Amit Ghosh's Blog, page 2

January 3, 2017

3 Skills to learn this year to Make Money Online

It is said that you must invest in yourself to the point that it makes someone else want to invest in you. Investing in yourself is the most profitable investment you’re ever going to make. But like any good portfolio it has to be diversified.

I will ask you to get 3 courses with 10$ each in Udemy Online Courses. They are giving everything in 10$ store-wide till Jan 10 as a part of their New Year promotions, Yay! You will certainly make more than 1k$ within 6 months at most from this investment of 30$ if you follow correctly.

Here are my three best picks –

#1 Learn Dropshipping Course Link: Click hereDrop shipping basically means that when a customer places an order from you, the supplier will ship the product  directly to the customer – so you don’t have to invest in building inventory and own a shop without making in investment. No risk of product not getting sold. All you need is a laptop.

directly to the customer – so you don’t have to invest in building inventory and own a shop without making in investment. No risk of product not getting sold. All you need is a laptop.

I’ve been into ecommerce industry since my college time and personally having our stores making 6 figure sales. Yes, that’s correct. Maybe I got lucky? Nope, the word luck sounds bitter when the work comes beneath the sweat.

Retail e-commerce is a $220 billion dollar market in the U.S. alone and is growing by nearly 17% a year.

In 2012 drop shipping accounted for 34% of products sold in 2011 by e-commerce giant, Amazon. Successful dropshippers focus on selecting niches that are untapped. Most new sites also focus on content marketing which provides more value than the product alone. By creating content that is related to the product being sold the site provides additional resources that major sites don’t have.

I started B2B dropshipping which was pretty weird as very few people are doing it. When I visited Darjeeling, I started approaching tea estates. Then it struck like a thunderbolt. I started a carpet business there – mainly became their official online voice.

I started B2B dropshipping which was pretty weird as very few people are doing it. When I visited Darjeeling, I started approaching tea estates. Then it struck like a thunderbolt. I started a carpet business there – mainly became their official online voice.

However, Like you, I was also hunting for online videos When I started looking for resource I landed to a guy who was selling bullshit at a value of 2000$. Well, if you know to google internet, 2000$ works as better investment in other places.

Then to my utter disbelief I found the whole thing is available in Udemy in 200$. One of the student of that earlier course did it. Cutting all the bullshit and straight to the point, he made a short sweet summary. It enriched my knowledge to a great extent. Here is the last dropshipping site I’ve made –

This is my humble product – Pacifruits.

This is my humble product – Pacifruits.

Analysing my peers, I’m sure this site will make around 150–300$ a month in sales on a 50–100$ investment in facebook. Yes, that’s how the system works mostly.

Most profitable dropshippers make a funnel. They put money into social campaign, it gets flush out as sales. I am buying this product in 1.25$ and selling it in 9.95$. Meanwhile I got orders worth of 100$+ in 3 days. See, it’s easy.

Well, grab the course from here. Though its basics, You will not regret it. You can figure out the rest :) In case you need my sales proof, here it goes –

virallocker_use = true;

Like or Tweet this page to reveal the content.

Tweet

#2 Learn to run an online blog business Course Link: Click here

Unsure how can a blog make money? See this for best idea. But do not watch beyond section 1. In later sections the instructor will flood you with his affiliate links.

Here is a case study on how blogging is so powerful. I created this blog last two months.

You can monetize in dozens of different ways when you produce quality content. So get it too from here. However if you want Amazon Affiliate proof, here it is –

virallocker_use = true;

Like or Tweet this page to reveal the content.

Tweet

#3 Learn Making VR Games Course Link: Click here

After a false-start in the 1980s, it really is finally time for VR to shine.  Facebook famously bought Oculus for $2bn in 2014, and this year will see several major headsets hit the market (Oculus Rift, Sony’s PlayStation VR, HTC Vive and more).

Facebook famously bought Oculus for $2bn in 2014, and this year will see several major headsets hit the market (Oculus Rift, Sony’s PlayStation VR, HTC Vive and more).

Don’t worry if you’re novice. Learn to code in .NET’s C# from scratch. Make virtual reality games in Unity. Google Cardboard, Oculus Rift and more.

The course will start from completely from ground up and end up making a game Shoot Hoop, an Oculus Rift compatible game as well as it will then show us to make a fun game for Google Project Cardboard – all using the free game development software Unity.

It’s not limited to games only. did you also know that virtual reality rides are also coming to theme parks in Los Angeles? According to the LA Times, Canada’s Wonderland amusement park will be just one of the many theme parks getting a VR addition to one of their coasters at the park this year, so that riders can choose to experience the ride in VR or in real life.

Canada’s Wonderland amusement park will be just one of the many theme parks getting a VR addition to one of their coasters at the park this year, so that riders can choose to experience the ride in VR or in real life.

What you can expect more in 10$? It’s insane. Start right away. I am one of those unfortunate ones who bought it on 95$ but well this is my brother applying the same skills. If you don’t intend to program, still learn because this business is still in its infancy!

What’re your goals this year? Please share in the comments and let’s sync.

The post 3 Skills to learn this year to Make Money Online appeared first on Amit Ghosh.

November 17, 2016

Apocalypse at Share Market

I was quite active in Quora for a brief period of 30 days. But I stopped writing after noticing that some people buy based on the answers blindly.

Don’t follow blindly anyone!The most tragic part was I never wrote the part when to exit which must have caused sheer pain to many fellow traders who align with my thoughts and opinions and just bought the stock being manipulated by the answer.

Probably some of them had hefty earning and someone them had me killed in their mind over dozen times. No!

The case of CUPIDOn the date of 10th October, I recommended to buy the shares of Cupid here.

I asked to buy around 290.-300. I was targeting to buy at 295 and the trading opportunity came around the next trading day where it touched 295. If you see the answer I was already holding 500 shares.

I also mentioned “These are my current holdings of my short term account. I am currently buying in every dips of Cupid and selling at a decent level and praying to God to make it come down due to some correction or this and that so that I can buy again. :) “

I also wrote that I was targeting it to touch 600 in next 30 months. But well, I do not have patience for that in short term holding. I added 4,000 shares more on the day of 13th October. I did a DCF analysis showing the ‘should-be’ stock price that time had to be around 410. So I was targeting to sell them around 355. (410-290 = 120 ; 120/2=60 ; 295+60 =355).

As It is a damn strong resistance.

I sold it at the top. You can verify here where I wrote I have sold my CUPID stocks on the day of Muharat Trading. I nailed it at 365.

I had 500 shares of CUPID bought at 284.50 as as well as 4,000 shares of CUPID at 295. As I have sold them at 365, the profit was huge (365-284.50)*500+(365-295)*4,000 =3,20,250 INR.

It is currently trading at 288.

I am snapping about 1,000 shares today and may snap more irrespective of it’s increase or decrease. I didn’t mean you to buy it, I recommended this one as I am going to buy this too based on some fundamentals and theories I believe in. If, you are buying on reading my answers, you need to read every single post I make on internet to stay tuned for the exit unless you understand it yourself. I receive average mails of 600-700 a day; and considering I reply to each mail giving my 5 mins; I am stripped of my time; so I might not see your mail at all.

Your money. Your loss.Take Profit or Stop Loss gets pivoted. I shifted it from 355 to 365 as their quarterly earning was far more awesome than what I had calculated myself.

SO LET'S GET YOU

Please feel free to subscribe to my newsletter and get exclusive online business strategies that you cannot find here on the blog, as well as free access to my eBooks.

Submit

x

.snp-pop-4841 .snp-theme11 { max-width: 530px;}.snp-pop-4841 .snp-theme11 .snp-header {font-size: 35px; color: #000000;}.snp-pop-4841 .snp-theme11 .snp-text {font-size: 17px;}.snp-pop-4841 .snp-theme11 .snp-text {color: #000000;}.snp-pop-4841 .snp-theme11 .snp-submit { background-color: #000000;}.snp-pop-4841 .snp-theme11 .snp-header span { color: #000000;}.snp-pop-4841 .snp-theme11 { background-color: #FFB919; }Hedge

People always show their profit and hide their loss. Today I will share the loss to motivate haha. Right now one of my Zerodha accounts is facing a massive draw-down of 13% where I never saw my portfolio down even 5%. Have a look here –

But well, I made 45% of profit of whatever you see negative here. So I am in profit of 45-13 = 30+ You may say how.

The moment I realized Biocon is at free fall I shorted 10x times of the holding amount intra day.I did the same with PC Jewellers from the day the demonetization kicked in. I made supreme profits for couple of bearish days but shot with loss yesterday as the stock ended up bullish but I had the trade closed after couple of hours of market opening. So it was short loss.Shorting Ambuja Cements since long time based on the fact how it stays at the time of 9:15 AM. I feel it stays bullish or bearish all day long without significant reversals so the opening time is a good indicator moment being. Started to short more after demonetization.I shorted Delta Corp when I heard of demonetization; there was no way a casino can survive well without black money.This is like hedging against your own share holdings based on intraday but on more aggressive and bigger scale. I also do hedge with options. That’s why following someone like me will may end up situations like this cause my data is incomplete and I believe if I hold it till I will have them all in profit!

The Trump installationHillary’s win was already appreciated by the market and if you read my answer regarding this topic, you can see I was biased towards Trump. Well, yes. I like Trump more than Clinton and so does everyone I known of.

On the doomsday I shorted the VIX options till the results of Florida was estimated by Wall Street Journal that Trump is going to win by 82% chance. I reversed my trades.

The following Indian trading day, I shorted my entire portfolio with more leverage as I was fearing market will run for a free fall and bought it back by end of the day. It turned out as a charm but Zerodha was having glitch like shit whole day long!

Tip: Use After market orders.

Post Quora Answer –After I wrote the above said Quora answer, I shorted Nifty Options and Bajaj Finserv with a good leverage for following days till today (Yeah, I made a loss today) as I calculated. Here are the results.

I started shorting Bajaj Finserv on 7th when the parabolic SAR confirmed the flip on the previous day. I got anxious as one of my portfolio manager was having this stock accumulated but well, I didn’t interfere them thinking they might have some plans.

But I was wrong! They didn’t close the position and I am serving a minus sign on my balance with them. But overall, I gained a hugesome here :)

Gaining 40 times with Nifty OptionsI shorted Nifty Options after the next day I wrote that answer and till now made around 2 Lakhs !! It was 6th November. Thanks demonetization. Now I am seriously thinking on giving trade more time than my website works. Here is the details:

virallocker_use = true;

Like or Tweet this page to reveal the content.

Tweet

The reason I did is – Max Pain Theory. I believe that NIFTY will end up higher than right now at the time of expiry; around 8200 as of I am writing. But I am unsure. Whoever followed me in this trade is sitting on huge chunk of cash for sure! Also instead of positing confirmations of my trades and making my posts smell like arrogance, I thought of releasing my trade details by the end of the 60 days Zerodha Challenge.But broadcasting in a public forum like Quora with continuous follow up with my trade setup took a toll on me.

I came to a conclusion after this NIFTY trade – I will be selling majority of my portfolio’s fundamental holding and focus more on derivatives. Option Selling has high probability of winning than any other instrument!

What I’m buying tomorrow –Good thing is I have plenty of available cash due to the option trading to grab some discounted stocks. I’m unsure of exact certainty of tomorrow as I do place the trade after lot of analysis in intra-day but –

I will be buying either Maruti or Eicherwill increase my stake on PC Jewellers by 1,000 shares400 shares of Fedder Lyod200 shares of Delta Corp100 shares of Ashok Leyland300 share of Cupid600 shares of IDBI (maybe)100 shares of Prabhat (maybe)Yeah.. Shopping time!

What did you do in these days of Trump and Modi effect? You made a killing or got killed. What’re you buying? Let me know on comments :)

PS: Here you can find nice trading related books!

The post Apocalypse at Share Market appeared first on Amit Ghosh.

October 16, 2016

The Astrological Call Strategy

Today, I will share a strategy based on scam and market manipulation. Though my strategy has worked out 100% perfectly, I will recommend you to invest only that amount of money which you can afford to loose.

I named my algorithm “The Astrological Call” which has a success probability of 100% since I have been testing.

Pact Industries Scam

Running a website company, I am pretty wellversed with Python and Excel. Recently when I answered a question Amit Ghosh’s answer to How do Ashwani Gujral and some others like Sandeep Wagle etc are able to predict the correct future high rate of a stock and that too when the stock rate is very low? it triggered me another similar question.

I researched using Python and Google Sheets. Here is the link of that sheet Stocks. With 16597 data points from ET Markets and 17989 data points from an another major site, I surprising found a mathematical relation which works perfectly as a winning move.

So, that’s not the question. Is it?

Once I was researching on Anurag Bhatia’s answer on a question in Quora. It’s called Who are the stock market operators? which triggered me to think – How can I take advantage of it.

Having access to nearly 20 demat accounts with various brokers, I had enough data point which lead me to similar research.

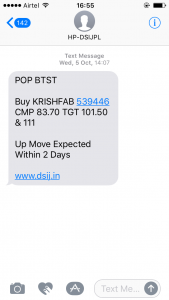

So, my wife’s iPhone got a nice message –

The strategy is –Whenever you get message like this, celebrate and start observing daily charts. Buy itI invest 10,000 INR in each trades for these cases.If you see a red bar in daily chart, put an order of Sell it immediately.Put a sell order of 10,000 INR stocks in the next day.Wait for the magic.Seems like it works like a charm.

Here is the result –virallocker_use = true;

Like or Tweet this page to reveal the content.

Tweet

Aplaya Scam

So, here are the scam messages –

So I have over exactly 28 messages and 6 calls to buy that stock in different numbers from different numbers but with same voice which calculates that is it is some genius behind this gimmick.

Though Capital Via is a shitty irritating company who calls and gives headaches. It was not them too. They are a good company (not too good!) cause my friend works there and gives me amazing shots on Gold but there are scammers who takes advantage of them.

But, Scammer left a clue. The phone number 7822076600. It’s Ashlesh Shah from Rajasthan. It is a easy find using Truecaller. Though the name is not original for sure but the location has to be Rajasthan.

I unfolded a similar scam from Rajasthan who was trying to promote his services strategically in Quora. Read here Amit Ghosh’s answer to How can www.punteraction.WordPress.com predict accurately about Indian stock markets?

But, Capitalvia is from Indore! Now what? Apply my strategy.

Here is the result –virallocker_use = true;

Like or Tweet this page to reveal the content.

Tweet

I made a nice rally upwards taking a buy position where I have written A. I took sell position at the point B.

Anyways, Look at the volume that fake messages managed to manipulate! If what I am assuming is true, Ashlesh Shah made crores of rupees using these scams and you can safely call him – ‘Jordan Belfort of India’.

Who’s nextI have shorted VARDMNPOLY, KRISHFAB, SUPREMETEX, APLAYA and PACT in the last month. Here are the rest of the supporting documents. If you see this, you know what to sell this Monday –

Did you noticed that why I coined it as “The Astronomical Call Strategy” ? Ha, In one of the messages (see the image) notice that it is written –

Invest in our 100% sure Astrological call..

Quite Astrological.

The humour in it made my day! But the term is actually –Crapshoot Investing. It’s a story about how Tech-Savvy Traders and Clueless Regulators turned the Stock Market into a Casino. I’m preparing a list of stock market books available online in e-book version. I can not share that in public, if you’re subscribed with me, wait for my e-mail.

Happy Investing!

SO LET'S GET YOU

Please feel free to subscribe to my newsletter and get exclusive online business strategies that you cannot find here on the blog, as well as free access to my eBooks.

Submit

x

.snp-pop-4841 .snp-theme11 { max-width: 530px;}.snp-pop-4841 .snp-theme11 .snp-header {font-size: 35px; color: #000000;}.snp-pop-4841 .snp-theme11 .snp-text {font-size: 17px;}.snp-pop-4841 .snp-theme11 .snp-text {color: #000000;}.snp-pop-4841 .snp-theme11 .snp-submit { background-color: #000000;}.snp-pop-4841 .snp-theme11 .snp-header span { color: #000000;}.snp-pop-4841 .snp-theme11 { background-color: #FFB919; }

The post The Astrological Call Strategy appeared first on Amit Ghosh.

October 2, 2016

Surgery on my Share Market income

Websites are my passion. Well it is strange that website making can be a fun and passion. I gave this strange question a thought too but then I thought, maybe the appreciation ? or maybe the correct valuation! So, when I earn money from websites I must grow it rather than throwing it idle in the bank right?

I am a forex trader by day (I like numbers and maths – that’s why I dumped my IIT CSC opportunity for a Msc) and web developer by night. My great wife Kavita has been managing my website business single handedly so I ventured into Stock Market. The question is –

Where do I invest my spare money? Invest in stock market or forex. But Forex is a non-bailable offence in India so unless you have a legal way around, do not do it ! Go for stock market.

Invest in stock market or forex. But Forex is a non-bailable offence in India so unless you have a legal way around, do not do it ! Go for stock market.

But don’t do it yourself. There are companies and individuals who take responsibility upto 15% drawdown with a legal agreement (drawdown means 15% is maximum you can lose – they will refund you for more loss) and most of them have good verified track records. Also I have used some algo trading firms who is generating about 20% increment on wealth consistently for the last five years but the ones I know will accept less than <5L in a single account or you have to make multiple accounts.

What I do myselfI divide my investment towards stocks into accounts of 1 Lakh- 10 Lakh each. I trade in half of them and other half of them are being managed by managers.

To give you confidence, let me share some proof –

After learning for 9 days and finishing 6 books and galloping videos (Check here to see where I started), I opened an account at Zerodha (18/07/2016) and started trading on monday 22/07/2016

My initial strategy was to pick some fundamentally good stocks and buy them when the technical confirms in chart and wait for 30 mins or 1 hour to hit.

I use few technicals like Stoch(14), MACD (12,26,9), Parabollic SAR, Bollinger Band and Pivot Points. Here is how a chart look like in my account. I did some long trades of 2–3 days in case of Prabhat, Cupid and few others but most of them are 30 mins guest.

My trades in Equity –Earnings: 9,728.45 INR. Here goes the proof –

virallocker_use = true;

Like or Tweet this page to reveal the content.

Tweet

At this moment my unrealized profit is 2770 INR. It is still not updated here as it didn’t counted today’s profit. Yesterday night this was my holding account’s chart view as per diversification by industry and marketcap

Earnings: 14,120.00 INR. Here goes the proof –

SO LET'S GET YOU

Please feel free to subscribe to my newsletter and get exclusive online business strategies that you cannot find here on the blog, as well as free access to my eBooks.

Submit

x

.snp-pop-4841 .snp-theme11 { max-width: 530px;}.snp-pop-4841 .snp-theme11 .snp-header {font-size: 35px; color: #000000;}.snp-pop-4841 .snp-theme11 .snp-text {font-size: 17px;}.snp-pop-4841 .snp-theme11 .snp-text {color: #000000;}.snp-pop-4841 .snp-theme11 .snp-submit { background-color: #000000;}.snp-pop-4841 .snp-theme11 .snp-header span { color: #000000;}.snp-pop-4841 .snp-theme11 { background-color: #FFB919; }Habbits – In stocks, I never sell. Never ever. If I do trade myself.I know all those company in my fingertips and except for Idea, SBI and Tata Powers; I can hold everyone of them for long term without worrying on them.GMRINFRA is a good construction company I some time gamble upto 5% of my portfolio’s worth on it for no reason.I invest after getting 400% sure but I made mistakes with Claris and Tata Power. :( Will try to not make same mistakes but well I will gain profits.I never bother how my managers are managing the rest of the funds unless I found their decision fundamentally incorrect.I have tons of accounts with almost brokerage firms across India.

I can lend you some of the managers contact whom I have personally used; just message me cause I do not want to share my all account statements as I have done some stuff to keep my taxes low which I can’t share in public.

Also I am not disclosing my current holdings but here is my entire account value.

virallocker_use = true;

Like or Tweet this page to reveal the content.

Tweet

The reason I am running fast is not money. I want to win Zerodha – 60 Day Challenge and want to get featured in Opentrade.in. Then I will overlook into my ecommerce venture allocating all the funds to the managers. There is a story behind me not loving stocks, read here if you have spare time – Thinking Forex? What is your threshold of pain?

I will be in the market for the next two months. Feel free to ask anything. What is your story? Comment here!

I won the challlenge

Updated on 2.12.2016 –

I won the Zerodha – 60 Day Challenge finally and though demonetization sucked my profit but I still managed to keep it profitable.

I won the Zerodha – 60 Day Challenge finally and though demonetization sucked my profit but I still managed to keep it profitable.

Thanks for your wishes. Thank you all.

Here are my top 10 best and worst contracts –

The post Surgery on my Share Market income appeared first on Amit Ghosh.