Claude Forthomme's Blog, page 54

July 19, 2012

Why the US Economy Recovered Faster than Europe from the 2008 Crisis

The Federal Reserve: The Biggest Scam In History (Photo credit: CityGypsy11)

The reason is simple and everyone knows it (including economists): quantitative easing. That's what the Federal Reserve has been doing - and done twice since 2008, spending hundreds of billions of $$$ to buy bonds (Treasury bills) thus automatically pumping money in the economy and helping to jumpstart it. And that's what the European Central Bank (ECB) has NOT done - or done very little of it: just €212 billion (some $ 260 billion).

Peanuts compared to the Fed!

So it should come as no surprise that the crisis in Europe has lingered on, indeed has grown explosively while things in America are looking (a little) better - and it might go on this way provided the whole world (and international trade) is not taken down by a European implosion...Not to mention the other four reasons threatening the world economy according to Mr. Doom (see the first article below about Nouriel Roubini's predictions - all frighteningly likely).

English: Nouriel Roubini, Turkish economist, professor of economics at the Stern School of Business, New York University. From the Confederation of Norwegian Enterprise conference, 2009. (Photo credit: Wikipedia)

This is also why the IMF, in a recent report highly critical of the Eurozone policies, called on establishing a stronger monetary union to break the tide stemming from what it diplomatically described as the "adverse links between sovereigns, banks and the real economy" that have grown "stronger than ever". It warned of an economic slow down accompanied by a high risk of deflation (25% by 2014), and told the ECB to engage in quantitative easing or else...

What's this business of "adverse links"? Put in simple words: European government finance their deficits with bonds (what the IMF calls "sovereigns") that are snapped up by banks (lately national banks rather than foreign) that finance themselves from the ECB at super low interest rates (less than one percent). Thus they are able to fill up with bonds that give them returns many times higher (in the 6% area and more) than the cost of the money they borrowed. And they do this rather than lend to local businesses ("the real economy"): it's a sure way to fill their coffers and achieve the reserve levels required of them by European regulators.

In short, a vicious circle.

Quantitative easing, since it turns the Central Bank into a major bond buyer, can break the said vicious circle. Banks will find the Central Bank is competing with them, hence, with more buyers in the bond market, rates on bonds will inevitably drop and become less enticing. That will force them to turn elsewhere to make money and (hopefully) start lending to business, which is what they really should have been doing all along.

But quantitative easing makes people uneasy and fiscal disciplinarians (like the Germans and the Republican Tea Party) downright furious. They see it as reckless pumping of money that causes inflation - for them, it's a scam, it's immoral, it's something that destroys the future of our children. Moreover when the ECB was established, it was meant to fight inflation, not deflation.

So will the ECB listen to the IMF's advice?

LONDON, ENGLAND - MAY 22: Christine Lagarde, the Managing Director of the International Monetary Fund, addresses a press conference in the Treasury on May 22, 2012 in London, England. A report on the IMF's annual assessment of the UK economy has recommended that the Treasury consider measures to improve its current economic weakness such as Quantitative Easing and cutting interest rates. (Image credit: Getty Images via @daylife)

But there's something else at work here: the ECB is also mandated to defend the stability of the Euro - thus if prices will slow down significantly, as they may well do, particularly in the so-called European southern periphery (read: Greece, Italy, Spain etc), the ECB may well have to engage in quantitative easing, whether it likes to or not.

Because worse than inflation is deflation: when consumer prices fall, investment prospects collapse, sales slow down, businesses close down and unemployment soars. Whatever advantage to the consumer may derive from lower prices simply evaporates.

Which brings me to my last point: sovereign debt is NOT the equivalent of a private household debt - whatever the Germans and the Tea Party say. There's no moral payback for keeping it in balance year in, year out. To think of it that way is wrong. But to never balance the budget is also wrong. You should be a fiscal disciplinarian in good times, not in bad times. When things are going well, that's when you should call on governments to balance their budget. Otherwise no. It's the government's role to ensure stability of the currency and limit economic downturns and the pain of unemployment.

Since John Maynard Keynes, we know what government policies work, so why not use them? Why repeat the mistakes of the Great Depression?

Related articles

Nouriel Roubini: Five factors that could derail the global economy

Nouriel Roubini: Five factors that could derail the global economy IMF says Europe needs stronger monetary union to stem contagion

IMF says Europe needs stronger monetary union to stem contagion IMF takes axe to UK growth forecasts and warns of global outlook risks - The Independent

IMF takes axe to UK growth forecasts and warns of global outlook risks - The Independent IMF Cuts Global Outlook as EU Ensnares Emerging Economies

IMF Cuts Global Outlook as EU Ensnares Emerging Economies Bank of England prints more money: Further £50bn of quantitative easing as interest rates held at 0.5%

Bank of England prints more money: Further £50bn of quantitative easing as interest rates held at 0.5% I.M.F. Warns of 'Sizable Risk' of Deflation in Euro Zone

I.M.F. Warns of 'Sizable Risk' of Deflation in Euro Zone

Published on July 19, 2012 02:20

July 16, 2012

The End of Commuter Trains? How the One Percent Uses Technology to its Advantage

High speed trains have displaced commuter trains - at least here in Italy on the much travelled Rome-Milano route, and I suspect in all other countries where super fast trainst have been introduced using the existing railways. Now if you build special railroads for your fast trains, there's no problem, it's an additional service for those who can afford it and are looking to save on their travel time - namely big time politicians and managers, in short the one percent.

But, and this is a big BUT, if you force your high speed trains on existing railways, you necessarily cut into the scheduling of slower local trains, in particular commuter trains. And that affects the rest of us, the 99 percent. I was sharply reminded of this yesterday when I decided to spend the day in Rome with my 98 year-old mother: I took the train from the Chiusi-Chianciano station which is not far from our summer place in the Umbrian countryside, figuring that it would be less tiring than driving into town. In addition, I'd be able to enjoy my Kindle and catch up on my reading. A nice train (yes, that's the picture up here) with good seats and air conditioning. But so slow...It took two hours on a trip that used to last one hour or maybe one hour and ten minutes only a few years ago!

And there was simply NO faster alternative!

Now, some five years ago when I travelled like this - in the halcyon days before the Rome-Milano high speed train service came on - it was possible to find several convenient options of reasonably fast trains that made it to Rome in about one hour.

No more.

The fastest train now makes it in one hour and 45 minutes and most of them take two hours. That's a doubling of the travel time! Plus the options are far fewer than before: about four or five trains a day as against a train every hour.

That makes for a very big difference! I remember I had colleagues who had chosen to live in nice big country houses near Chiusi Chianciano and used to commute into Rome every day, taking about an hour an half, considering the subway ride added at the end of the train trip. A long commute but bearable. I wonder how they manage now with a two and half hour commute!

Thus Italy can proudly say it has a "Ferrari" train service driving a "high-speed rail renaissance". Sounds good, looks good, here it is, the "Red Arrow" (Frecciarossa):

Italiano: Frecciarossa ETR500 a Milano Centrale, opera propria, 03/05/2009, l'autore sono io, copyright libero (Photo credit: Wikipedia)

But it's NOT GOOD for the 99 percent that travels locally, from Florence to Rome, from Bologna to Milano, and (like me) from Chiusi Chianciano to Rome...

It's interesting to see how technological development plays in the hands of the super-rich. But then, is it all that surprising?

Just take a peak at the article below (the last on the list) about a recent UCLA study on Japan's bullet trains: it came to the conclusion that such trains actually do not sustain economic growth. The introduction of high speed passenger service has "no discernible effect on growth"...That's because every station except the terminals is "blocked off from productive use".

Can't say I'm surprised! Are you?

Related articles

Protest convoy backs commuter train service

Protest convoy backs commuter train service Plans derailed for central Pennsylvania commuter trains

Plans derailed for central Pennsylvania commuter trains High speed trains are a reality, FINALLY!

High speed trains are a reality, FINALLY! 'Ferrari' train driving high-speed rail renaissance

'Ferrari' train driving high-speed rail renaissance Italo High-Speed Train Offers Touch Of Ferrari

Italo High-Speed Train Offers Touch Of Ferrari UCLA Study: Bullet Train Won't Create Growth

UCLA Study: Bullet Train Won't Create Growth

Published on July 16, 2012 06:56

July 9, 2012

Caravaggio: 100 Drawings Just Discovered...Really?

Medusa, after 1590, by Caravaggio; Uffizi Gallery, Florence, Italy (Photo credit: Wikipedia)

Caravaggio is one of my favorite painters. Imagine my joy when two Italian art experts unveiled last week their discovery of 100 drawings dating to Caravaggio's youth before he came to Rome and became famous. In fact, Caravaggio's formative years are a complete mystery, no one has ever seen any drawings or early work of the master. Which is why the discovery of 100 early drawings by Caravaggio is a major finding.

Or would be a major finding if true.

It's a pity the two experts didn't go the usual route of peer review and publishing their findings in a respected art journal. Instead they chose to produce an e-book and have it published by Amazon in four languages - or so it is reported in the press. I was only able to find the Italian version, here:

Including VAT and wireless delivery, it costs a hefty $17.50 (we e-book readers are not used to such prices!) but then it's a big book (over 470 pages) and it has plenty of illustrations. It is only available on advanded devices like the Kindle Fire, or else you can read it on your computer (Kindle Cloud Reader) or the Kindle for iPad or Android.

I downloaded a sample on the Cloud Reader and quite frankly I found myself a little frustrated. Oh sure, it's well done, the pictures are stupendous. But much time is wasted in the opening chapter on Carvaggio's early life with pictures of the places where he was brought up (the small town of Caravaggio of course, and Milan).

What I would have liked to see in the opening is a presentation of the method used to identify Caravaggio's work out of the 1378 drawings in the Simone Peterzano archives. True, we're told that as Caravaggio had the reputation of being a fast worker, one could reasonably assume that in the four years he spent in Peterzano's workshop he might have produced over 1300 drawings and other artwork. Therefore, to uncover just one hundred Caravaggio drawings in those archives is not all that surprising.

Maybe. Still, it would have been better to explain right away what criteria were used to identify the drawings. In addition, according to the curator of the Sforza Castle collection where the Peterzano archives are maintained, the two experts worked from black and white photographs they had asked for and not from the originals.

So is this discovery to be dismissed as a hoax - possibly just a novel marketing trick to launch an e-book?

Not necessarily. The authors of the book are serious people: Maurizio Bernardelli Curuz is the artistic director of the Brescia Musei Foundation (though not on the Executive Board), the author of many publications and an expert on...Caravaggio, of course. He is also the artistic director of the monthly magazine Stile Arte (he really is, I checked). It's an interesting magazine focused on art history as well as contemporary art issues - though no announcement in there of his e-book on Caravaggio, very discreet of him... His assistant in the Caravaggio project, Adriana Conconi Fedrigolli, is a young art historian, published author and expert in the Lombard painting school, with experience in the use of scientific analytical methods, including radiography, reflectography etc.

It's a pity they didn't pick a more conventional route to launch their Caravaggio project in the art world, because doing it this way has caused a negative backlash (take a look at the articles below). It will now take some time before other art historians verify their findings.

I'm no expert on Caravaggio, but based on the four drawings presented in the opening pages (an old man's head etc) and that are claimed to correspond to details in oil paintings produced later (the old man's head is repeated in an oil painting, pretty much under the same angle), I can say just one thing: the drawings are remarkably similar, yet...they are strangely better drawn than the later paintings! They appear to reflect a better control of the line, more nuances in the shadows than you can find in his later oil paintings.

Very strange. I know what you're thinking: it the drawings are better than the oil paintings - from a purely technical standpoint - then they can't have been done by Caravaggio, right? He couldn't have evolved backwards through time, getting worse at drawing as he grew older and achieved fame with his extraordinary chiaro-scuro oil paintings, a technique no one had ever used before him.

Well, I would argue the reverse. The fact that the drawings look "better" may just be an unwanted side-effect of using his chiaro-scuro technique. Believe me, it's a daunting technique to execute drawings: you use white paint on a dark background - in effect, it's the reverse of a classic drawing, say lead pencil or ink on a white paper. While it's possible to maintain volume and perspective, certain nuances and light plays are next to impossible to control using the chiaro-scuro technique.

I know because I experimented with it. I'm not Caravaggio (far from it!) but I liked the challenge of "drawing in reverse" and I did that for a while in 2007-8 (I called that "counterlight painting").

Let me show you what it looks like so you get an idea of what I'm talking about. Here's a woman asleep in the subway (I've done a whole series of people in the subway - I love the way people look weird in there):

And here's the drawing it's taken from:

The drawing is more nuanced, if you see what I mean. Did I go "backwards"? No, I don't think so (I hope I didn't!). What happened is that the chiaro-scuro technique constrained me. It forced me to simplify the lines, also the play of light. The simplification is not necessarily a step back, it makes for a stronger overall effect on the viewer (in my humble opinion). All this to explain why some Caravaggio drawings made in his youth before he became the famed creator of the chiaro-scuro technique could well look "better", and yet be really his and hardly a sign that he has evolved backwards!

So are the 100 drawings really his? I'd like to think they are but I don't know, I'm no expert. We have to wait for the conclusions of a peer review, and I sincerely hope we won't have too long to wait!

PS. If you're curious and want to see more of my "couterlight" paintings, you can find them here.

Related articles

Italian art historians 'find 100 Caravaggio paintings'

Italian art historians 'find 100 Caravaggio paintings' Early Caravaggio paintings found

Early Caravaggio paintings found Caravaggio claims spark Italian art world spat

Caravaggio claims spark Italian art world spat Art historians claim to find new Caravaggio works

Art historians claim to find new Caravaggio works

Published on July 09, 2012 06:56

July 5, 2012

The Real Solution to the Euro Crisis? Devaluation!

English: €2 commemorative coin Euro Zone 2007 50th Anniversary of the Signature of the Treaty of Rome Français : Pièce commémorative de 2 euros de la Zone Euro en 2007 pour le 50e anniversaire de la signature du Traité de Rome (Photo credit: Wikipedia)

The Euro Crisis started two years ago and thanks to Ms. Merkel's single-minded obsessive focus on austerity and debt reduction, we haven't moved one step closer to resolution of the crisis. The immediate result of this pig-headed approach is that default becomes the only alternative to devalution. Available fixes for the Euro mess are by-passed and the easiest one (devaluation) is simply ignored.

Why?

Because our narrow-minded, chauvinistic politicians can't think in Europe-wide terms. You have to consider the Euro-zone as a whole. If five out of the 17 member countries are in deep trouble (Greece, Ireland, Portugal, Spain and lately Italy) and a major 6th one is about to sink in recession (France) not to mention other smaller ones that are suffering too (Belgium, the Netherlands), why, it's obvious: you should stop pretending the Euro-zone currency is in perfect health!

It's not.

Its value on currency markets quite clearly does NOT reflect the real state of the Euro-zone economies. It makes no sense at all that the Euro should be higher than the dollar: the US is slowly climbing out of recession while Europe is falling ever deeper into it. The Euro could perhaps be a little above the dollar but not some 25% above it! That's way too much.

The economic solution to such a situation is a classic: devalue! We all know the reasoning: devaluing the currency makes exports cheaper giving them a boost. Et voilà! The economic machine whirrs up again. Exactly what the suffering Southern Europeans need, but mind you, it's also going to help the Germans. Their exports will soar and everybody will be happy again in Europe, and, incidentally, the rest of the world too. Because a sick Europe is making the whole world sick, including China, India, Brazil - the emerging economies that had pulled us out of the 2008 slump and are now in pain as they find they aren't exporting to Europe anywhere near the levels of two years ago. Yes, two years ago when the Euro crisis started...

So why the hell doesn't our political class wake up? I fervently hope Draghi is listening and that the ECB Board meeting will take the right economic decision today and lower the prime interest rate...That would be a first healthy step towards devaluation aand re-aligning the Euro with the dollar.

Related articles

New York Times News Article Tells Readers the Fix to the Euro Zone Crisis

New York Times News Article Tells Readers the Fix to the Euro Zone Crisis Devaluing the Pound Isn't a Solution, It's Default - Bloomberg

Devaluing the Pound Isn't a Solution, It's Default - Bloomberg German Unemployment Rose in June as Euro Crisis Started to Bite - Bloomberg

German Unemployment Rose in June as Euro Crisis Started to Bite - Bloomberg Euro Crisis' Winds Can Suddenly Intensify Without Warning - TD Bank

Euro Crisis' Winds Can Suddenly Intensify Without Warning - TD Bank Germany rebuffs Obama's advice on euro crisis

Germany rebuffs Obama's advice on euro crisis IMF: U.S. Recovery 'Remains Tepid' Due to Euro Crisis, U.S. Politics

IMF: U.S. Recovery 'Remains Tepid' Due to Euro Crisis, U.S. Politics

Published on July 05, 2012 01:40

July 3, 2012

Is The European Central Bank Becoming Like the Federal Reserve?

The much awaited Euro Summit of June 28-29 unexpectedly gave birth to a "real" decision, not the usual shuffling of political feet we had been used to up to now: the European Central Bank (ECB)has been squarely put in charge of the Euro.

Okay, it wasn't said in so many words, and a lot has been made in the press of the end of the Franco-German Axis and the rise of Italy (and Spain) as the Third Power, making it look like Europe might be from now on run by a troika: Germany still, the biggest economy, France the second biggest, and Italy, the third and with Monti at the helm, the smartest.

Indeed Italy seems to have produced three "super Marios" lately: Mario Monti, the Prime Minister who's a serious economist and also happens to know the inner working of the European Commission since he was in it for years; Mario Draghi, the head of the ECB and someone who comes from both Goldman Sachs (you won't fool him on derivatives!) and the Italian Treasury (he can negotiate his way out of any political mess as he's shown when he handled the sale of the Italian State telecom system); and of course, the Italian soccer team, including "Big Mario" Balotelli, the soccer player who trounced Germany in the semi-finale of Euro 2012 with two unbeatable goals...only to be defeated on Sunday 1 July by Spain in a damming score: 4-0, historically the worst ever for Italy.

Still, that makes for three Super Marios. On Sunday neighbors of ours in Rome adorned their house with the Italian flag hoping for victory:

It didn't come to pass, but that flag could certainly stay there to celebrate the other two Marios, Monti who successfully cornered Merkel at the Euro Summit and Draghi who reaped the fruits of Monti's efforts.

Strangely enough, the press didn't perceive this right away. They just went for the usual interpretations of European political meetings: that Europe's political class can't take decisions, it's a circus, each clinging to his national sovereignty like a life-saving jacket - particularly the Germans who have yet to realize that they are Europeans too.

This of course is all blah blah that we've heard a million times. We've had to wait four days to finally get a decent analysis in the press of what really happened at the Euro Summit. In the New York Times of course, click here. There's nothing much I can add to this, except make a prognostic (if I dare!)

The European Central Bank is not yet the Federal Reserve but it's definitely on its way now.

In a nutshell: it's been given oversight over the European banking system - the institutional construction is (as usual in Europe) highly complex, but the people who have to monitor the banking system are placed within the ECB. Now much will depend on how Mario Draghi manages his relationship with the Germans, who as always, are resisting the notion that they must pick up the bill for the mistakes of their Southern neighbors. But I'm quite sure Draghi, given his proven negotiating ability, will find the words to make them understand that they have no choice, that the alternative (to let Grexit happen etc etc) is much, much worse and will cost them much more pain and suffering.

In short, for once I'm (almost) optimistic! But it's still a long way to go and it needs to pass through a solid period of economic growth if we're ever to come out of the Euro-crisis woods.

Mario_Draghi (Photo credit: madmonk111)

Now growth also starts at home, and I sincerely hope German consumers will remember that they ought to start spending.

How about a nice vacation in Greece?

Related articles

European Central Bank Head, Draghi, Has New Powers

European Central Bank Head, Draghi, Has New Powers

Government by the Banks and For the Banks

Government by the Banks and For the Banks

European Leaders Move Toward Deals for Spain and Italy

European Leaders Move Toward Deals for Spain and Italy

More questions than answers linger over Spain

More questions than answers linger over Spain

European Union Meeting Opens Without French-German Accord

European Union Meeting Opens Without French-German Accord

Euro 2012 score: Marios 1½, Merkel 0

Euro 2012 score: Marios 1½, Merkel 0

Okay, it wasn't said in so many words, and a lot has been made in the press of the end of the Franco-German Axis and the rise of Italy (and Spain) as the Third Power, making it look like Europe might be from now on run by a troika: Germany still, the biggest economy, France the second biggest, and Italy, the third and with Monti at the helm, the smartest.

Indeed Italy seems to have produced three "super Marios" lately: Mario Monti, the Prime Minister who's a serious economist and also happens to know the inner working of the European Commission since he was in it for years; Mario Draghi, the head of the ECB and someone who comes from both Goldman Sachs (you won't fool him on derivatives!) and the Italian Treasury (he can negotiate his way out of any political mess as he's shown when he handled the sale of the Italian State telecom system); and of course, the Italian soccer team, including "Big Mario" Balotelli, the soccer player who trounced Germany in the semi-finale of Euro 2012 with two unbeatable goals...only to be defeated on Sunday 1 July by Spain in a damming score: 4-0, historically the worst ever for Italy.

Still, that makes for three Super Marios. On Sunday neighbors of ours in Rome adorned their house with the Italian flag hoping for victory:

It didn't come to pass, but that flag could certainly stay there to celebrate the other two Marios, Monti who successfully cornered Merkel at the Euro Summit and Draghi who reaped the fruits of Monti's efforts.

Strangely enough, the press didn't perceive this right away. They just went for the usual interpretations of European political meetings: that Europe's political class can't take decisions, it's a circus, each clinging to his national sovereignty like a life-saving jacket - particularly the Germans who have yet to realize that they are Europeans too.

This of course is all blah blah that we've heard a million times. We've had to wait four days to finally get a decent analysis in the press of what really happened at the Euro Summit. In the New York Times of course, click here. There's nothing much I can add to this, except make a prognostic (if I dare!)

The European Central Bank is not yet the Federal Reserve but it's definitely on its way now.

In a nutshell: it's been given oversight over the European banking system - the institutional construction is (as usual in Europe) highly complex, but the people who have to monitor the banking system are placed within the ECB. Now much will depend on how Mario Draghi manages his relationship with the Germans, who as always, are resisting the notion that they must pick up the bill for the mistakes of their Southern neighbors. But I'm quite sure Draghi, given his proven negotiating ability, will find the words to make them understand that they have no choice, that the alternative (to let Grexit happen etc etc) is much, much worse and will cost them much more pain and suffering.

In short, for once I'm (almost) optimistic! But it's still a long way to go and it needs to pass through a solid period of economic growth if we're ever to come out of the Euro-crisis woods.

Mario_Draghi (Photo credit: madmonk111)

Now growth also starts at home, and I sincerely hope German consumers will remember that they ought to start spending.

How about a nice vacation in Greece?

Related articles

European Central Bank Head, Draghi, Has New Powers

European Central Bank Head, Draghi, Has New Powers Government by the Banks and For the Banks

Government by the Banks and For the Banks European Leaders Move Toward Deals for Spain and Italy

European Leaders Move Toward Deals for Spain and Italy More questions than answers linger over Spain

More questions than answers linger over Spain European Union Meeting Opens Without French-German Accord

European Union Meeting Opens Without French-German Accord Euro 2012 score: Marios 1½, Merkel 0

Euro 2012 score: Marios 1½, Merkel 0

Published on July 03, 2012 01:28

June 25, 2012

Writing more and more books per year...Why should you bother?

Books (Photo credit: henry…)

Is it madness? American writers are gearing up to writing more than one book per year - some set themselves the goal of 4 books per year! Of course big name writers who have long been on the NYT best seller list and have the means can do it: they use teams of assistants to help them - people who do the research for them and (probably) write up pieces that they can then use with a minimum of editing. But the others?

Why should any author aspire to writing 4 books a year? A writer on a popular blog, Author Culture, recently wrote that he would "love to be in a position where [he] could churn out upwards of eight titles a year". Why would he ever want to do such an apparently insane thing? Because he is extremely ambitious, that's why: he's planned on producing some 50 to 60 titles over his lifetime as a fiction author, and by speeding up yearly production, he'd be able to achieve his life goal much, much sooner, in seven years instead of seventy! And probably produce more than 50 books, maybe double that or triple that amount! Imagine going to your grave having authored upwards of 200 or 300 titles!

Wow! I'm impressed! And why so many books? Because he says he's bubbling up with stories: he had started out with the modest goal of one book/year when he realized that if he kept that pace, he'd have to live past one hundred years "just to write the stories that had come to [his] mind in the last seven years"...An explosion, a tsunami!

Certainly this is admirable. And also it helps that he writes in a genre - action/adventure thrillers - where you tweak the setting, twist the plot and modify the characters and voilà, you get a new story with every new variant.

If you're in that enviable position of having so many stories to tell in your genre, then follow his advice, I found it quite thoughtful and spot on, particularly the idea of participating in NaNoWriMo to get your writing hand exercised (you have to write 50,000 words in one month) and as an added bonus, you get to make contacts with fellow writers both on line and physically - which can always come in handy should you decide to publish your NaNoWriMo produced book. I've got a fellow writer who did this and she was very pleased with the result.

Another good idea is to write more than one book at a time. Actually, I suspect that's something most writers do. I know I do: for example, I'm working on my novella I WILL NOT LEAVE YOU BEHIND, I'm putting the finishing touches on my BB novel A HOOK IN THE SKY (BB stands for Baby Boomers - the novel's main protagonist is a recently retired Baby Boomer), I'm translating Fear of the Past back into Italian with the help of an Italian editor, Giuseppe Bonanno di Linguaglossa who's curating it and has given it a smashing new title: IL VOLO DELLA FENICE ( the Flight of the Phoenix), love it! And he plans to release it in the form of a trilogy this fall. Then RICH, FAT AND BORED, a novel set in Tunisia needs a profound rewrite so that it takes in the events of the Arab Spring. And I've got a couple of non-fiction titles in the works as well: about the United Nations (having worked 25 years for the UN, I really know it from the inside) and the biography of Lievin Bauwens, Napoleon's favorite entrepreneur...

Will all this add up over time to some 50 titles or more? I doubt it. And it's certainly NOT my goal. I'll write just what comes to me naturally and following my interests and instincts. To try and produce a set number of books per year sounds so...mechanical. I know I couldn't do it and I'm not even interested. Because one thing is certain: if I don't enjoy what I'm writing, if I'm forcing myself to produce 5,000 words/day, then it's no good. Oh, sure, if a novel has got suspense or sex it might be fun to read, but it won't be literature.

Bottom line, it depends on your writing goal in life. If you want to be a successful genre writer and make money, it is true that you have to produce several titles a year, the more the better. If you're not a genre writer (my case), then you needn't worry. Write as much or as little as you like and feel comfortable doing.

In short: don't despair! This is one race you don't need to get into!

I know I won't. I can't possibly produce more than a couple of books/year, and probably only one book a year (if that) once I will have finished releasing my backlog. I'm totally, completely convinced that a high number of books produced does not equal a high quality of literature.

Indeed, even among the classics, I don't think there's more than two or three titles per author that matter - I mean books that are really worthwhile and memorable and will stay on as beacons in the History of Literature. Even a giant in world literature like Tolstoy is only associated with a couple of novels, War and Peace and Anna Karenina and perhaps the novella Death of Ivan Ilyich. Yet he's written a lot more...How many of his other books have you read or do you plan to read?

Because there's another consideration: how many readers are there out there who can absorb so many books? If you've got one million writers (the probably number in the English language), can one expect the market to absorb 200 million books over the next fifty years?

Published on June 25, 2012 02:41

June 18, 2012

Euro Crisis: Is Grexit Off the Table?

With the narrow victory of New Democracy, a pro-bailout party in Greece, relegating the anti-bailout radical left Syriza party to second place, can we expect "Grexit" - meaning the exit of Greece from the Eurozone - to be off the table?

Not really. Citigroup's chief economist, Willem Buiter (the one who coined the term "Grexit") doesn't think so, and he gives the chances of exit anywhere between 50% and 75%. That's as good as saying it's going to happen for sure, and a lot of the financial world (read: speculators) are of this opinion. They don't see how Greece still mired in debt and with a fast contracting economy can ever dig itself out of the hole's it's in. With 50% unemployment among its youth and the collapse of the welfare state (some 400,000 children are reportedly suffering from hunger), it is difficult to see how the so-called "seeds of dystopia" will not blossom in Greece.

Dystopia? Yes, that is where the Eurozone is headed. Look at this picture of a beggar, father of two hungry kids, in front of a supermarket:

You think that's Greece? Wrong, that's Italy! Near Perugia, in an area (Umbria) that not long ago was considered a perfect example of the "Italian Miracle". Have you forgotten the term? It refers to the boom the Italian economy experienced coming out of the Second World War and that seemed to go on for decades...Umbria until 2008 and even 2009 had survived the financial crisis and seemed to be doing very well, at least as well as the Germans, exporting its diverse luxury and artisanal goods to half the world. No more. A picture like this one is something I'd never thought I would see. The whole area used to be so prosperous, only a year ago! Shocking.

The crisis has hit here too, dystopia is on the march. Yesterday, in several Italian cities, people protested Monti's austerity measures and made ridicule of his (not very convincing) package of measures to stimulate growth.

Expect more protests across Europe.

Aren't the Germans aware of all this? Apparently not, even though much of their own youth is not happy with social policies that provide them with subsidized jobs (at €400 a month for the young worker and zero cost for the employer - all paid for by the State): young workers have learned that such jobs never lead to a career and that companies that have hired them never renew the contract. Rather than give them a chance, companies prefer to get another young worker at zero cost. That just makes good business sense!

There are really only two financial fixes: a banking union and Eurobonds. Both are difficult to get going (too many people involved) and Eurobonds in particular do not enjoy support from the Bundesbank. Indeed, the Bundesbank is dead set against them: not possible it says, unless we have a fiscal union with all Euro members relinquishing their authority over their national budget.

So, to solve the Euro crisis, we're back to politics. Everyone expects a lot from the end-of-June European summit, but what can German Chancellor Merkel do if the Bundesbank won't listen to reason? You'd think central bankers would be attentive to economic realities, but all they seem to be attentive to are their own balance sheets. This is a situation where the Germans could really bring down the European project.

People are fed up with austerity: they see that as measures to make them pay for the mistakes made by banks. Can you blame them?

One thing is certain: politicians in the Eurozone will need to listen more and more to what is happening in the street. In Greece, the new government (to be headed by the winning New Democracy's Samaras) will have to listen to the demands of whatever popular protest is orchestrated by Syriza (who, as of now, says it will stay in the opposition). It cannot afford not to do something to improve the lot of the average citizen - the famous 99 percent.

The time when the one percent called all the shots is over (read: the speculators buoyed by the American credit rating agencies, Fitch, Moody's et al). Which is why I have hopes that the situation will get fixed - not immediately but over the medium term and maybe, just maybe, the Euro will be saved, and along with it, the European project.

I'm keeping my fingers crossed.

As always, find below the articles I found most useful:

REMINDER: This Is What Happens If Greece Exits The Euro

REMINDER: This Is What Happens If Greece Exits The Euro

Is Grexit good for the euro?

Is Grexit good for the euro?

Greek Election Result: An assessment

Greek Election Result: An assessment

Greece Steps Back from the Brink

Greece Steps Back from the Brink

Citi's Buiter: Greece will be forced out of the euro regardless of who wins the Sunday elections

Citi's Buiter: Greece will be forced out of the euro regardless of who wins the Sunday elections

Merkel under pressure to soften bailout stance

Merkel under pressure to soften bailout stance

Osborne warns on consequences of Grexit

Osborne warns on consequences of Grexit

Not really. Citigroup's chief economist, Willem Buiter (the one who coined the term "Grexit") doesn't think so, and he gives the chances of exit anywhere between 50% and 75%. That's as good as saying it's going to happen for sure, and a lot of the financial world (read: speculators) are of this opinion. They don't see how Greece still mired in debt and with a fast contracting economy can ever dig itself out of the hole's it's in. With 50% unemployment among its youth and the collapse of the welfare state (some 400,000 children are reportedly suffering from hunger), it is difficult to see how the so-called "seeds of dystopia" will not blossom in Greece.

Dystopia? Yes, that is where the Eurozone is headed. Look at this picture of a beggar, father of two hungry kids, in front of a supermarket:

You think that's Greece? Wrong, that's Italy! Near Perugia, in an area (Umbria) that not long ago was considered a perfect example of the "Italian Miracle". Have you forgotten the term? It refers to the boom the Italian economy experienced coming out of the Second World War and that seemed to go on for decades...Umbria until 2008 and even 2009 had survived the financial crisis and seemed to be doing very well, at least as well as the Germans, exporting its diverse luxury and artisanal goods to half the world. No more. A picture like this one is something I'd never thought I would see. The whole area used to be so prosperous, only a year ago! Shocking.

The crisis has hit here too, dystopia is on the march. Yesterday, in several Italian cities, people protested Monti's austerity measures and made ridicule of his (not very convincing) package of measures to stimulate growth.

Expect more protests across Europe.

Aren't the Germans aware of all this? Apparently not, even though much of their own youth is not happy with social policies that provide them with subsidized jobs (at €400 a month for the young worker and zero cost for the employer - all paid for by the State): young workers have learned that such jobs never lead to a career and that companies that have hired them never renew the contract. Rather than give them a chance, companies prefer to get another young worker at zero cost. That just makes good business sense!

There are really only two financial fixes: a banking union and Eurobonds. Both are difficult to get going (too many people involved) and Eurobonds in particular do not enjoy support from the Bundesbank. Indeed, the Bundesbank is dead set against them: not possible it says, unless we have a fiscal union with all Euro members relinquishing their authority over their national budget.

So, to solve the Euro crisis, we're back to politics. Everyone expects a lot from the end-of-June European summit, but what can German Chancellor Merkel do if the Bundesbank won't listen to reason? You'd think central bankers would be attentive to economic realities, but all they seem to be attentive to are their own balance sheets. This is a situation where the Germans could really bring down the European project.

People are fed up with austerity: they see that as measures to make them pay for the mistakes made by banks. Can you blame them?

One thing is certain: politicians in the Eurozone will need to listen more and more to what is happening in the street. In Greece, the new government (to be headed by the winning New Democracy's Samaras) will have to listen to the demands of whatever popular protest is orchestrated by Syriza (who, as of now, says it will stay in the opposition). It cannot afford not to do something to improve the lot of the average citizen - the famous 99 percent.

The time when the one percent called all the shots is over (read: the speculators buoyed by the American credit rating agencies, Fitch, Moody's et al). Which is why I have hopes that the situation will get fixed - not immediately but over the medium term and maybe, just maybe, the Euro will be saved, and along with it, the European project.

I'm keeping my fingers crossed.

As always, find below the articles I found most useful:

REMINDER: This Is What Happens If Greece Exits The Euro

REMINDER: This Is What Happens If Greece Exits The Euro Is Grexit good for the euro?

Is Grexit good for the euro? Greek Election Result: An assessment

Greek Election Result: An assessment Greece Steps Back from the Brink

Greece Steps Back from the Brink Citi's Buiter: Greece will be forced out of the euro regardless of who wins the Sunday elections

Citi's Buiter: Greece will be forced out of the euro regardless of who wins the Sunday elections Merkel under pressure to soften bailout stance

Merkel under pressure to soften bailout stance Osborne warns on consequences of Grexit

Osborne warns on consequences of Grexit

Published on June 18, 2012 06:27

June 11, 2012

Can You Make it as an Indie Author?

How to Be Indie (Photo credit: Wikipedia)

How to Be Indie (Photo credit: Wikipedia)Book Expo of America (BEA), the major annual book pageant in the US, has just concluded and left behind some interesting indications of where the publishing industry is heading, in particular confirming that self-publishing is the "new frontier for writers" (to use agent Rachelle Gardner's words).

A new frontier? Maybe but not a very friendly one if we are to believe Author Jennifer Weiner, the keynote speaker for the Book Bloggers Conference, who said and I quote: " very few indie authors will make it! "

Wow!

And here's another unnerving observation made at the IDPF Digital Book conference about online discovery of books: if a book is not discovered in the top 10-20 results of a query, no chance of discovery ! Furthermore, if you consider that it is accepted wisdom that most digital books are discovered by search, then we are all wasting our time marketing on Internet. No need to tweet, blog or post on Facebook...Forget everything, relax and just focus on writing your next book!

These pearls were picked up by Anthony Wessel for DIGITAL BOOK TODAY. He recapped his experience in the form of bullet point notes that are fun to read and don't waste your time. Consider his recap of Author Bella Andre's keynote address - Bella André who's one of the most successful indie author in the pantheon of self-published writers. I can't resist quoting his notes in their entirety:

Speaker: Author Bella Andre – Making it as an indie author.

Currently at 700K in digital books sold

Ave. book price $4.99. Uses $0.99 only as a promo price.

Very clear author branding on her books (shown on overhead). FYI: take a look at her books on Amazon. A very good example.

Believes author name is the most important.

Readers don’t care if the author is an indie. They just want to read good books.

Series magic. Is a big driver of book sales.

Every time you gain another sale of book one in a series there is a corresponding increase in the other books in the series.

She was very dynamic.

Publishing in 2 different sub-genres under 2 different names.

Look at the branding of the pen name books written by “Lucy Kevin”.

Self published in foreign languages (I heard this theme elsewhere – emerging markets)

Uses an interpreter, editor, translator. Changes cover. Audio.

“I put out the books readers want. “ “I know my readership.”

“It takes a great deal of time and effort to self pub.”

“Readers don’t know that I am self pub.”

“In 3 weeks earned my money back on Audio.” (ACX.com)

Clearly, that's how you can make it as an indie author. Ready? Go!

For more, go to Anthony Wessel's excellent post on DIGITAL BOOK TODAY: click here You'll find invaluable tips on how to become a top Twitterer, a Bingo Blogger, in short a Master Internet Marketeer to sell your books, particularly in the Holiday Season (the only Big Season for book selling, in case you didn't know it). And you'll find that emerging markets in the rest of the world are the "next great opportunity" for writers.

And if you've got not time left to write books, well...hire a ghostwriter!

Published on June 11, 2012 02:25

June 4, 2012

What is the Source of the Euro Crisis: Public Deficits, Cultural Divergences or Globalization?

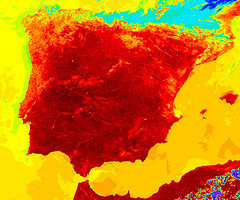

Explosive Spain : the next challenge to the Euro? (Photo credit: NASA Goddard Photo and Video)

We all know how the Euro crisis began: with Greece and lies about its public deficit. Then over the next two and a half years, the drama expanded to include Portugal, Ireland, Italy and Spain. Now the Spanish banking system threatens to collapse and take with it the Euro. But what is really causing the Euro crisis?

Is it "just" a problem of sovereign debt and speculative attacks fed by the bond markets conviction that the Euro is not defended by credible institutions and financial power the way the US dollar is? Or are other factors at work here, in particular cultural divergences and globalization?

Let's take them in turn.

Public Deficits

On June 2nd,

Soros, in a

memorable and much-discussed speech in Trento (Italy) has made the point that

Angela Merkel is the one single source of the crisis: she put a stop to Germany

in its traditional role as the engine of a federated Europe. How did she do

this? By declaring in 2008 after the fall of Lehman Brothers that "the virtual guarantee extended to

other financial institutions should come from each country acting separately,

not by Europe acting jointly." It took the markets a while to digest this

declaration but once they had, speculators (guided by the credit rating

agencies, Moody's et al) realized that the weaker economies on the Euro

periphery were open to attack - and attack they did, starting with Greece.

Furthermore,

he made an important and very convincing prediction that Germany (and the

Bundesbank) have only three months to stem the Euro crisis (see articles below

and if you can, take time to read Soros' speech here: it's

really worth the read). He is convinced that “the euro crisis threatens to

destroy the European Union."

Frightening

words! For him, the European Union itself is similar to a financial bubble. It

grew as a "fantastic project" from one "small step forward"

to the next, each time forcing politicians to take the necessary measures to

move it forward, closer to European union. That's how it went from the original, relatively

modest Coal and Steel Community in the

1950s to the current European Union, a process feeding "on its own

success, very much like a financial bubble."

Now, when

the Maastricht Treaty created a common currency without prior political union,

it took a step that was too big. And at the wrong time when

Germany, having obtained unification with East Germany had largely lost

interest in the European Union project. To this potent brew, add the fact that

the common currency threw together countries at very different levels of

development: for Germany (and other northern European countries like Finland or

the Netherlands – i.e. "the center"), the Euro was an opportunity to

expand exports (since the Euro was cheaper than the national currencies had

been) and they took the necessary measures to improve competitiveness (restraint

on salary increases etc). For Southern European economies (i.e. "the

periphery") the Euro became a source of cheap credit feeding a

dangerous consumption and housing boom.

Meanwhile commercial banks were allowed to accumulate government bonds

without having to set aside equity capital; so they were tempted to "to

accumulate the bonds of the weaker euro members in order to earn a few extra

basis points." When the 2008 crash came, "many governments had to

shift bank liabilities on to their own balance sheets and engage in massive

deficit spending. These countries found themselves in the position of a third

world country that had become heavily indebted in a currency that it did not

control. Due to the divergence in economic performance Europe became divided

between creditor and debtor countries." But it was a while before the

financial markets discovered that government debt was no longer sovereign and

could actually default. At that point, banks loaded with bonds discovered they

were insolvent. As Soros points out: “that constituted the two main components

of the problem confronting us today: a sovereign debt crisis and a banking

crisis which are closely interlinked."

The

international financial authorities moved in, but unfortunately they are

reacting to this crisis exactly the way they did in the 1982 banking crisis:

creditors are shifting the burden to debtors. Soros has some striking things to

say about this: "Just as in the 1980’s all the blame and burden

is falling on the “periphery” and the responsibility of the “center” has never

been properly acknowledged. Yet in the euro crisis the responsibility of

the center is even greater than it was in 1982. The “center” is responsible for

designing a flawed system, enacting flawed treaties, pursuing flawed policies

and always doing too little too late. In the 1980’s Latin America suffered a lost

decade; a similar fate now awaits Europe. That is the responsibility that

Germany and the other creditor countries need to acknowledge. But there is no

sign of this happening."

Are you listening Ms. Merkel? Your policies are

flawed and you are always doing too little too late! Wake up! Or do you want

Europe to suffer a lost decade? It could even be much more than that: a lost

historical opportunity, the killing of the European dream of a peaceful,

prosperous union! You always say you want "more Europe", but do you

really?

Okay, Ms. Merkel always

manages to make me very angry. Let me get back to the argument at hand. The

European Union is a political bubble about to burst. And it is also an economic

bubble. How? This is a little complex (if you want to know all about the arcane

Target 2 mechanism for the Euro, read Soros!) but in simple terms, what is

happening is this: financial institutions (central banks and commercial banks)

are reordering their financial exposure along

national lines, meaning the "center" is shedding bonds from the

"periphery" and conversely there's a capital flight from the

periphery towards the stronger Euro countries (i.e. towards Germany in

primis - German bond yields are practically zero...).

By March 2012 the Bundesbank had claims of some 660

billion euros against the central banks of the periphery countries - so now it is pulling everything in. It is against expanding the money supply (Euro-bonds are a no-no for them!) and it has taken measures to limit the losses it would

sustain in case of a breakup. Alas, this is a self-fulfilling

prophecy: once the Bundesbank does it, they all do it. As a result, credit to enterprises, especially the medium and small ones that are a major source of employment, becomes less available and unemployment soars.

Hence a deeper crisis. A wider divergence between Germany and the rest of the eurozone. A greater risk of political and social disintegration. Increased public opposition to austerity and distrust in the Euro.

In short: blow-up!

Why does

Soros give three months to the Germans who are in the "driver seat"

to reverse the situation? He expects that the Greeks in the next election (June

17) will elect a government ready to accept the bailout agreement but unable to

meet the conditions. So that “the Greek crisis is liable to come to a climax in

the fall. By that time the German economy will also be weakening so that

Chancellor Merkel will find it even more difficult than today to persuade the

German public to accept any additional European responsibilities. That is what

creates a three months’ window."

Between now and September.

And reversal will require some extraordinary and courageous measures. Among them:

- a European Bank Deposit Insurance scheme to stem capital flight;

- a functioning European Stability Mechanism capable of providing sufficient financial support to the banking system;

- euro-zone wide supervision and regulation.

And all within the existing European Treaties! By end June, a European Summit should come up with proposals on all these points.

A Euro-break up would be catastrophic at this point in time and will impact the whole world from the US to China. An orderly break-up is not possible mainly because the current re-ordering of Euro financial exposure within national boundaries has not been completed, far from it. And the ones who would ultimately suffer most from the break-up would be the Germans, no question about it. They've benefited the most from the Euro so far - a cheap Euro has been the source of Germany's success in exports - but they will also suffer the most if the Euro collapses: a restoration of their dear Deutschmark would be very dear indeed, as it is bound to be valued much higher than the Euro ever was.

Soros

believes Germany will do whatever is needed to preserve the Euro but no more, allowing the internal

divergences between the center and periphery to grow, thus profoundly altering

the very nature of the "fantastic European union project". Killing

off the dream of peace and prosperity. What is needed is to

convince the Germans to do more. Sure, this is bound to be difficult for the German

government confronted with a people who doesn't see or feel the problem: jobs

are still opening up in Germany, immigrants are coming in; the influx of light

capital is causing a housing boom. As Soros put it: "We need to do

whatever we can to convince Germany to show leadership and preserve the

European Union as the fantastic object that it used to be. The future of Europe

depends on it."

Can Ms. Merkel be convinced? Maybe.

I personally doubt that more than a strict minimum will be done by September this year. We'll need to boot Ms. Merkel out of Germany first, and that won't happen until 2013. By then, the current recession may well have bitten into German prosperity as it finds difficult to sell exports abroad: after all, recession winds are again slowing down the US and China.

2013 will be a year of reckoning and Germany might well be more amenable to sustain the Euro and solve the euro management problems.

But what if Soros was wrong: what if his reading of the situation was limited and some other negative forces were at work in Europe?

Cultural Divergences

Cultural divergences

could well be the factor that will tilt the boat.

Some researchers and most recently NYT columnist David Brooks (see his excellent article here) have argued that the European union project makes no historical sense in the face of deep-set cultural divergences. Brooks reminds us how the world, after the disasters of World War II, yearned for peace and harmony: it was in this favorable setting that multicultural and supranational entities like the United Nations were created and with it all the international organizations still with us, chief among them the World Bank and the IMF. Those were also the years of the birth of the European Union project that began with an optimistic effort by Germany and France to bridge their differences and "never" go to war against each other again.

Now, the pendulum has swung the other way: cultural divergences are increasing, not diminishing. There is a "failure of convergence" not just between countries but also within countries. Consider the United States: a single country with a single currency, but as Brooks points out: "the country has become more polarized, not less. The

country has become more difficult to govern, not less." This is what he calls "the segmentation century". With the rise of modern communication technologies and Internet, "people's tastes have become more parochial, not less."

For Brooks, "the failure of convergence is most striking in Europe. True, a tiny

sliver of European society is becoming more transnational. But only 2

percent of Europeans live in a different European nation than their

country of citizenship. On the whole, European nations still have very different understandings

of the rule of law and political order, different work ethics and

conceptions of citizenship. (italics added)"

True enough. For example, it seems that 40% of Danes believe that work is a “very important” part of their lives, compared with roughly 65 percent of the French. According to Pew Research surveys,

73 percent of Germans think that economic conditions are good right

now. In France, 19 percent think that, and in Spain only 6 percent.

For Brooks, "the euro crisis is not a crisis of debt. Total European debt levels are

not that high. It’s a crisis of legitimacy. Debt burdens are divergent

across nations, and Europeans with one set of habits and values do not

want to bail out Europeans with other habits and values."

Germans do not want to bail out the Greeks.

Europeans do

not trust Brussels. They don't believe in giving over their budgetary

sovereignty, the only ones who don’t mind are the Italians, according to Pew

research.

Add to that the fact that there's been a resurgence of local regionalism: the Basques in Spain, the Flemish-Walloon rift in Belgium, the Lombards' Northern Lega in Italy etc. Not to mention the remarkable success of nationalistic, anti-immigrant parties like Marine Le Pen's Front National in France, a veritable throwback to the 19th century chauvinism.

In this environment, it should come as no surprise that the European Union project has a hard time surviving...

But isn't there something else at work here? Let's turn now to the third negative factor at work, the one which I believe underlies the other two: globalization.

The Impact of Globalization

Much has been written about the effects of globalization, both good and bad, and there is no space here to go into details. But certain aspects of globalization are clearly impacting the eurozone and have had negative effects for the whole past decade:

- governments in Europe (and elsewhere, the US included) are losing control over their tax revenues: it becomes ever easier for big, global corporations and the ultra-rich (the 0,1%) to escape taxation. To illustrate, two examples will suffice: the Greek shipping industry is not taxed by the government, the theory being that if shipping magnates were taxed, they'd move elsewhere, hence it's useless to even attempt to tax them. So far, even the radical leftist Syriza does not specifically raise this issue: it just limits itself to calling for more "equality" and "taxes on the rich". General Electric, the American corporate giant, has over one thousand staff dedicated to exploiting tax loopholes with the result that GE pays one of the lowest corporate taxes in America: we all learned last year that despite $14.2 billion in worldwide profits - including more than $5 billion from U.S. operations - GE did not owe taxes in 2010.

- competitiveness in the industrial sector is threatened by emerging economies (the BRICS) and outsourcing is eliminating jobs causing increasing unemployment (agriculture is such a small part of GNP in the developed world that it doesn't enter the equation).

- the IT sector and other advanced technologies (eg. green energy) have not so far created enough jobs to cover the losses in industry - as a result, unemployment is not only sticky, it has grown especially large for new entrants in the labor market, i.e. the young.

Conclusion: Quo Vadis Europe, Can You Reform?

This is the general backdrop against which the Euro drama is unfolding. Which means that even if a "financial fix" is found to shore up the Euro, the long term downward economic trends due to globalization will continue as eurozone governments find it hard to raise adequate revenues; as European industry finds it hard to compete with cheap imports produced in the BRICS; as the loss of jobs in manufacturing is not compensated by gains in other newer sectors.

Over time, this means the eurozone as a whole is growing poorer (even if the Germans still feel rich!) And obviously less able to afford its expensive welfare system.

That means it will have to cut into pensions and health care benefits OR make the management of the welfare system MORE EFFICIENT.

That means reforming the state apparatus, cutting out unnecessary duplicative jobs, streamlining management processes, suppressing red tape etc. This concerns in particular the euro "periphery" though even the "center" is not immune to the need for administrative reform.

Are Europeans capable of reform? The Germans demand it. But will the cultural divergences stop reform in its tracks? Very possibly. People in the periphery are already rebelling against austerity: from there it's but a small step to rebel against any kind of reform, however much needed.

The only way to move forward would be to believe once again in something BIGGER: the "fantastic project" of the European Union. You need dreams to overcome the grim reality of chauvinistic retrenchment, each country behind its own borders.

Is the European dream dead? Can it be revived? I hope so. What do you think?

Related articles

In A Brilliant New Speech, George Soros Reveals The Exact Moment That Angela Merkel Started The Euro Crisis

In A Brilliant New Speech, George Soros Reveals The Exact Moment That Angela Merkel Started The Euro Crisis Germany has three months to stem euro crisis - Soros

Germany has three months to stem euro crisis - Soros Euro Crisis: Why A Greek Exit Could Be Much Worse Than Expected

Euro Crisis: Why A Greek Exit Could Be Much Worse Than Expected World Of Manufacturing Suffers Due To Euro Crisis

World Of Manufacturing Suffers Due To Euro Crisis OECD Sees Euro Zone Crisis Threatening Global Recovery

OECD Sees Euro Zone Crisis Threatening Global Recovery Divergence

Divergence George Soros: Blame Merkel

George Soros: Blame Merkel Liberals want G.E. CEO out of Obama admin.

Liberals want G.E. CEO out of Obama admin. Merkel rejects debt sharing as Obama urges Europe action

Merkel rejects debt sharing as Obama urges Europe action Europe slowdown adds tension to Greek drama

Europe slowdown adds tension to Greek drama

Published on June 04, 2012 09:51

May 31, 2012

Is it the End of Self-Publishing Success?

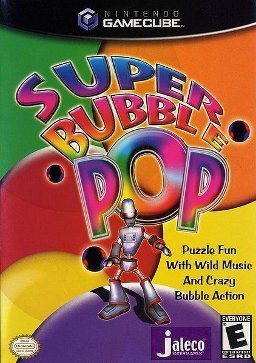

North American GC cover art (Photo credit: Wikipedia)

Is the self-publishing bubble about to burst? Suspense writer Russell Blake thinks so. Passive Guy (better known as PG) does not, read his post here:

http://www.thepassivevoice.com/05/2012/we-are-seeing-the-not-so-slow-motion-popping-of-the-amazon-self-publishing-bubble/

In my opinion, Blake's post is VERY convincing: the self-publishing bubble IS slowly popping. For once I don't agree with PG's reading of this post (I usually always agree with him...). PG sees it as a cop out in praise of legacy publishers. I don't believe Russell Blake is on the side of traditional publishers in any way. He's just based his conclusions on a series of (in my opinion) very acute observations.

PG disagrees: he says most sales on Amazon occur in the range between the 99 cents and $5.99 and that is where the real volume is. Since this is the favorite price range of self-pubbed authors, he argues this is proof that the self-pubbed bubble is NOT about to pop. But I believe he's mistaken in claiming that legacy publishers haven't noticed. They sure have! Now all of a sudden one can buy recent books of many of the big NYT best seller names in that very range, something that wasn't possible some time back.

This change seems to have started last month and was perhaps linked to the fact that 3 Big Publishers have already gotten out of the Apple-induced price collusion that led to the so-called "agency model" . A DOJ case is currently on-going and as far as I know, at least two Big Publishers are still stuck in the deal and their prices I believe haven't changed. They're still in the above $14 range but this of course would need to be confirmed over time and with more data...

All this suggests we should expect an outburst of real competition for indies on the very terrain where they were acting as kings. To fight back, indies will need to make sure that their books are not only cheaper but tops in quality: no more bad editing, inconsistencies, mistakes, typos... So, unless indies are able to improve their act quickly, I really do think that we are about to see a slow pop in the self-publishing bubble!

Published on May 31, 2012 01:02