David Gergen's Blog, page 4

August 7, 2011

In economic turmoil, U.S. needs a leader like Churchill

By David Gergen(CNN) -- Before returning to the States this weekend, I and others in my family spent enthralled hours at the Churchill War Rooms in London, along with the new museum in his honor next door. Now, there was a leader! There was a man whose example shouts out to us now in our hour of trouble.

On both sides of the Atlantic, the turmoil of this past week has sparked cries for those in political power to step up and for God's sake, lead. Fears are spreading across Europe as well as the U.S. that not only are our economies teetering but our politicians are ineffectual.

In their summit a short while ago, leaders of European democracies promised they had fixed the problems of their weakest player, Greece. Instead, their solution was so timid that fears of default have spread to Italy and Spain, the third and fourth largest economies in the euro zone. In the U.S., President Obama and Congressional leaders assured us that their budget deal would put us on a safe path. Instead, markets plunged and Standard & Poors stripped our county of its AAA credit rating for the first time ever.

It's not that you don't have the economic capacity to pay your bills, said S&P; we're just not sure you have the political capacity to pay them. One can well object to the decision, as the White House has, but the damage is done in international eyes. Gloom is thick across the waters.

Winston Churchill would have rejected this pessimism in an instant. He was offered the prime ministership in May, 1940, when Hitler had marched across much of Europe and chased British troops off the mainland. Many of Britain' older political leaders were so despondent they wanted to capitulate to Hitler, and had signed a peace treaty.

Churchill rallied younger ministers, turned around the cabinet, and inspired his people to fight to the end. He had few weapons but, as it was said, he mobilized the English language and sent it into battle. What we would give for leaders today who are as defiant in the face of trouble.

Churchill also understood the importance of banishing fear and steadying a country. The war rooms are the fortification where he, his ministers, military advisers and secretaries worked below ground as German bombs rained down on London streets. In taped interviews, those who had duties there spoke of cramped quarters, short rations, long hours, and claustrophobia -- but to a person, they dismissed that as nothing. Churchill drove them hard and could be overbearing, but they loved him for his courage and resolve. (Stiff upper lips, chaps!)

On several walls hang posters from those days: "Keep Calm & Carry On." That is very much the spirit that leaders of today need to instill in peoples across the Atlantic. They must replace fear with faith in the future.

In Europe and especially in the U.S., the public is disgusted with politics because their leaders squabble like kids in a sandbox. Churchill lived in a day when there were bitter fights, too. But upon taking the reins, he immediately formed a coalition government.

We must not let our arguments over the past dominate the present, Churchill said, or we will lose the future. There in the war cabinet room, one sees chairs reserved for Labor as well as Conservative ministers -- coming together, they could stop Hitler. Isn't that a lesson for us today, too?

Finally, Churchill understood the importance of a leader raising a banner, setting clear goals, and marching out in front -- especially in a crisis. None of his advisers would have ever said he "leads from behind"; that was inconceivable. Nor would he, as the European Central Bank has just done, have ever said that his approach to a problem was one of "constructive ambiguity." Who can take confidence in that?

Churchill had his flaws -- he was human. But his leadership turned Britain's darkest hour into its finest hour. Can our American and European leaders please schedule their next meeting in his war rooms?

August 2, 2011

The deal disappoints, but don't give up on America

By David Gergen, CNN Senior Political Analyst

August 2, 2011 3:32 p.m. EDT

Derbyshire, England (CNN) -- Tucked away here at a family reunion among rolling hills, one can easily drift into another, more pleasant world, but the old realities keep intruding. Time and again, English relatives have gingerly but worriedly asked, "What is to become of America after this debt struggle?"

How to answer? The truth is that none of us knows, and deep insights are especially elusive at this distance.

I try to tell them that the United States is going through a rough patch: the rise of lots of problems that we have allowed to fester over the years now coming to a head just when our politics are polarized, poisoned and paralyzed. Moreover, there is almost no one in high places who commands the full trust of the country -- from the White House to Wall Street, from Congress to the media.

But, I hasten to add, don't write off America -- we are usually at our best when we are down. These are the toughest tests we have faced since the 1930s and '40s, but remember how well we pulled together then.

As for the debt follies that have just unfolded, the compromise that emerged came out of a messy, frustrating, often disgusting process, but it did achieve two significant goals: It averted a crisis (yes, one that was wholly artificial, but still a crisis), and it should be good enough to prevent another fight like this until after voters have a chance to select winners and losers next November. So, some credit is due President Barack Obama as well as GOP and Democratic leaders on Capitol Hill.

Gergen: Debt bill a major GOP victory Obama: Everyone has to chip in The debt rhetoric: How we got here Debt uncertainty has rattled global markets

Still, this is a deal that deserves only one hand clapping, not two. It fell far short of a "grand bargain," a dream scuttled by the tea party as well as the White House. In particular:

• With at least $10 trillion in new deficits expected over the next decade, it cuts only a little more than $2 trillion. The grand bargain called for $4 trillion.

• It solves neither of our biggest fiscal problems: reform of Medicare, Medicaid and Social Security and reforms of taxes that are not only fairer but bring in more revenues, especially from the affluent.

• It does not provide for an equal sharing of burdens: The middle class and working people are likely to bear the most.

• It fails to provide an extension of payroll tax relief and jobless benefits into next year, which are so needed in this economy.

• It could well weaken the economy in the near term and, given the debates that will now arise in this congressional committee, will set off a flurry of lobbying and uncertainty in a business community that desperately craves a clearer sense of policy and regulation.

• And it threatens to savage the Defense Department with cuts that will force the United States to pull back from its leadership role in the world and reduce the pay and benefits of those in uniform.

With the fight over, it is like waking up to a bad dream and realizing that much of the nightmare is still here.

The markets recognized that hard realities still persist on Monday after the deal was done -- stocks sank at the end of the day -- and the rest of us will likely get our dose Friday with new unemployment numbers. The politicians will immediately turn their attention to jobs, but they seem to be mostly out of ammunition and so is the Fed. (QE 3 anyone?)

The threat of Standard & Poor's downgrading our AAA credit rating hasn't gone away. (Economist Carmen Reinhart, an authority, thinks S&P would still be justified in doing so.) And the debt crisis in Europe is still teetering on the edge. (It is widely believed here in the UK that leaders patched it up long enough to go on August holiday and expect to return to it in September.)

It is unbelievable that on Monday night, after the vote, the House of Representatives declared a five-week holiday without resolving the impasse over the Federal Aviation Administration.

But maybe we all need a break, so we can recover our perspective and our humor. Can Gabby Giffords just show up a few more times this summer? She surely reminds us that no one should ever give up on America.

August 1, 2011

July 29, 2011

Can a debt bill pass the House today?

A new version of the Boehner bill with a balanced budget amendment provision appears poised to pass the House today. How do you think the Senate should respond?

July 27, 2011

July 26, 2011

Is Washington slouching toward a solution?

Washington (CNN) -- With America now perilously close to default, here's where I sense we stand. My observations may be off as I have only had a brief time in Washington to take measure, but let me give it my best shot.

First off, the good news: The next several days are likely to be tortuous, but odds are shifting now in favor of a resolution that will prevent default. Behind the scenes, congressional leaders on both sides are talking to each other about ways out of this mess -- talks that are quiet, frequent and urgent.

Importantly, the two key plans now on the table -- one from House Speaker John Boehner, the other from Senate Majority Leader Harry Reid -- bear important similarities. Both are based squarely on spending cuts, and the Democrats aren't now pushing for tax increases. That makes it easier to find common ground.

Finally, there are hints that if a bipartisan deal is shaping up, President Barack Obama may be willing to accept an extension of the debt ceiling for a couple of weeks, give or take a bit. Default is still a serious threat, but there may be enough will and enough time to hammer out a compromise that both sides can swallow.

Now the bad news: Even if they reach a compromise and we avoid a default, prospects are growing that we will get hit by a second bullet: a downgrading of our AAA credit rating.

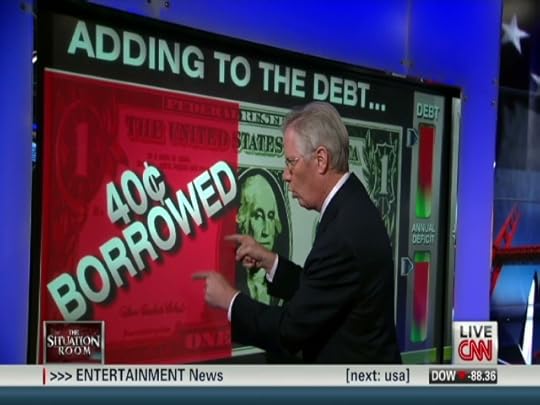

Where does U.S. debt come from?

Where does U.S. debt come from?Standard and Poor's, which rates securities such as U.S. bonds, has made increasingly clear that it is looking for more than a resolution of the debt-ceiling fight. It also wants the resolution to be built on a credible plan to reduce deficits by $3 trillion to 4 trillion over 10 years.

The president still wants that "grand bargain" and perhaps so does Boehner (see below), but it is a real long shot. Well-informed people now think that a credit downgrade is a near certainty. And that could bring some of the same damage as a default: higher interest rates, troubles in banks and state governments and a blow to American prestige. It shouldn't be an economic catastrophe by any means, but it is definitely bad news.

Those are the bottom lines. Now for a little speculation about how this may unfold in coming days.

As noted, there are two plans now on the table -- Boehner's and Reid's. House Majority Leader Eric Cantor and some of his GOP allies may be calculating that the Boehner plan will pass the House but the Reid plan will fail in the Senate. With that, Cantor may hope, the Senate could actually accept the Boehner plan, and it would be sent to the president with a simple message -- accept what you hate or veto and throw us into default.

Americans are rightly angry, frustrated and more than a little scared by this debt fight.--David GergenRELATED TOPICSJohn BoehnerBarack ObamaMitch McConnellNational DebtU.S. Congressional Politics

My sense is those calculations won't hold. Yes, Reid will never pass the House and may not even pass the Senate. (Where will Reid find seven Republican senators for cloture?) But by the same token, the Boehner plan doesn't have a bright future, either. Enough hard-line Republicans are coming out against it that it could fail in the House, and if it gets to the Senate, the president and Democrats are so dug in against it that it won't pass there.

What all of this means is that both the Reid and Boehner plans are likely to die by the end of the week, and congressional leaders will then be under intense pressure to unveil yet a new compromise -- that's why they are talking so much. Perhaps the new compromise will blend elements of Reid and Boehner. Perhaps Senate Minority Leader Mitch McConnell -- unrecognized as the key figure in this drama? -- will come up with a variation of his old plan, which would have allowed Congress to agree tacitly to increasing the debt ceiling while casting symbolic votes against it.

But there is yet another possibility that intrigues: Will Obama then try to persuade Boehner to go back to the "grand bargain" they nearly reached several days ago. (Question: Was that deal blown up by the sudden announcement of the "Gang of Six" plan? Maybe.) In any event, Obama clearly harbors a hope for a grand bargain.

Indeed, his prime-time TV speech was a strong appeal to his base and to independents to flood Congress with demands for a "balanced," grand approach -- and a rejection of Boehner's new plan. Indications early Monday night suggest that it may have worked: Electronic messages were reportedly pouring in, and Boehner's website (among other congressional pages) reportedly crashed. But it remains to be seen whether the heavy traffic was a grass-roots surge begging for compromise -- or a tea party-led clamor to hold the line.

Still, it seems that partisans in both parties will kill the idea of such a grand bargain -- after all it contains both higher taxes for some and Medicare cuts. Much more likely is a more modest agreement with all the danger that brings for our credit rating -- a blend of Reid/Boehner or a McConnell special.

Finally, what more deserves to be said about the two television speeches Monday night? Very little, frankly. Had they been given a few weeks ago, they would have been welcomed as standard rhetorical fare. But to have such political speeches -- both containing partisan barbs -- on the eve of a crisis struck me as one more reminder of how far we have drifted from the statesmanship of yore.

Americans are rightly angry, frustrated and more than a little scared by this debt fight. It has only confirmed that our politics have taken a terrible turn. And how striking it is to have an emergency that has not been caused by our foes -- but is entirely a self-inflicted wound. Wouldn't it be wonderful if we didn't have to listen to more arguments from politicians -- as well as pundits -- and could actually wake up to a bold, courageous, bipartisan solution?

CNN analysts react to Obama's debt appeal

Obama offers 'balanced' solution to debtSTORY HIGHLIGHTSGloria Borger: Speeches by Obama, Boehner appear to show sides aren't near a dealDavid Gergen: Remarks by both were far too political, and not usefulJames Carville: Democrats are giving up a lot in negotiations, and Republicans aren't budgingErick Erickson: Sides are closer to deal than speeches would indicateRELATED TOPICSNational DebtBarack ObamaJohn BoehnerU.S. Politics

Obama offers 'balanced' solution to debtSTORY HIGHLIGHTSGloria Borger: Speeches by Obama, Boehner appear to show sides aren't near a dealDavid Gergen: Remarks by both were far too political, and not usefulJames Carville: Democrats are giving up a lot in negotiations, and Republicans aren't budgingErick Erickson: Sides are closer to deal than speeches would indicateRELATED TOPICSNational DebtBarack ObamaJohn BoehnerU.S. Politics(CNN) -- U.S. President Barack Obama, in a televised address Monday night, called on Americans to pressure lawmakers to reach a compromise that would raise the nation's debt ceiling and avoid a possible national default.

The Treasury Department says the nation's $14.3 trillion debt ceiling must be raised by August 2. If it is not, the department says, the federal government won't be able to pay all its bills next month, and Americans could face rising interest rates and a declining dollar, among other problems.

Congressional Republicans have insisted that before the debt ceiling is raised, a deal to take steps to reduce the debt must be struck. Obama said Monday that such a deal should be balanced between spending cuts and revenue hikes -- though a plan outlined Monday by Democratic Senate Majority Leader Harry Reid would require no new tax increases in the short term -- and said that Republicans instead have insisted on spending cuts only.

House Speaker John Boehner, R-Ohio, countered in a televised speech minutes later that excessive government spending caused the debt problem, and cutting that spending is the only way to solve it.

Here's how CNN analysts reacted to the speeches:

Gloria Borger, CNN chief political analyst

On the speeches giving the impression that the two sides are nowhere near a deal, and on Obama talking about tax increases on a day when Reid offered a plan without them:

"You listen to both speeches, and it's as if we have not made any progress in this heated debate that we've been covering for most of the last month. It still comes down to the question of tax increases versus spending cuts, and each party is kind of living in a parallel universe here. And while they've been working to get around that ... when you listen to them, they're nowhere close to getting a deal, it seems."

"What was interesting also was that the debate we were having in Washington (earlier) today (with proposals offered by Reid and Boehner) seems to have moved beyond the tax increases, at least in the short term. Nobody today is talking about tax increases except for Barack Obama, who still talked about that tonight in his speech. The plan by Harry Reid contains no tax increases, in the short term. The plan by John Boehner (also) contains no tax increases."

David Gergen, CNN senior political analyst

On Obama and Boehner appearing to be appealing to their political bases, and on Obama asking Americans to call members of Congress:

"Had these speeches been given three or four weeks ago, I think they would have been welcomed as part of the political discourse -- you know, let's have some fisticuffs, each side presses its point of view, appeals to the American people. But to be given on the eve of a possible default, both individuals gave partisan speeches ... and I think each was intending to rally his own base. President Obama was clearly trying to rally his Democratic base to send an avalanche of calls and e-mails, twitters, whatever, to Congress to back the Democratic plans and to bash the Republicans. And John Boehner was trying to do just the opposite.

"And to have that happen on the eve, I think it's good politics, but in terms of getting the national answer in the next eight days, I think it left us farther away from getting an answer. It's going to further divide the country.

"I think probably each fellow came out better with his base, but I think the country is so tired of the political posturing, and people really want leadership that finds answers and gets us of the edge of a cliff."

James Carville, Democratic strategist and CNN contributor

On his belief that Democrats are giving up a lot in negotiations:

"The Democrats ... keep trying to surrender. They're saying, 'We'll cut Social Security, we'll cut Medicare, we'll cut Medicaid, we'll give you a plan that doesn't have any tax increases,' ... and (Republicans) keep rejecting it. This thing is a rout. The Republicans are winning this thing in a rout in terms of getting what they want.

"And poor Speaker Boehner came up with a plan today, and ... the Tea Party didn't even want that. So I think that you can't negotiate if one side is not interested in negotiating. This is like Napoleon and Moscow in 1812. 'I don't want to negotiate. There's nothing to talk about here.' So I don't know where this is going to end up. Maybe the Democrats can find somebody to take the white flag. So far, they haven't been able to do it."

Erick Erickson, RedState.com editor and CNN contributor

On how close he believes the sides are to a deal, and whether that deal will be sufficient to sustain the country's top credit rating:

"I actually think they're closer than all of these speeches would suggest. If you look at what Harry Reid is proposing and you look at what John Boehner is proposing, other than John Boehner requiring two votes and a few other issues, by and large their plans are identical. I suspect the plans will get merged within the week.

"Now, guys like me won't like it. We knew a compromise was coming. The problem is that neither plan cuts $3 trillion to $4 trillion, which is what Standard & Poor's said (lawmakers) would need to do to keep the credit rating at AAA."

July 25, 2011

No Way To Run A Country

By David Gergen, CNN Senior Political AnalystJuly 21, 2011 6:00 p.m. EDT

STORY HIGHLIGHTSDavid Gergen: Some of best options for debt ceiling talks seem to be failingHe says GOP won't go for tax increases; Democrats won't go for deep spending cutsGergen says the result is a nation hurtling toward a potentially devastating defaultThere is a good chance credit agencies will downgrade the credit rating on U.S. debt

(CNN) -- If Bill Safire were still with us and writing a column about the debt follies in Washington, he might well begin by asking readers: Which of the following outcomes is most likely in the days ahead?

(a) The president and Congress reach a historic accord that reduces deficits by some $4 trillion over 10 years while also lifting the debt ceiling through the 2012 elections.

(b) They reach a much more modest agreement that lifts the debt ceiling in stages, includes spending cuts of some $1 trillion to $1.5 trillion but once again postpones the really tough decisions.

(c) They are unable to get a bill through Congress before August 2, the U.S. defaults for the first time in history, and in the ensuing mess, they quickly pass a stop-gap measure.

(d) The credit rating agencies can't stand the mess anymore and downgrade America's AAA credit rating, something we have had since World War I.

(e) The worst of all worlds: a combination of (c) and (d).

So, brother Safire would ask readers, what do you think?

Obama and 'Gang of Six'RELATED TOPICSPublic FinanceThe White HouseJohn BoehnerTax PolicyNational Debt

Obama and 'Gang of Six'RELATED TOPICSPublic FinanceThe White HouseJohn BoehnerTax PolicyNational DebtLet me briefly tell you how I would respond:

For a long while -- since the days of the Simpson-Bowles commission -- I had hoped that option (a) would be the answer. The country desperately needs to get its fiscal house in order, and Simpson-Bowles provided the best plan anyone has devised. It also had bipartisan support, mostly because it had just about the right ratio of $2 in spending cuts for every $1 in tax increases. Sadly, the White House failed to seize that banner and start a parade.

The president, to his credit, has recently been trying to revive the idea of a grand bargain, working with House Speaker John Boehner, but it has been too little, too late. The excitement over the "Gang of Six" proposal this week -- also a commendable try -- lasted for less than 24 hours before that plan came under withering assault from labor unions as well as the right. Option (a) is dead, at least for now.

Over in the House, of course, the "Gang of 234" still hasn't abandoned its hopes for a conservative variation of option (a) but "cut, cap and balance" isn't going anywhere, either.

Given the shortcomings, I began thinking some days ago that option (b) is the best available answer. It would marry up the Harry Reid/Mitch McConnell plan for raising the debt ceiling with spending cuts that could assuage conservatives. But this week, opposition has been mounting to Reid/McConnell, especially within the GOP.

It is now a serious question whether a majority can be found in the House for option (b). There may never be enough spending cuts to satisfy a bloc of Republicans, and who can say how many House Democrats will go along with a package of cuts that doesn't include tax increases?

And time is rapidly running out. We now find ourselves on a boat sailing just above Niagara Falls. The closer we get to the edge, the greater the danger that we will be sucked over the precipice.

Several days ago, I would have put the odds on option (b) at better than 50-50; today, sadly, I reckon the odds are less than 50-50. In other words, the prospects point increasingly toward a default. Let us hope that is not the case. No one can be sure of the near-term financial consequences, especially if Congress then acted quickly to reverse itself, as it did over the Bush bailout in 2008. But a default, however short, will definitely fuel a growing perception in the world of America in decline.

We also know that the credit rating agencies such as Standard & Poor's and Moody's -- both eager to reclaim their manhood -- are watching these follies with a gimlet eye. Even if Washington passes a version of Reid/McConnell, averting a default, S&P has made clear that absent some sort of multitrillion plan that goes with it, there is a good chance it will downgrade our credit rating. If we actually default, the credit agencies are practically guaranteeing a downgrade.

So, where does all this come out? I deeply regret -- and hope that I am wrong -- that as of this eleventh hour, the answer is option (e) -- default and downgrade. We have one more hour till midnight.

This is no way to run a country.

David Gergen's Blog

- David Gergen's profile

- 24 followers