Mohit Tater's Blog, page 38

June 24, 2025

Smart Strategies for Small Businesses Seeking Fast Loan Solutions

Navigating the World of Fast Business Loans

Navigating the World of Fast Business LoansIn today’s rapidly evolving business environment, access to quick capital has become more than a convenience—it’s often a necessity. Whether you’re seizing a time-sensitive opportunity, managing unexpected expenses, or simply accelerating growth, fast business loans provide the flexibility many small business owners now rely on. This guide examines the evolving landscape of business financing, where traditional banking coexists with agile digital lenders, and speed must be balanced against cost and sustainability.

From understanding your funding options and eligibility requirements to preparing the proper documents and avoiding common mistakes, this comprehensive overview aims to equip entrepreneurs with the knowledge needed to make smart, timely financial decisions. With the right approach, fast business loans can be a valuable tool to drive momentum when used with care and clarity.

The Changing Landscape of Fast Business LoansFor small business owners, accessing capital quickly can be the difference between seizing a lucrative opportunity and missing out on it. Today’s market moves faster than ever—consumer behaviors shift, supply chains fluctuate, and competition is fierce. In response, a new generation of digital lending platforms now enables applicants to secure quick business loans with just a few clicks. This evolution frees entrepreneurs from the cumbersome processes of the past, where getting approval could take weeks and require face-to-face visits or piles of paperwork. Entrepreneurs can now upload required documents online, fill out simplified application forms, and sometimes receive approval within hours instead of days.

The urgency for fast capital often arises from unexpected situations. Imagine a scenario where a key supplier can offer a limited-time bulk discount, but immediate payment is required. Previously, that opportunity might have been out of reach. Today, business owners can submit their application and supporting documents digitally, and some lenders even offer same-day funding. According to recent coverage, business loans are being processed faster than ever due to fintech innovation, automation, and AI-driven underwriting, which are changing the game. The rise of non-traditional lenders and increased competition has driven traditional banks to modernize as well. In a recent Small Business Credit Survey, nearly half of the respondents reported pursuing external funding in the past year, underscoring the immense demand for fast and flexible options.

Diverse Funding Options Now AvailableToday’s lending market gives small business owners more choices than ever. Traditional banks continue to play a vital role, often offering loans with favorable terms and providing robust guidance. However, these loans may require significant documentation, a lengthy approval process, and a strong, established credit history. In contrast, digital-first lenders have entered the market with a promise: streamlined applications, light documentation, and rapid decisions. Fast business loans are no longer reserved for established enterprises; now, startups and younger ventures have options as well.

Bank Loans: Offer competitive rates, but approval can take several weeks, requiring stronger credit criteria and additional paperwork.Online Lenders: Provide speed and convenience, sometimes approving and depositing funds in under 48 hours. However, interest rates and fees may reflect the greater risk and convenience for the borrower.Alternative Lenders: Solutions like peer-to-peer lending and invoice financing help fill specialized needs, such as when a business has outstanding receivables but needs immediate cash.Your best funding source depends on the size of your need, the urgency, and how your business performs across key metrics, such as revenue, credit, and history. By weighing each lender’s trade-offs—speed versus cost, repayment terms, and eligibility requirements—business owners can align their financing choice with their broader goals for growth, flexibility, or risk management.

Speed vs. Cost: Weighing Up Your ChoicesThe appeal of rapid-funding is undeniable, but speed often comes at a price. Fast loans typically come with higher annual percentage rates (APRs), shorter repayment terms, and additional fees that help lenders mitigate risk. For many, this is a worthwhile trade-off—if immediate access to cash powers a short-term investment with a strong anticipated return. However, for others, the burden of higher costs may outweigh the benefits.

Consider this scenario: a catering business owner faces a one-week deadline to replace a malfunctioning oven before a significant event. A bank loan at 8% APR could take two weeks to process, but an online lender offers funds within 24 hours at 18% APR. While the cost is higher, the ability to fulfill the event contracts and maintain client satisfaction may more than compensate. On the other hand, repeated use of high-cost fast loans can strain cash flow or create a cycle of debt. Business owners should analyze the real costs and projected benefits before borrowing, calculating total repayment amounts, not just monthly payments. When used strategically, fast loans can drive growth; when chosen blindly, they can create future financial stress.

Key Eligibility Factors to Know Before ApplyingEach fast loan provider evaluates risk differently, but some core factors are nearly universal. The most critical considerations are creditworthiness, business history, revenue stability, and debt obligations. For loans from traditional banks, the standards may be higher, requiring a minimum personal or business credit score, two years of financial statements, and evidence of profitability. Online and alternative lenders may relax specific criteria, approving businesses with lower credit scores, shorter operational histories, or irregular income, often in exchange for higher interest rates and more stringent terms.

Credit Score: Some online lenders approve applicants with scores as low as 600, whereas banks typically require a score of 680 or higher.Business Age & Revenue: Lenders prefer companies that have been operating for at least six months to a year, with recurring revenue or a positive cash flow.Debt-to-Income Ratio: Excessive outstanding debt or inconsistent income can be red flags, signaling difficulty in servicing additional loans.Documents and Preparation: What Lenders ExpectLenders rely on documentation to assess a business’s stability, cash flow, and risk profile. Being prepared can streamline your application and accelerate approvals. Expect to provide:

Business registration certificates, licenses, or incorporation documentsPersonal identification for each principal or business partnerFinancial statements: profit & loss, balance sheet, cash flow reportsThree to six months of recent business bank statementsTax returns (business and sometimes personal, for microbusinesses)Business plan or executive summary, if seeking significant capital or starting a new ventureUtilizing cloud storage or accounting software allows for easy document organization. Some lenders now also integrate directly with bank accounts or accounting platforms to verify income, further reducing paperwork and expediting the process. Being proactive with these documents ensures that when the need for fast funding arises, all the necessary pieces are in place for speedy approval.

Avoiding Common Mistakes When Choosing a LoanWhen speed is the focus, it’s easy to overlook the details in a rush to access funds. Yet, caution is critical. Common missteps include failing to scrutinize the fine print of agreements, neglecting to comparison shop, or underestimating the impact of extra fees and penalties. Automatic repayment schedules tied to daily sales, automatic debits, or rigid prepayment policies may strain cash flow during slow periods.

Always clarify hidden fees such as origination, late payment, or early repayment penalties.Ask for the total cost of borrowing and compare using the annual percentage rate (APR) for apples-to-apples analysis.Review repayment terms—are they daily, weekly, or monthly? Do they fit your revenue cycle?Verify if the lender reports to credit bureaus, as this can impact your business’s future creditworthiness.Get offers from multiple sources to ensure you find the best mix of speed, affordability, and flexibility.Remember, the best financing is one that supports both your short-term needs and your long-term stability.

Mapping Out Your Next StepsFast business financing can unlock new opportunities and buffer against unexpected challenges. Here’s an action plan designed to help small business owners get the proper funding and make the most of their capital:

Assess your capital requirements and the urgency of your need.Review your credit history and gather recent financial reports and tax returns.Research a range of lenders and loan products to compare rates, fees, and terms.Organize all relevant documents digitally for rapid application completion.Carefully review all offers, paying attention to full repayment costs and the fine print.Apply online for the fastest turnaround and be ready to provide additional details if requested.Stay responsive during the approval process to avoid delays.Implement a system to track repayments and ensure cash flow alignment.Being prepared, informed, and vigilant ensures you choose a loan that fits your goals as well as your time frame.

The post Smart Strategies for Small Businesses Seeking Fast Loan Solutions appeared first on Entrepreneurship Life.

June 23, 2025

8 Common Influencer Marketing Mistakes and How to Avoid Them

Influencer marketing often seems like the ultimate shortcut to success. You partner with trending creators, get them to endorse your brand, and watch your sales multiply. But if you’ve ever tried it, you know it’s not that simple.

Mostly, it results in wasted budgets, influencers failing to deliver, low engagement rates, and audiences who see right through inauthentic promotions. Instead of boosting sales, poor influencer marketing strategies damage your brand’s reputation.

If you don’t want to go down this path, you need a strategic approach. And more importantly, you must steer clear of a few influencer marketing mistakes that are all too common.

Let’s talk about these mistakes and how to avoid them.

1. Choosing Influencers Based on Follower Count AloneSelecting content creators based on follower count alone is one of the biggest issues with influencer marketing. Many brands assume that more followers automatically means better reach, but that’s not always true.

What Goes Wrong?

Fake Followers: Some influencers buy followers to appear more popular.Low Engagement: A big audience doesn’t necessarily mean more engagement.Mismatched Audience: If their followers don’t match your target market, your campaign flops.How to Avoid It

Instead of focusing only on follower count, check engagement rates—likes, comments, and shares. Micro-influencers (10K-100K followers) often drive higher engagement and trust than mega-influencers.

Another way to avoid this marketing mistake is to vet influencers properly. Look at their past brand collaborations and how they worked out. Did they get genuine comments or just spammy ones like “Nice pic!”? If it looks fake, it probably is.

2. Ignoring Content AuthenticityLack of authenticity is yet another major issue with influencer marketing. People hate forced, salesy posts. If that’s what your content looks like, they’ll scroll right past it.

What goes wrong?

Brands often script every word, making the post feel robotic.Once an ad-like post goes out, it hurts your brand credibility.It also drowns the influencer’s own personal voice, leading to poor conversions.How to avoid it:

The easiest way to avoid this marketing mistake is to give your influencers the creative freedom they need. You should share the key brand messages but let them speak in their style. That right there is user-generated content (UGC), which around 40% of shoppers say is “extremely” or “very” important when making a purchase decision.

Many brands have used UGC to build long-term growth online. Gymshark lets fitness influencers showcase their workout sessions using Gymshark gear. Their posts feel natural and relatable, which is why they get millions of views.

3. Not Setting Clear GoalsIf you don’t define your goals before launching a campaign, how will you measure its success? This is one of the biggest issues with influencer marketing. Many brands still dive in without a plan and expect instant results.

What Goes Wrong?

No measurable objectives, which makes it impossible to track success.Setting unrealistic expectations like 2X sales overnight.No way to determine if the campaign was worth the investment.How to Avoid It

Avoid this marketing mistake by setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals. Do you want to boost brand awareness, drive website traffic, generate leads, or increase sales? Define your objectives and pick the right influencers and KPIs accordingly.

This is where partnering with an influencer marketing agency can help. Instead of guessing, a full-stack agency brings a data-driven approach, ensuring you get maximum ROI from your influencer partnerships.

4. Failing to Track PerformanceYour influencer keeps sharing fresh posts every week, but are they driving results? Simply posting isn’t enough. Without tracking every post, video, or content share, you’ll never know if your campaign is working or just wasting your budget.

What Goes Wrong?

Sometimes, brands don’t track engagement, reach, or conversions.Without performance tracking, you have no way to tell if an influencer drove actual sales.No data means you keep repeating the same influencer marketing mistakes without knowing what went wrong.How to Avoid It

Use UTM tracking links, discount codes, and analytics tools to measure your campaign performance. Identify which influencers bring the best ROI and optimize your overall strategy accordingly. Comparing influencers over time helps you invest smarter and avoid repeating marketing mistakes that cost you money.

5. Partnering with the Wrong InfluencersChoosing influencers without proper research is a major influencer marketing mistake that can damage trust and hurt your brand’s credibility.

What Goes Wrong?

You fail to research the influencer’s niche.The influencer’s audience isn’t interested in your product.The partnership feels forced and inauthentic.How to Avoid It

Work with influencers whose niche and audience align with your brand. If you sell skincare products, collaborate with beauty influencers, not gamers. Look beyond just follower count. Think about shared values, audience demographics, and content style if you want to build authentic partnerships and avoid this common marketing mistake.

6. Overlooking Long-Term RelationshipsMany brands see influencer marketing as a one-and-done deal rather than a long-term strategy. But treating it like a one-off transaction is a big marketing mistake, especially if you want to build lasting brand recognition.

What Goes Wrong?

With this approach, all you get is a handful of posts, which rarely creates lasting brand loyalty.Short-term deals often feel transactional and less authentic.Since audiences don’t get enough exposure, it’s challenging to build trust with your brand.How to Avoid It

Focus on long-term influencer partnerships. Consistent collaborations feel more genuine and help strengthen audience trust over time. That’s how today’s leading brands like Nike have built a strong online presence. This success is a result of hard work, including partnerships that go back years or even decades.

7. Forgetting to Disclose Sponsored ContentTransparency isn’t just a good practice; it’s a legal and ethical obligation. Yet, many brands overlook disclosure, leading to serious issues that can damage trust and credibility.

What Goes Wrong?

The Federal Trade Commission (FTC) can and does fine brands and influencers for failing to disclose partnerships.Your consumers feel misled, leading to backlash and loss of trust.How to Avoid It

Make sure all your influencers clearly disclose sponsored content using hashtags like #ad or #sponsored. People appreciate honesty, and when influencers are upfront, their recommendations feel more authentic.

Partnering with an influencer marketing agency can help you navigate legal requirements, ensuring all collaborations follow FTC guidelines. They typically handle contracts, enforce disclosure rules, and protect your brand from common ethical issues in influencer marketing.

8. Expecting Instant ResultsBuilding a successful influencer marketing strategy requires patience and long-term planning. Rushing the process is one of the most common influencer marketing mistakes that can drain your budget.

What goes wrong?

Brands expect an instant ROI after influencers share a couple of posts.They get impatient and abandon influencer marketing too soon.They don’t realize that trust and conversions take time.How to avoid it:

Think about a long-term strategy, not just short-term sales. Influencer marketing works best when it’s consistent, so keep testing, optimizing, and perfecting.

Also, understand your sales cycle. If you sell high-value items (like luxury watches), be prepared for consumers’ longer decision-making process. The influencer’s role in such cases is to build trust, not close sales overnight.

Final ThoughtsInfluencer marketing isn’t about chasing the biggest names; it’s about strategy, authenticity, and smart partnerships. To avoid common influencer marketing mistakes, start by analyzing your current approach and identifying weak spots.

Are you picking influencers just based on followers? Are you tracking performance and setting clear goals? Fixing these common marketing mistakes will help you build stronger, more effective campaigns. So, stay focused on long-term, transparent, and well-aligned collaborations to see your brand flourish online.

The post 8 Common Influencer Marketing Mistakes and How to Avoid Them appeared first on Entrepreneurship Life.

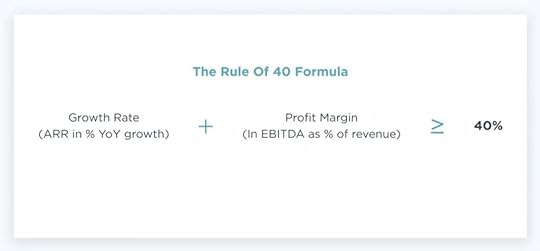

How to Use the Rule of 40 to Evaluate Growth & Profitability

Image via CloudZero

As someone who’s managing a SaaS company, you probably know how difficult it is to balance profit and revenue growth.

You need to strike a balance between rapid growth and continued profitability.

That’s where the Rule of 40 can help. It helps you assess whether your growth and profitability are balanced and if your business is scaling healthily.

If you want to learn how to use the Rule of 40 to evaluate your performance, this post will help. So, keep reading.

What is the Rule of 40 for SaaS Companies?Think of it as a quick health check for your SaaS business.

Simply add your revenue growth rate to your profit margin. If the number hits 40% or higher, you’re in good shape.

Growing rapidly but not yet making a profit? That’s totally fine, as long as your growth is strong enough to balance out those losses.

But if your growth starts to slow, you’ll want to focus more on turning a profit to keep investors interested.

Measuring Growth Rate and ProfitabilityTo get an accurate Rule of 40 score, use reliable and consistent growth numbers for your business. Focus on metrics like Annual Recurring Revenue (ARR) or year-over-year GAAP revenue, rather than one-time bookings or sales forecasts.

Stick to the same time frame and revenue definitions each time you calculate. Otherwise, your score can swing wildly and be misleading.

Also, make sure you’re using revenue recognized under the ASC 606 standard, not just upfront payments or invoices. Recognizing revenue over the contract’s duration provides a clearer picture of actual business performance.

According to Younium, a B2B subscription management and billing software, a specially designed SaaS billing management software can automate SaaS financial data recording and management.

Remember, if your growth number isn’t reliable, your Rule of 40 score won’t be either. Use metrics that reflect the true, recurring nature of your business.

Example of Rule of 40 for SaaS CompaniesLet’s say:

Your company grew 30% this yearYour profit margin is 15%Add them together: 30 + 15 = 45%

You’re over 40%, so you pass the Rule of 40!

Consider the alternative scenario:

Your company grew only 10%Your profit margin is -10%Your score will be 0%, which is a big red flag.

How to Use the Rule of 40 for SaaS CompaniesSo, you know the Rule of 40 means Growth Rate + Profit Margin ≥ 40%, but let’s discuss how to apply this to decision-making, instead of just doing the math.

Now, let’s get straight to the application aspect of the rule of 40 for SaaS companies.

1. Guide Growth vs. Profit DecisionsThink of the Rule of 40 as your balancing scale.

If you’re growing fast (say 50–60%), you don’t need to be profitable yet — you’re buying market share.If growth slows (10–20%), then profitability becomes more important.Ask yourself:

“Should I reinvest more into growth, or start tightening costs to improve margins?”

This will help you take strategic business decisions and guide your business in the right direction.

2. Spot Inefficiencies EarlyA low Rule of 40 score is an early warning sign. Growth is stalling, customer acquisition costs are too high, or margins are getting squeezed.

Track your score over time, quarterly or monthly, and look for patterns. A steady decline in your Rule of 40 score typically indicates that your unit economics require attention.

3. Make Informed Investor PitchesInvestors love metrics that tell a clear story, and the Rule of 40 does exactly that.

If you’re pre-profit, you can demonstrate strong growth to justify your burn; however, if you’re growing modestly, you can highlight healthy margins.

Include your Rule of 40 in your pitch deck or KPI slide, and explain why your specific balance of growth and profit is right for your stage.

4. Prioritize Budget and ResourcesLet’s say your Rule of 40 score is under 30%. That’s a sign something needs to shift — but what?

Use the Rule of 40 to prioritize:

Should you pull back on paid ads with low return on investment (ROI)?Should you pause hiring in non-revenue-generating roles?Should you invest more in customer success to reduce churn and boost margins?The Rule of 40 helps you ask the right questions and optimize how and where you allocate your budget and resources. It helps you focus resources where they have the most impact.

ConclusionThe Rule of 40 isn’t just a benchmark, but a practical way to help you balance growth and profitability as your SaaS business scales.

By tracking it consistently and using it to inform decisions, you can identify red flags, allocate resources effectively, and communicate your value to investors.

Keep it simple: if your growth and margins add up to 40% or more, you’re on the right path. If not, it’s time to dig deeper and adjust.

The post How to Use the Rule of 40 to Evaluate Growth & Profitability appeared first on Entrepreneurship Life.

ZTE Corp Breaks Boundaries with World’s First 1.6T DWDM Trial on Live Network

ZTE Corp, a global leader in integrated information and communication technology solutions, together with Türk Telekom, Turkey’s largest integrated telecom operator, has successfully completed the world’s first 1.6T Dense Wavelength Division Multiplexing (DWDM) trial over a live network.

The trial was conducted across Istanbul’s metropolitan area, leveraging 12THz bandwidth to transmit ultra-fast 800GE and 400GE client services. This achievement connects the European and Asian sides of Istanbul with unprecedented speed and capacity, marking a milestone for optical networking innovation.

The successful completion of this trial sets the stage for the upcoming large-scale deployment of 5G networks, supporting the broader digital transformation of industries across Turkey and bolstering economic ties between Europe and Asia.

ZTE Corp Accelerates Turkey’s Optical Network ModernizationWith the global expansion of digital economies and Turkey’s national focus on 5G infrastructure, building ultra-wide, high-capacity optical networks has become a strategic priority for operators. Türk Telekom, recognized for its leadership in transmission layer innovation, is the first operator in Turkey to implement a 1.6T single-channel optical transmission trial using next-generation DWDM technology on a live network.

The trial employed ZTE Corp’s flagship optical transport platform, the ZXONE 9700, integrated with a proprietary 1.6T optical module. Utilizing the ultra-wide spectrum of C6THz and L6THz bands, the system successfully accessed 800GE and 400GE client services. Data transmission spanned the critical metro DWDM network in Istanbul, which handles a significant portion of the city’s data traffic while physically linking two continents.

This effort highlights how enhanced spectrum utilization can meet future network demands without requiring additional fiber deployments. The ability to access broader spectrum bands enables a scalable, future-oriented network foundation suited for evolving service needs, such as ultra-high-definition video, cloud computing, and industrial IoT.

ZTE Drives Energy Efficiency with New Optical ModuleBeyond achieving higher transmission rates, ZTE Corp’s 1.6T optical module addresses another critical operator concern: energy efficiency. Compared with the previous 1.2T modules, the new 1.6T module achieves a 25% reduction in power consumption per Gbit.

This efficiency gain is vital for reducing operational expenses and supporting low-carbon network development strategies. By consuming less power per unit of data transmitted, network operators can deliver better services while minimizing their environmental impact.

In partnership with ZTE, Zafer Orhan, Deputy General Manager of Network at Türk Telekom, stated, “As the leading force behind Turkey’s digital transformation, Türk Telekom continues to develop innovative solutions to meet the growing demand for data speed, enhance manageability, and drive greater energy efficiency. We are laying the groundwork for next-generation technologies through sustainable and forward-thinking advancements in data transmission.”

He also emphasized that during the intercontinental speed test conducted across the Bosphorus, they achieved a significant increase in capacity along with notable energy savings. These next-generation data transmission technologies will help accelerate business processes and boost efficiency across a wide range of sectors, such as smart cities, autonomous vehicles, healthcare services, manufacturing, and digital gaming.

This focus on energy optimization also aligns with the global trend toward building greener telecommunications infrastructure, a growing requirement for operators under tightening regulatory and sustainability frameworks.

ZTE Corp Validates Technical Excellence in DWDM InnovationThe trial’s success is a strong testament to ZTE’s capabilities in the field of DWDM innovation. Executing such high-capacity transmission on a live, heavily used metro network demonstrates the robustness and reliability of the technology.

Peng Aiguang, Senior Vice President of ZTE, remarked, “This successful trial marks a new step in the technological innovation and cooperation between the two parties in the field of optical communications. Through this trial, we have not only verified ZTE’s leading strength in DWDM technology but also laid a solid foundation for the efficient, intelligent, and sustainable development of future networks.”

He also emphasized that ZTE is looking forward to continuing the deepening cooperation with Türk Telekom by jointly promoting the evolution of optical communication technology, providing global users with a better network experience, and promoting the vigorous development of the digital economy.

The successful implementation highlights not only the high performance of ZTE’s optical transport solutions but also the company’s focus on offering scalable, intelligent networking options that can adapt to emerging technological demands.

Supporting the Future of 5G and BeyondThe implications of this trial go beyond immediate network improvements. High-capacity optical transport systems like the one demonstrated are foundational for the success of 5G and upcoming 6G networks. These technologies require ultra-low latency, extremely high throughput, and the ability to support millions of connected devices seamlessly.

Building a network backbone capable of meeting these requirements depends on advances such as 1.6T DWDM. By investing in optical transport innovation today, operators position themselves to handle tomorrow’s technological demands without undergoing disruptive infrastructure overhauls.

In Turkey’s context, this development aligns with national initiatives aiming to strengthen digital infrastructure, improve industrial competitiveness, and offer citizens better access to advanced communication services.

Paving the Way for Commercial DeploymentWith the trial’s success, ZTE Corp and Türk Telekom have set a clear roadmap for future commercialization. The proven capabilities of the 1.6T optical module suggest that wider deployment across Turkey’s core and metro networks is not far behind.

Operators worldwide are observing such trials closely, as demand for multi-terabit optical transmission continues to grow. The pressure to deliver more bandwidth with higher energy efficiency, from metropolitan data hubs to long-haul national backbones, reshapes network planning priorities.

During this trial, the intercontinental transmission across the Bosphorus demonstrated technical performance and operational readiness for real-world conditions—giving operators a clear view of the benefits they can expect when scaling the technology for broader use.

ZTE Corp Strengthens Commitment to Optical InnovationZTE Corp’s ongoing efforts in optical network development reinforce its broader commitment to enabling digital transformation globally. By continuously pushing the boundaries of what optical transport systems can achieve, the company plays a key role in building the high-speed, sustainable, and intelligent networks that future societies will require.

Through collaboration with leading operators such as Türk Telekom, ZTE Corp aims to deliver technological solutions that address current challenges while anticipating future needs. This 1.6T DWDM trial is an example of what can be accomplished when innovation meets real-world network demands.

The successful trial sends a strong message to the industry: advanced optical networking is no longer a future vision. With proven deployments like this, the next communication era is already taking shape.

The post ZTE Corp Breaks Boundaries with World’s First 1.6T DWDM Trial on Live Network appeared first on Entrepreneurship Life.

The Line Between Smart Saving and Penalty Territory

If you’re serious about growing your superannuation balance, it’s natural to want to put in as much as you can. After all, super is one of the most tax-effective ways to save for retirement. But there’s a catch — go over certain limits, and your smart saving strategy can start costing you in penalties, rather than building your future.

That’s why it’s so important to understand how concessional contributions cap work before making additional deposits. Knowing the limit (and how it’s calculated) can help you make the most of your super without triggering an unexpected tax bill.

What Are Concessional Contributions?Concessional contributions are the “before-tax” contributions made into your super fund. These include:

Employer contributions (the standard 11%)Salary sacrifice paymentsPersonal contributions you claim as a tax deductionBecause they come from your pre-tax income, these contributions are generally taxed at 15% — which is usually lower than your income tax rate. This makes them appealing if you want to boost your retirement savings while reducing your taxable income today.

But like most tax-effective strategies, they come with boundaries.

The Current Cap (and Why It Matters)As of the 2024–25 financial year, the annual concessional contributions cap is $27,500 per person. This is the total amount you can contribute across all your super accounts under the concessional category.

Here’s where people trip up:

They forget that employer contributions count toward the capThey make a salary sacrifice arrangement without checking the totalThey claim personal contributions as deductions without realising it pushes them overIf you exceed the cap, the extra amount will be taxed at your regular income tax rate (minus the 15% already paid in your fund), and you might also be hit with an excess contributions charge.

Using the Carry-Forward RuleThere’s good news if you haven’t maxed out your cap in previous years. If your total super balance was under $500,000 on 30 June of the prior year, you may be eligible to carry forward unused concessional cap amounts from up to five previous years.

This is particularly useful if you’ve had a few years with lower income or inconsistent contributions (like time off work or part-time roles). It allows you to “catch up” without going over the limit in a single year.

Tip: You can check your available carry-forward cap in your myGov account linked to the ATO.

Mistakes to AvoidWhen it comes to concessional contributions, the most common missteps aren’t reckless — they’re accidental. Here’s how to steer clear of penalty territory:

1. Not tracking employer contributionsYour employer’s 11% may not feel like much, but over the year, it adds up — especially if you’re earning a solid income or working multiple jobs.

2. Overcommitting to salary sacrificeSetting and forgetting a salary sacrifice amount can be risky. If your income increases or you pick up extra shifts, the amount you’re contributing may change without you realising it.

3. Not reviewing personal deductible contributionsClaiming a tax deduction for your own contributions is great — but only if it doesn’t push you over the annual limit. Double-check your fund records before lodging your tax return.

Getting It Right: Simple Steps to Stay Within the CapYou don’t need to be a financial planner to manage your super responsibly — but you do need to stay informed. Here’s how to keep things on track:

Track your contributions regularly, not just at tax timeUse your super fund’s online portal or app to monitor totalsReview your salary sacrifice arrangements at least once a yearSpeak with a registered tax agent or financial adviser if you’re planning to make large top-upsSmart Saving Starts with Smart AwarenessMaking extra contributions to your super is a fantastic long-term strategy. But more isn’t always better if it pushes you past the concessional cap. A little planning and regular check-ins are all it takes to avoid penalties and make sure your efforts are genuinely building a stronger future.

The line between smart saving and costly mistakes is thin — but with a bit of knowledge, you’ll stay safely on the right side of it.

The post The Line Between Smart Saving and Penalty Territory appeared first on Entrepreneurship Life.

Why Retailers Should Prioritise Fast, Secure Online Payment Gateways for Their Websites

Turning online interest into revenue requires more than just great products or marketing. What happens at checkout can define whether a customer completes their purchase or leaves. A slow or insecure payment process disrupts trust and momentum, resulting in lost business opportunities and valuable conversions.

An efficient online payment gateway acts as a vital connector, bridging the gap between intent and transaction. It ensures that the final step in the customer journey is smooth, fast and secure.

For retailers looking to optimise performance and profitability, the payment experience isn’t a minor detail; it’s a core component of digital success that deserves strategic attention.

The rising expectations of digital shoppersToday’s digital shoppers expect speed, security and simplicity at checkout. Here’s how expectations have evolved:

Instant, frictionless transactionsConsumers demand fast and effortless payments. Lengthy forms, redirects or slow online payment gateways create unnecessary friction and often lead to abandonment.

One-click checkoutsWith convenience driving conversions, features like one-click payments are no longer optional; they’re expected. They reduce cognitive load and accelerate the buying journey.

Mobile responsivenessAs mobile commerce grows, a payment gateway must deliver a fully optimised experience across all devices. Any lag or UI issue on mobile can be a dealbreaker.

Diverse payment preferencesShoppers now expect to pay using UPI, cards, wallets or BNPL. A lack of preferred options signals outdated infrastructure and undermines user confidence.

Why speed matters in online payment gatewaysSpeed in payment gateways is crucial because it directly impacts conversion rates by ensuring a fast, smooth and frustration-free checkout experience.

Page speed directly influences conversionsStudies show that every one-second delay in page load can reduce conversions by up to 7%. A slow payment gateway creates friction at the most critical moment, increasing the chance of cart abandonment.

Slow or lagging gateways cause frustrationCustomers expect instant responses. Delays during payment processing or waiting for confirmation can erode trust and lead shoppers to abandon their purchases.

Real-time payment processing is essentialInstant authorisation and transaction approval minimise wait times, improving the overall customer experience.

Seamless payment confirmation builds confidenceFast, clear confirmation reassures customers their payment was successful, reducing anxiety and support queries.

Minimal redirects and fast API responses reduce frictionAvoiding multiple-page redirects keeps customers engaged, while quick API interactions ensure the checkout flow remains smooth and uninterrupted.

Security: The trust engine of e-commerceSecurity in e-commerce fosters trust by safeguarding customer data, preventing fraud and ensuring compliance, all of which are essential for maintaining brand loyalty and avoiding financial and reputational harm.

Customer data protection is crucialIn the digital age, safeguarding customer information is essential. A single data breach can lead to loss of revenue, reputational damage and reduced customer trust.

Common security risks include:

Phishing attacks targeting customer credentialsData breaches exposing sensitive financial informationPayment fraud and unauthorised transactionsPCI-DSS compliance builds trustA secure payment gateway that adheres to PCI-DSS standards helps encrypt and protect cardholder data during transactions, reducing the risk of unauthorised access.

Tokenisation enhances securityTokenisation replaces real card details with a secure token, ensuring sensitive data is never stored or transmitted in its original form.

Two-factor authentication (2FA) adds a layer of safety2FA requires users to verify their identity with a secondary method, significantly reducing the chance of fraudulent activity.

Fraud detection tools prevent riskAdvanced systems monitor transaction patterns in real time, flagging and blocking suspicious behaviour before damage is done.

Security strengthens brand loyaltyA secure and transparent checkout experience reassures customers and fosters long-term trust and repeat business.

Impact on conversion rates: Turning browsers into buyersA streamlined and secure checkout process has a direct impact on conversion rates. Features, such as saved payment methods, express checkout and minimal redirects, reduce friction, encouraging users to complete their purchases. Moreover, a high transaction success rate is indicative of a reliable payment system. Businesses have seen significant growth in transaction volumes by optimising their payment success rates.

Essential features in a payment gatewayWhen selecting a payment gateway, retailers should consider:

Multiple payment options: Support for various methods like UPI, cards and digital wallets.Ease of integration: Developer-friendly APIs and SDKs for seamless integration.Scalability: Ability to handle high transaction volumes without compromising performance.Security compliance: Adherence to standards like PCI DSS and implementation of advanced fraud detection.Real-time analytics: Access to transaction data for informed decision-making.Elevating e-commerce through optimised payment solutionsRetailers investing in their checkout experience often find that the smallest details, such as how quickly a payment is processed or how securely it’s handled, can have the biggest impact.

A reliable, fast and secure online payment gateway doesn’t just complete a transaction; it shapes the customer’s perception of the brand. It’s what makes a first-time buyer come back and a returning customer trust the process every time.

Platforms like Pine Labs Online bring together performance, protection and flexibility, helping retailers meet rising consumer expectations with confidence.

The post Why Retailers Should Prioritise Fast, Secure Online Payment Gateways for Their Websites appeared first on Entrepreneurship Life.

Why Compensation Strategy Requires Specialist Talent

Compensation is often reduced to salary benchmarks and benefits packages—but that’s like saying architecture is about bricks. In reality, compensation strategy is one of the most potent levers a business has. It determines not only who you attract and retain, but how people behave once they’re on board. Done well, it builds loyalty, equity and growth. Done badly, it leads to resentment, attrition and in some cases, regulatory risk.

In a post-pandemic economy defined by hybrid work, economic volatility and employee re-evaluation of value, the old templates don’t cut it anymore. Strategic compensation demands more than spreadsheets and HR instinct. It requires expertise, nuance and a highly specific understanding of what drives performance and fairness at the same time.

The Link Between Compensation and Long-Term CultureWhen most people think about compensation, they think money. But compensation strategy also means bonuses, equity, flexible benefits, cost-of-living adjustments, and internal pay equity—all of which send a signal about what a company values.

A strong compensation strategy can correct market misalignment, drive performance through meaningful incentives, and help embed cultural norms into tangible reward structures. A weak one, on the other hand, creates internal resentment, bloated salary bills and blurred accountability. And once people stop trusting the fairness or transparency of their compensation, it’s very difficult to rebuild that bridge.

That’s precisely why more employers are choosing to hire experts in compensation strategy rather than handling it internally. External specialists can look at your current reward setup with objectivity, benchmark it against your sector, flag inequities and spot where pay structures are misaligned with business goals. This is especially important in larger companies where decisions made by one function can ripple across departments in unexpected ways.

Navigating Pay Transparency and Regulatory ChangeIt’s no longer enough to quietly adjust pay behind closed doors. Increasingly, governments are pushing for greater pay transparency—and employees are demanding it too. Pay gap reporting, equal pay audits and formalised compensation bands are becoming standard in sectors that historically avoided scrutiny.

These changes may be progressive, but they also present challenges. The risk of underpaying or overpaying can become institutional if organisations don’t understand their own data or lack the capacity to interpret it correctly. And compensation decisions, once published, are hard to walk back. A poorly judged retention bonus or a clumsy attempt to level salaries can spark backlash both internally and externally.

In this context, relying on generalist HR advice is no longer sufficient. Specialists in reward strategy bring a depth of understanding that ensures these new pressures—legal, cultural and ethical—are navigated with clarity rather than panic.

Why Internal Bias Makes External Talent EssentialThere’s a paradox in reward strategy: it’s one of the most sensitive and high-impact parts of the business, yet it’s often managed by the same people involved in the decisions being assessed. That creates a blind spot. Even with the best intentions, internal teams may lack the distance to notice patterns, evaluate fairness or challenge outdated models.

Specialist consultants or reward professionals brought in through third-party hiring are more likely to ask uncomfortable but necessary questions. Why are bonus targets met every year, even when performance drops? Why are new joiners paid more than loyal staff in the same role? Why do senior leaders get long-term incentives while the wider team relies on discretionary bonuses?

These are cultural and financial questions, and they don’t resolve themselves. They need people who’ve seen these dynamics before, who know what works and what doesn’t, and who are not afraid to challenge business-as-usual thinking.

Scaling Strategies That Actually WorkAs companies grow, so do the cracks in their pay structure. What worked for a 20-person startup doesn’t scale when you hit 150. Suddenly, informal bonus schemes feel arbitrary. Salary negotiations start to spiral. Leadership wants to reward top performers, but struggles to define what that even means in a larger, more complex business model.

This is the moment where strategy becomes survival. Without a coherent, future-proofed approach to reward, businesses start to experience churn in their top talent, budget overruns and morale issues. Worse still, they begin losing people not to higher salaries—but to companies who simply communicate and deliver pay more thoughtfully.

A reward specialist doesn’t just fix the now. They help design scalable structures that support where the company wants to go. Whether that’s performance-based incentives, banded pay structures or long-term share schemes, these strategies need to be designed by people who understand the mechanics and psychology of compensation.

The Bottom LineYou wouldn’t hire a general contractor to design your financial model, so why leave your compensation strategy to chance? As employee expectations evolve and workplace cultures shift, pay is no longer a backroom decision—it’s a business-defining one.

Hiring specialist talent in compensation strategy isn’t about outsourcing responsibility. It’s about recognising that reward is both art and science—and getting it right is too important to wing.

The post Why Compensation Strategy Requires Specialist Talent appeared first on Entrepreneurship Life.

June 21, 2025

Why Your Twitch Username Is Important (And How to Get It Right)

Getting your Twitch account is the most significant first step in streaming… However, right from the start, Twitch poses an important question: What will your username be?

This may seem like a minor decision, but your Twitch username isn’t just a label — it’s your brand, identity, and first impression. A lot of new streamers like to rush this step, only to learn after the fact that their name isn’t brand-savvy, limits their discoverability, or “just doesn’t sound professional.”

In this post, we’ll explain why your Twitch username is so crucial and guide you through choosing the right one—a name that’s memorable, available, and growth-ready.

Why Your Twitch Username Is More Important Than You ThinkYour Twitch Username — The First Step of Branding Success It’s what your followers will call to mind when they think of your content, and it’s how people will get to know you when visiting your channel. That makes it more than an offhand label — it is your digital identity.

Your username is front and center whenever you go live, chat, show up in stream directories, or publish content on other platforms. A good-natured name works for you even before you open your mouth. If simple, original, and relevant, it adds professionalism and trust to your channel.

A good username also makes it easier for others to discover you. It is easily searchable, can be tagged, and people can remember it. It enhances your visibility in search engines and helps you gain impressions on platforms like Twitter or YouTube.

On the other hand, a bad username — something confusing, tricky to spell, or off-brand — can hinder your growth. It might even shame you as your stream develops. If you have to explain your name every time, or if it has nothing to do with what you put out there, then you’re creating friction instead of connection.

Choosing the correct username early will give you the best chance to establish long-lasting recognition, consistency, and success.

Common Mistakes Streamers Make When Choosing a UsernameChoosing a username seems straightforward — until you realize how easily you can mess it up. One of these mistakes has unintentionally damaged the branding for many streamers:

Using random numbers or underscoresNames such as “xXGamer_1234Xx” are messy and complicated to remember. They obscure your searchability and make you look unprofessional.

Going too long or complicatedWhen you have a name like “TheUltimateFPSGamerFromNYC, it’s hard to say and even harder to type. If your name is too long, it is instantly forgettable.

Copying popular streamersRiding the wave of someone else’s success—“ShroudFan23,” for example—dilutes your uniqueness and lowers your credibility. It also leads to confusion.

Using offensive, edgy, or crude termsWhat might seem humorous at the time can severely constrain your engagement later on. Inappropriate names could result in punishment from Twitch, and viewers may be turned off.

Being inconsistent across platformsIf you’re known as “PixelPlays” on Twitch, “GamerPixel1997” on YouTube, and something else on Twitter, your brand starts to dilute. You need consistency in branding everywhere.

If you employ some strategic thinking, you can easily avoid these common pitfalls. Having a strong username gives you a stronger identity and allows you to develop better—you won’t need an early rebranding.

How to Choose the Perfect Twitch Username: A Step-by-Step GuideStep 1: Brainstorm Based on Your Niche and PersonalityTake a step back before you type anything in the Twitch username field and ask yourself this: What type of content will you be streaming? Are you a cozy gamer, a sweaty esports player, an art creator, or just chatting?

Now, consider your own style. Are you sarcastic and edgy, calm and cozy, fast-paced and loud? Your name should include something about you and your brand, and connect to your target audience.

Mix pieces of your real name, favorite games, inside jokes, or even obscure references. Ensure that it aligns with your niche and service goals.

Step 2: Prioritize Simplicity and MemorabilityShorter names are easier to spell, pronounce, and remember. An amazing Twitch username is often less than 12 characters and flows like honey.

No hyphens, underscores, numbers, or tricky spellings. You want it to be searchable, clean, and easy to identify. Consider names like “Myth” or “Ludwig” — minimal and powerful.

Alliteration, rhymes, or puns if they fit your style. They can increase memorability and help your brand stand out.

Step 3: Check Availability on TwitchAfter compiling a list of name ideas, you have to check their availability on Twitch. Instead of manually checking, which is time-consuming, consider using a Twitch name checker. It’s an easy-to-use tool that tells you if your name is taken or available.

Get ready—many great names have already been claimed. You may need to improvise or modify your favorites without overcomplicating or losing your identity.

If your name is available, lock it down quickly. Twitch usernames are hard to come by, and good ones go quickly.

Step 4: Ensure Availability on Multiple PlatformsTry choosing a Twitch name that is similar to the names you already use on your social channels (e.g., YouTube, X (Twitter), Discord, and Instagram).

The short answer is that there are search tools, like a social media username checker, that let you see all at once where your name is available. A consistent identity helps build trust, increases visibility, and makes your channel easier to promote.

Imagine being “RetroWizard” across the board — simple for people to search, tag, and remember.

Step 5: Avoid Copyrighted or Trademarked NamesDo not borrow from major franchises, characters, or brands — e.g., “MarioMaster” or “GokuPlays.” It might be amusing, but it could result in takedowns, legal matters, or account penalties.

Stay original. Make your own name stand out.

Step 6: Get FeedbackCheck your favorite options with friends, online communities, and even strangers. Inquire whether the name is pronounced, spelle,d and recalled simply. See how it feels when others repeat it back.

But oftentimes, you are blind to it, and impartial feedback can be a great way to adjust your decision.

Step 7: Act Quickly but WiselyIf everything is green lights — the name’s available, the feedback is good, and it feels like you — go claim it. The most memorable names are claimed quickly.

But don’t rush. Be sure it fits not just what you are doing today but your future vision. The top names are made for long-term growth.

Examples of Great Twitch Usernames (And Why They’re Great)Now let’s dissect some strong Twitch usernames (real or made-up) why they’re so awesome:

LoFiLara

This name merges a casual genre (“LoFi”) with a personal name (“Lara”). It instantly gives off an aura of a calm, chill stream—perfect for music, study sessions, or cozy conversations. It’s short, original , and memorable.

PixelPunk

It is an artistic mix evoking retro gaming but today. “Pixel” relates to the digital world, and “Punk” brings attitude and personality. It is specific enough for niche-friendliness but broad enough to include all the variations of its content.

ChefQuest

Immediately evocative and ownable, the name implies a cooking channel with an adventurous or gamified approach. It’s engaging, fun, and impactful.

TheCraftKnight

A great fantasy-style name for Minecraft or RPG creators. The alliteration increases memorability, and the name suggests both creativity and combat — ideal for all kinds of stream themes.

ZenaZooms

A lighthearted and memorable fictional example. It feels personal and unique, suggesting speed, energy, or fast-paced gameplay.

Each username hits because it is simple, related, and easy to construct a brand identity around. They demonstrate how a deftly chosen name can convey tone, theme, and personality quickly.

Can You Change Your Twitch Username Later? (And Should You?)Yes, you can change your username on Twitch, but only once every 60 days. Although being able to do so is pretty cool—especially if you began gracing the app with your presence at a time when your content didn’t align with traditional nomenclature—there are some real drawbacks tied to the feature.

There are two reasons for this: first, changing your username can ruin your branding. Your new name may not be recognizable to your old followers. Some of your existing links, overlays, and social handles may no longer work or may differ from one version to another, diluting your mention exposure and linking power.

If you had linked your Twitch profile externally, you may also lose access to past searchability, SEO benefits, and backlinks.

That’s why it’s so important to get it right the first time—and a Twitch username availability checker can make all the difference. It helps you confirm that the perfect name is actually available, so you don’t waste time rebranding or starting over later.

Once you choose a name, it will be much harder to create new accounts in the future for any reason (for example, if you find another area you want to get into) as it is challenging to change your brand name on various platforms.

Change is possible, but it’s better to be intentional from the start .

ConclusionYour Twitch username isn’t merely a handle—it’s the foundational stone in erecting your streaming legacy. This impacts your branding, visibility, and the way new followers discover and edit your content.

A powerful username can help you stand out, provide continuity across platforms, and build an audience of the right people. It grows you, enhances your impressions, and creates trust with your viewers.

So don’t rush the process. Give yourself some space to think, research, experiment, and select a name that is true to YOU.

Because if your username is on point, everything else — from branding, to engagement — follows.

The post appeared first on Entrepreneurship Life.

June 20, 2025

Tips for Boosting Your Business Reputation

How your business is perceived can be the key to long-term success. Whether with customers, partners or even the wider community, every interaction shapes how others view your company.

As you navigate the complexities of modern commerce, it’s essential to remember that the trust you build and the values you uphold matter more than ever. Good standing isn’t built overnight, but it can be lost in an instant.

The good news is that there are simple, effective steps you can take to shape your image and position your brand for lasting prosperity.

Invest in sustainabilityAs businesses across the world face growing pressure to address environmental concerns, your commitment to sustainability can set you apart. For example, investing in energy-efficient boilers can reduce your carbon footprint while cutting costs in the long run.

Taking practical steps not only protects the environment but also shows people that you care about the world around you. Many consumers today are more likely to support brands that are committed to sustainability, and this can build long-lasting goodwill.

Focus on customer serviceNo matter what industry you’re in, your customers are at the heart of your business. Investing time and effort into offering good customer service is key to retaining loyal clients and earning positive word-of-mouth. People want to feel valued and respected, and meeting these needs should be at the core of your operations.

Train your team to actively listen to customers, resolve issues quickly, and provide personalised experiences. A well-handled complaint or a thoughtful follow-up call can turn a potentially negative situation into an opportunity to strengthen your relationship with your clients.

Build your online presenceA strong digital presence has become essential in today’s digital age, but building it takes time and consistency. Focus on developing a strong online presence by publishing content that resonates with your audience. Share your expertise through blogs, videos or social media posts.

But it’s not enough to have a website; you also need to engage with your audience by interacting with them on social media and responding to reviews. The key to success is authenticity – your audience wants to connect with real people behind the brand, not just faceless corporate messaging.

Reputation is everythingThe public perception of your company can be the deciding factor between growth and stagnation. By implementing the advice above, you take concrete steps toward crafting an image that resonates with today’s consumers.

Building a strong reputation takes time, but the rewards are well worth the effort. Take charge of your image today and set yourself up for tomorrow’s success.

The post Tips for Boosting Your Business Reputation appeared first on Entrepreneurship Life.

June 19, 2025

Digital Marketing for Startups: How to Get Clients Before You Run Out of Budget

When you’re running a startup, time and money are always in short supply. Every dollar counts and every week without a client adds pressure. The harsh truth? Many promising businesses fail not because of a bad product, but because they couldn’t attract customers fast enough. That’s where smart, lean digital marketing comes in. This guide will walk you through practical, cost-effective strategies to help you win clients before your budget runs dry. Whether you’re bootstrapped or pre-revenue, these proven tactics will show you how to get results without burning through your limited resources.

Go All-In on What Actually Brings You ClientsTrying to be everywhere at once is a fast way to drain your time and budget. Many startups spread themselves too thin, dabbling in every channel without seeing real traction. Instead, identify one or two high-impact platforms where your audience already spends time.

Focus on what gets results: cold email, Google Ads, SEO, or strategic partnerships. Test quickly, track the data, and double down on what works. You don’t need ten channels. You need one that converts

If Your Offer Isn’t Clear, Your Ads Will Burn CashEven the best marketing can’t save a confusing offer. If people don’t instantly understand what you do, who it’s for, and why it matters. they won’t click, let alone buy. That means every dollar you spend on ads is likely going to waste.

Clarify your offer with a simple formula: what you do, who you help, and the result they get. Use plain language. Avoid buzzwords. Ask: Would a stranger get this in five seconds? Once your offer is clear and compelling, your marketing becomes far more effective because your audience knows exactly why they should care.

Launch Fast, Learn Faster: Run Micro-Marketing TestsThe longer you wait to launch, the more you rely on assumptions and assumptions don’t win clients. Many startups over-plan their marketing, only to find out later it doesn’t convert. The smarter path? Use micro-tests to get real-world feedback quickly.

Start small: spend $50 on a Google Ads test, send 50 cold emails, or run a single LinkedIn post to gauge interest. Focus on actionable metrics like clicks, replies, and conversions. These fast, low-risk experiments help you learn what works so you can adapt quickly and spend smarter. And if you need expert help interpreting results or optimising campaigns, working with a team like 121Group.io can speed up the learning curve.

Use Sweat Over Spend: Hustle Marketing That WorksIf you can’t outspend the competition, outwork them. Many early-stage startups think results only come from ad budgets, but the truth is, effort often beats expense. Visibility and trust can be built through consistency, not cost.

Share valuable insights on LinkedIn, engage in niche communities, or send personal outreach messages to prospects. Join relevant groups, comment with intent, and position yourself as a helpful voice and not a salesperson. These hustle-driven tactics cost nothing but time, and they build momentum faster than you’d expect.

Work Smarter: Automate the Repetitive, Delegate the RestStartups waste valuable time on tasks that don’t directly lead to growth. Manually sending emails, scheduling posts, or chasing follow-ups adds up, and drains focus. The solution? Automate what you can and outsource the rest.

Use free or low-cost tools to handle lead capture, email sequences, and social scheduling. For tasks that still need a human touch, basic design or research hire a marketing agency to free up your time.

Your First Clients Are Closer Than You ThinkMany founders overlook the most obvious source of early traction, Their existing network. Instead, they jump straight into cold marketing and paid ads. But starting with warm contacts is faster,

Reach out to former colleagues, friends, or industry peers. Let them know what you offer and who you help then ask if they know anyone who might benefit. Share a short, clear message that makes it easy to refer or connect. These conversations build trust quickly and can lead to your first paying clients without spending a cent. Don’t underestimate the power of personal outreach.

You Don’t Need a Big Budget You Need Bold ActionGetting clients doesn’t require a massive ad spendit takes clarity, focus, and consistent action. Start small, test fast, and build momentum as you go. Every step you take brings you closer to your next win. Don’t wait for perfection. Just Start!

The post Digital Marketing for Startups: How to Get Clients Before You Run Out of Budget appeared first on Entrepreneurship Life.