Mohit Tater's Blog, page 580

April 11, 2019

3 Reliable Ways You Can Invest in Silver Today

There’s more to precious metals than just

gold. Silver is a popular gateway into precious metals investing thanks to its

lower price point. You can buy 1 oz. silver coins for a fraction of the cost of

a gold coin.

Silver doesn’t tend to attract the same amount of attention as gold, but it can be just as useful as an investment tool. Many precious metal investors buy gold and silver coins or bars, and there’s a good reason for balancing your precious metals investment between the two.

The reason for this split is because silver often moves faster than gold, both up and down. Bull markets tighten the gold-silver ratio while bear markets expand it. The gold-silver ratio refers to how many ounces of silver it takes to buy one ounce of gold. Historically, the ratio has been steady at around 15, but today silver is extremely undervalued, with the ratio hovering around the 80s. Gold provides precious metals investors more security, while silver shows higher growth potential.

Investing in silver means putting your money into the physical ownership of silver, or the production or trading of silver. Silver is a commodity like lumber or oil, but precious metals tend to act a little differently than other commodities. While there is a high demand for silver for industrial and commercial purposes, going into electronics, jewelry, medicine, and other industries, much of its value is due to its status as an investment vehicle.

Silver prices are affected by industrial

demand, but like gold, tends to be driven more by investment market demand.

Since silver doesn’t pay dividends or interest (unless you lease it, but that’s

something only major banks can do), silver demand runs opposite to stock market

performance.

There are more ways than one that you can

add silver to your portfolio.

#1 Silver Bullion

By far the most reliable way to invest in

silver, silver coins and silver bars are also among the most popular methods.

It’s straightforward and you can usually sell at any time at market prices.

There are no third-parties involved, and therefore lower risk. Make sure you

are buying pure silver bullion coins and bars if you choose to go this route.

If you are looking for the current price of silver, you can easily find it from an online silver shop. You can also save money on premiums when you buy silver online.

#2 Silver Futures

You can also invest in the silver futures

market – investing in silver trading. It’s an effective way to profit from

silver volatility, as you can profit from declining silver prices. Do your

research into how futures trading works.

#3 Silver Mining Companies

Mining stocks come with considerable

third-party risk. You are only tangentially investing in silver prices. As with

any time you invest in stocks, you are really investing in the particular

company’s management and ability to make a profit from silver production. A

poorly managed mining company can still run into problems when silver prices

are increasing.

Silver is a great investment vehicle for those who want an asset that moves counter to the stock market. Buy silver coins and silver bars, try silver futures, or invest in silver mining companies to get in on the action.

The post 3 Reliable Ways You Can Invest in Silver Today appeared first on Entrepreneurship Life.

How to Dress for Success in the Events Industry

Working in the events industry requires a

certain type of energy and presence. Projects need to be approached

enthusiastically, with maximum effort. As such, the clothes that you wear to

work are going to be appropriate for business settings yet also chosen with

comfort and suitability in mind. As a professional in the events industry, you

will be meeting people, setting up areas for clients, and keeping an eye on

events as they play out. Learn how to dress so that you can get the job done

while still being able to take on nearly any physically demanding task.

Staying Comfortable and Professional

There are styles that are perfect for the

office. Some dress shoes are just not made for walking and suits that are too

constrictive to allow for a wide range of motion. However, professionals in the

events industry don’t spend all of their time sitting behind desks. This

requires them to dress in comfortably business-oriented styles, like in polo

shirts and khakis. Imagine having a job that combines hands-on customer

service-related tasks, site management, and office work.

Some professionals in the events industry get to experience rides such as the Adrenalator in the morning and then meet with clients, take deposits, and sign contracts for future events in the afternoon.

You could also end up actually operating

and performing light maintenance on rides and games at events, so you want to

put on a professional appearance while being ready to take on anything.

Keep It Between Business and Casual

It is not hard to pick out clothing items that are appropriate for business environments. Casual clothing basically just includes jeans, t-shirts, sweats, sneakers, and athletic attire. There will be times in your career that showing up in a sweatshirt and jeans is absolutely okay. However, even a casual outfit can be ‘dressed-up’ and made more suitable for business-oriented events. Pairing jeans and a shirt with a smart jacket and dress shoes makes it clear that you are ready to spend as much time in the office as you are prepared to enthusiastically engage in a corporate event.

Practicality and Accessories

The wardrobes of events industry

professionals have a lot of the same staples. They basically all contain tons

of business slacks in khaki, tan, black, and navy. Most will have quite a few

pullover polo-styled shirts and perhaps some company branded button down and

t-shirts. Rip, tear, fray, and wrinkle-free jeans can also generally be paired

with an appropriate top in most instances. Where professionals in the business

industry differ a bit is with their selection of accessories.

Some of your co-workers might really like pairing sneakers with just about everything to help dress their looks down. A lot of your colleagues will like putting on nice watches and other jewelry to look more business casual. The fact of the matter is the corporate business look is starting to fall out of favor. The business casual style is truly starting to catch on, even outside of the events industry.

Imagine having a day at work where you do a lot of walking, you talk to a few clients by phone, and you also need to make a presentation to your boss. How would you ideally dress that day? Would you make sure that your feet were comfortable and that you felt confident when you meet with your direct superior? If so, you probably have all of the elements needed to pull off a business casual look.

The post How to Dress for Success in the Events Industry appeared first on Entrepreneurship Life.

Blinkist Review – An All-You-Can-Eat Buffet of Book Summaries

You’re well aware that reading is an essential aspect of personal growth and development. And if you’re a bookworm like me, you also know that it isn’t always easy to find good reads. If you keep on adding reading as your goal fairly regularly and fail to do it because you can’t find time to read, then you know the disappointment you feel every time.

The path gets even trickier if you’re a fan of non-fiction. Reading something that has zero value in terms of broadening your horizons is a big expense, not so much money-wise but time-wise.

What if there was a way to get the general idea of what a book is all about? Or some software that simplified and spat out the key points from a non-fiction book?

Frankly speaking, all of that seemed like a far-fetched dream until I stumbled upon Blinkist.

Blinkist is a “here’s what you’ll get” book summary app for mobile and desktop where people can listen to or read roughly 15-minute summaries of over 2,000 non-fiction titles across a range of categories.

Text Summaries

Text summaries present around 10 screens and you need to click to proceed to the next. The audio version, on the other hand, plays through automatically. Each summary or “blink” is also placed into a category so users breeze through it with ease.

Since I really like the app, I decided to write an in-depth review. Read on to learn how it feels to be a Blinkist user.

Quick Access to Categories and Synopsis

Blinkist takes you to the first blink as soon as you click on a title in your library. You can add books by browsing the app’s categories or by searching for a specific title. The “Discover” button at the top of the homepage presents you with 27 categories, plus “see recently added titles” and “see popular titles” sections for the latest blinks.

The following graphic highlights the names of available categories:

The categories are as follows:

Entrepreneurship & Small BusinessScienceEconomicsCorporate CultureMoney & InvestmentsSex & RelationshipsParentingNature & EnvironmentCareer & SuccessPoliticsHealth, Fitness and NutritionHistory Management & Leadership PsychologyTechnology & the Future EducationSociety & Culture Creativity Marketing & Sales Personal Growth & Self-ImprovementCommunication & SkillsMotivation & InspirationProductivity & Time ManagementMindfulness & HappinessReligion & SpiritualityPhilosophyBiography & Memoir

Pressing on a category takes you to its individual page with a header visual.

As you scroll down, you come across trending, just added, and featured audio blinks in that category (in the exact same order). A “see all blinks in this category” option is also available.

Your next option is to click on the magnifying glass at the top left corner. Doing so allows you to search for a specific non-fiction title.

As you write the name of the author or book, results get populated in a dropdown window.

Whether you select a book from the search bar or the category view discussed earlier, you’ll arrive on its synopsis page.

The page provides you with all the information you need. A quick summary of the book’s content, an option to add the synopsis to your library, a way to buy the book, as well as advise on who the book is well-suited for along with some background on the author. As a premium user, I also got the option to send the summary to Kindle.

As you can see, Blinkist offers a quick way to know what a book is all about and whether it’ll be worth your attention and time.

Audio Summaries

Clicking on a title inside your library takes you to the first blink, which is titled “what’s in it for me.” Here, you get to learn about the benefits you’ll realize by reading the blink at hand.

But what stands out for me is the audio player for the web. It’s located in a bar at the bottom of the page.

When you click on the play button, Blinkist presents you with an audio version of the summary. You then hear the next audio automatically, and so forth. This feature used to be available only in the Blinkist mobile app, but it’s now available for web users too, which is fantastic.

As you move through the audios, eventually you will reach the end of the summary. Blinkist will then revisit what you have learned and offer you some actionable advice to follow. Often, there is an advice to read further, and an option to provide feedback, if you have any.

Social Sharing and Friend Invitations

Remember the Discover button at the homepage? Alongside it are a few more options. “Highlights” redirects you to a collection of all the marks and notes you’ve taken. You can filter them by titles or by date; for either option, they’ll pop up in a beautiful format.

Also, you can click on the three dots at the bottom right corner to share your highlight to Twitter, Facebook, or through email. The same process can also be used to delete highlights. I find this handy, as it lets me go through summaries again, but at a quicker pace, and allows me to revisit what I’ve learned when I read them for the first time.

Lastly, the right side of the menu has a “You” option, clicking which opens a sub-menu that gives you access to settings, help & support, gift cards, and more. The standout feature here is “Invite Friends.” It gives Blinkist users a chance to create their referral link, which they can use to invite peers to try out the app.

The best part? You get a commission every time someone signs up to Blinkist’s monthly or annual plan using your referral link. Feel free to copy it and send it to your contacts through iMessage, Viber, WhatsApp, email, or any other methods, or share it directly on LinkedIn or Quora.

It also has a wishlist option, you can type in the book you want. If the book is available then you will be directed directly to the book, if it isn’t then you can either add it if isn’t there or the wishlist and if it is already on the list then you can upvote it. More the upvotes, more the chances of it being the next book to be added to Blinkist.

Apart from sending the Blinks to your Kindle, you can also add it to a notebook in Evernote. I personally love that option because then I will have the main takeaways that I got from the Blinks with me on my phone all the time.

My Final Verdict

With over 2,000+ books in its database, and increasing at an astonishing pace, the decision to save time and enjoy Blinkist is yours. No matter whether you want to read about personal development, entrepreneurship, science, or nomadism, I’m confident that you’ll find a valuable title to read.

Blinklist costs $14.99 a month or $89.99 a year (billed at $7.49 monthly). You get a free 7-day trial if you opt for the annual option. Learn more here.

The post Blinkist Review – An All-You-Can-Eat Buffet of Book Summaries appeared first on Entrepreneurship Life.

April 10, 2019

Interview with Bobby Genovese: Why He Considers Giving Back a Responsibility

Bobby Genovese is an entrepreneur and business executive who

holds by the principal that success in business means connecting enthusiastic

people with winning opportunities. To

the executive, success also means giving back to one’s community. As a result, over the years, Bobby Genovese

has been an active supporter of a number of organizations, perhaps most

prominently Toronto’s Hospital for Sick Children.

Although you are known as a

business executive

and entrepreneur, you place great importance on giving back to the community.

Can you tell us why charitable involvement is a key part of your life?

Bobby Genovese: I think giving to others is a responsibility

and a privilege, especially to those organizations that serve children. Toronto’s Hospital for Sick Children leads

the list of organizations that stole my heart many years ago. It’s Canada’s

largest and most sophisticated centre for pediatric cancer research, treatment

and care, and through supporting this organization, we’re in turn able to help

provide critical resources and support for their pediatric cancer initiatives,

from research and treatment to practical advancements like chemotherapy

backpacks that free young patients from confining hospital stays.

You have been involved with the annual Car and

Boat Rally for Kids with Cancer since it began in 2007. Tell us why these

events are so special to you.

Bobby Genovese: The Boat Rally for Kids with Cancer has

raised more than $20 million over the years for Toronto’s Hospital for Sick

Children. It has turned into the event of the summer in Muskoka, Ontario. Not

only does this demonstrate how successful we can be in coming together for a

common cause — it shows how necessary it is for each of us to be involved.

I’ve been honored to chair these rallies and join forces with an amazing team

of people behind this effort.

BG Parks was established to help conserve the

environment and protect important parcels of land by partnering with several

state parks in Florida. In 2015, you secured a partnership with Florida’s

Department of Environmental Protection to oversee recreation and hospitality

concessions at three of south Florida’s most popular parks. Can you give us

more details of this initiative?

Bobby Genovese: We were thrilled and honored to be a major

force in bringing to life and making accessible these incredibly beautiful

parks for a whole new generation of visitors to enjoy. Not only are we

privileged to help preserve and cultivate these extraordinary natural resources

but we are especially honored to play a role in restoring the popularity of

these south Florida treasures. In addition, the partnership gives us the

ability to touch more than 4 million people. Now it’s our responsibility to

give them activities to do and create special events. We can also connect

people to some of our other complementary businesses to promote the entire BG

experience.

As an executive with more than two decades of

business leadership experience, do you have any tips for budding entrepreneurs

and business leaders?

Bobby Genovese: I believe that if you are passionate about

what you do, success will follow. There is a big difference between working

hard and working smart. What I encourage even with my own children is to look

at the big picture. I always tell people who come to me for advice that you’ve

got to love what you do because then it is not work.

The post Interview with Bobby Genovese: Why He Considers Giving Back a Responsibility appeared first on Entrepreneurship Life.

The Benefits of Choosing a Stock-Based Loan

As an

entrepreneur or small-business owner, there are many reasons why you’ll need

some financial backing from time to time. Whether you need some substantial

seed money to get your business off the ground, or you require some additional

financial support for revamping the company, it can be daunting to approach the

realm of money-borrowing. There are many potential pitfalls that can put

individuals and companies in tough financial situations down the line. As such,

it is extremely important to navigate the wide world of loans with caution and

a thoroughly researched agenda.

There are

many different types of loans that individuals can seek out, but some have

fewer drawbacks and risk than others. One of the best options on the market

today, in terms of minimal credit risk and flexibility, is a stock loan.

What Is a

Stock Loan?

Stock loans,

also referred to as securities lending, are essentially the process of

borrowing money on stock owned in a publicly traded company. If you want to

hang onto that stock and don’t want to sell, you can still utilize that money

to your advantage by borrowing against it.

Typically, securing funding through securities lending is far more appealing than opting for the traditional margin stock offered through brokerage firms and banks. Many companies can help you navigate the process, such as Easy Stock Loans, and advice from ESL is easy to obtain through their website.

Here are a

few of the primary benefits of securities lending:

Flexibility

When you choose to borrow money through traditional, credit-based methods, there are often strict restrictions placed on what the money is used for. If you want an auto loan, for example, the money you are acquiring is for a very specific purpose and is regulated as such. But with securities lending, the money you borrow can be utilized for almost anything. This gives immense freedom to borrowers, especially those who have various and somewhat complicated expenses in relation to starting a business.

Maximizing Value

With credit-based or margin borrowing, the cut off for how much you can borrow typically falls around 50% of the stock’s value. But with stock loans, you have the potential to secure up to 80% of the stock’s value for your loan. This makes a monumental difference for folks needing a substantial amount of seed money for a project. More value comes from one loan, and it becomes less likely the borrower will need to seek out a variety of financial sources.

Low, Fixed Interest Rates

While

interest rates of bank loans have a tendency to fluctuate with the market and

are often pretty high, the interest rates of securities lending are, typically,

much lower comparatively. Stock loans are also generally set at a fixed rate,

meaning you know what to expect of the financial commitment going in and can

adequately prepare.

Stock Appreciation and Non-Recourse Action

Stocks are a

fickle game. There is constant fluctuation in the market, and changes can

happen rapidly and unexpectedly. Borrowing against your securities is a great

way to hang onto a stock that you feel may appreciate in value, while still

utilizing the funds of that stock for your business or personal projects. If

the stock appreciates, you still benefit.

Plus, most

stock loans have non-recourse agreements. That means that if the stock value

plummets, you can potentially relinquish it and still maintain the money

borrowed against it. You also have the option to terminate the loan with no

backlash or harm to your credit.

There are

many types of loans that can help those in financial need, but if you are able

to choose a stock loan, it is well worth the consideration. Why wait? Get the

financial support you need today with a stock loan.

The post The Benefits of Choosing a Stock-Based Loan appeared first on Entrepreneurship Life.

April 9, 2019

8 Reliable Tips on Business Planning for First-time Entrepreneurs

Photo by rawpixel.com from Pexels

Traffic is getting worse; the internet is creating opportunities. Think of the possibility of not commuting as often and running a shop from your laptop at home or any place convenient.

Indeed, selling online is one of those modern

low-cost business ideas that can generate profit. The devil is in the details

as written out in your business plan. Get dibs into these tips on business

planning to help you turn your idea into a lucrative venture.

Why Do You Need a Business Plan

Business plans never go out of fashion no

matter how digital or fast-paced the world has become. Your hard work in doing

business or managing your commercial affairs is grounded and made realistic

when you have a detailed map that gets through from Point A to B.

This business plan:

Gives structure and direction to

your visionCommunicates this vision

effectively to investors, clients, and customers Guides you throughout the

business, allowing you to reflect or revise as you go

Are you new to business planning? Let’s begin.

1. Take time to create your

business plan.

This document lays the groundwork of your

venture and is as detailed as possible. It should answer all the relevant

questions, mainly how you will make money from the business. And if you are to

present your plan to your audience, it should answer what’s in it for them.

Expect the exercise of writing your business plan to take time because you will do the market research and analysis for your numbers and statements. Work on the substance and the format.

2. Set specific goals within a

reasonable time.

You are a new company so no one can

realistically assume that you can make money from a few months of operating.

Work with this leeway and set goals for your

business within a reasonable or a more extended timeframe. As much as possible,

break down big goals into clear and doable action items.

3. Be realistic with your

numbers.

Forecasting financials or financial projections are one of the common failings of new business owners. You can learn from other entrepreneurs’ mistake by:

Back your claims with real and

correct data.“Over budget” your expenses to

account for unforeseen costs.Make your projections based on

industry standards.

When dealing with figures, opt to make safe

assumptions. This move will work to your benefit if you perform better than

your projections. Seek the help of accountants on how to crunch and present

your numbers.

4. Polish your executive summary.

It’s the first thing that your intended

audience sees. Write your executive summary such that it is a high-level

overview that encapsulates the critical points of your business plan.

This executive summary is your hook for people

to continue reading your “proposal”. It saves time, too.

5. Come up with a tailor-made

business plan.

In line with point no. 4, prepare tailored-fit

versions of your business plan to your target audience. They are investors,

lenders, or other sources of potential funding.

Because the business plan is essentially your

pitch for them to invest or lend you money, you might as well present it in a

form that appeals to each one of them, their interests and thrusts.

6. Be creative in presenting your

ideas.

Adding visuals can enhance the readability of

your business plan. Insert charts, images, and other graphics to break the

walls of text. Look up templates or take inspiration from sample business plan

formats.

This creativity boosts the appeal of your business

plan that ought to be reliable and credible in the first place.

7. Review and revise.

Your first draft might have missed out on a

few necessary details. Have other people, most likely professionals or those

with experience in business planning, look at your plan for revision or

editing.

Their insights and points might help improve

your business plan, its soundness and feasibility. Also, ask your family and

friends; they might have questions or suggestions that you can add to your

business plan.

8. Explain the process.

It’s not unusual to have a business plan

without an actual product that may be in development. After all, you can

explain the process of how to make, deliver, or sell this product in your plan.

Identify what to sell online and provide detailed descriptions. More importantly, set out how these products fit into the market, what edge they possess over the competition, and what their potential for growth is, among other vital details.

Points to Remember

In business, always have a plan in written

form for yourself and others. Keep the document trimmed and concise, steering

clear of vagueness, fluff, and over-optimism.

It is hard work -putting into the details for your first business plan -but the process can get better when you update your business plan the next time.

The post 8 Reliable Tips on Business Planning for First-time Entrepreneurs appeared first on Entrepreneurship Life.

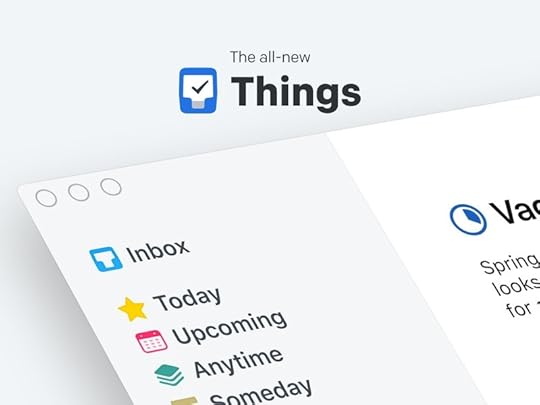

Things 3 Review – A To-Do App That Works

I’ve been using new tools ever since I received a Casio Calculator Watch as a present in high school and a Blackberry on Christmas. If you can’t recall these gadgets with nostalgia, you may consider me to be horribly antiquated – but for several years, productivity software for Mac was not much superior. It wasn’t until 2011 that Mac apps in various fields began to consistently stand out.

Thus began my journey to find the perfect to-do app (aka task management app).

Over the years, I’ve tested several to-do apps for Mac and iPhone, and they’ve all done a decent job at raising my productivity level. My latest discovery is Things 3, which offers the perfect balance between enticing new features, timeless design, power and simplicity, and delightful interactions.

What’s So Good About Things 3?

Things 3 allows users to take a guilt-free approach to task management. I’ve highlighted some of its prominent functionality below.

Set Important Dates

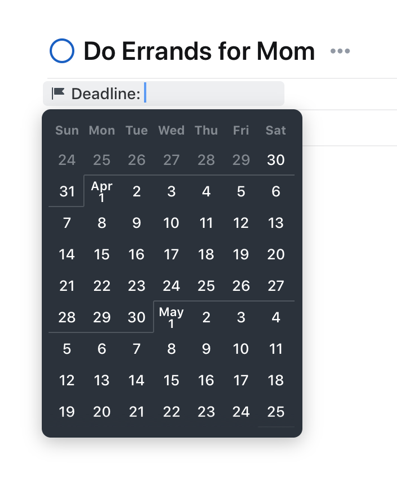

Not every task is associated with a date. Some can just be completed when you get time. Others, however, are closely associated with dates, and Things 3 is quite accommodating, offering numerous ways to work with them.

For example, it lets you add a deadline to any task or project. My mom asked me to run errands, so I added that task to Things 3 and listed a deadline for it.

Most to-do apps have this functionality. Things 3 goes a step above by conveniently enabling you to include a few other kinds of dates.

For example, I can add a start date to ensure I start working on a particular task at the right time.

While setting the start date, I can also create Reminders to have Things 3 display an alert to remind me of any pending tasks.

I can also use the “when” option to create start dates and reminders, and keep tabs on my activity to ensure you’re on track with upcoming tasks.

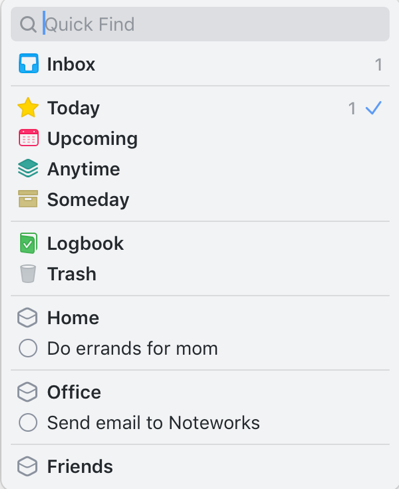

Group and Organize Your Tasks

Once you begin using Things 3 to organize different aspects of your life, you can populate it with dozens, or even hundreds, of tasks. This can create a mess, so you need a way to organize and group your projects and tasks. Things 3 lets you do that via “areas” and “tags.”

You can create areas for several different aspects of your life. I’ve made one for home, one for office, and one for friends.

Not only do these let me organize my tasks logically, but they also serve as helpful prompts to ensure I’m driven and responsible in all of my responsibilities.

All projects and tasks can be further streamlined with the help of tags. You can use these to arrange your tasks in several different ways.

Tags associate your tasks with certain contexts (like home, office, pending, important) as well as with people. You can highlight a task’s importance, or indicate the amount of time needed to get the job done. The options are endless.

Know What’s Ahead

I especially love this about Things 3: it lets me keep tabs on tasks I want to complete in the future without cluttering my active list of projects. When I’m busy, they’re not a distraction. But when I’m planning to review what’s left, they can be. Things 3 offers three distinct views for the purpose:

Here’s a quick breakdown of each:

In Upcoming, I’m able to see a calendar of tasks that have either a start date or a deadline associated with them. In Anytime, I can view a list of tasks that I can work on in my free time. These aren’t categorized by an area or project. Neither are they associated with a deadline. In Someday, I can view the set of tasks that I haven’t planned on working but may do someday. I use this space to list my life goals.

Maybe one day I’ll visit Antarctica. I want to list goals like these in my to-do app, so that I can remind myself about what I want to achieve. But I don’t want to be distracted when I’m concentrating on what matters now. Things 3’s “someday” feature handles these items pretty nicely.

Overall, Things 3 allows you to sensibly organize tasks by tags, projects, and areas of responsibility. Your calendar and to-do list can be seen in a variety of ways – tasks to do in the near future, tasks that you need to complete today, and tasks you may work on someday. And you get to prioritize, sync and organize each task, area, and project.

Things 3 Pricing

I wish Things 3 was free to download and use. Sadly, it isn’t – you need to pay $49.99 to be able to experience the to-do goodness. But trust me, you’ll be getting your dollars’ worth. With that said, I recommend you to take the 15-day free trial and rate it for yourself before making a purchase decision.

My Verdict

Things 3 is a nice addition to the productivity and to-do space, not just because of its aesthetic appeal, but because the folks over at Cultured Code (the developer) have packaged some of the most wanted features in the tool. They’re constantly listening to entrepreneurs and implementing their feedback consistently. In 2018, for instance, they added a mail feature to the app and enabled users to repeat tasks within projects.

So if it isn’t apparent already, I highly recommend Things 3 as a productivity app for your Mac. It’s incredibly useful, clever, appealing, and it makes tracking and completion of various tasks a breeze.

The post Things 3 Review – A To-Do App That Works appeared first on Entrepreneurship Life.

April 8, 2019

Toronto Executive Mathieu Chantelois on Going From Media to Non-Profit

Mathieu Chantelois can’t remember a time he’s

been without a pen and paper. So, it

makes sense he’d grow to pursue a career in media and journalism. Since then, Chantelois has had an extensive

professional career as a television presenter, magazine editor, published

journalist, and now, Vice President for the Boys and Girls Clubs of Canada.

Like many journalists often do, Mathieu Chantelois

decided to turn his attention to the non-profit sector to further utilize the

skills and knowledge he developed while working in the media.

More importantly, he wanted to make a

difference.

With years of experience

already under his belt working with local charities, Chantelois has

successfully led campaigns for a range of non-profit organizations including:

Pride Toronto, the Toronto Museum of Contemporary Art, the Canadian Foundation

for Aids Research and the 519 Church St Community Centre in Toronto for which

he served as chair of the board.

After an “a-ha” moment came to him on his 40th

birthday, Chantelois decided to take his non-profit experience in tow and

accept a position with The Boys and Girls Clubs of Canada.

In his new role as Vice President of

Development and External Affairs, Chantelois is responsible for making sure the

organization meets its fundraising targets. Given that his role relies heavily

on advocacy, he is also regularly tasked with travelling to Ottawa to meet with

elected officials and other leaders in the non-profit sector.

“I work with an amazing team at the Boys and

Girls Clubs of Canada and have been tasked with making sure that we meet all

our fundraising goals,” explains Chantelois.

One major deciding factor in his decision to

switch careers was Chantelois’ displeasure with the current climate of the news

media.

“Digital media has led to an era of fake news

and clickbait, much of which is written very quickly to be used for web traffic

driving and engagement,” he said. “It amazes me to go to a press conference and

see young reporters working from their phones and writing stories from their

phones.”

Chantelois continues to explain, “I’ve always

wanted my storytelling to be impactful and to make a real difference, so I

thought at this point, the best way to do that was through non-profit work.”

Since accepting his position with the Boys and

Girls Club of Canada, Chantelois has successfully launched a number of

high-impact campaigns for the organization, including the PSA, “Kids of

Privilege” which was picked up by Cineplex Media and several local radio and TV

stations around the country. He also

helped to publish the cookbook Kid Food

Nation, which won a 2018 Content Marketing Award in the nonprofit

publication category.

Chantelois says, “I am grateful this position

allows me to focus my passion and drive towards the good of others, and I’m

proud that our campaigns are really resonating.”

While his passion lies in his non-profit work,

Chantelois still frequently appears on Radio-Canada, speaking on topics in

politics, culture and social life.

The post Toronto Executive Mathieu Chantelois on Going From Media to Non-Profit appeared first on Entrepreneurship Life.

Should Small Businesses Outsource the Task of Bookkeeping?

Starting a

business of your own is scary to people, there are a lot of aspects that we

don’t know about. When we start researching is when the dread sets in. All

these big words about maintaining your business, technical and financial things

you need to do once you start the business – can be taxing. Taking every thing

one at a time helps.

One of the

important aspects of running a business is having a clean set of financial

records, it helps you run and manage your business smoothly. Money is a

resource that you don’t have in abundance when you start out. Daily bookkeeping

can be a huge factor when it comes to the “make or break” of your business.

Updating the book daily gives you a deeper understanding of your business.

Bookkeeping is

one of the essential factors of running a business, though carried out in a

manner that makes sense to every business, it is the backbone of every company.

Some of the ways it helps is getting funds, managing cash flow, staying

compliant, and organizing your business operations in the most logical manner.

When the book is

not updated daily, there are chances that when you get around to doing it, the

data can be full of errors, and flawed. When you go seeking investors, this can

be a deal breaker. They are impressed by small businesses who know exactly

where every penny goes and comes from. Keeping up with your bank transactions

in a regular manner helps you monitor the cash flow of your business, this then

gives you an idea about the cash required for the upcoming week or month, and

then you can make informed decisions based on this.

Talking about making informed decisions, evaluating books that are up to date will give you insights in the areas your business makes more or less profit, and you can use that information to figure out what can be done to optimize problem areas.

Apart from

helping you understand more about your business, it can also help you keep your

business tax compliant. Not being up to date can result in fines and penalties,

when you are keeping track of your financial intakes and payments, the chances

of missing a deadline is less. It will help you calculate taxes, and be ready

whenever the payment needs to go out. Like taxes, auditing is another headache.

Having the data updates to the recent transaction takes the stress of the

process.

Hiring a

professional bookkeeper can be a smart decision. Most of the times, they are

not even full-time employees. The work can be easily outsourced. Look out for

services that focus on small to medium-sized businesses, these services have

strategies in place, and they provide services and solutions as and when

required by you.

As the business

grows, tax planning and accurate bookkeeping become more complicated, this is

something that you have to keep in mind. It can be difficult to handle your

books and accounting while focusing on growing your business. So, taking the

present and future into account, it is advisable to outsource the task.

The post Should Small Businesses Outsource the Task of Bookkeeping? appeared first on Entrepreneurship Life.

April 7, 2019

Auto Loan Information: Why Loan for a Car?

Believe it or not, there was a time when a single person did not have any kind of transportation. The feet of humans were already enough to navigate the world. Back then, the land bridges were convenient with this kind of travel. Different tribes went all over continents just on foot searching for better ground. Food and water can be scarce in many areas so early humans had to move or learn to love with the land. Their feet were already enough to cover wide distances until humans discovered that they can leave this to something else. Comfort became a priority as walking was viewed as a tiring experience. Learn about the history of cars by clicking here: https://www.history.com/topics/inventions/automobiles.

Fast track to the future and cars are

already the kings of the road. Gone were the days of walking in the middle of the

street without a care in the world. Do that today, and you will get hit 95

percent of the time. Cars were once a luxury, a thing for millionaires and

billionaires to spend their money. Nowadays, as cars became more common it has

proven to be a necessity for any household. Covering large distances on foot is

not just a thing anymore. We are living in a fast paced, “instant” society.

Wasted time is wasted dollars and even more important, it can be wasted effort.

Your energy is very important in dealing with a lot of things like work and

school. Saving all of that for walking will make you an ineffective employee or

student.

This is why there are a lot of people longing to have a car of their own (read more). It makes your life really easy as you navigate any terrain. In rural areas, people take advantage of cars for their ability to travel longer distances while pulling more weight. Life in Alaska or rural Texas will never be the same without their trucks, for example. However, in highly urban areas like most cities in New York or California, cars are need for their ability to save time and effort. Having a car is almost a blessing for many people since it gives a lot of conveniences. Aside from shortening the distance between point A and B, it also grants the person the privilege of travelling in the middle of the road. Traffic is your only enemy but navigating the city with a car is so worth the stress.

However, it is rather expensive to buy a car in an instant. Unless you earn like a quarter million dollars a month, then it might be impossible to buy a car with cold hard cash. Not all of us are that rich or even half as fortunate. Fortunately, there are options to avail a new car without wrecking your budget. Loans can be very advantageous for this. It may sound a bit shady, but there are a lot of legitimate loaning institutions around like Empower car loans.

Why should you avail of a car loan?

Well, here are two reasons:

You

can have a brand new car for a more affordable price.

This is a no-brainer but hear us out. Loaning a car might be more expensive than buying a car outright. However, if you do not have the budget it can be impossible for you. Buying a second hand car might be an option, but why stick to something already used when you can have brand new car? Used cars are great, but they can also be prone to damage and can already be an older model. Some parts might need to be repaired and that would still cost you money. A new car will seldom have defects and you are assured that it is still topnotch in quality.

You

can have a payment plan for your loan.

It depends on how long you are willing

to pay for your car. If you want a shorter duration, you would pay for more but

the interest would be lower. On the other hand, longer plans will cover more

interest. However, having this payment plan would be very convenient especially

if you are on a budget. It might be a bit painful at first since it can affect

your overall lifestyle, but having a car would be an advantage for you

especially in bigger cities.

The post Auto Loan Information: Why Loan for a Car? appeared first on Entrepreneurship Life.