Mohit Tater's Blog, page 595

January 10, 2019

Guidance for PCI DSS

Any business that accepts credit cards

online for good or services rendered needs to comply with the Payment Card

Industry Data Security Standard (PCI DSS).

PCI DSS comprises of several guidelines

that merchants must comply with to protect their customers’ credit card data.

However, many companies struggle with security requirements. In most

organizations, InfoSec managers are not sure whether their networks and systems

fall under the PCI DSS scope.

What

is PCI DSS?

PCI DSS is an acronym for Payment Card Industry Data Security Standard. The five major payment card companies created the security standard: Visa, MasterCard, JCB International, Discover Financial Services and American Express, and provides the best practices for handling and storing cardholder data (CHD).

PCI DSS requirements are a series of

standards for processing card payments that protect both merchants and

consumers. These standards are generally referred to as the Payment Card Data

Security Standard.

Understanding

Cardholder Data (CHD)

PCI DSS defines cardholder data (CHD) as

any information that can identify a person and link them to a credit or debit

card. The personally identifiable information (PII) may include the name

of the customer and their address.

Apart from PII, cardholder data includes

the primary account number (PAN) of the cardholder, together with the card

service code and expiration date.

Securing

Cardholder Data Environment (CDE)

Cardholder data environment (CDE) refers

to any infrastructure or systems that process, transmit or store cardholder

data.

The infrastructure includes components

such as computers, applications, and networked devices that have direct or

indirect contact with cardholder data. These infrastructure components must be

PCI DSS compliant.

Network

Segmentation

The PCI standard requires the cardholder

data environment to be separated from other systems or components used by your

organization. Any devices connecting to the CDE through insecure connections

could put your firm at risk of third-party intrusions and, consequently, heavy

fines by regulatory bodies.

Overview

of the PCI DSS Scope

For your firm to be PCI-compliant, you

have to determine the CDE. Make a list of the networks, systems, applications,

and devices that interact with CHD and are, therefore, part of the CDE.

All the systems and components that

transmit, handle or store CHD in any form should be separated from the other

infrastructure and secured according to PCI requirements.

Importance

of Creating a Data Flow

It is essential to know the exact steps

that data follows when it is transmitted, managed and handled in your IT

infrastructure. For example, your network may be set up to store CHD and, at

the same time, receive data from a non-cardholder application.

In such a case, the non-cardholder

application will have to be secured according to PCI standards since it is in

the CDE. If the user is not protected, a malicious intrusion through it can

compromise the CDE.

Understanding how data flows in your IT infrastructure is critical to determining the security measures to implement for risk mitigation and prevention.

What

is an SAQ?

The PCI Security Standards Council has a Self-Assessment Questionnaire (SAQ) that merchants can fill to review their technology and find out whether they are PCI-compliant. The SAQ limits the CDE and makes it easy to identify which infrastructure components fall under PCI DSS scope.

Merchants that take credit card payments

physically at their establishments can use PCI SSC approved point-to-point

encryption (P2PE) devices to be PCI DSS compliant. This lower compliance standard

applies to merchants that:

Process payments using

PCI DSS-approved P2PE devicesHave P2PE devices that

only interact with their approved Point of Interaction (POI) devicesHave implemented all the

required P2PE controlsDi not collect, transmit

or store electronic cardholder dataDo not store legacy

information electronically

The lower PCI-compliance standard is

applicable for brick-and-mortar stores that use PCI-compliant devices and do

not store electronic cardholder information in any form.

PCI

Compliance Audits

Your organization’s PCI compliance must be

overseen by third parties known as Qualified Security Advisors (QSAs). These

auditors are trained in PCI compliance and will review your cardholder data

environment to ensure it is appropriately secured.

If your organization uses a

Software-as-a-Service (SaaS) platform to process payments, the platform is also

considered part of the PCI compliance scope if it stores, processes or

transmits CHD. For this reason, it is critical to establish whether the payment

platform you may want to use is PCI-complaint.

Vendors need to provide the following

documentation to prove compliance:

Independent assessments

carried out annually and presented to their customersMultiple on-demand

evaluations that may be required by users

Use

Compliance Software to be PCI-Compliant

You can use various programs to meet your

firm’s PCI compliance requirements. The compliance software will act as a

single-source-of-information, enabling you to see your current security controls.

You can then map your organization’s controls align with PCI DSS requirements.

Author Bio

Ken Lynch is an enterprise software startup veteran, who has always been fascinated about what drives workers to work and how to make work more engaging. Ken founded Reciprocity to pursue just that. He has propelled Reciprocity’s success with this mission-based goal of engaging employees with the IT governance, risk, and compliance goals of their company in order to create more socially minded corporate citizens. Ken earned his BS in Computer Science and Electrical Engineering from MIT. Learn more at ReciprocityLabs.com.

The post Guidance for PCI DSS appeared first on Entrepreneurship Life.

Tips for Creating Effective Brand Awareness

It’s not news that brand awareness is essential for businesses to thrive. But building brand awareness in today’s marketing climate is much more than simply running ads or buying a domain name. Having an active online and social media presence is important, but the online space is over saturated with ads, raising prices and lowering impact.

Creative thinking is essential in crafting successful brand awareness strategies that stand out. Below are some tips to bear in mind when creating brand awareness initiatives.

Get To Know the Consumer

Understanding who comprises your target market and what they want is essential for raising brand awareness. Often it is the case though that an unanticipated demographic interacts with a brand because it’s being used in unexpected ways. StickerYou for example, an e-commerce store specializing in user-made customizable stickers assumed their customers would mostly comprise of young people and artists. Although this indeed became the case, the company also found that other businesses were using their customizable products to further their branding and promotional incentives. By paying close attention to who was buying our products, we were able to adjust branding awareness strategies to include this new audience.

Make an Emotional Impact

It’s not enough to highlight what a product or company does. Successful brand awareness initiatives hinge on how the brand makes consumers feel. Evoking an emotional response with branding efforts can help connect the brand with consumers in a memorable way. And the emotion doesn’t have to be the standard “happy.” Highlighting how a product or service can solve a problem for a customer can foster feelings of trust and safety. By focusing on a specific emotional response, brands become more relatable, and by proxy, more trusted.

Cross-Promote

Traditional and outbound marketing still prove effective in terms of brand awareness because they are successful ways to ensure products or services are seen by customers. The problem is that audiences who aren’t interested in the brand are going to ignore these efforts. Targeting specific demographics and increasing brand awareness to tap into new ones works best with cross-promotional tactics, as this helps expand brand awareness via each customer base. Having an e-commerce store cross-promote in a physical brick-and-mortar location for example can be a mutually beneficial strategy. The brick-and-mortar helps the e-commerce store by exposing the brand to an audience that might spend a lot or any time online. Conversely, an e-commerce store can promote online exclusive deals to increase the brand awareness of the brick-and-mortar.

Team Up with Influencers

Establishing relationships with influencers that operate in a niche market and focusing on a specific product or service is useful in increasing brand awareness. For example, at StickerYou, we promote the ability to customize sticker designs using our online Sticker Maker tool. This ability to customize designs appeals to street artists who want to create stickers to promote their work in their own networks, which are often niche target audiences interested in art and design. By working with street artist influencers, we are able to engage with their target audiences in a more meaningful way than if we were to try to access these audiences on our own. We often post blogs featuring the creative work of artists that have purchased from us that they can then share on their own social channels and networks. This way, both parties gain increased brand awareness and exposure in different specific market segments.

Package Makes Perfect

Putting the finishing touches on orders via branded packaging is an easy, affordable, and unique way to raise brand awareness. Having a visually pleasing and functional package advertises a brand not only when the customer receives it, but also while the package is in transit. Branded packaging can make a lasting impression that encourages repeat purchases and positive word-of-mouth references.

Raising brand awareness is an important element in growing a successful business. Knowing who the customer is, evoking an emotional response, and spreading the company message via influencers, creative promo campaigns and packaging allow brands to affordably increase brand awareness in creative ways.

Author: StickerYou Founder & President, Andrew Witkin

As the founder of a global e-commerce leader in custom-printed, die-cut products, Andrew Witkin is widely recognized as a leading authority on e-commerce, customization, startups, marketing and the tech economy. Witkin has also served as VP North American Licensing for Nelvana/Corus Entertainment and Director of Marketing for MegaBrands/Mattel.

The post Tips for Creating Effective Brand Awareness appeared first on Entrepreneurship Life.

The world’s Best Hotels for Business Travel

Traditional offices and chained-to-desk positions are no longer as commonplace as they used to be. Workspaces are popping up left and right, catering to the growing population of remote workers (Fast Company called remote work “the new normal”). Coffee shops are doubling as temporary offices. And hotels are developing well-planned business centers for business travelers.

All around the world,

hotels are designing spaces that cater to business people whose positions are

transient. Whether you’re looking for the perfect hotel in Tokyo to host an

entire company, or simply an ultra comfortable room to independently handle

some business in New York City, there’s an unique option out there for you.

The key is to choose

hotels that are known for catering to business travelers. Some hotels focus on

tourists; others on long-term guests. By understanding which hotels operate

with your lifestyle in mind, you’re putting yourself in a much better position

to enjoy your stay and get some work done. Here are some of the world’s best

hotels for business travel:

Concorde

Hotel, New York

When it comes to New York, business travelers are everywhere. And business hotels are a dime a dozen. But in a city inundated with hotels, it can be difficult to choose the right one. The boutique Concorde Hotel in New York City is ideal for business travelers seeking to combine luxury comfort with efficiency. For travelers not just looking for a room—but a temporary home—Concorde is ideal.

Suites and penthouses

are designed with the business traveler in mind: luxurious, high-end

comfortable furniture spans throughout the layout, making it easy to get a good

night’s rest after a long flight. The hotel is also centrally located, making

it a simple access point for reaching meetings throughout the city. With a

complete business center at your disposal, combined with printing and mail

services and fast WiFi, there’s nothing you won’t be able to get done here.

Manchester

Grand Hyatt, San Diego

Standing tall in the heart of Downtown San Diego is the Manchester Grand Hyatt equipped with 100,000 square feet of indoor meeting space. This makes it the perfect space to do everything from independent work to gathering entire teams or using the hotel as a base to host a work retreat. There’s also plenty of event space, as well as easy access to a championship golf course and nearby beaches.

The

Peninsula Hong Kong

Tokyo is one of the biggest cities in the world for business, and the Peninsula in Hong Kong lives up to the challenge. In a study conducted by Fortune Magazine Travel + Leisure, Peninsula was ranked one of the best hotels for business travelers. A bedside panel makes it easy for travelers to control everything from the television to the thermostat to the lighting to concierge requests—all with the touch of a few buttons. Gyms and business centers are available 24/7. Guests are even transported from the airport to the hotel in a Rolls Royce or BMW that’s equipped with WiFI.

Hilton

Anatole, Dallas

There are many things a business traveler needs, and the Hilton Anatole in Downtown Dallas, Texas ticks several boxes. The hotel boasts three executive floors, over 50,000 square feet of event and meeting space, and an on-site FedEx center. It’s also located in a prime area (near multiple main attraction), and several boardrooms offer skyline views. No matter what you need to get done, Hilton Anatole make it’s easy to do business.

Orchard

Hotel, Singapore

The Orchard Hotel in Singapore offers packages dedicated exclusively to business travelers. For example, the Executive Club Deal considers the meeting-to-meeting lifestyle of the average business travel. It comes with limo rental services, shoe shining services, complimentary laundry, and evening cocktails.

Its 13 function rooms

have a team award-winning chefs and event planners who can help coordinate your

events and ensure they’re running as smoothly as possible. What’s best is that

rooms here run as low as $150 per night.

Waldorf

Astoria, Chicago

The Waldorf Astoria in Chicago was rated the best hotel in the United States by Conde Nast Traveler. The rooms have terraces, soaking tubs, and marble floors. In the Balsan Private Dining Room, an entire team of business travelers can be treated to a private meal during a meeting break. All Waldorf properties are equipped with unique boardrooms. The Chicago location boardroom, called the Hemingway Salon, is decorated to represent 1920s Paris with high ceilings, natural light, and elegant fittings. There are eight meeting rooms and a formal ballroom, and private dining room for groups as well.

The post The world’s Best Hotels for Business Travel appeared first on Entrepreneurship Life.

January 9, 2019

Jacques Poujade Shares: 5 Questions To Ask Your Mortgage Broker When Buying A Home?

Jacques Poujade is a financial industry executive, with more than three decades of experience. During his career, he has worked in prominent roles in Canada, the UK, and the US. Therefore, he has the practical knowledge to help budget conscious entrepreneurs, from a range of backgrounds, obtain real estate financing to buy their ideal home. These days, he leverages that expertise at the non-bank mortgage provider, LendPlus. Here he shares five questions he commonly gets asked and that you, too, should ask your mortgage broker when buying a home.

1.

What Documents do you Need to Process my Loan?

You should ask this question upfront, so

you will have plenty of time to get your documents together. Proof of Income

enables lenders to check that your earnings are sufficient to cover mortgage

payments and living costs (i.e. utility bills and furnishing costs). Lenders

will gauge your risk profile by researching your credit history too.

Frequently, lenders ask for documents like

bank statements to ensure that mortgage applicants have the funds to cover

several monthly mortgage payments. This is just in case anything unexpected

occurs – like having an accident that prevents you from working, or

unexpectedly losing your job. Lenders may wish to see your tax return as well

to check that the information you gave to the IRS corresponds with the income

report you submitted to them.

2.

Am I Eligible for an FHA Loan?

FHA loans are specialized loans provided by

the FHA (Federal Housing Administration), which enable people with zero credit

or bad credit to acquire mortgages. Usually, these loans are given to first

time house buyers. The FHA permits these buyers to buy a house for a mere 3.5

percent down payment, in some cases. This makes home ownership possible for

many more people. A minimum credit score of 580 is required for approval.

3.

How Much Money Should I set Aside for Closing Costs?

Generally speaking, sellers pay closing

costs, although sometimes, they might negotiate with buyers to split the cost.

These costs include recording fees, commissions, title insurance, and mortgage

fees. Buyers who have mortgage insurance with an annual payment option pay

their lender the initial twelve month’s premium upon closing. Buyers who opt

for monthly mortgage insurance payments only must pay their lender for one

month upon closing.

Long story short, when determining how much

you can put down on a house, you should include ancillary fees like closing

costs and/or mortgage insurance.

4.

Can I Pay Off My Mortgage Early?

Yes, absolutely. If you wish to release

capital for other purposes, or lower the total interest charged for your

mortgage, paying your mortgage off ahead of time could help. You make interest

payments on your remaining balance every month your mortgage exists. If you pay

off your balance early, you will avoid years of additional interest on the

loan.

Also, fully paying your mortgage off

increases your monthly cash flow. This eases the financial burden on your home

and provides you with extra resources to save or invest. Over the long term,

this approach could give you bigger returns.

5.

Can I Benefit from Mortgage Insurance or PMI?

Yes, mortgage insurance gives lenders a financial guarantee that protects them, if borrowers default on their loans. If you want to purchase a house, signing up to loan conditions that feature mortgage insurance boosts your buying power to a large extent.

By purchasing mortgage insurance, you have

the chance to buy a house with a five to ten percent down payment, rather than

the twenty percent that is frequently needed if the lender isn’t protected by

mortgage insurance. This is an ideal option for would be borrowers, who cannot

make big down payments.

Connect with Jacques If you would like to receive further advice relating to finance and real estate, you can follow Jacques Poujade on Twitter and Facebook for his latest thoughts. He also covers these subjects in considerable detail on his personal website, JacquesPoujade.com

The post Jacques Poujade Shares: 5 Questions To Ask Your Mortgage Broker When Buying A Home? appeared first on Entrepreneurship Life.

3 Due Diligence Points for Mortgage Lenders

A combination of the 2008 financial crisis and the expansion of Fintech has caused large swaths of retail investors to dabble in the mortgage lending markets. While banks scaled back their debt portfolios after the Great Recession, other financing businesses quickly occupied the newly-vacant space. In this article, I will highlight three points of due diligence for investors who are interested in mortgage lending to consider.

#1: What rank is the mortgage?

A mortgage

is a legal tool that is used to secure a debt against real estate. Ultimately,

it stops the debtor from selling a property until secured lenders are repaid in

full.

A piece of

real estate can have multiple mortgages registered against it. This is a

concept known as “lien priority” or “rank.” For instance, let’s assume that Joe

purchased a house in 2010. He paid $500,000 for it, which included borrowing

$400,000 from the bank. The bank placed a mortgage on his home. It will be

lifted once Joe’s debt to the bank is paid off.

In 2012,

Joe borrowed $50,000 from you. Since you wanted collateral for the loan, you

required him to allow you to register a second mortgage on his residence.

Now, let’s

say that Joe wants to sell his house in 2019. After listing it on the market

for two months, he is able to earn $600,000 from it. Before he can retain any

of the proceeds, he must first repay the bank. Then, he has to pay you back.

After both secured creditors recoup their funds, Joe can keep what remains.

Rank is

important because it is directly correlated to risk. The earliest lenders get

their money back first. The deeper down the ladder one goes, the greater the

chance of not being repaid if the borrower defaults.

#2: What is the loan-to-value ratio of the

property?

Assessing

the mortgage rank is important, but it’s not enough for complete due diligence.

The lender must also know how much debt there is on a property when compared to

its worth. This is a concept known as the loan-to-value ratio or LTV.

In the

prior example, we saw that Joe’s house was purchased for $500,000. It had two

mortgages on it: the first for $400,000 and the second for $50,000. As such, it

had a cumulative debt of $450,000, which is 90% of $500,000. As such, the LTV

was 90%.

However,

Joe’s property price increased over the years. By the time 2019 came around,

the house was worth $600,000. Thus, the LTV ratio was reduced to 75%. In fact,

he was likely making principal payments to both you and the bank, so the LTV

would have dipped even further.

LTV matters

because it helps the lender understand how much room there is for the real

estate’s price to decline. If it falls below the value of the mortgage, then

there is a high risk of the lender losing money if the borrower defaults. This

is called being “underwater.” Sadly, it was all too common during the 2008

economic collapse.

As an

example, let’s say that the economy slows down. People now have less disposable

cash, so they’re unable to purchase homes as frequently. This places downward

pressure on all houses, causing the price of Joe’s to plummet to $420,000. Six

months later, he loses his job and can’t meet his obligations on either of his

mortgage loans.

After

repeated warnings, the bank loses patience with Joe. It files a lawsuit against

him and moves to foreclose on his property. The court approves a sale of the

home at market price, $420,000. As such, the bank recoups its money and can

move on.

After

paying back the bank, there is only $20,000 left. All of that goes to you. But

you loaned $50,000, so you’re still out $30,000. You’ll now have try to collect

the balance from Joe’s remaining assets, which can be substantially more

difficult.

We can

therefore see that lending at a 90% LTV was a costly decision. So, what is a

good loan-to-value ratio? 30%? 50%? 80%? There is not a perfect answer to this

question. However, many in the industry consider 75% to be comfortable. That

number provides for a property devaluation of 25%.

It is

critical to note that our discussion of LTV thus far was a bit simplistic.

Oftentimes, the court will approve a sale of the property at below market

value. That can skew the picture. Further, the lender will probably incur legal

fees during the foreclosure process. These are usually tacked onto the balance

of the borrower’s debt. But they should be accounted for, or at least

considered, in the LTV equation.

For

instance, in Joe’s case, the bank may have spent $10,000 on attorney fees to

foreclose on the home. Thus, his debt to the bank would have increased to

$410,000. That eliminates another tranche of capital that could have otherwise

gone to you.

#3: What is the borrower’s exit strategy?

The lender

should know how the borrower intends to repay the debt. It might be through a

property sale, from a refinance or via generating capital in another way. But

regardless, it is risky to give a loan without knowing how it will be paid

back. It could result in the borrower’s inability to repay the loan by the

agreed-upon maturity date.

Conclusion

Mortgage

lending can be a good investment. Among other things, it can provide for

security in real estate and consistent interest payments. However, it can be

risky if done incorrectly. The foregoing three points are just the tip of the

iceberg. Thorough due diligence will call for a comprehensive review of the

borrower, the asset, the local market and the economy in general.

Further,

some jurisdictions require a license to be a lender. Before embarking your

journey as a private debt financier, it may be worthwhile to consult with an

attorney. That person could be useful to you later on, as well. You will likely

need help with legal documentation, such as promissory notes and mortgage

agreements.

Author Bio

Alexis Assadi is an investor, writer and entrepreneur. He operates various financing companies, including Pacific Income Capital Corporation and Assadi Capital Corporation. Alexis lives in Vancouver, Canada with his family.

The post 3 Due Diligence Points for Mortgage Lenders appeared first on Entrepreneurship Life.

How to transfer WhatsApp Messages from iPhone to Android

It is never easy to switch from iPhone to Android as data transfer from one device to another becomes a difficult task to deal with. For example, Whatsapp transfer is a time consuming and tedious affair across any iOS to Android platform.

Of course,

while hunting for how to transfer WhatsApp chats history from iPhone to Android

you may get a list of different solutions. But, not many of them are remotely

functional and would save your time. So, to make everything simple and

effective and to avoid multiple attempts to carry out the WhatsApp transfer

from iPhone to Android you need to rely on a well- structured program that is

useful and convenient.

Well, if you are still searching for one but haven’t been successful in getting any then we will help you discover the right solution that is already tried and tested so that you do not have to invest your valuable time in knowing about the transfer process. iSkysoft Toolbox is an easy and time saving transfer solution that helps you transfer WhatsApp messages from iPhone to Android successfully within a few clicks.

Part 1: iSkysoft Toolbox – Best program that helps transfer WhatsApp from iPhone to Android

iSkysoft

Toolbox- Restore Social App is well-designed software that lets you transfer

WhatsApp data from iPhone to Android following simple steps that just takes a

few seconds. The easy steps enclosed in the transfer process makes the tricky process

of transfer faster.

Just follow

the steps given below carefully to discover the extremely simple and automatic

transfer process.

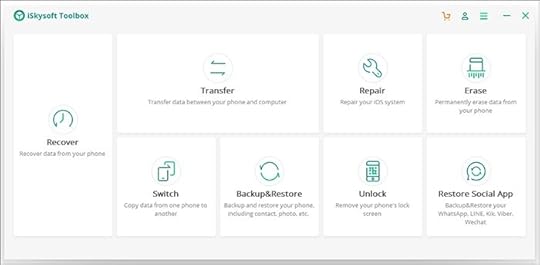

Step 1. On

your computer- Install the software- iSkysoft Toolbox. Now connect iPhone and

your Android device to your PC with the help of an USB cable. Run the program –

iSkysoft Toolbox and click- “Restore Social App” to start the process.

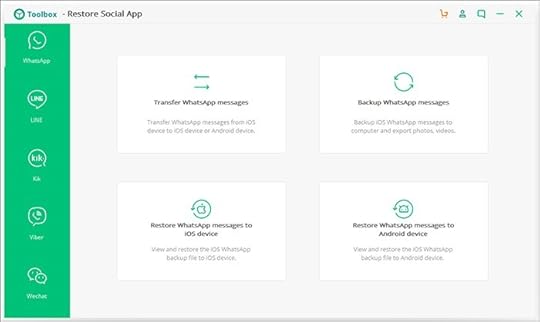

Step 2. The

next screen will display 4 options. On the left hand side you will be able to see

the option – “WhatsApp”. Just click on it. Now you need to click on the option

– “Transfer WhatsApp messages” to begin the transfer.

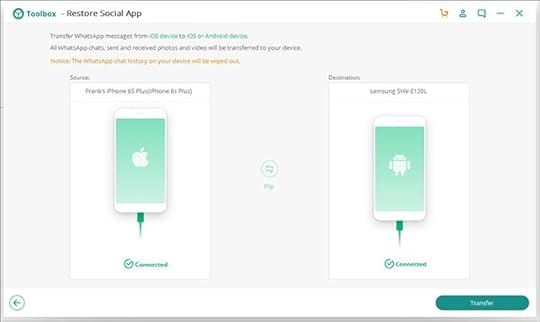

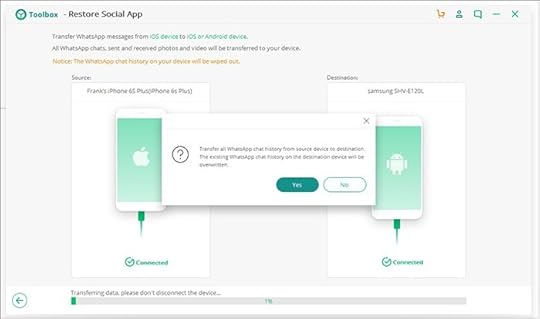

Step 3. To

initiate the process click – “Transfer”. Ensure that the connection is not lost

between your phones and PC.

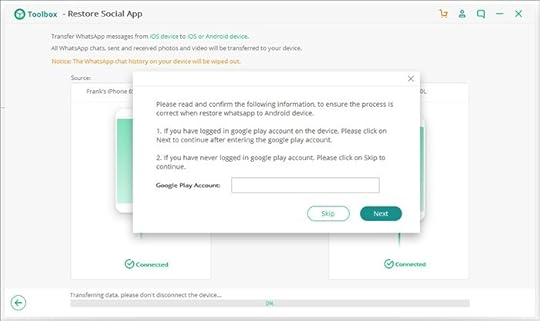

Step 4. At

this point, the software will ask you to type in your Google play account to

initiate the process of retrieving WhatsApp data. You can skip the process in

case you don’t possess a Google Play ID.

Step 5.

Halfway in the process, you will get a message seeking your permission to

overwrite the current WhatsApp messages on the target phone. Simply click –

“Yes” to continue.

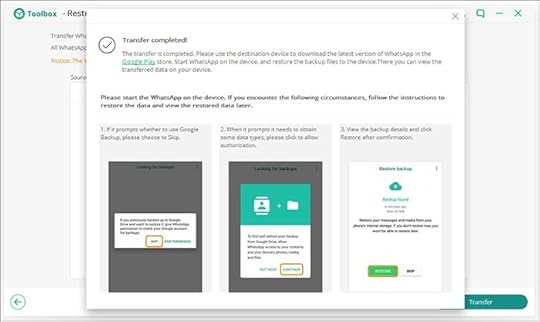

Step 6. Now

you will be able to view the window as shown below after your WhatsApp messages

are transferred successfully.

iSkysoft

Toolbox- Restore Social App treats transfer process in a simplified manner and

has a range of features.

Transfer your WhatsApp documents,

messages, photos, videos etc. from iPhone to Android easily.Transfer process takes less time and

the screen instructions are easy to follow.You can preview your WhatsApp data

before you choose to restore which helps you restore preferred messages

selectively.Within a single click you can also

backup WhatsApp messages to your computer.Supports an array of newest versions

of iOS devices so, iSkysoft Toolbox is compatible with almost any iOS device

you own.Offers WhatsApp data transfer from

iOS to iOS/Android devices too.

iSkysoft Toolbox- Manages messaging

apps with ease

Using a different messaging app other than WhatsApp? No worries! iSkysoft offers backup, transfer and restore features for other messaging apps too such as Viber, KIK, WeChat, and LINE. So, it becomes easy to manage your messaging apps no matter whether you decide to buy a new phone or want to backup your data to store them in a secure manner.

iSkysoft Toolbox – User friendly and

clean interface

The user

friendly interface and step by step guides lets you crawl through simple

process in a few clicks. You don’t have to face any data loss during the

transfer process. Your data security and privacy is managed well with iSKysoft

Toolbox. You don’t need to worry about your data being transported to any

external sources as data is secure on iSkysoft Toolbox platform only.

iSkysoft

Toolbox supports Operating systems like Windows and Mac. Now you don’t need to

look for different solutions for backup, transfer or restore WhatsApp data as

iSkysoft Toolbox offers one solution that helps meet all these needs.

Conclusion

You may try a

different ways to transfer whatsapp from iphone to android, but if you are

looking for a reliable, faster and easier way to do the transfer and restore

your WhatsApp messages safely and selectively then iSKYsoft is certainly the

ideal solution. It is just one solution that can meet your transfer, backup and

restore needs.

The post How to transfer WhatsApp Messages from iPhone to Android appeared first on Entrepreneurship Life.

January 8, 2019

5 Tips for Managing Money in Retirement.

Retirement is that time you want to relax and

enjoy life with your loved ones. Managing money during retirement is somewhat

easier because your sources of income are rather limited. As such, you want to

be more disciplined with your spending without being too frugal. This guide

offers five tips on how you can manage money during retirement.

Convert Home Equity to Income

Home equity makes a great source of income for homeowners in their retirement. There are several ways of converting such capital to income that helps them during this time. First, they can downsize to a small space. This alternative is ideal for homeowners living in extremely expensive neighborhoods or houses that are extremely large for the senior’s needs. Another way of converting home equity into a source of income is to apply for a reverse mortgage. This loan is designed to eliminate ongoing mortgage payments and take out a loan against your home, though the borrower retains ownership of the property.

Have a Plan for Out of Pocket Health Expenses

Most retirees account for fixed expenses like utility bills and property taxes when making a retirement budget but leave out medical expenses. Admittedly, it is difficult to plan for health expenses. Plans such as Medicare don’t always cover 100% of health care costs hence, the need to anticipate for out of pocket expenses. Health insurance policies also come in handy, but they also don’t cover all the medical expenses. Retirees can open a health savings account which helps account holders prioritize retirement savings. The savings are tax deductible, the interest is tax-deferred, and you can spend the money on medical expenses without any tax implications. Another way of planning out of pocket health expense is to take out a whole life insurance policy. Find an insurance company that will sell life insurance policy which allows you to take out a loan against the policy during an emergency. Alternatively they can enroll to Medicare Supplementary plan. The traditional Medicare plan only covers a part of the healthcare cost, but the Supplementary program covers the remaining cost of medical expenses.

Talk with Family

A family is a great source of joy, especially

during old age. This does not mean you should spend all your retirement money

helping out adult children. Keep in mind you don’t have as many opportunities

to make money; you can only make the best of what you have hence, the need to

account for every expense.

Wait as Long as Possible to Start Social Security

Social Security provides fixed monthly income for as long as you live, so you want to wait long enough before you start using social security. The difference in the value of your social security when you are 65 and 70 years can be hundreds or thousands of dollars. If you have other sources of income, you should consider delaying until an older age. This way, you enjoy a higher standard of living, especially when your body is not as strong to work.

Make Trade-Offs

Some retirees are tempted to travel places they

desired to go for years. When it is a great way to relax and enjoy life, you

need to focus on what is important. If you still want to visit Paris, you need

to plan and make several cutbacks.

The post 5 Tips for Managing Money in Retirement. appeared first on Entrepreneurship Life.

January 7, 2019

How to use content to drive PR

Consumers are getting smarter about marketing, and the avenues which were once staples no longer reach them. In fact, engaging in spam tactic style PR stunts could even cause consumers to react negatively to your brand. So, what’s a new business owner to do? You obviously need to build brand awareness, but how do you do it in a way that makes people love your brand rather than loathe it? The answer is creating amazing content that creates good public relations.

How do you make good content for PR?

Good content makes people stop what they’re doing and share it. It’s interesting, it’s informative and it’s your ticket to the front page of top social media sites like Reddit or directly into the feeds of consumers on Instagram. However, consumers aren’t dumb, and you can’t just put up a thinly veiled ad for your company in the hopes that they will share it. This type of activity is actually more likely to create a negative brand image when these users figure out your game plan.

Instead, focus on content that’s useful and doesn’t try to sell anything. Of course, the content you share should be relevant to your products, and that’s why identifying your target audience is key. Valuable evergreen content like tutorials and how to guides on a variety of subjects from health to fashion are often the best ways to market your brand. Every niche can benefit from this type of content, and it’s an easy win for you.

Need some ideas for your viral content? Spend a few days browsing through relevant niche groups on Reddit to see what kind of content makes it to the front page. Odds are, you’ll be able to get some great ideas for your own marketing plan that can help your brand to outshine the competition.

No one knows your brand, product and/or service than you do. Outsourcing your digital PR to an agency can be an option for bigger companies. But in today’s digital world, you don’t need a PR agent to reach media and blogs. You can simply use Contento to get your articles placed on top sites. Also see article “Do You Actually Need A PR Agency?“

How to use quality content to get your brand on high authority websites

The name of the game here is outreach, and it’s not an easy task. Be prepared for the disappointment of getting one successful placement for every fifty or so emails that you send out to publishers in your niche. While this can be a little soul crushing at first, the rewards are worth the trouble, because guest posting your content on to popular blogs in your niche puts your brand in front of your target audience in a way that advertising will never be able to do.

The PR boost for guest posting is so massive because these publishers have cultivated an audience. That audience trusts them, and some of that trust flows back to you. However, if you don’t really have time for manual outreach, then there are services out there that can help. These agencies do the heavy lifting of placing your PR content on niche relevant blogs so you can get back to running your company.

Using a PR agency will take a little money out of your pocket, and it will put a lot more time back into your day, but it’s up to you to decide how much your time is worth. The good news, of course, is that these types of services are getting more and more affordable, and many of them will even allow you to start for a relatively nominal cost, allowing you to scale your PR efforts as your business grows and your marketing budget gets a little fatter.

How good content boosts your search rankings

Link building is still one of the most important aspects of SEO, and high-quality content not only boosts your company’s PR, but it can also benefit your search rankings as well. Evergreen content that teaches people how to perform a skill or task is not only routinely shared on social media, but it also gets linked to by other sites forever.

That’s part of what makes content-based digital PR marketing one of the most effective marketing strategies, because while an advertising campaign may only bring in business for your company for a few months while the ad is running, quality content continues to bring in money year after year, making it one of the best returns on investment when it comes to marketing.

While you should, of course, put out high-quality content for your guest posts, it’s also important to save the very best posts for your own website. Hosting massive guides that have the answers that consumers are searching for lends you authority, and soon they’ll see you as an expert in your field and trust your products that much more.

The post How to use content to drive PR appeared first on Entrepreneurship Life.

How to Pull your Small Business Out of a Cash Crunch?

From

a very early stage in life we are taught that failure means the end but

reflecting back at history, it can be appropriately said that failure is just a

stepping stone for success. Sometimes before a business finally leaps for the

positive slope on the progress-time graph it takes a steep negative slope. Most

successful businesses today are the ones that pulled their enterprises out of

there instead of giving up. We have compiled a few suggestions for you, that

might give you an insight in pulling your business out of a cash crunch.

Frequent SWOT Analysis

SWOT stands for Strength, Weaknesses, Opportunities and

Threats. A good quality SWOT analysis will help you monitor the progress of

your enterprise and predict its rise and fall. Such predictions might come

handy in preparing beforehand for the losses and might save you from the panic

attacks.

Value your customers

According to Gartner statistics, eighty percent of a

company’s revenue comes from twenty percent of its customers. Know those twenty

percent customers and keep them close. Try involving them in your business

strategies and maintain your goodwill with them.

Invest in an Advisor or Mentor

One thing you can always learn from

is the experiences of people who took similar paths as you have chosen. A good

advisor would be a great asset not just in times of profits but more so in

times of loss.

Consolidate Debt

Try to combine your debts into a low fee and low interest

product. Try finding better deals while you are refinancing your current debt

arrangements. It could save you some trouble if multiple debts having varying

interest rates could be combined in order to have a relatively lower interest

rate.

Rely on Government Grants

When opening up a small business or enterprise, look out for

insurance policies and schemes that are meant to assist small-scale enterprises

and young entrepreneurs. Backup is great when considered from the very start.

Recover Outstanding Debt

While borrowing or lending money, always make sure you have a condition of sale agreement in writing that outlines your terms and conditions, very clearly. In times of occurring losses, chase up as many outstanding payments as you can. You can ever outsource your debt collection with a reputable debt collection agency.

Sell Assets

If you have some unwanted assets, which do not add up in your

profit equation, you could sell them and reduce your storage costs. To help you

spread the cost over a longer time period, you could also consider leasing your

assets, until you fully recover from the losses.

New Marketing Techniques

Times of traditional business settings are long gone. In this

era of social media and globalization, you might just be a few clicks away from

recovering your losses and elevate your enterprise. Make right and extensive

use of the World Wide Web and try to reach potential customers throughout the

globe. You can even offer additional payment methods online, which will open

for you different markets.

Good

businesses thrive on risks. But it is highly inadvisable to take those risks

without precautions. Moreover, it is important to not give up without trying

recovering your enterprise from a negative slope. Personal assets, help from

friends and family should be one’s first preference once all the precautions

are utilized exhaustively. It might take a whole of of perseverance and

patience but running your own enterprise despite all the losses that one might

face, is one of the most satisfying jobs.

The post How to Pull your Small Business Out of a Cash Crunch? appeared first on Entrepreneurship Life.

January 6, 2019

Odds and Ends: Making Your Store More Memorable (and Profitable)

Regardless of the type of store, there are

always some things that don’t really fit the mold, as far as their stated

intention is concerned. What this means is that even hardware stores or stationery

shops have chocolate bars in their checkout lanes and exciting items on the

ends of their aisles that might not directly fit into their chosen niche. The

items might be completely unrelated or might act to solve a common problem or

recurring complaint with the main products sold by the store.

This concept can be applied to both online

and offline stores. This isn’t entirely about impulse-bought items meant to

exploit the psychology of customers, but that’s not to say the money you

receive from impulse buying is any less green than the money obtained from

other products. In fact, having the right impulse-bought items that aren’t

easily found can easily make your store more memorable as a one-stop shop, or

give you an edge over people who are selling similar items. As far as online

shopping goes, having a few odds and ends can help your store. This is when a

customer is just below a certain threshold for something like free shipping or

a discount, and you give them the ability to take advantage of specific offers

on your site without making them feel cheated by having to buy another

big-ticket item just to qualify. While the price of these items might not seem

like they make for big profits, they typically have more significant profit

margins because you bought them in bulk, and they aren’t really specialized

items.

Let’s look at some examples:

Branded Clothing

Adding some peculiar items in the form of hats and t-shirts can be a boon to your bottom line. There are thousands of wholesalers now that deal in both branded and non-branded items of clothing like Wholesale For Everyone that enable you to order personalized clothing to sell at your store. Think abstract when wondering if this is the right choice for you. For instance, it might seem weird if a paint store was selling hats & shirts, but when you think that most people wear clothing they don’t particularly care about while painting under the expectation it’ll get dirty, a $5 t-shirt and a $7 cap can just become that much more appealing to the customer. Not only that, if you have enough return customers purchasing from you, they might end up buying one just as a utility item or even as something to sleep in. This is more likely to happen if they’re just a pinch shy of getting a deal on shipping or something, however.

“Bucket Handle” Style Products

What these kinds of products mean is that

while the bucket is an amazingly useful item, the bucket handle is innovative

and makes using the bucket much easier. Think about what kind of things you

sell, and then look for accessory products that compliment them. If you sell

brushes, selling something that makes a brush more comfortable in hand would

come to mind. Think about all of the products you have on offer, and do some

serious research into what people have invented to make using them simpler and

more stress-free.

Conclusion

The secondary or even tertiary items to the ones you sell mainly on your store can end up making just as much, or even more than your primary items, if you leverage interest in them properly. Adding extra items that remove problems from the existing ones might end up making you two sales you wouldn’t have made, instead of the customer passing entirely on your store. All of these things increase your customer’s experience with purchasing from you and make your store more memorable in the end. Ideally, your store can obtain, convert, and retain customers as easily as possible. A part of this is, of course, having the right inventory.

The post Odds and Ends: Making Your Store More Memorable (and Profitable) appeared first on Entrepreneurship Life.