V.L. Thompson's Blog, page 20

September 13, 2013

Can You Be Generous and Still Pay the Bills?

Article from relevantmagazine.com by Tyler Ward

I understand how unappealing it can be to financially give.

Most days, the anxiety-free lifestyle that a healthy savings account provides can be far more enticing than writing a check for a child’s education in Myanmar. However, could there be other benefits to generosity, besides the satisfaction of imagining a kid on the other side of the world going to school every day?

I spent 2012 putting this question to the test.

For the first six months of the year, my wife and I only gave away a small percentage of our income. A need would arise, so we would give, but it was always unintentional. For the last six months of 2012, we intentionally put 8-15 percent of our paychecks into a special bank account. The money in this account was then, over time, given to needs, causes, churches or an occasional act of kindness throughout the month.

With the help of a personal-finance-tracking app, I was able to monitor the amount of money we gave away in proportion to the unexpected income we received over the 12-month-period of time. Unexpected income was considered to be anything beyond my base income (which stayed fairly consistent), including special projects, random gifts or work bonuses.

The results built a jaw-dropping case for generosity.

1. It is six times better to give than to receive.

I had to compute and recompute the math several times before I believed the numbers. But, when Analee and I intentionally gave over the last six months of the year, our return on investment (for lack of a better phrase) was 610 percent. This means for every $1 we gave away in a six month period of time, an average of $6.10 of unexpected income came back to us.

Please understand, I’m not building a case for some sort of prosperity gospel. God isn’t obligated to pay me back for the times I give. I am only telling you what I personally experienced and informing you that the biblical adage about how it is “better to give than receive” has proven to be very literally true in my life. The numbers my wife and I calculated draw a perplexing, but beautiful conclusion about giving.

2. We didn’t starve when we didn’t financially give.

While it’s true that we saw a lot of benefits to generosity, another intriguing discovery to me during this experiment was that when we didn’t financially give, we didn’t suffer.

Over the first 6 months of 2012, we unintentionally gave away a little over 2 percent of our base income. And even then, for every $1 we gave, we received $3.40 of random and unexpected income.

Read entire article on relevantmagazine.com

The post Can You Be Generous and Still Pay the Bills? is one of many from experts around the net. Read other interesting posts herethey are an awesome expert from the site listed above

Seven Tips for Shifting a Mindset in Your Organization

Article from blog.hbr.org by John Butman

We’re all fascinated by new ideas and how they can grab hold of us, influencing how we think and affecting how we take action. How does Atul Gawande (the checklist doctor) get inside my head, when others don’t? Why does Gwyneth Paltrow make me adjust my behaviors, when others can’t?

In business, especially, we’re inundated with new ideas—so many we can hardly process or evaluate them.

If you have tried introducing a new idea into your organization or community—especially if it’s an abstract idea like sustainability, diversity, or innovativeness—you know it’s tough. People may ignore your idea, pooh-pooh it, or just steal it. You put your energy, your reputation, and maybe your future, on the line.

Still, when you have an idea you think is valuable and could change things for the better, some inexplicable force may compel you to “go public” with it. You want to change a prevailing mindset and you’re willing to stick your neck out, at least a little, to do it.

The question is how, especially when you’re not Gawande or Paltrow, to change an organization from the inside when you don’t necessarily have a ton of formal authority on your side.

Take a look at what the “idea entrepreneur” does. This is the new type of cultural player—idea-driven people like Gawande and Paltrow, Michael Pollan (food), Cesar Millan (dogs), Blake Mycoskie (business = philanthropy), and many others—who reach large audiences and gain widespread influence.

These are independent operators. They’re wealthy and famous. They publish books and appear on TV. But do their methods of idea-spreading apply to the office-dweller, the organizational citizen, the manager or executive? The answer is yes, with some modifications.

These are independent operators. They’re wealthy and famous. They publish books and appear on TV. But do their methods of idea-spreading apply to the office-dweller, the organizational citizen, the manager or executive? The answer is yes, with some modifications.

To illustrate, let me introduce Samantha Joseph, who works for Iron Mountain Incorporated, a leader in records storage and information management services. Sam is young, ambitious, and idea-driven: she believes that for-profit companies can drive significant business value when they take a strategic approach to social and environmental sustainability. After earning her MBA from MIT in 2009, Sam could not find a position in sustainability, so she joined Iron Mountain as a manager in strategy, knowing the company had no sustainability function and hoping to build it.

Sam saw opportunity. She plunged into the strategy job, but also began to work on bringing the idea of sustainability to Iron Mountain—an exciting if daunting task, considering the number of employees, locations, facilities, trucks, and other real assets involved.

Here are some of the things that big-time idea entrepreneurs do that Sam adapted for her quest:

Accumulate evidence

To gain influence for an idea, you need an awful lot of supporting material—data, references, cases, stories, and analysis—which can take decades to gather. Sam didn’t have that long, but she did accumulate enough material to make her the “resident expert.” It took her a year to develop her case—largely on her own time—before she started talking about sustainability in public. But she was talking privately with lots of people all the while: gathering opinions, refining the ideas and practices, making connections and gaining supporters.

Develop practices

An idea is an abstraction that won’t produce change until you provide people with specific, practical ways to put it into everyday use. Cesar Millan’s ideas get their teeth from his training methods of “calm assertiveness.” Sam worked with colleagues from across Iron Mountain to develop a volunteer program, a solar energy pilot, and a strategic charitable partnership—which got people doing sustainability without having to pledge allegiance to a theory first.

Create a sacred expression

Practices without theory are nothing more than tips and techniques. You need to find your best form and use it to create a “sacred” expression—a talk, a video, a written piece, a visual—the most complete, authoritative, and compelling articulation of your idea that you can manage. Sam put together a short video that made the case, showed how Iron Mountain was involved with the community, and got people energized and emotionally engaged.

Encourage “respiration” around your idea

Sam did not expect to do a TED talk or appear on Colbert, but she needed to engage with the audiences who would be most affected by, and most able to implement, the sustainability idea. The only way to get an idea breathing on its own is to show up, in person. Sam put together a road-show and visited many of Iron Mountain’s corporate departments and facilities, conversing and responding to questions. After she left, people kept talking. The idea started to come to life.

Read entire article on blog.hbr.org

The post Seven Tips for Shifting a Mindset in Your Organization is one of many from experts around the net. Read other interesting posts herethey are an awesome expert from the site listed above

September 9, 2013

The Christian Entrepreneur’s Outlook

Have you ever felt a nudge toward business ownership, but are unsure about how successful you can be? Do you secretly dream of leaving your job to pursue a great idea but pressures around you warn you about the possibility of failure? This episode of Promote Smart encourages those who are thinking about, or are already engaged in business ownership to strengthen their business efforts with faith and trust in Jesus Christ.

The post The Christian Entrepreneur’s Outlook is one of many from experts around the net. Read other interesting posts hereceo

September 5, 2013

Payment Process Rules for Freelancers: Set a Deadline

Previously we visited the practice of asking for deposits upfront when dealing with your clients. Next, we’re going to talk about payment deadlines.

Previously we visited the practice of asking for deposits upfront when dealing with your clients. Next, we’re going to talk about payment deadlines.

I’m preaching to myself with this post because I still have outstanding payments from clients that should have been collected by now. I think every freelancer does. But what we need to focus on is not just how long you will give the client to pay but what clients will walk away with before payment and what will happen if they don’t pay at all.

When we discuss deposit, we want to think of it in terms as the starting “shot” in your race to finish the project. The client shouldn’t receive any design work, not one peek before you have money in your hands. When you go to purchase a car, they don’t give it to you to take home with the promise of pay. When you go to purchase a house, they don’t let you go from touring the place to moving in with no money upfront. So why should it be any different with your services? The deposit is the client’s investment into the project. Yes, you’re doing the work, but if for some reason the client changes their mind (for reasons that have nothing to do with you) you shouldn’t be left out in the cold because you did the work you were hired to do.

When moving on into deadline for final payment, we must also discuss it in similar terms. The client should not have any final designs in their hand before you have payment. Not a final email, not a design on disc, not the printed product, nothing. Whoever holds the artwork holds the power. They can’t use the logo design without paying if they don’t have it. Make a deadline for payment that is conducive to your monthly budget and financial needs. If you know that a certain project can take four weeks from initial consultation to completion of payment, you might not have that long to wait. Maybe you should make your payment deadline seven days instead of 10 or 15. Whatever your preferences, make it the same for everyone and enforce it, which brings me to my next point.

There must be a collections time limit and a consequence when that limit is reached. After your client has missed their seven-day deadline and their three-day grace period, don’t be afraid to suspend the project. Clearly state the reason for suspension, reiterate your company’s guidelines on client payment and let them know the instructions to make payment in the future if they choose to do so. Do not go months and months on end begging people to pay you. Your time and effort are too valuable to waste and setting a standard of professionalism and stake in you and your company’s belief system will show future clients that if they want to do business with you, they must do it in just as professional a manner as you do.

Is Ambition Unbiblical?

Jack Zavada of Inspiration-for-Singles.com continues his series of teachings for Christian men only by asking the question, “Is Ambition Unbiblical?” He encourages Christian men to take a moment to consider the worthiness of their ambitions. In light of eternity, what pursuits will bring the greatest rewards?

For Men Only – Is Ambition Unbiblical?

Every man has a competitive nature, and Christian men are no different.

But as we strive to fulfill our ambitions, are we doing something that’s contrary to God’s law?

Is ambition, especially in our career, unbiblical? Jesus addressed the dilemma Christian men face today:

“No servant can serve two masters. Either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve both God and money.” (Luke 16:13 NIV).

His warning sounds pretty clear. We may not despise God because of our job, but it’s dangerously easy to grow cold toward Him.

Let’s face facts. Everything costs money, from the necessities of life to the luxuries we all enjoy, and we get that money by working for it. Typically, the harder you work or the more hours you put in, the more money you make.

If you have children, you want to provide them with everything you can, from dental braces to a college education. In between are toys, clothing, computers, electronic gadgets, vacations, and everything else that makes life more enjoyable.

Along the way, if we excel at what we do, we get promoted, gain an impressive title, and earn respect by being someone important. And yet if we’re not extremely careful, our career can crowd God right out of our life.

It’s no coincidence that most of the men who are actively involved in their church are retired. When they were working, they were either at work during the day or resting at home in the evening so they’d have enough energy to get up the next morning and do it all again.

So where do we draw the line with our ambition? Must we choose between God and money? Can’t we have both?

All God, All the Time

If you’re a Christian, you never truly separate God and work. Just because you’re on the clock doesn’t mean you can’t pray, praise and worship God throughout the day. This kind of constant communication should be secret because its purpose is not to impress others. It’s to acknowledge that God is the true master in your life, not your job.

The man who remembers God throughout the work day is not only more productive, but he also enjoys his work more since he puts it into an eternal context. Serving coworkers and customers becomes not a nuisance but rather a privilege.

Certainly God’s laws should govern our conduct at work as well. If your job requires that you consistently violate biblical principles of honesty and fairness, it’s time to look for a new place to work. How seriously you take that obligation shows who is truly your master.

Your job should not consume so much of your time that you’re unable to attend church services. In the 35 years that my father worked rotating shifts in a glass bottle factory (days, afternoons, nights), he always went to church on Sunday, even if he had to go early in the morning after working all night.

Heavenly Things Now

Material goods can be seductive—a flashy car, large house, even exotic vacations—but if we covet those status symbols, it’s a warning signal that we’re serving money instead of God.

We need to spend more time on our spiritual growth than on the growth of our investment portfolio. Our relationship with Jesus Christ should come before our relationship with our stock broker.

Regular Bible study brings God’s timeless truths into your life in the here and now. Business fads come and go, but this source of wisdom is always reliable. A power lunch with the wealthiest executive in the world pales in comparison to personal guidance from the Creator of the Universe, found in his Word.

If, as Christian men, we have our priorities straight, we’ll be able to earn a good living while living a good life. In today’s uncertain economy, it’s rare to work at one company until your retirement, but as a believer, you’re guaranteed a place with Christ for all eternity. That truth alone should put things into the proper perspective.

Read entire article on christianity.about.com

The post Is Ambition Unbiblical? is one of many from experts around the net. Read other interesting posts herethey are an awesome expert from the site listed above

Is Ambition Unbiblical

For Men Only – Is Ambition Unbiblical?

Every man has a competitive nature, and Christian men are no different.

But as we strive to fulfill our ambitions, are we doing something that’s contrary to God’s law?

Is ambition, especially in our career, unbiblical? Jesus addressed the dilemma Christian men face today:

“No servant can serve two masters. Either he will hate the one and love the other, or he will be devoted to the one and despise the other. You cannot serve both God and money.” (Luke 16:13 NIV).

His warning sounds pretty clear. We may not despise God because of our job, but it’s dangerously easy to grow cold toward Him.

Let’s face facts. Everything costs money, from the necessities of life to the luxuries we all enjoy, and we get that money by working for it. Typically, the harder you work or the more hours you put in, the more money you make.

If you have children, you want to provide them with everything you can, from dental braces to a college education. In between are toys, clothing, computers, electronic gadgets, vacations, and everything else that makes life more enjoyable.

Along the way, if we excel at what we do, we get promoted, gain an impressive title, and earn respect by being someone important. And yet if we’re not extremely careful, our career can crowd God right out of our life.

It’s no coincidence that most of the men who are actively involved in their church are retired. When they were working, they were either at work during the day or resting at home in the evening so they’d have enough energy to get up the next morning and do it all again.

So where do we draw the line with our ambition? Must we choose between God and money? Can’t we have both?

All God, All the Time

If you’re a Christian, you never truly separate God and work. Just because you’re on the clock doesn’t mean you can’t pray, praise and worship God throughout the day. This kind of constant communication should be secret because its purpose is not to impress others. It’s to acknowledge that God is the true master in your life, not your job.

The man who remembers God throughout the work day is not only more productive, but he also enjoys his work more since he puts it into an eternal context. Serving coworkers and customers becomes not a nuisance but rather a privilege.

Certainly God’s laws should govern our conduct at work as well. If your job requires that you consistently violate biblical principles of honesty and fairness, it’s time to look for a new place to work. How seriously you take that obligation shows who is truly your master.

Your job should not consume so much of your time that you’re unable to attend church services. In the 35 years that my father worked rotating shifts in a glass bottle factory (days, afternoons, nights), he always went to church on Sunday, even if he had to go early in the morning after working all night.

Heavenly Things Now

Material goods can be seductive—a flashy car, large house, even exotic vacations—but if we covet those status symbols, it’s a warning signal that we’re serving money instead of God.

We need to spend more time on our spiritual growth than on the growth of our investment portfolio. Our relationship with Jesus Christ should come before our relationship with our stock broker.

Regular Bible study brings God’s timeless truths into your life in the here and now. Business fads come and go, but this source of wisdom is always reliable. A power lunch with the wealthiest executive in the world pales in comparison to personal guidance from the Creator of the Universe, found in his Word.

If, as Christian men, we have our priorities straight, we’ll be able to earn a good living while living a good life. In today’s uncertain economy, it’s rare to work at one company until your retirement, but as a believer, you’re guaranteed a place with Christ for all eternity. That truth alone should put things into the proper perspective.

Read More…

How to Cut Costs When Hitting Rough Financial Spots

We all worry about money sometimes, especially when running our own small businesses. Your bank account can run low, creditors can start to call, and pretty soon your financial worries can seem to take over your creative flow. Take it from me, I’ve been there, and it is not a happy place to be. But one thing I’ve learned is that a lot of the time, I seemed to be wasting money that could have easily been spent on bills. Looking over past receipts and purchases, I noticed that there were plenty of opportunities to save my money or use it to build my business instead of my debt. Don’t let the same thing happen to you.

We all worry about money sometimes, especially when running our own small businesses. Your bank account can run low, creditors can start to call, and pretty soon your financial worries can seem to take over your creative flow. Take it from me, I’ve been there, and it is not a happy place to be. But one thing I’ve learned is that a lot of the time, I seemed to be wasting money that could have easily been spent on bills. Looking over past receipts and purchases, I noticed that there were plenty of opportunities to save my money or use it to build my business instead of my debt. Don’t let the same thing happen to you.

Here are some great ways to save money when hitting financial rough spots.

Keep energy costs low

Wasted electricity is probably one of the biggest money zappers that you can encounter. Since we were kids, we’ve left the lights on, stood in front of the refrigerator too long and evened out the air conditioning by turning on the heat. But these are habits that can cut deep into your wallet if your not careful. Turn off computer and lights when you’re not using them. Instead of going right to the thermostat, grab a blanket in the winter, or go out to Starbucks and work offsite in the air conditioning during the summer. Your electric bill will thank you.

Take a break from cable TV

Don’t kill me for this one because I’m a TV junkie myself. But sometimes your financial situation may cause you to cut back on “luxury” items that can and should be removed to save money, even if it’s only temporary. Cable TV might just be one of those luxuries, but don’t fret: The Internet has you covered. With such Web sites as Hulu.com, you can watch regular TV right from your computer, eliminating the need for cable TV. Keep in mind that most of these programs run a week behind, but most major networks allow viewers to watch online feeds of the hottest shows as early as the day after they air on cable.

Have a yard sale

Instead of moving around the unused items in your home, have a yard sale to get some extra cash. Old electronics, clothing, kitchen items and home accents can all attract your neighbors or people in town who hunt for bargains. Your local newspaper often has a section where you can list your yard sale, and you can also post up flyers in your neighborhood.

Cook at home instead of eating out

Big ticket item = restaurants. If there is one thing I love more than cable TV, it’s food! But eating out every night or even every weekend can get pricey. Paying for an extra value meal here and there can add up to hundreds of wasted dollars every month. Try going to the grocery store at least twice a month and stock up on items that will last. Collect your favorite recipes and start a potluck club with your friends where you all bring a dish and rotate houses.

Lose the gym membership and go outside

Staying fit is important, but sometimes the gym can get a little expensive. Paying money to run inside might make sense when the cash is rolling in, but when you’re scraping the bottom of the barrel, the park might be more fitting. Take your bike and hit the trail or grab your iPod and go for a walk around the block.

Thrift stores instead of retail

One of my favorite things to do is go thrifting. Find your local thrift stores and check them out. Some people might be turned off by the fact that the items sold are used, but just imagine what you might give away. Your closet is probably filled with lots of stuff that is still in great condition but is too small. I always purchase items from the thrift store that still have the hang tags on them!

Drive slower

We all hear about actions that may or may not waste gas. Running the air conditioner as opposed to rolling the windows down is still debatable, but one thing that we know wastes gas is going faster instead of slower. I’m a speed demon myself, but going the speed limit will not only keep you off the police radar – it will keep that gas in your tank just a little bit longer.

Check your bank account regularly

I hate bank fees! Can I repeat that? I hate bank fees! Just had to get that out. Sometimes checks from employees could bounce, or your account doesn’t balance. ATM fees can sometimes go undetected and you could forget about them. Checking your account regularly can help you to detect charges that are incorrect or allow you to see where you could make transactions differently to avoid them.

Shopify Debuts Fully Integrated Credit Card Payment Processing For Its E-Commerce Platform

Article from techcrunch.com by Darrell Etherington

Canadian startup and Ottawa-based company Shopify announced a big change to its business model today, with the integration of Shopify Payments to its online storefront platform. Traditionally, as with other e-commerce solutions, merchants have had to set up a third-party payments processor like Stripe, PayPal or others and tied that to their online store account – now Shopify does both.

What’s the advantage? It’s much easier for merchants to set up, for one thing, as they don’t have to go and set up a payments processor separately. Shopify Payments also ties store inventory and sales directly to revenue and payments information, so that you can see in real-time when payments come in and for what instead of having to stitch together that data from multiple sources.

Other advantages include instant approval of merchant payment accounts, so that as soon as a store goes live on Shopify the payments engine is already in place, as well as chargeback recovery, which allows sellers to have a better chance of winning out during disputes since Shopify auto-generates full reports about the nature and specifics of chargebacks for any charges contested by consumers.

“A lot of our customers that we’ve spoken to just kind of expected Shopify to be taking care of this for them,” explained Louis Kearns, Shopify’s Director of Payments during an interview. “If you haven’t sold online before, you’d open up your store and you’d want to be able to accept credit cards right away, and we’re happy to be able to solve that for them.”

Shopify also offers a unique spin on pricing that could save its customers money. This works by changing the rate of transactions based on what kind of Shopify plan the merchant already has, so for Basic plan users the rate is 2.9 percent plus $0.30 per transaction, but for Pro users it’s 2.5 percent plus $0.30, and for Unlimited plans it’s 2.25 percent plus $0.30. In other words, higher volume merchants get a rate price break, and that doesn’t require any additional work to happen – if you’re on one of those plans already you’re already getting that rate. Also, there are no additional fees for processing American Express or international credit cards, or for PCI Compliance, unlike at many existing payment gateways.

8 Tools That Ensure You’ll Never Lose An Idea

Article from blog.liferemix.net by Glen Stansberry of LifeDev

There are plenty of tools for people wanting to improve their productivity. Planners, lists, calendars… all these tools are awesome helpers for getting stuff done.

However, many people overlook one very important aspect of productivity: The Capture. It doesn’t matter how well a list of todo’s is organized if the list isn’t complete. How fast you can complete tasks doesn’t really matter if some fall through the cracks and never get done. Ideas don’t matter if they’re never recorded. The capture of these ideas and tasks is all-too crucial when it comes to becoming more efficient.

It’s been my experience that good ideas never come at a convenient time. Never. In the shower, on the way to the store, mowing the lawn. These are when ideas really happen.

We’re going to look at 8 tools that help ensure our important ideas and tasks are recorded properly, and never forgotten.

1. iGTD with Quicksilver (mac only). I recently converted from the dark side from a PC to a Mac, and quickly found there is a wide selection of GTD-style task management software available. iGTD quickly became my central hub of productivity, thanks tointegration with an equally-impressive piece of Mac goodness, Quicksilver.

In a nutshell, I can use these two pieces of software to effortlessly and quickly add ideas as I’m working on the computer. I just hit a keyboard command, type my idea/todo into quicksilver, save, and all the sudden I’m back to whatever I was working on.

The integration of Quicksilver into iGTD really deserves a whole post dedicated to the topic, so I’ll point you to the excellent guide on using iGTD with Quicksilver at 43Folders.

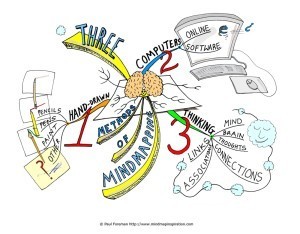

[image error]2. Freemind. Mind mapping is a great way to have a visual layout for your ideas. You can retrace your steps and thought processes with mind maps, and can make visual connections that allow for great amounts of detail. Plus, it’s a great way to get those creative juices flowing and think “outside the box”. This helps with preserving the entire idea, from start to finish.

Freemind is mind mapping software that is free and open to most computer platforms (Windows, Mac, Linux) and works pretty darn well. If you’re looking for a web-based mind mapper, check out Bubbl.us.

3. Water-proof paper for shower ideas. Showers are great (but not very convenient) times for having ideas. If you’re serious about jotting something down, keep a wax pencilhandy to mark on your tile. If you want to get a little more fancy, buy a waterproof notebook to scribble in while you’re bathing.

4. Jott. On the go and nowhere to put your idea? Try Jott. Jott is a phone service that allows you to “jott” down ideas via voicemail, which the service transcribes into email, and delivers to your inbox. This can be a lifesaver when you’re moving around or don’t have any paper handy.

5. Cheap voice recorder. While this may not be as elegant and streamlined as Jott, it can still be a lifesaver. Any recorder will do, but the digital recorders are very handy.

6. Backpack. Backpack is an incredible web-based collection system that allows you to easily capture your thoughts or todo’s from any computer with internet access. Set up notes, reminders, and todos, plus collaborate with other people.

What’s your life’s purpose?

Article from christianity.about.com by Karen Wolff

If finding your life purpose seems like an elusive undertaking, don’t panic! You are not alone. In this devotional by Karen Wolff of Christian-Books-for-Women.com you’ll find reassurance and practical support for finding and knowing your life purpose.

What’s Your Life Purpose?

While it’s true some people seem to find their life purpose easier than others, it’s also true that God really does have a plan for every single person, even if it takes a while to see what it is.

Most people think finding your life purpose means doing something you truly love. It’s an area that just seems natural to you and things just seem to fall into place. But what if things aren’t so clear for you? What if you’re not sure what your gifts are? What if you haven’t discovered any particular talent that makes you think it could be your true calling in life? Or what if you’re working somewhere and you’re good at it, but you just don’t feel fulfilled? Is this all there is for you?

Don’t panic. You’re not alone. There are lots of people in the same boat. Take a look at the disciples. Now, there’s a diverse group. Before Jesus came on the scene, they were fishermen, tax collectors, farmers, etc. They must have been good at what they were doing because they were feeding their families and making a living.

But then they met Jesus, and their true calling came into focus very quickly. What the disciples didn’t know is that God wanted them to be happy—even more than they did. And following God’s plan for their lives made them happy inside, where it really matters. What a concept, huh?

Do you suppose it could be true for you too? That God wants you to be truly happy and fulfilled even more than you do?

Your Next Step

The next step in finding your life purpose is right in the Book. All you have to do is read it. The Bible says Jesus told his disciples they were supposed to love one another as he loved them. And he wasn’t kidding. Getting really good at this part of the process is like building the basement of your house.

You wouldn’t dream of moving forward without a rock solid foundation. Discovering God’s purpose for your life is exactly the same. The foundation of the process means getting really good at being aChristian. Yup, that means being nice to people even when you don’t feel like it, forgiving people, and oh yes, loving the unlovable people in the world.

So, what does all that stuff have to do with what I’m supposed to be when I grow up? Everything. When you get good at being a Christian, you also get good athearing from God. He’s able to use you. He’s able to work through you. And it’s through that process that you’ll discover your true purpose in life.

But What About Me and My Life?

So if you get really great at being a Christian, or at least you think you are, and you still haven’t found that true purpose—then what?

Getting really good at being a Christian means you stop thinking about you all the time. Take the focus off you and look for ways to be a blessing to someone else.

There is no better way to receive help and direction in your own life than to focus on someone else. It seems completely opposite of what the world tells you. After all, if you’re not looking out for yourself, then who will? Well—that would be God.

When you focus on someone else’s business, God will focus on yours. It means planting seeds in great soil, and then simply waiting for God to bring a harvest into your life. And in the meantime …