Jeremie Averous's Blog, page 34

January 7, 2020

How Economic Recessions Are Actually Positive (on the Long Term)

There is a lot written these days about the upcoming recession. There has been already a very long cycle without a recession (the last one in 2008 has been particularly strong though). But is a recession necessarily a bad thing?

From my perspective I do observe currently in the economy some ‘irrational exuberance’ to use the term coined by Alan Greenspan in the 1990s. There is a lot of money thanks to low interest rates, and it is sometimes or even often invested in ventures of dubious success probability. I observe this effect for example in the start-up financing field.

A recession is nothing more than a readjustment of the economy, a clean-up that removes activities that are not any more adjusted to the requirements of new era, and a number of activities that are only just marginally profitable. And from my observation that is probably needed now in a number of economic fields.

Unfortunately, it would appear that the complex economy does not manage to run this clean-up effort more effectively than through an overall recession from time to time.

Of course, this economic clean-up has consequences on employment and on the perspectives of individuals if they are impacted. A strong social support net is needed to amortize the effects of a recession for the individuals. Recessions also tend to remove from employment those whose skills are not adapted any more to the economy, and there needs to be ways to upgrade those skills to give them a new role to play. It can thus be felt negatively across consumption.

All in all I tend to believe that recessions are rather inevitable, a good thing in the longer term and policies that aim to avoid or postpone them will only create stronger and harder recessions at the end.

January 4, 2020

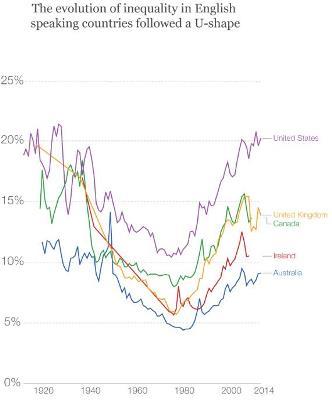

How the Relative Increase in Asset Value Explains Increasing Social Inequality

Still following up from our previous post ‘How the Current Asset Over-valuation Changes Economic Behavior‘, and referring to the research paper ‘Bubble or nothing‘, the increase in the relative value of assets is also a good explanation for the increase in social inequality: those who have assets see their wealth increase substantially (doing nothing) compared to those who don’t. And it becomes harder for those who don’t have assets to acquire them.

This however comes with a pinch: if most of the increase in wealth of the the richer is based more on asset value than on actual direct income, any economic shock that would decrease substantially asset values would also reduce a large part of this apparent inequality.

On the other hand if the relative increase in asset value is a deeper, longer term trend linked with the Fourth Revolution (see our post ‘How the Increase of Asset Values Could be Linked to the Fourth Revolution Transformation‘), then we should expect this effect to be permanent and even increase in the foreseeable future. Access to ownership of assets will then become a major issue to address inequality (including property, as the family house is the prime asset for most people).

There are deep, multi-decade trends pervading our economy and traditional economic studies may not sufficiently understand them. It seems like the Collaborative Age will require quite a different approach to the economy, and probably to taxation and redistribution.

January 2, 2020

How the Increase of Asset Values Could be Linked to the Fourth Revolution Transformation

Following up from our previous post ‘How the Current Asset Over-valuation Changes Economic Behavior‘, the question is open whether this historical trend about historically extremely high asset prices and always lower interest rates since the 1980s (the Era of Big Balance Sheets) is a temporary situation, or if it could be representative of a shift created by the Fourth Revolution (a shift to the virtual, global economy).

In the research paper ‘Bubble or nothing‘, the enclosed graph and a few others remind us that there is currently overcapacity in terms of assets compared to the production capacity (this observation seems to apply to manufacturing as well as to offices or any class of asset supporting value production). This can be explained partly by the high value of assets but also by the fact that actual physical production does not increase any more and is disconnected from overall economic growth: the economy becomes increasingly virtual with the Fourth Revolution.

One of the reasons behind asset relative value increase could thus be that value being created virtually in the new economy drives up the value of the physical assets, which are in limited quantity. Therefore, an interpretation of the current overvaluation of assets could be the virtualisation and increased productivity of the Collaborative Age economy. This would be a bit similar to the Baumol effect explaining the relative increase in cost of less productive areas of the economy such as healthcare (see our post ‘How the Relative Increase of Cost for Education or Health Care Can be Explained‘). If that is the case, then we should not expect asset valuations to drop off anytime soon (independently from temporary recessions and readjustments).

I would be quite interested to see whether there has been some economic studies about the impact of the virtual economy on asset valuation. Please contact me if you know of any such study.

December 31, 2019

How the Current Asset Over-valuation Changes Economic Behavior

I can only recommend to read this enlightening research paper ‘Bubble or nothing‘, produced by an American Think Tank. It may require some time to read, but I believe it is absolutely worthwhile to understand how the current economic situation differs from the 20th century economic situation – and how therefore, history can only be of limited value in understanding future economic behavior.

The point is that “The evolution of the economy’s aggregate financial structure [with a much higher value of assets compared to value production] has, over decades, altered the playing field for financial decision makers throughout the economy, increasingly skewing their available options toward higher risks, lower returns, or both.” Basically, the increase in asset value implies low interest rates. Those low interest rates are much below the return rates expected from financial players (such as retirement funds), and this leads them inevitably to take higher risks than they would have in the past.

The author calls the time since the mid-1980s the “era of the Big Balance Sheets”. According to him, this excessive risk-taking behavior explains situations as the one giving way to the 2008 financial crisis, which stemmed from the property market. “Each successive crisis, with more bloated balance sheets to stabilize, was more difficult to resolve and therefore required the government to engineer dramatic new lows in interest rates, heavy fiscal stimulus, and other measures to stabilize economic conditions. The measures eventually overcame recession and chronic weakness, but in doing so they necessarily caused further expansion of balance sheets relative to income.“

This current situation appears to be quite metastable, with excessive risk-taking happening since the early 2010s, and may lead to another hard recession with substantial asset value decrease. Whether this decrease will be temporary or more permanent is still open (previous recessions have not changed the excessive asset value on the long term).

As a summary, “The U.S. economy continues to face a bubble-or-nothing outlook. Participants in the economy and markets will keep increasing their financial risk until the expansion breaks down, and the bigger the balance sheets are relative to income, the more severe the breakdown is likely to be.”

Take some time to read this instructive analysis, as it provides an interesting explanation of the changes in our economy in the last decades.

December 28, 2019

How to Develop Realistic Expectations for Mega-Projects

This interesting podcast and post from Freakonomics website ‘Here’s Why All Your Projects Are Always Late — and What to Do About It‘ proposes a good analysis of all the reasons why mega-projects, and particularly public mega-projects, always fall so dramatically behind in terms of expectations.

All the usual fallacies and symptoms applicable to large complex projects are mentioned in a quite good synthesis and summary: the planning fallacy (overly optimism in spite of historical evidence to the contrary); optimism biais; neglecting the time and effort for coordination; student’s effect (procrastination); inadequate expectations set to sell a public project, etc.

The interesting approach mentioned at the end of the post as being possibly a successful approach is to align estimates for time and cost (or overruns) for new projects on the observed history of similar projects. This seems to be applied today in the UK. The post mentions that this approach seems to “be reasonably accurate and the cost overruns to be reasonably small — about 7 percent from the planning stages of a transportation project to completion. All of which suggests that pricing in the optimism bias and using reference-class forecasting are truly useful tools to fight the planning fallacy.” This approach can only work of course if there is a representative database of similar past projects, which is not always the case. For example it is known that some major UK infrastructure megaprojects such as High Speed train lines do still face huge overruns in schedule and cost.

Megaprojects failure to deliver on time and on budget is a major societal issue (and the sunk cost fallacy leads us to finish those projects even if they appear to be grossly failing). I am not sure the solution is as simple as the solution mentioned in the post, but it worth noting that some governments have identified the issue and try to address it proactively.

December 24, 2019

How to Subtly Shift One’s Mind to Overcome Procrastination

Leo Babauta in his post ‘Mindfully Shifting Your Approach to a Task Can Shift Everything‘ reminds us that to tackle a task that is not easy or nice, and to overcome procrastination, all it takes is a subtle mindset shift.

“So you either run to distraction and procrastinate, or you do it but really don’t enjoy doing it. Neither of these is helpful. So what can we do instead of procrastinating or disliking the task? We can bring some subtle, mindful, powerful shifts to the task. And in fact, we can do this to any activity.”

Many of the approaches then described by Leo Babauta involve more self-consciousness of our feelings and changing our view on this unpleasant task by living more in an appreciative manner, closer to the present. In summary, it requests more presence and self-consciousness about the importance of the task.

In general it is true that it is often effective to change slightly one’s mindset regarding some event or some task to find that it is finally easier to perform than one would expect.

Next time you’re faced with procrastination, try to change slightly your mindset and view about the difficult task you can’t seem to be able to perform!

December 21, 2019

How We Need to Know How to Enforce Replenishment Periods

As Leo Babuta reminds us in his post ‘Antidotes to Overwork‘, we need to learnt to “Do Less By Enforcing Replenishment Time“.

“Enforcing time for rest and replenishment doesn’t come naturally to most of us, especially in our society. In our world, it’s always a matter of doing more and more. It’s always connected, always cram in more, always respond. All the time.”

“How often do you take an hour or two just to go for a walk and not read or listen to anything useful? To find silence and time to contemplate? To find space for yourself, to find room to breathe? We don’t value that, but it’s so important. You can’t function at your best without it.”

Leo Babuta continues by suggesting some approaches and techniques to really find the time to replenish. What I find interesting is the recognition for the need to have some balance between very active moments and replenishment moments. Replenishment is not just relaxation it is also being open to new ideas, people, locations and thus taking the time to grow.

When are you taking the time to grow?

December 19, 2019

How to Account for the Cobra Effect

In complex systems, actions or decisions tend to have unintended consequences. That appears to be called the ‘Cobra effect’ after a 2001 book. This is explained with many funny examples on Wikipedia (Cobra effect article) and Quartz (Cobra effect post).

The name itself stems from an attempt by the british colonial power to eradiate cobras in New Delhi. The reward policy for each snake led people to breed them and increase their number to get the rewards. And when the reward system got cancelled, all those cobras were released, which had finally the opposite effect than the one expected.

This reminds us that in complex systems with people possibly taking decisions to game the system, decisions that look straightforward can have a different or even opposite effect. Therefore we need to systematically test the effect of a decision on a smaller scale before spreading it. And sometimes the solution to a problem is not an obvious one, but rather doing something that only looks remotely connected with the problem at hand!

December 17, 2019

How a Rich Vocabulary Is Essential to Creativity

In this interesting post ‘The Mind of a Creator‘ Valeria Maltoni explores what make the creative mind and focuses on the importance of a diverse and precise vocabulary. Unfortunately we observe that the average vocabulary in our society becomes quickly much poorer on average.

“Language becomes poorer progressively. With technology it becomes poorest, almost zero. Linguist Tullio de Mauro did some research and found that the average person had a vocabulary of 1,500 words in 1976. Twenty years later, in 1996, that vocabulary dropped down to 640 words. In 2016, the average person has 200 words, says Galimberti.”

The problem is that “You cannot think beyond the words you know. You can think within the words you know.” Creativity is nourished by the ability to express subtle, precise concepts and ideas. With a poor vocabulary, creativity dwindles.

If you want to be become more creative, seek to expand your vocabulary!

December 14, 2019

How To Avoid Losing Our Identity While Collaborating With AI

Following on our previous post ‘How We Need to Learn to Work with AI‘, there are also interesting points of view of how AI may lead to losing our identity, such as this article ‘Would You Survive a Merger with AI?‘

This article is focused on actual hybridation between humans and machine (a physical merger of sorts) but takes it at the philosophical level. It then shows that we can’t at the same time merge with AI, or replicate ourselves, without losing our identity.

There are thus some limits (luckily, quite remote and still very much science-fiction) beyond which our joint working with AI may lead to losing our identity, or being unclear about it.

In the short term, in order to benefit from AI without losing our identity, it may be a good idea to make sure we keep some of our identity to ourselves and do not share everything with AI, however enticing this may look!