Jared Tendler's Blog, page 7

February 7, 2022

Share Your Mental Game Experience

Albert Einstein famously said, “You do not really understand something unless you can explain it to your grandmother.” In the learning process, when you understand the material so well you don’t even have to think about it anymore (and can explain it to your grandmother), you’ve hit the Holy Grail of learning.

But there is a curious point in the learning process where sharing what you know with someone else actually helps you learn it better. In other words, on your way to the Holy Grail, it helps to bring others with you.

So this month I’m asking you to bring each other along by sharing things from your Mental Game process and learnings. What has helped you make progress? Where are you stuck? What do your Mental Hand Histories look like? Sharing this knowledge with each other will help others improve their Mental Game while solidifying your own existing knowledge.

At the end of this post are the specifics of how you can help, but first here is a bit more detail for those of you who may be thinking, “sure, that’s nice, Jared, but I need to fix my own Mental Game stuff, not someone else’s. Are you sure this will help me?” I can’t offer guarantees, but I can give you some theory and research to back it up.

New skills, knowledge, or expertise are acquired through a predictable learning process that has a distinct start and finish. Although certain aspects along the way may differ from one person (or skill) to the next, such as how quickly you learn, what comes easily to you, and where you get stuck, the overall process is exactly the same every time and each stage has parameters that distinguish it from other levels.

Of course when you are knee-deep in it, the learning process is much more fluid and blurry. A particular skill or piece of knowledge will often go back and forth between two levels many times before being firmly planted in the more advanced one. But the point is to keep skills steadily moving through the learning process so that high levels of performance can be maintained.

STAGE 1 — Unconscious Incompetence. You don’t even know what you don’t know. In other words, you’re blind to the ways that you lack skill or the weaknesses holding you back. It’s like being a beginner and sitting down to play Texas Hold ‘Em, or the first time you look at the order flow of a stock – you have no idea what’s actually going on.

STAGE 2 — Conscious Incompetence. Now you start to become conscious of what you don’t know. But that doesn’t make you skilled, it just means you now know what needs to improve. Think about this like the trader who’s learned some of the fundamentals of Technical Analysis, but doesn’t yet understand how to correctly utilize the indicators seasoned traders rely upon.

STAGE 3 — Conscious Competence. If you’ve reached this stage, it means you’ve done some work, gained experience, and can prove that you’ve got some skill. But there’s a catch. In order to remain competent, you need to think about what you’ve learned. If you don’t have the energy, or your emotions are too intense, you lose the competence and return to incompetence. This is what happens when you make mistakes even when you know better. Generally you do know better and that’s why you’ve reached this stage. But since you haven’t reached the next stage, under certain situations your skills still have the possibility of eroding.

STAGE 4 — Unconscious Competence. Now you’ve reached the finish line. At this stage, you’ve learned something so well that it is totally automatic. Meaning that the knowledge you’ve acquired is applied consistently, instantly, correctly, and without thinking, at all times, even under the most extreme circumstances.

Reaching Unconscious Competence is how you permanently upgrade your weaknesses, move the backend of your Inchworm forward, and thrive under pressure. Too often poker players, traders, etc. get ahead of themselves and lose sight of the need to achieve this level of mastery.

Side note, keep in mind that when I talk about mastery, I’m talking about the mastery of individual skills here, not the mastery of a craft. I’m not suggesting that you can be unconsciously competent as a trader, poker player, golfer, etc. I’m suggesting that individual skills and knowledge must be developed to that level in order to progress in your field of expertise.

In order to train your knowledge to that level where it is automatic, you need a lot of repetition in varying different environments. Sharing knowledge with other people is a way to help reinforce the things that you are learning and get the reps that you need to reach unconscious competence. At a minimum, you solidify your existing knowledge, and that creates the conditions whereby you free up mental space to learn new things.

Another reason to consider helping others with their Mental Game is that research around testing in schools suggests it is important because testing helps learners practice retrieving information. I’m not going to test you, but the concept is interesting.

When you explain what you’ve learned to someone else, you’re in essence taking a test. Think of the times when you can’t explain what you know – that’s evidence that you don’t quite understand it yet. You failed the test. Retrieving information from your mind to share with each other is a different way of practicing and reinforcing that knowledge for YOU.

And yet another data point comes from what may be an unlikely source. In Alcoholics Anonymous, the 12th step of the program is helping another person with alcoholism recover. The philosophy behind this approach includes giving you a sense of purpose and accountability, ensuring you don’t become complacent, and inspiring others. Participating in the 12th step seems to lead to a greater rate of success. (For those interested in hearing more on the idea of service, consider listening to this podcast with author Simon Sinek. Around minute 11 he starts talking about AA and the role of service in general.)

Now I am not equating Mental Game issues with the trials of addiction, but I find it interesting that such a widespread and successful program embraces helping others as such a profound part of getting them on more stable ground. And if they are using it to deal with something so intense, what could it mean for something like the Mental Game? Would it speed up the process by which you improved?

Assuming you’re convinced this is a good idea, here are the details. Over the next two weeks, I’ll collect a sampling of contributions and bundle them together (anonymously) and post them on my website for others to read and learn from.

Here’s what I think would be helpful:

Story of how you’re learning to correct a problem, where you ran into trouble, what helped you make improvements, etc.Examples of your Maps or A to C-game AnalysisExamples of Mental Hand HistoriesExample of Goals WorksheetIf you don’t have these worksheets yet, click here to download them.

Or maybe you have another idea to share. I’m open minded and know full well that sometimes it’s the creative answers that do the trick. I worked with one trading client who had a caricature drawn of himself with the details from his confidence profile. Looking at a picture of a cartoon version of what he looked like when he was acting entitled helped him laugh, gain some perspective, and restabilize his confidence. If you’ve done something creative, let’s hear that too!

Please email your contribution to me here: info@jaredtender.com

The post Share Your Mental Game Experience appeared first on Jared Tendler.

January 10, 2022

Resolutions Are Stupid, Here’s Why

I recently read another blog on this topic that suggested New Year’s Resolutions would not fail if we thought of them as intentions, not resolutions. Here’s the problem: Changing the name don’t get to the heart of why, regardless of what you call them, resolutions fail. In this blog, I promise to give you a new perspective on the process of change.

While the calendar turns a page and starts fresh, that doesn’t mean that you do. And problems arise when you don’t see that. You feel inspired by the promise of a new year and feel like you have a clean slate with which to work from. You’ve got a fresh start. A chance to do the things you know you ought to do but haven’t been able to yet. The intent is great, but it’s not accurate and it’s not conducive to lasting improvement. Why?

While starting a New Year might feel like you wiped the slate clean, you have the same “Inchworm” on January 1st that you had the day before. For those not familiar with Inchworm, let me explain.

Progress doesn’t just happen all at once. You improve in stages. Your progress, regardless of what you are trying to improve, is modeled by a small caterpillar called an inchworm that moves in a distinctive way.

Imagine the head of the inchworm is you at your best. The middle part is your average level of performance, and your worst is at the backend. Another way to think about the different levels of your capacity is to use a structure common in sports: A-game, B-game and C-game. The front of your Inchworm is your A-game, the middle is your B-game, and the backend is your C-game.

Resolutions fail because you believe your C-game, or the backend of the Inchworm, is suddenly gone. You have the false belief that your C-game has been wiped clean and you don’t have to think about it anymore. You may also believe you can count on your A-game to show up every day, which is a false belief all on its own. You have to earn your A-game, it’s not a given.

So what happens?

You start the year with a lot of motivation, inspiration and desire to change your diet, get fit, improve your execution in trading or poker, or whatever resolutions you set. But since your C-game is still firmly planted where it was on December 31st, it lurks in the background.

Eventually, once the inspiration starts to fade, or something throws you off, the gravitational force of C-game pulls you down and causes a host of issues. You either give up because the momentum is gone and you’ve already failed to live up to what you intended, or you try again but continue to get tripped up until you eventually give up.

So resolutions are stupid.

The question you should be asking is not “what is my resolution,” but “why haven’t I already achieved it?” Let’s face it—resolutions are typically not brand-new ideas that you’ve suddenly realized are important. Instead, they are areas of your personal or work life that you’ve tried for a while to improve and you are using the motivation of a new year to try again.

If you really want to make a change, what you need to do is look at your C-game and understand what’s holding you back. Write out why you haven’t improved already, define what’s tripping you up, and make a plan that addresses each of the things you’ve found.

What you’re most likely going to find are reasons that are more complex than your current inspiration would have you believe, but hopefully not so complex that change feels unattainable. And you may have to accept that the process is going to be messier and take longer than you expect.

That’s the reality that most of you face. Embrace it or it’ll take you far longer to actually get there.

[image error]

So if you aren’t making resolutions, what should you be doing? Setting goals.

There is a difference between a resolution and a goal. Resolutions are top-line and focused only on results. It’s a blindly optimistic way of trying to achieve something. Then when momentum is disrupted, everything goes awry.

Goal setting, on the other hand, define a realistic process for achieving the results while also identifying what’s going to derail you. For many of you this last step is the most important step. If you think your goals will be achieved easily and without any problems, you’re either overconfidence or not setting your sights high enough.

Listen—I’m all for harnessing any motivation you are feeling in the new year. But you need to focus that energy in a way that will lead to lasting change. For help with your 2022 goals, you can download this new Goal Setting worksheet

window.fd('form', { formId: '61dc77576758a3ddd643e93d', containerEl: '#fd-form-61dc77576758a3ddd643e93d' }); If you’d like to get feedback on your goals, send them to me here and I will select a handful and provide feedback on my next Office Hours on January 19th, 2022.The post Resolutions Are Stupid, Here’s Why appeared first on Jared Tendler.

December 16, 2021

Why Playing Smaller Field MTTs is Good For Your Mental Game

The following is an excerpt from Endgame Poker Strategy: The ICM Book by Dara O’Kearney and Barry Carter. The first book to take a very deep dive into the subject of ICM in poker tournaments.

The more players in a tournament, the softer it will be. In the words of my friend and legendary podcaster/author Andrew Brokos, “if a tournament has 1,000 players it must be good, because there aren’t 1,000 good players”.

The more people left in a tournament the bigger your edge should be. You will have a bigger edge with two tables left than when you are down to five players. You will have a bigger edge at a nine max table than a six max table. This might go against the consensus in poker that short handed is softer. You might often see inexperienced players make short handed mistakes, but the more bad players who remain in the field boosts your own ROI.

To see this you only need to look at winrates for the best SNG players in the world, which are often barely 10% ROI for single table tournaments. This is why SNG regulars tend to migrate to tournaments because they enjoy a bigger edge. Most regulars greatly overestimate their edge on one table but equally underestimate their edge with two tables left, or more.

The more players left, the more bad players will tend to be left. When a bad player makes an error it improves your equity, even if they are on another table. Every mistake gets divided up between the winning players left in the tournament. Sometimes in a hand the equity from one bad player goes directly to another bad player, who will then make bad decisions with a bigger stack. Bad players have a compounding effect on your equity.

Does this mean we think you should devote all your time to 10,000 runner fields? No. In fact we think the best advice for most MTT grinders from an ICM perspective is to concentrate on small field tournaments, with some shots at larger field tournaments thrown in.

There are three reasons why you should probably concentrate on MTTs with fields around the 50-300 runner mark, rather than 600-10,000 runner fields.

Players who started in SNGs like I did naturally understood ICM because it was the biggest part of the game. Then we saw ICM fall out of favour with the poker community for a while, but now everyone realises they need to understand it again. 75% of the private coaching I do is people who realise they have major ICM leaks.

When you play one table SNGs ICM is the most important aspect of poker strategy. For people who play 10,000 runner fields, ICM is not as big a part of what they do. They know they should play tight on the bubble but they only make a final table every 1,000 MTTs on average, so ICM is not as obvious to them. Unfortunately for them that means when they do make a final table they often make massive ICM mistakes, which are amplified because the prize pools are so big compared to the buy-in. An ICM mistake in the $22 Mini Sunday Million might cost you $3,000 in equity, for example.

If you play 200 runner fields, however, you will make the final table every 20 tournaments on average. You get to experience ICM extreme situations much more often and practice what you have learned in books like this. You will have the ranges drilled down and have an innate understanding for things like Bubble Factor, when to ladder, what a good deal looks like and so on. These things will be second nature to you for when you do actually go deep in a major event.

I once wrote a controversial article where I said I would take an average mid stakes online MTT grinder two tables out in the WSOP Main Event over Irish poker legend Andy Black. Andy is a great live poker player but had only made 15 notable live final tables at the time. I would much rather take the guy who has made thousands of final tables and has his ranges drilled in.

If you had unlimited time and unlimited patience then you should only ever play 10,000 runner fields because you will have the greatest edge in them. The best players in the world probably have a 400% edge in the WSOP Main Event, in a soft 100 runner live game it would not be 100%, in a 45 person field it would be about 40%, in an SNG it might be 20%. Variance and ROI have a proportional relationship, the bigger the field the bigger the edge, but also the bigger the variance.

The bigger the field size the bigger your sample size of tournaments has to be to realise your edge. In my own 14 year career I have never had bigger than a $20,000 downswing but it is normal for people to play 10,000 runner fields to have losing years. You don’t need a massive sample to realise your edge when the field sizes are 100-300. This is one of the reasons why Super High Roller tournaments, which tend to have 30-50 runners, thrive despite being made up of tough regulars, you might only need a sample of 500 MTTs.

Let’s put some numbers on this.

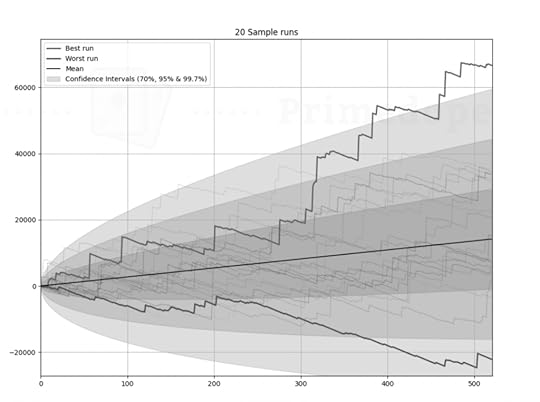

Looking at the flagship online poker tournament, the $109 Sunday Million at PokerStars. Assume it gets 7,000 runners on average each week and you have a 25% edge in this tournament. Using the tournament variance calculator at www.primedope.com you can see what happens if you played that event every Sunday for 10 years (520 game sample):

[image error]

The graph above shows 20 random samples from 1,000 simulated samples. As you can see there is one massive outlier where we win almost $500k in profit but most of our runs end in a loss. Our EV is just $14,170 with a standard deviation of $83,632. With a bankroll of $10,000 (100 buy-ins) our risk of ruin is 86.5% and probability of loss is 56.9%

Compare that to the €109 SuperNova on Sundays at Unibet, which gets closer to 300 runners every weekend.

As you can see our 20 random samples are all closer together but with lower upside when we run great. Our EV is $14,170 and our standard deviation is $15,115. Our risk of ruin is now just 15.10% and our probability of loss is just 17.3%.

The upside is obviously much greater in the Sunday Million but 56.9% of the time we will lose money playing it every weekend for a decade. That only happens 15.10% of the time in the SuperNova. You would need to play a sample in the tens if not hundreds of thousands to realise your edge in a massive tournament like the Sunday Million or the WSOP Main Event. When you do the simulation for 10,000 tournaments then your risk of ruin goes down to 30% and probability of loss goes down to 0. This is simply never going to happen, you can never realise your edge in a tournament like this because you will never have time, but you can easily realise your edge in a 300 runner field event like the SuperNova.

Players who concentrate exclusively on large field tournaments often go broke and frequently have to get staked to keep playing where they will be in makeup for long periods, or they need a massive bankroll. I have never had to be staked to play, other than selling pieces, because I have always focussed on low variance formats.

It’s good to take shots at bigger field events, in fact shot taking is a legitimate bankroll strategy. Binking a large field MTT is a springboard to playing higher stakes – you cannot really grind your way to the high rollers. I now play large field events because I am at a stage in my career where I have other income streams for when I go on downswings. For up and coming players and those who want longevity in the game, concentrating on smaller fields will keep variance at bay.

If those simulations for the Sunday Million scared you, that neatly introduces the third reason why I advocate playing smaller field MTTs. Not having to deal with the swings of large field MTTs and having practiced all the tough ICM spots in smaller field MTTs over and over again will naturally give you fewer mental game problems to deal with. Dealing with long losing stretches can finish off a lot of good players and the pressure of tough spots in big moments can lead a player to perform poorly when it matters the most.

I have never had more than a $20,000 downswing in my career but I know very talented players who go long periods questioning if they will ever win again? Not having to rely on staking or being in makeup means you will have a much clearer head when you play poker. Knowing you have been in this situation thousands of times before in a tough ICM spot makes it easier to do the right thing and makes it easier to deal with when the cards do not fall your way.

The post Why Playing Smaller Field MTTs is Good For Your Mental Game appeared first on Jared Tendler.

December 13, 2021

You’re Standing on a Mountain of Skill and Accomplishment

Every one of you has climbed higher on a proverbial mountain this year built from your accomplishments and learnings. Sure, you’ve had your share of licks and bruises from mistakes, failures, or setbacks, and some of you may feel like you haven’t climbed as high as you’ve wanted to yet. That’s ok. Regardless of where you are, at the end of the year it’s important to take a step back and look at your mountain.

One reason it’s important to look at your mountain of accomplishments is to avoid a common problem I discussed in The Mental Game of Trading: uncertainty breeds fear and, in many cases, exists when you fail to recognize your accomplishments and skills.

In the book, I asked you to imagine you’re standing on top of a mountain that’s so high you’re above the clouds. Everything below you is obscured, so it seems like you’re actually standing on a cloud and at any minute you could slip through the cloud and free-fall back to earth. But just then the cloud dissipates entirely, and you see the huge mountain beneath you. You are, in fact, on solid ground.

The mountain is the base of knowledge and experience that you’ve acquired as a trader or poker player. When you fail to recognize your accomplishments or don’t see the skills you’ve acquired, you feel unstable when you shouldn’t.

Becoming more proficient at seeing your competencies can provide a base of certainty that cuts through the inherent uncertainty in trading and poker, reducing your propensity to experience fear and stabilizing confidence. You’re not inventing or making up skills that aren’t there. You’re simply correcting the flaw in your perspective that’s caused you to be unaware of them.

The end of the year is a great time to take stock and review your competencies and accomplishments.

Another reason taking stock of your mountain is important is it helps to guide and shape your goal-setting for next year (more on goals in January).

Bill Gates once famously said “Most people overestimate what they can do in one year and underestimate what they can do in ten years.” Why is that? Part of the problem is many of us don’t really take the time to evaluate what we did accomplish in a year. In an institutional environment this is standard. But working for yourself, you’ve got to put in time and effort to make it happen.

First thing you want to look at is, compared with your goals at the start of the year, how good were you at setting goals and accomplishing them?

I realize this is tough in poker and trading, when you don’t have full control over your results in the short-term. So, conceivably, you could have an amazing year, making way more money than you could have imagined, but underperformed relative to your skills and the quality of execution. Or the flip side could be true. You had poorer results than last year despite feeling like you performed at a higher level this year.

As many of you have heard me say before, stability in your confidence is really important. And having an accurate sense of your capabilities going into next year is going to help you be successful at making strides in the areas that you have full control of, as well as in outlining what you intend to achieve.

Here’s a straightforward task to help you take stock of this year:

Look at your goals from the start of the yearWrite out what you accomplished (include accomplishments that may not have been on original goal list)If there were differences between your goals and your results, write out whyComplete this task to understand gaps and get ready for goal-setting for 2022. It’s easier to know what’s next when you have a clearer idea of what you’ve done.

Lastly, celebrate your wins. If you stop to look at how far you have come, it creates more confidence that you can keep going higher next year.

Photo by Rohit Tandon on Unsplash

The post You’re Standing on a Mountain of Skill and Accomplishment appeared first on Jared Tendler.

December 6, 2021

Results of Trading Industry Survey

Earlier today I distributed a press release with the results from the Trading Industry Survey we conducted in November. First off, I want to thank all of you who took the time to complete the survey. I greatly appreciate your participation and, as you’ll soon see, the results were intriguing. I also want to thank my survey partners (listed below) who shared the survey with their audience and ensured that we had a wide and varied group of traders participating.

The Big Disconnect

As I said, the survey results were enlightening. There is a big disconnect in the trading community and we saw that it was consistent no matter how we sliced up the data. Take a look below at the survey demographics. The disconnect was evident regardless of age, gender, or geographic location.

What’s the big disconnect? Here it is in simple terms:

97% of traders believe that psychology plays an important role in trading.96% of traders believe emotions can negatively affect your trading decisions.91% are able to recognize when emotions like fear, greed, anger, overconfidence and lacking confidence impact your performance.BUT…

Only 34% have a system in place to manage those emotions.One of my first questions when I was looking at the data was “I wonder what these answers would have been 10 years ago?” My guess is that the percentage of those first three stats would have been much lower. Many fewer traders would believe that psychology is important or that emotions impact trading decisions. And even fewer would be able to recognize when emotions like fear, greed, anger, overconfidence and lacking confidence impact performance.

The fact is, the experts in the trading psychology community have done great work in laying the foundation. Experts like Mark Douglas, Brett Steenbarger, Van Tharp, and Denise Shull have all helped traders to be more aware. And I would be that you wouldn’t find 90+% of people in other fields able to have that much awareness of the impact that psychology or emotions has on their job. I doubt we would find the same results from a survey of 1,200 engineers, teachers, lawyers, or doctors.

Pivoting from Awareness to Action

So the good news is that the trading community has won a significant battle. We don’t have to fight for awareness anymore. I was part of that wave in Poker a decade ago when my first poker book came out. In trading, it’s huge to get to this point. Stand up, high five, run a victory lap – it’s big news. And it’s clear of the next opportunity. Now we can turn our attention to closing that 56 point gap between awareness of emotions and a strategy to manage them.

I’m excited by this opportunity. I’ve spent the last 16+ years honing a system that is strategy-based, practical, and repeatable. That said, while I’ve been working with traders privately for years, I understand that my work is brand new for many of you. Some of you are just beginning to work with my book, The Mental Game of Trading, and others are finding out about the book for the first time now.

But rest assured that my goal from here forward is to figure out how to close that gap. What are the resources you need? What needs more explanation? Where do you need extra help? These are the questions I’m curious about and if you have thoughts, please email me directly.

A Mental Game Quick Guide

The first step that I’ve taken to help you all develop a strategy for trading psychology is to provide a quick guide for my system. The system is laid out in The Mental Game of Trading and some of my readers suggested this would be helpful. I shared drafts with a handful of traders who gave me feedback and I’m actually offering two different formats because some of you may appreciate one more than the other. You can find them on the worksheets page.

I have other ideas of what might be helpful and in January will ask for your feedback in a follow up survey designed to help me narrow in on what will serve you best. If you want to participate, be sure to sign up for my newsletter. (Scroll to bottom of the page.) There will be plenty of space in the survey for you to share any ideas you have as well.

Data can be very useful. Sometimes it changes the way you think about a problem entirely. Sometimes it validates a hypothesis you already had. For me, this survey told me I am in the right place at the right time. I am passionate about helping you perform at your best and I know improving your mental game is a key part of your success. Clearly we’ve got work to do and I’m excited to dig in and dramatically change that number in future surveys.

Thoughts From Survey Partners

I also asked some of my survey partners what they had to say about the results and what they think the industry needs. Here’s what they had to say:

Morad Askar of Convergent Trading, recognizes the situations where retail traders tend to struggle the most with their emotions, it’s “Situations of extremely high or low market volatility, like we’ve seen in several indices recently. This kind of activity can cause traders to second guess themselves as changes in market behavior can be abrupt. Changing market dynamics can lead to an erosion of emotional capital, increased trading errors, and frustration. This is when accountability and peer group-support really matter.”

Corey Lane from Traders Army, shared these thoughts on the survey, “Most traders tend to focus on mastering the mechanics of their trading. And while that is important, it’s clear that the skill that often gets ignored, is the mastering of one’s self, and their emotions around trading and investing. As educators, it’s not only an opportunity for us to focus on this with our students, we feel like we have an obligation to help train the student in the area of emotion management. Without it, it’s leaving the door wide open for a difficult road ahead for the student, no matter how well they’ve refined their trading strategy.”

Kim Klaiman from Steady Options thinks the 34% may be even too optimistic, “We know that many traders overestimate their abilities.” And thinks that one of the reasons for this disconnect, however large, is because humans desperately want to believe there is a way to make money with no or little risk. That’s why Madoff existed, and it will never change.

Steve DArgenio from Microefutures Trading Community worries, “Many members in our trading room feel, incorrectly, that spending mental capital addressing the emotional issues is time better spent mastering the technical aspects of trading. So the challenge we have is showing them the ROI benefits of working on the emotional actions items needed in tandem with the technical.”

The power of a survey grows exponentially based on the size and scope of the participation. We would never have gotten there without our terrific partners. Big thanks to:

Convergent Trading

Anthony Crudele

Traders Army

Microefutures Trading Community

Steady Options

Cringle Academy

Swing Pony

Romulus

The post Results of Trading Industry Survey appeared first on Jared Tendler.

November 9, 2021

Burnout Basics: Recognition and Recovery

Traders and poker players often underestimate the mental demands of their profession. Even though many of you pursued these tracks because a “normal” job wasn’t appealing, you still compare yourselves to those working 9 to 5. That mistake is a common cause of burnout.

Below you’ll find an introduction on the basics of burnout. On top of that, I’ve got a special treat for you all. You can get detailed strategies and advice on recognizing burnout and recovering from it through a sneak peak at the Avoiding Burnout module from my new Mental Game Tune Up video course. It’s totally free for the next two weeks only.

You can think of burnout like burning your skin, there are different degrees of severity and the worse it is, the longer it takes to recover. Sometimes, the trick is to just delay the burnout a little longer.

For instance, if you are a poker player in a tournament, you want the burnout at the end of the tourney, not in the middle. Or if you are a trader who knows the markets will be closed for an upcoming holiday, you might just need to keep going for a few more days before getting a three-day weekend. But when you are really burnt out, you need more time to recover. And that’s a hard pill for many of you to swallow.

As a trader or poker player you are closer to a professional athlete or performer than you are to a normal 9 to 5er. Why? Because you are paid based on your performance. Showing up isn’t good enough. You have to show up in good mental condition otherwise it’ll cost you money, quite literally out of your own pocket.

Imagine how different the corporate world would be if employees were paid on a daily basis based on their performance. The mental demands would be significantly greater and burnout would be an even bigger problem than it already is. Which brings us back to you. Since many of you lack the appreciation for the mental demands of trading and poker, burnout is a common and often hidden problem.

Let’s dig in.

Feeling Crusty

When burnout is small you want to take steps to get yourself back on track. Mild burnout is where you are just a little crusty. Maybe you don’t feel great when you get up. Traders may find they just don’t have it in them to do their normal premarket prep. Poker players may find it harder to work on their game, or sustain focus across the same number of tables online.

The sooner you recognize that you’re starting to get burned out, the sooner you can make decisions and adjustments. In order to do that you need to know the signs. Unfortunately, the best time to research your signs of burnout and identify the key factor is after each occurrence of burnout. But you can certainly think back to previous instances and do your best to map this problem like you would any other. Take good notes, and the next time around, use what you’ve found to spot the early indicators of burnout. Then you can take steps just prior to reaching that point.

When burnout is mild, some simple things you can do to recover are to prioritize your cooldown, diet, exercise, and sleep. In addition, I recommend being social, engaging in your hobbies, reading for enjoyment and not development, or doing something fun and not overly mentally stimulating. Taking these steps will help to not only delay the onset of burnout but possibly prevent it entirely—you stay right at the edge, without quite going over it.

Fully Toasted

At the other end of the spectrum is major burnout, where it’s hard to even think. You find it hard to muster the energy to trade or play poker. Just the idea of it weighs heavily on your mind. It’s a stark contrast to how you normally feel.

To prevent a severe burnout, you need to figure out the one or two signs that indicate you’re nearing that point. The signs could be emotional—you no longer have any control over tilt or greed. Or it could be evident in your discipline. Maybe you can’t follow rules and have proper entries and exits or push marginal edges, and play hands out of position that you know you should fold.

Burnout also intensifies your mental game problems and limits your ability to improve them, even if you have correctly identified the root cause. Your mind is in a weakened state, so you lack the strength, clarity, and poise to execute your strategy and fight for progress. Emotional volatility is higher, and emotions accumulate at a faster rate, which means you have more emotion to handle and less mental strength or willpower to battle it. As a result, your performance drops.

When burnout reaches this point you need rest. There’s no other way around it. The problem is that the kind of rest that you need to recover from burnout is costly. You don’t make money when your trading business is closed, or when you’re not at the poker table. Sure, sometimes it might make sense to push through, like an injured athlete in the playoffs. But you can’t push through forever.

Be Proactive

For many of you, scheduling time off feels wrong, or even irresponsible. That thinking is dangerous to your bottomline and EV. Burnout is costly. Do the math. How much more do you make from your days off if it results in improved performance on the days you are trading or playing?

Hard to say for sure I know. But many of you think that taking days off only costs you money and that’s short-sided thinking. Change your perspective to that of an athlete and think about how you get paid for days off when they help you to perform better and more often, and when that leads to greater learning and improvement.

For more on what you can do to avoid burnout, for the next two weeks you can watch 80 minutes of free content on this subject in my video series. You’ll even get to see me coach two poker players. You can see the four videos in the image below.

Burnout is a common problem but it doesn’t have to derail you.

The post Burnout Basics: Recognition and Recovery appeared first on Jared Tendler.

October 19, 2021

Don’t Trade Crypto at the Poker Table!

There is a distinct overlap in the world of poker and crypto trading lately, which has caused a number of issues with my clients.

If you’re into cryptocurrency as an investor, trader, or speculator, you’ll know that most of crypto Twitter is expecting the bull market to last till end of the year. With the WSOP scheduled during October and November, the chances are high that you’ll be playing the tournaments of your life, in the midst of a bull market like never before.

Poker Player & Crypto Trader

Poker and Crypto seem to appeal to a similar set of people. My clients include numerous poker pros who switched to full time (crypto) trading, as well as those who both play and trade simultaneously. They don’t have their TradingView & Bybit open while they long or short Bitcoin and at the same time play poker. However, they will have relatively large investment portfolios in cryptocurrency, while they are still grinding poker for a living.

Numerous mental problems can arise from this, like the lack of motivation to play poker. If you see your portfolio going up by just clicking refresh, you’ll lose the feeling of necessity to grind that 3bb win rate or play in what now feels like a lower BI tournament.

Or some players even experience winner’s tilt. They start bluffing in spots where they are most likely facing the top range of their opponents, purely because the money isn’t relevant for them anymore, and their ego needs a small boost at the poker table.

It’s very possible to trade crypto while keeping poker as your main source of income. Many players already do. But keep in mind the downsides that it can cause while playing in a tournament series like the WSOP.

The Constant Need to RefreshDo you constantly refresh your portfolio, without making an actual trade?

Why is that?

The crypto markets are exciting. The amount of money that many of you have made, or that you have on the line, makes you want to know what’s going on. It’s like you’re a fan watching a football game sweating the score go back and forth. Only with crypto and trading, the game doesn’t end!

Unless you’re making crypto trading or investment decisions on a daily basis, there is no need to constantly check on the value of your coins or portfolio. Having it constantly in the back of your mind is costing you more than you realize.

WSOP Crypto FOMO

Like I said before, many poker players like to trade crypto. What they like even more is to talk about it.

Imagine you’re at the Main Event, and half of your table is talking about insane gains they’ve been making on the cryptocurrency market. They’re discussing the next hot alt coin. Or maybe some are even flipping NFT’s and just made 7 figures flipping a Crypto Punk. Are you going to FOMO buy something? Are you going to do your due diligence of a project, while you’re at the table?

I doubt it.

It’s all fun and games to talk about things you’re interested in, crypto included. But don’t let emotions take the best of you. You are there to play poker. So keep your eye on the ball, or in this case keep your eyes on the cards.

Portfolio is Green, But We’re Looking for Diamonds

Not only will you hear about tons of investment opportunities within the crypto landscape. If the theory of this bull cycle plays out. We might be mid bull cycle while you’re in Vegas!

Hypothetically, BTC can jump from 70k to 150k in a matter of days. If you’re heavily invested in Bitcoin, it will be difficult to remain at the top of your A-game at the poker table. Watch out for signs of mental flaws:

Refreshing blockfolio or other crypto trackersMake overconfident playsRebuy quickly after busting, without taking a breatherPushing your luck to win the tournament, instead of making the best long term decisionsBuying into events that are outside your poker bankrollPlaying too loose and aggressiveObviously, it’s amazing if the cryptocurrency market will go up the remaining of the year. But don’t let it affect your poker abilities. We’re here to make some diamond flushes, not to see green candle sticks.

Do Not Trade Crypto at the Table

Create a few basic rules for yourself to protect you from mistakes. A WOSP / Crypto Bull framework of rules.

Some examples are:

Only look at portfolio during breaksDo not bring up crypto yourself, only engage in conversations about it if you want toDo not buy any project or NFT without doing your own researchMake any sell decisions before the series starts based on a analysis of your goals and portfolio – so you’re not influenced by random opinions

Come Best Prepared!

If you want to actually prep for the WSOP, check out my new video course “Mental Game Tune Up For Tournament Poker”, which will help you get ready to capitalize on the opportunities in the tourney. Good luck!

Best of luck in Vegas and let’s hope it will be an amazing bull run.

Photo credit: Executium on Unsplash

The post Don’t Trade Crypto at the Poker Table! appeared first on Jared Tendler.

October 7, 2021

Book Review: Market Technicians Journal

Very excited to have The Mental Game of Trading reviewed in the prestigious journal “Market Technicians”, which is associated with the Society of Technical Analysis. It’s big for the book to get praise from a group that is dedicated towards the advancement of technical analysis in investing and trading. They understand the role the mind and emotions has on decision making and believe my book has value in helping trader/investor’s improve.

If you’re on the fence about picking up the book, take a look at the review below.

The post Book Review: Market Technicians Journal appeared first on Jared Tendler.

October 1, 2021

WSOP Articles for PokerNews

To help you be at your best during the WSOP, I’m releasing a series of articles on PokerNews. They’ll cover a range of critical topics. You can see the list below and I’ll be updating this page as each article is released. Enjoy!!

Setting Yourself Up for WSOP SuccessTilt – A Phenomenal ROI KillerFour Surprising Ways to Handle Pressure at the WSOPDon’t Let Burnout Ruin Your WSOPKeeping Focused at the WSOP While Bitcoin MoonsYou can also have a listen to my interview with Chad on the PokerNews Podcast where I talk about Entitlement Tilt, Phil Hellmuth’s big blow-up and the release of my new video series: Mental Game Tune Up for Tournament Poker.

The post WSOP Articles for PokerNews appeared first on Jared Tendler.

September 13, 2021

NEW VIDEO COURSE

I’m excited to announce a brand new video course called The Mental Game Tune Up for Tournament Poker will be live this Wednesday, September 15th. I designed the course to take you step-by-step through the same tools and strategies that my clients rely on, time and again, to prepare for big series like the WSOP. It covers all the major areas that you need to be thinking about to get your game ready, such as controlling tilt and other emotions, avoiding burnout, getting into the zone, thriving under pressure and improving focus. The course is comprehensive, yet compact and practical. Plus, you can use it again and again to help you prepare.

One of the most exciting features of the course are a series of videos called “Coaching the Pros,” featuring unscripted 1:1 coaching sessions with two notable professional poker players: Diego Ventura, the 27th ranked online poker player in the world, with lifetime winnings of over $6.7 million, and Matt Affleck, one of the most popular players in the world, with total live earnings of over $3.3 million, plus several million more won online.

One of the most exciting features of the course are a series of videos called “Coaching the Pros,” featuring unscripted 1:1 coaching sessions with two notable professional poker players: Diego Ventura, the 27th ranked online poker player in the world, with lifetime winnings of over $6.7 million, and Matt Affleck, one of the most popular players in the world, with total live earnings of over $3.3 million, plus several million more won online.

You’ll see how top poker players prepare for tournaments by walking through a series of concrete, repeatable steps. This is the first time I’ve ever released coaching videos like this. The Mental Game Tune Up for Tournament Poker contains 34 videos adding up to over 13 hours of content.

Want to preview the course, check out the first video here.

Want an inside look at the course? Join me live this Wednesday at 2:30pm ET for Office Hours. I’ll be walking everyone though the ins and outs of the course, and as always answering your questions live.

The post NEW VIDEO COURSE appeared first on Jared Tendler.