Greg Palast's Blog, page 100

November 2, 2012

Starting Today: No Charge for my Bestselling Book. No Joke.

Palast Fund to give away FREE copies of Bestseller

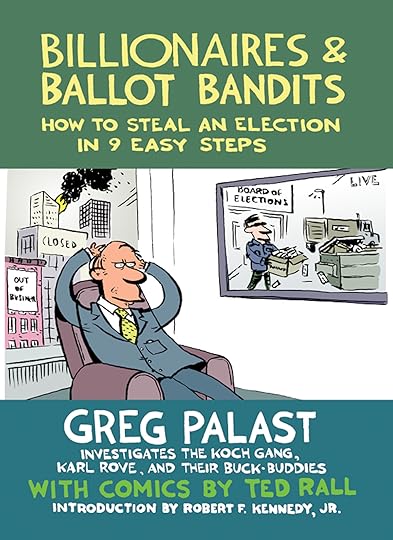

Billionaires & Ballot Bandits:

How to Steal an Election in 9 Easy Steps

A personal note from Greg Palast

A personal note from Greg Palast

Call me crazy. The Palast Investigative Fund is dead broke and our office in New York is under water. No kidding.

But America is drowning and I can’t stand by and watch.

So I’ve made a decision: For the last few days leading up to the election, you can download a complete copy of my New York Times bestselling book, Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps.

Stone cold free.

No tricks. I am asking those of you who can, to make a tax-deductible donation when you download the book or simply make a contribution here. Totally voluntary. That’s the only way we can keep our investigative team alive and make sure we can report on the wholesale shoplifting of the ballot I am witnessing here in Ohio.

My staff is currently operating on our dangerously exploding credit card balance. But America is in the balance and they haven’t cancelled our card yet.

I’m not making this up, my friends. Please donate $200, $20, $2000, $5. Whatever you can. And if you want a signed (dry) book or film, go to our “store” and make a tax-deductible donation there.

Or give zero.I just want you and your friends to read this book. If you do want the printed edition or the NOOK and Kindle version, you can get those from your bookstore,Amazon, IndieBound or Barnes & Noble.

Billionaires & Ballot Bandits has been on the New York Times bestseller list for the five weeks since its release – at the cover price of $15. Now, YOU can get it for FREE. (I will cover the publisher’s loss. Somehow.)

It contains details, which we revealed in the The Nation cover story “Mitt Romney’s Bail-out Bonanza,” of how Mitt Romney profited directly at the taxpayers expense. The book also tells you the full sickly funny but horrific tale of Romney’s secret business partner and top donor Paul Singer a.k.a. The Vulture, and dishes the dirt on his other sugar daddies, the Ice Man, the Snake, and the three Koch brothers.

From our wet, dark office, and on the road, we are producing stories for Nation,Democracy Now! and a hundred other outlets. Hell or high water we will expose the 9 ways these ballot bandits are stealing the vote in Ohio, Colorado, and Florida.

We do old fashioned non-partisan investigative reporting.

We will keep digging but are asking you to donate and help to pay for our shovels. TODAY, if you at all can.

And get the book. In print, for eReader or download it free.

I thank you and my sleepless team thanks you.

This is Greg Palast, in Toledo, Ohio, reporting …until they pull the pencil from my cold, dead hand.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and can get a signed copy of the book or make a contribution of any amount to support our work.

MEDIA REQUESTS: For interviews, review copies and excerpts contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

Did The Romneys’ Auto Bailout Bonanza Violate Federal Ethics Law?

By Greg Palast for The National Memo

At the same time, taxpayer-subsidized Delphi expanded its workforce in China to 25,000. Today, Delphi supplies GM and Chrysler parts from Mexico and China.

This week, Republican vice-presidential nominee Rep. Paul Ryan arrived in Ohio to accuse the Obama administration of cutting the pensions of the Delphi non-union pensioners. In fact, says the UAW’s King, it was the Singer-Romney group that simply refused to pay any pensions whatsoever to union and non-union workers alike. The company’s $6.2 billion pension obligation, says King, “was dumped on the US government Pension Benefit Guarantee Corporation (PBGC) which is limited by law — not by President Obama — in the sums it can pay retirees.”

None of this surprises observers of Paul Singer’s hedge fund, Elliott Management, which partnered with Ann Romney. Elliott is notorious for what the finance industry calls “vulture” attacks, in which speculators seize old debts of bankrupt corporations — and even nations — then demand payments of ten or a hundred times their investment, while making threats of economic ruin.

These vulture tactics are at the core of charges in the ethics complaint, which cites not just Elliott’s seizure of Delphi but the hedge fund’s infamous attacks on the treasuries of the Congo and Peru, which have caused an international diplomatic uproar.

Last April, President Obama and Secretary of State Hillary Clinton took the extraordinary step of filing an action in a US federal court to stop the Singer fund’s vulture attacks on Argentina. The government argued that the actions of Singer (and thus also his partners, the Romneys) have a “significant, detrimental impact on our foreign relations.”

The Singer group responded to the U.S. State Department legal action by seizing the Argentine Navy’s training ship, Libertad, which is a square-rigged sailing frigate. Which seems to suggest that the Romneys now own a piece of a real-life pirate ship.

Public Citizen’s ethics expert, Dr. Craig Holman, notes that as president, Romney would have to choose between U.S. allies and his business partners. He is barred by law from using a “blind trust” to conceal such conflicts of interest.

* * * * * *

Greg Palast is the author of the New York Times bestseller, Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, which along with his Nation magazine article on the bailout helped to trigger the public interest complaint against Mitt Romney to the Office of Government Ethics.

October 31, 2012

UAW Files Charges Against Romney on his Auto Bail-out Profiteering

Broke ethics law hiding millions, say good government groups

by Greg Palast

Toledo, Ohio

For Mitt Romney, it's one scary Halloween. The Presidential candidate has just learned that tomorrow afternoon he will charged with violating the federal Ethics in Government law by improperly concealing his multi-million dollar windfall from the auto industry bail-out.

At a press conference in Toledo, Bob King, President of the United Automobile Workers, will announce that his union and Citizens for Responsibility and Ethics in Washington (CREW) have filed a formal complaint with the US Office of Government Ethics in Washington stating that Gov. Romney improperly hid a profit of $15.3 million to $115.0 million in Ann Romney's so-called "blind" trust.

The union chief says, "The American people have a right to know about Gov. Romney’s potential conflicts of interest, such as the profits his family made from the auto rescue,” “It’s time for Gov. Romney to disclose or divest.”

“While Romney was opposing the rescue of one of the nation’s most important manufacturing sectors, he was building his fortunes with his Delphi investor group, making his fortunes off the misfortunes of others,” King added.

The Romneys' gigantic windfall was hidden inside an offshore corporation inside a Limited Partnership inside a trust which both concealed the gain and reduces taxes on it.

The Romneys' windfall was originally exposed in Nation Magazine, Mitt Romney's Bail-out Bonanza after a worldwide investigation by our crew at The Guardian, the Nation Institute and the Palast Investigative Fund. [Ed. - The full story of Romney and his "vulture fund" partners is in Palast's New York Times bestseller, Billionaires & Ballot Bandits.]

According to ethics law expert Dan Curry who drafted the ethics complaint, Ann Romney does not have a federally-approved blind trust. An approved "blind" trust may not be used to hide a major investment which could be affected by Romney if he were to be elected President. Other groups joining the UAW and CREW include Public Citizen, the Service Employees International Union, Public Campaign, People for the American Way and The Social Equity Group.

President Obama's approved trust, for example, contains only highly-diversified mutual funds on which Presidential action can have little effect. By contrast, the auto bail-out provided a windfall of over 4,000% on one single Romney investment.

In 2009, Ann Romney partnered with her husband's key donor, billionaire Paul Singer, who secretly bought a controlling interest in Delphi Auto, the former GM auto parts division. Singer's hedge fund, Elliott Management, threatened to cut off GM's supply of steering columns unless GM and the government's TARP auto bail-out fund provided Delphi with huge payments. While the US treasury complained this was "extortion," the hedge funds received, ultimately, $12.9 billion in taxpayer subsidies.

As a result, the shares Singer and Romney bought for just 67 cents are today worth over $30, a 4,000% gain. Singer's hedge fund made a profit of $1.27 billion and the Romney's tens of millions.

The UAW complaint calls for Romney to reveal exactly how much he made off Delphi -- and continues to make. The Singer syndicate, once in control of Delphi, eliminated every single UAW job --25,000-- and moved almost all auto parts production to Mexico and China where Delphi now employs 25,000 auto parts workers.

Forensic Economist Greg Palast's investigative reports can be seen on BBC Television. His latest bestseller, Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps contains a comic book by Ted Rall and chapters by Robert F. Kennedy Jr. www.BallotBandits.org

Advisory: UAW files ethics charge on Romney auto bail-out profiteering

Unions, Good Government Groups to File Ethics Complaint Against Romney For Failing To Disclose His Big Auto Rescue Profit

Groups Urge Office of Government Ethics to Make Romney Disclose or Divest

WASHINGTON – A coalition of community, labor and good-government organizations is calling on the U.S. Office of Government Ethics to investigate GOP presidential candidate Mitt Romney for noncompliance with the Ethics in Government Act and compel him to either disclose his investments or divest them.

“The American people have a right to know about Gov. Romney’s potential conflicts of interest, such as the profits his family made from the auto rescue,” said UAW President Bob King. “It’s time for Gov. Romney to disclose or divest.”

In a Nation magazine cover story, investigative reporter Greg Palast reported that the Romney family personally profited at least $15.3 million from the auto loans of 2009 through his investment in the Delphi Corp. auto parts company. Yet Romney’s June 1, 2012, Public Financial Disclosure Report to the Office of Government Ethics did not reveal this windfall because he did not disclose the underlying holdings of his private equity and limited partnership funds.

“While Romney was opposing the rescue of one of the nation’s most important manufacturing sectors, he was building his fortunes with his Delphi investor group, making his fortunes off the misfortunes of others,” King added.

The groups sending the complaint letter, including SEIU, UAW, Citizens for Responsibility and Ethics in Washington, Public Citizen, Public Campaign, People for the American Way and The Social Equity Group, believe that Romney’s undisclosed stock holdings create serious conflicts of interest. They point to the auto rescue as a key example.

Here are details of a joint news conference to be held Thursday in Toledo, Ohio:

WHO: UAW President Bob King

SEIU Executive Vice President Tom Woodruff

Investigative reporter Greg Palast,

author of “Mitt Romney's Bailout Bonanza,” The Nation and “Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps”

Delphi workers

WHAT: News conference on Mitt Romney’s conflicts of interest with his investments, including his profiting from the auto bailout

WHERE: UAW Local 12

2300 Ashland Ave Toledo, Ohio

WHEN: Thursday, Nov. 1, 2pm

For more information contact Julia Wouk: phone 760 929 1111 or e-mail. You can also visit UAW.org or SEIU.org

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and can get a signed copy of the book or make a contribution of any amount to support our work.

MEDIA REQUESTS: For interviews, review copies and excerpts contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

Sandy De-Filed Us!

A personal note from Greg Palast

Damn that Sandy! She flooded our New York office.

I am asking those of you who can, to make a tax-deductible donation when you download my New York Times bestselling book Billionaires & Ballot Bandits: How to Steal and Election in 9 Easy Steps or simply make a contribution here. Keep us afloat!. Keep our investigative team above water.

My staff is currently operating on our dangerously exploding credit card balance. I’m not making this up, my friends. Please donate $200, $20, $2000, $5. Whatever you can.

And if you want a signed (dry) book, go to our “store” and make a tax-deductible donation there. If you do want the printed edition or the NOOK and Kindle version, you can get those from your bookstore, Amazon, IndieBound or Barnes & Noble.

From our wet, dark office, and on the road, we are producing stories for Nation, Democracy Now! and a hundred other outlets. We do old-fashioned non-partisan investigative reporting.

We will keep digging but are asking you to donate and help to pay for our shovels. TODAY, if you at all can.

And get the book. In print, for eReader or download it for a donation.

I thank you and my sleepless team thanks you.

This is Greg Palast reporting …until they pull the pencil from my cold, dead hand.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and get a signed copy of the book or make a contribution of any amount to support our work.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

October 26, 2012

A Hostile Takeover of our Country Treasonous, Noxious, Thieving, Tyrannical

by Robert F. Kennedy Jr., for EcoWatch

from the foreword to Billionaires & Ballot Bandits

American democracy is under assault.

In one super-PAC alone, Karl Rove and the Enron grifter Ed Gillespie, have assembled $200 million from big polluters and Wall Street moguls to buy the 2012 election.

Two of the Koch Brothers, Charles and David, pledged $130 million to elect candidates who favor unrestrained corporate profiteering.

The senators and congressmen they fund and elect are not representing the United States—they are representing Koch and its oil industry cronies, Big Pharma, and the Wall Street banksters currently mounting a hostile takeover of our government.

I have no problem characterizing these corporate-centric super-PACs as treasonous. We are now in a free fall toward old-fashioned oligarchy; noxious, thieving and tyrannical.

The most corporate-friendly Supreme Court since the Gilded Age had declared in its notorious Citizens United decision that corporations are people and that money is speech. Those who have the most money now have the loudest voices in our democracy while poor Americans are mute.

And the money is talking; in 97 percent of federal elections over the past two decades, the best-funded candidates were victorious.

America, the world’s proud template for democracy and a robust middle class, is now listing toward oligarchy and corporate kleptocracy.

America today is looking more and more like a colonial economy, with a system increasingly tilted toward enriching the wealthy 1 percent and serving the mercantile needs of multinational corporations with little allegiance to our country.

These radical forces already dominate the national press, with Fox News and talk radio snugly in the pocket of the corporate Right.

This is the first time in American history that corporate and media interests have been so clearly and so perilously aligned.

With the media in their hands, and unlimited money, the final strategy of Rove, Koch, the Chamber of Commerce, and others of that ilk is to permanently cripple representative democracy by stopping Americans from voting.

A boatload of new Jim Crow laws target Democrats by erecting impediments that deter poor and minority communities, senior citizens, and students from exercising their franchise.

Voter suppression is a crime.

In Billionaires & Ballot Bandits, Greg Palast details each of these devious scams for disenfranchising vulnerable voters . . . but also, crucially, Palast here follows the money that powers the machinery of democracy’s destruction.

This is not a partisan issue. Clearly the GOP agenda is to suppress votes, as Karl Rove has repeatedly and unashamedly signaled. But Billionaires & Ballot Bandits exposes the vote-count blindness, biases, venality, and ballot gaming by Democrats as well. I don’t believe there are Republican children or Democratic children.

Every American citizen ought to have the right to vote and everybody ought to have the right to clean air and clean water, to integrity and transparency in the marketplace, and to a functioning democracy.

Palast is the last of the great, old-fashioned muckraking investigative reporters. He’s an “outlier,” unafraid of corporate tyrants. Together, we have been investigating and exposing voter suppression for years. In 2008, we co-wrote a story for Rolling Stone warning of the ugly future of a new Jim Crow operation.

Now, it's here.

Voter suppression is real. And it’s happening to YOU. But there is something that you can do to prevent it. That is the message of Palast’s book.

Remember, this is YOUR democracy. You can do all the campaigning you want, but if your vote isn’t counted, you’re going to lose the presidency—and our democracy.

Read our book Billionaires & Ballot Bandits. Pass on the link www.BallotBandits.org and download the 7 Ways to Beat the Ballot Bandits. And get the word out! There’s still time to steal back your vote..

Read our book Billionaires & Ballot Bandits. Pass on the link www.BallotBandits.org and download the 7 Ways to Beat the Ballot Bandits. And get the word out! There’s still time to steal back your vote..

Read Kennedy's entire A Hostile Takeover of our Country in Billionaires & Ballot Bandits: How to Steal and Election in 9 Easy Steps by Greg Palast. The New York Times bestseller includes a 48-page comic book insert by artist Ted Rall.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and can get a signed copy of the book or make a contribution of any amount to support our work.

MEDIA REQUESTS: For interviews, review copies and excerpts contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

October 25, 2012

How Mitt Romney Profited from Delphi Workers' Misery

Cenk Uygur breaks down the numbers from investigative journalist Greg Palast’s report detailing how Ann Romney’s blind trust profited from the government bailing out General Motors. Exactly how much money did the Romneys make? Between $15 million and $115 million. “What happened, Romney? I thought you were against bailouts,” Cenk says. “Apparently you’re not as against it when it goes into your pocket.”

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and can get a signed copy of the book or make a contribution of any amount to support our work.

MEDIA REQUESTS: For interviews, review copies and excerpts contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

October 23, 2012

Romney & Co Shipped Every Single Delphi UAW Job to China

by Greg Palast | Truthout

He's kidding, right? Did I just hear Mitt Romney say, "I would do nothing to hurt the US auto industry"

Really? REALLY?

Here's the facts, ma'am:

As I reported in this week's Nation magazine cover story "Mitt Romney's Bail-out Bonanza", the Romneys are in a special partnership with the vulture fund that bought Delphi, the former GM auto parts division.

[Watch our Democracy Now! report on the Romney group's auto plant closures.]

The Romney vulture fund investment syndicate shipped every single UAW production job – EVERY job – to China.

Just after Nation broke the story, Washington newsletter The Hill received the Romneys admission of profiteering:

"Romney's campaign did not deny that he profited from the auto bailout in an email to The Hill, but it said the the report showed the Detroit intervention was 'misguided.'"

The truth? On June 1, 2009, the Obama Administration announced that Detroit Piston's owner Tom Gores, GM and the US Treasury would buy back Delphi. The plan called for saving 15 of 29 Delphi factories in the US.

Then the vulture funds pounced.

Nation discovered that, in the two weeks immediately following the announcement of the Delphi jobs-saving plan, Paul Singer, Romney's partner, secretly bought up over a billion dollars of old Delphi bonds for pennies on the dollar.

Singer and partners now controlled the company ... and killed the return of Delphi to GM.

These facts were revealed in a sworn deposition of Delphi's Chief Financial Officer John Sheehan, confidential, but now released on the web.

Sheehan said, under oath, that these speculators threatened to withhold key parts (steering columns), from GM. This would have brought the auto maker to its knees, immediately forcing GM's permanent closure.

The extortion worked. The government money that was supposed to go to save jobs went to Singer's hedge fund Elliott and its partners, including the Romneys.

Once Singer's crew took control of Delphi, they rapidly completed the move to China, sticking the US taxpayers with the bill for the pensions of the Delphi workers cut loose.

Dan Loeb, a million-dollar donor to the GOP, who made three-quarters of a billion dollars off the legal scam, proudly announced that, once he and Elliott took control, Delphi kept “virtually no North American unionized labor”

In all, three hedge funds run by Romney's million-dollar donors have pocketed $4.2 billion, a return on their "investment" of over 3,000%, all care of the US taxpayer. The Romneys personally earned minimum $15.3 million, though more likely $115 million – a range their campaign does not dispute.

Frankly, I'm no fan of the way Obama handled the Delphi bail-out. Allowing these speculators to crank the US taxpayers for $12.9 billion in subsidies – and losing almost all the auto parts jobs in the process.

But when I heard that Son of a ...Detroit, Mr. Romney, tell us, 'I would do nothing to harm the US auto industry,' I thought I'd lose my dinner. I suggest Romney repeat this directly to the Naylor family of Kokomo, Indiana.

Bruce Naylor lost his job at Delphi, then his health insurance (terminated by the Romney syndicate) - then his home to foreclosure.

Should Obama have done something about that? You bet. If I were the president, I'd have started with putting the vulture speculators out of business – including Elliott's silent, hidden partner, one Mitt Romney.

* Want the full story of Romney's vulture-pack partners? I have several chapters on Paul "The Vulture" Singer and other million-dollar donor magnates backing Romney (and those backing Obama too) in my new book, "Billionaires & Ballot Bandits," with an introduction by Robert F. Kennedy Jr. and illustrations by Ted Rall.

* And a question to the US media: HELLO, ANYBODY HOME?

This info on Romney's profiteering and the shipping of Delphi jobs to China by his cronies is on the COVER of Nation Magazine and in a New York Times bestseller (Billionaires & Ballot Bandits). So, where is the New York 'Paper of Record'? Or, for that matter, MSNBC?

Bill Press explained it to me when I was on his show this morning, "Sorry, Greg. There's no more investigative reporting in America. No reporters, just repeaters."

That's why I fear Jimmy Carter's statement that, "The American people deserve a president as good as they are." Now I'm afraid that's exactly what we'll get.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and can get a signed copy of the book or make a contribution of any amount to support our work.

MEDIA REQUESTS: For interviews, review copies and excerpts contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

October 22, 2012

Romney's Auto Bailout Profiteering Palast on Democracy Now!

Watch Greg Palast talk about his new Nation magazine article Romney's Bailout Bonanza.

Elements of this story appear in Palast’s brand new New York Times Bestseller:

Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and can get a signed copy of the book or make a contribution of any amount to support our work.

MEDIA REQUESTS: For interviews, review copies and excerpts contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

Romney's Auto Bailout ProfiteeringPalast on Democracy Now!

Watch Greg Palast talk about his new Nation magazine article Romney's Bailout Bonanza.

Elements of this story appear in Palast’s brand new New York Times Bestseller:

Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps.

* * * * * * * *

Greg Palast is the author of the New York Times bestsellers The Best Democracy Money Can Buy, Armed Madhouse and Vultures' Picnic.

Palast's brand new NYT bestseller Billionaires & Ballot Bandits: How to Steal an Election in 9 Easy Steps, is available from Barnes & Noble, Amazon or Indie Bound and on the NOOK and Kindle.

Author's proceeds from the book go to the not-for-profit Palast Investigative Fund for reporting on voter protection issues.

Donate and can get a signed copy of the book or make a contribution of any amount to support our work.

MEDIA REQUESTS: For interviews, review copies and excerpts contact us.

Subscribe to Palast's Newsletter and podcasts.

Follow Palast on Facebook and Twitter.

Greg Palast's Blog

- Greg Palast's profile

- 138 followers