Ivan Idris's Blog, page 17

October 21, 2012

NumPy Cookbook chapter 5

Loading images in memory maps

Adding images

Blurring images

Repeating audio fragments

Generating sounds

Designing an audio filter

Edge detection with the Sobel filter

The book [...]

October 14, 2012

NumPy Cookbook chapter 4

Using the buffer protocol

Using the array interface

Exchanging data with Matlab and Octave

Installing RPy2

Interfacing with R

Installing JPype

Sending a [...]

October 6, 2012

NumPy Cookbook chapter 3

Summing Fibonacci numbers

Finding Prime Factors

Finding Palindromic numbers

Steady State Vector determination

Discovering a power law

Sieving Integers with the Sieve of Erasthothenes

The book is due [...]

September 23, 2012

NumPy Cookbook Chapter 2

Install SciPy

Install PIL

Install Matplotlib

Slice multidimensional arrays of images

Indexing with booleans

Indexing with lists of indices

Select rows and columns with the ix [...]

September 16, 2012

NumPy Cookbook Chapter 1

Installing IPython

Using IPython as a shell

Reading manual pages

Configuring IPython

Running a HTML notebook

Exporting a HTML notebook

Importing a HTML notebook

Running a public notebook server

The book is [...]

September 9, 2012

Imminent Release of NumPy Cookbook

April 30, 2012

Statistical Bootstrapping by Case Resampling

I haven’t blogged in a while, because I am supposed to work on a Big Secret Project (BSP). Obviously, I am not allowed to talk about that. The Product Owner/Manager of our FHF (Fantasy Hedge Funds) has come [...]

March 3, 2012

Simulated Random Trading

Our Product Owner and Product Manager got talking about our latest strategy. They decided that our Fantasy Hedge Fund needs to have simulations of these strategies. The new User Story:

Simulate periodic trading with random buying and selling.

We will [...]

February 27, 2012

NumPy Project Euler Problem 9

1. Create m and n arrays

The Euclid's Formula defines indices m and n. We will create arrays to [...]

February 25, 2012

NumPy Periodic Dips

NumPy Strategies 0.1.5

The stock market has periodic dips to the downside and sometimes to the upside, but those have a different name. Our Fantasy Hedge Fund needs to rebalance its portfolio 5 times a year (this is all part of our plan of Total World Domination). Therefore this User Story:

I want to buy and sell stocks 5 times a year.

We will have a look at the probability distribution of the stock price log returns.

1. Get close prices

Let's start by downloading historical data for a stock. For instance, AAPL.

1

2

3

4

5

today = date.today()

start = (today.year - 1, today.month, today.day)

quotes = quotes_historical_yahoo(sys.argv[1], start, today)

close = numpy.array([q[4] for q in quotes])

2. Get log returns

Second, calculate the daily log returns of the close prices.

1

logreturns = numpy.diff(numpy.log(close))

3. Calculate breakout and pullback

Now comes the interesting part. Let's say we want to trade 5 times per year or roughly every 50 days. One strategy would be to buy when the price drops by a certain percentage and sell when the price increases by another percentage. By setting the percentile appropriate for our trading frequency, we can match the corresponding log returns. Scipy offers the scoreatpercentile function, that we will use.

1

2

3

freq = 1/float(sys.argv[2])

breakout = scipy.stats.scoreatpercentile(logreturns, 100 * (1 - freq) )

pullback = scipy.stats.scoreatpercentile(logreturns, 100 * freq)

4. Generate buys and sells

Use the NumPy compress function to generate buys and sells for our close price data.

1

2

3

4

5

6

buys = numpy.compress(logreturns < pullback, close)

sells = numpy.compress(logreturns > breakout, close)

print buys

print sells

print len(buys), len(sells)

print sells.sum() - buys.sum()

The output for AAPL and a 50 day period is:

1

2

3

4

[ 340.1 377.35 378. 373.17 415.99]

[ 357. 370.8 366.48 395.2 419.55]

5 5

24.42

So we have a profit of 24 dollar, if we buy and sell 5 times an AAPL share.

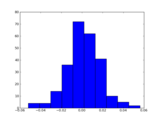

5. Plot a histogram of the log returns

Just for fun let's plot the histogram of the log returns with Matplotlib.

1

2

matplotlib.pyplot.hist(logreturns)

matplotlib.pyplot.show()

Below is the complete code or get it from Github.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

from matplotlib.finance import quotes_historical_yahoo

from datetime import date

import numpy

import sys

import scipy.stats

import matplotlib.pyplot

#1. Get close prices.

today = date.today()

start = (today.year - 1, today.month, today.day)

quotes = quotes_historical_yahoo(sys.argv[1], start, today)

close = numpy.array([q[4] for q in quotes])

#2. Get log returns.

logreturns = numpy.diff(numpy.log(close))

#3. Calculate breakout and pullback

freq = 1/float(sys.argv[2])

breakout = scipy.stats.scoreatpercentile(logreturns, 100 * (1 - freq) )

pullback = scipy.stats.scoreatpercentile(logreturns, 100 * freq)

#4. Generate buys and sells

buys = numpy.compress(logreturns < pullback, close)

sells = numpy.compress(logreturns > breakout, close)

print buys

print sells

print len(buys), len(sells)

print sells.sum() - buys.sum()

#5. Plot a histogram of the log returns

matplotlib.pyplot.hist(logreturns)

matplotlib.pyplot.show()

If you liked this post and are interested in NumPy check out NumPy Beginner's Guide by yours truly.