fell to a low 4.9% from 5.4% last year.

These stats point to strong rental market.

Image by Mario Cuitiño /Flickr

Picking an area

Your decision on which neighborhood to invest in comes down to the risk/reward, similar to any investment. If you have a high tolerance for risk, an up-and-coming area should provide you have higher price appreciation potential and a higher capitalization (cap) rate.

You may feel comfortable purchasing an apartment to rent in an established neighborhood. In our experience, below 23rd street offers the best rental potential. There are a lot of amenities that draw people, such as the nice restaurants and cafes. You can draw comfort that it has been this way for decades.

The more established areas are, the safer choice, particularly in today’s market. While more speculative properties should have more capital appreciation upside, you are in for a wilder ride when the housing market corrects. The rental yields are not necessarily higher than you could expect to receive in a more established area. Our simple rule is to invest in areas where New Yorkers want to live, and there is a lack of competition from rental buildings.

“It is best to buy an apartment that a New Yorker would appreciate and want to live in,” Gea Elika, principal broker at Elika Real Estate and Director of The National Association of Exclusive Buyers Agents (NAEBA) said.

Choosing a rental unit

The same factors that go into choosing the right residential property to invest are useful in finding a property that the will outperform as a rental (e.g., neighborhood, building). There are other things to consider since this is an investment property, however.

Condo units are easier to rent than co-op units. The former typically has less restrictive rules regarding renting, with some placing a complete ban while others limit the amount of time. It is also likely to take longer to purchase a co-op since you have to pass muster with the board. While you may be willing to bear this hindrance if you plan to live there, the extra time means a longer closing and a delay in rental payments.

Delving deeper, you will find one, and two bedroom units are easier to rent than three bedroom condos. Three bedroom units compete with single-family homes. If you choose a studio, your unit may be vacant a greater amount of time since the tenant may leave for a bigger apartment.

There is further work to do, such as the rent a similar unit fetches. A buyer’s agent can help you with this information.

Final thoughts

It is important to budget your cash inflows and outflows, and calculate how a potential vacancy affects your finances.

While not a get rich scheme, rental units can provide a steady source of extra income. If you choose, you can use your income stream to buy additional properties as time goes on.

The post Tips to Buying a New York City Investment Property appeared first on - Elika Real Estate.