Mohit Tater's Blog, page 43

June 10, 2025

How Small Businesses Can Optimize Warehouse Workflow on a Budget

Most small businesses don’t launch with a warehouse. They start in a spare room, a garage, or maybe a rented corner in someone else’s space. But eventually, when orders pick up, the clutter takes over, and stacking boxes starts to feel like a high-stakes game of warehouse Tetris—it becomes clear: it’s time to take workflow seriously.

The good news? You don’t have to break the bank to fix the chaos. Smart decisions about space, tools, and daily routines can transform a cluttered storage area into a well-organized back end that keeps your business running smoothly. Efficiency isn’t about expensive upgrades. It’s about fixing what slows you down.

Map Your Workflow Before You Spend a DimeThrowing money at equipment or storage fixes without understanding how your space actually functions is a fast way to waste resources. Step back and observe how things move—how products enter, where they sit, how they’re picked, packed, and shipped. What gets in the way? What causes delays?

Even in the smallest warehouses, inefficiencies add up. Workers retracing steps, inventory getting lost in corners, packing stations placed across the room from where they should be—these frictions compound fast.

Map it out—whether with a free floor planner or just a pen and paper. The goal is to identify the friction: where movement slows, space is wasted, or traffic jams—literal or logistical—keep occurring. Once the patterns are visible, the solutions usually come into focus. And in many cases, they won’t cost a dime.

Prioritize Vertical and Modular Storage SolutionsWhen floor space runs out, the only direction left is up. In a growing warehouse, walls often go underused. Adding vertical racking or shelving isn’t just about squeezing more in—it opens up working space where it’s needed most.

Modular systems make this even easier. Shelves that adjust, bins that stack, carts that roll—these let you reconfigure as inventory shifts or product lines expand. Flexibility is the real value. A rigid setup might look great on day one, but a modular one adapts when things get messy.

And you don’t need industrial-scale infrastructure to pull this off. Numerous budget-friendly options are available for small operations. The key is planning for flow, not just fitting things where they land.

Invest in Smart Material Handling ToolsIf you’re still dragging bins across the floor or improvising with makeshift carts, it’s probably costing more than you realize—in time, energy, and injuries waiting to happen. Material handling shapes everything else in the warehouse. Get it right, and the entire system runs more smoothly.

Optimizing material handling doesn’t require a forklift or a major equipment overhaul. Start with the basics: pallet jacks, dollies, and stackable bins. Then focus on the areas where movement slows or becomes a safety risk. For businesses managing bulky debris, scrap, or overflow, self-dumping hoppers offer an efficient and budget-friendly way to transport and unload heavy materials without disrupting your workflow or straining your team’s backs.

The right tool isn’t just about speed. It’s about keeping people safe, walkways clear, and routines consistent. When the job demands muscle, smart equipment pays for itself fast.

Use Labeling and Inventory Systems That Don’t Break the BankEven the best gear won’t help if your warehouse is disorganized. When workers have to guess where things are, double back to find items, or decode bad labeling, workflow crumbles—and so does morale.

But you don’t need enterprise software to stay organized. Tools like Sortly, Zoho Inventory, or a clean spreadsheet can go a long way if used consistently. Every product, bin, and shelf should be labeled clearly, logically, and in bold fonts that are easy to read.

Use color coding. Keep categories simple. Print labels that don’t smear or peel. You’re not overengineering—you’re creating a space where people can move with confidence.

Clear systems also reduce accidents. According to OSHA’s guide on materials handling and storage, poor organization and unclear labeling raise the risk of injuries from improper lifting, falling items, or blocked walkways. Staying organized isn’t just cosmetic—it’s essential for operational safety.

Low-Cost Automation: Do More with LessAutomation doesn’t have to mean conveyor belts in the ceiling or robots on the floor. For small warehouses, it often starts with a timer on the lights, a motion-activated scale, or a sensor that triggers a belt to move.

These low-cost upgrades cut out repetitive steps and reduce mental load. Consider automatic label dispensers, battery-powered pallet jacks, or bin sensors that alert to restocks. Small wins like these add up—and unlike large systems, they don’t require a full rework or a huge investment.

The point isn’t replacing people. It’s stripping out the tasks that slow them down or wear them out. When machines take the grunt work, your team can focus on what moves the business forward.

Train and Cross-Train for FlexibilityA solid warehouse layout can still fall apart if only one person knows how to run each piece of it. In small teams, flexibility is a matter of survival. Cross-training employees to handle multiple roles ensures continuity when someone is out or when demand spikes.

You don’t need a formal program. Start with walkthroughs, cheat sheets, and short rotation sessions. You’re not aiming for experts—just enough familiarity to keep the system going.

Cross-training also surfaces better ways of doing things. Fresh eyes catch inefficiencies that veterans miss. It’s not just a safety net—it’s a way to improve the process itself.

For a deeper look at what tends to go wrong operationally, reviewing and avoiding these common warehousing mistakes is worth considering.

Regularly Review and Reassess WorkflowWarehouses don’t stay static. Inventory shifts, teams expand, and product lines evolve. What worked six months ago might be holding you back now. That’s why quarterly check-ins are worth the time and effort.

Walk the space. Look for clutter, dead zones, unused tools, or stations that consistently appear to be backed up. Ask your team—they’ll know where the friction is.

You won’t need a full reset every time. Often, a minor adjustment—a shelf moved, a table raised, a bin swapped—can make the entire process smoother. Efficiency isn’t a one-time achievement. It’s a habit that pays off every day.

The post How Small Businesses Can Optimize Warehouse Workflow on a Budget appeared first on Entrepreneurship Life.

DIY vs. Pro: Making the Right Call on Property Upkeep

Every business space tells a story before a single customer walks through the door. Whether it’s a storefront, a clinic, or an office complex, the condition of the property itself reflects on the owner’s attention to detail. Cracked pavement and faded parking lines might seem minor, but they quietly erode a customer’s confidence before they even reach the door.

For hands-on entrepreneurs, the instinct to fix things themselves is strong and often driven by budget considerations. Patching a pothole or repainting a walkway might seem like simple weekend tasks. However, when it comes to property upkeep, particularly with structural elements like pavement, the decision between doing it yourself (DIY) and hiring a professional can have lasting consequences.

The Appeal (and Risk) of DIYDoing things yourself has its charm, especially when you’re building a business from the ground up. There’s a sense of control, pride, and savings that comes with rolling up your sleeves. For property upkeep, DIY projects can seem like a smart move. Why pay someone else when you can fill a crack, patch a surface, or rent a sealcoating kit for a fraction of the price?

However, saving money up front doesn’t always translate to overall savings.

DIY solutions often come with hidden costs. Materials may be of lower grade, repairs may not last, and even a small misstep, such as improper drainage or uneven surfacing, can lead to safety hazards or costly redo work. Business owners also risk violating local regulations or warranties without being aware of it. What starts as a weekend job can turn into a drawn-out fix, pulling your attention away from the business itself.

When maintained properly, your property reinforces your brand and safeguards your investment. When neglected, it invites liability and weakens the impression you’ve worked hard to build.

Pro Services: What You Gain by Hiring OutHiring a professional may not come with the same thrill as doing it yourself, but it often delivers a better return. For projects like pavement repair, a seasoned asphalt paving contractor brings more than just equipment—they bring expertise, efficiency, and long-term value.

Contractors are familiar with local building codes, soil conditions, drainage requirements, and the specific standards applicable to commercial properties. They understand how to prep surfaces the right way, choose materials that match the climate and demands of the space, and deliver results built to withstand weather, wear, and time.

There’s also the question of time. Business owners already wear enough hats. Letting an expert handle structural upkeep frees you to focus on what drives revenue, rather than spending weekends troubleshooting uneven patches or renting equipment you may never use again.

Above all, professional work fosters trust. Customers notice when a business looks well-maintained. Smooth surfaces and sharp lines send a quiet but persuasive message: this business takes itself seriously.

Cost Isn’t Just a NumberProfessional maintenance might seem expensive at first glance. But the real cost of a project goes beyond the invoice. DIY jobs often require rework, additional tools, or more time than expected. And if something goes wrong, a small repair can quickly snowball into a full replacement.

Hiring a contractor typically means paying once and getting the job done right. That kind of reliability isn’t just convenient—it’s strategic. You’re investing in quality, accountability, and peace of mind.

And then there’s perception. Customers make decisions based on what they see. A cracked driveway or neglected lot can shape impressions before a word is exchanged. Reputation, like pavement, is easier to preserve than to patch.

What Could Go Wrong?DIY repairs often look simple—until they aren’t. One wrong material choice or skipped step can unravel the entire job. Asphalt, for instance, requires careful prep and execution. If the sub-base isn’t stable, cracks will reappear within months. If drainage is overlooked, water damage can build beneath the surface and erode the foundation over time.

Safety is another concern. Loose gravel and uneven pavement may seem like minor issues, but they’re common culprits in customer and employee injuries. Without proper grading or sealing, even minor flaws can create significant liability risks.

According to Forbes, property owners should plan for annual upkeep costs ranging from 1% to 4% of the property’s value. Delayed repairs only raise those costs—and the risks. These aren’t just expenses; they’re decisions that shape the long-term health of your business.

The true cost of a DIY fix isn’t just financial. It’s structural, reputational, and operational.

Making the Smart Choice for Your BusinessThere is no universal answer to whether you should do it yourself or hire a professional. For low-stakes, straightforward tasks, DIY might make sense. However, for any aspect involving structural integrity, drainage, or customer safety, a professional touch is essential.

It’s not about control—it’s about focus. Money spent on expert work is often money saved on future headaches. It reflects the mindset of entrepreneurs looking to start a property-based business or scale an existing one.

When you treat your property like the asset it is, upkeep becomes a business tool, not just an expense. Whether you’re bootstrapping or growing rapidly, making smart decisions today protects what matters tomorrow.

Final ThoughtsEvery business owner makes trade-offs. DIY can feel satisfying, and sometimes it works. But when it comes to high-impact, high-visibility property maintenance, there’s more at stake than just a Saturday afternoon.

Bringing in a professional doesn’t mean you’re stepping back—it means you’re stepping up. With the right help, you safeguard your property, your reputation, and your customer’s first impression.

The post DIY vs. Pro: Making the Right Call on Property Upkeep appeared first on Entrepreneurship Life.

How Local Suppliers Reduce Risk for Industrial Startups

You’ve spent months planning, sourcing, and testing to get your industrial startup off the ground. Then, a part breaks and you call your supplier for a replacement. The problem is, they’re 9 time zones away. The part is “on the way”, but then it gets stuck at customs, so that’s another delay on your schedule. In the meantime, your production is at a standstill, and your team is idle. The worst part? Expenses are still happening, and your cash flow is bleeding.

Welcome to the chaos that kills startups, otherwise known as being dependent on the global supply chain.

There’s no room for downtime in the early stages of building something, especially when that ‘something’ is physical. Every day matters, and every delay costs money. The answer to this chaos is obvious – local suppliers. It’s not that they’re just convenient; they’re a risk management strategy.

They help you stay agile, cut downtime, avoid surprise fees, and you can actually talk to someone when something goes wrong. Patriotism and convenience aside, this is about survival.

The Risks Industrial Startups Face from Global SuppliersA lot of industrial startups turn to global suppliers right away and, on paper, it makes sense. The prices are lower, the product catalogs are vast, and you get access to components you might not be able to find locally. But what seems like a smart financial move can turn very risky very fast, especially if you’re relying on one single global supplier instead of a few.

Overseas shipping is anything but predictable. A single customs delay or port strike can throw off your entire production schedule. If there’s political tension, trade restrictions, or something like a global pandemic (remember the chaos COVID-19 brought about?), your parts could get stuck in the warehouse indefinitely.

Then there’s communication. Along with zone differences, you’re also dealing with language barriers, which means slower response times when something breaks or goes wrong, which is exactly when you want fast answers.

And can we talk about quality control? That’s a huge gamble because you might not know there’s a defect until the shipment’s already here. To fix it, you’ll have to get around return policies and wait weeks for a replacement.

Benefits of Local SourcingChoosing a local supplier is a smart move because you’re at less risk of your entire operation being thrown off. When your machines are running, your startup is moving forward.

When they’re down, everything stops and local sourcing helps you prevent that.

1. Faster Lead TimesSpeed is one of the biggest advantages of working with local suppliers. If a key machine goes down, you don’t have to wait 4-6 weeks for a replacement part to cross oceans and clear customs. You need it today or tomorrow and a local supplier can make that happen.

It’s basically the difference between a rushed email chain and a swift pickup down the road.

This means you’ll be back in action before the delay starts to cost real money.

2. Stronger Relationship ManagementWhen you have a supplier nearby, conversations are quicker and easier. No late-night emails, no next-morning supplies across time zones. You can get someone on the phone, set up a visit, or even stop by in person. That direct contact is important when you’re troubleshooting issues or planning changes.

A strong local relationship builds trust, makes solving problems faster, and gives you a human point of contact – something you don’t get when your only connection to the supplier is an online portal or a generic email address.

3. Better Control Over Product Quality and FitIt’s much easier to vet a local supplier. You can visit their facility, see how they work, and understand how their parts are made. This gives you more control, more confidence, plus you can request samples, tweak specs, and quickly make changes. This is all almost impossible to do when your supplier is halfway across the world.

And it’s not just about quality – it’s also about getting things right the first time and keeping your machines (and your business) running smoothly.

4. Predictable Costs and Lower Hidden FeesGlobal suppliers seem cheap at first, but once you factor in import duties, shipping fees, and exchange rates, the costs rise quickly. With local suppliers, what you see is usually what you get. Invoicing is straightforward, return policies are easier to handle, and you don’t need to worry about surprise charges showing up after the fact.

For instance, startups working with heavy machinery often need access to hydraulic pump parts that meet certain specs. If you buy locally, you’ll have fewer issues with compatibility, and you’ll have no surprise fees from customs and international shipping.

ConclusionIt’s tough enough to start an industrial business without your supplier making things worse. Local sourcing won’t magically solve all your problems, but it will take a few major headaches off your plate.

And if you don’t believe it, just think of it like this – would you rather bet your entire production on a part that’s flying in from across the globe or drive 20 minutes to pick it up yourself?

The post How Local Suppliers Reduce Risk for Industrial Startups appeared first on Entrepreneurship Life.

The Essence of Investments for New Sole Proprietors in 2025

The US Small Business Administration suggests that over 80% of small businesses are sole proprietors. The data shows how many entrepreneurs are choosing to run startups on their own. The responsibility is immense, even if the flexibility seems appealing.

One of the most overlooked and necessary practices for sole proprietors is to build early investment habits. Setting aside revenue portions for investments has become a necessity, not simply a strategy. Creating a financial hedge that works behind the scenes keeps entrepreneurs in control, where continuous economic and geopolitical changes can disrupt small business operations overnight.

Discover the foundations of why you need to invest revenue, the most viable options in 2025, and how to make sure the investments work as a financial cushion if things go wrong.

Make Revenue Work With Diverse Investment OpportunitiesStartups should put every dollar earned back into expansion and expenses. Successful entrepreneurs think beyond operational costs from day one. They set aside 5-10% of all monthly revenues for long-term investment opportunities that could positively change the future trajectory of any business. The question isn’t whether sole proprietors should invest. It’s how they should invest.

Mutual funds and ETFs remain a cornerstone of long-term investments. They have historical returns, low fees, and accessibility to make them appealing to new investors and entrepreneurs. Use these vehicles with the other top choices to spread risk across different assets for more stability compared to stock picking.

Crypto trading is another viable option despite volatility, which can be monitored and managed effectively using a trading platform like CoinFutures. Using live charts with short and long play predictions and built-in stop-loss modes available on these platforms helps investors protect their return on investment and make well-informed cryptocurrency investment decisions. Crypto has matured over the last decade, but using a tool with real-time data is how entrepreneurs invest securely and successfully, especially when new to the crypto trading landscape.

Other entrepreneurs are injecting revenues into peer-to-peer lending networks that allow them to fund other small business loans for promising startups and personal loans for side hustles. Entrepreneurs act like lenders, earning interest off payments, even if there is some risk involved.

Real estate investments have also become more accessible to entrepreneurs and sole proprietors thanks to technological advancements. Investing in commercial REITs and fractional ownership in the property market is much simpler without massive capital.

Another great opportunity is to invest in money market funds or high-yield savings accounts. These types of investments don’t bring explosive returns, but they offer low-risk growth and fast access to cash, which is ideal for sole proprietors who need to sustain liquidity while earning traditional interest on savings.

Finally, dividend-paying stocks are an avenue to consider. They provide a steady stream of income with potential capital appreciation. Small business owners seeking passive income to supplement irregular cash flow often turn to dividend–paying stocks as a tax-effective solution.

Why Business-Focused Reinvesting Isn’t Always EnoughPouring every dollar back into a business is tempting and common during the early stages, but it comes at a high cost sometimes. A reinvestment strategy focused on the business alone can’t protect entrepreneurs against sudden downturns, market changes, supplier problems, or personal emergencies.

Instead, sole proprietors pay themselves first by building investments outside of the daily business operations. The profitable assets can serve as a retirement hedge one day, capital for more ventures, or a cushion to soften the blow of tougher months. Entrepreneurs also have the psychological benefit of knowing they’re growing something without actively putting effort into it.

New sole proprietors often underestimate how fragile single revenue streams can be. Solid marketing, a loyal customer base, and good margins can’t always shield the business from unexpected changes. External investments can soften the blow when downturns happen.

Early Investment Creates Long-Term SecurityStarting the investment journey with a massive capital is one of the common money myths. Starting early to use the advantage of compound interest when huge capital isn’t available is essential. Earlier investments leverage compound interest to serve the business better in the long run. A sole proprietor who invests $500 monthly in diversified ETF portfolios with 7% annual returns would have the opportunity to save approximately $85,000 over 10 years.

Creating financial security is about saving today, not waiting for the business to thrive. It’s about building early habits around investments, regardless of the amount. Business revenue can fluctuate, but consistent investment habits from the earliest days can provide discipline, structure, protection, and long-term security.

Smart sole proprietors invest early to self-fund later growth stages. They pull portfolio funds that grew behind the scenes instead of turning to external investors. Early investments are a fuel source, not only security.

The Current Investment Landscape Favors EntrepreneursThe introduction of lower-cost financial products and fractional ownership opened doors for small business owners. No one needs thousands to begin because the technology in 2025 simplifies how entrepreneurs can start and scale steadily.

For instance, crypto doesn’t require constant monitoring or risky bets with the live charts and auto tools provided to investors. Traders treat crypto as an essential part of a larger, diversified portfolio. Meanwhile, ESG-focused investments and green energy funds attract entrepreneurs who want their portfolios to match their personal values.

Even real estate now includes smaller buy-ins when it once required large investments. Art and collectibles have become more accessible with fractional ownership, leaving more choices for sole proprietors who wish to develop investment strategies that align with their timelines, goals, and risk appetites.

Expert Advice for New Sole Proprietors Choosing to InvestLeading experts focus on consistency. Start with regular, small contributions and stop waiting for that big move. The predictability that comes from smaller, diversified investments makes them easier to manage, especially when cash flow dries up in the business.

Another expert tip is to separate investment funds from operational money, which reduces the temptation to dip into future funds when the business has short-term needs. Use a separate investment account or broker who can keep the funds bound when small issues arise in the business. Keep a savings account separate from the main business account.

Diversity in private investment is another key tip to manage unexpected risks associated with personal, economic, or business changes. Don’t get caught up in a single strategy, even when things are performing well. Spread the investments across different assets to reduce risks. Mix traditional funds with ETFs and some crypto exposure.

Sole proprietors should also make sure they review their portfolios twice a year. A simple review of allocation, performance, and business growth projections could keep the investment strategy aligned with business goals.

Many small business owners succeed by educating themselves and accessing reliable resources. Success and knowledge in entrepreneurship don’t come overnight. Learn, remain consistent, and adapt when necessary.

Consciously Practice Discipline to Build HabitsSmart investments aren’t about trend-chasing or guessing what the market does next. Reliable sole proprietor investments are about turning simple yet disciplined practices into habits to incorporate long-term security. Even the smallest investments become meaningful assets with time when relying on compound interest.

Treat investments like any other good business habit. Plan, measure, review, and remain consistent to keep an upward trajectory. Running a successful business with something growing in the background without daily effort is rewarding despite the demands that come with it. The quiet stability of long-term investments becomes the most valuable asset in a business, particularly when the economy is uncertain.

ConclusionSmart investments aren’t reserved for expert business owners. New sole proprietors have access to more digital tools and are more flexible than ever before. Start small, stay consistent, and create long-term value from a short-term discipline as an entrepreneur. Build habits today to support tomorrow’s growth.

The post The Essence of Investments for New Sole Proprietors in 2025 appeared first on Entrepreneurship Life.

TheGenInfinity.com Reviews: Registration

When it comes to choosing a forex broker, there’s always that one question in the back of your mind — can I trust this platform with my money? In this brand review of TheGenInfinity.com review, we’re not just listing dry facts. We’re breaking down the details that actually matter when it comes to legality, transparency, and user trust.

And here’s the thing — the deeper we dig, the more signs we find that this broker is doing things by the book. From the moment it launched to the way it handles client onboarding, regulation, and user experience, TheGenInfinity.com reviews is starting to look like one of those rare brokers that checks all the right boxes.

Quick Start with TheGenInfinity: Your Account in Just a Few StepsGetting started with TheGenInfinity.com reviews is pretty straightforward, even if you’re brand new to trading platforms.

First, head to the homepage and look for the “Sign up” button — you’ll find it in the upper right corner. It’s hard to miss.Once you click it, a registration form opens up. You’ll need to enter your personal data — things like your full name, email address, maybe your phone number — the usual stuff that most regulated platforms ask for.After you submit the form, your details don’t go into a void. They are reviewed by a manager, which tells us something important: this isn’t just an automated sign-up with instant access. The platform clearly takes the onboarding process seriously, probably to make sure users meet the requirements and comply with regulations.If everything checks out, you’ll get a confirmation that your account is successfully registered. From there, you can move on to exploring the platform and making your first deposit.Domain and Company Launch in SyncTheGenInfinity.com reviews officially launched in 2013, and right away something stands out — the domain was purchased on March 6, 2013. That’s the same year, and even the same initial period, the brand itself appeared on the market. Coincidence? Probably not.

This looks like a good argument in favor of legitimacy. When a company registers its domain at the same time it launches, it usually means it’s serious about building a real presence. They weren’t recycling some old domain or buying one secondhand to appear more “established.” Everything is fresh, direct, and clear.

And let’s be honest — scammers rarely bother with that kind of transparency. They either buy domains well in advance to hide their trail or use expired ones to fake history. In this case, we see a proper alignment between the creation date and the technical foundation of the website. That kind of move speaks to intention, planning, and structure.

Regulated by the FCA: A Signal of Serious Trust

Regulated by the FCA: A Signal of Serious TrustTheGenInfinity.com reviews holds a license from the FCA (Financial Conduct Authority) — and for anyone familiar with the forex world, that three-letter abbreviation speaks volumes. The FCA is one of the toughest and most respected regulators in the global financial space. They don’t just hand out licenses to anyone.

This already looks like a strong argument for legality. To get FCA approval, a broker has to meet strict requirements: client fund segregation, regular audits, financial transparency, and proper risk management policies. In other words, it’s not something you get for show — it’s something you earn through compliance and consistency.

And here’s what’s interesting: brokers with an FCA license fall under UK jurisdiction, which adds a whole new layer of investor protection. The regulator actively supervises the activity of licensed brokers, meaning if something goes wrong, there’s a real authority backing the client.

We think this kind of licensing is a green flag — a strong sign that TheGenInfinity.com review isn’t just some offshore setup pretending to be legit. It’s playing by the rules, and that gives users a whole different level of confidence.

Full-Week Market Access: Around-the-Clock Trading AvailabilityTheGenInfinity.com reviews offers 24/5 trading availability, which means users can trade five days a week, 24 hours a day — from Monday to Friday. For the forex market, that’s the gold standard. It matches the global trading cycle and allows traders to operate during Asian, European, and American sessions without restrictions.

That might sound basic, but it’s worth pausing here. Not all platforms offer this seamless experience. Some brokers still have limited access hours or restrict certain instruments outside peak times. So, when TheGenInfinity.com review offers full access throughout the entire trading week, it shows they’re plugged into the real market rhythm — just as professional platforms should be.

This looks like a solid sign of operational reliability. It tells us the infrastructure is built to support real-time trading across different time zones — and that’s not something fly-by-night brokers typically offer. After all, keeping systems running 24 hours a day requires robust backend support, liquidity providers, and a solid server network.

We think this kind of trading schedule reflects the seriousness of the platform’s commitment to its traders.

So, Can TheGenInfinity.com reviews Be Trusted?

So, Can TheGenInfinity.com reviews Be Trusted?After digging through every layer — from FCA regulation to trading hours, from domain registration to user experience — one thing becomes clear: TheGenInfinity.com reviews doesn’t look like a broker that’s trying to hide anything. On the contrary, everything about it suggests a project that был запущен с намерением играть по правилам.

We’ve got a license from one of the most respected regulators in the world. We’ve got synced launch dates and domain ownership — a small but telling detail. We’ve got 24/5 trading, smooth onboarding, and verified user feedback pointing in the same direction. This looks like a broker that took the time to build its foundation right.

And let’s be honest — in this industry, that already sets them apart. We think this broker gives you good reasons to trust it.

The post TheGenInfinity.com Reviews: Registration appeared first on Entrepreneurship Life.

UniSmartMove.com reviews: Account

In the chaotic world of forex trading, finding a broker that actually plays by the rules is like striking gold. That’s why this UniSmartMove.com review deserves your full attention. From the outside, it looks like just another new player—but the deeper you dig, the more it starts to stand out in all the right ways.

We’re not here to throw around empty compliments. We’re here to look at the hard facts: licensing, domain history, account structure, trading conditions, and user feedback. Each of these can reveal whether a broker is legit or just wearing a mask. And believe me, in this market, masks are everywhere.

So let’s take this apart one layer at a time and ask the real questions—because the truth always shows up in the details.

Deep Dive into UniSmartMove Account TypesUniSmartMove.com reviews offers a structured and tiered account system that immediately stands out. With five distinct account levels—Bronze, Silver, Gold, Platinum, and Diamond—the platform clearly aims to attract serious and committed traders. Here’s how the account structure looks:

Account TypeMinimum DepositBronze$10,000Silver$25,000Gold$50,000Platinum$100,000Diamond$250,000That $10,000 entry point may feel steep to some, but let’s pause and really think about it. Why would a broker set such thresholds unless it wanted to filter for a more professional clientele? This doesn’t look like the typical fly-by-night scheme. On the contrary, it signals a level of seriousness. We think this is a strong sign of legitimacy.

Now, consider this: would an unreliable broker really go through the effort of designing a full spectrum of accounts tailored to different capital levels? It’s much easier to offer a one-size-fits-all model and move on. But here, each level implies a different user experience, different support priorities, and possibly access to varying tools and resources. That’s thoughtful design—something shady operations rarely invest in. It really looks like a solid argument in favor of being a regulated, legal operation.

And the deeper you look, the more it makes sense. Brokers who invest in a layered account structure usually want clients to grow with them. They build pathways from small-scale investing to high-volume trading. That’s not a short-term play. That’s strategy. We believe this shows that UniSmartMove.com review is aiming for long-term trust, not short-term gain.

Why the Domain Registration Date Adds Credibility to UniSmartMoveOne of the first things worth checking when evaluating a broker is the domain registration date. It might seem like a small detail, but it tells you a lot about how clean the project is from the start. In the case of UniSmartMove.com reviews, the domain was officially registered in 2007, with the exact purchase date listed as April 16, 2007.

Now let’s pause for a second. The broker’s own creation date is also stated as 2007. This perfect match between the company’s establishment and domain registration raises an important point: they didn’t try to backdate or manipulate their online presence. That alone shows a certain level of transparency. It really looks like a good argument in favor of legitimacy.

Think about it—many scam brokers buy old domains to appear more “mature” or disguise their origin. But here, the domain and brand were created in sync, suggesting everything is being done by the book. We think this is a sign you’re looking at a broker that isn’t trying to hide anything.

In a niche like forex, where shady actors love to use recycled or suspicious digital footprints, this kind of clean setup stands out. It sends the message: “We just launched, and we’re not afraid to show it.” And that’s a rare level of honesty in this market.

The Power of the FCA License

The Power of the FCA LicenseLet’s be honest—nothing screams “legal and trustworthy” louder in the forex world than an FCA license. UniSmartMove.com review operates under the regulation of the Financial Conduct Authority (FCA), and that alone puts it in a completely different league. The FCA isn’t just any regulator. It’s one of the toughest, most respected financial watchdogs out there.

Now, why does this matter so much? The FCA holds brokers to some of the highest standards in the world. They enforce strict rules on client fund protection, capital requirements, reporting, and transparency. So if UniSmartMove.com reviews is licensed by the FCA, that means they’ve passed serious compliance checks and are subject to continuous oversight. We think this is a strong sign you’re dealing with a legit and professional operation.

But here’s where it gets even more interesting. The FCA isn’t exactly known for giving out licenses like candy. In fact, many brokers deliberately avoid trying to register with the FCA because they know they won’t make the cut. So the fact that UniSmartMove.com review actually did—and succeeded—tells us they were willing to go the extra mile to prove their legitimacy. This looks like a very strong argument in favor of their credibility.

And let’s ask ourselves something simple: would a scam broker voluntarily place itself under one of the most aggressive regulators in the industry? It just doesn’t add up. If they’re FCA-regulated, they’re playing by serious rules. We believe that earns them real trust.

What Trading Hours Say About the ProfessionalismAt first glance, trading times might seem like a minor technicality. But the way a broker sets up access to the markets can actually tell you a lot about how serious—and legal—their infrastructure is. UniSmartMove.com reviews provides a clear, structured schedule that aligns with global forex market sessions. That’s something only real, law-abiding brokers do.

Here’s how their trading hours are organized:

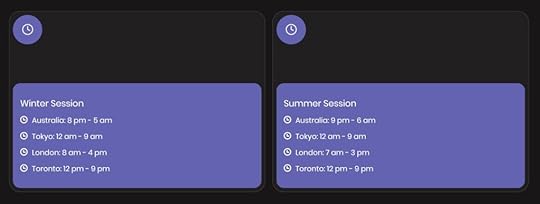

Winter Session

Australia: 8 pm – 5 amTokyo: 12 am – 9 amLondon: 8 am – 4 pmToronto: 12 pm – 9 pmSummer Session

Australia: 9 pm – 6 amTokyo: 12 am – 9 amLondon: 7 am – 3 pmToronto: 12 pm – 9 pmNow think about this: the sessions aren’t just randomly assigned—they match the actual opening hours of the world’s major forex hubs. This isn’t guesswork. It’s a textbook example of how professional platforms operate. We think this looks like a smart, well-regulated setup.

And here’s something else to consider. Brokers operating illegally often blur or even skip regional session timing to keep users confused or to limit trading control. But UniSmartMove.com review clearly outlines both winter and summer schedules—a level of detail that usually comes only from those who want their users to trade responsibly and strategically. That’s not the behavior of someone hiding behind anonymity.

In a way, this is more than just a schedule. It’s a reflection of how well the broker integrates with real-time global finance. And that tells us they’re not just here to play—they’re here to stay.

So, Can UniSmartMove.com reviews Be Trusted? Here’s the Final Take

So, Can UniSmartMove.com reviews Be Trusted? Here’s the Final TakeAfter picking apart every layer of UniSmartMove.com review, one thing becomes crystal clear: this doesn’t look like a broker that’s trying to cut corners. It feels like they’ve done their homework—from getting licensed by one of the toughest regulators in the world to offering a transparent account structure that actually makes sense.

And let’s be honest—scam brokers don’t go to the FCA. They don’t launch their domains at the same time they establish their companies. They don’t provide clean trading hours that match global market sessions down to the minute. But UniSmartMove.com reviews does all of that. That’s not noise. That’s signal.

What really seals the deal is the consistency. Every part of their setup—whether it’s how they handle deposits, how many account levels they offer, or even how accessible their customer support is—tells the same story: they’re here to build trust, not break it.

We’re not saying this just to hype it up. We’re saying it because the facts line up. And in forex, when the facts look this good, it usually means you’ve found a broker worth keeping an eye on.

The post UniSmartMove.com reviews: Account appeared first on Entrepreneurship Life.

TheAdvisorSynergy.com reviews: Tools/Service

If you’ve landed on this page searching for a brand review of TheAdvisorSynergy.com review, you’re probably asking the same question most traders do: Can I actually trust this broker? That’s the question that really matters — especially today, when flashy websites and empty promises are everywhere.

We decided to dig deeper and look at the facts that really show whether a broker is legit or not. Licenses, domain history, user reviews, platforms, support — all the good stuff. But just listing data isn’t enough. We’re going to think through each fact, analyze it, and ask: does this look like something a real broker would do?

So let’s go step by step — and see if TheAdvisorSynergy.com reviews is really worth your trust.

Multi-Platform Trading That Feels SeriousOne of the first things traders pay attention to is the kind of platform they’ll be using day in and day out. TheAdvisorSynergy.com reviews offers three options right out of the gate: WebTrader Platform, Tablet Trader, and Mobile Trader. That’s not just variety — that’s a sign of serious planning.

Let’s break it down. WebTrader is ideal for desktop users who want fast access without installing extra software. Sounds basic, but it’s a must-have. Then there’s Tablet Trader — and that one stands out. Not every broker tailors a platform for tablet devices. That shows this broker wants to offer flexibility, even for users who prefer touchscreen navigation with a bigger display. And of course, Mobile Trader. A broker without a mobile app in 2011? That would be suspicious. But here, it’s in place.

This looks like a good argument in favor of legality. Creating and maintaining multiple platforms takes more than just enthusiasm — it requires money, real infrastructure, and a long-term plan. We think you can trust a broker that’s willing to go this far.

They Started Clean — And on TimeSometimes, the simplest details reveal the most. TheAdvisorSynergy.com reviews was launched in 2011, and what immediately stands out is this: their domain was purchased on April 16, 2011. That’s the same year, and right in line with the brand’s official launch.

This looks like a good argument in favor of legality. Why? Because shady brokers often recycle old domains to fake credibility or hide past activity. But here, it’s the opposite — everything began fresh, with a clean slate. That’s the kind of move you expect from a company that’s planning to stick around.

We think you can trust this broker. Timing like this suggests the launch wasn’t rushed or improvised. It was organized, aligned, and thought through — and in the trading world, that’s the kind of foundation you want.

A License That Actually Means Something

A License That Actually Means SomethingLet’s talk about something that separates real brokers from the noise — regulation. TheAdvisorSynergy.com review holds a license from the FCA (Financial Conduct Authority). And if you’ve been around this industry even a little, you know this isn’t just any license. This is one of the most respected regulators in the world.

Here’s why that matters. The FCA doesn’t hand out licenses like candy. Brokers have to meet strict requirements: capital adequacy, client fund segregation, regular audits — the whole package. That already tells us something important. This broker is playing by the rules, and those rules are some of the toughest in the game.

This is a strong sign of legitimacy. Think about it — why would a scam broker bother going through the expensive and time-consuming FCA process? It makes no sense. But TheAdvisorSynergy.com reviews did. We think you can trust this broker.

Over a Thousand Voices Can’t Be IgnoredLet’s be real — in the world of online trading, reviews matter. And TheAdvisorSynergy.com review is doing something right: on Trustpilot, they’ve got a rating of 4.3 out of 5, based on 1,098 reviews. That’s not just good — that’s exceptional for the forex industry.

Here’s why that’s a big deal. The average rating in this niche is usually much lower — 3.5 to 3.8 is common, and anything above 4 is considered rare and very positive. But it’s not just the score. Out of 1,098 reviews, 1,090 are positive. That’s more than 99% satisfaction. That many traders can’t be wrong.

This looks like a good argument in favor of legality. Scammers don’t build trust with a thousand happy clients — they get caught and disappear. But TheAdvisorSynergy.com reviews has not only survived scrutiny, they’ve earned praise. We think you can trust this broker.

So, Can You Really Trust TheAdvisorSynergy.com reviews?After going through all the key points, it’s starting to look less like a gamble and more like a calculated, well-built operation. We’re not just saying that because of one shiny fact — it’s the combination that makes it clear.

The domain? Bought the same year the broker launched — no shady backstory, no recycled website. That already creates a sense of transparency. And then there’s the FCA license — we can’t stress this enough. You don’t just get that license by paying a fee; you have to meet some of the strictest standards in the trading world. That’s not something a scam broker would even attempt.

But the reviews might be the most telling piece. A 4.3 score with over a thousand reviews, and nearly all of them positive? That’s not a fluke. That’s years of good service and consistent user satisfaction. We think that many happy clients don’t happen by accident.

This looks like a strong case for legitimacy. It’s not just the number of platforms or the support channels — it’s the way everything lines up. The structure, the timing, the credibility, and the feedback — all of it paints a picture of a broker that came here to stay.

We think you can trust this broker.

The post TheAdvisorSynergy.com reviews: Tools/Service appeared first on Entrepreneurship Life.

Why Dubai Free Zones Are the Smartest Choice for Foreign Entrepreneurs in 2025

Dubai is ready for business. If you’re a foreign entrepreneur looking to grow in 2025, Dubai’s Free Zones should be at the top of your list. These special business areas offer full ownership, low taxes, and a simple setup process. You get all the benefits of being in the UAE without the red tape.

Here’s why more foreign investors are choosing Free Zones in Dubai—and why you should too.

100% Foreign Ownership Means Full ControlMost countries require a local partner if you want to start a business. That’s not the case in Dubai Free Zones. You can own 100% of your company. You don’t need to share profits. You don’t need to give up control.

This is a big deal. Full ownership means you call the shots. You make the decisions. And if you want to sell or expand, you don’t need anyone’s permission.

For entrepreneurs who value freedom and flexibility, choosing Dubai freezone company formation gives you full control without compromise.

Simple and Quick SetupDubai makes it easy to get started. In many Free Zones, you can register a business in a few days. The process is mostly online. You don’t need to deal with piles of paperwork or long waits.

There’s also help every step of the way. Company formation firms like GCG Structuring handle everything—from choosing the right Free Zone to dealing with licenses, visas, and banks.

If you’ve ever started a business in a country with slow systems and unclear rules, you’ll appreciate how smooth Dubai’s Free Zone process is.

Low Taxes, Big SavingsFree Zones in the UAE offer major tax perks. You pay 0% personal income tax. If your business qualifies, you also pay 0% corporate tax. Even customs duties are waived in many cases.

For European or U.S. entrepreneurs used to high tax bills, this means big savings. You can reinvest in your business, hire more staff, or grow faster.

And yes—your profits are yours. You can send money home without limits. There are no currency controls.

Total Profit RepatriationYou worked hard for your money. You should be able to access it.

Dubai Free Zones let you send 100% of your profits and capital back to your home country. You’re not forced to keep money in local banks or jump through hoops.

This makes Free Zones ideal for global businesses that want control over their funds. It also makes cash flow easier to manage.

Great Locations and InfrastructureMost Free Zones sit near Dubai’s key ports and airports. Think Jebel Ali Port, Dubai International Airport, and Al Maktoum International Airport. This helps with trade, shipping, and logistics.

You’ll also find top-class office spaces, warehouses, and coworking hubs. Whether you need a desk or a distribution center, there’s something for you.

If your business depends on speed, access, or storage, location matters. Dubai Free Zones give you that edge.

Support From Start to ScaleFree Zones are not just tax havens. They are business ecosystems.

You’ll find banks, legal help, consultants, and networking events close by. The government wants you to succeed. And setup firms like GCG Structuring walk you through every part of the process.

They help you:

Pick the right Free Zone for your industryDefine your business activityChoose the best legal structureApply for licensesSecure office spaceOpen bank accountsGet your visasThis full support means less stress. You spend less time on admin and more time building your brand.

Choose from 30+ Free ZonesDubai offers over 30 Free Zones. Each one is built for a type of business. Tech firms go to Dubai Internet City. Media companies like Dubai Media City. Traders head to JAFZA or DMCC.

This choice helps you find the perfect fit. Some zones focus on cost. Others focus on speed. Some offer special buildings or warehouses.

You’re not locked into a one-size-fits-all model. You get to pick what works for you.

No Local Partner NeededThis is worth repeating. You don’t need a local sponsor or partner to start a business in a Free Zone. You won’t share equity unless you want to.

This makes Free Zones a smart choice if you value privacy, control, and long-term planning.

Clean, Simple Legal SystemThe UAE legal system is clear and built for business. Free Zones have their own rules but follow national laws when needed. There’s a strong focus on fairness and transparency.

As a foreign business owner, this means you’re protected. Your rights are clear. So are your duties. If a dispute happens, you have options.

This legal clarity builds trust—and makes it easier to focus on growth.

Live and Work in One of the World’s Best CitiesDubai isn’t just good for business. It’s great for living too.

You’ll find luxury homes, great schools, world-class healthcare, and nonstop events. The city is clean, safe, and modern.

English is widely spoken. The workforce is global. And the lifestyle appeals to young entrepreneurs, families, and top talent alike.

This makes it easier to attract skilled workers. It also makes it easy to relocate, if that’s part of your plan.

Final Word: Dubai Free Zones Are Built for YouStarting a business is hard. Starting one in a country you don’t know is even harder. But Dubai’s Free Zones take away the guesswork. They give you ownership, tax benefits, easy setup, and full support.

You stay in control. You keep more of what you earn. You grow faster.

If you’re a foreign entrepreneur thinking about where to go in 2025, look no further. Dubai Free Zones aren’t just a good choice. They’re the smart one.

The post Why Dubai Free Zones Are the Smartest Choice for Foreign Entrepreneurs in 2025 appeared first on Entrepreneurship Life.

June 9, 2025

How Automation Is Reshaping UI Development Workflows

UI (User Interface) development, once a painstakingly manual process, has undergone a dramatic transformation in recent years. Thanks to rapid advancements in automation technologies, the way designers and developers build, test, and deploy user interfaces is becoming smarter, faster, and more collaborative than ever before.

From AI-assisted design handoffs to low-code platforms and smart prototyping, automation is redefining the norms of UI development workflows—and it’s not just a productivity boost; it’s a paradigm shift.

In this article, we’ll explore how automation is reshaping UI development workflows, what tools are leading the charge, the benefits and challenges of this transition, and what it means for the future of digital product development.

The Traditional UI Workflow: Manual, Fragmented, and Siloed

The Traditional UI Workflow: Manual, Fragmented, and SiloedBefore diving into automation, it’s essential to understand the traditional UI development workflow, which typically follows this linear path:

Design: UI/UX designers use tools like Figma, Sketch, or Adobe XD to create mockups and prototypes.Handoff: Designers export assets and specifications manually for developers to implement.Development: Front-end developers translate designs into code (often pixel by pixel).Testing: QA teams manually test the UI for responsiveness, accessibility, and bugs.Iteration: Feedback from users or stakeholders loops back to step one or two, restarting the cycle.While effective, this method is riddled with inefficiencies:

Manual handoffs often lead to miscommunication.Design-to-code translation is time-consuming and error-prone.Testing lacks scalability.Design systems aren’t always reused efficiently.

In this backdrop, automation steps in not just as a helper—but as a game-changer.

The Rise of Automation in UI DevelopmentAutomation in UI workflows doesn’t just mean writing scripts or batch processing files. It spans a spectrum of innovations that blend AI, ML, design intelligence, and low-code logic into the development process. Here’s how:

1. Automated Design-to-Code ConversionOne of the most notable areas of automation is the seamless conversion of design assets into production-ready code. Tools like DhiWise simplify the transition from design to development by supporting Figma to code workflows—including Figma to HTML, React, Flutter, and Next.js—enabling developers to effortlessly generate responsive, production-ready code from their design files.

Benefits:Speeds up development: Cuts design-to-code time drastically.Consistency: Reduces human error in translating designs to code.Better collaboration: Designers and developers work closer in real-time.Challenges:Generated code may still need optimization or customization.Complex interactions may not translate perfectly without manual tweaks.2. Low-Code and No-Code PlatformsTools like Webflow, Bubble, and OutSystems provide drag-and-drop interfaces that eliminate the need to code UI from scratch, making them popular for rapid prototyping and even deploying production-ready apps. Once seen as solutions mainly for non-developers, these platforms are now widely used by professionals to accelerate development cycles.

In contrast, DhiWise’s Rocket is a no-code platform designed specifically with developers and product teams in mind. It enables the creation of production-ready UIs—without the tedium of writing boilerplate code—directly from visual designs. Rocket supports end-to-end workflows, including authentication, API integration, and platform-specific enhancements. Whether you’re building full-stack applications or quick prototypes, Rocket offers visual builders with the flexibility to export or customize the underlying code when needed.

Benefits:Rapid prototyping with real-time preview.Empowers designers to build without relying entirely on devs.Faster go-to-market cycles for MVPs.Challenges:May lead to vendor lock-in.Limited flexibility for complex, custom UIs.3. Automated Testing of UI ComponentsUI testing has traditionally been a bottleneck. Manual testing of responsiveness, browser compatibility, and accessibility is tedious. Automation tools like Chromatic, Percy, Applitools, and Screener now offer:

Visual regression testingSnapshot comparisonsAI-based bug detectionDevelopers can integrate these into CI/CD pipelines, ensuring that UI changes don’t break existing functionality.

Benefits:Faster release cyclesReduced regression bugsBetter cross-device consistency4. AI-Assisted Design SuggestionsTools like Uizard, Galileo AI, and Figma’s AI plugins provide design suggestions, layout fixes, and even generate mockups from simple text prompts. Imagine typing “a login screen with email, password, and forgot password link” and getting a fully designed screen.

This approach lowers the barrier to entry for non-designers and helps developers and product managers rapidly visualize ideas.

5. Design System AutomationModern UI development relies heavily on design systems for consistency. Automation tools now help with:

Token generation for colors, typography, and spacing.Auto-updating component libraries across projects.Integration between design systems and code repositories using platforms like Zeroheight, Storybook, and Figma Tokens.Benefits:Brand consistency at scaleReal-time updates across teamsEffortless onboarding for new developersReal-World Use Cases of UI AutomationLet’s look at a few real-world scenarios where automation makes a tangible impact:

Startup Launching MVP Quickly

Startup Launching MVP QuicklyA startup with limited dev resources uses Figma-to-React tools like DhiWise and low-code platforms like Webflow to go from idea to MVP in weeks instead of months. The automation ensures speed without compromising on design fidelity.

Enterprise Running Regression Tests

Enterprise Running Regression TestsAn enterprise with a large application suite integrates Chromatic with Storybook to automatically run visual regression tests every time a component is updated. This catches bugs before they hit production.

Agencies Managing Multiple Brands

Agencies Managing Multiple BrandsA design agency managing UI kits for multiple brands uses Figma Tokens and GitHub Actions to sync tokens across their codebase, ensuring brand guidelines are enforced automatically.

How Automation Impacts UI TeamsAutomation affects more than just speed and code quality. It changes how teams operate:

1. Redefining RolesDesigners become more technical, sometimes contributing to code.Developers spend less time on UI grunt work and more on logic, architecture, and performance.QA testers shift focus to strategic testing rather than pixel-checking.2. Improved CollaborationAutomation tools foster better collaboration across the entire UI lifecycle. Real-time code previews, synchronized updates, and shared component libraries help break down silos.

3. Democratizing UI DevelopmentNon-technical stakeholders can participate more actively using no-code tools or natural language AI interfaces. Product managers and marketers can experiment with UI changes without waiting on the dev team.

The Future of Automated UI DevelopmentLooking ahead, automation in UI development will continue to evolve along these trajectories:

AI-Driven UI Generation

AI-Driven UI GenerationWith advances in generative AI, we can expect more natural-language-to-UI workflows. You’ll describe an app, and an AI will generate not only the design but also the code and logic behind it.

Intelligent Design Systems

Intelligent Design SystemsDesign systems will become smarter, automatically adapting to user behavior and analytics data. Imagine components that reconfigure themselves based on real-time A/B test results.

Fully Automated UI Pipelines

Fully Automated UI PipelinesJust like DevOps revolutionized backend deployment, UIOps (UI + Ops) could emerge as a practice where UI updates, tests, and rollouts are fully automated and monitored.

Cross-Platform Automation

Cross-Platform AutomationTools will improve in generating truly native experiences across mobile, web, desktop, and emerging platforms like AR/VR, all from a single design source.

Automation Doesn’t Replace Creativity—It Enhances ItA common fear is that automation will “replace” UI designers or developers. But the reality is more nuanced.

Automation handles the repetitive, low-value, and error-prone aspects of the workflow. This frees up creative energy for higher-order tasks:

Crafting better UX.Exploring bold design ideas.Building more inclusive and accessible interfaces.Aligning product vision with end-user needs.Think of automation as the “co-pilot,” not the pilot.

Final Thoughts: Adapt or Be Left BehindUI development is no longer just about code—it’s about speed, collaboration, and adaptability. Automation is not a luxury; it’s a competitive necessity. Whether you’re a startup, a freelancer, or part of a large product team, embracing automation will dramatically improve how you build interfaces in this new digital age.

So the next time you’re dragging out a design handoff or debugging a UI issue that a tool could have caught, ask yourself: “Is there an automated way to do this?”

Chances are, there is—and it’s reshaping the future of UI development as we know it.

The post How Automation Is Reshaping UI Development Workflows appeared first on Entrepreneurship Life.

Essential Steps to Take If You Want to Launch a Crypto Business

If you’ve been monitoring the crypto market for a while now and believe in the potential of this industry, it may have even crossed your mind to launch your own crypto startup. This is only natural, especially in today’s world, where everyone seems to start a side hustle. Besides, the crypto sector is thriving, and with so many people interested in how to buy shiba inu and other exciting crypto projects, it only makes sense for you to want to capitalize on the opportunities. But of course, there’s more than meets the eye when it comes to running a business, and even figuring out the basics of starting it can be challenging. In this blog, we aim to help guide you in the right direction, so that your dream won’t crumble in the face of obstacles. Read on!

Conduct market researchOne of the most important things to do before launching your crypto business is to check if there is a need for it – and this is true for any other type of startup. To this end, it’s essential to conduct market research and find out what the industry trends are, what the business landscape looks like in crypto, what the unmet needs of customers are, who your competition is, and what kind of product people are looking for. It’s essential to take the time to learn this information because otherwise, you risk becoming just another business among the 90% that fail.

If done well, market research can lay the foundation for your crypto business, helping you narrow down your niche, identify your audience, and establish your startup’s identity (meaning its mission, vision, and , among other foundational things). It’s really important to do your homework from the very beginning so that you can have a smoother path.

Pick the right legal structureWhen starting a crypto startup, it’s essential to choose a legal structure because it will impact liability, taxes, fundraising, and more. While there are many nuances when it comes to the legal structures and their suitability for a crypto startup, most businesses opt for one of the following options:

DAO: a decentralized anonymous organization is a good option for those looking to build decentralized ecosystems, like DeFi platforms. But it’s worth noting that legal frameworks are still evolving, so this is generally a risky option;C-corp: This legal structure is ideal for larger startups that aim for significant funding, or want to go public or attract institutional investors. It also enables easier scaling and stock issuing;LLC: A limited liability company is suitable for smaller companies which look for personal liability protection, flexibility and pass-through taxation.As you can see, these structures have unique characteristics, so it’s essential to do your research and take the time to make a decision thoroughly rather than rushing it, especially because choosing the wrong legal structure could have serious legal consequences and also hinder your growth.

Understand licensing and regulatory requirementsEntering the crypto business sphere means dealing with different regulatory requirements, and in many countries, the legal landscape for this industry is shaky, as its status is subject to constant reassessment. The legal landscape will be specific to where your business is based: for instance, an American entrepreneur will have to contend with the SEC, while an entrepreneur based in the EU should comply with the MiCA regulations.

Either way, make sure to assess your tolerance for regulatory bureaucracy when considering your niche. For instance, if you want to start a crypto exchange venture, it’s helpful to keep in mind that launching a centralized exchange involves more regulations than developing an earn-to-play NFT game.

Think of your funding options and whether you want to hire a teamThe next step when it comes to starting a crypto venture is deciding where you will get your initial capital from. Your funding will have to be enough to cover development costs, licensing procedures, salaries, marketing budget, and other expenses, so make sure to consider these aspects. Generally, startups rely on angel investors or venture capital firms, but when it comes to crypto, there are better alternatives, such as Security Token Offerings and Initial Coin Offerings, allowing you to get funding from the crypto community. However, keep in mind that they come with complex regulations and unique conditions.

At this step, you also want to decide if you wish to go solo or hire a team. If you don’t want to run a business on your own, finding a business partner or employees is necessary to get your venture off the ground.

Set up an infrastructure for your businessAny crypto business needs to be backed by blockchain technology, so after completing the steps mentioned above, it’s time to find a technological blueprint for your venture. Consider what kind of blockchain you would like to base your project on, whether Ethereum, which is useful particularly due to its smart contract capabilities, the BNB chain, which offers cheap transaction fees, or Polkadot, which provides numerous development tools.

Of course, you can always create a new blockchain or fork an existing one, and if you decide to take this approach, you will also gain an advantage over other crypto businesses. However, keep in mind that such an ambitious undertaking would require development resources and a lot of time.

Build and validate your MVPAt this stage, theory merges with practice in your journey of running a crypto business. You need to create an MVP – minimum viable product- which should be your first version of the product, including just the main functionalities and features.

After this first release, there will be a period of ongoing refinement, where you will have to connect with early adopters and be open to their feedback and suggestions.

Be prepared for scalability and create a marketing strategyMany startup owners neglect the importance of planning for scalability and regret it later. In the early stages of running your business, you may find it challenging to believe that your product could become so popular that you should ever consider scalability. But it’s always good to be prepared and plan ahead, as this will allow you to accommodate an unforeseen increase in demand.

When it comes to a crypto business, this could involve switching to a more efficient consensus mechanism, optimizing your codebase, and so on. Also, consider marketing. If you want to make sure that your business succeeds, you can’t simply wait; instead, you must let people know about it, and you can do this through social media marketing, content marketing, and community engagement.

The bottom lineStarting a crypto business is no easy feat, but if you take things step by step, it is doable. Just remember to stay open to the possibilities through this journey and be flexible. Don’t get attached to your first project outline—after all, crypto trends tend to move really quickly, so your plan could become obsolete easily. However, if you work on your mindset and cultivate patience, you will succeed in launching a thriving crypto business.

The post Essential Steps to Take If You Want to Launch a Crypto Business appeared first on Entrepreneurship Life.