S. Lakshmi Narasimhan's Blog, page 2

July 16, 2011

Table Turnover & Meal Period Analysis – 2 Paths to Restaurant Revenue Growth Nirvana

Two paths to restaurant revenue growth are table turnover ratio and the meal period analysis.

If you arrived at this post directly, you may want to visit Market Segmentation Reports – Road Map to Revenue Results and 5 Myths about Financial Analysis, to catch the thread of earlier related posts. These are key to operational analysis, a powerful compliment to effective financial analysis.

Restaurant Table Turnover Ratio

We saw in the earlier blog post 2 Paths to Revenue Growth Nirvana that incremental revenue from existing customers is a faster, cheaper and better method of sustaining growth. For hotel restaurants, this works differently. Revenue growth here is achieved by re-selling capacity and turning tables over faster. This process is measured by and known as the Table Turnover Ratio. What is this ratio about?

Table Turnover Ratio is a simple ratio which measures the number of times a table in a restaurant is turned over during a particular meal period. In effect, how many number of times the same table in a restaurant is sold.

Obviously a high turnover ratio means higher incremental revenue for the restaurant.

3 Major factors affecting Table Turnover

Table turnover is affected by a number of reasons but the following are three major ones:

Type of Restaurant Outlet

Meal Period

Hotel or Resort

1. Type of Restaurant Outlet

The single most important factor impacting table turnover is the type of restaurant outlet. What do we mean by this?

For example: a Coffee Shop by virtue of the nature of fare it serves is a busy, bustling, fast turnover outlet with an elaborate buffet spread laid out. The buffet not only allows customers to pick food of their choice but also to do so quickly and then be on their way. In contrast, a Fine Dining or Speciality restaurant is a sit-down restaurant serving a-la-carte (to be ordered from the menu) fare with an elaborate three course meal of soup or salad, entree and dessert accompanied by wines, spirits etc. It is a restaurant outlet catering pre-dominantly to lunch or dinner.

2. Meal Period

The second critical factor is the meal period. Table turnover is very different for breakfast as it is for lunch or dinner. Breakfast is normally a fast turnover (for exception, see the next section) event dominated by the buffet spread. Lunches and dinners despite having buffet spreads are sit down events mostly and undergone more leisurely although lunches targeted at office goers like executive lunches can be quick turnaround ones as well. Read more about this in the next section on meal periods analysis.

3. Hotel or Resort

This factor creates a diametrically opposite impact on table turnover depending on whether the restaurant outlet is part of a hotel (generally a city hotel) or a resort. This normally has more to do with the purpose of stay.

Stay in a city hotel generally is for business purposes (assuming a pre-dominantly corporate customer base) while it is for leisure in a resort. This for example has the effect of making even a breakfast meal period (in the Coffee Shop) very leisurely and long winded in a resort. Guests in resorts normally come down for breakfast very late (this is one reason why the breakfast meal period is stretched to accommodate this behavior) and they are buffet spreads as well. Thus, table turnover actually becomes a moot point since the patronage of the breakfast meal period will almost entirely be in-house guests. The only exception in the case of a resort will be one which is located close to a city or town area and attracts local customers.

Meal Period Analysis

The second path to restaurant revenue growth is meal period analysis. This is actually very closely related to table turnover ratio seen earlier. In fact, we can go as far to say that the optimum path to restaurant revenue growth nirvana is a combination of both these factors.

But what then is meal period analysis?

Meal period analysis is to restaurant revenue management what market segmentation is to room revenue management. It is a study of data and information on what contribution each meal period in a hotel or resort's restaurant outlets is making. This of course depends first on the type of outlet.

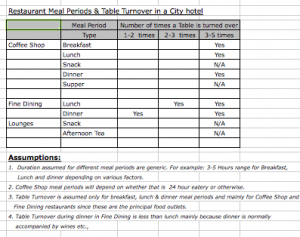

Meal period analysis requires accurate identification of specific meal periods that are applicable to each of a hotel or resort's restaurant outlets. Generically, the standard meal periods for a city hotel are breakfast, lunch, snack, dinner, supper although this is more applicable to a Coffee Shop.

Table Turnover & Meal Periods as powerful analysis tools

Having understood factors which affect table turnover and meal period analysis, how then are these considered powerful operational as well as financial analysis tools and how do these actually contribute to restaurant revenue growth.

Revenue contribution in restaurants is made by two key elements – food and beverage covers (number of guests) and the average food & beverage check. These are also known as the quantity (or volume) and price contributions. This is made clear by the following formula:

Restaurant Revenue = Food & Beverage Covers X Average Food & Beverage Check

When the above formula is applied for each meal period, these become the building blocks of a revenue estimate. However, this revenue estimate is on the assumption that each guest or cover is based on a turnover of one. If we are to assume different table turnover ratios for different restaurant types and meal periods, then we need to multiply the earlier revenue estimate with this ratio to arrive at the final revenue estimate. Please see Table below (Download Excel file here):

Meal Period & Table Turnover in City Hotel

For example, taking the earlier formula further:

Restaurant Revenue = Food & Beverage Covers [X Table Turnover Ratio] X Average Food & Beverage Check

An alternate way of calculating restaurant revenue is:

Restaurant Revenue = Restaurant Seating Capacity X Table Turnover Ratio X Average Food & Beverage Check.

One very important aspect to remember in using Table Turnover ratio is that the ratio must be accurately applied. When applied to full seating capacity, the factor will be less than when computed based on covers.

So, the approach is to estimate revenues assuming table turnover ratio is 1 and then multiplying actual cover count (or seating capacity) with the table turnover factor (number of times a table is turned over) to arrive at the final estimate.

This is why table turnover and meal periods in tandem are such powerful elements of budgeting or forecasting restaurant revenues.

New Hotel Revenue Projection

Another area of financial analysis where table turnover and meal period are used together is for new hotel revenue projections. This is done by actually applying table turnover ratio to the full capacity of the restaurant.

Moreover, table turnover can be generically used to determine various other factors like manning requirements, supplies etc.,

What are your thoughts and views on the restaurant revenue growth nirvana in this post?

Leave a comment and tell us what you think.

Click this RSS Link or the one on the Top Right side of the home page to be updated automatically when a new post appears or forward to your friends who you think will benefit from the discussion.

In our next post in this series, we will be looking at the first of some key human resources indices, namely Staff to Room Ratio.

Staff to room ratio is a key index for estimating manning requirements and critical for accurate labour cost budgets and forecasts.

It is as important an index as table turnover ratio and meal period analysis is for restaurant revenue growth nirvana.

July 13, 2011

Repeat Guest Ratio & Average Length of Stay – 2 Paths to Revenue Growth Nirvana

Two sure paths to revenue growth nirvana for hotels are the repeat guest ratio and the average length of stay which are very critical indices of operational analysis.

Every business enterprise is chasing the perennial revenue growth nirvana which is the basic ingredient for continuous top and bottom line performance.

If you arrived at this post directly, you may want to visit Market Segmentation Reports – Road Map to Revenue Results and 5 Myths about Financial Analysis, to catch the thread of earlier related posts.

Repeat Guest Ratio

It is a kind of mantra in marketing circles that incremental revenue from existing customers is a faster, cheaper and better method of sustaining growth. In the hotel industry, this is measured by the Repeat Guest Ratio. What is this ratio about?

Repeat Guest Ratio is a simple ratio which measures the extent of guests who are coming back to patronize the hotel compared to the total number of guests. In effect, how many number of times a guest stays in a particular hotel.

Repeat Guest Ratio has two major elements to it:

Room nights and

Room stays.

Room nights measure the number of nights a guest stayed at your hotel in a particular stay or the total number of nights during a certain period. Stays measure the number of times a guest stayed at your hotel over that period irrespective of the number of room nights that constitutes. Both these elements are expressed in terms of number of guests.

3 Awesome benefits of a High Repeat Guest Ratio

A high repeat guest ratio simply means that a majority of the guests staying at a hotel during a certain period are guests who have stayed there before. This can be calculated by dividing the total number of guests in the hotel at any point of time who have been there before by the total number of all guests.

This is a very powerful method of measuring the perpetuation of growth in revenues and has numerous qualitative as well as quantitative benefits to it. Apart from the obvious benefits of appreciative guest patronage, referrals, etc., the three most awesome quantitative ones are:

Revenue per guest goes up substantially if you consider that actually the number of guests are less (if you consider the repeat factor)

Guests who patronize hotels repeatedly also talk to their friends, family and colleagues resulting in incremental revenue without resultant marketing costs

High Repeat Guest Ratio also has a significant impact on the departmental profitability of rooms since average rates of repeat guests do not fluctuate wildly (as first time guests could possibly).

Average Length of Stay

Average Length of Stay is the other path to Revenue growth nirvana. While the repeat guest ratio measures the loyalty that guests feel and show towards a brand or hotel, the average length of stay is a direct element of the room stay (which is also tracked for repeat guests).

Simply stated, average length of stay is ratio of guest nights to guest arrivals. What it seeks to measure is how long a guest stay amounts to expressed in number of days. The higher the average length of stay, the higher the resultant revenues (not just room revenues but also from food and beverage and other facilities like, spa, laundry, gift shop etc.,).

Average length of stay is impacted by many factors like the extent of flights in and out of the city where the hotel is located (this may mean that guests do not stay over the weekends preferring to leave and return), the availability or otherwise of comparably priced serviced apartments, whether stay is for leisure or for business, whether it is a hotel or a resort to name a few. The key point is that often these factors are out of the control of the hotel.

3 Awesome benefits of a higher Average Length of Stay

To begin with, the higher the average length of stay compared to a previous period, the higher will be the incremental revenue earned (room as well as others).

A higher average length of stay also results in lesser manpower deployment (check-ins and check outs are averted since guest stays more nights in the same stay)and even some variable costs

Finally and most importantly, the higher the average length of stay the better the contribution to departmental profitability generally speaking.

Repeat Guest Ratio & Guest Recognition and Loyalty Programs

Now that we have seen how beneficial it is from a revenue growth and profitability perspective to enjoy high repeat guest percentage and average lengths of stay, it is important to know that guest recognition and loyalty programs are put in place in hotels to attack these very indices (actually applies more to repeat guest factor than average length of stay). In fact, one can go as far to say that the success of these programs can be measured definitely by the success of the repeat guest percentage.

What are your thoughts and views on the revenue growth nirvana in this post?

Leave a comment and tell us what you think.

Click this RSS Link or the one on the Top Right side of the home page to be updated automatically when a new post appears or forward to your friends who you think will benefit from the discussion.

In our next post in this series, we will be looking at Table Turnover Ratio and Meal Period Analysis, two major indices of restaurant revenue growth and how they contribute significantly to financial analysis carried out on monthly food and beverage departmental statements.

These are as critical to the food and beverage operation as repeat guest ratio and average length of stay are for the rooms operation.

July 10, 2011

Market Segmentation Reports

Imagine that you have driven for hours and hours and finally arrived at a place which looks like a big city. Would you not want to know where you have reached and more importantly whether that is the city you wanted to reach.

How would you do that? Probably, by whipping out a Road Map and tracing your journey from source to destination so that you can determine whether you have achieved what you set out to do – meaning, reaching the place you wanted to go to.

Actually the Road Map is to be used the other way – you decide where you want to reach and use the Road Map to chalk out your driving directions. This is planning to arrive at a certain place and making ensure you do arrive at that place.

What does the Market Segmentation Report do?

The Market Segmentation Report is the Road Map for the target markets and consumer segments from which a hotel plans to earn its major revenues.

The Market Segmentation Report is a Revenue Management Tool and in its basic form lays out the various market segments that have contributed to the earning of the revenues during a particular business performance period.

What are Market Segments?

Market Segments are consumer groups with differing tastes, preferences and objectives to which hotels can target and market in a focused manner matching their needs and budget.

In short, the market segments are categories of consumers who will patronize the hotel and generate revenues for it. Since different types of consumers have varying needs in terms of the hotel product they are looking for and the price they are willing to pay, market segments determine in a structured manner each of those types which the hotel will adopt. This is key to generating revenues and meeting targets while also ensuring that profitability is enhanced and growth is achieved.

Different forms of market segmentation

Market segmentation can take different forms depending on important criteria applied for determining them. These criteria could be geographic, demographic, psychographic, or behavioral to name the major ones.

A geographic variable, as the name implies, relates to the consumer's geographic area of residence. Countries are often classified into geographic regions in order to pin point the market targeting effort.

A demographic criteria takes variables such as age,gender, income and expenditure patterns, family size, stage in the family life cycle, educational level achieved, and occupation.

Psychographic criteria refers to segmentation based on lifestyle, attitudes, and personality.

Behavioral criteria refers to segmentation based on behavior of consumers like extent of loyalty, inclination to respond to marketing targeted at them etc.,

How to use the Market Segmentation Report?

The Market Segmentation Report normally is a reflection of how the hotel is positioned in its competitive set market. Competitive set refers to the hotels which are considered as direct competition within the geographic area of operation.

Market Segmentation Reports are barometers of measurement of performance of a hotel in its core revenue sources. For example, if a hotel is positioned as a corporate hotel, then the corporate and related segments would be the bread and butter revenue earners for that hotel.

The Market Segmentation Report normally measures performance from three angles: revenues, room nights and average rate.

As said earlier, whether the hotel is driving room nights or average rates or both will be determined by the positioning of the hotel in the competitive set. Moreover, all marketing efforts will also follow this positioning and the resultant market segments.

Market Segmentation Reports & Financial Analysis

Since results from market segments are tracked according to revenues, room nights and average rates, these have a direct bearing on the profitability of the hotel.

One of the golden rules of profitability arising out of financial analysis is the fact that revenue contribution due to higher rates than room nights generates more profit.

It simply means that a hotel's room department will show better profits in dollar terms when average rate has contributed to the revenues more than room nights. This is based on the principle that increased average rate will not be accompanied by any costs and thus will go straight to the bottom line. We will be looking at this principle of financial analysis in greater detail in a later post.

In the earlier blog post on Financial versus Operational Analysis, we discussed how informed decision making is key to effective decisions and results and the market segmentation is all about informed decision making on a hotel's revenue sources.

The Market Segmentation Report is one of the most powerful tools for effective financial analysis.

In our next post in this series, we will be looking at two key areas related to Market Segmentation Reports – Repeat Guest Ratio and Average Length of Stay and how they significantly impact hotel revenues and profits.

July 4, 2011

Financial Vs Operational Analysis

Before we dive headlong into what financial analysis is and what operational analysis is, let us see what analysis means.

If you arrived at this post directly, you may want to visit Market Segmentation Reports – Road Map to Revenue Results and 5 Myths about Financial Analysis, to catch the thread of related posts. These are key to operational analysis, a powerful compliment to effective financial analysis.

Meaning of analysis

The word analysis is generically defined as follows:

"The examination and evaluation of relevant information to select the best course of action from among various alternatives"

From the definition, we can clearly see that analysis is very closely linked to relevant information and decision making.

In short, making informed decisions.

Informed Decision Making Model

Informed decision making requires that that we ask a particular sequence of questions:

What are we trying to achieve?

What information do we have?

Did we achieve what we wanted?

Keeping this concept of informed decision making in mind and before we dive into the exciting world of financial analysis, it is only fair to visit an area which is equally, if not, more important. This is the world of operational analysis.

What is Operational Analysis?

Operational analysis is the study of the operation or service delivery process on which the entire business is built. There can neither be any operational analysis nor any financial analysis without the existence of this operation.

So, what then is the operation?

In the case of a hotel or resort, the operation refers to the entire process beginning with the guest room reservation, check in at the front desk, use of the facilities in the hotel including food and beverage, laundry, transportation, business centre, health club etc., and ending with the checking out of the guest after settling his or her room charges.

We shall be dealing with the hotel industry when discussing with financial or operational analysis in these series of blog posts.

Quantitative financial Vs Qualitative operational analysis

Financial Analysis mainly deals with the financial statements and related reports that are generated on a monthly basis like the Profit and Loss Account, Balance Sheet, Cash Flow and Capital Expenditure Statement.

In a manner of speaking, financial analysis looks at the end result or the output of any operation or service. By virtue of looking at the output, financial analysis may not reveal qualitative aspects of the operation or service. For instance, the monthly Profit and Loss Account may show a good profit for the month, but it will not be able to say whether customers were happy with the service provided. It is conceivable that customers are unhappy with the service or facilities and decide not to patronize the organization in future.

Operational analysis on the other hand goes behind the financial statements and takes a look at the processes that contribute to the key elements in those statements, namely revenues and expenses. Often, they emphasize the qualitative aspect of a financial index which is related to revenues and expenses and may relate to functions like human resources, training, engineering, etc.,

In the informed decision making set of questions we looked at earlier, one of the questions was what information do we have. Operational analysis provides that basic information which we must have before we conclude anything on the basis of financial analysis. In short, an operational analysis is a pre-requisite for effective financial analysis.

While operational analysis deals with a myriad of indices that are studied and reported upon, we shall be listing a some key ones that throw significant light on the performance of the hotel operation. These complement the financial analysis process perfectly providing a comprehensive picture of the business results of the hotel.

What are the Key Indices of an operational analysis?

The following are the key operational indices that we shall be looking at in these blog posts. These cover various areas of the hotel operation (rooms, food and beverage, other operating departments etc., as well as other functions like sales & marketing, human resources, training, engineering:

Market Segmentation Reports (including demographics, geographical origin, reservation source reports etc)

Repeat Guest Ratio

Average Length of Stay

Staff to Room Ratio

Table Turnover Ratio

Meal Period analysis

Staff Opinion Surveys

Employee Turnover Ratio

Personnel Development Cost as % of Total Basic Pay

Training Hours per Employee

Credit Card as a % of Gross Revenue

Utility Consumption per occupied room

Up-selling Niche facilities

In our next post in this series, we will be looking at Market Segmentation Reports and how they contribute not only to operational analysis but significantly also to financial analysis carried out on monthly financial statements.