Raj Shankar's Blog, page 13

March 27, 2016

XIME Conference on Business Incubation and Acceleration 2016

Last week I was at the Xavier Institute of Management and Entrepreneurship (XIME) campus in Electronics City, Phase 2, Bangalore. While I enjoyed the talks and panels, I also benefitted from the long and detailed comments from three senior academics in entrepreneurship.

There are a few reasons why attending this conference was special to me:

I listened to speakers, many of whom were from the theme areas identified for the conference. Few academics and many practitioners presented their thoughts. This clearly highlights the limited scholarly work conducted in the area and the greenfield for potential research that exists.

I enjoyed the keynote address (talk) by Prof Larry Cox from Pepperdine University USA. His short creativity exercise was interesting and useful. His discovery of India’s ‘Language of Horns’ was hilarious and eye-opening. Above all his idea of taking intellectual property from labs and bringing it to the classroom was exciting and my biggest take-away from the conference.

Having three senior academics (Prof Mathew Minimal, Prof Jay Mitra, Prof Larry Cox) especially from your same domain, listening to your paper presentation is itself a lot these days. But them, spending 30 minutes on your paper, providing specific feedback, comments and inputs for improving the manuscript are just a bonus. I am writing this because it is such a rare occurrence in an academic conference these days. If you attend many conferences in India, you will appreciate the value of what I have just shared. Thanks to XIME for making this happen.

I made new friends and enjoyed the hospitality of the institute. I believe academic agencies / institutions have to make it financially easier for doctoral students to attend more such conferences. It will be a big contribution to the research ecosystem in this country.

I must also mention that I received the ‘Best Paper Award’ too at the conference. This was a cherry on the cake! Thanks to the reviewers and conference chairs to giving me and my co-author (Dr Balachandran) this award.

Thoughts from moving around in Bangalore: While I have had wonderful experiences in Bangalore, during this trip I spent time travelling across the city for a few meetings. Every intra-city move took a few hours, cost a lot of money, and exposed me to the growing pollution (all kinds) that we are creating for ourselves. While I do not want to give a discourse on what we need to do to become more sustainable, I can only say that I did become more sensitive to the growing risks of sustainability. If we don’t do something about it soon, reversal may not be a possibility. I am sure this will not be the end, but it may not be a very pleasant beginning of something else either. Lets sensitise ourselves of this growing challenge and take small individual actions. Let us apply Mahatma Gandhi’s age-old wisdom – ‘Be the change you want to see’.

Happy Thinking and Happy Acting!

March 19, 2016

Finance for Entrepreneurs: How to value startups?

Valuation is a funny game, especially when it comes to startups! While speaking at a recent panel I was intrigued by the number of times companies that were going after ‘valuation’ rather than sustainable ‘value’, were being quoted. This led me to raise the question – Should entrepreneurs go after ‘value’ or ‘valuation’? But how are we to value startups? Is there any particular method? During a recent competition where I judged (along with an entrepreneur) a valuation competition I realised that almost all students participating in the event were ill-equipped to value startups. Read here about the experience.

I find that even faculty of accounting and finance are not exposed to the continuously evolving approaches to valuing startups. While it is easy to dismiss most of these methods as non-scientific, one must acknowledge that the billions of dollars being invested are using these methods. Hence it makes sense to expose ourselves to them. This is not a tutorial on how to conduct the methods, but a consolidated list of many widely used methods to value startups. While I intend to detail every one of them as individual posts later on the blog (Under the Series: Finance for Entrepreneurs), the proactive and inquisitive ones can search online and learn them too.

While there could be many variation and anymore, here are at least nine methods to value startups:

Venture capital method

Dave Berkus Method

Scorecard Method

Risk Factor Summation Method

Asset Value Method

Discounted Cash Flow Method

Earnings Multiple Method

Cost of Replacement Method

Comparables Method

While the first five methods are fairly logical to use with startups, the remaining four are almost impossible to be of value. But surprisingly many, if not most, students of finance use the bottom four in competitions and routine calculations.

Try your hands at exploring some of these methods or wait for a few weeks and I shall attempt to detail every one of them and justify their use (non-use) with startups.

Happy learning!

March 15, 2016

Finance for Entrepreneurs: Value and Valuation

While today we speak of companies such as Flipkart and Zomato, most of them seem to be running a ‘valuation’ game. But according to my understanding entrepreneurs must run a ‘value’ game. While the two should be related, there is a huge difference between the two.

Value – is what is created by the entrepreneur for a consumer. In the process the entrepreneur gets rewarded. All of this if done in a sustainable way, the business runs for a long period of time. Rare, but examples exist.

Valuation – is when an entrepreneur attempts to create value for themselves and their investors. They provide consumers services to make this happen. If the business makes through the difficult mathematical puzzle of numbers, it exists, else death is certain. Examples are a plenty, but exceptions exist.

If a startup create value for its customers, over time it is rewarded by valuation too! But if valuation is the focus, value is at times compromised, industries undergo turmoil and there is a shakeout of good players too. This is not very good for the long term.

Last week when I was speaking at a panel discussion I was reminded of this: why creating business models and identifying value are more important than raising money.

I hope entrepreneurs and startups understand this and live it. It is important considering the fact that, even if all the Venture Capital money flows in and gets invested, the number of startups getting funded will be a minuscule portion of the startup population. And more importantly, entrepreneurship is a career, a journey, not just a race or a competition.

Think and decide to take the plunge into entrepreneurship. Its fun and fulfilling! I can vouch for it both from my personal experience and of having groomed many.

Happy entrepreneuring!

Value and Valuation

While today we speak of companies such as Flipkart and Zomato, most of them seem to be running a ‘valuation’ game. But according to my understanding entrepreneurs must run a ‘value’ game. While the two should be related, there is a huge difference between the two.

Value – is what is created by the entrepreneur for a consumer. In the process the entrepreneur gets rewarded. All of this if done in a sustainable way, the business runs for a long period of time. Rare, but examples exist.

Valuation – is when an entrepreneur attempts to create value for themselves and their investors. They provide consumers services to make this happen. If the business makes through the difficult mathematical puzzle of numbers, it exists, else death is certain. Examples are a plenty, but exceptions exist.

If a startup create value for its customers, over time it is rewarded by valuation too! But if valuation is the focus, value is at times compromised, industries undergo turmoil and there is a shakeout of good players too. This is not very good for the long term.

Last week when I was speaking at a panel discussion I was reminded of this: why creating business models and identifying value are more important than raising money.

I hope entrepreneurs and startups understand this and live it. It is important considering the fact that, even if all the Venture Capital money flows in and gets invested, the number of startups getting funded will be a minuscule portion of the startup population. And more importantly, entrepreneurship is a career, a journey, not just a race or a competition.

Think and decide to take the plunge into entrepreneurship. Its fun and fulfilling! I can vouch for it both from my personal experience and of having groomed many.

Happy entrepreneuring!

March 13, 2016

Entrepreneurship is a verb

How much of entrepreneurship is spoken?

How much of entrepreneurship is done?

If one takes a candid look at it, one is bound to see that all the talk leads to nothing, but even an iota of action leads to value creation. Even a failed entrepreneur does good things: moves experimentation forward, learns lessons and improves himself/herself.

When I authored a textbook, I defined entrepreneurship technically, but above all I shared with my readers that ‘entrepreneurship is a way of life’. One lives entrepreneurship. And living is a verb, not a noun! Internalising this makes a huge difference to how one lives life entrepreneurially.

Think about it!

March 9, 2016

Speaking to a cow

Though strange, the cow seemed to understand what I said! Surprised? Even I was, earlier today.

As I was walking back from my institute to home, I saw a herd of cows cross the road. Quite common in this part of the country. While a few (lazy/ naughty) were trying to catch up with the herd, a calf was caught up in a fenced enclosure busy eating. When she realised that the rest of the herd were already crossing the road, the little one ran towards the fence only to realise that she was enclosed. As I saw her try hard to try various parts of the fence, even I wondered, how she got in, in the first place? I soon saw that the little gap to get into the enclosed lawn was at the exact opposite end of where she was looking to cross. Without any second thought, I spoke to her “Hey, the opening is there” pointing in that direction. She turned once, saw the opening and turned to run through it. Alas she was free and within a few seconds she ran to join the herd.

I felt glad and kept walking. It was after a few minutes that it occurred to me that I had actually spoken to a cow and more importantly, she had understood it. At least thats what it looked like. Wonderful isn’t it? Not sure if all this is ‘maya’, but I truly felt nice at her intelligence.

I don’t want to use my rational mind (human strength) to analyse this situation. Let me just bask in the little joys of life. They are truly what make life worth living!

March 5, 2016

Evaluating Startup Valuation at EDII’s Empresario 2016

I was invited to be a judge for the ‘Startup Valuation Competition’ at Entrepreneurship Development Institute of India’s (EDII) Annual Entrepreneurship Fest ‘Empresario 2016’. Being there last Saturday and sitting alongside the entrepreneur (Abhishek) whose company was being valued in the competition was fun. I learned a lot from my interactions both with the entrepreneur and the participants. While all the teams involved people who had a management background, there was one team of third year engineering students, who impressed both of us (judges) by their attempt at valuation.

During the little conversations that we had (Abhishek and I) prior to the event, the entrepreneur kept harping on how and why valuation was so much art than science. He recounted his earlier rounds of raising money and the current one in which they are engaged – and highlighted the little science that could justify valuations. He even quoted some other startups (both from India and abroad) that had unimaginable valuations. But much to the entrepreneur’s surprise, almost all the teams attempted to use the Discounted Cash Flow (DCF) method to arrive at a value. We had teams arriving at values ranging from 0.1x to 100x where x – entrepreneur’s value of his own company. Two companies came close to x and both of them did not use the DCF method.

At the end of the session the entrepreneur (Abhishek) clearly highlighted the importance of looking at subjective parameters to arriving at value. Without discounting the DCF the entrepreneur (himself an engineer) clearly explained why early stage companies need to be seen through a different valuation lens. I wish he and his partners raise the money they require at the valuation that they deserve and gain all the success.

Some interesting learnings as a teacher of entrepreneurship:

The students who designed and organised the competition (Manoj Karthik, Monil Gunjaria, and Dipali Shah of PGPM-BE Course) need to be lauded. Not only did they take the courageous approach of writing a fresh case study for the competition, but also that of a startup that was in the process of raising another round of funding. There are students who can write well. Why don’t we (teachers) identify and engage with them (interested students) to do more serious content creation?

I think fresh cases of startups make the class so lively and interesting. Getting the entrepreneur to do the evaluation along with an academic gave the event a balance that many entrepreneurship educators need to learn from. Can we not have classes where we can teach together (academic + entrepreneur)?

Can we not write so many cases of startups around us? Will that not make classroom learning so much more interesting? Will it not shed light on which tools, techniques, methods are best suited in relevant contexts? Will not entrepreneurship education become more contextual then? The constant complaint is that not many companies share information – but my question to academics is: how many have you asked after the first few said no?

One team in particular used a crazy heuristic to arrive at a multiplier that gave both me and my co-judge (the entrepreneur) goosebumps! How could this be so close to what so many scientific and historic methods give after tremendous calculations? I’m still stumped!! I asked them many questions to learn on their assumptions. This is what makes valuation a fun game. This is what makes teaching so much fun. I learned from my students (participants) and came away more informed.

I had written a few weeks back on how crazy this startup valuation is but being a judge at this competition gave me a bird’s eye view to the reality that ‘may be we are not equipping our MBA finance students with the right tools to engage in such kind of new age valuation’. Its time we did something to our valuation syllabi in entrepreneurship courses (if there is one?).

I had lunch with Mr Shalabh Mittal (CEO of the entrepreneurial venture School for Social Entrepreneurs) and listened to a brilliant panel discussion moderated by him post the meal. Though it was on sustainability, I kind of liked the philosophical debates and perspectives shared. I had a good Saturday.

I will write soon on the many techniques currently being used for valuing startups in a following post, but until then, read the newspaper and look with awe at the subjectivity that exists in all the startup valuations being reported. They are facts!! Enjoy.

I am glad that I chose teaching for a career. Every time students conduct an event, they surprise me by doing things that teachers can only learn from. But will teachers be ready to learn?

March 1, 2016

Vedantic Wednesday: Is this ‘maya’?

I have been looking for a new arrival book in the library for a week now. A search on the electronic catalogue says ‘available’ but I have not been able to locate it. When I asked the library professional manning the front desk, she said ‘it is at this (identified) location’. Both of us search to no avail. She does some search and figures out that it is a new arrival (cannot be issued out) and hence will be in the new arrival section. She dashes off with a sense of accomplishment only to return disappointed. After all this, she could only say that ‘Someone must have taken it to read. We will have to wait until they put it back’.

Something that says ‘available’ but remains ‘unavailable’ reminded me of the subtle message that philosophy attempts to teach. While this may not be the ideal example for teaching the concept of ‘maya’ – why not use every opportunity to remind ourselves of the elusiveness of this world?

So, is this ‘maya’?

Some humour, some truth! That’s life.

Think.

February 28, 2016

Accessible and Inclusive Higher Education Seminar

I spent most of today (Sunday) at a seminar titled ‘Accessible and Inclusive Higher Education’ organised by the Equal Opportunities Office (EOO) of The Indian Institute of Management Ahmedabad (IIMA). My respect for IIMA increased several notches today. I am sure I also came away, a slightly better human being.

We are not sensitised to the many other worlds that exist in the same world we live in. There are people who live in the same world but see it differently. Some only hear it, some only see it and some don’t see and hear it, but feel it. My eyes had tears as I saw some traces of how educational institutions could play a significant role in identifying and enabling the next Helen Keller or Stephen Hawkings! Could we be missing them by keeping our education system less accessible to the differently abled amongst us? I don’t think we have the right to say they are ‘disabled’ because some of them have done much more than what many of the so called ‘enabled’ have accomplished. Lets not get caught up with the right term – ‘disabled’ or ‘differently abled’ etc, but lets get to the root of the challenge we face as a society.

I reflected and enjoyed the intellectual stimulation on some of these thoughts presented and discussed:

Handicap = Disability * Barriers

The ‘so what’ test?

The us (enabled) and them (disabled) debate – seems so wrong!

Why seats reserved for persons with disabilities at higher educational institutions don’t get filled?

Have you thought of ‘Situational Disability’? Almost all of us face this every day.

How can we engage in action research to bring awareness to policy makers, intended recipients of the policy benefits, and so on?

I believe that people need to be sensitised to the needs of the differently abled people in our society. In a way all of us are differently abled and its just a matter of perspective which group we fall under. As one of the speakers rightly asked, why does this discussion always have to be about ‘us and them’? Aren’t we all one? Is inclusivity and accessibility just about ‘being human’?

Then, my big lesson is ‘being human’ – that is enough to make a place beautiful to live. I continue to believe that life is about being what we are meant to be and allowing others to be what they were meant to be. Lets not compete. Lets enable. Lets coexist. Lets simply be human.

It was truly a very different Sunday, one that I will not forget in a long time. Also it was a rekindling of a feeling that exists deep within – to be as human as we can.

Think. Sensitise yourself. Feel yourself in the other. Let us create equal opportunities for all – “Do unto others as you would have them do unto you.” and the many equivalents of this message that exist. Let us try to live it.

February 24, 2016

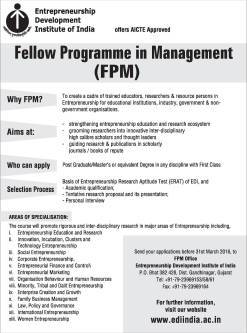

FPM at EDII

The Entrepreneurship Development Institute of India (EDII) has announced the ‘Call for  Applications’ for its third batch of the Fellow Program in Management (FPM). The FPM is a 4 year AICTE approved doctoral program. EDII’s FPM focusses on entrepreneurship.

Applications’ for its third batch of the Fellow Program in Management (FPM). The FPM is a 4 year AICTE approved doctoral program. EDII’s FPM focusses on entrepreneurship.

There are thirteen areas within entrepreneurship offered to pursue doctoral work. It is a full time program run at the beautiful EDII campus in Bhat Village, Gandhinagar.

I am posting it here for two reasons:

a) I am a student of EDII’s FPM program

b) I am a student of entrepreneurship

For brochure and application form, look here: http://ediindia.ac.in/new/FPM.asp

If you have any queries kindly call the FPM Office and I am sure they will be happy to clarify any doubts you may have.

Best wishes