Gregory S. Lamb's Blog

October 1, 2024

Cold Plunge : Week 2

Just two days into my second week of consistent cold plunging and I am a believer. Aside from the information on the placard photographed in the previous post, I felt a need to do a bit more research regarding the benefits of the Cold Plunge (Cryotherapy). I found this eBook at the library:

Long story short, it is a quick read and reveals an untold amount of different types of benefits that can be achieved through regular cryotherapy. For me, among the most significant are the sense of well being as a result of the endorphin rush that occurs during and after a plunge. Additionally, I receive a full body dose of anti-inflammatory wellness. And finally, and perhaps most importantly, one doesn’t always know when they are suffering from depression, until the sense of it is completely lifted.

I now look forward to and embrace the cold!

September 29, 2024

Cold Plunge Day 6

Day 6 of euphoric cold plunging was a milestone for me. Now that I’ve embraced the benefits and have become a “believer” in the cold plunge benefits, I decided this capstone post should include today’s big event.

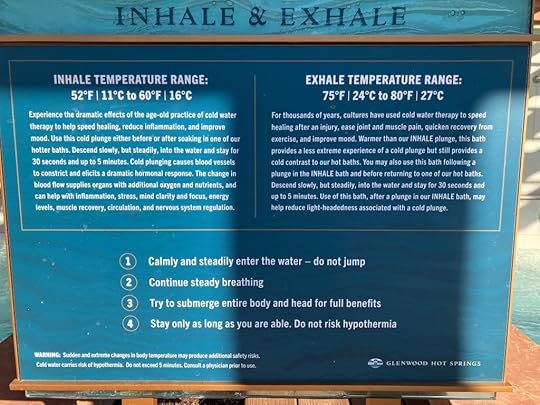

I began today’s adventure in the morning hours since I’d discovered that the temperature range of the “Inhale” pool would be at its lowest. Initially I found myself shivering, even in the “exhale” pool. It wasn’t hard to convince myself to immerse in the “inhale” pool, but the shivering continued for my first plunge.

Since Glenwood Springs is still experiencing summer temps in the afternoon, the pool temps tend to be warmer later in the day. After calming the initial morning shivers, I proceeded with my previously established routine but with one exception. Today I immersed my entire self to include my head, several times. I expected to experience an “ice-cream headache” but that didn’t happen. I inhaled, went under, exhaled under water and surfaced. WOW! As a result of the euphoria, I ended up doing 3-4 total immersions.

I’ll conclude this series of posts with some words of encouragement: Read the words from the plaque (see the image above). The Cold Plunging benefits are very straight forward and now having reaped the benefits myself, I’m not only a believer, but an advocate.

September 28, 2024

Cold Plunge Day 5

Today’s plunge was pretty much a repeat of Day 4. A long plunge into the “Exhale” pool, followed by a short “Inhale” immersion for 2-3 min before warming up again in the less cold “Exhale” pool. Again, I was able to stay in the cold plunge “Inhale” Pool for about 20 min as a result of the distraction of chatting with another cold plunge fan.

Among some of the benefits I’ve discovered, now having chats with a couple of older gentlemen, maybe 7-10 years my senior (I’m 64 yrs old) was relief from a variety of ailments aside from inflamation. Both men told me their motivation to cold plunge stems from having experienced peripheral neuropathy in the feet, toes, and finger tips. Two separate guys on two different days telling me they have noted a vast improvement in their well being as a result of taking advantage of a cold plunge routine.

One thing I hadn’t yet mentioned, was the after glow. After my last two plunges I noticed some welcome positive tingling after cold plunging and returning to the 90 degree mineral pool. It wasn’t as pronounced those first few days, but now that I’ve been able to immerse for 15-20 min, the after glow warming has been really great. The tingling is gentle and the sensation fills my entire body.

My plan is to continue daily as long as practical. Sometime in the very near future, I’ll bring a photo device to the pool and snap a pic of the official plaquard explaining the “Inhale” and “Exhale” pools.

September 27, 2024

Cold Plunge Days 3 and 4

The air temperatures in Glenwood Springs these past few days have topped out in the high 80s with no wind to speak off. Perfect temperatures for riding my bike the 1/2 mi to and from Glenwood Hot springs.

Day 3 was my first mid-day plunge. I soaked in a warm/hot pool for about 15 min before going through my routine of slow immersion. The set up at the resort has one pool in the 60-70 degree range labeled “Inhale”. I eased myself into the water and breathed freely for about 10 min before stepping out and easing into the “Exhale” pool at 52-60 degrees. Previously, this was an intimidating step for me, but knowing the positive feelings I’d experience during and after, was a big encouragement. Upon first immersion, I was only able to stay in for about 45 seconds (whole body up to my chin).

While immersed, aside from the first sensations of taking my breath away, I tend to experience a cold numbing pain at the joints (ankles, knees, hips, and elbows). Once the aches set in, I count to 30 and exit back to the “Inhale” pool. I give it 10 min there and return to “Exhale”. Round two took me to 2 minutes and I exited without any joint pain.

Day 4: I was eager to get into my new routine of cold plunge! I started with the 90+ degree soak for about 15 min followed by my previously established routine. Immersing in the “Inhale” pool was easy and I was impatient to move on but stayed for the entire 10 min I’d set for myself. Moving into the cold “Exhale” was a much anticipated experience, but I have somehow found my pace – in up to my chin in less than 30 sec. I sat where I could see a clock and noticed the joint pain setting in at about 15-30 seconds and totally subsided at 2 min. I exited to repeat.

On round 2, it was much easier to get into the groove. After 2 minutes and feeling pretty good I ended up in a chat with another plunger. We conversed and 20 min later I exited feeling elated. I followed with 5 min at 90 degrees or so.

The bike ride home was enjoyable and I’m now thinking about tomorrow and what sort of wellness will accompany another cold plunge

September 25, 2024

Quick Cold Plunge Day One and Day Two

Here in Glenwood Springs we have access to some amazing hot springs. The main site for soaking is the famous Glenwood Hot Springs pool – the biggest outdoor pool in the world. Recently the resort upgraded their property with additional pools at different temperatures. Included is a pair of “cold plunge” pools.

I wasn’t a believer on Day One, but attempted the plunge anyway. I must say it is intimidating to immerse oneself into waters colder than those of Oregon’s Pacific Ocean. All said, having read the plaque explaining the procedures and benefits of a cold immersion, I took the plunge. I only lasted about 30 Seconds and was only able to do one immersion.

I spoke with a woman who’d been in the cold water for several minutes and she said it took her about a week of daily immersions to get used to the cold. Having read the physiological benefits of cold soaking, I was intrigued enough to try again a day later.

Day 2: I was ready. What stayed at the forefront of my mind that allowed me to overcome the discomfort of facing an uncomfortable cold plunge was what I’d read about the benefits. Reduced inflammation of the joints, hormonal shifts that result in positive mood change are enough to have me interested in a positive experience on Day 3.

January 26, 2021

Real World Math Part 3 – What are Logarithms good for?

In the previous article about depreciation, we introduced the exponential depreciation model. It is an excellent tool for use in a variety of fields. However, when applied to depreciation of monetary value over time, such as our automobile example, we discovered the difficulty of working with variables when they show up as an exponent.

In the previous article about depreciation, we introduced the exponential depreciation model. It is an excellent tool for use in a variety of fields. However, when applied to depreciation of monetary value over time, such as our automobile example, we discovered the difficulty of working with variables when they show up as an exponent.

Guess and check put us in the ball park for determining when our example vehicle – the Toyota Corolla MSRP at $21,000 financed over 5 years, has a value less than the cost of financing the car.

Instead of using the ball park method, there is a more elegant way to calculate a precise interval of time before our Toyota’s value is less than the finance charge. The following should give you some appreciation for why I like having logarithms available in my real world math tool kit.

First of all, logarithms are used to convert equivalent values between Log expressions and exponential expressions. For example:

Say we have an exponential expression: 1,000=10x When this expression is translated into a logarithmic expression, it it will look like this: log(1000)=3

When using the “Log” symbol on most calculators, it implies the log base is 10:

log10 1000 = 3

Our exponential decay model in the depreciating Toyota example follows:

$21,000 x 0.8(yrs) < $6,189 Simplified to – 0.8(yrs) < 0.2947

This inequality is still in exponential form with the variable in the exponent, so let’s convert it to logarithmic form:

log0.8(0.29) = yrs

But wait, my calculator doesn’t allow me to change the base of the logarithm from 10 to 0.8!

No worries, there is a formula for this very specific situation and it is called (would you believe?), the “change log formula.” As applied to our problem we get the following, which we can type into our calculator to get the exact amount of years:

log(0.29)/log(0.8) = 5.54 yrs

As you can see, the mathematicians of old have done a lot of hard work figuring things out for us. There are more situations where this relationship between exponential expressions and logarithmic expressions can be useful. Perhaps the most important point of this real world math exercise is the understanding that numbers, mathematical operations, ratios and formulas can be related to one another in a variety of ways. Filling your math tool kit with knowledge of these relationships can save lots of time spent wondering how to solve real world math problems.

January 20, 2021

Real World Math Part 2 – Depreciation

Previously we took a look at the down side of buying a new car with a loan. This time let’s do some further analysis using another cool formula to keep at the ready which can assist you with making purchase decisions. Works for cars, laptops, a new roof for your house, or any other thing you can buy that ages, goes obsolete or simply wears out.

We’ll use our $21,000 MSRP Toyota Corolla to look at asset depreciation. Granted, there are several factors that play into the depreciation of a new car. Milage, age, condition, adherence to a manufacturer’s maintenance schedule etc. all factor into a cars value at a certain point in its lifespan. However, for the purpose of analyzing rate of depreciation, we’ll leave out the other factors. In fact each manufacturer uses the various quality factors to calculate a vehicle’s affordability. Some cars are built to be inexpensive to own/maintain but have short lifespans, while others have strict and expensive maintenance schedules that are geared toward reliability and a long life.

The Problem:

Leaving all the other factors out, if our $21,000 Corolla depreciates 20% over the first year of its life, how many years would pass before the car’s value is equal to or less than the amount of interest we would have paid for the $19,500 we financed?

Cost of vehicle = $21,000.Total interest paid on vehicle = $6,189 Rate of depreciation = 20% subtracted from 100% leaves 80% or a factor of 0.80 for annual depreciation.Formula: Cost x Rate^yrs = depreciated value

$21,000 x 0.8 (yrs)≤ $6,189

(Figuring out the value of the exponent will give the number of years before the car’s value is equal to or less than the amount of interest we paid on the loan)

0.8 (yrs)≤ $6,189÷$21,000 this gives 0.8 (yrs)≤ 0.2947

To calculate the number of years, we need to guess and check by plugging in some values for the exponent. You can even bracket the values of the exponents:

0.8 2 = .64 which is bigger than our 0.2947 and we’re looking for the same or less

0.8 8 = .1677 which is smaller, so the number of years will be somewhere in between.

Let’s try an exponent of 6: 0.8 6 = 0.2621 which is less than or equal to the figure in our formula.

The answer here is that the car’s value will be less than the interest paid on the loan after 6 years. Another way to look at this is when the car loan is paid at the end of 5 years, you’ll be driving a paid for car for 1 year before it has little or no value – if you sell it for $6,200 you’ll essentially be getting nothing since this is the money you already paid to the bank to finance it.

In part 3 of Real World math, we will look at compounding interest at rates other than annual (semi annual, quarterly, and monthly).

January 15, 2021

Real World Math – Why you should never get a car loan

As a private Math tutor, my students often ask why or when in the real world, they will ever need the math skills they’re required to develop in middle and high school. The example below seems to work and gets their attention.

So you want to buy a new car someday? Better start saving up, and here is why:

Let’s say you decide on the most practical and popular car sold in the USA, a Toyota Corolla with an MSRP around $21,000. We all know there will be additional costs that could jack that price up by a couple thousand more, but for this example we can use the MSRP. You might think that is a lot of cash to save, so you look into a car loan.

While doing some research you learn that most dealers require a down payment. A good thing you banked $1,500 from the lifeguarding job you had last summer between your Junior and Senior year. Plus, now that you have a regular part time job at Petco grooming poodles, you can actually qualify for a loan so long as your parents co-sign.

Since your parents agree to co-sign, the dealer offers you a killer loan – with an annual interest rate of 5.75% for 60 months. Of course the dealer wants to sell you the car based on a monthly payment and convince you to purchase additional options – “Bluetooth hands free will only cost you an addition $8/month, you’ll also want the Navigation and color display I showed you during your test drive for another $22/month.”

You figure since you’re financing the car anyway, what’s a couple extra bucks a month? Besides, you love the candy apple metallic red with cream faux leather interior. With mom and dad on the sidelines wishing your experience at the dealer will serve as an education you begin to wonder how much this car is actually going to cost you.

A nagging memory from 11 grade algebra comes into play because you recall there is a quick and easy way to do the calculation, but you don’t remember the formula. So in case you read this article before shopping for a car, here’s a quick review:

The exponential growth model is an excellent tool to file away in your memory. Hopefully you’ll use it so often that it will immediately come to mind anytime a credit card application arrives in the junk mail.

Base x rate with an exponent the value of the time interval. In this case you will be financing $19,500 at 5.75%, 60 months translates to 5 years, so that will be your exponent. Your formula and result will look like this:

$19,500 x 1.05755 = $25,689

That doesn’t even include the down payment! Oh and the monthly payment is what now? $418 per month? Are you going to have enough left over from your part time job to maintain your nice new car, put gas in it, be nice and offer to pay your parents the add on to their insurance policy?

Your mom and dad are pleased when you realize the car will actually cost you more than $6000 above the price advertised. When you leave the dealership with your parents but without a new car, your dad says he’ll give you an interest free loan and help you find a safe/reliable pre-owned car for close to the amount the interest you’d have had to pay if you’d financed a new car.

September 30, 2020

The latest from Greg Treks

March 8, 2020

Social Security: When to Start Drawing?

Boomers are smack dab in the middle of eligible retirement age facing a decision about when to draw from Social Security, better known as Supplemental Security Income (SSI). There is no such thing as a one size fits all decision tool. For example, if both partners in a marriage are at an age for drawing SSI and one partner passes away, the surviving partner is eligible for the higher of the two original incomes.

What if you want to draw SSI and continue to work part time? This is definitely something to think about, because there is potential for a reduction in the SSI benefit you would be receiving if your income from working part time exceeds $18,240.

What if you are a disabled veteran in receipt of a service connected monetary monthly benefit? The basic rule is a recipient isn’t allowed to double dip. In other words, the beneficiary will receive the higher of the two monthly income benefits but not both. Usually the way this works is if SSI income exceeds the VA benefit, the veteran will only receive SSI. If the VA benefit is higher, the beneficiary will receive SSI and the VA will augment to make up the difference. For example if a veteran is permanently disabled at a condition rating where the veteran is receiving $1,200/month from VA and is eligible for SSI at $1,050/month, the beneficiary will receive the total $1,200/month ($1,050 from SSI and $150 from VA). What if the veteran’s disability rating results in monthly income greater than the SSI early retirement figure? That would amount to an easy decision to wait until full retirement or delayed retirement (whichever results in a figure greater than the VA benefit).

For most people, the first order of business might be to gain a clear picture of the basics. For those of us born during/after 1960, eligibility for early retirement is age 62 and full retirement is age 67. There is also a different monthly income figure for people wishing to delay drawing until age 70. One way to help analyze the decision for when to draw SSI is to determine at what age would a person be when the amount drawn from early retirement vs full retirement is the same.

Let’s say for a person born 1960 and later, the figure for drawing early from SSI is $1,120/month. Waiting another 5 years for full retirement and drawing at age 67 would generally be 30% higher at $1,600/month. For every year after up to age 70 (3 more years) a delay would be 108% for each year’s monthly income over age 67. e.g. delaying to age 68 your income would be $1,728/month. For age 69 it would be $1866/month and age 70 (maximum) would be $2,015/month. These differences as a person ages seem to indicate some advantage for waiting for full retirement or even delaying drawing SSI until age 70, but is it really an advantage? Knowing how all the facts line up before making the decision to draw makes good sense. Using the figures above we can analyze the facts using basic algebra in the following example:

What we want to know is the number of years before the amount drawn at full retirement age of 67 is the same as the amount one would have drawn starting early at age 62.

Draw at 62: $1,120/month = $13,440/yr

For years 62-67 amount drawn = $67,200

Draw at 67: $1,600/month = $19,200/yr

Let x = number of years before amount drawn is the same.

First 5 years:

Early = $67,200

Full = $0

Variables:

Full = $19,200x + $0

Early = $13,440x + $67,200

Formula:

$13,440x + $67,200=$19,200x

$67,200 = $5,760x

$67,200/$5,760 = x

The dollars cancel leaving 11.6 years, so the retiree’s age would be 78.6 years old before the amount drawn is the same. To calculate your own figures, just plug them into the template above. You can also assess the advantage or disadvantage if you delay beyond age 67.

As mentioned above, there is no one-size solution for these decisions. An individual’s health and longevity will play heavily into the equation.