James C. Molet's Blog, page 7

December 9, 2018

Solo 401k vs SEP IRA – what you should choose if are self-employed?

As a self-employed person, you have more control over your retirement plan. One reason is because you get to choose your retirement plan. There are two plans that self-employed people commonly choose between:

The solo 401k retirement plan; and

The Simplified Employee Pension (“SEP”) IRA

In this article, we’ll talk about the features of each plan. At the end, you’ll get a clear idea of which one you should go for.

What is a Solo 401k?

A 401k retirement plan (a.k.a individual 401k) is a retirement plan designed for business owners who don’t have full-time employees. It only covers the business owner and their spouse.

So, as a self-employed person you’d come under this scheme.

Requirements:

To qualify for a solo 401k retirement plan, you must:

Prove that you are earning an income as a self-employed individual.

Not have any full-time employees.

Features of the Solo 401k plan (updated for 2018):

The contribution limit is $18,500 from your personal income (what you pay yourself as a salary) plus 25% of the business’ income, and the total is capped at $55,000

Your limit is increased by $6,000 more (catch-up contributions) if you’re over 50 years old.

Contributions to your Solo 401k plan are tax-deferred (i.e. you pay taxes only when you withdraw money from the account)

It’s available for a variety of business structures e.g. sole proprietorship, LLC, C-Corp and S-Corp.

You can choose the self-directed solo 401k plan where you decide whether to invest in real estate, stocks, mutual funds and private businesses.

It comes with a built-in Roth sub-account with no restrictions on what you can contribute

It comes with a loan feature – you can borrow up to $50,000 or 50% of the amount account (whichever is lower) for ANY purpose. Plus, you don’t incur any penalties or taxes when you take a loan. Your interest rate is the prime rate.

What is the SEP IRA?

SEP IRA stands for simplified employee plan (SEP) IRA and it is a retirement plan designed for both business owners and people who are self-employed.

Requirements:

You have to be over 21 years of age

You must have actively running and operating your business for a full three years in the last five years

Your business must have earned at least $600 that year

Features of the SEP IRA plan (updated for 2018):

The contribution limit is 20% of the company’s income, up to $55,000.

The business makes the contributions.

The funds in your SEP IRA are tax-deferred.

Early withdrawals before retirement age attract penalties.

Should you choose the Solo 401k or SEP IRA?

By and large, we’d highly recommend going for the Solo 401k because it offers so many more great features than the SEP IRA. Let’s examine some of the benefits of the Solo 401k over the SEP IRA below:

It’s easier to max out your Solo 401k contributions vs the SEP IRA. This is because they allow for a fixed $18,500 Salary Deferred portion, regardless of how much your business makes. For the SEP IRA, your contributions are 20% of your income which means your business needs to earn at least $275,000 in income before you can max out your contributions.

The self-directed Solo 401k has a Roth option, but the SEP IRA does not. This means you can make contributions towards your Roth account (meaning your earnings from your investments will be tax-free)

You can borrow from the Solo 401k, but not the SEP IRA. This is a great way for you to access your savings. You also pay the prime interest rate, which is the lowest interest rate you can get. For the SEP IRA, your funds are pretty much locked up unless you choose to pay the penalty.

The Solo 401k can be more tax efficient. This is because you’re able to decide whether to contribute funds from your personal income or business income. So you can make more contributions from the income that is taxed at the lower rate.

With a solo 401(k) plan you don’t have to worry about paying any custodian fees as you would with an IRA plan since a custodian is not used.

Planning for when you become a small business owner

Your choice of retirement plan may be affected if you foresee that you’ll be hiring a team and running a small business in the near future.

A SEP IRA plan is considered a good option for small business owners with less than 5 employees. A Solo 401k only covers you and your spouse. So if you’re looking to have a small team, then consider the SEP IRA. If you expect to expand quickly, then choose a traditional 401k or Simple IRA.

Conclusion

As we saw from the analysis above, the Solo 401k beats the SEP IRA in terms of flexibility and features. This is especially so for self-employed people earning less than $275,000.

For solopreneurs earning more than $275,000 however, the benefits of the Solo 401k may be diminished. This is because you can likely hit the maximum contribution under the SEP IRA as well. If you don’t expect to borrow from your retirement account, then the loan feature in the Solo 401k also has limited value.

Despite these caveats, the ability to direct money into a built in Roth account makes the Solo 401k the clear choice for self-employed people. So if you’re not on the plan already, you should go and set one up! The cost for setting up either plan is very affordable (about $1,200 for a Solo 401k).

Have any ideas about what makes one plan better than the other? Let us know in the comments!

The post Solo 401k vs SEP IRA – what you should choose if are self-employed? appeared first on Retirement Savvy.

The 501k Explained and Plan Review

The 501(k) retirement plan is gaining a lot of traction as it claims to offer more advantages than the traditional 401(k) retirement plan.

These claims have been backed up by the very person who created the 401(k) plan, Ted Benna, who says that Wall Street and Big Business debauched the 401(k) concept and it should be destroyed.

In an interview with the Palm Beach Research Group, Ted Benna reveals 3 risk factors that could affect your 401(k) plan. He also says that these risk factors could reduce your savings by almost 40%, which is significantly high.

In the interview, he explains why the 501(k) plan is a much better retirement plan alternative than the 401(k) plan because it’s not government sponsored.

Ted Benna, a retirement consultant is highly acclaimed for finding an ingenious way people can increase their retirement savings based on the stipulations of Internal Revenue Code Section 401(k).

What is 501k?

The 501(k) is a name that the Palm Beach Research Group has given their concept, which is similar to the Bank On Yourself concept.

The Bank On Yourself concept is a strategy whose focus is on safe savings and building of wealth. This strategy is purely based on a high cash value dividend paying whole life insurance. The 501(k) is based on the same whole life insurance policy.

A cash value dividend paying whole life insurance is an insurance policy that helps you build up your savings, much like a savings account. But the money you accrue is not taxed.

The policy does more than pay out a death benefit. It also a source of an income. So if you have a cash value whole life insurance policy and you want to retire, you never need to worry about cash because the policy provides living benefits.

With this type of policy, when you pay your premiums, your cash value increases each year. But this cash can also grow in many other ways.

The 501(k), according to Ted Benna, is a better retirement plan alternative compared to the 401(k) plan. And these are his reasons:

The 401(k) plan could be repealed by the government – in other words, the government could overturn the tax-advantages that come with these plans. This means you will not be able to feed your 401(k) account with more cash or the amount you put into your account will reduce significantly.

An imminent market crash that could see all your savings in your 401(k) account wiped out.

Hidden fees that could reduce your retirement savings considerable. And most people do not even know about these hidden fees.

My Opinion on the 501k

The 501k plan is a copycat version of the Bank On Yourself concept. So despite the fact that Palm Beach Research group is trying to get people to think that it is a new concept, it is not.

Nevertheless, the 501k plan has proven to have greater advantages than the 401k plan in these ways:

You can contribute after-tax income, which you can access later without paying income tax

There is guaranteed growth of your retirement income

501k plans are not volatile. So you never have to worry about losing money even when the marketing is performing poorly. Your principle remains intact and every coin of growth you have earned in your 501k plan is yours for the keeping.

With 501k plans, you don’t have to worry about by penalized by the government. There are also no restrictions. If you want to withdraw money from your plan early, you can do it and you’ll not be penalized. So in case of emergency and you need money quickly, you can take it out of your 501k plan.

501k plans have tax advantages. You can access your principle and interest without paying any tax.

You can take out money from your plan any time you want.

The death benefit that goes to your family could be way more than you paid for during your lifetime. Your beneficiaries will continue to receive the money tax-free and without having to go through probate.

With 501k plans, you can be guaranteed a peace of mind. This is because there is no volatility and there is guaranteed growth of your money.

He 501k plan avoids the pitfalls of the 401k plan.

When you compare the 501k plan with the 401k plan, a number of things stand out. For example, with the 401k plan, you cannot access your money whenever you want or when you really need it. In other words, you cannot withdraw your money early. If you decide to withdraw your money early, you’ll be penalized.

The other thing is with the 501k plan you can borrow money from your account whereas, with the 401k plan, you can only borrow if your plan enables you to do so. If it does, the money you borrow, you will have to return it with interest.

The other issue with 401k plans is the high fees associated with them. Surprisingly, not many people are aware of the hidden fees that come with 401k plans. A survey done by the American Association of Retired Persons found that over 65% of the participants believed that there were no fees associated with the 401k plans.

Should you get a 501k retirement plan or stick with a 401k

Given the advantages the 501k plans have over the 401k plans, it would make sense to go for the 501k retirement plan. But before you go putting your money in any retirement plan, make sure you know everything you need to know about the plan.

Find out every bit of information about the retirement plan you are considering buying. Find out about its pros and cons, and if there are any fees associated with it.

In short, consider all your options before settling on a retirement plan including your goals and what you expect in terms of cash flow. The 501k plan concept is viable and you can easily fit it into your financial plan.

The post The 501k Explained and Plan Review appeared first on Retirement Savvy.

How to build a CD ladder in 2019

Certificates of deposit is a type of savings account that earns higher interest rates than other savings accounts. This approach can help you grow your savings as long as you are willing to go for long periods of time without accessing the savings.

It’s a long-term strategy, which can be very rewarding because apart from offering high-interest rates, it also offers security and liquidity.

What is the CD ladder strategy?

For starters, CD stands for Certificates of Deposit. It is a type of savings account with a fixed interest rate and maturity date.

CDs offer high-interest rates, but to enjoy these rates, you’ll need to keep your money in the account for a good length of time. If you get a short-term CD, let’s say one year, you will earn less interest as compared to one that is for five years.

Since the goal is to earn high-interest rates, you cannot withdraw your money before the maturity date. But if you apply the CD ladder strategy, you can access high rates without losing access to your money.

The CD ladder strategy involves using multiple CDs with different maturity dates. This way, you can earn high-interest rates and still be able to gain access to your money.

How to build a CD ladder

To better explain how to build a CD ladder, let’s use an example:

Let’s say you want to invest $6,000 in a CD ladder. Instead of investing the entire $6,000 in a single CD account, you split up your money such that you have three or more separate investments. Each CD investment has a different maturity date and interest rate.

If you put your money into 4 investments. Let’s say you get a one-year, two-year, three-year, and four-year CDs. This means at the end of year one, your CD will have matured and you can withdraw your funds. The following year, the two-year CD will have matured and would have earned higher interest what you earned with the one-year CD.

By the time the four-year CD matures, you’ll have earned more interest than if you had locked your money into a single CD.

Although most people prefer one-year CDs, you have the option of getting one that is less than one year.

With that said, it should be understood that if you withdraw your money early before the maturity date, you will be penalized. So if you are looking for an investment option where you want to have access to your many at any time, this investment strategy may not be ideal for you.

The benefits of CD laddering

A long-term CD offers higher interest rates than a short-term CD. And if you put in a large sum of money into a long-term CD account, you will enjoy higher interest rates.

The only drawback with investing in a CD is that you cannot gain access to your money before the maturity date. So if you need money quickly, you would have to look for it elsewhere. Otherwise, if you choose to withdraw your money from your CD account early, be prepared to pay a penalty.

If you apply the CD laddering strategy, you are bound to gain more in terms of interest rate.

Some of the benefits of CD laddering include:

Accessibility – when you have multiple CD accounts with different maturity dates, it means that you’ll have more access to your cash than when you have once CD account.

Higher interest rates – you can choose to get long-term CDs with high-interest rates and still be able to access your money.

Flexibility – you have the option of putting your money into several investments.

Free of worry – whether the interest rates rise or fall, as long as you have put your money in long-term CDs that have higher interest rates, you are safe financially.

The CD ladder model

The CD ladder model splits your investment into five investments each with the same amount of money. Let’s say you want to invest $20,000, you could split your money into five investment like this:

One-year CD – $4,000

Two-year CD – $4,000

Three-year CD – $4,000

Four-year CD – $4,000

Five-year CD – $4,000

When your first CD matures, you can choose to reinvest that cash in a new four or five-year CD. When you second CD account matures, you can reinvest the cash into another four or five-year CD. Eventually, you’ll have multiple long-term CDs that are earning you very high-interest rates.

If you want to know how much interest you’ll earn from your CDs, you can use a CD ladder calculator. You can find one online that can help you calculate how much interest you will have earned after five years.

Conclusion

Financial laddering is a smart way of ensuring that your savings grow each year. Moreover, with CD laddering, you get to enjoy high-interest rates that other savings accounts don’t offer.

But CD laddering has its disadvantages. For one, even though the interest rates rise or fall, the initial amount you put into your CD account will not be affected. In other words, you will not lose your money.

However, your returns may be affected if the interest rates take a dive. You could be looking at low returns if this happens.

The other issue with CD laddering is that if you decide to withdraw money from one of your CD accounts before the maturity date, you will be penalized. The penalty can be 4 or more months’ worth of interest, which is rather a hefty price to pay.

When you decide to invest your money into CDs, you can either do it yourself or find a financial adviser to do it for you. However, keep in mind that the services of a financial adviser can have high fees.

Alternatively, you can choose to use a robo-advisor to manage your investment; instead, of a human financial advisor. The difference between the two is not significantly high, but at least with the computer-based advisor, you don’t have to worry about paying any fee charges.

The post How to build a CD ladder in 2019 appeared first on Retirement Savvy.

Why the lazy portfolio works and how you can build one yourself

Who said you cannot be lazy and still make money? This is what a lazy portfolio enables you to do. With lazy portfolios, you can build your wealth easily and with little to no effort.

What is a lazy portfolio?

A lazy portfolio is an investment strategy, which usually is an exchange-traded funds (ETF), you can invest your cash in at a fixed percentage. For example, you can invest 70% of your cash in one ETF and 30% in another ETF.

These portfolios are referred to as lazy because you don’t need to actively manage them and they require very little of your attention and effort. You don’t need to engage in any active trading or check your stocks every other day or pay some hedge fund manager who can’t beat the market to manage your cash.

They are a “buy and hold” strategy, which looks to achieve financial independence and security. Simply put, a lazy portfolio is a passive investment strategy.

What kind of performance can I expect from a lazy portfolio?

Lazy portfolios are like self-driving cars, once you set up your portfolio that’s it. You sit down and watch the magic happen. Additionally, with lazy portfolios, you can avoid making mistakes and poor decisions.

So what kind of performance can I expect from a lazy portfolio?

Most lazy portfolios do well in most market conditions. They can even outperform professional investors. But if want your lazy portfolio performance to rise, you need to diversify your portfolio with equity security and fixed-income. By doing this, you’ll limit your losses when the market is performing poorly.

How to start building your own lazy portfolio

To help you build a lazy portfolio here is what you can do:

1. Set up an investment account

If you don’t have a 401k plan, to start investing you’ll need to set up an investment account. If you have never opened one before, open an Individual Retirement Account.

Once you have set up your investment account, it’s time to figure out where to put your money.

2. Work out your asset allocation

You need to invest in more than stocks if you want to build a good portfolio. Consider investing in both stocks and bonds.

When it comes to asset allocation, you need to work out what percentage of stocks and what percentage of bonds should make up your portfolio.

One rule of thumb for asset allocation you can use is the age rule. The principle behind this rule is that when you subtract your age from 100, the answer you get should be the percentage that goes into stock investing.

For example, if you are 40 years old, deduct that from 100 and you’ll remain with 70. So you’ll allocate 70% assets in stocks and 30% in bonds. However, you can choose to do it differently.

If you can’t figure out how to allocate your assets, there are a number of tools that can help. You can visit Personal Capital, a website that tracks investments. It can show you how to allocate your assets.

3. Select a couple of index funds

Select some index funds. Keep in mind that index funds are not actively managed, so this is not something you’ll need to worry about.

Index funds are made up of stocks and bonds, and what they do is match a stock index based on its performance. So basically, you don’t need to put much effort toward maintaining or managing your portfolio.

The reason index investing is so attractive is because of its low operating costs, low fees, and high returns over time.

4. Create your lazy portfolio

Once you have decided on what index funds to invest in, it’s time to create your lazy portfolio. Bear in mind that you can start with one or more funds. But if this is the first time you are investing in index funds, consider starting with three funds.

There are several lazy portfolios, but the easiest one to create is the Rick Ferri’s two-fund portfolio, which uses two Vanguard funds: Vanguard Total Bond Market Index Fund and Vanguard Total World Stock Index Fund.

This fund uses the 60/40 rule to allocate resources. 60% goes into stocks and the 40% into bonds.

The other type of portfolio that is easy to create is the three-fund lazy portfolio. This fund also uses the 60/40 rule, but unlike the two-fund lazy portfolio, it suggests investing in the stock market index funds and the international index funds.

There are three types of three-fund lazy portfolios:

Taylor Larimore’s three-fund portfolio

Rick Ferri’s lazy three fund portfolio

Taylor Larimore’s three fund portfolio

Other lazy portfolio options include:

Bill Schultheis’s “Coffeehouse” portfolio

David Swensen’s lazy portfolio

Rick Ferri’s four core portfolio

William Bernstein’s “Coward’s” portfolio

When you create your lazy portfolio make sure it is simple and balanced.

5. Contribute and Rebalance

Once you have bought your index funds and you are happy with the asset allocation, now you need to work out how much you will be putting into your investment account.

With a 401k plan, since it is sponsored by your employer and the money is tax-deferred, your investments will grow over the years. Since every month, a percentage of your paycheck goes into your 401k plan, it means that you are able to make monthly contributions towards your investments.

If you have an investment account, you need to figure out how much you want to put into your account each month. Remember, the more you contribute to your account, the more your investments will grow.

With lazy portfolios, you don’t need to keep checking to see how it is performing. Leave it alone and avoid obsessing over it. However, make sure to check every year and rebalance.

What this means is that you want to keep your portfolio balanced. For example, if you have invested 60% in stocks and 30% in bonds and you find that the stocks did well that year, you’ll need to re-balance that such that it matches your initial asset allocation.

So instead of putting more money into stocks, start putting the money into bonds. After some time, your portfolio will balance out.

Final Remarks

A lazy portfolio is a rewarding investment strategy for investors who are looking to invest long-term (i.e. 10+years). It also a good strategy for someone who is looking to create a good nest egg for retirement, as long as they start investing early.

The post Why the lazy portfolio works and how you can build one yourself appeared first on Retirement Savvy.

What to do with an old 401k after leaving your job

When you have an employer-sponsored 401k retirement plan, it’s natural to worry about what will happen to it if you move jobs. Fortunately, this is not something you need to worry about because you have options.

These options include:

Leave the funds in your old 401k account

Roll over the funds to your new employers 401k plan or a new IRA plan

Cash out all your money

Start taking distributions

Have an old 401k? Here’s what you need to do:

1. Leave the funds in your old 401k account

If your 401k funds exceed $5,000, most 401k plans allow you to leave the money the account even after you get a new employer. But if the money is less than $1,000, the company may offer you a check to force out the funds from the account.

But if the amount is less than $5,000 but more than $1,000, the company is obligated to help you open up an IRA account they can transfer the funds to if they are pushing you out.

However, if your previous employer is not forcing you out of the 401k plan, and you have a significant amount saved, you can leave it there. But if you are not happy with the plan’s fee charges or investment options, then you can consider other options.

2. Roll over your 401k plan

If you get a new job, find out if your new employer will offer you a 401k plan and when you will able to participate. Some employers require that a new employee works for several months before they are eligible for a 401k plan or any other retirement plan.

Once you enroll in a 401k plan with your new boss, you can move your old plan. You can request your employer or the administrator of the old 401k plan to transfer your funds into your new plan. Alternatively, you may choose to have the funds made to you in check form.

Whichever option you go with keep in mind that you only have 60 days to transfer all your funds from your old 401k plan into your new one. If you transfer the entire or part of the money after the 60 days, the money will be subject to income tax.

Also, ensure that before transferring your funds to the new 401k plan, it is active and you can make contributions to it before liquidating your old plan.

3. Cash out your 401k funds

Cashing out your 401k can be appealing. I mean if you have a substantial amount in your plan, think of all the things you can do with that cash. While no one can stop you from cashing out your 401k funds, your financial advisor may strongly advise against it.

When you receive a lump-sum distribution, this distribution is subject to income tax. So the bigger the amount, the higher the income tax you will be required to pay. In the end, cashing out your 401k funds may not be worthwhile if the taxes will impact your savings significantly.

You can also look at it like this, if you withdraw your entire savings, it means that you have to start saving for retirement from scratch. So it is better to just leave the funds in your old 401k plan or to roll over the old plan into a new plan.

4. Take the IRA option

If you have a new job, but your new employer does not offer a 401k plan and you don’t want to leave your old plan with your former employer, you can roll over your old plan into an IRA plan.

You can get the administrator of your old 401k plan to transfer the funds to your IRA account or you can withdraw the entire amount and deposit it in your IRA account within 2 months (60days).

There are several advantages of rolling over an old 401k into an IRA account, but the main one is that with an IRA, you can invest in whatever you want.

So if you are not happy with the investment options your old 401k offers, then it may be ideal to roll over your plan into an IRA plan, which offers better investment options.

5. Take distributions

You can take out distributions from your old or new 401k if you are over 60 years of age. If you leave your old employer for a new job or for retirement, you can start taking out distributions. However, keep in mind that when you take out distributions from a traditional 401k plan, that money is subject to income tax.

But if you have a Roth account, and you are over the age of 60, the distributions are tax-free as long as you have been holding the account for no less than 5 years. If you have not held the account for 5 years, the earnings share of your distribution will be taxed.

If you are 60 years and you switch jobs or if you choose to retire before you turn 55, you can still take out distributions from your 401k plan. Unfortunately, besides paying an income tax, you may need to pay a 10 percent penalty tax on the taxable share of your contributions.

However, the 10 percent penalty tax does not apply if you retire after the age of 55 and not before age 60.

Can you roller over part of your 401k?

Yes. You can roll over part of your 401k and leave the rest in the account. Some 401k plans allow partial rollovers, while others don’t.

A good reason to roll over your 401k plan is when it has one good investment option, but the rest are not so good. In this case, it makes sense to keep in your account just enough cash to hold that investment and roll over the rest to an IRA account.

Another advantage of partial rollovers is that you can access your money if you between age 55 and 60 without incurring a penalty. However, with an IRA account, you have to be over 60 to gain access to your money penalty-free.

So you may want to roll over part of your 401k plan into an IRA plan to be able to invest in whatever you want and leave the rest in your 401k plan to pay for your living expenses when you retire.

Final thoughts

Some 401k plans are more flexible than others in that they offer better investment options and allow partial rollovers. So if you intend to get a new job or you already have a new job, review your options before making a decision on what to do with your old 401k plan.

The post What to do with an old 401k after leaving your job appeared first on Retirement Savvy.

What is the mortgage accelerator program?

A mortgage accelerator program is a mortgage loan program that is tied to your home equity line of credit (HELOC). The goal of the program is to help you pay off your mortgage faster and save tons of money.

Types of mortgage acceleration programs

Mortgage acceleration programs are of two types. There is the bi-weekly mortgage plan where you pay your mortgage after every two weeks. So basically, by doing so, you pay off your mortgage faster. The other one is a mortgage plan that is linked to your home equity line of credit.

Mortgage accelerator programs are quite popular in Australia, the United States, and the United Kingdom. In Australia alone, over a third of homeowners use mortgage accelerator programs.

These programs are ideal for people who don’t want to spend years paying off their mortgage. In any case, the sooner you are able to pay off your mortgage, the better as your home equity will start to increase sooner.

How it works

The mortgage accelerator program is linked to your home equity line of credit. Your paychecks go directly into that account and your mortgage balance is deducted from that amount. In this case, your HELOC account serves as your checking account.

For example, you purchase a home for $300,000 and you put down 20% or $60,000. You take out $30,000 HELOC, which goes towards paying your mortgage. So now your home equity is $60,000, your HELOC is $30,000 and your mortgage is $240,000.

Basically, when you transfer money from your HELOC account to your mortgage and then pay off your HELOC account, you will clear your mortgage debt faster.

Keep in mind that the more you save, the less interest you’ll pay at the end of loan period because your savings are going into paying off your HELOC.

Benefits of a mortgage accelerator program

HELOC programs offer a number of advantages. These include:

Fast payment of your mortgage – when you deposit your paycheck into your HELOC account, your mortgage is deducted. By doing so, the principle balance of your mortgage is reduced. Since you make payments every 2 weeks, you’ll be able to clear your mortgage debt faster.

Less interest – since you pay your mortgage off faster, the total interest you end up paying at the end of loan period is reasonably low.

Build home equity faster – with mortgage accelerator programs, you are able to build your home equity much faster. This is because the programs allow you to pay off your mortgage within a shorter time than you would if you took a 30-year mortgage loan.

No extra costs – mortgage accelerator programs allow you to pay your mortgage debt without increasing the mortgage payments.

Better financial management – with mortgage accelerator programs, you can either make payments on a weekly or biweekly. This enables you to manage your money better since you know exactly how much goes into paying your mortgage.

This is a great financial product that is ideal for people who are disciplined in the way they handle their cash. Even those who max out their earnings faster than you can say Jack Robinson can learn how to save and budget with a mortgage accelerator program.

Drawbacks of a mortgage accelerator program

HELOCs are ideal for people who have a steady cash flow. But if you have a negative cash flow, you will only add to your mortgage debt.

Despite the fact that mortgage accelerator programs (HELOC) enable you to pay off your mortgage faster, there are some drawbacks. Some of the disadvantages of using mortgage accelerator programs include:

High interest – your mortgage accelerator loan program may have higher interest rates than the traditional mortgage loan.

High fees – with biweekly mortgage plans, lenders tend to charge a setup fee and a monthly fee. There may be other additional fees you may end up paying for as well.

Ties your money up – with bi-weekly mortgage plans, you are obligated to make payments towards your mortgage every 2 weeks. So even if you need extra money to pay for something or buy something, your biweekly mortgage payment have to be made.

Remember, when you decide to have a bi-weekly mortgage plan, you have the option of creating one yourself or you can choose to hire a financial services company to do this for you.

But you have to pay an initial fee and then some amount each year to the service provider. So this can be costly and quite frankly, it is unnecessary because you can manage a HELOC account on your own.

Final Thoughts

Bi-weekly mortgage plans are different from bi-monthly or semi-monthly mortgage plans. Since payments are made every 2 weeks with a bi-weekly mortgage plan, this translates to 52 weeks per year. So in total, you make 26 payments per year.

The one thing about bi-weekly mortgage plans is that you don’t need a lender to create one for you. You can create one for yourself, or you need to do is make the extra payments whenever you get your paycheck. Of course, this requires a lot of discipline and good planning.

The advantage of creating and managing your bi-weekly mortgage plan is that you don’t have to pay any fees, which lenders charge for this kind of service.

So if there is a company offering to change your bi-monthly plan to a bi-weekly mortgage plan for a fee, you are better off doing it yourself. Furthermore, you be able to cultivate good habits when it comes to managing your money.

Lastly, make sure that your mortgage loan does not have a prepayment penalty. While not many mortgages have a prepayment penalty, some do.

Avoid these types of mortgages because they will penalize you for trying to clear your mortgage debt quickly. This is because by doing so, the lender will not earn as much interest as they would like. So do your due diligence, find better options and stay clear of mortgages that have prepayment penalties.

The post What is the mortgage accelerator program? appeared first on Retirement Savvy.

December 7, 2018

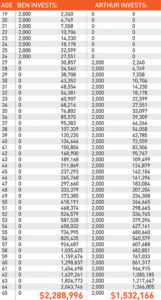

What is the Ben and Arthur Chart, and What it means for Your Retirement?

The Ben and Arthur chart is an illustration by personal finance guru, Dave Ramsey. It purportedly shows how important it is to invest early.

The Ben and Arthur Chart Explained

The Ben and Arthur chart illustrates how investing early can be more powerful than putting in more money.

Here’s the story behind the chart:

Ben and Arthur are close friends. Ben starts investing at the age of 19. For 8 years he invests $2000 annually in investments that earn him 12% in compound interest every year. By the age of 26, Ben stops placing any more funds into his investments. So in total, he has invested $16,000.

Arthur starts investing at the age of 27. He puts $2000 each year in his investment funds that earn him an annual interest of 12%. However, unlike Ben, Arthur continues to invest even after he has reached retirement age (60+ years).

In total, Arthur invests $78,000 over a period of 38 years, while Ben invests a total of $16,000 over a period of 8 years.

Now, who do you think ended up with a larger portfolio by the time they were each 65?

Here’s the shocking reveal:

When Ben and Arthur turn 65, Ben has accumulated $2,288,996, while Arthur has accumulated a total of $1,532,166. The reason why Ben has more money than Arthur is because he started investing earlier than his friend.

Because interest compounds, Ben begins to earn interest on his investments a lot earlier than Arthur. By the time Arthur starts investing, Ben’s interest already outstrips the yearly contributions Arthur can make.

How you can apply the principles of Ben and Arthur to your investing

The fundamental principles of Ben and Arthur are:

Start investing early

Invest some amount of money each year at a favorable interest rate

The earlier you start investing, the sooner you start earning interest. The idea is to increase your money through compound interest.

To better explain how the Ben and Arthur concept works here is an example:

If you invest $1,000 and earn an interest rate of 10%, this means that your interest after 1 year will be $100. So if you add that to the original amount you invested, in this case the $1000, your total will be $1100.

If you take the $1100 and invest at the same interest rate, your interest at the end of the following year will be $110. When you add that to the $1100 you invested, your total will come to $1200.

So the amount of money you earn from the interest continues to grow. This is what is referred as compounding. When you reinvest the amount you earn each year from your investments, your total earnings continue to increase.

The formula for calculating compound interest is as follows:

A = P (1 + rn) nt

P = this is the principle amount i.e. the original amount you invest.

A = this is the future value of the principle amount.

r = this is the interest rate.

n = n is the number of times you receive interest in a given year.

t = this is the time in years the principle amount is invested for.

Example

Brian wants to have a sizeable amount of money in 30 years for his retirement. He decides to invest $100,000 in an investment that is paying 10% interest rate that is compounded monthly, if he decides to invest this money for 30 years, by the end of that period, how much will he have?

P = $100,000

r = 10%

n = 12 months

t = 30 years

If you apply the formula, you’ll see that at the end of the 30-year period, Brian would have earned approximately $1,983,739.94. The total interest he will have earned alone is about $1,883,739.94.

As you can see, in the 30 years, Brian will have earned $1,983,739.94. Compounding interest can grow your investment funds exponentially.

Criticisms of the Ben and Arthur illustration

While some financial experts agree with the Ben and Arthur illustrations, some do not. According to some investment experts, the Ben and Arthur illustrations are utterly rubbish.

Here’s why:

While it is true compound interest can boost your returns, in the case of Ben and Arthur. The assumption is that you can earn a 12% interest each year, for several years whether the market is good or bad.

This is not true. Compound interest can only earn you good returns, if the interest rate does not fluctuate throughout the duration of the investment period. However, if the market prices fall, this would affect the interest rate, and subsequently the total returns.

Today, it’s nearly impossible to earn a 12% interest yearly. For example, the S&P 500 in 2017 had an average yearly return of about 9%. In the last two decades S&P 500 has averaged about 7% overall.

Given the numbers, if you are planning for retirement, it is better to stick with a realistic number like 7% or 8%. With a projection of 7% or 8% average return rate, you are able to control your savings rate.

So it is better to keep your focus not on the return estimate but on the savings rate. It’s great if you can average a return rate of 7% or 8% over a long period. However, there are times when you can get an average return rate of 19% and there are times you can get a return rate of -14%.

Between 1995 and 1998, S&P 500 overall average return rate was 28%. So those who invested within the 5-year period tripled their money. But in the subsequent 3 years, the market had toppled and those who had tripled their investment found that their investment had reduced by about -14%.

The other observations was that the Ben and Arthur illustrations work on the assumption that what you can purchase with $2000 at the age of 19, your age-mate can purchase the same thing 10 years later.

This is untrue. If everyone earns a fixed amount of interest on their investments consistently over several years. This means that everyone will have more cash, but will not be richer or wealthier. If the vast majority of people have more cash, prices will go up.

So what you could purchase with $2000, 8 or 10 years ago, cannot have the same value today. Either this value would have reduced or increased significantly, depending on how well or not the market has been doing over the years.

Final thoughts

The Ben and Arthur story teaches a valuable lesson of the benefit of investing early. But it is important to look at things from a realistic point of view before investing.

Interest rates for example fluctuate when market prices fall and rise. So whatever interest rate you earn on an investment in a given year, may not be the same rate you earn in a different year.

So even though the Ben and Arthur illustrations encourage young people to start saving money early, it is misleading. It is therefore, important that you do your homework before making any kind of long-term investment for your retirement.

What is a long term care annuity and should you get one?

Saving for retirement requires careful planning and commitment. And the earlier you start working towards making and saving money for retirement, the better. I mean, the last thing you want is to find that you don’t have enough savings to retire on.

But with the cost of living constantly rising and the fact that now people are living way beyond retirement age (65), it is important to have a steady income stream.

Why? Because your savings may not be enough for your retirement.

If you want to attain financial security, think about making an investment that brings in a steady income that will last a lifetime. And one such investment is called an annuity.

What is a long term annuity?

A long term annuity is a financial vehicle for accumulating money for retirement. This money is tax-deferred and that is what makes annuities so attractive.

There are two types of annuities:

Fixed – fixed annuities offer a fixed return rate

Variable – variable annuities offer a variable return rate

A fixed annuity has less risk than a variable annuity. This is because variable annuities offer multiple investment options.

When choosing an annuity, you can also choose an annuity based on how long you need to wait to collect your income. These annuities are classified under deferred or immediate.

Deferred annuities have an accumulation period, while immediate annuities do not.

The accumulation period is the length of time (usually in years) when you start making your premium payments and when you start receiving your income payments.

For example, if the accumulation period is 5 years. In those 5 years, your money will accumulate based on a fixed or variable return rate, depending on which one you choose. You will start to receive your income payments once this set period expires.

It should be noted that during the accumulation period, your annuity earns interest and continues to do so even after this phase is over. It does not matter whether your contract is variable or fixed, the annuity will continue to grow.

With an immediate annuity, you start receiving income a month after you purchase the policy. What you need to know about long term care annuities is that you stand to benefit a lot especially if you buy a rider.

A rider, in this case, is basically a benefit attached to the policy. Having an annuity with a long term care rider can be beneficial in that, thanks to the rider, you are guaranteed an income even when you are retired.

Who needs a long term annuity?

Depending on your circumstances, you can choose whether to buy long term care annuity or not. However, there are circumstances where a long term annuity can be valuable.

When you find yourself in the following situations, consider getting a long term care annuity:

You have maxed out your 401k plan and other tax-deferred retirement accounts

You are not interested in the stock market

You want guaranteed income

You cannot get life insurance coverage

You want long term care protective cover

There may other reasons why you may want to get a long term care annuity. However, don’t let any insurance agent push you into getting one. This is an investment decision should be made based on what you want and not what the insurance agent is offering.

When do you get your annuity payouts?

If you plan on getting an immediate annuity, you will start receiving your income payments after one month. But with a fixed annuity, you’ll start receiving income payments once the set period (which is usually set by you) expires.

Where to get a long term care annuity

If you are considering getting a long term care annuity, it may maybe advisable to seek the services of a financial adviser.

A financial expert can help you determine which annuity is suitable for you by assessing your current income and other factors.

But remember to do your homework as well. There are some key factors you need to look at before settling on a long term care annuity. These factors include:

Quality of service – go with an insurance company that has a good reputation in terms of quality of service. Many companies promise to provide high-quality services, but in reality, do the opposite.

Independent ratings – a number of organizations rate the financial stability of insurance companies. Some of these companies include Moody’s, A.M Best, Fitch, and Standard Poor’s.

You can go to these sites to see which insurance have the best or the highest ratings and this could help you make a more informed decision.

There are other factors that you may need to consider such as legal accreditation, customer service, locality, and price.

With that said, here are some of the top-rated insurance companies that provide long-term care annuity.

Mutual Omaha – A+ rating. Its tax-deferred long term annuity has an annual return rate of 12.6%.

Lincoln Financial Group – A+ rating. Its deferred long term annuity has a return rate of 11.8% per annum.

New York Life – A++ rating. The company offers long term annuity at a return rate of 11.5% per annum.

Summary

Buying a long term annuity can be beneficial especially if you don’t want to worry about money as a retiree. However, long term annuities are not for everyone and some financial experts don’t think they are a good investment option.

Reasons why investing in a long term annuity may not be a good idea include:

Emergency money: If your long term annuity is still within the surrender period, that is the time period before your annuity expires, getting your money back will be a costly affair. If you need money right away for an emergency or something else, you may get penalized for withdrawing your money early.

So it’s advisable to ensure that you have some savings set aside for emergencies.

Family. While some long term care annuities cover spouses and family members not all of them do.

Some people prefer not to purchase long term care annuities because they don’t want their money tied up in an investment for too long.

But when you really look at it, annuities can guarantee you a lifetime income. Which is important because you don’t want to retire and find that you don’t have enough in your nest egg to retire comfortably.

However, there are other investments that can also guarantee you a lifetime income. But consider this, with long term annuities, your income is not taxed. So you save more.

What happens to your 401k when you die? All about 401k inheritance

If you have a 401k retirement plan, there is the assurance that when you die, your loved ones will be taken care of financially. However, you need to make sure that the beneficiaries of your 401k plan can be able to access the money without any hassle. And this requires knowing how inherited 401k plans work.

How does an inherited 401k work?

When you open a 401k plan, you have to assign a primary beneficiary and alternative beneficiaries. The primary beneficiary is the one who receives the money in your 401k plan when you die before retirement age.

However, if the primary beneficiary becomes deceased, the money goes to the alternative beneficiaries. If you have no surviving beneficiaries, the money goes to your estate and it is distributed according to your wishes as stated in your will.

When you assign a primary beneficiary this can be any one of your choosing, it doesn’t necessarily have to be your spouse. However, if your spouse is not the primary beneficiary of your 401k plan, legally you are required to get the consent of your spouse in writing. After which you need to file it with your 401k retirement plan provider.

If you choose to change the primary beneficiary to assign a different one, you will still need your spouse to provide their consent in writing and you will need to file it with your 401k provider.

If when you opened your 401k plan, you assigned your spouse as your primary beneficiary and you later get divorced, your spouse inherits your 401k plan. To prevent this, you will need to assign a different primary beneficiary. You may even need a court order to effect this change.

What are the 401k spouse and non-spouse beneficiary rules?

When a spouse inherits a 401k plan, they cannot withdraw less than the required minimum distributions. But they can choose to withdraw more than the required minimum distributions.

A spouse can choose to roll over the funds in the inherited 401k plan to an inherited IRA plan. Distributions are based on your life expectancy and you can choose to withdraw more the required minimum distributions, but you cannot withdraw less.

For a non-spouse beneficiary, rolling over inherited 401k plan funds into their own IRA account is not allowed. The beneficiary needs to create an inherited IRA account, which has to be separate from their other retirement accounts.

A spouse who has inherited a 401k plan is expected to have withdrawn all the money in the account within 5 years after their spouse’s death. You have the option of taking out a lump-sum distribution or the required minimum contributions.

How to avoid taxes on your 401k inheritance

Many 401(k) plans state that beneficiaries should withdraw all the money inherited in a 401(k) account in a lump sum. To avoid paying hefty taxes on your 401(k) inheritance, do not take out the lump sum and deposit it into a non-retirement account.

If you do this, all the money you have inherited from the 401(k) plan will be subject to income tax the moment you make a withdrawal.

And if you have a sizable amount in your account, chances are that you may end up paying higher taxes. The most ideal thing to do is withdraw the money and deposit it into an inherited IRA account. That way you will be able to control your taxes.

However, keep in mind that according to IRS rules, a lump sum payment should be made before 31st December of the year after the death of the 401(k) owner. So for example, if a 401(k) owner died in 2018, the inheritance should be paid out to the beneficiary before or by December 31st, 2019. So it is important that you open an inherited IRA account before the deadline.

On the other hand, you can choose to stick with receiving the required minimum contributions, all you need to do is extend your payouts. When you spread out the withdrawals over a lengthy period of time, it means you are taking out small amounts each year. Doing this ensures that your tax bill is not affected.

Conclusion

Do not underestimate the process of selecting a beneficiary as it can be complicated. You may need the services of a financial adviser to help you with the process. In any case, it does not hurt to get professional help to ensure that you take the right steps.

The reason why you need to take your time when choosing a beneficiary has to do with trust. You want to assign a beneficiary who you can trust to fulfill your wishes when you die.

Aside from that, other things you need to consider include:

If you have no listed beneficiaries on your 401k plan or if the listed beneficiaries are all deceased, the money in your account will be moved to your estate and distributed as stated in your will. Keep in mind that when this happens, these monies will be subject to income tax.

If you get divorced and the beneficiary of your 401k account is your spouse, make sure to assign a different beneficiary as soon as possible. Otherwise, you may find that your 401k funds have been automatically transferred to your spouse.

Ensure that if you have listed young beneficiaries, you assign a primary beneficiary you trust to manage your account until the beneficiaries become of age.

If you have listed a beneficiary who happens to die, or get sick or get married or divorced, make sure to change the beneficiary to a different one.

If you choose to roll over your 401k funds to a different institution or custodian, the beneficiaries’ designations do not carry over.

When choosing your beneficiaries ensure that they are in the low income bracket so that they don’t have to pay high taxes on the contributions.

In short, consider consulting a financial advisor before setting up a 401k plan. These plans offer numerous benefits; however, it is important that you consider what will happen to your 401k account if you die.

Knowing that your family will not struggle financially is a great thing. So make sure that you know everything you need to know about 401k inheritance.

Here are the 10 best retirement planning books in 2019

Here at Retirement Savvy, we’re big on having a fulfilling and secure retirement. Here are our top recommendations for books to read on retirement in 2019!

1. HOW TO RETIRE HAPPY, WILD AND FREE

Many people look forward to retirement. They have dreams of all the things they could possibly do. However, that excitement quickly gives way to boredom and a lack of purpose.

For that reason, some fear retirement. In this book, Ernie J. Zelinski, takes a refreshing view on retirement – pearls of wisdom about how to take advantage of your retirement years to follow your dreams.

And that is what is so unique about this book. It does not offer complex strategies and techniques on how to save for retirement like most retirement planning books. Instead, it offers solid advice on equally important aspects of retirement, like taking care of your health and staying connected socially.

Some key takeaways from this book include:

Find the courage to retire early in order to enjoy more rewards

Invest your money intelligently that you do not need millions to retire

Enjoy your retirement by doing things that you enjoy

Follow your dreams

Take control of your physical and mental health

2. THE NEW RULES OF RETIREMENT: STRATEGIES FOR A SECURE FUTURE

While certain principles of retirement planning never change, you must employ updated strategies that address modern day challenges.

Robert C. Carlson provides his readers with proven retirement strategies in an era of low investment returns, higher taxes and less comprehensive Social Security and Medicare programs. This resource offers valuable information on how you can create financial security using profitable techniques.

You will also learn how to save for your retirement, how to invest before and during retirement. This edition brings into focus some key areas such as income taxes, estate planning and IRA management for financial security.

Some key takeaways from the book include:

How to identify potential threats to your financial security and how you can overcome them

How to estimate your retirement spending and build a sustainable strategy to spend wisely

How to diversify your portfolio to maximize returns even when in difficult situations.

3. HOW TO RETIRE WITH ENOUGH MONEY: AND HOW TO KNOW WHAT ENOUGH IS

This short retirement planning book was written by Dr. Teresa Ghilarducci, an economics professor and a retirement and savings specialist.

We love how the book examines the whys behind most pre-retirees poor saving and spending habits.

Dr. Teresa also addresses the issue of poor policy making and how it also contributes to poor saving and excessive spending.

As a result, you can expect to get a bigger appreciation for the challenge that lies ahead once you understand the context that surrounds retirement planning.

Finally, the book offers tactics on how you can get your spending under control without needing the services of a financial planner. It also explains how you can save for retirement using simple rules of thumb.

Some key takeaways from the book include:

Take advantage of your 401k retirement plan

Delay taking your social security benefits if possible

Avoid financial planners because of their high charges

Invest in low fee index funds

Spend less and save more

Avoid accumulating too much debt

4. THE 5 YEARS BEFORE YOU RETIRE

If you’re close to retirement and haven’t quite got your plan in place, then this book is for you.

Emily Guy Birken explains you can maximize your savings in just 5 years to retire comfortably. Think of it as “just-in-time” advice.

What we liked about this book is that it explains how many are not able to save enough money for retirement despite having good incomes.

Birken explains how you can make better financial, medical and familial decisions when it comes to saving money. She advises readers to enroll in Medicare, invest in real estate and take advantage of the 401k retirement plan offered by employers.

This is certainly advice that you can use even if you’re not close to retirement age.

One criticism we had of the book is that it spent a lot of time talking about Medicare, which is frequently updated. This could make the advice somewhat dated by the time you get your hands on it.

Some key takeaways from the book include:

What you need to do before retirement age in terms of finances, housing and Medicaid.

How to do all of this in a short time before you retire.

5. HOW TO MAKE YOUR MONEY LAST: THE INDISPENSABLE RETIREMENT GUIDE

A wonderful resource from Jane Bryant Quinn. The author shares strategies on how to manage your money when you’ve already retired.

The book gives practical, solid advice on topics like fund types, portfolio rebalancing, asset allocation and more.

So if you are looking for strategies to help you grow your money ensuring your pot of savings never runs dry after retiring, then you’ll find this book to be invaluable.

Some key takeaways from this book include:

How and where to invest

Take advantage of your social security

Understand that your house is an asset

Know how much to withdraw each month

6. RETIRE INSPIRED

Retire Inspired by Chris Hogan is perfect for working adults young and old who aspire to escape from living paycheck to paycheck.

Retire Inspired by Chris Hogan is perfect for working adults young and old who aspire to escape from living paycheck to paycheck.

What we really like about the book is Chris’ goal-based approach to retirement:

He explains that retirement is a financial number and not an age. He explains that when it comes to planning your retirement, you should have a target number – the sum of money that you need in order to enjoy a stress-free retirement.

He’ll guide you on setting reasonable expectations, and provides advice on how to get there.

Some key takeaways from this book include:

Understanding the different retirement plans options that are available and which one you should use.

What insurance coverage you should get

How to be free of non-mortgage debt

Why you need to have an emergency fund

Types of tax-advantaged accounts

Ways you can invest

7. HOW TO RETIRE HAPPY

What makes this book stand out among most retirement literature? Stand Hinden, the man behind this incredible book uses insights from his personal experiences to show how you can retire happy.

This step-by-step resource is easy to understand and it touches on almost all areas of retirement, including financial aspects, and mental and emotional health.

Some key takeaways from the book include:

Choosing where to live when you retire

Solid advice on health and other types of insurance

When you should take certain steps like apply for social security, take money out of your IRA etc.

8. THE TRUTH ABOUT RETIREMENT PLANS AND IRAS

Many retirement experts have emphasized on the importance of saving money for retirement. However, not many people who by the time they get to retirement age have enough money to live on. This is because many people don’t know how to save wisely.

In this guide written by Ric Edelman, he explains how you can save for your retirement. He also debunks and clears up the dangerous myths people believe in when it comes to retirement planning.

Edelman explains that by making wise investment choices and converting your 401(k) retirement plan into an income, you can create long-term financial security.

Some key takeaways from this book include:

How to invest wisely

Understanding the power of compound interest

Retirement plans and how you make contributions even when you don’t think you can afford to

9. THE SMARTEST RETIREMENT BOOK YOU’LL EVER READ

The book’s title certainly makes a bold promise, and we’re happy to announce that it lives up to that promise.

It comes as no surprise, as the author Daniel R. Solin writes for prestigious publications such as The Huffington Post, and USNews.com.

This is a simple to read book for beginners that know next to nothing about retirement planning. It’ll give you a good enough foundation to properly evaluate advice that financial planners and gurus offer you.

Some key takeaways from this book include:

How to ensure that the money you earn lasts longer than your lifetime

How to avoid common mistakes that can leave your loved ones impoverished

How to identify scams that may rob you of your savings

Discover simple methodologies to help you diversify your portfolio(s)

10. THE COMPLETE CARDINAL GUIDE TO PLANNING FOR AND LIVING IN RETIREMENT

Retirement requires good planning; however, the financial complexities associated with it can be intimidating. This book by Hans Scheil covers the challenges, opportunities and the choices from an investment, Social Security, insurance and Medicare standpoint.

The guide provides you with tools that can help you understand how to make more informed choices.

The motivation behind this book is to offer guidance on the retirement alternatives available for retirees. It highlights strategies that you can use now, to make your retirement successful financially.

Some key takeaways from this book include:

How to transfer your assets and life insurance to your next of kin

How to deal with tax rate changes after your retire

What investment strategies can help you finance your retirement years