Anuar Shah's Blog, page 2

March 12, 2015

PENTAS, my new fiction book with Fixi is out!

I may have never announced it in this blog or most of my professional-related channel.

As a lawyer who owns a legal firm, telling the world I am writing Bahasa Malaysia novels for an imprint such as Fixi, which is known to sell edgy, uncensored, witchcraft-laden, mind-fuck, transgender-friendly, adultery, fill-with-murders, science-fiction books unlike the at-least-200,000 copies love story cum religious-undertone type of stories sought by most Malaysians, may not be a good idea.

So, although I have a nearly-one-year book with Fixi, Pinjam, I never really promoted it here. Here is Pinjam's cover :

Me holding Pinjam for the first time at Bookerville, Putrajaya Book Fair 2014 on 21st March last year

Pinjam is now in its fifth print run and is selling quite well.

So, today, on the second Friday the 13th of 2015 (there was one in February), the eBook of my second fiction book, Pentas is out and can be bought at Google Playstore, Kaki Buku (Appstore), E-Sentral and Bachabooku.It is priced at RM9.90 as an eBook.

It will be released as a physical book next week on 20th March.

Pentas' release was delayed because of certain objectional content in it but all is good now.

There will be a launch event on 21st March 2015 at Dataran Underground with Pentas being one of the other 2 novels by Fixi launched that day. Do come over to buy, talk to me or just hang out.

As a lawyer who owns a legal firm, telling the world I am writing Bahasa Malaysia novels for an imprint such as Fixi, which is known to sell edgy, uncensored, witchcraft-laden, mind-fuck, transgender-friendly, adultery, fill-with-murders, science-fiction books unlike the at-least-200,000 copies love story cum religious-undertone type of stories sought by most Malaysians, may not be a good idea.

So, although I have a nearly-one-year book with Fixi, Pinjam, I never really promoted it here. Here is Pinjam's cover :

Me holding Pinjam for the first time at Bookerville, Putrajaya Book Fair 2014 on 21st March last year

Pinjam is now in its fifth print run and is selling quite well.

So, today, on the second Friday the 13th of 2015 (there was one in February), the eBook of my second fiction book, Pentas is out and can be bought at Google Playstore, Kaki Buku (Appstore), E-Sentral and Bachabooku.It is priced at RM9.90 as an eBook.

It will be released as a physical book next week on 20th March.

Pentas' release was delayed because of certain objectional content in it but all is good now.

There will be a launch event on 21st March 2015 at Dataran Underground with Pentas being one of the other 2 novels by Fixi launched that day. Do come over to buy, talk to me or just hang out.

Published on March 12, 2015 21:17

March 11, 2015

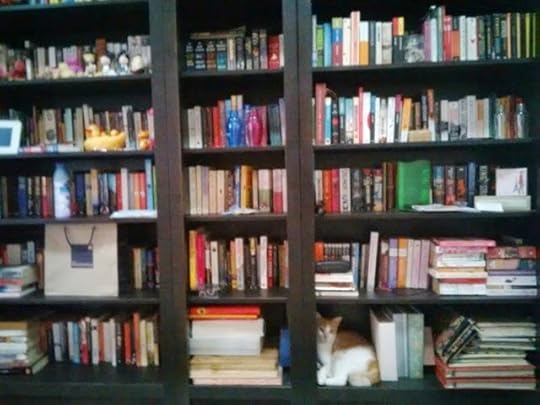

40 Questions You Should Ask Your Lawyer Before Applying Housing Loan in Malaysia

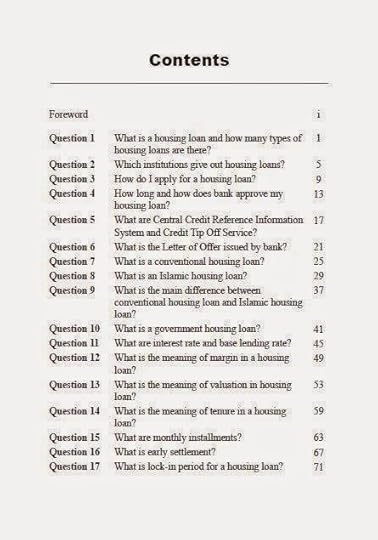

This book of mine is already out in bookstores across Malaysia and can be bought online at my publisher's website since December 2014. My publisher's website can be access here : Book Planet.com.my

This book is the continuation of my other books : 40 Questions You Should Ask Your Lawyer Before Buying A Residential Property in Malaysia, published in 2010; and 40 Questions You Should Ask Your Lawyer Before Buying A Residential Property in Malaysia, published in 2013.

All the Ask the Lawyer series books

I also have the books in Bahasa Malaysia with 40 Soalan Yang Anda Patut Tanya Peguam Anda Sebelum Membeli Rumah di Malaysia being sold as a physical book since 2011 and 40 Lagi Soalan Yang Anda Patut Peguam Anda Sebelum Membeli Rumah di Malaysia sold as eBook. The link to my eBook is aptly named Lawyer Hartanah (Property Lawyer) and can be access here : Lawyerhartanah.com.

I am currently writing the Bahasa Malaysia equivalent for 40 Questions You Should Ask Your Lawyer Before Applying Housing Loan in Malaysia named 40 Soalan Yang Anda Patut Tanya Peguam Anda Sebelum Memohon Pinjaman Perumahan di Malaysia which will be released soon.

Here are some previews of the book :

Published on March 11, 2015 23:04

March 5, 2015

Time to Dig In and Reassess Your Investment

The new year 2015 has brought a new landscape to the investment scenario, either to the property market or the investment market as a whole.

2014 can be called as the year where most investors had expected to make less money but surprisingly, most can claim it was not too bad of a year after all. Most investment funds such as Amanah Saham Bumiputera, real estate unit trust, unit trust and Employee Provident Fund have declared good returns more than what were expected from them. The stock market had climbed to new heights. Property market did return to a semblance of the good old days.

Alas, it didn’t last. By the end of the year, the stock market had turned southward, the oil prices started its sharp decline, the property market started to go soft and the fun is lacking in funds. If statistics are to be trusted, we are expecting 2015 to be a bad year. To add salt to the wound, we are expecting a period of ‘adjustment’ due to the introduction of the Goods and Sales Tax (GST) starting this 1st April 2015 in Malaysia. The words ‘uncertain’, ‘not going to be much impacted’ and the favourite ‘…going to pick up’ are keywords which are being used extensively when the experts are asked what lies ahead. No one will commit that we are heading for a bad time.

For those who had lived long enough, they recognised the next few months as the time to dig in and to reassess their investment. It’s not as if they have never seen it before. Right?

How about the young ones? The ones who had just start their work lives and are just starting to invest in places they thought were good enough for them to get good returns? Should they keep on investing? Should they cut their losses and wait until the market stabilised? Is property still a safe bet?

The answer is simple: It is time to dig in and reassess your investment. It is good to do this every once in a while. You need to understand the concept of holding power and the time to cut your losses.

There are a few rules all property investors or any other type of investors should always keep in mind:

1) ALWAYS RESEARCH WHAT YOU ARE INVESTING IN

Understand the concept of investment, know the product, and know how much you are spending and what your exit strategy is. Before jumping into the water, you should know whether it is cold, warm or hot.

2) ALWAYS KNOW THE SELLER AND MANAGER THOROUGHLY

One of the lessons I’ve learned about investing in property is how important it is to know the seller, be it the property development company, the bank auctioning the property or the seller of the property. Most people do not research properly the seller especially if they buy a property from a housing developer. Past success (or lack thereof) does not ensure future success.

3) RESEARCH THE PRODUCT YOU ARE BUYING

This advice is redundant of the advice No. 1 but this goes to the specifics. This is when you research the place and the type of property you are buying instead of knowing about how to invest in property. As an example, if you shunned areas such as Nilai or KLIA a few years ago, it might be of interest to you to know that the property investment landscape in those areas has changed. People are starting to buy in those areas. If you are looking for deals, this may be a good time but not for long.

4) UNDERSTAND THE COST (APPARENT OR HIDDEN)

People who buy properties should ask a lot of questions until the sale person who handles the queries starts to hate you. In all my years of being a lawyer, I find people are indifferent when it comes to the fees a lawyer can charge and why he/she is charging that much. They only look at the total amount and only care about how much discount they can get from the lawyer without asking why there’s a separate cost for disbursement and what each disbursement is for. I also find people are surprised at the idea of paying monthly charges, quarterly charges and annual charges for their strata properties to pay for monthly maintenance, sinking fund and assessment rate, respectively. When they sell their property, they are again ignorant of the fact of the Real Property Gain Tax that they will have to pay.

5) THERE IS NO SUCH THING AS A QUICK RETURN

Everyone wants to make a quick buck. As PT Barnum had allegedly said, “There’s a sucker born every minute.” These two rules have made a few enterprising spirits into crooks. The modus operandi maybe different but the rules have never change. There is no easy money. Period.

6) READ

Read the news, read about the change in law, read about the change in the interest rate regime, read about the debate on the implementation of Goods and Sales Tax, read about the debate on lowering of the prices of goods and, finally, read the fine print. Read every single thing. And understand it.

7) YOU CAN ALWAYS EXIT ANYTIME YOU WANT

If you have invested, surely you have read the fine prints and you have planned your exit strategy. Even if your debt is as simple as a credit card, as you aged, wouldn’t you want to close all those cards that are eating up your disposable cash and start to be smarter? If you had bought a property which you planned to rent but it is giving you negative cash flow, shouldn’t you check the market value and see if you can sell it for a good price? Why must you have debts that are not helping you to gain more money?

8) THERE’S ALWAYS OPPORTUNITY EVEN DURING THE BAD TIME

Yes, the oil prices dropped, the ringgit is at its lowest and the economy is going to be bad. Foreign investors are leaving in droves. People are not buying as much as they did a few years ago. If you have kept some money for such times, this is the time to buy properties. There are so many choices in the market. People rather rent than buy. If you had wanted to rent your property, you can start now. If you get good rental, don’t sell the property yet. Check your tenant properly, make sure you have an ironclad tenancy agreement and make sure you can sell the house when you get a good offer.

9) DO NOT STOP INVESTING. THIS TOO SHALL PASS.

As you reassess, exit your investment, recuperate, change tactics and reinvest your money somewhere safer, try to look for opportunities that are less risky. I’ve met so many people who insist in investing in properties but do not have any investment at all in safer portfolio such as ASB or unit trust. They rather take the high risk, high return route as if the winner-takes-all attitude is the only way for investors to live.

10) HAVE MULTIPLE SOURCES OF INCOME

Remember the time when even the government allows for its staff to have business? This happened a few years back. As much as you rely on your salary and allowance for your livelihood, why don’t you make money from what you do in your spare time? If you are a traveller or a cyclist, invite others to join you and you can charge them for organising the tour or event. Make sure you really know what you do and do it well so that the word of mouth will spread. It might just be your next career move.

This was first published as an article with Property Insight Magazine, March 2015 edition http://propertyinsight.com.my/time-to-dig-in-and-reassess-your-investment/

2014 can be called as the year where most investors had expected to make less money but surprisingly, most can claim it was not too bad of a year after all. Most investment funds such as Amanah Saham Bumiputera, real estate unit trust, unit trust and Employee Provident Fund have declared good returns more than what were expected from them. The stock market had climbed to new heights. Property market did return to a semblance of the good old days.

Alas, it didn’t last. By the end of the year, the stock market had turned southward, the oil prices started its sharp decline, the property market started to go soft and the fun is lacking in funds. If statistics are to be trusted, we are expecting 2015 to be a bad year. To add salt to the wound, we are expecting a period of ‘adjustment’ due to the introduction of the Goods and Sales Tax (GST) starting this 1st April 2015 in Malaysia. The words ‘uncertain’, ‘not going to be much impacted’ and the favourite ‘…going to pick up’ are keywords which are being used extensively when the experts are asked what lies ahead. No one will commit that we are heading for a bad time.

For those who had lived long enough, they recognised the next few months as the time to dig in and to reassess their investment. It’s not as if they have never seen it before. Right?

How about the young ones? The ones who had just start their work lives and are just starting to invest in places they thought were good enough for them to get good returns? Should they keep on investing? Should they cut their losses and wait until the market stabilised? Is property still a safe bet?

The answer is simple: It is time to dig in and reassess your investment. It is good to do this every once in a while. You need to understand the concept of holding power and the time to cut your losses.

There are a few rules all property investors or any other type of investors should always keep in mind:

1) ALWAYS RESEARCH WHAT YOU ARE INVESTING IN

Understand the concept of investment, know the product, and know how much you are spending and what your exit strategy is. Before jumping into the water, you should know whether it is cold, warm or hot.

2) ALWAYS KNOW THE SELLER AND MANAGER THOROUGHLY

One of the lessons I’ve learned about investing in property is how important it is to know the seller, be it the property development company, the bank auctioning the property or the seller of the property. Most people do not research properly the seller especially if they buy a property from a housing developer. Past success (or lack thereof) does not ensure future success.

3) RESEARCH THE PRODUCT YOU ARE BUYING

This advice is redundant of the advice No. 1 but this goes to the specifics. This is when you research the place and the type of property you are buying instead of knowing about how to invest in property. As an example, if you shunned areas such as Nilai or KLIA a few years ago, it might be of interest to you to know that the property investment landscape in those areas has changed. People are starting to buy in those areas. If you are looking for deals, this may be a good time but not for long.

4) UNDERSTAND THE COST (APPARENT OR HIDDEN)

People who buy properties should ask a lot of questions until the sale person who handles the queries starts to hate you. In all my years of being a lawyer, I find people are indifferent when it comes to the fees a lawyer can charge and why he/she is charging that much. They only look at the total amount and only care about how much discount they can get from the lawyer without asking why there’s a separate cost for disbursement and what each disbursement is for. I also find people are surprised at the idea of paying monthly charges, quarterly charges and annual charges for their strata properties to pay for monthly maintenance, sinking fund and assessment rate, respectively. When they sell their property, they are again ignorant of the fact of the Real Property Gain Tax that they will have to pay.

5) THERE IS NO SUCH THING AS A QUICK RETURN

Everyone wants to make a quick buck. As PT Barnum had allegedly said, “There’s a sucker born every minute.” These two rules have made a few enterprising spirits into crooks. The modus operandi maybe different but the rules have never change. There is no easy money. Period.

6) READ

Read the news, read about the change in law, read about the change in the interest rate regime, read about the debate on the implementation of Goods and Sales Tax, read about the debate on lowering of the prices of goods and, finally, read the fine print. Read every single thing. And understand it.

7) YOU CAN ALWAYS EXIT ANYTIME YOU WANT

If you have invested, surely you have read the fine prints and you have planned your exit strategy. Even if your debt is as simple as a credit card, as you aged, wouldn’t you want to close all those cards that are eating up your disposable cash and start to be smarter? If you had bought a property which you planned to rent but it is giving you negative cash flow, shouldn’t you check the market value and see if you can sell it for a good price? Why must you have debts that are not helping you to gain more money?

8) THERE’S ALWAYS OPPORTUNITY EVEN DURING THE BAD TIME

Yes, the oil prices dropped, the ringgit is at its lowest and the economy is going to be bad. Foreign investors are leaving in droves. People are not buying as much as they did a few years ago. If you have kept some money for such times, this is the time to buy properties. There are so many choices in the market. People rather rent than buy. If you had wanted to rent your property, you can start now. If you get good rental, don’t sell the property yet. Check your tenant properly, make sure you have an ironclad tenancy agreement and make sure you can sell the house when you get a good offer.

9) DO NOT STOP INVESTING. THIS TOO SHALL PASS.

As you reassess, exit your investment, recuperate, change tactics and reinvest your money somewhere safer, try to look for opportunities that are less risky. I’ve met so many people who insist in investing in properties but do not have any investment at all in safer portfolio such as ASB or unit trust. They rather take the high risk, high return route as if the winner-takes-all attitude is the only way for investors to live.

10) HAVE MULTIPLE SOURCES OF INCOME

Remember the time when even the government allows for its staff to have business? This happened a few years back. As much as you rely on your salary and allowance for your livelihood, why don’t you make money from what you do in your spare time? If you are a traveller or a cyclist, invite others to join you and you can charge them for organising the tour or event. Make sure you really know what you do and do it well so that the word of mouth will spread. It might just be your next career move.

This was first published as an article with Property Insight Magazine, March 2015 edition http://propertyinsight.com.my/time-to-dig-in-and-reassess-your-investment/

Published on March 05, 2015 15:28

February 10, 2015

Judge in the Jessup Moot 2015 Competition

I was invited and given the opportunity to be one of the panel of judges in the Jessup Moot 2015 Competition last Saturday, 07.02.2015.

It was an experience I would always remember because the only other time I was involved in the competition was nearly 20 years ago in 1995 when I was a second year student in Universiti Kebangsaan Malaysia handling the same competition in ILKAP, Institut Latihan Kehakiman dan Perundangan, the training center for those in the judiciary. At that time ILKAP was in Wisma Sime Daby in Kuala Lumpur and not in its current

How time have changed.

It was a great experience as I was partnered with Session Court Judge, Tuan Hakim Timothy Finlayson and Encik Saiful Izan, the legal officer for Malaysian Red Crescent.

The competing teams were quite good in their submissions of the case and one of them, the UiTM mooting team went on to the finals but was beaten by the eventual winner from University Malaya.

Congratulations to the winner and hope they'll be as good in Washington for the world finals.

It was an experience I would always remember because the only other time I was involved in the competition was nearly 20 years ago in 1995 when I was a second year student in Universiti Kebangsaan Malaysia handling the same competition in ILKAP, Institut Latihan Kehakiman dan Perundangan, the training center for those in the judiciary. At that time ILKAP was in Wisma Sime Daby in Kuala Lumpur and not in its current

How time have changed.

It was a great experience as I was partnered with Session Court Judge, Tuan Hakim Timothy Finlayson and Encik Saiful Izan, the legal officer for Malaysian Red Crescent.

The competing teams were quite good in their submissions of the case and one of them, the UiTM mooting team went on to the finals but was beaten by the eventual winner from University Malaya.

Congratulations to the winner and hope they'll be as good in Washington for the world finals.

Published on February 10, 2015 20:43

June 16, 2014

Why a housing bubble will always happen again and again. All over the world

If you read the news around the world, there are people keep saying a housing bubble is imminent in their county. Although it has just happened, like in the United States when the last housing bubbles brought down a few investment banks which had been hit by the sub-prime scandals, people who are smart enough say a housing bubble is in the making there. China is another country people is expecting to have its property bubble burst anytime soon. Why does this keep happening again and again?

It is due to the nature of housing. People keep on buying houses to live in it and to try to make a lot of money out of it by selling it at a higher margin. The question is, why don't people learn that they will drag down the economy due to their greed to make a profit? Why do they keep on doing the same thing again and again? Aren't the governments around the world doing anything about it?

Here's the thing about housing. There are genuine buyers who want to have a roof above their head and there are those who think houses as an investment. They are mixed together without any borders separating them in the same space. When you see a long line queuing up at a property launch, you cannot determine who are the genuine buyer and who are the speculators. The speculators who buy and want to make money out of the property want the same treatment the genuine house buyers are getting. It will make the profit higher as the housing developers will throw in so many things into the sale. Including cheaper housing loans.

Governments around the world have been trying to control speculative buying of property by imposing tax on the profit anyone makes when a property is sold. In Malaysia it is known as Real Property Gain Tax. The current tax regime impose tax on property sold within 5 years of the property being bought. The tax imposed is a withholding tax where the seller will have to pay the Internal Revenue Department and only get it back once it is checked out there was no profit made on the property transaction. The withholding tax for Malaysian property sellers is 2%.

Does this current withholding tax stop or reduce the property transactions or sales of houses? Does it stop the speculative buying of houses? No. It does not.

Here's why.

Any good property speculator will know you only have to factor in the cost of the Real Property Gain Tax into the margin that you will make from the sale of the property. This Real Property Gain Tax is not the only thing the property speculator has to contend with. The Malaysian government has imposed in 2010 a maximum margin of 70% on any third housing loan taken by any one buyer. That is already a deterrent factor there. Still people buys houses speculatively and try to make huge profits out of it.

Banks are also culprits in the making of housing bubbles. Why? Because they make so much money out of giving out housing loans to people who want to buy houses, whether they need it or not. A speculators adage has always been "If you can use other people money, do not use your own money." This has also been the adage that fueled a few of economic crisis in the world.

Another factor why housing bubble will visit the world every few years in this modern era is due to the property gurus that keep teaching people to buy and sell property to make a profit out of it. While these property gurus go running and laughing to the bank thanking the gullible students for paying them an arm and a leg trying to learn how to make money from property speculation, new property speculators are born and play the property speculation game all over again

So, as the sun keeps on shining and people keeps on needing a house, a housing bubble will keeps on visiting each property hot spot.

Again and again...

*Originally wrote this as a LinkedIn post : https://www.linkedin.com/today/post/article/20140617041553-25491383-why-a-housing-bubble-will-always-happens-again-and-again-all-over-the-world?trk=prof-post

It is due to the nature of housing. People keep on buying houses to live in it and to try to make a lot of money out of it by selling it at a higher margin. The question is, why don't people learn that they will drag down the economy due to their greed to make a profit? Why do they keep on doing the same thing again and again? Aren't the governments around the world doing anything about it?

Here's the thing about housing. There are genuine buyers who want to have a roof above their head and there are those who think houses as an investment. They are mixed together without any borders separating them in the same space. When you see a long line queuing up at a property launch, you cannot determine who are the genuine buyer and who are the speculators. The speculators who buy and want to make money out of the property want the same treatment the genuine house buyers are getting. It will make the profit higher as the housing developers will throw in so many things into the sale. Including cheaper housing loans.

Governments around the world have been trying to control speculative buying of property by imposing tax on the profit anyone makes when a property is sold. In Malaysia it is known as Real Property Gain Tax. The current tax regime impose tax on property sold within 5 years of the property being bought. The tax imposed is a withholding tax where the seller will have to pay the Internal Revenue Department and only get it back once it is checked out there was no profit made on the property transaction. The withholding tax for Malaysian property sellers is 2%.

Does this current withholding tax stop or reduce the property transactions or sales of houses? Does it stop the speculative buying of houses? No. It does not.

Here's why.

Any good property speculator will know you only have to factor in the cost of the Real Property Gain Tax into the margin that you will make from the sale of the property. This Real Property Gain Tax is not the only thing the property speculator has to contend with. The Malaysian government has imposed in 2010 a maximum margin of 70% on any third housing loan taken by any one buyer. That is already a deterrent factor there. Still people buys houses speculatively and try to make huge profits out of it.

Banks are also culprits in the making of housing bubbles. Why? Because they make so much money out of giving out housing loans to people who want to buy houses, whether they need it or not. A speculators adage has always been "If you can use other people money, do not use your own money." This has also been the adage that fueled a few of economic crisis in the world.

Another factor why housing bubble will visit the world every few years in this modern era is due to the property gurus that keep teaching people to buy and sell property to make a profit out of it. While these property gurus go running and laughing to the bank thanking the gullible students for paying them an arm and a leg trying to learn how to make money from property speculation, new property speculators are born and play the property speculation game all over again

So, as the sun keeps on shining and people keeps on needing a house, a housing bubble will keeps on visiting each property hot spot.

Again and again...

*Originally wrote this as a LinkedIn post : https://www.linkedin.com/today/post/article/20140617041553-25491383-why-a-housing-bubble-will-always-happens-again-and-again-all-over-the-world?trk=prof-post

Published on June 16, 2014 23:10

April 28, 2014

Blog ini sebagai manuskrip

Aku diminta menulis oleh Dubook Press, syarikat buku indie yang menerbitkan beberapa buku indie non-fiction. Sebenarnya aku tak at nak tulis apa sebab siri buku Ask the Lawyer! atau Tanyalah Peguam! yang aku terbitkan bawah True Wealth, syarikat Azizi Ali tu macam indie jugaklah. Cuma bahasa dalam buku-buku tu tak indie sangat. Dia proper sikit.

So, aku nak mulakan menulis buku untuk Dubook Press ni menggunakan blog ini. Mungkin taktik aku ni akan mengurangkan ke'laku'an buku tu nanti tapi aku rasa masih ada market. Kalau blog post aku yang aku nak gunakan sebagai manuskrip ni ramai yang baca, aku rasa aku boleh jual buku tu. Kalau tak ramai, Dubook masih nak publish, aku ok je.

Apa yang diorang mintak aku tulis adalah tentang pembelian rumah oleh remaja. Macam a ke cakap tadi, aku rasa buku 40 Soalan Yang Patut Anda Tanya Peguam Anda Sebelum Membeli Rumah di Malaysia tu dah cover mostly everything yang patut orang pertama kali beli rumah tahu.

Mungkin ada market untuk pembeli belia kut? Aku ingat nak tulis tentang benda yang lebih basic. Contohnya bagaimana nak kumpul deposit 10%. Trick-trick macamana nak mark-up. Tentang bagaimana nak mintak lawyer tolong buat SPA yang bagus. Benda-benda macam tu.

Nanti korang komen lah kalau nak tau lagi. Boleh aku baiki manuskrip aku sebelum publish.

Kala korang tak tau kenapa aku sekarang nak jadi 'indie' sikit kerana aku dah ada buku terbitan Fixi. Nama buku : PINJAM. Nama pena : Anuar Shah. Kenapa Anuar Shah? Nama penuh aku Khairul Anuar. Shah tu sebahagian nama bapak aku.

Make, entri selepas ini akan jadi entri buku aku yang belum ada title. Mungkin title dia 'Senangnya Beli Rumah' atau 'Baiti'. Tengoklah camne.

So, aku nak mulakan menulis buku untuk Dubook Press ni menggunakan blog ini. Mungkin taktik aku ni akan mengurangkan ke'laku'an buku tu nanti tapi aku rasa masih ada market. Kalau blog post aku yang aku nak gunakan sebagai manuskrip ni ramai yang baca, aku rasa aku boleh jual buku tu. Kalau tak ramai, Dubook masih nak publish, aku ok je.

Apa yang diorang mintak aku tulis adalah tentang pembelian rumah oleh remaja. Macam a ke cakap tadi, aku rasa buku 40 Soalan Yang Patut Anda Tanya Peguam Anda Sebelum Membeli Rumah di Malaysia tu dah cover mostly everything yang patut orang pertama kali beli rumah tahu.

Mungkin ada market untuk pembeli belia kut? Aku ingat nak tulis tentang benda yang lebih basic. Contohnya bagaimana nak kumpul deposit 10%. Trick-trick macamana nak mark-up. Tentang bagaimana nak mintak lawyer tolong buat SPA yang bagus. Benda-benda macam tu.

Nanti korang komen lah kalau nak tau lagi. Boleh aku baiki manuskrip aku sebelum publish.

Kala korang tak tau kenapa aku sekarang nak jadi 'indie' sikit kerana aku dah ada buku terbitan Fixi. Nama buku : PINJAM. Nama pena : Anuar Shah. Kenapa Anuar Shah? Nama penuh aku Khairul Anuar. Shah tu sebahagian nama bapak aku.

Make, entri selepas ini akan jadi entri buku aku yang belum ada title. Mungkin title dia 'Senangnya Beli Rumah' atau 'Baiti'. Tengoklah camne.

Published on April 28, 2014 10:28

September 16, 2013

Lawyer Hartanah : 40 Lagi Soalan Yang Patut Anda Tanya Peguam Anda Sebelum Membeli Rumah di Malaysia

Buku eBook saya Lawyer Hartanah : 40 Lagi Soalan Yang Patut Anda Tanya Peguam Anda Sebelum Membeli Rumah di Malaysia mula dijual pada hari ini. Pemasaran affiliate boleh didapati di JomNiaga : http://www.jomniaga.com/affiliate/tools/17104/go. Pra-pelancaran untuk buku ini adalah dari 17hb September 2013 sehingga 29hb September 2013. Pelancaran penuh akan dilakukan pada 30hb September 2013.

eBook Bahasa Malaysia ini adalah terjemahan dari buku saya : 40 More Questions You Should Ask Your Lawyer Before Buying A Residential Property in Malaysia. Saya telah menterjemahkan buku ini sendiri untuk memastikan maksud yang saya cuba sampaikan tidak hilang. Dapatkannya sekarang di pasaran atau melalui web di www.bookplanet.com.my.

Published on September 16, 2013 21:35

July 6, 2013

Nomad Offices : The office away from home office for lawyers

Kompleks Mahkamah Kuala Lumpur

As a lawyer, when I was practicing as a litigation lawyer, speed is everything. You sometimes need to amend or use the facilities you have at your office as soon as possible but your office is just too far away. Even if your office is within Kalng Valley, when you have only a few hours to spend before you go back to court.

Of course you have the Bar Room which has nearly everything you need as a lawyer. However, wouldn't it be more convenient if you can drive just around the corner where you can have all the convenience of your own office at your fingertips?

Kompleks Mahkamah Syariah Wilayah Persekutuan

MATRADE building

An office like Nomad Offices is the perfect alternative for an office away from home office for lawyers.

The new Nomad offices Is located at Soalris Mont Kiara within the area of MATRADE, Kompleks Mahkamah Kuala Lumpur and Mahkamah Syariah Wilayah Persekutuan.

With other Nomad offices in Pavilion KL, the Gardens and Menara Hap Seng, it is perfect for anyone to use it as a base. Nomad has hotel and residences. With branches in Manila, Jakarta, Bangkok, Ho Chin Minh, it is perfect as a satellite office.

Nomad offices has meeting rooms for 3 to 6 people, charging stations, waiting areas, hot desks, a big room for 5 people with a manager's room and even a Playstation to unwind.

Located at Level 7 of Block L, Solaris Mont Kiara, it is just perfect as an office away from your home office in Kuala Lumpur.

Published on July 06, 2013 00:54

June 24, 2013

What is a housing loan and how many types of housing loans are there?

I am writing a new book. It is about Housing Loan and of course, in continuation of my Ask The Lawyer series, I have titled the book '40 Questions You Should Ask Your Lawyer Before Taking A Housing Loan in Malaysia'. I want to be as concise as possible so there will not be 40 More Questions You Should Ask Your Lawyer Before Taking A Housing Loan in Malaysia.

My two books tackled issues about buying residential property from housing developer and is skewed towards buying these residential property in cash. Why? Because I opined you need to understand the basic before involving purchasing property using a housing loan. A housing loan needs it's own book to be understood. Now that I have columns in New Straits Times' Real Estate and Decor and also in thestarproperty.my with occasional articles in various other publications, I will complement my published books and to-be published books with articles in them.

As always, I use this blog to gauge responses from my readers or would-be readers. If you still have not got my book from bookstores like MPH, Times or Kinokuniya, you can order online through my publisher Book Planet. The link for my books is here : .

While waiting for my book to finish, go through this first chapter. Consider it like reading an excerpt of the whole book as this first question is the whole template for the whole book. Comments and complains are welcome, as usual :

Question 1

Housing

loan is a financial instrument borne out of a need of the consumers, who are

house buyers seeking to buy houses. In this day and age, everyone has some form

of debts or another. Borrowing money has become a norm and it is recognised by

financial institutions around the world as the best way to check the financial

credibility of a potential customer. In short, the more debts you have with one

financial institution, the potential for you to get any type of loan from

another financial institution is higher. Of course, as a borrower, you must

make sure you are capable to manage all the loans you have taken from all the financial

institutions you have taken loans from before you are given another loan by

another financial institution. One of the biggest amounts of money by borrowing

one will take in his or her lifetime is the housing loan. House, even the

smallest one, is expensive. The need for a house has never diminished as people

need somewhere to live whether they can afford it or not. Hence, housing loan

is needed to help people to buy a house according to their need and for those

who buy house as investment, as one way to finance the investment.

In the whole scheme of property purchase,

there can only be two types of house buyers. There are those who buy a house to

stay in it and those who buy a house as a form of investment. All the housing

loans in Malaysia are tailored for those who buy houses in order to stay in it

and not for those who buy a house for investment. With the current property

climate in Malaysia where government has to intervene in order to fulfill the

supply of affordable houses to the masses, I don’t think we will ever see

financial institutions coming up with housing loans for the investors. That is

why all borrowers of housing loans are asked to sign a letter of undertaking

(which will be explained in this book) affirming that they will be living in

the house they bought and taken a housing loan for. In order to answer the

question “What is a housing loan?” the answer is - any type of loan taken from

a licensed financial institution in Malaysia to finance the purchase of a

residential property in Malaysia. In order to explain the concept of housing

loan further is to dissect each type of the housing loan available and to see

the mechanics of each type of housing loan. As questions relating to housing

loan are answered one by one in this book, the enigma surrounding housing loan is

unraveled one by one.

There are so many types of housing loan

available to finance the purchase of any type of property in Malaysia. These

housing loans relate to all types of properties available for sale from either

housing developers or individuals. There are so many ways to divide housing

loans into basic categories. Types of properties are divided into property

issued with title and property without title or property to be subdivided later.

Housing loans available to finance the purchase these properties can be divided

into the same category too. The documentations for housing loan given by

financial institution for residential property with title is very much

different from documentations for housing loan given by financial institution for

residential property to be subdivided later. The difference between these

documentations will determine the process and the cost to prepare the documentation

for the housing loan. The documentation for the housing loan to finance purchase

of property with title is more straightforward than the documentation for

housing loan to finance property to be subdivided later. The nature of

residential property to be subdivided later requires another round of

documentations to be executed when the property is finally issued with a title.

However, the more popular way to divide the

types of housing loan on offer by financial institution is whether a housing

loan is a conventional loan or an Islamic loan. As financial institutions

streamlined the operation of their conventional banking and Islamic banking,

when a bank officer attend to a customer’s enquiry about housing loans, the

first question the loan officer will ask is whether the customer is applying

for a conventional housing loan or an Islamic housing loan. Both housing loans

are different from each other and the documentations for both types of housing

loans are very much different. Both conventional housing loan and Islamic

housing loan are different products. The terms used to explain how the conventional

housing loan and Islamic housing loan is given and disbursed are different among

financial institutions. Conventional banking term such as ‘interest’ is

substituted with ‘profit’ when being referred in Islamic banking. This is just

one of the terms which differ between a conventional housing loan and Islamic

housing loan. An explanation on the difference in either the concept or the

documentations of an Islamic housing loan can be found within this book.

There is no right way to list the types of

housing loans. Like all loan products offered by financial institutions, when

you want to take a housing loan, the important question is to ask yourself why

you are taking the loan. It is understandable if the housing loan is to finance

the purchase of your dream home. If you have saved to pay the deposit on the

house and able to pay the installments until the time the house is yours,

there's an array of housing loans to choose from. However, there are many other

types of housing loans which relates to houses but is not intended to be used

for the purchase of a house. These types of loans include, as was mentioned

above, taking housing loan for investment purpose, refinancing of existing

house after a few years as value of the house rises and mortgaging a house free

from any encumbrances to the bank for cash. Currently, housing loan for residential

property is one of the cheapest loans around among a bank’s various products and

is a favorite way to own a property under your own name.

Published on June 24, 2013 18:00