David Thomas Roberts's Blog, page 2

February 20, 2017

Building a Bootstrapping Mentality

Bootstrapping a business startup is an art. It can be a lot of fun if approached the right way.No matter how well-funded your business startup may be, the fundamentals of bootstrapping should never be forgotten - and should always be applied.Bootstrapping is not the same thing as being "cheap". Cheap is penny-wise but dollar foolish. In my second venture in the air freight forwarding business I needed a cargo van to pickup client shipments, but to also use it as a rolling billboard for my business. I couldn't afford to go out and spend over $30,000 at the time for a new van. I searched and searched until I found a used cargo van for $1,200. It had a lot of miles on it but I had a mechanic check out and, with no immediate mechanical issues that he could find, I bought it.Next I took it to body and paint shops for estimates where I found one willing to paint the exterior and put my logo on the van for $600. For less than $2,000, I got a cargo van, that saves us thousands monthly in local cartage charges for another company to pickup our customers' freight, and a traveling advertisement for our business on all sides of the van.That van was nothing special on the inside, but I can't tell you how proud of it I was. That van had MY business name on it! I sold my personal car and drove that cargo van to work and back everyday for almost two years. We kept it maintained and the van lasted us four years before having to replace it.Our office furniture was a combination of furniture remnants bought at a used office furniture outlet, garage sales and even Goodwill. I can't tell you the sense of pride we would have when finding a good deal on a metal filing cabinet that was in perfect shape but bought for ten cents on the dollar!Take immense pride in your bootstrapping success! So many times I meet entrepreneurs who instead take pride in how much money they raised or in the size of their "burn" rate. A "burn" rate indicates the rate at which the business is losing money. Bootstrapping a business allows for the entrepreneur to cross over into profitability sooner.I met an entrepreneur who looked in his shed for any idea he had to avoid buying a desk. The result was an old door set on two concrete cinder blocks that provided his working space for nearly two years - and his business is flourishing.Staying "mentality broke" is one of the keys to financial independence, and applying this mentality to a business startup will force you to look for opportunities to bootstrap for all business expenses.Make it fun! Make bootstrapping a part of a winning attitude!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theTheup to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Bootstrapping a business startup is an art. It can be a lot of fun if approached the right way.No matter how well-funded your business startup may be, the fundamentals of bootstrapping should never be forgotten - and should always be applied.Bootstrapping is not the same thing as being "cheap". Cheap is penny-wise but dollar foolish. In my second venture in the air freight forwarding business I needed a cargo van to pickup client shipments, but to also use it as a rolling billboard for my business. I couldn't afford to go out and spend over $30,000 at the time for a new van. I searched and searched until I found a used cargo van for $1,200. It had a lot of miles on it but I had a mechanic check out and, with no immediate mechanical issues that he could find, I bought it.Next I took it to body and paint shops for estimates where I found one willing to paint the exterior and put my logo on the van for $600. For less than $2,000, I got a cargo van, that saves us thousands monthly in local cartage charges for another company to pickup our customers' freight, and a traveling advertisement for our business on all sides of the van.That van was nothing special on the inside, but I can't tell you how proud of it I was. That van had MY business name on it! I sold my personal car and drove that cargo van to work and back everyday for almost two years. We kept it maintained and the van lasted us four years before having to replace it.Our office furniture was a combination of furniture remnants bought at a used office furniture outlet, garage sales and even Goodwill. I can't tell you the sense of pride we would have when finding a good deal on a metal filing cabinet that was in perfect shape but bought for ten cents on the dollar!Take immense pride in your bootstrapping success! So many times I meet entrepreneurs who instead take pride in how much money they raised or in the size of their "burn" rate. A "burn" rate indicates the rate at which the business is losing money. Bootstrapping a business allows for the entrepreneur to cross over into profitability sooner.I met an entrepreneur who looked in his shed for any idea he had to avoid buying a desk. The result was an old door set on two concrete cinder blocks that provided his working space for nearly two years - and his business is flourishing.Staying "mentality broke" is one of the keys to financial independence, and applying this mentality to a business startup will force you to look for opportunities to bootstrap for all business expenses.Make it fun! Make bootstrapping a part of a winning attitude!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theTheup to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Bootstrapping a business startup is an art. It can be a lot of fun if approached the right way.No matter how well-funded your business startup may be, the fundamentals of bootstrapping should never be forgotten - and should always be applied.Bootstrapping is not the same thing as being "cheap". Cheap is penny-wise but dollar foolish. In my second venture in the air freight forwarding business I needed a cargo van to pickup client shipments, but to also use it as a rolling billboard for my business. I couldn't afford to go out and spend over $30,000 at the time for a new van. I searched and searched until I found a used cargo van for $1,200. It had a lot of miles on it but I had a mechanic check out and, with no immediate mechanical issues that he could find, I bought it.Next I took it to body and paint shops for estimates where I found one willing to paint the exterior and put my logo on the van for $600. For less than $2,000, I got a cargo van, that saves us thousands monthly in local cartage charges for another company to pickup our customers' freight, and a traveling advertisement for our business on all sides of the van.That van was nothing special on the inside, but I can't tell you how proud of it I was. That van had MY business name on it! I sold my personal car and drove that cargo van to work and back everyday for almost two years. We kept it maintained and the van lasted us four years before having to replace it.Our office furniture was a combination of furniture remnants bought at a used office furniture outlet, garage sales and even Goodwill. I can't tell you the sense of pride we would have when finding a good deal on a metal filing cabinet that was in perfect shape but bought for ten cents on the dollar!Take immense pride in your bootstrapping success! So many times I meet entrepreneurs who instead take pride in how much money they raised or in the size of their "burn" rate. A "burn" rate indicates the rate at which the business is losing money. Bootstrapping a business allows for the entrepreneur to cross over into profitability sooner.I met an entrepreneur who looked in his shed for any idea he had to avoid buying a desk. The result was an old door set on two concrete cinder blocks that provided his working space for nearly two years - and his business is flourishing.Staying "mentality broke" is one of the keys to financial independence, and applying this mentality to a business startup will force you to look for opportunities to bootstrap for all business expenses.Make it fun! Make bootstrapping a part of a winning attitude!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theTheup to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Bootstrapping a business startup is an art. It can be a lot of fun if approached the right way.No matter how well-funded your business startup may be, the fundamentals of bootstrapping should never be forgotten - and should always be applied.Bootstrapping is not the same thing as being "cheap". Cheap is penny-wise but dollar foolish. In my second venture in the air freight forwarding business I needed a cargo van to pickup client shipments, but to also use it as a rolling billboard for my business. I couldn't afford to go out and spend over $30,000 at the time for a new van. I searched and searched until I found a used cargo van for $1,200. It had a lot of miles on it but I had a mechanic check out and, with no immediate mechanical issues that he could find, I bought it.Next I took it to body and paint shops for estimates where I found one willing to paint the exterior and put my logo on the van for $600. For less than $2,000, I got a cargo van, that saves us thousands monthly in local cartage charges for another company to pickup our customers' freight, and a traveling advertisement for our business on all sides of the van.That van was nothing special on the inside, but I can't tell you how proud of it I was. That van had MY business name on it! I sold my personal car and drove that cargo van to work and back everyday for almost two years. We kept it maintained and the van lasted us four years before having to replace it.Our office furniture was a combination of furniture remnants bought at a used office furniture outlet, garage sales and even Goodwill. I can't tell you the sense of pride we would have when finding a good deal on a metal filing cabinet that was in perfect shape but bought for ten cents on the dollar!Take immense pride in your bootstrapping success! So many times I meet entrepreneurs who instead take pride in how much money they raised or in the size of their "burn" rate. A "burn" rate indicates the rate at which the business is losing money. Bootstrapping a business allows for the entrepreneur to cross over into profitability sooner.I met an entrepreneur who looked in his shed for any idea he had to avoid buying a desk. The result was an old door set on two concrete cinder blocks that provided his working space for nearly two years - and his business is flourishing.Staying "mentality broke" is one of the keys to financial independence, and applying this mentality to a business startup will force you to look for opportunities to bootstrap for all business expenses.Make it fun! Make bootstrapping a part of a winning attitude!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theTheup to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on February 20, 2017 04:57

February 13, 2017

The Most Valuable Inheritance - "A Work Ethic"

9:00 AM comes especially early for kids or young teenagers. It is even more debilitating when your father is the alarm clock that has a snooze button you don’t want to press. Today by 9:00 AM I have run a mile, been at work for an hour, and had my first cup of coffee. But back then, not so much. There was always something to do around the house and my father made sure that we were up to do it. Of course, we were never in the best of moods in the morning and this reaction would be met with a rhetorical question from my father such as “do you think this is a resort?” He always had us doing something even if it was completely useless to keep us busy. I realize now, as a grown adult, it was all about using our time productively and that’s what I learned from my serial entrepreneurial father.By no means did I have it bad as a kid growing up, although, my thirteen year old self might say otherwise, but in hindsight I was extremely fortunate. There are kids who had it much worse and I thank God for my family and the childhood I experienced. I learned some valuable lessons growing up from my father, who had a strong work mentality. I remember being yelled at one time as I rolled past him on my bike into the garage because I didn’t bring the trashcans up from the driveway. When confronted, I simply stated that I was never asked to do that. That is when I had my first lesson on taking initiative. Doing things that need to be done without being told to do them. It has stuck with me to this day. It was a simple message that was received and learned at a very young age. I also remember learning early on that entitlement doesn’t go too far in our house. I had the normal daily chores but I never received an allowance because my dad didn’t “believe” in allowances (I used to get so irritated at that statement). If we wanted money, we either had to get a job or do extra work around the house. Again, nothing major but a simple principal that stuck with me as I got older. There was an old Dire Straits song that my dad always sang when we became a little entitled called “Money for Nothing”.I would always get frustrated because I knew our family had money but when I went out with friends I was always the one with no money. I got used to saying, “yeah my family has money but I don’t.” So before I turned sixteen I would do things like wash my dad’s car for money (which I never did right) or clean out the garage which was always a mess from weekend projects. As soon as I was able, I got my first job and received a thousand dollar 1994 Honda Passport to get to work. Again, another point of frustration because I knew my dad had more money to spend rather than on a piece of junk, but truthfully, I actually loved that car. Yet, I did not contribute to the purchase of the car so I learned to be grateful for what I received. From then on I worked through high school and college developing a bigger appreciation and gratitude for everything I learned at a younger age.I have enjoyed some success early in my life and look forward to a future with the knowledge that there is no such thing as “money for nothing.” I am grateful for my family and the opportunity, from a young age, to learn the values that made my father a successful entrepreneur. What once was bag of cliché sayings became the lessons I live by today.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theDefiance Press and Publishing websiteTheup to a $25,000 investment to the best business plan submitted on . Read on this website for details.

9:00 AM comes especially early for kids or young teenagers. It is even more debilitating when your father is the alarm clock that has a snooze button you don’t want to press. Today by 9:00 AM I have run a mile, been at work for an hour, and had my first cup of coffee. But back then, not so much. There was always something to do around the house and my father made sure that we were up to do it. Of course, we were never in the best of moods in the morning and this reaction would be met with a rhetorical question from my father such as “do you think this is a resort?” He always had us doing something even if it was completely useless to keep us busy. I realize now, as a grown adult, it was all about using our time productively and that’s what I learned from my serial entrepreneurial father.By no means did I have it bad as a kid growing up, although, my thirteen year old self might say otherwise, but in hindsight I was extremely fortunate. There are kids who had it much worse and I thank God for my family and the childhood I experienced. I learned some valuable lessons growing up from my father, who had a strong work mentality. I remember being yelled at one time as I rolled past him on my bike into the garage because I didn’t bring the trashcans up from the driveway. When confronted, I simply stated that I was never asked to do that. That is when I had my first lesson on taking initiative. Doing things that need to be done without being told to do them. It has stuck with me to this day. It was a simple message that was received and learned at a very young age. I also remember learning early on that entitlement doesn’t go too far in our house. I had the normal daily chores but I never received an allowance because my dad didn’t “believe” in allowances (I used to get so irritated at that statement). If we wanted money, we either had to get a job or do extra work around the house. Again, nothing major but a simple principal that stuck with me as I got older. There was an old Dire Straits song that my dad always sang when we became a little entitled called “Money for Nothing”.I would always get frustrated because I knew our family had money but when I went out with friends I was always the one with no money. I got used to saying, “yeah my family has money but I don’t.” So before I turned sixteen I would do things like wash my dad’s car for money (which I never did right) or clean out the garage which was always a mess from weekend projects. As soon as I was able, I got my first job and received a thousand dollar 1994 Honda Passport to get to work. Again, another point of frustration because I knew my dad had more money to spend rather than on a piece of junk, but truthfully, I actually loved that car. Yet, I did not contribute to the purchase of the car so I learned to be grateful for what I received. From then on I worked through high school and college developing a bigger appreciation and gratitude for everything I learned at a younger age.I have enjoyed some success early in my life and look forward to a future with the knowledge that there is no such thing as “money for nothing.” I am grateful for my family and the opportunity, from a young age, to learn the values that made my father a successful entrepreneur. What once was bag of cliché sayings became the lessons I live by today.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theDefiance Press and Publishing websiteTheup to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on February 13, 2017 04:31

February 6, 2017

Balancing Life as an Entrepreneur

The need to strike a balance in life between work and family is not lost on the entrepreneur.The effort required to get a startup over the hump to profitability can take months or even years.During this time, there is a very focused and intense effort to get the job done. But - it is also important that all affected family members are pulling in the same direction and know what the overall family objectives are. The "business" was always the "family business" even though Rose and the kids weren't materially involved in the day-to-day operations.During my air freight forwarding days, we ran so lean that we couldn't get the billing done on a daily basis, therefore I would have to come in over the weekend to rate invoices and get them sent out to our customers. If I didn't get them out on time, it would effect our cash-flow - therefore it was imperative we billed timely and regularly.Beside the long twelve to sixteen hour days during the week it was also not unusual for me to entertain clients on Friday or Saturday night - or both. Thank God my wife Rose was understanding.Our family made the business part of our routine. Many times the kids would go with me on Saturdays to play on the office machines while I was doing the invoicing, or beg me for a ride on the forklift out in the warehouse.I have seen spouses who were not supportive of the dreams and aspirations of their spouse, adding the most difficult obstacle of all to their chances of success. We set family goals, at first very small ones to make the kids part of the dream. A small success like a new account may have meant a day at the beach in Galveston, a night out to dinner or a special breakfast after church on Sunday.I give all the credit of the support I received in building my businesses to my wife, Rose - as she kept the kids in engaged in the goals the family as a unit was trying to achieve. Instead of complaining about my long hours and depose me to our kids, Rose reinforced the sacrifices being made to the benefit of the family.We weren't always able to take the nicest vacations or give the kids everything they wanted at Christmas, but somehow we cultivated a strong sense of the family unit - everyone pulling in the same direction. We celebrated small successes and we looked at failures as temporary.The sense of togetherness as a family when tied to an entrepreneurial dream cannot be overstated. A man or a woman on a mission to follow an entrepreneurial dream is contagious. People like to follow dreamers, and that especially includes your kids.Make your spouse and your kids part of the dream. You'll be thankful they were on the journey with you!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theDefiance Press and Publishing website.The Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

The need to strike a balance in life between work and family is not lost on the entrepreneur.The effort required to get a startup over the hump to profitability can take months or even years.During this time, there is a very focused and intense effort to get the job done. But - it is also important that all affected family members are pulling in the same direction and know what the overall family objectives are. The "business" was always the "family business" even though Rose and the kids weren't materially involved in the day-to-day operations.During my air freight forwarding days, we ran so lean that we couldn't get the billing done on a daily basis, therefore I would have to come in over the weekend to rate invoices and get them sent out to our customers. If I didn't get them out on time, it would effect our cash-flow - therefore it was imperative we billed timely and regularly.Beside the long twelve to sixteen hour days during the week it was also not unusual for me to entertain clients on Friday or Saturday night - or both. Thank God my wife Rose was understanding.Our family made the business part of our routine. Many times the kids would go with me on Saturdays to play on the office machines while I was doing the invoicing, or beg me for a ride on the forklift out in the warehouse.I have seen spouses who were not supportive of the dreams and aspirations of their spouse, adding the most difficult obstacle of all to their chances of success. We set family goals, at first very small ones to make the kids part of the dream. A small success like a new account may have meant a day at the beach in Galveston, a night out to dinner or a special breakfast after church on Sunday.I give all the credit of the support I received in building my businesses to my wife, Rose - as she kept the kids in engaged in the goals the family as a unit was trying to achieve. Instead of complaining about my long hours and depose me to our kids, Rose reinforced the sacrifices being made to the benefit of the family.We weren't always able to take the nicest vacations or give the kids everything they wanted at Christmas, but somehow we cultivated a strong sense of the family unit - everyone pulling in the same direction. We celebrated small successes and we looked at failures as temporary.The sense of togetherness as a family when tied to an entrepreneurial dream cannot be overstated. A man or a woman on a mission to follow an entrepreneurial dream is contagious. People like to follow dreamers, and that especially includes your kids.Make your spouse and your kids part of the dream. You'll be thankful they were on the journey with you!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE on theDefiance Press and Publishing website.The Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on February 06, 2017 04:36

January 29, 2017

Family Blessings

In a family of 12 children, my father, the oldest of six boys, was told at the age of 14 he was old enough to be on his own. He found a garage apartment and began working as a mechanic. He worked to learn the business then opened his own shop in El Campo, Texas at the age of 17. Shortly after, he met my mother and married her two years later. I was the oldest of four girls and had an older brother.My mom worked in the family business too by keeping the books and handling the administrative duties. After preparing all of our meals each day and getting us off on the bus to school, my mom and my baby sister (who was not yet in school) would leave with my dad for the shop. By the time we arrived home from school, my mom was always there to greet us. On weekends, after chores at home were done, all of us would often head to my dad’s shop to help him. This is where I learned a little about cars. I learned how check the oil, change the oil, spark plugs and basic engine operation.Growing up in a family business meant everyone pitched in and sacrificed to support our dad. My older brother’s responsibilities were differed much from my own. He helped with what I call “outside chores” – lawn, home repairs and maintenance. Being the oldest of four girls, I was in charge of making sure the house was clean and my sisters were bathed and dressed each day. I also helped with the laundry by either hanging clothes on the clothesline or making sure they were inside and folded before dark. “There is always housework to do” my dad would say if we even thought about lounging around in front of the TV.By the age of 14 I desired the independence of having a little money of my own. I didhave to lie about my age, but I really wanted a job. I kept a small portion of my paycheck to cover my school lunches but the rest and all of my tips were given to my dad. I still had my responsibilities at home but by this time they were easy.I remember the feeling of excitement when Friday came. This was the time that we all dressed up to eat out, usually at Dairy Queen, where my Aunt was the manager or at Landry's Drive-In if it was during Lent. The best part was ordering dessert! I understand now that this was my dad’s way of giving back for our help during the week. He was so proud to able to feed all seven of us without worries.Saturday nights were exciting too because we'd pile up in the back of dad's pickup truck and go to the drive-in theater. Sometimes, our neighbors and relatives would caravan there so we could all park next to each other. The grownups sat outside the cars on their lawn chairs and visited while watching the movie. Mom would always bring pillows and blankets for us to fall asleep in the back of the pickup at a decent hour. We all worked very hard, but it also meant we enjoyed the many blessings of a united family.

In a family of 12 children, my father, the oldest of six boys, was told at the age of 14 he was old enough to be on his own. He found a garage apartment and began working as a mechanic. He worked to learn the business then opened his own shop in El Campo, Texas at the age of 17. Shortly after, he met my mother and married her two years later. I was the oldest of four girls and had an older brother.My mom worked in the family business too by keeping the books and handling the administrative duties. After preparing all of our meals each day and getting us off on the bus to school, my mom and my baby sister (who was not yet in school) would leave with my dad for the shop. By the time we arrived home from school, my mom was always there to greet us. On weekends, after chores at home were done, all of us would often head to my dad’s shop to help him. This is where I learned a little about cars. I learned how check the oil, change the oil, spark plugs and basic engine operation.Growing up in a family business meant everyone pitched in and sacrificed to support our dad. My older brother’s responsibilities were differed much from my own. He helped with what I call “outside chores” – lawn, home repairs and maintenance. Being the oldest of four girls, I was in charge of making sure the house was clean and my sisters were bathed and dressed each day. I also helped with the laundry by either hanging clothes on the clothesline or making sure they were inside and folded before dark. “There is always housework to do” my dad would say if we even thought about lounging around in front of the TV.By the age of 14 I desired the independence of having a little money of my own. I didhave to lie about my age, but I really wanted a job. I kept a small portion of my paycheck to cover my school lunches but the rest and all of my tips were given to my dad. I still had my responsibilities at home but by this time they were easy.I remember the feeling of excitement when Friday came. This was the time that we all dressed up to eat out, usually at Dairy Queen, where my Aunt was the manager or at Landry's Drive-In if it was during Lent. The best part was ordering dessert! I understand now that this was my dad’s way of giving back for our help during the week. He was so proud to able to feed all seven of us without worries.Saturday nights were exciting too because we'd pile up in the back of dad's pickup truck and go to the drive-in theater. Sometimes, our neighbors and relatives would caravan there so we could all park next to each other. The grownups sat outside the cars on their lawn chairs and visited while watching the movie. Mom would always bring pillows and blankets for us to fall asleep in the back of the pickup at a decent hour. We all worked very hard, but it also meant we enjoyed the many blessings of a united family. My most vivid memory of childhood, which I believe prepared me the most for the roller coaster ride of supporting entrepreneurship, was when our house burned to the ground when I was five years old. At that age, I understood that you could have everything you want on one day and it could all be gone the next. We had to start over. I believe this experience made me stronger on the inside and taught me to be thankful for my life and family and not for material things.My father’s actions spoke volumes and I am so grateful he taught me the value of a strong work ethic. Without this, the entrepreneurial ride with my husband would have been much more difficult. We have had failures but our perseverance, together, ultimately led to great success with my husband leading the way.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at thewebsite.Theis offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

My most vivid memory of childhood, which I believe prepared me the most for the roller coaster ride of supporting entrepreneurship, was when our house burned to the ground when I was five years old. At that age, I understood that you could have everything you want on one day and it could all be gone the next. We had to start over. I believe this experience made me stronger on the inside and taught me to be thankful for my life and family and not for material things.My father’s actions spoke volumes and I am so grateful he taught me the value of a strong work ethic. Without this, the entrepreneurial ride with my husband would have been much more difficult. We have had failures but our perseverance, together, ultimately led to great success with my husband leading the way.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at thewebsite.Theis offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on January 29, 2017 14:33

January 23, 2017

Know Your Customers to Know Your Business

Aspiring entrepreneurs often ask me for my opinion on their creative ideas, and there have been a few instances where I have been very impressed with the ingenuity and originality behind them. Too often is the case, however, when asked the following five questions, aspiring entrepreneurs are not prepared to answer the real rubber-meets-the-road questions about their business model, strategies and their target audience: the customer.1. Who will be the customers that will use and buy this service or product? It is imperative to know who your target market is, or that a market even exists for your proposed idea. This can be tested through talking initially with trusted friends, family and professional peers, and further tested through market research and focus groups.2. Who are the competitors of similar services or products? You need to know your competition; otherwise, you will be blindly entering into a business with insufficient knowledge of competitive threats. Your competition will certainly know you, and will take advantage of your lack of in-depth knowledge.3. Companies who market successfully have a strongly crafted and clearly communicated Unique Selling Proposition (USP). What differentiates your service or products from the competition? If you are unable to distinguish yourself with ease of use, pricing, quality, service or design, it is unlikely you will stand out in the marketplace and gain market share.4. If your idea is a new concept, service or product, who would use it? Is there demonstrable demand for this unproven idea? Why hasn’t someone else already launched this business? Are there regulatory, licensing, environmental or other barriers to entry, or are you like Steve Jobs and just know what people want before they do? If you have that kind of money behind you, go for it, otherwise further market research and focus groups may be in order for proof of concept and viability.5. What does the service or product cost to produce? What will profit margins look like and what volume will it take to produce a profit?Many entrepreneurs launch their businesses without having solid answers to these questions, and believe the creativity behind their ideas will be enough to see them through. Keep asking yourself these questions from the inception of your idea, and then again, year-after-year, to ensure your business doesn’t become obsolete. Where would ATT be today if the leadership wasn’t willing to re-evaluate the business model and continued to offer only landline phone service? Blockbuster Video failed to ask these questions, relying entirely on past success all the way to bankruptcy. They ignored emerging innovators like NetFlix, RedBox and Apple TV, and are now a mere footnote in business history.(Disclosure: I have long been an ATT stockholder.)Richard “Gordy” Bunch is the EY Entrepreneur of the Year® for the Gulf Coast for Products and Services. He is also the founder, president and CEO ofThe Woodlands Financial Groupbased in The Woodlands. You may submit suggested topics for future business columns to him at gordy@twfg.com, or through the editor of this publication.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at theDefiance Press and Publishing website.TheRenegade Capitalistis offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Aspiring entrepreneurs often ask me for my opinion on their creative ideas, and there have been a few instances where I have been very impressed with the ingenuity and originality behind them. Too often is the case, however, when asked the following five questions, aspiring entrepreneurs are not prepared to answer the real rubber-meets-the-road questions about their business model, strategies and their target audience: the customer.1. Who will be the customers that will use and buy this service or product? It is imperative to know who your target market is, or that a market even exists for your proposed idea. This can be tested through talking initially with trusted friends, family and professional peers, and further tested through market research and focus groups.2. Who are the competitors of similar services or products? You need to know your competition; otherwise, you will be blindly entering into a business with insufficient knowledge of competitive threats. Your competition will certainly know you, and will take advantage of your lack of in-depth knowledge.3. Companies who market successfully have a strongly crafted and clearly communicated Unique Selling Proposition (USP). What differentiates your service or products from the competition? If you are unable to distinguish yourself with ease of use, pricing, quality, service or design, it is unlikely you will stand out in the marketplace and gain market share.4. If your idea is a new concept, service or product, who would use it? Is there demonstrable demand for this unproven idea? Why hasn’t someone else already launched this business? Are there regulatory, licensing, environmental or other barriers to entry, or are you like Steve Jobs and just know what people want before they do? If you have that kind of money behind you, go for it, otherwise further market research and focus groups may be in order for proof of concept and viability.5. What does the service or product cost to produce? What will profit margins look like and what volume will it take to produce a profit?Many entrepreneurs launch their businesses without having solid answers to these questions, and believe the creativity behind their ideas will be enough to see them through. Keep asking yourself these questions from the inception of your idea, and then again, year-after-year, to ensure your business doesn’t become obsolete. Where would ATT be today if the leadership wasn’t willing to re-evaluate the business model and continued to offer only landline phone service? Blockbuster Video failed to ask these questions, relying entirely on past success all the way to bankruptcy. They ignored emerging innovators like NetFlix, RedBox and Apple TV, and are now a mere footnote in business history.(Disclosure: I have long been an ATT stockholder.)Richard “Gordy” Bunch is the EY Entrepreneur of the Year® for the Gulf Coast for Products and Services. He is also the founder, president and CEO ofThe Woodlands Financial Groupbased in The Woodlands. You may submit suggested topics for future business columns to him at gordy@twfg.com, or through the editor of this publication.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at theDefiance Press and Publishing website.TheRenegade Capitalistis offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on January 23, 2017 07:43

January 16, 2017

From U.S. Secret Service to Entrepreneur

I started my career in the U.S. Secret Service in 1989 and worked for 25 years before becoming an entrepreneur. I was initially assigned to the White House and after several transfers, ended up in the training division a few years prior to retirement. I was one of those people, scratching my chin, wondering what I was going to do after retiring from such an exciting, think on your feet, and fast paced career. What could possibly top this?In the U.S. Secret Service I protected Presidents George H. W. Bush, Bill Clinton, George W. Bush and Barack Obama. I never realized how much my role in the U.S. Secret Service would prepare me to become a successful entrepreneur. PLANNING is key. When a President takes a trip, anywhere, there’s what is called “advance work” that is conducted prior to the trip. The Secret Service will send an Advance Team to scout every route and literally every step the President will take, down to his bathroom breaks. Everything is surveyed and researched then resurveyed and researched again prior to the President starting his journey.The same “advance work” referenced above applies to starting a business. After making the decision to start my own business it was time to come up with a plan. Let the due diligence begin!One of the biggest enjoyments in my career came when I was assigned to the training division. I LOVE to instruct and teach others. After contemplating this fact, adding in safety and tactical knowledge, I determined that a gun range and training facility would make a great second career.First, I ordered a market and demographic report from the National Shooting Sports Foundation that would help me decide where I wanted to open my business. Texas was the obvious answer for this type of venture because of their strong support of the 2nd Amendment and being one of the best states in the nation to operate a business.I visited many gun ranges to get a feel for what was out there and did intense market research. I concluded the typical gun range market was not providing a good customer experience. Time to take a different approach. How would I differentiate my business from the status quo in the industry? I identified two areas that were lacking in the gun ranges I visited: 1. A unique experience, and 2. Friendly customer service.All of the gun ranges I visited had the same feel and the experience of checking in, shooting, and leaving. The staff were terse in demeanor and ruled with an “iron fist”. There is a high degree of safety compliance involved so I understood, somewhat, the terseness, but there is a way to be firm yet polite.In 2015 I openedSaddle River Rangein Conroe, Texas that offers private memberships to cater to a high-end clientele, a gun range open to the public for those who just want to practice, archery, training classes, retail, a café in case you get hungry, and most importantly, a friendly and competent staff at your disposal for your unique experience.To sum it all up, when opening a business three things are critical, 1. Planning, planning, planning, 2. Differentiation and 3. Great customer service.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at theDefiance Press and Publishingwebsite.TheRenegade Capitalistis offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

I started my career in the U.S. Secret Service in 1989 and worked for 25 years before becoming an entrepreneur. I was initially assigned to the White House and after several transfers, ended up in the training division a few years prior to retirement. I was one of those people, scratching my chin, wondering what I was going to do after retiring from such an exciting, think on your feet, and fast paced career. What could possibly top this?In the U.S. Secret Service I protected Presidents George H. W. Bush, Bill Clinton, George W. Bush and Barack Obama. I never realized how much my role in the U.S. Secret Service would prepare me to become a successful entrepreneur. PLANNING is key. When a President takes a trip, anywhere, there’s what is called “advance work” that is conducted prior to the trip. The Secret Service will send an Advance Team to scout every route and literally every step the President will take, down to his bathroom breaks. Everything is surveyed and researched then resurveyed and researched again prior to the President starting his journey.The same “advance work” referenced above applies to starting a business. After making the decision to start my own business it was time to come up with a plan. Let the due diligence begin!One of the biggest enjoyments in my career came when I was assigned to the training division. I LOVE to instruct and teach others. After contemplating this fact, adding in safety and tactical knowledge, I determined that a gun range and training facility would make a great second career.First, I ordered a market and demographic report from the National Shooting Sports Foundation that would help me decide where I wanted to open my business. Texas was the obvious answer for this type of venture because of their strong support of the 2nd Amendment and being one of the best states in the nation to operate a business.I visited many gun ranges to get a feel for what was out there and did intense market research. I concluded the typical gun range market was not providing a good customer experience. Time to take a different approach. How would I differentiate my business from the status quo in the industry? I identified two areas that were lacking in the gun ranges I visited: 1. A unique experience, and 2. Friendly customer service.All of the gun ranges I visited had the same feel and the experience of checking in, shooting, and leaving. The staff were terse in demeanor and ruled with an “iron fist”. There is a high degree of safety compliance involved so I understood, somewhat, the terseness, but there is a way to be firm yet polite.In 2015 I openedSaddle River Rangein Conroe, Texas that offers private memberships to cater to a high-end clientele, a gun range open to the public for those who just want to practice, archery, training classes, retail, a café in case you get hungry, and most importantly, a friendly and competent staff at your disposal for your unique experience.To sum it all up, when opening a business three things are critical, 1. Planning, planning, planning, 2. Differentiation and 3. Great customer service.For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at theDefiance Press and Publishingwebsite.TheRenegade Capitalistis offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on January 16, 2017 08:03

January 9, 2017

Building a Big Brand on a Small Budget

Creating a recognizable brand should be a top priority of any business, no matter your size or budget. The branding of your business will either attract customers or it will drive them away. It's that simple. Branding should be one of the very first considerations of a new (or existing) enterprise - yet it is shocking how little many entrepreneurs focus on the branding of their company and their products or services.Nothing screams "small time"to me more than a business owner who hands me their business card which has neither a website to reference nor, more frequently, an email address tied to their domain name.A serious entrepreneur shouldneverhave an email address that is tied to Gmail, Yahoo, Hotmail or any one of the litany of free email accounts. I personally do not like to send or answer emails to these free email sites due to the obvious ease into which they can get hacked! (See the John Podesta hacked emails...)Having this kind of email screams laziness at worst or the lack of attention to detail at best. Email addresses should always be you@yourbusinessname.com or .net, etc. The website domain host should be able to provide you a branded email account. Consider having several email accounts such as info@ or sales@ your domain. You can have all addresses pointed to one catch-all email account.Beware of the many domain hosting companies that offer free templates to build your website. Many of these free sites will host our site if you reserve the domain name through them,but they keep your domain name!You don't own the URL, nor can you transfer it at a later date. There is often fine print that allows them to attach their name or brand prominently to your website. Avoid these hosting companies at all costs. Again, the idea is to brand professionally without the professional budget. If it becomes obvious your business is using afreewebsite building template you broadcast an amateur status.A brand begins with a logo. There are countless inexpensive freelance websites that can help you develop a logo very inexpensively. Make sure your logo is also attached to your email signature to convey your band as a professional organization.With branding, the little things all add up to create the image you want. Business cards, invoices, letterhead, etc. should have a common look, feel and logo.If the name of your business doesn't automatically tell customers what you do (e.g. Oak Street Meat Market) then consider developing a short tag line. At Teligistics, we came up with a brilliant tag line that encompasses exactly what we do, "Making Cents of Your Telecom Dollars". Hence, large enterprises know we are in the business of reducing telecom expenses.Your website should be simple, straightforward and an effective brochure for your business. We drive leads to our websites by offering white papers on various topics where potential customers register. There are dozens of inexpensive website design templates from a multitude of providers. Avoid incorporating large pictures or flash in your design that will contribute to a long load time for the consumer. Various studies show that once a prospective customer visits your site, you have about twenty seconds to keep them there. Make double sure the mobile design of your website works on cell phones, tablets, and all browsers.Today, content it everything. The most successful websites are those that offer content that educates the consumer, whether it be a retail consumer or B2B consumer. Educating builds confidence in the potential customer.Make sure a potential customer has an obvious link to reach you through a prominent Contact Us page and link. How many times have you had to search on a website for a way to contact the merchant? It's frustrating and for me it's an immediate sign the enterprise will be hard to reach for customer service, etc.Consider using an SEO (search engine optimization firm) if your budget allows or consider Google Adwords to drive traffic to your website. At a minimum, your hosted domain website template builder should allow you to add embedded key words to allow potential customers to find you in web searches. Building a website does not guarantee anyone can find it. It must be part of an overall branding campaign.After creating a professional logo or image, tag line, business cards and a website consider producing regular press releases about your product or service. Again, the Internet is a wonderful place to find services that will write press releases. However, unless you are a gifted writer make sure you have a professional editor. The damage done to your brand by issuing a press release that is incoherent or has spelling errors is almost irreparable in the short term.Finally, one greatly overlooked area of branding is how your new venture answers live phone calls.I personally get turned off by the difficulty of reaching a live person in a company I'm prepared to spend money with - or one in which I have already spent money. Nothing beats a call answered live by a human being. Again, with todays' technologies there are a myriad of services that will forward your office phone to your mobile device, etc. Beware however, if you use this approach to never miss a phone call, make sure customers don't reach your mobile phone voicemail - or worse that your mobile voice mail message is less professional than your greeting on your business phone number!Branding your venture is essentially the building of your company's business reputation. Taking care of the small details goes a very long way to creating the image of a successful operation - and everyone likes to do business with a success!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at the Defiance Press and PublishingThe Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Creating a recognizable brand should be a top priority of any business, no matter your size or budget. The branding of your business will either attract customers or it will drive them away. It's that simple. Branding should be one of the very first considerations of a new (or existing) enterprise - yet it is shocking how little many entrepreneurs focus on the branding of their company and their products or services.Nothing screams "small time"to me more than a business owner who hands me their business card which has neither a website to reference nor, more frequently, an email address tied to their domain name.A serious entrepreneur shouldneverhave an email address that is tied to Gmail, Yahoo, Hotmail or any one of the litany of free email accounts. I personally do not like to send or answer emails to these free email sites due to the obvious ease into which they can get hacked! (See the John Podesta hacked emails...)Having this kind of email screams laziness at worst or the lack of attention to detail at best. Email addresses should always be you@yourbusinessname.com or .net, etc. The website domain host should be able to provide you a branded email account. Consider having several email accounts such as info@ or sales@ your domain. You can have all addresses pointed to one catch-all email account.Beware of the many domain hosting companies that offer free templates to build your website. Many of these free sites will host our site if you reserve the domain name through them,but they keep your domain name!You don't own the URL, nor can you transfer it at a later date. There is often fine print that allows them to attach their name or brand prominently to your website. Avoid these hosting companies at all costs. Again, the idea is to brand professionally without the professional budget. If it becomes obvious your business is using afreewebsite building template you broadcast an amateur status.A brand begins with a logo. There are countless inexpensive freelance websites that can help you develop a logo very inexpensively. Make sure your logo is also attached to your email signature to convey your band as a professional organization.With branding, the little things all add up to create the image you want. Business cards, invoices, letterhead, etc. should have a common look, feel and logo.If the name of your business doesn't automatically tell customers what you do (e.g. Oak Street Meat Market) then consider developing a short tag line. At Teligistics, we came up with a brilliant tag line that encompasses exactly what we do, "Making Cents of Your Telecom Dollars". Hence, large enterprises know we are in the business of reducing telecom expenses.Your website should be simple, straightforward and an effective brochure for your business. We drive leads to our websites by offering white papers on various topics where potential customers register. There are dozens of inexpensive website design templates from a multitude of providers. Avoid incorporating large pictures or flash in your design that will contribute to a long load time for the consumer. Various studies show that once a prospective customer visits your site, you have about twenty seconds to keep them there. Make double sure the mobile design of your website works on cell phones, tablets, and all browsers.Today, content it everything. The most successful websites are those that offer content that educates the consumer, whether it be a retail consumer or B2B consumer. Educating builds confidence in the potential customer.Make sure a potential customer has an obvious link to reach you through a prominent Contact Us page and link. How many times have you had to search on a website for a way to contact the merchant? It's frustrating and for me it's an immediate sign the enterprise will be hard to reach for customer service, etc.Consider using an SEO (search engine optimization firm) if your budget allows or consider Google Adwords to drive traffic to your website. At a minimum, your hosted domain website template builder should allow you to add embedded key words to allow potential customers to find you in web searches. Building a website does not guarantee anyone can find it. It must be part of an overall branding campaign.After creating a professional logo or image, tag line, business cards and a website consider producing regular press releases about your product or service. Again, the Internet is a wonderful place to find services that will write press releases. However, unless you are a gifted writer make sure you have a professional editor. The damage done to your brand by issuing a press release that is incoherent or has spelling errors is almost irreparable in the short term.Finally, one greatly overlooked area of branding is how your new venture answers live phone calls.I personally get turned off by the difficulty of reaching a live person in a company I'm prepared to spend money with - or one in which I have already spent money. Nothing beats a call answered live by a human being. Again, with todays' technologies there are a myriad of services that will forward your office phone to your mobile device, etc. Beware however, if you use this approach to never miss a phone call, make sure customers don't reach your mobile phone voicemail - or worse that your mobile voice mail message is less professional than your greeting on your business phone number!Branding your venture is essentially the building of your company's business reputation. Taking care of the small details goes a very long way to creating the image of a successful operation - and everyone likes to do business with a success!For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at the Defiance Press and PublishingThe Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on January 09, 2017 04:00

January 3, 2017

A Tale of Two Brothers

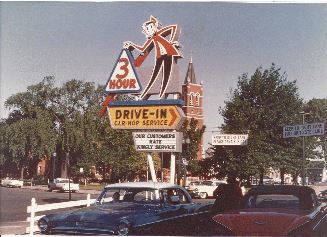

The market crash of 1929 kicked off a period in American history known as the Great Depression. My grandfather's home construction business weathered the first few years but finally succumbed to a market that had all but dried up by 1932. To make ends meet for a family of eight, he and my grandmother started a residential laundry in their home. A 1924 Ford truck that had been used for construction was pressed in to service for laundry pick up and delivery.The business grew from a home operation in their basement to plants in the neighboring cities of Syracuse and Rochester, New York. My dad's oldest brother Brud, eventually took over the Syracuse operation and my dad took over the second plant in Rochester.As I look back on my dad and uncle's businesses, it's a great study in the difference between an entrepreneur and a laborer. In David Thomas Roberts' book, "Unemployable!" he points out that an Entrepreneur may be someone who visualizes a new concept or they take a proven idea and improve it and bring additional value. In contrast, a laborer is someone who looks at a business concept and focuses on the constraints of the status quo rather than looking beyond those constraints. Ronald Reagan once said; "Status quo, you know is Latin for 'the mess we`re in'." Entrepreneurs don't see constraints, they see opportunity.My uncle was the classic laborer. His 1,800-square foot plant in Syracuse was a store front operation that perfectly fit the mold of every other laundry in town. Dad's operation was initially the same size but when the neighboring car dealership closed its doors in 1948, he quickly made an offer on the 10,000-square foot building. The extra space enabled him to add a modern dry cleaning operation for the growing middle class of white collar workers. The increased laundry capacity also empowered him to go after the local high school and college sport uniform cleaning and repair business.He then added a covered drive-through so customers never had to get out of their car. In 1949, it was probably the first drive-through laundry/dry cleaner in the US. As a customer drove through the drop off lane a car hop, dressed smartly in black slacks and a white shirt with a black bow-tie ran out to the car with a hot cup of coffee. Later that day, when they came back to pick up their laundry a car hop met them with a cold drink of their choice. While they waited for their laundry, a second young man was cleaning their front windshield.Dad's operation was a model of efficiency. Eventually he rebranded it as "Toth's 3-Hour Laundry." A customer was guaranteed that they could drop off laundry in the morning and pick it up at lunch. Dad understood that his product offering was not only of greater quality but the level of service far eclipsed his competitors and as a result, he was able to charge more.In 1978, as I was driving to Syracuse with my dad to see his brother, I asked him the $54,000 question. "Dad, why is Uncle Brud's business so small and yours is so huge?" Like most Socratic teachers, he answered my question with a question. "What do your Uncle's hands look like?" He asked me. "They're black. Almost like they are stained with grease" I said. He smiled and said; "When we get to Uncle Brud's plant, he'll have a wrench in his hands and he'll have his head underneath a press that he's repairing. Brud would rather save $40 and fix a press or a washing machine himself than pay someone to do it for him. I would rather pay someone to make repairs so that I can plan about how to grow my business.Entrepreneurs know that to grow a business, they need to spend as much time working on their business as they do working in their business. My dad and his brother were workaholics, but dad was very disciplined at making sure that he allotted time for planning and vision casting and it paid off.My dad is 90 years old now with his workaholic days behind him. I called him the day after Christmas and he closed the conversation with this: "Steve, shoot high and keep your standards high and be prayerful about all that you do. Oh, and the cheesecake Babette sent was awesome."For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at the Defiance Press and Publishing website.The Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

The market crash of 1929 kicked off a period in American history known as the Great Depression. My grandfather's home construction business weathered the first few years but finally succumbed to a market that had all but dried up by 1932. To make ends meet for a family of eight, he and my grandmother started a residential laundry in their home. A 1924 Ford truck that had been used for construction was pressed in to service for laundry pick up and delivery.The business grew from a home operation in their basement to plants in the neighboring cities of Syracuse and Rochester, New York. My dad's oldest brother Brud, eventually took over the Syracuse operation and my dad took over the second plant in Rochester.As I look back on my dad and uncle's businesses, it's a great study in the difference between an entrepreneur and a laborer. In David Thomas Roberts' book, "Unemployable!" he points out that an Entrepreneur may be someone who visualizes a new concept or they take a proven idea and improve it and bring additional value. In contrast, a laborer is someone who looks at a business concept and focuses on the constraints of the status quo rather than looking beyond those constraints. Ronald Reagan once said; "Status quo, you know is Latin for 'the mess we`re in'." Entrepreneurs don't see constraints, they see opportunity.My uncle was the classic laborer. His 1,800-square foot plant in Syracuse was a store front operation that perfectly fit the mold of every other laundry in town. Dad's operation was initially the same size but when the neighboring car dealership closed its doors in 1948, he quickly made an offer on the 10,000-square foot building. The extra space enabled him to add a modern dry cleaning operation for the growing middle class of white collar workers. The increased laundry capacity also empowered him to go after the local high school and college sport uniform cleaning and repair business.He then added a covered drive-through so customers never had to get out of their car. In 1949, it was probably the first drive-through laundry/dry cleaner in the US. As a customer drove through the drop off lane a car hop, dressed smartly in black slacks and a white shirt with a black bow-tie ran out to the car with a hot cup of coffee. Later that day, when they came back to pick up their laundry a car hop met them with a cold drink of their choice. While they waited for their laundry, a second young man was cleaning their front windshield.Dad's operation was a model of efficiency. Eventually he rebranded it as "Toth's 3-Hour Laundry." A customer was guaranteed that they could drop off laundry in the morning and pick it up at lunch. Dad understood that his product offering was not only of greater quality but the level of service far eclipsed his competitors and as a result, he was able to charge more.In 1978, as I was driving to Syracuse with my dad to see his brother, I asked him the $54,000 question. "Dad, why is Uncle Brud's business so small and yours is so huge?" Like most Socratic teachers, he answered my question with a question. "What do your Uncle's hands look like?" He asked me. "They're black. Almost like they are stained with grease" I said. He smiled and said; "When we get to Uncle Brud's plant, he'll have a wrench in his hands and he'll have his head underneath a press that he's repairing. Brud would rather save $40 and fix a press or a washing machine himself than pay someone to do it for him. I would rather pay someone to make repairs so that I can plan about how to grow my business.Entrepreneurs know that to grow a business, they need to spend as much time working on their business as they do working in their business. My dad and his brother were workaholics, but dad was very disciplined at making sure that he allotted time for planning and vision casting and it paid off.My dad is 90 years old now with his workaholic days behind him. I called him the day after Christmas and he closed the conversation with this: "Steve, shoot high and keep your standards high and be prayerful about all that you do. Oh, and the cheesecake Babette sent was awesome."For more solid business principles, read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at the Defiance Press and Publishing website.The Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on . Read on this website for details.

Published on January 03, 2017 13:17

December 27, 2016

Borrowing Startup Capital from Relatives

For most entrepreneurs, their startup venture is not a likely candidate for a bank loan. Many entrepreneurs turn to family members to fund or to supplement funds for a startup.Accepting money from relatives has its own unique perils for the entrepreneur. Involving family in your venture may or may not be a smart move.Here's a few general guidelines to contemplate when considering approaching a family member about funding your business:1. This option should be a last resort. Borrowing from family can reduce the relationship to a financial transaction and has ruined many family relationships. Make sure you have exhausted all other options from crowdfunding, to micro lending to an equity investment from a partner before turning to this source of funds.2. Pick your relative carefully. Don't ever pick your source of capital simply because they have the funds. Do you genuinely like this family member? One thing I've learned from watching others do this is that involving money between two family members will magnify the relationship that is already there - good or bad. Life is too short to be in business with someone you detest, just because they have the money you think you need. Try to pick a family member who is willing to invest in you who has some history and experience in business for themselves. A seasoned business owner's advice and direction may actually be more valuable than the money you borrow from him or her.3. Is it a loan or an equity investment - or both? It's one thing to owe money to a family member, it's quite another to have them own a piece of your business. Sometimes, there can be a combination of the two. The entrepreneur needs to be prepared to for the family member who may want an ongoing concern in the business, which may conflict with your ownership plans.4. Execute a loan or equity document. One thing is for sure when it comes to borrowing money from family, there will be two (or more) stories about how the loan was supposed be repaid and what the original terms were. When I lend to an individual or family member, I am very strict about what the use of those funds. Without a fully executed loan or investment document, the interpretations blur over time and circumstances. It's worth a few hundred dollars to have a legal document drawn up. Make sure it includes a "confidentiality" clause unless you want all of your third and fourth cousins to be able to chime in with their "opinions". The repayment plan should be crystal clear. If the investment comes with equity in your business, you should also have a prepared "divorce" document known as a buy/sell agreement that specifically dictates how you can buy them out, whether they want out or not.5. Set expectations with your family financier. Make sure your family investor is fully aware of the business plan, the risks and your path to profitability.6. Set rules of engagement. There's nothing worse than a "hoverer" who is looking over your shoulder at your every move. Make sure your family lender knows his or her place in the business and if they have a day-to-day role or not.7. Don't borrow someone's life savings. It's one thing to risk your own life's savings for a startup you really believe will be a home run, but borrowing your grandma's life savings who is living on a fixed income is extremely risky. Generally speaking, whatever you borrow from a family member should be an amount they are willing to risk and lose completely.8. Pay off the loan BEFORE purchasing lifestyle. There's nothing worse than lending money to a family member, only to see them get into lifestyle debt (new car, home, jewelry, clothes, etc.). Absolutely do not spend any of these funds on anything other than what is documented for in the use of funds section of the loan or investment document. When the business starts cash-flowing, this debt should be the number one item in line to get paid off first without exception.Family members will continue to be a main source of funding for the bootstrapping startup. But, just because it may be a family member doesn't mean it shouldn't be treated as a professional transaction. Properly documenting the transaction protects both parties and thus the relationship so that it is beneficial for both!For more solid business principles read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at the Defiance Press and Publishingwebsite.The Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on See the website for detailswww.defiancepress.com

For most entrepreneurs, their startup venture is not a likely candidate for a bank loan. Many entrepreneurs turn to family members to fund or to supplement funds for a startup.Accepting money from relatives has its own unique perils for the entrepreneur. Involving family in your venture may or may not be a smart move.Here's a few general guidelines to contemplate when considering approaching a family member about funding your business:1. This option should be a last resort. Borrowing from family can reduce the relationship to a financial transaction and has ruined many family relationships. Make sure you have exhausted all other options from crowdfunding, to micro lending to an equity investment from a partner before turning to this source of funds.2. Pick your relative carefully. Don't ever pick your source of capital simply because they have the funds. Do you genuinely like this family member? One thing I've learned from watching others do this is that involving money between two family members will magnify the relationship that is already there - good or bad. Life is too short to be in business with someone you detest, just because they have the money you think you need. Try to pick a family member who is willing to invest in you who has some history and experience in business for themselves. A seasoned business owner's advice and direction may actually be more valuable than the money you borrow from him or her.3. Is it a loan or an equity investment - or both? It's one thing to owe money to a family member, it's quite another to have them own a piece of your business. Sometimes, there can be a combination of the two. The entrepreneur needs to be prepared to for the family member who may want an ongoing concern in the business, which may conflict with your ownership plans.4. Execute a loan or equity document. One thing is for sure when it comes to borrowing money from family, there will be two (or more) stories about how the loan was supposed be repaid and what the original terms were. When I lend to an individual or family member, I am very strict about what the use of those funds. Without a fully executed loan or investment document, the interpretations blur over time and circumstances. It's worth a few hundred dollars to have a legal document drawn up. Make sure it includes a "confidentiality" clause unless you want all of your third and fourth cousins to be able to chime in with their "opinions". The repayment plan should be crystal clear. If the investment comes with equity in your business, you should also have a prepared "divorce" document known as a buy/sell agreement that specifically dictates how you can buy them out, whether they want out or not.5. Set expectations with your family financier. Make sure your family investor is fully aware of the business plan, the risks and your path to profitability.6. Set rules of engagement. There's nothing worse than a "hoverer" who is looking over your shoulder at your every move. Make sure your family lender knows his or her place in the business and if they have a day-to-day role or not.7. Don't borrow someone's life savings. It's one thing to risk your own life's savings for a startup you really believe will be a home run, but borrowing your grandma's life savings who is living on a fixed income is extremely risky. Generally speaking, whatever you borrow from a family member should be an amount they are willing to risk and lose completely.8. Pay off the loan BEFORE purchasing lifestyle. There's nothing worse than lending money to a family member, only to see them get into lifestyle debt (new car, home, jewelry, clothes, etc.). Absolutely do not spend any of these funds on anything other than what is documented for in the use of funds section of the loan or investment document. When the business starts cash-flowing, this debt should be the number one item in line to get paid off first without exception.Family members will continue to be a main source of funding for the bootstrapping startup. But, just because it may be a family member doesn't mean it shouldn't be treated as a professional transaction. Properly documenting the transaction protects both parties and thus the relationship so that it is beneficial for both!For more solid business principles read the book Unemployable! by David Thomas Roberts. Available for 40% off using promo code: RENEGADE at the Defiance Press and Publishingwebsite.The Renegade Capitalist is offering up to a $25,000 investment to the best business plan submitted on See the website for detailswww.defiancepress.com

Published on December 27, 2016 05:29

December 19, 2016

The Deadliest Sin in Business