Delvin R. Chatterson's Blog, page 17

March 26, 2015

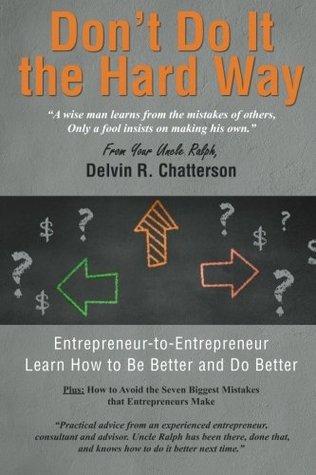

Go to Goodreads.com – Win a free copy of “Don’t Do It the Hard Way”

Don’t Do It the Hard Way

by Delvin R. Chatterson

Giveaway ends April 16, 2015.

See the giveaway details at Goodreads.

The post Go to Goodreads.com – Win a free copy of “Don’t Do It the Hard Way” appeared first on Learning Entrepreneurship.

March 16, 2015

Is BoomerPreneurship next for you? Here is how to succeed.

As recently posted on FindependenceHub with Jonathan Chevreau.

As recently posted on FindependenceHub with Jonathan Chevreau.

Young entrepreneurs seem to get all the attention, but there are also a lot of experienced Boomers considering entrepreneurship for the next phase of their career or retirement plan. Are you one of them?

The first important point for you to recognize if you are considering that option, is that past success in business or management or even as a business owner, does not ensure you will succeed in a new business. You need to be smart and humble enough to seek support, advice and market feedback before you start.

I have worked with many entrepreneurs on new business start-ups, and my advice is the same for any entrepreneur, young or old, experienced or not: Look before you leap.

Yes, that does mean you have to do a Business Plan, but remember, “It’s not about the plan, it’s about the process.” Preparing the document is much less important than the  process of strategic analysis and testing the financial consequences for alternative business models and potential operating scenarios.

process of strategic analysis and testing the financial consequences for alternative business models and potential operating scenarios.

My recommendation for going through the process is to start with the basics. First, do you have what it takes to succeed as an entrepreneur? Here is my short checklist list of the Characteristics of a Successful Entrepreneur to consider:

Energetic, independent, confident, competitive, persistent, action-oriented, decisive.

Passionate, persuasive communicator.

If you don’t have all these personal characteristics yourself, then you better look for a partner to include in your plans. If any of those characteristics are missing in the leadership team, the business simply cannot succeed.

The second question is whether you and your family are ready for the life style choices that are associated with being a business owner – no longer the regular hours, professional support and infrastructure that you may be used to. In your own business you will love the independence and doing it your way, but you may not enjoy being often alone and in unfamiliar territory. If that’s all part of the attraction, then you are off to a good start. The key at this stage is to assess if your personal skills, interests and objectives are all consistent with the plans for your new business venture.

If the answer is yes, then you are ready to take a closer look at the Before You Launch Checklist to ensure you have everything you need before you start:

Skills, knowledge, experience, and contacts relevant to your business plan.

Expectations and preferences for the entrepreneurial lifestyle – work routine and environment, prestige and compensation, work/life balance.

Personal strengths and weaknesses that will help, not hurt, the business.

A healthy foundation – family, physical and financial. Solid not shaky.

Strategic resources in place – partners, suppliers, facilities, key customers and employees.

Financing for start-up – including money in the bank to cover the first few months of negative cash flow. If you can’t put a checkmark with confidence in every one of those boxes, then you are not yet ready. You need to accept and analyze the deficiencies then start to work on filling in the missing elements.

If you have completed these checklists and the light is green for GO (or at least flashing amber for proceed with caution), then you are ready to start on a more complete Business Plan.

Good luck, that also helps.

The post Is BoomerPreneurship next for you? Here is how to succeed. appeared first on Learning Entrepreneurship.

March 5, 2015

The ups and downs – you win, you lose

This year’s Honda Classic was a fascinating and dramatic display of old talent coming back and new talent rising fast.

In a final round play-off on Monday 43-year old veteran Padraig Harrington prevailed over 21-year old rookie Daniel Berger who had an outstanding final round of 64 to surge into the lead from nine shots back. The other contenders fell behind as they made costly mistakes on the tour’s toughest course at the PGA National in Palm Beach Gardens, Florida.

In a final round play-off on Monday 43-year old veteran Padraig Harrington prevailed over 21-year old rookie Daniel Berger who had an outstanding final round of 64 to surge into the lead from nine shots back. The other contenders fell behind as they made costly mistakes on the tour’s toughest course at the PGA National in Palm Beach Gardens, Florida.

What made it interesting was the spectacle of former champions challenging the rising stars. Tiger Woods was a no show and Rory McIlroy failed to make the cut. Other 40-year olds that have made a run for it recently include Vijay Singh and Retief Goosen.

Harrington twice won the British Open and then the PGA Championship, but all back in 2007-2008. Since then he had lost the magic and fell from the top to about 300 rungs lower, right off the tour. Always analytical and hard working he kept at it and suddenly was a winner again this week. It wasn’t pretty, but he never has been. Missed some short putts and hit it into the water, but also made some great long putts and hit it close often enough to come back into a tie after four rounds and hang on to win with a bogey on the second play-off hole.

All encouragement for the prospect of a comeback to former times of glory. Maybe short-lived and maybe only close, but always worth the consistent effort, patience and persistence.

In business like golf.

The post The ups and downs – you win, you lose appeared first on Learning Entrepreneurship.

March 2, 2015

A Good Business Plan is Not Enough

Entrepreneurs often find themselves working hard to prepare a Business Plan, because the bank asked for one. So they spend a lot of time and effort, and sometimes a lot of money, to prepare a very elaborate documented business plan with all the supporting facts and figures and extensive financial projections. And the bank still says no.

Entrepreneurs often find themselves working hard to prepare a Business Plan, because the bank asked for one. So they spend a lot of time and effort, and sometimes a lot of money, to prepare a very elaborate documented business plan with all the supporting facts and figures and extensive financial projections. And the bank still says no.

It’s a painful lesson: a good business plan is not enough. It is necessary, but not sufficient, to get financing.

The first question most potential investors and lenders ask is, “Can I see your Business Plan?” And usually the entrepreneur needs help with the strategizing, documentation and financial analysis to put one together. But I always ask entrepreneurs to confirm that they can meet all the other requirements before committing time and resources to a Business Plan. Too often after we have spent time and effort together to prepare a solid business plan that confirms the prospect of a viable business and the potential returns to investors and lenders, we then discover that the owners cannot deliver on the other requirements that we should have known from the start. So what else is required?

Lenders and investors have a checklist. It includes more than the request for a Business Plan. Be sure you are aware of the whole list and that you can meet all the other requirements before delivering your Business Plan. Remember the first requirement is to invest sufficient cash yourself (or from the three F’s – friends, family and fools) before you ask for more cash from the cold-blooded banker or investor who is neither friend, family, nor fool.

Here are some more observations from experience with borrowers, bankers and investors:

1. They will not get it.

Start by accepting that your lenders will never fully understand what you do for a living or why, your motivation, your challenges or your circumstances. But you do have to try to get them to understand enough about you and your business plans that they can be confident that working with you will be good for them.

Remember their objective is to earn a return on their investment and limit the risk of losing any money. Learn to speak their language and address their needs.

2. It’s only for the money.

You will need to prove that their money is all you need; because you have already looked after everything else.

The banker or investor does not want to worry about your customers, your management team, your sales and marketing efforts, your operating efficiencies, your health, your marriage or anything else except the financing you need.

3. They do have a checklist.

When you meet and fill in all the forms, remember the banker wants to be satisfied on these five criteria:

Character – do you have a reputation of integrity and responsibility on prior financial obligations?

Capital – do you have enough personally invested in your business to also be at risk?

Capacity – does your business have the ability to support the cash flow requirements?

Collateral – if your business cannot support the loans, what assets are available to cover them?

Conditions – is your industry in good economic condition or in a downturn?

Good answers on these points will provide the start to a good relationship with a confident and willing partner instead of tentative support from a cautious and reluctant partner.

So be prepared to meet all the requirements in addition to a good Business Plan and you are more likely to get the green light for GO!

Good luck. That also helps.

The post A Good Business Plan is Not Enough appeared first on Learning Entrepreneurship.

February 2, 2015

The Biggest Challenge: Strategic Leadership + Effective Management

It is my favourite theme and the owner/manager’s biggest challenge: balancing strategic leadership with effective operating management. Lack of strategic leadership may be the biggest mistake made by entrepreneurs and can be fatal to their business.

(Following is an extract from “Don’t Do It the Hard Way” by your Uncle Ralph.)

(Following is an extract from “Don’t Do It the Hard Way” by your Uncle Ralph.)

“Today I’m going to start by admitting to you my own biggest mistake as an entrepreneur – failing to continually think strategically. I was too often pre-occupied with operating issues and short-term problem solving. Stuck in the old dilemma of too busy fighting fires to ever work on fire prevention.”

“This was especially true in my first business, computer products distribution. There was so much detail to keep on top of – markets and technologies, customer service issues, managing employees and learning everything I had to know as a new entrepreneur about running a business - from accounting systems and freight rates to lines of credit and payroll deductions.”

“I had all the usual excuses for being drawn into the daily crises and never getting back to the drawing board to review the original strategic plan and see if we were still on track. To be honest, our original plan was not very strategic and never looked past the first two or three years. It was only focused on making our numbers, not on strategic positioning and managing our important business relationships. We made good short-term decisions to maintain profitability and win our share of competitive battles, but did not effectively protect ourselves from conflicts with our major suppliers and were not prepared for the rapid decline in profit margins as competitors flooded the market.”

“Don’t make the mistake I did of getting lost in the operating details and neglecting to raise the periscope and scan the horizon for oncoming threats or opportunities. Be prepared to respond. Strategic vision and leadership need to be constantly applied to daily decision making.”

(Read more in “Don’t Do It the Hard Way” by your Uncle Ralph.)

The post The Biggest Challenge: Strategic Leadership + Effective Management appeared first on Learning Entrepreneurship.

January 21, 2015

Step Back and Look at your Business

Take the time to get a wider perspective and adjust your plans.

Review recent performance against your current b usiness plan and expected results before we get too far into 2015. Seize the opportunity to make improvements and enhance the value of your business.

usiness plan and expected results before we get too far into 2015. Seize the opportunity to make improvements and enhance the value of your business.

Here are some ideas to inspire you to do better than ever.

1. Check your numbers against the top performers.

You probably already know the key variables to manage profitability in your business – gross margin, sales per square foot or sales per employee, for example – but have you compared your numbers to the top performers in your industry lately?

How has the current economy affected their growth rates or performance ratios compared to yours? You will have to do some homework to get the answers. Be sure to find the most comparable companies by industry size or type of business and then try to select the top performers. You may get useful comparisons from available data on public companies, from trade journals or from industry data bases. Your banker likely has access to RMA (Risk Management Association) data that is used by the banks to assess your credit worthiness. It is worth knowing what they are looking at and how they assess your performance so you know what they know.

2. Ask for key stakeholder opinions.

In addition to the bank’s assessment you should also regularly solicit feedback from your other key stakeholders. Those would be your employees, your customers and your major suppliers.

The key questions to ask are:

How would you describe our company relative to our competitors?

What do you think we do best?

Where do you think we need to improve?

What opportunities do you think we are missing?

3. Listen and learn.

Often business owners are surprised to find that the perceptions of their employees, customers and suppliers are quite consistent, but very different from their own.

You may think that your business is best known for low prices and fast service, but others see you as having expertise that is valuable and worth paying the perceived higher price and accepting relatively poor service. Oops!

Now you have something to work on. First, try to ensure that your perceived strategic position in the market is the one that you want; then work on delivering what is expected. And finally, assess the feedback on perceived opportunities that you are missing. In asking customers that question, recognize that you will have now established receptive prospects for new initiatives, so follow-up quickly.

4. Verify your readiness for growth

In order to pursue new opportunities and grow your business it is also timely to verify that you have a solid foundation for growth. The foundation needs to be resilient, flexible, and expandable in all the dimensions related to organisation, facilities, financing, and infrastructure.

A fitness test on all these areas is a necessary first step before launching new initiatives.

5. Focus on maximizing long-term value.

During the performance review there will be some obvious and easy “quick fixes” to generate revenue or cut costs. But as Einstein apparently once said, “For every serious and complex problem, there is an easy and obvious answer that is wrong.”

For businesses the error is usually to focus on short-term profitability, rather than long-term value. In fact, the accumulation of short-term decisions to control costs or pump revenue may actually diminish the long-term value that arises from sustainable and profitable growth. Typical examples are under-qualified staffing, low cost facilities and equipment, cutbacks in marketing or product development and chasing big customers with low profit margins or accepting questionable credit risks.

6. Identify and select the priority opportunities.

After completing the review and assessing the opportunities, the list of potential action items may be long. A selection of priorities to address in the immediate future is required. And more than three priorities means you have not yet made a selection, only a ranking. Try harder.

7. Make a new plan. Then make it happen.

With a short list of priorities you can make a realistic and achievable plan to improve performance. Simply list the steps required with names and dates assigned to each step.

Take this opportunity to rethink your business and make something happen. Remember if nothing changes, nothing happens.

Be better. Do better.

The post Step Back and Look at your Business appeared first on Learning Entrepreneurship.

January 8, 2015

How are we doing so far in 2015?

We start the year in uncertain and dangerous times. We have been here before and it has been even worse in the recent past, but planning and management in this environment has us wondering about the impact on our businesses. What are the right management strategies and action plans to get through this year and build a more resilient and successful business?

We start the year in uncertain and dangerous times. We have been here before and it has been even worse in the recent past, but planning and management in this environment has us wondering about the impact on our businesses. What are the right management strategies and action plans to get through this year and build a more resilient and successful business?

Here are the lessons we have learned in the past:

1. Do not react to the headlines. They are primarily trying to get your attention and a train wreck, death and disaster are always more interesting than a business success story. You will not likely get balanced or insightful input to your planning or decision making. You will have to dig deeper. Make sure your market feedback and competitive analysis are current and accurate.

2. Communicate. Communicate. Communicate. Keep employees and customers informed. They are also worried and confused and need to be reassured that they can count on you. You may not have good news for them, but it will be appreciated that they are hearing directly from you and are not left guessing what’s next.

3. Keep on Selling. Now is not the time to cut back on marketing and sales. Your efforts now will be even more conspicuous and effective if your competitors are reducing their marketing and sales efforts. Be selective and very focused. Work on building stronger customer relationships by being relevant and responsive to the current circumstances. Calmness, confidence and competence are much more appealing to those potential buyers who are still spending and want reliable, long term suppliers.

4. Do quickly what obviously needs to be done. If it’s clear to you it’s also clear to the people affected. They are waiting for you to act and will be more confident and proactive themselves if they see you taking action. Face the facts, don’t fight the facts. 5. Adapt. Remember Darwin’s “survival of the fittest”: those who adapt to their environment are most likely to survive; not the strongest or the biggest. This is not the time to be stubbornly persistent about your plans. Look around and be creative. Your destination may still be the same, but the route, the vehicle and the passengers may need to be changed.

6. Be confident, but cautious. Recognize the difference between taking a calculated risk and taking a wild swing hoping for the best. Make a decision if the potential outcomes and the probabilities are reasonably clear, but hold fire if they are not.

7. Show conspicuous leadership. This is not the time to hide in your office. Strong leaders understand the need to be the most conspicuous communicator on current issues. No one can do it better than the one who is ultimately responsible for taking action. We may not all be adept at it, but we can all speak with more sincerity than any spokesperson or intermediary on our concerns, our strategies and our plans.

Good management will be tested again this year, but good decisions will mean a better business for the future. Keep at it and better times will follow soon. Stay hopeful and optimistic.

Happy New Year,

Del Chatterson

© January 2015

The post How are we doing so far in 2015? appeared first on Learning Entrepreneurship.

December 11, 2014

Seven Biggest Mistakes & How to Avoid Them

Some ideas to put on your New Year’s Resolution list for better results in 2015.

A few years ago, I came up with “The Seven Biggest Mistakes that Entrepreneurs Make and How to Avoid Them” for a breakfast seminar presentation. The presentation was well received and has since been used many times, eventually expanding into several chapters of my latest book for entrepreneurs, “Don’t Do It the Hard Way”.

A few years ago, I came up with “The Seven Biggest Mistakes that Entrepreneurs Make and How to Avoid Them” for a breakfast seminar presentation. The presentation was well received and has since been used many times, eventually expanding into several chapters of my latest book for entrepreneurs, “Don’t Do It the Hard Way”.

This is a short version of my list of the seven biggest mistakes followed by my recommendations to avoid them by seeking balance.

#1 Too Entrepreneurial

Certain characteristics of entrepreneurs are necessary for them to be successful. But if over-indulged they can lead to big mistakes. These include the tendency to be too opportunistic and not sufficiently selective and focused; to be too optimistic and miss or ignore the warning signs; to be too impatient and expect too much too soon.

Entrepreneurs usually have great confidence in their instincts, but the mistake is to neglect or ignore market feedback and analysis of the facts. Being action-oriented, the tendency is to “just do it”.

Entrepreneurs are expected to be decisive and demonstrate leadership, but both can be overdone – deciding too quickly and providing too much direction so that input, initiative and creativity are stifled. All these mistakes can arise from being “too entrepreneurial”.

#2 Lack of Strategic Leadership

Another tendency of many entrepreneurs is to get lost in the daily details and completely forget their original strategic plan. Operating decisions demand continuous attention and there is seldom time dedicated to stepping back and looking at the business from a strategic perspective. The common observation is that the owner is too busy working in his business to effectively work on his business.

Defaulting to continuous short-term decision-making can result in the business not having consistent strategic direction and straying far from the original plan. Lack of strategic direction may be the single Biggest Mistake that Entrepreneurs Make.

#3 “That was Easy, Let’s Do It Again!”

Another common mistake that can have devastating consequences on the business is the over-confident entrepreneur who concludes, “That was easy, let’s do it again!” So he or she jumps into new markets, new product lines, or even a new business or investment opportunity without doing the homework first.

It’s important to remember: Making money doesn’t make you smart. Look at every opportunity with the same detached analysis as the first time you started a business. Many successful entrepreneurs have made the mistake of jumping into a new venture – merger, acquisition, restaurant franchise or real estate investment – and blown away the equity value they generated in their original business. Another big mistake to avoid.

#4 Focused on Profit

Being focused on profit doesn’t seem like a mistake. After all, isn’t that the whole purpose of running a business? No, actually. The primary financial objective of any business is “to enhance long-term shareholder value.”

A focus on short-term profits will do exactly the opposite. It is easy to improve short-term profit by reducing the maintenance and marketing expenses, neglecting product development, cutting employee wages and benefits, ignoring safety and environmental regulations and avoiding taxes, but these actions can all destroy long-term value. Paying attention to these requirements will help to build it.

Managers need to look at all their key performance variables and react quickly to avoid big mistakes.

#5 Neglecting Key Relationships

The key relationship for any business is the one between management and staff. Good communications are essential to providing strategic leadership and ensuring that management and staff are working effectively as a team toward common goals.

Sometimes we are distracted from our key relationships by the most annoying and challenging employee or customer. Often your biggest customers are not the “squeakiest”; just the most important. And do you need to squeak more yourself? Do your suppliers appreciate you enough?

Another important relationship is with your banker: Is your bank a welcome and willing partner in your business? Building and protecting these key relationships are essential to keeping your business on track and meeting your strategic objectives.

#6 Poor Marketing and Sales Management

There are usually obvious signs of poor marketing and sales management. Feedback from customers will also highlight your failures in customer service. Opportunities for growth are being missed and current customers are fading away.

No business can survive without effective marketing and sales management supported by consistent customer service. All three functions need to be done well to build loyal, long-term profitable customer relationships.

#7 Distracted by Personal Issues

Personal issues can seriously affect business performance regardless of whether they come from the owner, management or staff. Family businesses introduce particular challenges to managing personalities and corporate culture. Can you include family members in the management team without excluding others?

In summary, my list of the Seven Biggest Mistakes that Entrepreneurs Make:

Too Entrepreneurial

Lack of Strategic Direction

“Let’s do it again!”

Focus on Profit

Neglecting Key Relationships

Poor Marketing and Sales Management

Personal Distractions

How to Avoid Them?

Each of these Big Mistakes is a result of the entrepreneur failing to achieve balance between opposing forces.

The Answer is Balance!

Avoiding these mistakes requires the entrepreneur and business owner to:

Balance Energy and Drive with Planning and Analysis

Balance Strategic Vision with Operational Detail

Balance the Logical Head with the Intuitive Heart

Balance Short-term Profit with Long-term Value

Balance Personal Priorities with Strategic Objectives.

Balance these issues to grow and prosper in your business and avoid the Seven Biggest Mistakes that Entrepreneurs Make.

Enjoy the Holiday Season and have an outstanding New Year.

Del Chatterson

An excerpt from Don’t Do It the Hard Way, A wise man learns from the mistakes of others: Only a fool insists on making his own” by your Uncle Ralph, Delvin R. Chatterson

The post Seven Biggest Mistakes & How to Avoid Them appeared first on Learning Entrepreneurship.

December 3, 2014

Profiling is a Problem

I am not referring to the policing tactics that lead to so much turmoil, but to the never-ending management of your own personal profile. It is essential to your personal branding and the presence of so many online profiles on different platforms is extremely important to perceptions of your reputation and credibility.

Profile maintenance is never-ending, requiring continuous revision your life story on LinkedIn, Facebook, Twitter plus your website, CV, and other marketing and PR bios and blurbs. It’s hard to be consistent and effective in presenting yourself. And you may be fighting other versions of your story that are still found on the Internet. Aren’t you the guy who …?

I’m reminded of the story of Dizzy Dean, a baseball hero of the 1940′s. (I know, before your time and mine, but there was a movie….) Apparently after his first game with the Yankees he created a media frenzy with his sensational pitching. He spent hours in the dressing room after the game with one reporter after  another asking him to tell them his life story.

another asking him to tell them his life story.

The next day in the papers, remarkably everybody had a different story. His manager asked him, “What happened?”

“Well,” Dizzy Dean replied, “I just didn’t think it was fair to give them all the same story.”

Maybe not a good branding strategy, but perhaps an early example of “mass personalization”? Everyone got a story that was interesting and original to them. It is part of every pitch to adjust for the particular target audience and appeal to the areas you have in common. So long as it’s all true and you’re not inventing a new life story that is complete fiction. Unless you are writing your biography, keep your profile concise, simple and consistent. Focus on the key points that are important to your chosen target audience and do not try to appeal to everybody.

In my own profile I am re-branding myself as your Uncle Ralph. It’s the persona I want to present as the experienced, wise and friendly advisor for entrepreneurs. Not an academic management professor, not a celebrity CEO and not a new techie billionaire. Just a former business owner and entrepreneur who is now consulting, advising, writing and cheerleading for entrepreneurs.

In my own profile I am re-branding myself as your Uncle Ralph. It’s the persona I want to present as the experienced, wise and friendly advisor for entrepreneurs. Not an academic management professor, not a celebrity CEO and not a new techie billionaire. Just a former business owner and entrepreneur who is now consulting, advising, writing and cheerleading for entrepreneurs.

Del Chatterson is your Uncle Ralph.

The post Profiling is a Problem appeared first on Learning Entrepreneurship.

My Unplanned “Retirement” at 52

It’s better to have a plan

My unplanned retirement at 52 seems to have been successful, if I look back over the last 15 years, but I could have done it better and suggest that you can too, if you have a plan.

Here is my story and the lessons I have learned. I am sharing them on the assumption that it’s never too late for you or me to do it better. At age 52, I quit my day job and headed into the unknown. At that time I certainly did not call it “retirement”. It was more “seeking new opportunities”, “time for a change of career plans” and other appropriate clichés.

How did I get to that point? Well, I was just another engineer/MBA with a career in corporate positions and management consulting followed by twelve years in my own business. My business in computer products distribution grew fast and did very well during the booming PC revolution of the ‘80’s. Then in the ‘90’s the PC market rapidly changed and smaller players were squeezed out by the few surviving big manufacturers, distributors, and retailers. So the business become less fun and less rewarding as I went through the challenges of a merger, wind-up, re-start and finally an exit. My decision to leave was simply based on the lack of personal satisfaction. The stimulating challenges and my motivation had evaporated. It was time to move on.

During most of the 25 years after my MBA, I had earned good compensation and was apparently smart enough to manage a sound savings and investment plan (encouraged by the wise and practical advice of Jonathan Chevreau, the Wealthy Barber and many others.) The biggest bump in compensation and savings happened, of course, during the good years in my own business when sales and profits were booming. But when I quit working and starting searching for new opportunities there were two things missing: I did not know what I really wanted and I didn’t have a plan

Financially, I was able to carry on without income and live off my investments. My savings and investment plans, starting in my early 30’s, were based on reasonable risk and return assumptions in a well diversified portfolio. I started with a brokerage account and a commission-based broker. But after some bad advice and a couple of big losses, I switched to another broker for a few years and then finally decided to go 100% self-directed. I had learned that my choices were as good as those of the big brokerage research advisors and I now had the luxury of boasting about the winners and keeping quiet about my mistakes. I remained cautious on 85% of the portfolio, although it was 95% in equities, as I could never justify the low returns of fixed income and was willing to be patient through the downturns. I often explain (usually to aggressive wealth management sales people) that my decision to continue to manage my own investments is not for the better returns, but for the education and entertainment value. Admittedly, sometimes an expensive education and sometimes more horror story than action-adventure.

Over the years, however, I had achieved acceptable average returns and at age 52 I could quit working and earning income. I could “retire”.

My Rule of 15

How did I know that? Well, being an engineer and MBA, I did have spreadsheets to run through various scenarios that showed I could live well and still leave an inheritance behind whenever I checked out. I even developed a simple “Rule of 15” that saves you all the trouble of preparing those spreadsheets. If you have fifteen times your annual spending invested, then you are good to retire. That’s it: if you need $50,000 a year to live on, you can retire on $750,000. That amount will take thirty years to decline to zero if you can earn at least 5% a year return on it. The experts of course, will tell you it’s more complicated than that and you need to consider inflation and volatility of returns, housing, health and family issues, but they are not predictable anyway and you have some room for error and the ability to manage within the 5% return and the thirty-year time frame assumptions. Don’t make it complicated and suffer paralysis by analysis. The Rule of 15 is a simple reality check on your retirement plans

But financial independence, findependence as Jonathan Chevreau calls it, is not enough. You may know how you are going to spend your money during your retirement, but how are you going to spend your time? That turns out to be even more important to your long-term health and well being.

In my own case, I meandered aimlessly into my unplanned retirement and tried to keep it interesting by dabbling in everything from Internet start-ups to building a consulting business; from running marathons to running for MP, playing golf to playing guitar. I dealt with some family issues, separated and divorced and did some voluntourism by helping entrepreneurs in developing economies and aboriginal communities.

After fifteen years of wandering between consulting, semi-retirement and self-unemployment, I recognized that this approach was not giving me much satisfaction. I needed more passion and purpose in my life.

Since my own process was clearly not working, I started soliciting input and advice from professional resources to help figure out what I really needed for personal fulfillment. It began with a personal assessment of who I was and what I wanted. Better knowledge of myself helped me focus on what I should be spending my time on to achieve the goals of personal fulfillment. Clarity helps.

Here are the most important lessons that I learned in my unplanned retirement:

Do not make decisions by neglecting them until events decide for you.

Have a plan that recognizes your personal needs, goals, resources, limitations and timetable.

Assess who you are and where you are now; decide where you want to be and when; and then start acting according to your plan. Hope for a little luck along the way, but don’t count on it.

Have a happy retirement

The post My Unplanned “Retirement” at 52 appeared first on Learning Entrepreneurship.