Susan B. Weiner's Blog, page 52

September 6, 2016

Email inbox efficiency–can you go too far?

Email productivity is a goal of most people whom I know. We all receive and send too many emails.

But how far are you willing to go to trim the amount of time you spend on email? It’s the rare person who’ll go as far as Cal Newport recommends in Deep Work: Rules for Focused Success in a Distracted World.

Deep Work rule for email productivity

Newport suggests that you boost your email productivity with the following rule:

Do not reply to an e-mail message if any of the following applies:

It’s ambiguous or otherwise makes it hard for you to generate a reasonable response.

It’s not a question or proposal that interests you.

Nothing really good would happen if you did respond and nothing really bad would happen if you didn’t.

He admits there are exceptions to his rules. For example, he says you should reply “If an ambiguous message about a project you don’t care about comes from your company’s CEO.”

Could YOU apply this Deep Work email rule?

I can see how Newport’s rule boosts his email efficiency. I could dramatically cut my email volume if I ignored ambiguous emails. But I can’t envision myself applying Newport’s rule often. I need to respond to clients and prospects.

Your ability to apply this rule at work depends on your relative status and role in the company. If you’re a company’s top dog, you have more leeway than a lower-level person who’s serving clients.

Still, perhaps you can alter your behavior on the margin. I like how Newport’s book makes me question my assumptions about my daily work routines.

Disclosure: If you click on the Amazon link in this post and then buy something, I may receive a small commission. I only link to books in which I find some value for my blog’s readers.

The post Email inbox efficiency–can you go too far? appeared first on Susan Weiner's Blog on Investment Writing.

August 30, 2016

How to write calendar dates in your financial communications

August 30 or August 30th—which is the best way to write the calendar date?

Major style guides prefer August 30. I like it, too, because there’s less visual clutter. August 30th becomes even uglier when Microsoft Word uses superscript to raise the “th.”

The Chicago Manual of Style says, “Although the day of the month is actually an ordinal (and so pronounced in speaking), the American practice is invariably to write it as a cardinal number: 18 April or April 18, not 18th April (the British preference) or April 18th.”

The Associated Press Stylebook agrees.

When you write out dates for a global audience, keep in mind that preferences vary about whether the date goes before or after the month.

Image courtesy of Stuart Miles at FreeDigitalPhotos.net

The post How to write calendar dates in your financial communications appeared first on Susan Weiner's Blog on Investment Writing.

August 23, 2016

Financial writing lesson from my sneakers

Don’t try to cram your right foot into your left sneaker. It doesn’t work. However, on the plus side, my absentminded action made me flash on a lesson for financial writers.

The financial writing lesson? Don’t try to force things where they don’t belong. Sure, I could have painfully squeezed my right foot into my beat-up left sneaker. But, I shouldn’t do it. Similarly, a financial writer shouldn’t put content into the wrong format.

Imagine that you have some breezy comments about what’s going on in the stock market today. Should you give them a formal design treatment in a PDF document that will take a week to produce because of the difficulty of getting into your designer’s schedule? No, put the comments on your blog after making sure that they fall within your firm’s compliance guidelines.

On the flip side, a meaty 3,000-word research-driven piece may get plenty of social media shares, but it may not actually get read on your blog, as I discussed in “What’s too long for a blog post?” Also, when you publish online you can’t control how your piece will look when people read it. Attentions spans drop off quickly on mobile devices. You may get the best of both worlds if your blog publishes teaser copy for your piece or breaks it up into multiple posts. You can still distribute a nicely formatted PDF for readers who prefer them.

The post Financial writing lesson from my sneakers appeared first on Susan Weiner's Blog on Investment Writing.

August 16, 2016

Email productivity booster for investment and wealth management

Whether you’re an investment or wealth manager—or a professional or vendor who supports them—you can probably benefit from an email productivity booster. Take advantage of Microsoft Outlook’s “signature” feature to summon up basic email templates at the click of a button. I imagine that other email programs may offer a similar feature.

Writing emails from scratch is a productivity killer, not a productivity booster

If you’re like most of us, you have emails that you send repeatedly, with minimal variations. Maybe it’s a prospecting email. Or a new client welcome email. Or an email asking if you can update the recipient’s contact information.

If you’re like most of us, you have emails that you send repeatedly, with minimal variations. Maybe it’s a prospecting email. Or a new client welcome email. Or an email asking if you can update the recipient’s contact information.

You shouldn’t start from scratch every time you write an email. You waste time repeating steps that you’ve already gone through many times before. Sure, you can save templates in your word-processing software, but it’s even more efficient to use one of Microsoft Outlook’s underappreciated features, the signature.

Email productivity booster: Microsoft Outlook’s signature feature

Did you know that you can save an entire model letter in Microsoft Outlook as a so-called “signature”? Most people use Outlook’s signature feature to insert classic signature information, such as your name, contact information, and other promotional information that goes under where you sign off with your name. But, as I learned from organizer Lorena Prime, you can use the Outlook signature for much more.

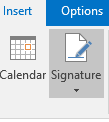

As you’ll see in the image below, I turned an entire email into an Outlook signature.

After loading an email as an Outlook signature, it’s easy to customize and send.

Go to the Insert tab, then click on Signature to view a drop-down menu of the signatures you’ve previously saved.

I simply go to Outlook’s Insert tab, click on Signature, and then select by title the text that I want to use. After filling in my “To” and “Subject” lines, and adding a greeting, I’m ready to hit “Send.”

This is way faster and easier than writing an email from scratch. It’s even easier than copy-pasting from a Word file because I’d probably forget where I saved the dratted model email.

Here’s what Microsoft says about creating signatures in Outlook 2013 or 2016.

YOUR email productivity booster ideas?

If you have ideas for boosting email productivity, please share them.

Of course, sometimes the best productivity booster is to keep your email closed and pick up the phone for a quick solution to a pressing problem.

Image courtesy of ddpavumba/FreeDigitalPhotos.net

The post Email productivity booster for investment and wealth management appeared first on Susan Weiner's Blog on Investment Writing.

August 9, 2016

3 fixes for lousy quotes in your financial writing

Quotes are a great way to add oomph to your writing. This is true whether it’s a short piece, such as a blog post, or a long white paper for your investment or wealth management firm. But what if you’re quoting lousy writers or interviewees who haven’t expressed themselves well?

Quote fix 1. Rewrite the quotes

Rewriting can be controversial.

Sure, no one will protest if you add or delete a comma in a sentence. No one will even notice the difference between the mispunctuated “He said ‘Thank you’ ” and the correct “He said, ‘Thank you.’ ” You can even change “average annualized returns” to “annualized returns,” removing the redundant “average.” I think most people are fine with small tweaks that don’t change the meaning of the person who wrote or spoke the words.

Sure, no one will protest if you add or delete a comma in a sentence. No one will even notice the difference between the mispunctuated “He said ‘Thank you’ ” and the correct “He said, ‘Thank you.’ ” You can even change “average annualized returns” to “annualized returns,” removing the redundant “average.” I think most people are fine with small tweaks that don’t change the meaning of the person who wrote or spoke the words.

However, purists would say that you should reproduce written materials word for word or note changes, for example, by inserting ellipsis (…) to show where you’ve deleted even one word. “Quotations must be identical to the original, using a narrow segment of the source. They must match the source document word for word and must be attributed to the original author,” says the Purdue Online Writing Lab.

People also agree that you can’t make radical changes and still call something a quote. Here’s a before-and-after example where no one would call the “after” a quote. This example originally appeared in “Seven Ways to Talk Your Financial Execs Out of Jargon and Bad Writing, ” my guest post on MarketingProfs (registration required):

BEFORE:

Proposals from the German/French axis in the last few days have heartened risk markets under the assumption that fiscal union anchored by a smaller number of less debt-laden core countries will finally allow the ECB to cap yields in Italy and Spain and encourage private investors to once again reengage Euroland bond markets. To do so, the ECB would have to affirm its intent via language or stepped up daily purchases of peripheral debt on the order of five billion Euros or more. The next few days or weeks will shed more light on the possibility, but bondholders have imposed a “no trust zone” on policymaker flyovers recently. Any plan that involves an “all-in” commitment from the ECB will require a strong hand indeed.

AFTER:

Prices of riskier investments rose in response to recent proposals by German and French leaders, but we are skeptical that this will continue. Investors seem to believe that the proposals will strengthen the euro zone by capping bond yields. This would make euro-zone bonds more attractive to private investors. However, success would require the European Central Bank (ECB) to use strong language or to boost its daily purchases of the troubled countries’ debt by at least €5 billion. To convince distrustful investors will require strong action. That may be more than the ECB can achieve.

Things get murky in the middle ground between tiny tweaks and massive rewrites. Many of my writer friends say that it’s fine to smooth out quotes when your interviewees express themselves poorly in a live interview. However, reporters have gotten into trouble for taking this too far. Have you noticed how some question-and answer stories now come with disclaimers? For example, the “Talk” column in the magazine section of The New York Times says, “Interview has been condensed and edited.”

Edits are particularly risky when the editors don’t know the topic well. They may unwittingly change the speaker’s meaning.

Edits are less risky when they will be checked for accuracy by the speaker or author. This tends to happen more when a company interviews or uses source materials from an employee.

Quote fix 2. Paraphrase the quotes

Paraphrasing is an underutilized tool, in my opinion. Paraphrasing means taking the words of the speaker or author and summarizing or rewording them without quotation marks, but still attributing them to the source. This is a great way to streamline sentences so they focus on the expert’s main message.

I’ve seen too many writers string together quotes to form an article. These articles are held hostage by their experts’ wording. As a result, they often lack the connective tissue that makes an article flow well.

Quote fix 3. Delete the quotes

Some information doesn’t deserve quotation marks and a source. Do you need a sentence along the lines of ” ‘There are 50 states in the United States of America,’ says Jane Doe”?

You can share common knowledge without attributing it to anyone.

What’s YOUR take on fixing quotes?

I’m always interested in what you think about the writing questions that I pose on this blog. Please chime in.

Image courtesy of kibsri/FreeDigitalPhotos.net

The post 3 fixes for lousy quotes in your financial writing appeared first on Susan Weiner's Blog on Investment Writing.

August 2, 2016

7 ways Compliance can work with investment writers for their mutual success

Compliance officers for investment management firms want their employers to market themselves successfully. After all, the lack of sales could kill the company. However, they also want their firms to stay safe from legal and regulatory threats. Marketing and compliance professionals sometimes clash. But they don’t have to. The two areas can work together so that both sides achieve their goals. I’ve observed some best practices from my years on staff—and as a freelancer—at asset management firms. Compliance officers, consider the following techniques as you seek the best possible outcomes for the companies you serve. Your firm’s investment marketing compliance and its marketing will benefit.

One of the most useful things you can do is to educate members of the marketing department. Help them to understand what’s forbidden outright, where there’s room for negotiation, and what’s indisputably acceptable. Let them know how to work most effectively with you, in terms of issues such as turnaround time and when to involve you in projects. After you teach them, you’ll have fewer headaches. Writers can’t avoid investment marketing compliance mistakes that they don’t understand.

This piece incorporates feedback from three compliance professionals who generously gave me feedback on it. A fourth pro responded to my initial draft with, “It’s perfect. Good information…great piece!!!”

1. Train employees in investment marketing compliance

If you’re a compliance officer for an investment management firm, you know the most common mistakes that marketers make. They’re things like over-promising what the firm’s investments can deliver or failing to use the proper disclosures. If your firm has the resources, create a course that trains writers in investment marketing compliance as it relates to communications. Your firm already offers some sort of compliance training so it should be simple to add a communications unit.

Firms that I’ve freelanced for have conducted training in different ways. A very large firm offered automated online training to its writers. A smaller firm simply put me on a phone call with a compliance officer.

Compliance consultant Nancy Lininger of The Consortium suggests the following:

Compliance officers should provide the writers with the outline of the 5 advertising rules under the Investment Advisers Act as a handy reference:

1. Testimonials are prohibited.

2. Past specific recommendations must include multiple disclosures.

3. Graphs, charts, formulas, or other devices must disclose limitations and difficulties with respect to its use.

4. Statements of free services must actually be free without conditions.

5. The Act contains a general anti-fraud prohibition, “which contains any untrue statement of a material fact, or which is otherwise false or misleading.”

She says, “Whatever the SEC does not like and cannot pin to a specific rule, they will peg to #5 as ‘otherwise false or misleading.’ ”

Wayne Holbrook, chief operating officer and chief compliance officer, Cornerstone Investment Partners, offered suggestions for topics to cover in training or in one-on-one discussions with writers. “I have my regular topics to check for: past specific recommendations, guarantees, sourcing of all data, proper GIPS performance disclosures and then disclose, disclose disclose. For me, whenever in doubt, add a disclosure.”

He also recommends asking writers, “Who is your audience?” He says, “From there it has been easier to train folks that different audiences have different rules,” referring to differences in how one can communicate with current clients vs. institutional investors vs. retail investors.

2. Link to regulatory resources

Written resources can help to educate your firm’s writers in best practices for investment marketing compliance. A starting point might be to provide links to relevant publications from regulators. These may include SEC publications, such as Investment Adviser Use of Social Media, or from FINRA or state securities regulators. FINRA tends to issue more explicit guidelines than the SEC. Third parties, such as law firms or compliance consultants may also publish useful resources.

Holbrook says that no one wants to read regulations. I don’t either. But sometimes you run into writers who seek back-up for your opinions. They don’t believe you without documentation. Pointing them to the regulations can help. However, my suggestion #3 may prove more informative for your writers.

3. Interpret the regulators’ rules in writing

Regulators’ publications can be difficult to interpret. After all, that’s partly why you play such an important role in your company. If you sometimes struggle to understand the regulators’ intent, imagine how much harder it is for writers to understand investment marketing compliance regulations.

As a writer, I’d like to see specific examples of what is—or is not—acceptable, with an explanation of why. You might create a table with three columns:

Example

What’s wrong with the example—and why

A rewritten example that works—and why

You might divide your document by topic. For example, assets under management, disclosures, documentation, links to external sites, performance, or record-keeping.

I wish someone had created a document like this for me when I worked as a staff writer. However, as I learned new tips, I recorded them for the future. I became a big user of hedging terms, such as “we believe.” I squirreled away disclosures that could be updated when I couldn’t avoid mentioning a mutual fund. I also learned to note the source and date of any third-party information that I used.

Speaking of hedging, Lininger says,

Most marketers/writers do not want to use hedging words. They believe the most impact is made with bold statements such as, “You will be able to retire in style by following our advice.” That would be promissory language that would be false and misleading. In addition to getting you in trouble with the regulators, you have given yourself a noose to hang on in court when a client sues. I believe with the right choice of words, you can appropriately hedge (thus protecting the firm and the advisor) while still making a marketing impact. A rewrite might look like this, “Our goal is to lead you to retiring in style by balancing your stated risk/reward objectives.”

By the way, the Holbrook says, “I really liked your idea about creating a table in #3. I am going to try to create one for my firm.” That comment made my day.

4. Provide feedback—in writing and face to face

Training and written materials can’t prepare you or your firm’s writers for every situation. This makes your feedback essential. You can help your writers grasp the nuances of broad rules for investment management compliance.

When content raises compliance issues, suggest ways to rewrite it—including adding disclosures—to make it acceptable. If you delete content as too objectionable, say why.

A compliance officer who asked to remain unnamed says, “Work with writers to find a way to say, ‘yes.’ Sometimes it may require the compliance officer to answer the question of ‘Is this truly non-compliant or just something that hasn’t been done before?’ and then think through the communication rules.”

Sometimes it makes sense to meet face to face with the writers. A back-and-forth conversation can clear up misunderstandings faster than a chain of emails. Holbrook says, “I try to sit down with the writers to go over the material face to face rather than through emails. It is easier for me to tell if someone is understanding what I am correcting when we can discuss it at length.” I like his point about watching the writer’s face to see if they grasp his message.

5. Distinguish between comments on compliance vs. on style

I know some compliance officers who are fine editors and proofreaders. I’ve benefited from their feedback.

However, please be clear if what you’re suggesting is a stylistic suggestion rather than a compliance necessity. There can be legitimate differences about style.

6. Manage expectations for turnaround times

You can almost never complete your compliance review fast enough to make the writers happy. However, you can ease the tension by managing writers’ expectations about the speed of your review.

Provide guidelines about how long it will generally take you to review documents. Your guidelines may vary according to the length, timing, or complexity of the document submitted for review.

7. Tell writers how to work with you

Make your job easier by telling writers how to work better with you.

For example, on a project such as a brochure or a web page for a new product, you may wish to see a first draft so you can flag issues early on. It’s frustrating for everyone if the text gets approved all the way up the corporate hierarchy only to be shot down by compliance. An early intervention could have directed everyone’s energy more productively.

Make writers aware of back-up documentation, if any, that you’d like them to submit as part of the review process. Of course, writers also need to know what to keep to satisfy record-keeping requirements.

YOUR suggestions?

What are your suggestions for how compliance professionals and writers can work together more productively on investment marketing compliance? As the unnamed compliance professional says, “We sometimes get a bad rap as ‘Sales Killers,’ but the best understand the need to market to potential new clients (and make sales) AND the need to be compliant!” Your suggestions can help compliance professionals and writers to balance these goals.

‘Image courtesy of Stuart Miles/FreeDigitalPhotos.net

The post 7 ways Compliance can work with investment writers for their mutual success appeared first on Susan Weiner's Blog on Investment Writing.

July 26, 2016

6 ways financial advisors can differentiate themselves

It’s difficult for financial advisors to differentiate themselves. Whether you’re a financial planner, wealth manager, or investment advisor, what you offer has a lot in common with your peers’ offerings. Saying that your service and offerings are exceptional won’t convince prospects of that fact. Advantages that might have set you apart 10 years ago, no longer work. You must dig deeper.

How can you stand out? Ask yourself the questions below to start your research.

1. Process

What is your process for bringing on and helping new clients? Does it aim to fit clients into a standard set of products, or are offerings tailored to the clients after you learn about their needs?

What is your process for bringing on and helping new clients? Does it aim to fit clients into a standard set of products, or are offerings tailored to the clients after you learn about their needs?

Differentiation questions:

What is your process? How do you assess clients’ needs and desires?

In your process, do you ask questions that drive home how you help clients? For example, you may ask an unconventional question about clients’ values, goals, or worries.

What concern for clients drives your process? Are you passionate about something specific?

How does your process allow you to deliver what your clients need?

What results has this process achieved for your clients? In other words, what problems does your process solve for clients?

Do you manage money yourself, use a third-party asset management firm, or avoid dealing with investments? If you invest, do you use funds, standard portfolios, or do you customize?

Do you have access to products or services that are difficult to access?

2. Target clients

You can’t serve all types of clients equally well. Also, an advisor who tries to attract all clients, connects deeply with none. Specialization is essential.

Advisors slice their target audiences in many ways. For example, level of wealth, age, financial goal, industry, or employer. When you’re focused, your prospects will feel more comfort that they’re with the right advisor.

If you’ve been in business awhile, consider conducting a survey about why your clients like doing business with you. You could do this informally, by asking questions in meetings. You might get more honest answers if you ask in an impersonal way. For example, you could run an anonymous online survey using a tool such as SurveyMonkey or you could hire a marketing firm to interview your clients.

Differentiation questions:

What kind of clients do you focus on? Who do you avoid?

Why do you feel passionately about your target group?

What client problems are you most successful in solving? The answer to this question matters a lot to your clients and prospects.

What kind of successes have you achieved with clients in your target audience? By the way, consider sharing case studies to illustrate successes, if your compliance officers allow them.

3. Service

You can’t simply say “We offer great service.” Back up your statement with specifics.

Differentiation questions:

How accessible are you to clients? Must they wait a week or longer for a response from you, or are you more accessible?

Do you spell out your commitment to clients in a service-level agreement?

Do you make it easy for your clients to hold up their end of the relationship by providing a written summary of key decisions and their next steps after your meetings?

4. Client communications

How do you communicate with your clients? At one extreme, do you figure that your clients’ statements from their custodians give them all the information they need? That’s not enough for many clients. Plus, it gives you no chance to show your expertise and concern for your clients.

At another extreme, do you call clients whenever the market is volatile, post updates on your blog, send regular newsletters, and schedule quarterly face-to-face meetings? If you focus on your individual clients’ concerns, tailoring your content to their needs, they will feel your concern and see your expertise. On the other hand, some clients may feel suffocated. When I worked on staff for an asset management firm, we had clients who essentially said, “Don’t bother me for more than an annual meeting.”

Differentiation questions:

What communications do you provide?

Are your communications segmented to appeal to your clients’ needs and personalities?

How frequent are your communications?

What media do you use to communicate—print, email, online, phone, text, social media?

What’s your communication style? For example, do you present yourself as an authority who must be obeyed or are you more of a collaborator?

Are your communications written in a way that’s compelling, clear, and concise—or will your clients struggle to figure out what the heck you mean?

5. Credentials and training

Your education counts. Academic and on-the-job training enable you to help clients make progress on their financial goals. Of course, as others have said, basic training is the price of admission to this industry.

Differentiation questions:

What’s your academic training?

What credentials do you hold? What do they mean for your clients? The average person on the street has no idea, for example, what the CFA credential stands for.

Do you invest in ongoing professional development?

What are your specialties, if any?

6. Personal history and personality

Nobody has the same personality or history as you. Capitalize on this by being yourself as you market your firm. I like what advisor Tim Maurer says about selling his golf clubs in “Financial Advisors: Differentiate Yourself By Being Yourself“:

It signaled an official decision to permit myself to be something other than what I had come to believe the financial industry wanted me to be. I was officially granting myself permission to be myself.

Since making that decisions, Maurer has followed his instincts in other ways. It seems to have worked well for him.

Differentiation questions:

Why are you in this business? Did a personal experience inspire you?

What are you passionate about?

What are your hobbies, and what do they say about you?

What are your strongly held values?

Are you active in your community?

Image courtesy of Sira Anamwong/FreeDigitalPhotos.net

The post 6 ways financial advisors can differentiate themselves appeared first on Susan Weiner's Blog on Investment Writing.

July 21, 2016

Top posts from the second quarter of 2016

Check out my top posts from the last quarter!

They’re a mix of practical tips on investment commentary (#1, 2, 4), white papers (#5), writing (#8), blogging (#6), marketing (#3, 7), social media (#9), and email (#10).

Who are the fixed-income commentary winners–and why?—I’d like to send a big “thank you” to all of the savvy fixed-income and other investment professionals who answered my survey

Fonts: By the numbers—a guest contribution by @JoyceWalsh13

Who’s writing the great investment content?

5 rules for using quotes in investment commentary—a guest contribution by @RobertMartorana

Financial white paper writers who say “yes”

Naming your financial blog–Is it necessary?

Stop saying “Click here”!

Style guidelines for financial services firms

I’m no extrovert, but I play one on social media and so can you—if you’re an introvert, this may resonate with you

Email and the mystery of the missing agreement

The post Top posts from the second quarter of 2016 appeared first on Susan Weiner's Blog on Investment Writing.

July 19, 2016

Stop being happy–and win more readers

Does the following sentence inspire you to dig into the writer’s newsletter?

The XYZ Financial team and I are happy to bring you this month’s newsletter.

It doesn’t inspire me. I doubt it inspires you. However, I often see financial professionals start their emails, letters, and newsletters with similar sentences. If they’re not “happy,” they’re “pleased,” “delighted” or something similar. This is so wrong. Stop being happy!

Why to stop being happy

Please stop talking about how great your content makes YOU feel.

Please stop talking about how great your content makes YOU feel.

Unless you’re writing to close family members or friends, no one cares about your emotions. They care about WIIFM—what’s in it for me, your reader. When you talk about your happiness you sacrifice the opportunity to appeal to their WIIFM.

In addition, focusing on YOUR emotions may make you seem self-centered or self-important. It’s as if you’re saying, “We are great. Bow down at our feet and worship us.” Okay, I’m exaggerating. Still, I hope you get the idea that I’m trying to communicate.

Your alternative to being happy

How else can a writer open their message? Start with something that solves a problem that your reader has. This will appeal to their WIIFM.

For example:

Curious about how the new tax law affects you? Avoid problems with the IRS by learning about the three things you may need to do differently, as covered in this month’s newsletter.

In addition to focusing on the reader’s WIIFM, this new introduction also gets to the point quickly. That’s essential to grabbing the attention of readers whose email inboxes are overcrowded.

Not sure how to identify your unhappy topic?

If you have trouble identifying your readers’ problems, read “Identifying ‘WHAT PROBLEM does this blog post solve for them?’” The same issues apply to blogs and newsletters. In fact, today’s newsletter articles often originate as blog posts.

Stop being happy and start attracting more readers and clients!

Image courtesy of stockimages/FreeDigitalPhotos.net

The post Stop being happy–and win more readers appeared first on Susan Weiner's Blog on Investment Writing.

July 12, 2016

“Deep Work” rules to help you write more

Many people struggle to write as much as they’d like. This is especially true if the writing isn’t a core part of your job. I found some rules that may help you when I read Deep Work: Rules for Focused Success in a Distracted World by Cal Newport.

What is “deep work”?

Here’s how the author defines “deep work”:

Here’s how the author defines “deep work”:

Professional activities performed in a state of distraction-free concentration that push your cognitive capabilities to their limit. These efforts create new value, improve your skills, and are hard to replicate.

It’s clear to me that writers will benefit from this kind of concentration. How do you achieve it? One way is to develop rituals that signal to you that it’s time to focus.

I suggest that you create rules to answer the questions that Newport says must be addressed by an effective deep work ritual.

Rule 1. Pick a location for your deep work

Newport asks you to pick a location for your deep work. As he says, “If it’s possible to identify a location used only for depth—for instance, a conference room or quiet library—the positive effect can be even greater.” But you might be able to get away with working in your usual work place if you can set other rules to help you focus.

I think that being in a different location is one reason why I’ve been so successful with blogging on vacation, as I discussed in “No batteries required: My favorite blogging technique.” When I’m not on vacation, I do most of my blog post writing either on steno pads, which I can use anywhere, or at my PC, which plunks me down in my office.

Rule 2. Pick a length of time for your deep work

“…give yourself a specific time frame to keep the session a discrete challenge and not an open-ended slog,” says Newport.

I have tried a variation on this by committing to work for a minimum of 15 minutes, as I discussed in “15 minutes to busting your writer’s block.” I haven’t tried putting a limit on how long I can work. That simply hasn’t been a problem for me. However, I can see how it would help some people to know that they need not continue working beyond their predetermined limit.

Rule 3. Limit distractions during your deep work

For example, this could mean closing email and blocking social media during your deep work.

Rule 4. Support yourself

Newport says this could mean you “start with a good cup of coffee.” It also means creating an environment that supports your work by keeping necessary supplies handy. Newport says, “…this support needs to be systematized so that you don’t waste mental energy figuring out what you need in the moment.”

I love Newport’s line about “…don’t waste mental energy figuring out what you need in the moment.” I think that’s one of the biggest benefits of any rituals or systems that help you to write.

For me, the support for my blogging means having a handy list of potential blog post topics so I never have to start from scratch.

For some writers, it might mean always starting from the most recent stopping point in your work, as I discussed in “Break your writer’s block with Robert Benson and Eric Maisel.”

What rules help you to do deep work?

If you’re achieving deep work, what rules work for you?

Disclosure: If you click on the Amazon link in this post and then buy something, I may receive a small commission. I only link to books in which I find some value for my blog’s readers.

The post “Deep Work” rules to help you write more appeared first on Susan Weiner's Blog on Investment Writing.