Gea Elika's Blog, page 123

April 7, 2018

What goes into a Exclusive Listing Agreement when Selling Real Estate?

You’ve thought it out, and now, at last, you’re ready to sell your home. If you’re like the vast majority of sellers in NYC, you’ll be hiring a listing agent to help with the sale. The benefits of having a good agent are well established, and if you’re in a hurry to sell, they can more than pay for themselves. Once you’ve met and interviewed prospective brokers and found one you’re happy with it’s time to sign the exclusive listing agreement. This is a relatively straightforward procedure, but it helps to understand what goes into one. Here’s what you need to know about exclusive listing agreements with NYC brokers.

Exclusive Listing Agreement Sample Below

What is a listing agreement?

A listing agreement is a contract between a seller and a real estate agent (listing agent) that says the agent has the right to list your house. These contracts are good for the agent, as it obligates you to work with them for a set time. It’s also good for the seller because it sets out the responsibilities of the agent and what you can do if they don’t meet them. It’s essential that you understand the terms of the agreement as you’ll be bound legally by them.

Usually a page or two long, these contracts are typically written in straightforward language. Brokerage firms usually have their in-house form that individual agents adapt as necessary. Keep in mind that you can have some terms changed or added if you’re not happy with something.

What goes into a listing agreement?

It’s essential that you read the contract carefully. If something seems a bit vague, ask the agent for clarification. Although it’s uncommon to have an attorney look over the contract, it certainly wouldn’t hurt. These are the most important things that you’ll see in any listing agreement.

The Commission – this is the amount you’ll pay the agent. The standard amount in NYC is 6% of the selling price, but you may be able to negotiate a lower rate if you have a previous relationship with the broker or have multiple properties to sell.

Exclusive right to sell – this gives exclusive rights to the agent to list, market and sell your home for the duration of the agreement.

Duration – the contract will specify when it starts and ends. This is usually for six months, but three-month agreements are not uncommon. Three to six months should be fine, but if it hasn’t been sold by then, it could signal that something may be wrong. If so then you can always reevaluate the price or marketing.

Safety and protection clauses – while the contract will have an expiration date it’s likely it’ll also include a clause to protect the broker after that date. This prevents a seller from holding back on a buyer until the agreement expires to avoid paying the commission.

Duties – the exact responsibilities of the agent will usually be spelled out. This is worth looking closely at. If there’s something you disagree with or would like added, you can always negotiate changes.

Representations – you may also be required to verify your legal position to sell the property.

Dispute Resolution – the contract will state how any disputes will be handled should they occur. For instance, through mediation or binding aberration

There are several other things that the listing agreement may state, such as the marketing plan and whether or not co-brokering is allowed, but this is the bare bones of most contracts. One other thing you’ll likely find in NYC contracts is a particular notice on lead-based paint. Any property built before 1978 is legally obliged to disclose to the buyer any information on its presence.

Don’t sign until you’ve read everything and also don’t be afraid to ask for amendments if you’re uncomfortable with something. Listing agreements are very straightforward but as with anything that you’re being asked to sign you should always read through it carefully.

Exclusive Listing Agreement Sample

Date:

Address: 555 Park Avenue, New York, NY 10055

Re: Listing Agreement for 555 Park Avenue, New York, NY 10055

Dear Mr & Mrs Smith

Thank you for choosing ACME Residential to market your apartment. We have already discussed the various steps to be taken to bring you as many well-qualified customers as possible and I assure you that I am committed to getting you the best possible price in the shortest possible time.

The following reflects the agreement between us. If this meets with your approval, please sign and return the enclosed copy.

You have employed ACME Residential as a real estate broker with exclusive right to sell the above-captioned apartment. You represent that Mr & Mrs. Smith, Inc. the owner of the above property.

This agreement shall be effective as of August 20, 2018. It shall continue in full force and effect until November 20, 2018.

ACME Residential is authorized to offer the apartment for sale at a price of $1,000,000 and to represent that the common charge of the apartment is currently $1,000 per month, and the Real Estate tax is $900 per month.

ACME Residential is authorized to solicit the cooperation of other licensed real estate brokers who will act as agents for the prospective purchasers and to work with them on a cooperating basis for the sale of the above apartment. If the apartment is sold pursuant to this agreement, whether to a Purchaser or to the Board of Managers who has exercised its right of first refusal, including a sale to the Lessee whether during the term of this agreement of afterward, ACME Residential ’s fee for service to be paid by you shall be five (5%) percent of the total sale price of the apartment. In the event another licensed real estate broker solicited by us is involved in this transaction, ACME Residential shall pay the cooperating broker a fee for service by separate agreement with such broker and in no such event shall the fee for service paid by you exceed five (5%) percent of the selling price.

During the term of this exclusive right, you agree to refer to ACME Residential all inquiries, proposals and offers received by you regarding the apartment, including, but not limited to those from principals and other brokers, and you agree to conduct all negotiations with respect to the sale or other disposition of the apartment solely and exclusively through ACME Residential.

Within three (3) business days after the expiration of the listing term, we shall deliver to you in writing a list of no more than six (6) names of persons who inspected the premises during the listing term. If within three (3) months after the expiration of the listing term a contract is signed to sell the premises to a person on said list, we shall be entitled to the service fee paid by you which will equal to and in no event shall exceed either: a. five (5%) percent of the selling price when the purchaser is represented by an outside cooperating broker; or b. three (3%) percent of the selling price when the buyer presented is a direct client of ACME Residential.

In the event that any settlement monies due to buyer’s default on a fully executed contract with all contingencies fulfilled is received by you, ACME Residential will be entitled to 10% of said monies. In the situations, when the property subsequently gets sold to another buyer from the said list within three (3) months after the contract expires, ACME Residential shall apply received 10% of the settlement monies toward the amount of the service fee paid by you, which should be equal to but in no event exceeding five (5%) of the selling price for non-direct sale, or three (3%) percent of the selling price for direct sale.

ACME Residential represents you, the Seller, on ACME’s exclusives.

Special Lead Paint Notification:

If your property was built before 1978, you have an obligation to disclose to the Purchaser and the Purchaser’s agent all information known to you regarding the presence of lead-based paint and lead-based paint hazards within this target housing. All information known to the Seller’s agent regarding the presence of lead-based paint and lead-based paint hazards within this target housing will be disclosed to the Purchaser. Federal laws require that the Purchaser is given a 10-calendar day period (unless otherwise agreed in writing) to conduct a risk assessment or inspection for the presence of lead-based paint before becoming obligated under the Contract of Sale to purchase the target housing.

Fair Housing Notification:

ACME Residential is committed to upholding the city, state and federal Fair Housing requirements prohibiting discrimination.

This agreement shall bind and benefit the personal representatives, successors or assigns of the parties.

Facsimile signatures shall be construed and considered original signatures for purposes of enforcement of the terms of this Agreement. Same may be executed in counterparts and taken together shall constitute the whole of this Agreement. This agreement may not be changed, rescinded, or modified except in writing, signed by both of us.

Agreed and Accepted by the Property Owner____________________

ACME Residential____________________

The post What goes into a Exclusive Listing Agreement when Selling Real Estate? appeared first on | ELIKA Real Estate.

April 6, 2018

Home Appraisals in NYC: What you need to know

If you’re looking to refinance a mortgage or buy a home through a loan, the lender will need what’s called an appraisal on the home. This is an objective assessment of the value of the home. Something of great importance to a lender considering this is their collateral on loan. Whether you’re a buyer or seller, it will help you immensely to understand how the appraisal process works. Here you’ll find everything you need to know about home appraisals in NYC and how they work.

What do home appraisals involve?

The job of an appraiser is similar to a home inspector but differs in some respects. The appraiser will look through the home, considering the land it’s on as well as other things to arrive at an estimate of the properties market value. Everything, whether big or small, will be taken into account. It will then be compared with like-kind properties that sold in the past 12 months to arrive at a final appraisal price.

What goes into a home appraisal?

Even if a buyer loves a place and is fine with the price, the lender will still require that a third party – in the form of an appraiser – take a look at it to determine its value. To arrive at an accurate estimate of the home’s value, they will look at every area of the property. This includes all of the following:

The exterior of the Home – the appraiser will look at every part of the construction. This consists of the foundation, roof, and walls, looking for any problems that could lower its value.

Size of the Property – the value of a home depends a great deal on the size of the square feet and lot. The more rooms and bathrooms bring a higher valuation. Knowing the floor area (FAR) of the property will tell you whether or not it has space for extensions which factors into its market value.

Condition – just like the exterior, the interior of the home will be looked at closely. This includes the flooring, kitchen, plumbing, electrical, lighting and plumbing components of the home.

Improvements – if any new additions have been made to the original construction this will also be factored in. A new bathroom or HAVC system can add many more years of life to the property which pushes the value higher.

Who is the appraisal information available to?

The information and final verdict gathered by the appraiser is entirely at the disposal of the one who ordered it, in most cases the lender. It is entirely at their discretion how this information is distributed, regardless of who paid for it. However, if the buyer orders the appraisal, the lender is required by law to provide them with a copy.

How long is an appraisal valid for?

In most cases, an appraisal is valid for six months. However, market prices can change fast so a lender may only consider an appraisal valid for no more than three months in some cases. Sometimes an appraisal will need to be recertified if it’s considered out of date. Any changes, both to the market and the property, can drastically affect its price.

As such, it’s often better than a seller does not get an appraisal as a way to justify the asking price. The buyer’s lender will still want to see their one from an independent source.

Summary

Appraisals are a standard part of any real estate purchase that requires mortgage financing. Understanding how they work will make the buying process, for both buyer and seller much easier. If you’re a seller, especially for a townhouse, expect to be dealing with this when a potential buyer shows up.

The post Home Appraisals in NYC: What you need to know appeared first on | ELIKA Real Estate.

Everything you Need to Know about Home Appraisals in NYC

If you’re looking to refinance a mortgage or buy a home through a loan, the lender will need what’s called an appraisal on the home. This is an objective assessment of the value of the home. Something of great importance to a lender considering this is their collateral on loan. Whether you’re a buyer or seller, it will help you immensely to understand how the appraisal process works. Here you’ll find everything you need to know about home appraisals in NYC and how they work.

What do home appraisals involve?

The job of an appraiser is similar to a home inspector but differs in some respects. The appraiser will look through the home, considering the land it’s on as well as other things to arrive at an estimate of the properties market value. Everything, whether big or small, will be taken into account. It will then be compared with like-kind properties that sold in the past 12 months to arrive at a final appraisal price.

What goes into a home appraisal?

Even if a buyer loves a place and is fine with the price, the lender will still require that a third party – in the form of an appraiser – take a look at it to determine its value. To arrive at an accurate estimate of the home’s value, they will look at every area of the property. This includes all of the following:

The exterior of the Home – the appraiser will look at every part of the construction. This consists of the foundation, roof, and walls, looking for any problems that could lower its value.

Size of the Property – the value of a home depends a great deal on the size of the square feet and lot. The more rooms and bathrooms bring a higher valuation. Knowing the floor area (FAR) of the property will tell you whether or not it has space for extensions which factors into its market value.

Condition – just like the exterior, the interior of the home will be looked at closely. This includes the flooring, kitchen, plumbing, electrical, lighting and plumbing components of the home.

Improvements – if any new additions have been made to the original construction this will also be factored in. A new bathroom or HAVC system can add many more years of life to the property which pushes the value higher.

Who is the appraisal information available to?

The information and final verdict gathered by the appraiser is entirely at the disposal of the one who ordered it, in most cases the lender. It is entirely at their discretion how this information is distributed, regardless of who paid for it. However, if the buyer orders the appraisal, the lender is required by law to provide them with a copy.

How long is an appraisal valid for?

In most cases, an appraisal is valid for six months. However, market prices can change fast so a lender may only consider an appraisal valid for no more than three months in some cases. Sometimes an appraisal will need to be recertified if it’s considered out of date. Any changes, both to the market and the property, can drastically affect its price.

As such, it’s often better than a seller does not get an appraisal as a way to justify the asking price. The buyer’s lender will still want to see their one from an independent source.

Summary

Appraisals are a standard part of any real estate purchase that requires mortgage financing. Understanding how they work will make the buying process, for both buyer and seller much easier. If you’re a seller, especially for a townhouse, expect to be dealing with this when a potential buyer shows up.

The post Everything you Need to Know about Home Appraisals in NYC appeared first on | ELIKA Real Estate.

Are Co-op Apartments in NYC a Good Investment?

When it comes to choosing a home in New York, the choice is usually between a co-op and condo. The two are vastly different in both the legal and financial areas as well as how you buy them. When it comes to co-ops, whether they make a good investment depends on what you are looking to do with it. Are you planning to live in it for many years or rent it out? Whichever one you choose, these are the areas you need to consider.

What is your budget?

The main selling point for co-ops is how much you can save on them compared condos. If you have your heart set on a condo but are on a tight budget, you may need to change your mind. Co-ops in NYC usually sell for 10-30% cheaper than condos of similar size and quality.

Co-ops are also far more plentiful in NYC then condos and in far less demand. Coupled with that you’ve got the co-op board approval process. It can be a long and sometimes frustrating ordeal that puts many people off. This combines to create very affordable prices for co-ops when compared to condos.

If plans change and you need to sell the process is far more expensive and complicated then selling a condo. The high closing costs of a co-op sale coupled with the flip tax discourage many speculative buyers.

How long do you plan to live there?

If you don’t see yourself staying there for the long-haul co-ops, do not make an ideal investment. If you only need a place for a few years or are planning to sublet, condos make far more sense. They’re easier to sell as you fully own the unit and there are usually few restrictions on subletting. Co-ops are more suited for long-term ownership and the most part, are not designed with investors in mind.

Most co-ops, if they allow it at all, require a period of residency before you can sublet your apartment. For example, a co-op board may allow sublets for every two out of five years. Which is still subject to board approval on a yearly basis. The subletting process for co-ops is entirely subject to board approval and a troublesome applications process that differs little from the board package purchase application that you have to go through when purchasing the unit.

How do you feel about disclosing all your finances?

Condo boards also require a financial statement and references, but the process is far more invasive and intense when buying a co-op. The co-op board is going to want to see everything as shareholder finances affect the whole building.

In addition to other things, they’ll want to see proof that you can cover the down payment, know how much money you’ll have after the sale is closed and your debt to income ratio. There’ll also be at least one in-person interview with the board in which they’ll judge whether you would make both a good buyer and neighbor. There’ll be questions about your family, your job, previous homes you’ve had and what your plans for the future are. You’ll need to be comfortable with this because without board approval there’s no way you’re getting that apartment.

Conclusion

Buyers with transparent employment and financial background on a budget who are looking to put down some roots will find co-ops to be an attractive investment. Although the board approval process can be long and intrusive, it does come with a feeling that you are part of a community, one that cares about the upkeep of the building and the kinds of tenants it allows.

However, those who only need a place for the short term or wish to sublet would be better to look at condos. The strict rules on subletting and the high closing costs on a sale make them far from ideal for speculative investors.

The post Are Co-op Apartments in NYC a Good Investment? appeared first on | ELIKA Real Estate.

Co-op Apartments in NYC: Are they a Good Investment?

When it comes to choosing a home in New York, the choice is usually between a co-op and condo. The two are vastly different in both the legal and financial areas as well as how you buy them. When it comes to co-ops, whether they make a good investment depends on what you are looking to do with it. Are you planning to live in it for many years or rent it out? Whichever one you choose, these are the areas you need to consider.

What is your budget?

The main selling point for co-ops is how much you can save on them compared condos. If you have your heart set on a condo but are on a tight budget, you may need to change your mind. Co-ops in NYC usually sell for 10-30% cheaper than condos of similar size and quality.

Co-ops are also far more plentiful in NYC then condos and in far less demand. Coupled with that you’ve got the co-op board approval process. It can be a long and sometimes frustrating ordeal that puts many people off. This combines to create very affordable prices for co-ops when compared to condos.

If plans change and you need to sell the process is far more expensive and complicated then selling a condo. The high closing costs of a co-op sale coupled with the flip tax discourage many speculative buyers.

How long do you plan to live there?

If you don’t see yourself staying there for the long-haul co-ops, do not make an ideal investment. If you only need a place for a few years or are planning to sublet, condos make far more sense. They’re easier to sell as you fully own the unit and there are usually few restrictions on subletting. Co-ops are more suited for long-term ownership and the most part, are not designed with investors in mind.

Most co-ops, if they allow it at all, require a period of residency before you can sublet your apartment. For example, a co-op board may allow sublets for every two out of five years. Which is still subject to board approval on a yearly basis. The subletting process for co-ops is entirely subject to board approval and a troublesome applications process that differs little from the board package purchase application that you have to go through when purchasing the unit.

How do you feel about disclosing all your finances?

Condo boards also require a financial statement and references, but the process is far more invasive and intense when buying a co-op. The co-op board is going to want to see everything as shareholder finances affect the whole building.

In addition to other things, they’ll want to see proof that you can cover the down payment, know how much money you’ll have after the sale is closed and your debt to income ratio. There’ll also be at least one in-person interview with the board in which they’ll judge whether you would make both a good buyer and neighbor. There’ll be questions about your family, your job, previous homes you’ve had and what your plans for the future are. You’ll need to be comfortable with this because without board approval there’s no way you’re getting that apartment.

Conclusion

Buyers with transparent employment and financial background on a budget who are looking to put down some roots will find co-ops to be an attractive investment. Although the board approval process can be long and intrusive, it does come with a feeling that you are part of a community, one that cares about the upkeep of the building and the kinds of tenants it allows.

However, those who only need a place for the short term or wish to sublet would be better to look at condos. The strict rules on subletting and the high closing costs on a sale make them far from ideal for speculative investors.

The post Co-op Apartments in NYC: Are they a Good Investment? appeared first on | ELIKA Real Estate.

April 3, 2018

Open House NYC – Insider Tips to Hosting a Successful Open House in NYC

A crucial part of selling any home in New York is the open house. When done right it can solicit multiple offers and more than cover the costs of it. When done poorly it can end up being a waste of both time and money. If you’re going to make it work you have to have it well planned out and organized. With a good combination of timing, marketing, and advertising you can see your investment pay off big.

Understanding the Open House

If you’re not familiar with the concept, an open house is a block of time when a property is available for viewing. It typically runs for 1-3 hours and is normally held on a weekend afternoon. People can just walk in and view the property for themselves to get an idea of what living there would be like. The listing agent will be present at all time to show people around and answer any questions.

However, many buildings in New York, especially co-ops, do not allow open houses. Some require that two agents be present at all times, others only allow open houses by appointment and others still have no restrictions whatsoever.

How to host an Open House in NYC

Every part of the plan for the open house should be well taught out before you advertise the date. Go through each of these areas and you’ll be able to plan and execute the best open house possible.

Choose the perfect time

The first thing to decide is what the best time and date is for hosting the open house. Sunday is the most common day, a legacy of the days when the real estate section of the Sunday newspaper drove most of the traffic. You’ll want it to be a time when you can attract the most potential buyers so stick with Sunday from 11-5pm, the most popular time slot.

The only exception to the Sunday rule is if it falls near a national or religious holiday. If that happens you should maybe consider either skipping the weekend or try a weeknight open house. After work hours on Tuesday and Wednesday from 6-7pm can work but just know that weekday open houses can be hit and miss.

Marketing and advertising

When it comes to advertising, start with a simple sign. Have it not just on the door of your unit but also the doors leading into the building. If the building has a doorman make sure you keep him in the loop so he can properly greet and direct any visitors.

Most importantly, if you don’t have any online advertising you effectively don’t have any advertising. A good listing agent can help you with this and put the word out to other brokers who could be willing to send potential buyers in exchange for a co-brokering commission.

If the building requires appointments make sure this is mentioned in the advertising. A potential buyer may get in but a doorman can be difficult to work within this situation.

Home Staging

Last but not least, get the apartment set up for the open house. It would really help to hire a staging expert for this. They can recommend what changes are needed that will make the home appeal to the most buyers.

All clutter and personal items should be stored away so the place looks as neutral as possible. The whole point of an open house is to help visitors envision what living there would be like. It’s hard to do that if you’ve got family photos and other personal items lying around. Every room should be deep cleaned and any defects, such as a crack in the wall, should be amended or covered up as a last resort.

If you can do just this much you should be able to make the most of your open house. With luck, you’ll get multiple offers that could even lead to a bidding war, more than justifying the expanse of the staging and marketing.

Checklist: 11 Tips to Host a Successful Open House in Your Apartment

If you’ve decided to pull the trigger and, you or your broker will more than likely be hosting open houses on a regular basis until you have a contract signed. Moreover, you’ll want to make sure your home is in top-notch shape and looking its best, so you stand out above the competition.

You may not have given your place’s appearance much thought, but primping goes a long way when it comes to your living space. While the list below might seem like menial work right this moment, I can assure you it’s necessary. In other words, keep your eyes on the prize –– an asking price offer –– as you check each item off the list and move one step closer to a sale.

1. Know your buyer.

Your broker can help you determine who your market is. If your apartment appears dated and isn’t appealing to the right age group, you’ll need to make a few changes to secure a sale. Knowing your buyer could mean losing grandma’s rocking chair or a few other tchotchkes temporarily, which brings me to number two.

2. De-clutter.

Clean house, and I don’t mean vacuum. That comes later. Your living space shouldn’t be cluttered or crowded, and if it is, pare down to the essentials and store the rest.

3. Rent a storage unit

If you don’t have basement storage or space for a family member, you’ll need to rent an outside storage unit for the duration until your home is sold. Don’t stuff closets and drawers. Potential buyers will open closets and look in every nook and cranny to see how you’ve lived in your apartment, so they, in turn, can imagine themselves living in the space.

4. Make repairs.

That leaky faucet? That floorboard that squeaks? Repair anything in your apartment that doesn’t work well. You’ll want ever last thing in tip-top shape when lookers start traipsing through.

5. Clean up.

Scrub every inch of your apartment. And if you hate to clean or it’s not your forte, hire a professional cleaning service to get the job done right.

6. Be sure halls are tidy

If your public spaces are dirty, ask your super to clean them, or take a broom yourself. Be sure your front door is clean and has a fresh coat of paint.

7. Let go emotionally.

Take down family photos and think of your apartment as an item you’re selling and not your home. It’s best to detach yourself emotionally from the get-go.

8. Buy fresh flowers.

Flowers add color and life to any room, so before each open house, head to the nearest bodega, purchase a bunch and arrange in a pretty vase.

9. Light a fragrant candle or use air freshener.

Everyone wants to live in a fresh-smelling apartment. Light a candle with a subtle fragrance to match the season in which you’re trying to sell.

10. Adjust temperature.

Run the air conditioning in the summer or at any warm time of the year, and if it’s the dead of winter, be sure your digs are warm and cozy.

11. Bake cookies or serve something cold to drink.

I don’t recommend turning the oven on if it’s July or August, but nothing makes any home smell better than cookies fresh out of the oven. In warmer months, try serving iced tea or lemonade to your open house guests.

The post Open House NYC – Insider Tips to Hosting a Successful Open House in NYC appeared first on | ELIKA Real Estate.

Open House Tips – Guide to Hosting an Open House in NYC

A crucial part of selling any home in New York is the open house. When done right it can solicit multiple offers and more than cover the costs of it. When done poorly it can end up being a waste of both time and money. If you’re going to make it work you have to have it well planned out and organized. With a good combination of timing, marketing, and advertising you can see your investment pay off big.

Understanding the Open House

If you’re not familiar with the concept, an open house is a block of time when a property is available for viewing. It typically runs for 1-3 hours and is normally held on a weekend afternoon. People can just walk in and view the property for themselves to get an idea of what living there would be like. The listing agent will be present at all time to show people around and answer any questions.

However, many buildings in New York, especially co-ops, do not allow open houses. Some require that two agents be present at all times, others only allow open houses by appointment and others still have no restrictions whatsoever.

How to host an Open House in NYC

Every part of the plan for the open house should be well taught out before you advertise the date. Go through each of these areas and you’ll be able to plan and execute the best open house possible.

Choose the perfect time

The first thing to decide is what the best time and date is for hosting the open house. Sunday is the most common day, a legacy of the days when the real estate section of the Sunday newspaper drove most of the traffic. You’ll want it to be a time when you can attract the most potential buyers so stick with Sunday from 11-5pm, the most popular time slot.

The only exception to the Sunday rule is if it falls near a national or religious holiday. If that happens you should maybe consider either skipping the weekend or try a weeknight open house. After work hours on Tuesday and Wednesday from 6-7pm can work but just know that weekday open houses can be hit and miss.

Marketing and advertising

When it comes to advertising, start with a simple sign. Have it not just on the door of your unit but also the doors leading into the building. If the building has a doorman make sure you keep him in the loop so he can properly greet and direct any visitors.

Most importantly, if you don’t have any online advertising you effectively don’t have any advertising. A good listing agent can help you with this and put the word out to other brokers who could be willing to send potential buyers in exchange for a co-brokering commission.

If the building requires appointments make sure this is mentioned in the advertising. A potential buyer may get in but a doorman can be difficult to work within this situation.

Home Staging

Last but not least, get the apartment set up for the open house. It would really help to hire a staging expert for this. They can recommend what changes are needed that will make the home appeal to the most buyers.

All clutter and personal items should be stored away so the place looks as neutral as possible. The whole point of an open house is to help visitors envision what living there would be like. It’s hard to do that if you’ve got family photos and other personal items lying around. Every room should be deep cleaned and any defects, such as a crack in the wall, should be amended or covered up as a last resort.

If you can do just this much you should be able to make the most of your open house. With luck, you’ll get multiple offers that could even lead to a bidding war, more than justifying the expanse of the staging and marketing.

The post Open House Tips – Guide to Hosting an Open House in NYC appeared first on | ELIKA Real Estate.

The Mortgage Recording Tax in NYC

New York residents should know that there is a mortgage recording tax for new and refinanced loans. The state and city both charge the tax, but the latter consolidates the amount in one bill.

The applicable rate depends on the mortgage amount, with the payment due at closing when purchasing a Condo or Townhouse.

It doesn’t always apply

The mortgage recording tax only applies to real property. This means it does not include co-ops, which are shares in a corporation. Since it only applies to those taking out a mortgage, cash buyers are also exempt from the tax.

What is the Mortgage Recording Tax rate?

There are different rates that are triggered at varying borrowing levels. It is inclusive of New York State’s mortgage recording tax. The tax applies to the loan’s principal amount, not the entire purchase price.

For mortgages less than $500,000, the mortgage recording tax is 2.05% (1% New York City tax plus 1.05% New York State tax). The tax rate bumps up to 2.175% (1.125% NYC tax and 1.05% for NYS) for original loans greater than $500,000 on one-to-three family homes and condo units. It is a 2.8% combined rate for any other properties (i.e. commercial) with an original principal amount that exceeds $500,000.

The lender has responsibility for part of the tax, which is 0.25%.

When is it the Mortgage Recording Tax due?

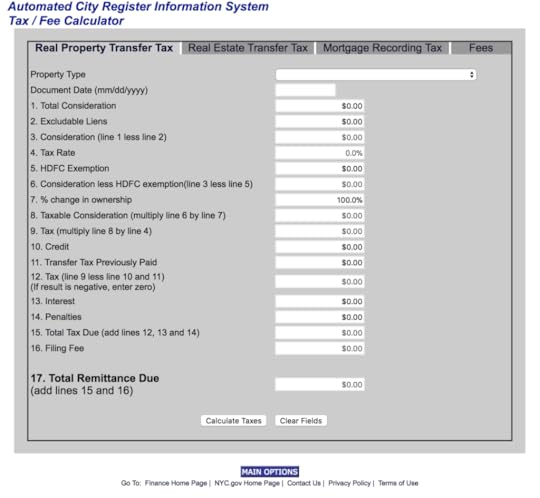

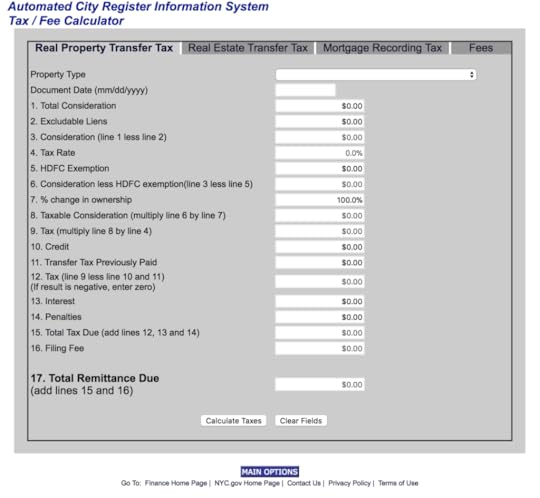

The buyer owes the mortgage recording tax at closing. The city’s Automated City Register Information System (ACRIS) is used to record all the property’s documents. ACRIS can also help you calculate the amount due.

Potential relief

You can reduce, or even eliminate the mortgage recording tax through a process known as the Consolidation Extension and Modification Agreement (CEMA). You can use this tool when you refinance your mortgage. Assuming you are using a new lender, you need both to agree to use CEMA to assign the loan. The tax applies only to the new money borrowed since you have already paid the tax on the previous amount borrowed. If you borrow more than the current principal amount owed, the tax applies only to that amount. If you are not borrowing an additional amount, you do not owe anything else. The process gets streamlined if you use the same lender to refinance.

It can be used for new purchases, too. The seller’s bank assigns the remaining mortgage balance to the buyer’s bank. The buyer becomes responsible for that portion and pays the tax on any additional balance needed to finance the purchase. A seller may be willing to use CEMA since it also reduces his/her transfer tax.

There are additional fees when you use CEMA charged by the banks and lawyers. You need to know these in advance to determine the costs versus the monetary benefits.

Final thoughts

Buyers face a potentially high mortgage recording tax given New York City’s high housing costs. It totals over $10,000 for a $500,000 mortgage. If you are on the cusp of this threshold, you may want to consider ways to borrow less. Perhaps you have extra cash you can part with, or you can raise it easily, such as from friends and family.

The post The Mortgage Recording Tax in NYC appeared first on | ELIKA Real Estate.

Understanding The Mortgage Recording Tax in NYC

New York residents should know that there is a mortgage recording tax for new and refinanced loans. The state and city both charge the tax, but the latter consolidates the amount in one bill.

The applicable rate depends on the mortgage amount, with the payment due at closing when purchasing a Condo or Townhouse.

It doesn’t always apply

The mortgage recording tax only applies to real property. This means it does not include co-ops, which are shares in a corporation. Since it only applies to those taking out a mortgage, cash buyers are also exempt from the tax.

What is the Mortgage Recording Tax rate?

There are different rates that are triggered at varying borrowing levels. It is inclusive of New York State’s mortgage recording tax. The tax applies to the loan’s principal amount, not the entire purchase price.

For mortgages less than $500,000, the mortgage recording tax is 2.05% (1% New York City tax plus 1.05% New York State tax). The tax rate bumps up to 2.175% (1.125% NYC tax and 1.05% for NYS) for original loans greater than $500,000 on one-to-three family homes and condo units. It is a 2.8% combined rate for any other properties (i.e. commercial) with an original principal amount that exceeds $500,000.

The lender has responsibility for part of the tax, which is 0.25%.

When is it the Mortgage Recording Tax due?

The buyer owes the mortgage recording tax at closing. The city’s Automated City Register Information System (ACRIS) is used to record all the property’s documents. ACRIS can also help you calculate the amount due.

Potential relief

You can reduce, or even eliminate the mortgage recording tax through a process known as the Consolidation Extension and Modification Agreement (CEMA). You can use this tool when you refinance your mortgage. Assuming you are using a new lender, you need both to agree to use CEMA to assign the loan. The tax applies only to the new money borrowed since you have already paid the tax on the previous amount borrowed. If you borrow more than the current principal amount owed, the tax applies only to that amount. If you are not borrowing an additional amount, you do not owe anything else. The process gets streamlined if you use the same lender to refinance.

It can be used for new purchases, too. The seller’s bank assigns the remaining mortgage balance to the buyer’s bank. The buyer becomes responsible for that portion and pays the tax on any additional balance needed to finance the purchase. A seller may be willing to use CEMA since it also reduces his/her transfer tax.

There are additional fees when you use CEMA charged by the banks and lawyers. You need to know these in advance to determine the costs versus the monetary benefits.

Final thoughts

Buyers face a potentially high mortgage recording tax given New York City’s high housing costs. It totals over $10,000 for a $500,000 mortgage. If you are on the cusp of this threshold, you may want to consider ways to borrow less. Perhaps you have extra cash you can part with, or you can raise it easily, such as from friends and family.

The post Understanding The Mortgage Recording Tax in NYC appeared first on | ELIKA Real Estate.

April 2, 2018

Gift Money for Down Payment Letter Sample

A stressful aspect for many home buyers is coming up with the down payment. To help cover it, many first time and repeat buyers get help from a friend or relative through a gift payment. Many lenders allow for cash gifts to cover conventional loans as well as FDA, USDA, and VA loans. If you need help with covering a home mortgage loan a gift payment can be of invaluable help. However, they come with some restrictions, and if you receive it within 60 days of your closing, you will need to provide a source for where you got it.

Types of Gifts Allowed

Most money gifts come from either one or more individuals. In most cases, these types of gifts are restricted to family members. The exception is FHA loans which typically allow gifts from a friend, relative or employer. However, an FHA loan is subject to a maximum gift payment of 6% of the purchase price, which can only be used for the closing costs.

Another type is a down payment that comes in the form of home equity. For instance, a family member could offer to sell you the home for less than its appraised value. The price difference you save can then be used as the down payment, similar to a cash gift.

What Gifts are Unacceptable?

The most important thing with any gift payment, regardless of the type of loan, is that it be legitimate. There can be no side arrangements between the donor and receiver to pay back the mortgage.

The gift can also not come from anyone who would benefit from the sale, such as a lender, agent or seller. Even if they are related to the buyer. Any funds received from someone involved in the transaction is subject to the limits of “interested party contributions” as designated by the terms of the loan. Any funds such as this cannot be used for the down payment, only the closing costs.

Gift Letter for Mortgage Down Payment

If you do use a gift payment, then you’ll need what’s called a gift letter for the mortgage if the gift is made within three months of the closing. Typically, lenders want to see your statement history for the last three months. If the gift was made before then, it’s unlikely you’ll need one. If though it has been recently received or still in the donors account you’ll need to prove it is legit with no strings attached.

Even if you are not taking out a mortgage loan and paying all cash, you’ll still need a gift letter to explain the source of the funds. This is usually not the case when buying a condo in NYC but should be expected if buying a co-op. As part of the application process, the co-op board will be reviewing all your finances. If you’re receiving a gift payment from family to cover the costs, then you’ll get a gift letter, even if you’re not taking out a mortgage.

Gift Letter Sample 1

You can keep it simple and informal if you’re only writing for a co-op board or seller that wants to verify the gift. See the second example below for one to use when applying for a mortgage.

April 2nd, 2018

1058 Laymen Court

New York, NY, 10001

Dear Sir or Madam:

We, Kyle Jowett and Kim Jowett intend to make a cash gift of $600,000 to Philip Jowett, our son, to be used for the purchase of the property located at 545 Raver Croft Drive, New York, NY 10019.

No repayment is expected or implied in the gift, either in the form of cash or future services, and no lien will be filed by us against the property.

The source of the gift is Bank of United States.

Signatures of Donors

Kyle Jowett and Kim Jowett

Telephone Number: 555-555-555

Gift Letter Sample 2

If the gift letter is for a mortgage lender it needs to be a little detailed and formal. Something like the following should suffice.

April 2nd, 2018

1058 Laymen Court

New York, NY, 10001

1. General Information

Dear Sir or Madam:

I, Kyle Jowett of [Donor’s mailing address and telephone number] wish to provide a gift of $[Amount] to my son, Philip Jowett, to close the mortgage transaction on the purchase of the property located at [Address].

2. Location of the Funds

The location of the funds is at [Account information: Depository name, address and account number].

3. Donor/Recipient Certification

This is a bonafide gift, with no obligation, expressed or implied, that it be paid back in the form of cash or future services. The funds provided to the homebuyer have not come from any person or entity with interest in the sale of the property.

Donor Signature and Date:

Recipient Signature and Date:

The post Gift Money for Down Payment Letter Sample appeared first on | ELIKA Real Estate.