Rudolf Falat's Blog, page 3

June 30, 2021

June summary!

In case you missed out on the June episodes of the Voice of FinTech podcast, here is the monthly summary! You can listen to all the episodes on the Episodes pages of this website or when you subscribe to your favorite podcast apps under Subscribe.

Accelerate your hiring with Playter Pay

Jamie Beaumont is a founder of Playter, creator of hire now, pay later service for SMEs using recruitment agencies. Jamie spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about the need for SME financing focused on hiring through recruitment agencies.

Here is what they talked about:

Jamie's back story and why he decided to start your own company

What were your very first steps when starting Playter

Playter Pay, the world’s first hiring accelerator. What is it?

Why do SMEs need recruiters? Isn’t using recruitment agencies a question of cost rather than the timing of cash flow?

Target customers

Business model

Geographic focus

Jamie's views on the key pain points for candidates and employers, its solutions and how has it changed in the last five years?

Where is Playter on its journey now and plans for the future

Best way to reach out

Africa Series with Stacey Japhta: Building digital businesses with Basalt

Stacey Japhta, Head of Strategic FinTech Partnerships at Talent in the cloud, emerging markets FinTech executive search firm and host of Talking success podcast, talks to Wayne Zwiers, founder of Basalt. Basalt is a global Fintech studio focusing on designing and developing digital banking and insurance solutions for the future, based in Johannesburg, South Africa.

Basalt co-creates solutions for our clients, turning ideas into profits. Partnering with clients as "one team" to build new products and processes using an ever-changing and improving tech stack that utilizes modern architectures (such as domain-driven design, micro-services patterns) and cloud computing.

Basalt's proficiencies include:

Core banking technologies

Integration + now API (open banking)

Customer Interface Solutions

Wayne discusses all things FinTech, important attributes to look for in your leadership team, and the difference between the traditional model and the new model of VCs in Africa.

FinTech meets MusicTech: Classical and jazz music streaming with Vialma

Guillaume Descottes, founder and CEO of Vialma, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about how a dedicated classical and jazz streaming platform helps clients discover such music and improve artists' economics.

Here is what they covered:

Guillaume's backstory

Motivation to start his own business

What is Vialma? A problem solver or a delight for customers?

Very first steps to get going

Why do we need a dedicated classical or jazz music streaming service?

Target customers - demographics and more

Business model

Favorite composer and piece of classical music? Beethoven, for example, Violin concerto.

Where is Vialma on its journey in terms of product development, geographic reach, funding, hiring?

Key milestones ahead of Vialma

Best way to reach out

Thank you, Rebecca Gibergues, Daniel Mika and the Swiss Finance + Technology Association (SFTA) for making it happen!

Instant access to Finance with Seedstars World Competition Winner: Finology, a digital broker from Malaysia

Jared Lim, the co-founder of Finology, spoke to Wani Baumgartner, guest co-host and Finance and Life Sciences recruiter, and Rudolf Falat, founder of the Voice of FinTech podcast, about making access to financial products instant and effortless.

Here is what they covered:

Jared's backstory and serial entrepreneurship journey in Malaysia

Finology: how does it work? Problem definition.

What is Finology's unique advantage? How are they different from other digital brokers in Asia?

Business model

Target customers

The journey so far and milestones ahead

Lessons learned for potential entrepreneurs thinking of starting their own business

Finology is the Seedstars World Competition 2020/21 winner! What does this award mean to Finology?

Favorite business book: Built to last by Jim Collins

Best way to reach out

Financial services combating climate change - MSCI

Oliver Marchand is Global Head of ESG Research & Models at MSCI and founder of Carbon Delta (now part of MSCI). Oliver spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about how to provide portfolio managers with insights to assess climate change impacts on the businesses they invest in.

Here is what they talked about:

Oliver's backstory: from computer sciences to asset management and meteorology

Motivation to start his own business

What is Carbon Delta? What is the problem you are solving?

What were your very first steps in starting Carbon Delta?

Why have you created Carbon Delta in particular?

Target customers

Business model

Scaling up

The rationale for sale: Oliver's role post-sale and the set-up within MSCI

How can Financial Services help combat climate change?

Plans and ambitions ahead

Where can interested parties reach you?

The future of Open Banking in the US with Duncan Barrigan, Chief Product and Growth Officer at GoCardless

David Yakobovitch spoke to Duncan Barrigan, Chief Product and Growth Officer at GoCardless about Open Banking in the US, innovation in payments and the FinTech megatrends.

Here is what they covered:

1) Brief introduction of GoCardless

A potted history of the last 10 years

Growth in the US

GoCardless’ recent open banking feature-Instant Bank Pay, a new open banking feature directly integrated into its global payment platform

2) a) Payments landscape discussion of the US, UK/Europe

Recurring payments and the subscription-based economy

2) b) Open Banking in the UK and what that means for the US

Open Banking discussions are heating up in the US-but are we ready?

What will we need to make it successful?

3) Development of FinTech globally

UK FinTech as one of the OGs in 'Silicon Roundabout' in London

How the industry is developing globally

Who the major players are in the US/UK

4) Upcoming payment trends for this year and beyond: what trends we see in UK/ Europe vs. the US

Digital payments

Account-to-account payments

5) The best way to reach out and be part of the open banking future

Tech-led customer centricity in the insurance industry with Wefox's co-founder and CFO, Fabian Wesemann

Fabian Wesemann, co-founder and Group CFO at Wefox, spoke to Wani Baumgartner, guest co-host and Finance and Life Sciences recruiter and Rudolf Falat, founder of the Voice of FinTech podcast about using technology to bring the insurance industry to the new level of customer-centricity.

Here is what they covered in more detail:

Fabian's road towards entrepreneurship

What led Fabian to co-found a business? How do Fabian and Julian Teicke complement each other?

What is Wefox? What is the problem that Wefox is solving?

What were your very first steps to get going with Wefox?

Who are the target customers?

How does Wefox make money? How do they think about unit economics and scale?

Switzerland, Germany, Austria, Poland - what's next in terms of international expansion?

What would be the critical piece of advice you would Fabian give to his younger self?

A favorite non-fiction book for aspiring entrepreneurs: The Inner Game of Tennis: The Classic Guide to the Mental Side of Peak Performance

What are the trendy hobbies on the Berlin start-up scene?

Where are you on your entrepreneurial journey after the latest USD 600 m raise (and USD 3bn+ valuation)?

Best way to reach out

Voice of FinTech Africa Series: Building trust infrastructure for underserved SMB in Africa with Hilda Moraa from PezeshaIn the end, it will be okay, and if it's not okay, it's not the end.

Fabian Wesemann

In this episode of the Africa Series, Patrick Awori spoke to Hilda Moraa, founder and CEO of Pezesha; a Kenyan headquartered digital financial marketplace platform that connects quality SMB to working capital from investors on its marketplace.

Hilda is a trailblazer in the Kenyan and African FinTech space. From founding and exiting her FinTech startup in 2015, Weza Tele, she has done it all, rising to both national and international acclaim. She now runs Pezesha, a digital financial ecosystem connecting and empowering the underserved in Africa through financial education, credit assessment and connecting SMB with affordable financing.

Here is what they talked about:

What Pezesha does and the recent developments at Pezesha

Partnerships that Pezesha is currently engaged in or looking to develop to deliver services to customers in your markets

Open banking trends, and environment in Kenya/East Africa, and how is Pezesha positioned to play a leading role in the space

Hilda's and Pezesha's experience as part of the first cohort inducted into and eventually exiting from the Kenya CMA Regulatory sandbox in 2020. Basis/rationale of regulatory sandboxes in accelerating innovation in Africa’s FinTech industry

How has COVID 19 impacted how you normally do business at Pezesha? How do you plan to sustain growth in the “new normal”?

As part of a Kenya Government COVID-19 ICT & Innovations Advisory team appointed in 2020, wider interventions to cushion and support the ICT based economy of Kenya that are currently in play, and what lessons about these efforts so far that other African policymakers could draw from your experience

Opportunities for FinTech actors to enhance the long-term social development of your domicile markets and African communities in general

How can the sustainability impact best be measured?

Key advice for listeners considering a similar career as employees or entrepreneurs: resilience!

Best way to learn more about Hilda/Pezesha and reach out

Digital transformation in the EU with MEP Eva Kaili

Eva A. Kaili spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about digital transformation in the EU and the policy framework that is being created or adapted to facilitate the adoption of digital technologies. Eva Kaili is MEP from Greece, Chair Science & Technology, Chair Centre for Artificial Intelligence and co-founder of the World Future Foundation - very active in shaping European policy regarding digital transformation, blockchain, AI and more.

Here is what they talked about:

Eva, you are Chair Science & Technology, Chair Centre for Artificial Intelligence, co-founder of the World Future Foundation, and MEP – how does it tie altogether?

After your broadcasting career, you entered politics and there you have been focusing on new technologies, science, digitalization and blockchain. What has driven you to this?

How has your life as a politician and speaker changed during the pandemic – what has kept you busy?

Many commentators agree that pandemics have accelerated the digital transformation around the world. Where do you think the private sector or the governments grabbed the opportunity and where is more to be done?

What can the EU do to be more competitive vs. Asia or the US when developing and adopting new technologies?

Cryptocurrencies have experienced extraordinary times recently. How do you see the potential of cryptocurrencies to be used as currencies?

Where are with blockchain utilization in Europe more broadly? Lately, it seems the focus has been on tokenization and digital assets, but blockchain adoption has been more selective elsewhere.

Where do you see the most significant potential for digital assets and tokenization adoption in Europe?

Many people are (somewhat) worried about the rise of AI. What can we do in terms of governance of nascent technologies to benefit from their strengths while addressing the public's concerns?

I know you are a fan of Black Mirror. Do you also have a favorite book related to technology (AI, Blockchain or anything else) that you recommend? The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power by Shoshana Zuboff and Thank You for Being Late: An Optimist's Guide to Thriving in the Age of Accelerations by Thomas L. Friedman

What is ahead of you this year in the European Parliament and your outside activities?

What's the best way to find out more about what you do? Follow Eva on Twitter here or European Parliament Research Service (EPRS app for iPhone or Android)

If you have suggestions for topics or guests on the show or have ideas about how to make this podcast better for you, please e-mail us at info@voiceoffintech.com. Alternatively, you can also leave a voicemail here.

Keep safe!

Sincerely,

Resources RSSJune 18, 2021

Voice of FinTech: Summer 2021 book tips!

Photo by Chen Mizrach on Unsplash

Hope you are well and safe! In the second season of the Voice of FinTech, we featured many guests who authored amazing books and we often asked guests for the book tips. We also chatted on Clubhouse about inspirational books on entrepreneurship, leadership, management, investing, FinTech, Tech. Here is the summary - Voice of FinTech 2021 summer book tips list! If you have more great tips or comments on these, don’t hesitate to e-mail us at info@voiceoffintech.com.

The most often recommended by our podcast guests: The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers. A truly great book by Ben Horowitz! Yes, it’s tempting to read only about hockey sticks and amazing riches, but often there are near-death experiences you need to overcome as a founder. How to get out of the hole and turn around a near-bankrupt business into a unicorn? This book is one of the few that gives you a realistic preview of being an entrepreneur - extremely useful!

Talking to Strangers: What We Should Know about the People We Don’t Know. Why are we so bad at judging people in person? Most people, including world leaders or judges or trained investigators, are hopelessly bad at “reading” people in person, explains Malcolm Gladwell. Why then you often hear at virtual conferences: “Let’s soon meet in person”? Do investors need to feel guilty when they cannot meet founders in person and overcompensate by excessive Zoom calls?

No Rules Rules: Netflix and the Culture of Reinvention. A collaboration between Reed Hastings, CEO of Netflix and Erin Meyer, an INSEAD Professor and an expert on a company and business culture, studying the culture of Netflix! Can no vacation and no expense policy work? It’s even a listed company! Well, no rules don’t mean anarchy or literally no rules. Read more or listen to an audiobook — how to run a company in a modern way! The New York Times bestseller.

No Filter: The Inside Story of Instagram. Winner of the 2020 Financial Times and McKinsey Business Book of the Year Award. It’s based on countless interviews of insiders from Instagram and Facebook, giving you a peek into what’s it’s like to build a unicorn with 13 employees and try to keep it intact within Facebook. Worth a read (or a listen) from Sarah Frier for sure!

The End of Procrastination: How to Stop Postponing and Live a Fulfilled Life. I guess we all know some procrastinators and occasionally, it may be us! Petr Ludwig shares many practical tips on getting out of the vicious cycle of procrastination and finally getting something done!

The Future of Finance: The Impact of FinTech, AI, and Crypto on Financial Services. I spoke to Henri Arslanian about crypto, digital assets, blockchain and how it is all changing the world of Finance as we know. This book is essential for your understanding of what’s coming! A great foundation before you can deal with bits and pieces on these topics in the media. You can also listen to what Henri had to say about it here.

Where to Play: 3 steps for discovering your most valuable market opportunities. Last year, Marc Gruber explained on our podcast how his book complements the Lean Startup framework by helping you find the best markets and opportunities before getting lean:)! Easy to follow (and use!) diagrams included.

The Currency Cold War: Cash and Cryptography, Hash Rates and Hegemony (Perspectives). We also spoke to Dave Birch on the podcast about his fondness of digital currencies, going back decades, and where he thinks this will lead. Is cash still going to be the King in the future? You can also listen here.

The Rise of Technosocialism: How Inequality, AI and Climate will Usher in a New World Order. Brett King, founder of Moven and #1 FinTech podcast in the world, wrote a book about technology that will radically change society as we know it today. It is being updated for the impacts of the pandemic. Coming soon! Listen to what Brett told us about this here.

Blink: The Power of Thinking without Thinking. How to perfect your “gut” feeling so it produces better results… Gut feeling is not necessarily irrational, nor it’s a gift possessed by a few. It can be trained, apparently! Again, by Malcolm Gladwell.

Banking on it: How I disrupted the industry. Anne Boden’s story about how a woman in her 50ties, very much part of the banking establishment, started a mobile-only bank in the UK to great success. You will find many inside stories about well-known FinTech entrepreneurs too.

Singapore: The FinTech Nation by Varun Mittal, EY EM FinTech leader who spoke about entrepreneurship and innovation with Angela Conroy on the podcast.

Never Split the Difference: Negotiating As If Your Life Depended On It: it’s never a bad idea to refresh and hone your negotiating skills!

The Organizational Analytics - a free e-book by Prof. Puranam from INSEAD who spoke live on the Voice of FinTech: Live Speaker Series about Data-driven changes to Org Design.

Guns, Germs and Steel: A short history of everybody for the last 13,000 by Jared Diamond, Pulitzer Prize winner and named one of TIME’s best non-fiction books of all time. Jared Diamond puts the case that geography and biogeography, not race, molded the contrasting fates of Europeans, Asians, Native Americans, sub-Saharan Africans, and aboriginal Australians. What do you think?

The Man Who Solved the Market, shortlisted for the FT & McKinsey business book of the year. The story of Jim Simmons’ Renaissance hedge fund.

The Secret of Silicon Valley, Sara Palmbush interviewed Eva Schram, a Dutch journalist based in the Bay Area, who co-authored this book on the Voice of FinTech, about what made this part of the world such a hub for innovation.

On my shelf, the next one to do: Pre-Suasion: A Revolutionary Way to Influence and Persuade. The author of the legendary bestseller Influence, social psychologist Robert Cialdini shines a light on effective persuasion and reveals that the secret doesn’t lie in the message itself but the key moment before it is delivered.

A book tip by Ripple’s James Wallis: CORE: How a Single Organizing Idea can Change Business for Good. Listen here to what James said about why this book resonated so much with him.

Simple ideas are sometimes the best, explained Lianna Brinded from Yahoo UK here. Her favorite book: The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger.

Recommended books by Foraus think leaders Fabian Ligibel and Nadir Franca: People, power and Profits: Progressive Capitalism for an Age of Discontent by Joseph E. Stiglitz, Development as Freedom by Amartya Sen or The Entrepreneurial State: Debunking Public vs. Private Sector Myths or Value of Everything: Making and taking in the global economy by Mariana Mazzucato and also discussed Capital in the Twenty-First Century by Thomas Piketty.

You cannot have a business book list without Warren Buffet. Here is ours, a classic - Essays of Warren Buffett!

Barbarians at the Gate: a favorite of our guest Lawrence Lee (and mine!). Also, look for the HBO TV adaptation - very, very entertaining!

Trillion Dollar Coach by Eric Schmidt, former CEO and Chairman of Google, about coaching lessons of Bill Campbell, a football coach whose mentoring of some of our most successful modern entrepreneurs has helped create well over a trillion dollars in market value.

Intelligent Investor - a classic text by Benjamin Graham, updated for the current times, about long-term investing.

Bloomberg by Bloomberg, Who is Michael Ovitz? Memoir - the autobiography of the co-founder of Creative Artists Agency, High Output Management by Andrew S. Gore, former Chairman and CEO of Intel.

Delivering Happiness, by late Tony Hsieh, founder of Zappos. How to build a billion-dollar sales e-commerce business and try to find the balance between chasing profits and life?

The Inner Game of Tennis: The Classic Guide to the Mental Side of Peak Performance: the mental guide for professional and amateur tennis players as well entrepreneurs - it’s all in your head!

Stay safe and enjoy!

Kind regards,

Resources RSSMay 28, 2021

May summary!

In case you missed out on the May episodes of the Voice of FinTech podcast, here is the monthly summary! You can listen to all the episodes on the Episodes pages of this website or when you subscribe to your favorite podcast apps under Subscribe.

Financial Services need a radical overhaul: PE perspective

Miroslav Boublik, Managing Partner at Financial Services Capital spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about how financial services firms held privately may have more appetite for a radical overhaul.

Here is what they covered:

Miroslav backstory (e.g. former Managing Partner at Home Credit International VC arm)

Financial Services Capital is "a new generation Private Equity firm". What does it mean?

Origins of the firm

What’s your target fund size and where you with the fundraising?

Example of FinTechs FSC invested in: Nymbus.

Deal sourcing and investment approach

Funding availability for early-stage and growth companies in Europe vs. the US or Asia?

Favorite business book: Benjamin Graham's Intelligent Investor

Wrap up: appeal to inspiring entrepreneurs to learn more about Financial Services Capital and approach you if they meet your criteria

Americas Series with David Yakobovitch: How to master banking for your small businesses with Ryan Conway from Oxygen

David Yakobovitch spoke to Ryan Conway, SVP, Head of Business Development & Strategic Partnerships at Oxygen about how Oxygen improves banking for SMEs.

Here is what they covered:

FinTech evolution

Fintech industry trends

Predictions for fintechs and traditional banking

FinTech 1.0 - unbundling

FinTech 2.0 - rebundle multiple products

FinTech 3.0 (smart money/ AI)

Crypto

SME banking

Now more than ever, the importance of banking for small businesses

Banking for small businesses

Oxygen recently announced a partnership with Fundera (Nerd Wallet) to help small businesses and self-employed people who were largely left out of the 1st PPP round

COVID-19 and banking

How COVID has changed banking

Digital banking is here to stay and traditional banks have to be prepared to handle all aspects of their business through digital channels

COVID-19 has also been the biggest digital acquisition driver and many customers are finally embracing their digital tools, but fintechs have re-examined ways to drive every account process to be more efficient and user friendly

Brand equity

Creating and maintaining brand equity

Ex: Robinhood/ GameStop stock situation

Oxygen's journey

Oxygen’s milestones

Series A

Peek of products- segmenting of cards, the elevation of the brand, additional features

Best way to reach out

Raise your Finance game with Finimize

Maximilian Rofagha, the founder of Finimize, leading Finance community worldwide, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about how to raise your Finance game efficiently.

Here is what they talked about:

Max, tell us about how you got where you are today

You founded Finimize five years ago. Why? What’s your mission?

You have one million subscribers and you say you are the most engaged community in the world. How did you get started?

What is your key advice for community builders (online or offline) on how to grow their communities?

How have you been affected by the pandemic? I know you also organize in-person events – have you turned them to online and how different was it in terms of participation and engagement?

Finance education – in which areas have you seen the most significant demand? How does it differ among regions (say Europe vs. US or Asia)?

How do you manage different levels of education among your users?

How do you manage to keep the engagement level high? How do you learn what users like?

What’s in store for your this year?

Your favorite book (or a business-related movie)? Bloomberg by Bloomberg, Who is Michael Ovitz? Memoir -the autobiography of the co-founder of Creative Artists Agency, High Output Management by Andrew S. Gore, former Chairman and CEO of Intel

The best way to find out more about Finimize

Asia Pacific Series with Chia Jeng Yang 谢征阳: Open banking in South East Asia - Brankas example

In this episode of Voice of FinTech: Asia Pacific Series, Chia Jeng Yang, Principal of Saison Capital based in Singapore, speaks to Todd Schweitzer, CEO of Brankas, building Open Banking for Southeast Asia.

Todd Schweitzer is co-founder and CEO at Brankas, the leading Open Finance technology provider in Southeast Asia. Todd founded Brankas in 2016 to address the technology gaps that hindered fintech-bank partnerships. Today Brankas provides Open Finance technology to banks, insurers, mobile wallets, e-commerce platforms, alternative lenders, and other suppliers and users of financial services APIs. The company has since expanded to the Philippines, Vietnam, Thailand, Singapore, and Bangladesh, and its technology has enabled new fintech products and partnerships that serve millions of users around the region. Todd holds degrees in Economics and International Studies from the University of California, Irvine, and a Master in Public Policy from Harvard University's Kennedy School of Government. Todd currently resides in Manila, Philippines.

Chia and Todd talk about:

Brankas, the Open Banking platform for Southeast Asia - its journey so far and future roadmap

Common myths and opportunities for Open Banking

The state of Open Banking in the context of Southeast Asia as well as in the global fintech ecosystem

Exciting developments and potentials for Southeast Asia Open Banking

Insurance for SMEs with Helvengo

Vedran Pranjic and Benedikt Andreas, co-founders of Helvengo spoke to Wani Baumgartner, guest co-host and Finance and Life Sciences recruiter and Rudolf Falat, founder of the Voice of FinTech podcast about how to make insurance for SMEs more efficient and less painful.

Here is what they covered:

Why Vedran and Benedikt decided to start their own company?

What is Helvengo? How does it work?

What is Helvengo's unique advantage? How are you different from other solutions for SMEs out there?

How does Helvengo make money?

Why did they choose the B2B path?

Where are Vedran and Benedikt on their journey now

Lessons learned for potential entrepreneurs thinking of starting their own business

Next steps this year and beyond

Favorite business book: Delivering happiness, by Tony Hsieh, founder of Zappos

Best way to reach out

Africa Series with Adejoke Adekunle: Early Stage Investment and Fundraising with Tobi Oke of V8 Capital Partners

In this episode of the Voice of FinTech: Africa Series, Adejoke Adekunle, CEO of VVM Group and the founder of the African Tech Woman podcast, based in Lagos, Nigeria, spoke to Tobi Oke, Managing Partner at V8 Capital Partners, also based in Lagos, Nigeria.

Here is what they talked about:

Why does V8 Capital focus largely on early-stage companies?

V8 Capital portfolio companies

From all of these start-ups you have mentioned, I see some bits of fintech there; for example, Kobo360, a logistics platform, may at some points provide access financing service to their customers. What are your thoughts on the intersection between FinTech and other sectors in the start-up space?

What are the things that have helped Tobi get through in his investing career?

Tobi's views on fundraising in Africa; what has remained constant and what has changed recently

With the recent exit by Paystack and Flutterwave, which recently raised 170 million and also achieved unicorn status, we are seeing more interest from investors in FinTech companies in Africa - what's your advice on how FinTech start-ups can capitalize on this?

Fundraising tips for founders

What do you think are some understated industries where you see some strong potential for exponential growth and how are you preparing V8 Capital for that?

Voice of FinTech Americas with Clementina Giraldo (in Spanish / En español): FIRA y Mario Valle nos hablan del criptoarte tendencia global y su relación con FinTech

En este episodio de Voice of FinTech Americas Series, conducido por Clementina Giraldo, fundadora y CEO de Dots & Tech, con sede en Colombia, Clementina habla con FIRA, criptoartista colombiana y una de las líderes del criptoarte en América Latina y con Mario Valle Reyes, cofundador y managing partner de Altered Ventures, con sede en San Francisco, Estados Unidos, inversionista en videojuegos, realidad aumentada, realidad virtual, criptoarte y creador de Altered Gallery. Para ver las imágenes citadas en el episodio visitar http://alteredgallery.art/.

América Latina hace parte de la tendencia global de criptoarte. Conoce el proceso que le permitió a FIRA convertirse en la primera criptoartista de Colombia, los avances que ella ha alcanzado y los desafíos de la tecnología. Detalles del lanzamiento de Altered Gallery que reúne a más de 100 criptoartistas y realizará periódicamente convocatorias a artistas. Así como experiencias por parte startups líderes de la región como Platzi y la forma en que han promovido becas en educación por medio del criptoarte.

In this episode of Voice of FinTech Americas Series, hosted by Clementina Giraldo in Spanish, founder and CEO of Dots & Tech, based in Colombia, Clementina speaks with FIRA, a Colombian crypto artist and one of the leaders of crypto art in Latin America and with Mario Valle Reyes , co-founder and managing partner of Altered Ventures, based in San Francisco, United States, an investor in video games, augmented reality, virtual reality, crypto art and creator of Altered Gallery.

Latin America is part of the global trend of crypto art. Learn about the process that allowed FIRA to become Colombia's first crypto artist, the advancements she has made, and the challenges of technology. Details of the launch of the Altered Gallery that brings together more than 100 crypto artists and will periodically call for artists. As well as experiences by leading startups in the region such as Platzi and the way they have promoted scholarships in education through crypto art.

Abdulla Almoayed, CEO and founder of Tarabut Gateway, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about open banking in MENA, why he set up the business UAE's ADGM (Abu Dhabi Global Market) in particular and his thoughts on data-driven innovation.

Here is what they covered:

Abdulla's back story

Reasons to start his own company

What is Tarabut? The problem that Tarabut is solving

Largest open banking platform in MENA - what is its unique advantage? How is it different from other open banking platforms?

Team in the UAE and abroad

Target customers

How can data-driven innovation break the curse of the oil industry?

Very first steps of starting the business

Growth plans after recent fundraising - hiring!

Best way to reach out

At the intersection of Insurtech and Real Estate with Derek Merrill (LeaseLock)

David Yakobovitch spoke to Derek Merrill, CEO of LeaseLock about how to get rid of one of the most painful steps in real estate transactions, paying a security deposit, by using technology. Derek is a product and financial technology-focused entrepreneur with a special interest in building data-driven products that service the enterprise.

As CEO, Derek leads the overall product, marketing, sales and engineering efforts at LeaseLock. Prior to LeaseLock, Derek founded Infreeda, a mobile advertising platform acquired by AT&T. Next, he founded MoVoxx, a pioneering mobile messaging ad network acquired by Motricity. In search of a large industry late to apply technology, Derek launched EverySignal to automate the detection of life events for insurance agents across social networks using natural language processing and machine learning. He later joined ZipRecruiter, the fastest-growing job.

LeaseLock's founding story

After being denied housing in New York City because he did not earn the requisite 80x the monthly rent to live at a certain building, co-founder Reichen Kuhl set out to solve this problem to help people at all rent levels ease the expensive move-in experience while still providing the financial protection apartment owners need. He joined the Mucker Capital accelerator program in 2014 where he met Derek who had been working with a small engineering and data science team. After meeting, the two joined forces and LeaseLock was founded.

LeaseLock's flagship product

LeaseLock's flagship product is “Zero Deposit” lease insurance. The company leverages artificial intelligence to eliminate security deposits and deliver the world’s first financial technology platform for enterprise rental housing. Its product seamlessly deploys through native property management systems, allowing properties to:

Market their communities as Zero Deposit to drive more traffic & leads

Replace upfront security deposits with a small monthly fee in the online leasing checkout

Automatically gain $5,000 insurance against rent and damage loss in-system

Automate the claims process in native receivables processes during move-out

Automate billing through our integrations with all major property management systems

LeaseLock leads the overdue disruption of the insurance and real estate industries

The multifamily industry is known to be somewhat hesitant to truly embrace change. Renter’s insurance is a prime example. It was years before operators recognized that requiring renter’s insurance did not negatively impact the ability to lease apartments, but rather, provided positive outcomes for both the resident and community.

Renter’s insurance is now status quo within the apartment industry. LeaseLock believes that the same will hold true for lease insurance as the leading replacement to security deposits.

Why security deposits and surety bonds are done

Security deposits are the most common way apartment owners shelter themselves from financial risk associated with residents.

Security deposits are extremely expensive for the renter and require a significant amount of administration for an owner to manage.

Surety bonds and other security deposit alternatives have been in the multifamily industry for quite some time. But these don’t always benefit both parties.

Surety bonds may answer the affordability pain point for renters as they are less expensive than security deposits, but they fail to offer sound risk mitigation for operators. Also, bonding companies run collections on renters for claims paid to the property, resulting in a damaged reputation

Lease insurance is a seamless replacement for both of these practices that benefits both residents and properties. With LeaseLock’s “Zero Deposit,” renters pay a small monthly deposit waiver fee in place of an upfront security deposit along with their monthly rent and properties gain over $5,000 in coverage per lease on the standard plan

LeaseLock's B2B Model ultimately benefits the consumer

LeaseLock is NOT insurance for the resident, it’s a deposit waiver program that makes the leasing experience more affordable.

LeaseLock doesn't deal directly with residents, but residents do benefit from a lower barrier to access rental properties.

Renters do not need to apply to LeaseLock (unlike deposit alternatives/surety bonds), and LeaseLock does not run collections on renters for claims paid to the property

LeaseLock's mission

LeaseLock exists to power a faster, simpler, more affordable rental transaction. Ultimately, LeaseLock aims to help people at all rent levels have a smoother and more affordable move-in experience while still providing the financial protection apartment owners need. We help the world find a home

LeaseLock is, at heart, a technology company

LeaseLock created an entirely new category of insurance powered by AI

LeaseLock is engineering a financial technology platform that removes friction, cost, and regulatory risk from apartment operators’ operating infrastructure

Conclusion

Because LeaseLock sells to properties, its lease insurance product does not need to be sold by leasing staff and doesn’t require out-of-workflow application processes

If you’re an apartment owner/operator, feel free to reach out today to learn more about what LeaseLock can do for you

If you have suggestions for topics or guests on the show or have ideas about how to make this podcast better for you, please e-mail us at info@voiceoffintech.com. Alternatively, you can also leave a voicemail here.

Keep safe!

Sincerely,

Resources RSSApril 29, 2021

April summary!

Photo by Rico Reutimann on Unsplash

In case you missed out on the April episodes of the Voice of FinTech podcast, here is the monthly summary! You can listen to all the episodes on the Episodes pages of this website or when you subscribe to your favorite podcast apps under Subscribe.

Asia Pacific Series with Angela Conroy: Investing in private markets with iSTOX

In this episode of the Asia Pacific Series, Angela Conroy, co-founder and CEO at Notarum, an awesome RegTech based in Singapore, talks to Oi Yee Choo, Chief Commercial Officer at iSTOX, about enabling access to private markets for investors for whom these opportunities were out of reach previously. iSTOX is the first MAS-licensed integrated issuance, custody and trading platform for digitized securities.

Here is what they talked about:

How does iSTOX work? Accredited investors (as per Singapore rules) can invest in hedge funds using iSTOX platform, which breaks down large tickets required by hedge funds and the like into smaller tickets

Growing allocation to alternative assets of private markets among investors and the need to make the process more efficient

Building a FinTech in Singapore and working with the Monetary Authority of Singapore (sandbox)

Challenges of ramping up during the pandemic

Importance of partnerships when building a platform (e.g., SGX as an investor)

Digitization of capital markets

Sustainable Finance with Foraus, a Swiss Foreign Policy think tank

Nadir Franca, Senior Sustainable Fellow, and Fabian Ligibel, co-lead at Foraus - Sustainable FinTech, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about Sustainable FinTech or Finance.

Here is what they covered:

Nadir's and Fabian's backstories

What is Foraus? What are its mission and objectives?

What is a think tank industry? What’s the competitive landscape for think tanks and how do you compare each other?

How do you define Sustainable FinTech or Finance?

Sustainability and impact investing are intertwined and both become mainstream. What’s the difference, especially when they are FinTech related?

Most people by now heard about ESGs/SDGs – how can FinTech help humanity in achieving them?

Examples of FinTechs, which can make a noticeable impact vs. SDGs/ESGs and be financially sustainable as well. Yova, a Swiss sustainable investment platform - also appeared on this podcast earlier here

Recommended books: People, power and Profits: Progressive Capitalism for an Age of Discontent by Joseph E. Stiglitz, Development as freedom by Amartya Sen or The Entrepreneurial State: Debunking Public vs. Private Sector Myths or Value of Everything: Making and taking in the global economy by Mariana Mazzucato and also discussed Capital in the Twenty-First Century by Thomas Piketty

Planned publications and events this year

What’s the best to find out more about Foraus, sustainable FinTech and its research

Thank you Daniel Mika and the Swiss Finance + Technology Association (SFTA) for making it happen!

Foraus is a proud member of the Green Fintech Network Switzerland. Check out the Foraus - Sustainable FinTech for the network's recommendations on how to improve green FinTech in Switzerland.

Barbod Namini, Partner at HV Capital, an exceptional German-based VC with over a 20-year track record, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about investing in FinTech perhaps longer than the term has been fashionable.

Here is what they covered:

HV Capital origins

Barbod's journey to HV Capital from Rocket Internet and Citigroup

HV Capital investment philosophy

How much money they have raised since inception and for how many start-ups?

What kind of start-ups HV Capital focuses on investing?

What kind of FinTechs HV Capital invests (where in the lifecycle, size, tech, geography, etc.)

How do scouting and due diligence work? What are Barbod and HV Capital looking for?

How do they cooperate with other actors in the start-up ecosystem?

What’s HV Capital's investment approach? E.g., min size of the stake, board seat, time to exit, economics?

Success stories of the start-ups HV Capital invested in? Scalable Capital, Penta, SumUp, BUX, Yapily or Solaris Bank in FinTech and more broadly Zalando, HelloFresh or Delivery Hero

Reflections on the FinTech’s growth in Europe and the rest of the world over the past two decades since HV Capital has been operational

Recommended business book: Essays of Warren Buffett and The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers

The best way to reach out

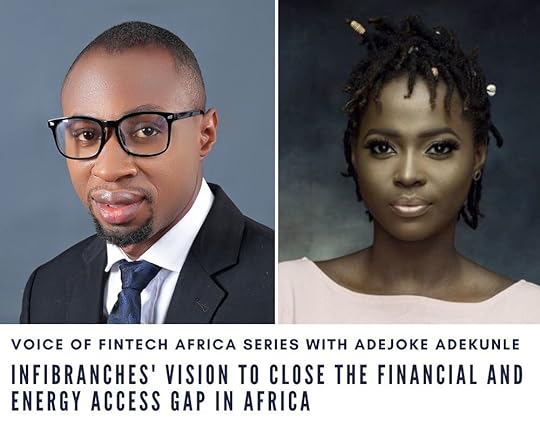

Africa Series with Adejoke Adekunle: Infibranches' vision to close the financial and energy access gap in Africa

In the first episode of the Voice of FinTech: Africa Series, Adejoke Adekunle, CEO of VVM Group and the founder of the African Tech Woman podcast, based in Lagos, Nigeria, spoke to Olusola Owoyemi, CEO of Infibranches.

Here is what Adejoke asked Olusola:

What Infibranches does and what's the origin story?

It’s not clear why under-served communities have remained so for the longest time - common assumptions such as “low spending power and economic activities make it rather unattractive to build a business around consumers in these communities - I’m curious! Infibranches seems to have a different view on that and I’d love for you to expand on your thesis about why you are focused on the underserved communities - what aren’t we seeing?

What are some of the overlooked opportunities you’ve seen with respect to these communities?

What are the common misperceptions about rural communities and consumers who need basic financial services?

What are the most important success factors for servicing the last mile consumer in Nigeria?

What are the critical challenges in running a business like yours?

There’s the saying that every company is a FinTech company, what are your views about that looking at it through the Infibranches lens?

I’d like for you to unpack the intersection between FinTech and energy access from an Africa perspective

Let’s discuss the big picture for Infibranches, what are the long-term goals you have and where are you today?

What’s one thing you are most proud of since running InfiBranches?

Beyond Africa, what are your thoughts around scaling up a platform like Omnibranches, their flagship product, beyond the continent?

FinTech M&A lessons with Baker McKenzie

Lawrence Lee, Partner in Baker McKenzie's Palo Alto office, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about FinTech M&A and other routes to liquidity.

Here is what they talked about:

Backstory: How did Lawrence get to do what he does today?

Baker McKenzie's approach towards advising FinTechs - M&A or other matters? Does it mean B&M advises only scale-ups or incumbents interested in this space?

What are the specifics of the FinTech M&A and any lessons learned you can share?

The average time to go public has increased tremendously. As Fintechs grow larger and more mature, what are liquidity and exit options for these companies?

Payments and lending were probably the first areas where FinTech grew. Are we bound to witness a significant consolidation wave in this FinTech vertical?

SPACs seem to be the favorite buzzword of the day. What are the examples of SPACs operating in the FinTech space?

Lawrence also worked as an in-house counsel at Coinbase – what attracted him to switch back to an advisory from a corporate?

Let's talk about the recent Bitcoin rise – is it due to diversification because investors are worried about inflation due to Covid government support or anything else?

What’s in store for you this year?

The most impactful business book for Lawrence is an all-time classic: Barbarians at the Gate. Don't also forget a satirical HBO movie based on this book.

What’s the best way to reach out

Americas Series with David Yakobovitch: How to save money on your auto financing with MotoRefi

David Yakobovitch spoke to Kevin Bennett, CEO of MotoRefi, about auto FinTech, its potential and how MotoRefi helps consumers save money on their car loans.

Here is what they covered:

What MotoRefi is and does

Saves consumers $100/month

Instant refi on their auto loans

Origin story

Auto finance as an underlooked area of fintech

Low awareness among consumers

Virtually no one was trying to solve this problem

HUGE market - $1.3 trillion industry in US alone

Self-service API Ecosystem

FinTech for the loans/finance, in particular, is a movement

Mortgages

Students loans / personal loans

Now auto loans too

Sofi, Even Financial, and Trellis

Growth thus far & recent news

2020 - 6x’d revenue, tripled headcount

New office in DC, added new senior hires

Final thought

Financial markets innovation with Boerse Stuttgart“Most people’s cars aren’t doing them any favors when it comes to their finances, we’re on a mission to change this.” - MotoRefi CEO Kevin Bennett on overlooked auto FinTech

Ulli Spankowski, Chief Digital Officer at Boerse Stuttgart, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about Boerse Stuttgart's commitment to innovation to provide access to more financial products for retail investors.

Here is what they talked about:

Boerse Stuttgart and its competitive edge

Boerse Stuttgart’s approach to startups overall

Ulli's multiple hats

How do you cooperate with other actors in the ecosystem? Partnership with SBI regarding digital assets example.

The most promising use cases for digital assets in the near future

A favorite non-fiction book: Trillion-Dollar Coach

Best way to reach out

Asia Pacific Series with Angela Conroy: Investing made easy with Sharesies

Brooke Roberts and the team at Sharesies are aiming to build the most financially empowered generation.

What started as an agreement between 13 friends and family members to deposit $50 a week into a shared investment account laid the foundation stones for Sharesies. Their laser focus on building trust, keeping it real and providing the same access to markets for someone with $5 as someone with $5 million has seen Sharesies go from $0 to $1 billion in assets under management in 4 years.

Listen in to find out how:

Sharesies is building confident and motivated investors through education

The team of 6 co-founders uses trust to makes it work every day

Growing confidence is seeing a change in their customers investing strategies over time

If you have suggestions for topics or guests on the show or have ideas about how to make this podcast better for you, please e-mail us at info@voiceoffintech.com. Alternatively, you can also leave a voicemail here.

Keep safe!

Sincerely,

Resources RSSMarch 31, 2021

March summary!

Photo by Martin Sattler on Unsplash

In case you missed out on the March episodes of the Voice of FinTech podcast, here is the monthly summary! You can listen to all the episodes on the Episodes pages of this website or when you subscribe to your favorite podcast apps under Subscribe.

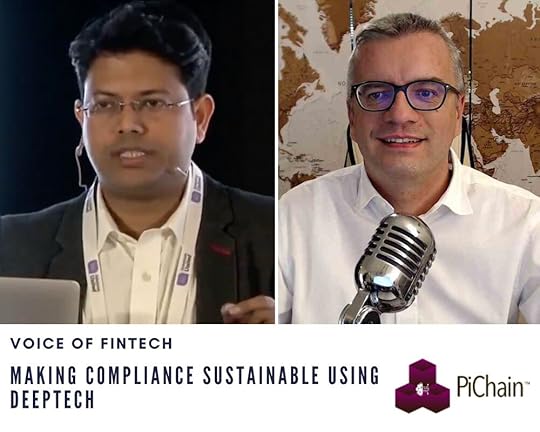

Making compliance sustainable using DeepTech

Shub Nandi, co-founder and CEO at PiChain explains what is sustainable compliance and RegTech and how to leverage the latest technologies to bring banking to underbanked in India. Hosted by Rudolf Falat, founder of Voice of FinTech podcast.

Here is what we talked about:

Shub, you are a serial entrepreneur and thought leader in the blockchain and AI space. What has attracted you to it?

What’s your latest venture PiChain about? What’s the problem you are solving?

What does it mean, sustainable compliance? What’s your solution?

I know you already have many products – why such a wide range already now and how do you distinguish those from “solutions”?

Who are your target clients?

What’s deep tech to you and how does it relate to FinTech?

You have been also an adjunct faculty in the AI field for a number of years – do you think your students are ready for the work-life where AI is commonplace?

Can you also comment on the Indian FinTech scene? Where do you think it’s strong and where you would like to see further progress?

Your favorite business book you have read recently?

What’s in store for you and PiChain this year?

What’s the best way to reach out and find out more about PiChain?

Investing in technology for the Financial Services sector - with Finch Capital

Sara Palmbush talks to Radboud Vlaar, co-founder and partner at Finch Capital, based in Amsterdam, the Netherlands about how and why Finch Capital backs companies developing great new tech for the financial services sector.

Here is what Sara asked Radboud:

What is Finch about?

How much money have you raised since inception and for how many start-ups?

What kind of start-ups have you invested in?

What kind of FinTechs have you invested in?

How do you find them? How do scouting and due dligence work? What are your selection criteria?

What’s your investment approach? E.g. min size of the stake, board seat, time to exit, economics?

Can you share success stories of the start-ups for which you raised funds (exited)? How do you view the start-up scene in Europe?

What are some tips you can give foreign VCs about investing in European (or Dutch) companies? What are the unique differences and challenges posed?

The best way to reach you if you are a founder looking for investment

Voice of FinTech Americas with Clementina Giraldo (in Spanish / En español): Pierpaolo Barbieri nos cuenta cómo lidera una revolución contra el efectivo con Ualá

En este episodio de Voice of FinTech: Americas Series, conducido por Clementina Giraldo, fundadora y CEO de Dots & Tech, con sede en Colombia, Clementina habla con Pierpaolo Barbieri, fundador y CEO de Ualá, líder de la industria FinTech en América Latina, sobre la revolución que impulsa Ualá para incluir a más latinoamericanos a servicios financieros modernos y universales.

Argentina cuenta con más de 260 empresas FinTech y lidera después de Brasil y México el desarrollo de la industria en América Latina. En este episodio Pierpaolo Barbieri, emprendedor argentino, nos cuenta cómo identificó la oportunidad para emprender y fundar Ualá movido por un gran problema en América Latina, región en la que más del 50% de los adultos no han tenido acceso a un método de pago diferente al efectivo, sumado a la exclusión que esto genera. Pier nos compartió cómo fue el proceso de crear empresa al regresar a su país, después de haber vivido varios años fuera de Argentina, cómo conformó su equipo, lanzando un producto o cuenta universal y cómo convenció a los inversionistas de creer en esta revolución contra el efectivo apostándole al éxito en el largo plazo. La energía de Pier es impresionante y eso explica porque Ualá, cuenta hoy con un equipo diverso de 700 personas, con más de 46% mujeres, comprometidos con esta revolución im

Ani Petrova, founder of The FinTech Marketing Hub and Araminta Robertson, a FinTech writer at Mint Studios, spoke to Rudolf Falat, founder of Voice of FinTech podcast.

Here is what they talked about:

Araminta and Ani – how did you end up interested and working in FinTech Marketing? Why have you joined forces?

Tell us about The Fintech Marketing Hub – what’s your mission?

Specifically, what services you provide for FinTechs?

Say I am a B2C FinTech early-stage start-up – what would be your advice on building a brand with a limited budget in the shortest possible space of time? Is it possible at all?

Are online ads worth the money and effort at all? When can they work and when?

Is traditional marketing (apart from digital) relevant and useful for FinTechs? If yes, how?

Perhaps slightly less relevant, but what you recommend B2B start-ups? How to impress their enterprise clients?

Can you mention some success stories of clients you have worked with? And conversely, lessons learned?

The best book for a FinTech founder? Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine and Fintech Founders: Inspiring Tales from the Entrepreneurs that are Changing Finance

What’s in store for you this year?

What’s the best way to reach out and find out more about you?

Voice of FinTech Africa Series with Patrick Awori: FinTech supporting the gig economy in Africa

Patrick Awori, Founder and CEO at Imaginarium, a Kenyan-based FinTech behind the Circle, a virtual savings platform, hosts another episode of Voice of FinTech: Africa Series. Patrick talks to Tatenda Furusa, co-founder of ImaliPay.

A burgeoning gig economy has presented opportunities for the youthful workforce in Africa's fast-growing economies where formal employment has fallen short. Overall, McKinsey estimates that about 63 percent of the total labor force in Africa engages in self-employment. This trend continues as the formal economy grapples to keep up as hundreds of thousands of new entrants join the labor market each year. There is also some evidence that a formal job may not always be the best option for all.

In this episode, we explore this topic through the lens of Tatenda Furusa, co-founder of Imali Pay, a promising Nairobi and Lagos-based start-up offering tailored financial solutions to Africa's informal or self-employed workers. He walks us through his analysis of the gig economy's current market trends, COVID-19 and its impact, the future of work and how Imali Pay leverages financial technology and partnerships to meet informal workers at their point of need and proceeds to carve their share of what is a "billion-dollar" business opportunity.

Digitizing Wealth Management with Addepar

Alastair Cairns, Head of Insights and Marketplace at Addepar, based in New York, spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about managing wealth more efficiently.

Here is what they covered:

Alastair's journey from being Partner at McKinsey, Head of Strategy at a hedge fund Silver Point Capital, Head of Asset Management Strategy and then Co-Head of Global Products and Solutions at Credit Suisse to Head of Insights and Marketplace at Addepar

What is the problem Addepar is solving?

Who are Addepar's key clients? Who are their end clients?

What is Addepar's unique advantage? Why them and not someone else? Why are in-house solutions for your clients insufficient?

What is Alastair's view on the long-term prospects of WealthTech?

Which areas of WealthTech are the hottest right now

Large banks are focusing on ever-larger clients, RMs are more productive, Loans/AuM are going up, and costs being slashed – but where do innovation and WealthTech fit into all of this?

Where do you think the US leads the way in wealth management and where things could get better?

Where is Addepar on their journey (Addepar raised USD 117m in November 2020 and acquired RCI in January 2021)

Plans for the rest of the year

Favorite business book? Hard things about hard things by Ben Horrowitz - the most popular book on this podcast!

Best way to reach out

Asia Pacific Series with Taneia Bhardwaj: Turning phones into mobile point of sale with Mswipe

In this episode of the Asia Pacific Series, Taneia Bhardwaj, Nium's SME business lead for India, sits down with Manish Patel, founder and CEO of Mswipe Technologies, one of India's leading POS merchant network providers. The two talk about:

Manish's entrepreneurial journey that spans across medicine, alcohol distribution and digital payments

How Manish turned his idea into a business and validated his product-market fit

How POS-based payments players like Mswipe raised the game in a pandemic year

Mswipe's industry-first product called Bank Box - an acceptance solution that enables merchants to process all debit and credit card transactions, without incurring any rental or merchant discount rate

The future of last-mile retail transaction technology in India

Voice of FinTech Live Speaker Series: Tokenization and blockchain prospects in 2021

In this edition of Voice of FinTech: Live Speaker Series, our outstanding virtual panelists were:

Lothar Cerjak is Head of Institutional Services & Products at Bitcoin Suisse.

Lily Fang, Finance Professor at INSEAD. Check out the new INSEAD online FinTech course, led by Lily Fang here.

Anthony Lamy, Partner at Wecan Group

Emi Lorincz, Business Development Director at Ledger.

The key topic we discussed:

Switzerland now lets tokenized securities trade on a blockchain with the same legal standing as traditional assets. The new law went into effect recently. Swiss lawmakers decided to adapt the current legislation for specific features of distributed ledger technology. What does it mean for you for DLT and blockchain prospects in Switzerland this year

We also covered the medium and long-term prospects of the whole blockchain ecosystem (including crypto and digital currencies), potential end states and examples of tokenization and other blockchain-related use cases utilized by Bitcoin Suisse, Wecan Group, Ledger and macro views from an academic perspective.

Business media and FinTech trends with Lianna Brinded, Head of Yahoo Finance UK

Lianna Brinded, Head of Yahoo Finance UK, spoke to Rudolf Falat, founder of the Voice of FinTech podcast. Here is what they covered:

How did Lianna, at first interested in being a war correspondent, ended up in the business media

Lianna's role as a Head of Yahoo Finance UK – what does it entail?

How has the world of business media changed and where is it headed? Lianna reflecting on her experience at Yahoo, CNBC, Business Insider and more

Is TV dead? If video, on-demand style is the answer, why only a few video first outlets are succeeding?

Does Lianna prefer live programming or recorded? Why?

What was the most memorable interview Lianna has ever done?

I heard that your boss once told you to curb your enthusiasm. How did you deal with that?

How has FinTech changed in the UK and the world in last few years?

What will Lianna speak about during FinTech Talents North America on March 24?

Lianna's favorite business book: The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger

What is in store for Yahoo Finance UK and Lianna for the rest of the year?

What's the best way to reach out and find out more

Financial responsibility made easy with vlot

Daniel Schmidheiny, co-founder and COO of vlot, a Swiss-based InsurTech, spoke to Rudolf Falat, founder of Voice of FinTech podcast. vlot is reinventing life insurance policy by helping individuals to become more financially responsible.

Here is what they talked about:

Daniel's serial entrepreneurial journey

What is vlot? How does it work? Why now?

What is vlot's unique advantage? How is it different from other solutions out there?

How does vlot make money?

Who are your target customers? Is it B2B or B2BC or B2C?

Where is vlot on their journey?

Lessons learned for potential entrepreneurs thinking of starting their own business

What's in store for vlot this year?

Daniel's favorite business book

The best way to reach out

Corporate Venturing with DB1 Ventures (Deutsche Boerse)

Eric Leupold, Managing Director and Rebecca Qian Gong, Vice Present at DB1 Ventures spoke to Rudolf Falat, founder of the Voice of FinTech podcast, about Deutsche Boerse's investment approach and success stories.

Here is what they covered:

Deutsche Boerse's current business range

DB1 Ventures is a corporate venturing arm of Deutsche Boerse

What kind of start-ups has DB1 invested in?

How does DB1 see start-ups? As disruptors, competitors or partners?

How does DB1's deal sourcing work?

How do they cooperate with other actors in the ecosystem?

How does the selection process work?

How does economics work?

How does the monitoring of the investments work?

Success stories of the start-ups that DB1 invested in

What's the best way to learn more about Deutsche Boerse Ventures and reach out

If you have suggestions for topics or guests on the show or have ideas about how to make this podcast better for you, please e-mail us at info@voiceoffintech.com. You can also leave feedback using a quick form here: https://www.voiceoffintech.com/feedback. Alternatively, you can also leave a voicemail here.

Keep safe!

Sincerely,

Resources RSSMarch 11, 2021

Voice of FinTech: Book tips chat!

Photo by Craig Bradford on Unsplash

Thank you all for joining the first Voice of FinTech book tips chat on clubhouse last month!

Here are (some!) of the books that were mentioned during our chat! If you have more burning tips or comments on these, don’t hesitate to comment here or e-mail us at info@voiceoffintech.com.

Talking to Strangers: What We Should Know about the People We Don’t Know

Why are we so bad at judging people in person? Most people, including world leaders or judges or trained investigators, are hopelessly bad at “reading” people in person, explains Malcolm Gladwell. Why then you often hear at virtual conferences: “Let’s soon meet in person”? Do investors need to feel guilty when they cannot meet founders in person and overcompensate by excessive Zoom calls?

No Rules Rules: Netflix and the Culture of Reinvention

A collaboration between Reed Hastings, CEO of Netflix and Erin Meyer, an INSEAD Professor and an expert on a company and business culture, studying the culture of Netflix! Can no vacation and no expense policy work? It’s even a listed company! Well, no rules don’t mean anarchy or literally no rules. Read more or listen to an audiobook — how to run a company in a modern way! New York Times bestseller.

No Filter: The Inside Story of Instagram

Winner of the 2020 Financial Times and McKinsey Business Book of the Year Award. It’s based on countless interviews of insiders from Instagram and Facebook, giving you a peek into what’s it’s like to build a unicorn with 13 employees and try to keep it intact within Facebook. Worth a read (or a listen) from Sarah Frier for sure!

The End of Procrastination: How to Stop Postponing and Live a Fulfilled Life.

I guess we all know some procrastinators and occasionally, it may be us! Petr Ludwig shares many practical tips on how to get out of the vicious cycle of procrastination and get something finally done!

The Hard Thing About Hard Things: Building a Business When There Are No Easy Answers.

A truly great book by Ben Horowitz, suggested to us by a couple of podcast guests so far. Yes, it’s tempting to read only about hockey sticks and amazing riches, but often there are near-death experiences you need to overcome as a founder. How to get out of the hole and turn around a near-bankrupt business into a unicorn? Extremely useful reading for any entrepreneur!

The Future of Finance: The Impact of FinTech, AI, and Crypto on Financial Services.

I spoke to Henri Arslanian about crypto, digital assets, blockchain and how it is all changing the world of Finance as we know. This book is essential for your understanding of what’s coming! A great foundation before you can deal with bits and pieces on these topics in the media. You can also listen to what Henri had to say about it here.

Where to Play: 3 steps for discovering your most valuable market opportunities.

Marc Gruber explained on our podcast last year how his book complements the Lean Startup framework by helping you to find the best markets and opportunities before getting lean:)! Easy to follow (and use!) diagrams included.

The Currency Cold War: Cash and Cryptography, Hash Rates and Hegemony (Perspectives).

We also spoke to Dave Birch about his fondness of digital currencies, going back decades, and where he thinks this will lead. Is cash still going to be the King in the future? You can also listen here.

The Rise of Technosocialism: How Inequality, AI and Climate will Usher in a New World Order.

Brett King, founder of Moven and #1 FinTech podcast in the world, wrote a book about technology that will radically change society as we know it today. It is being updated for the impacts of the pandemic. Coming soon! Listen to what Brett told us about this here.

Blink: The Power of Thinking without Thinking.

How to perfect your “gut” feeling so it produces better results… Gut feeling is not necessarily irrational, nor it’s a gift possessed by a few. It can be trained, apparently! Again, by Malcolm Gladwell.

Banking on it: How I disrupted the industry.

Anne Boden’s story about how a woman in her 50ties, very much part of the banking establishment, started a mobile-only bank in the UK to great success. You will find many inside stories about well-known FinTech entrepreneurs too.

Follow me on #clubhouse under @voiceoffintech — many more exciting live audio events are coming your way soon!

Many thanks,

Resources RSSFebruary 28, 2021

February summary

Photo by Craig Bradford on Unsplash

In case you missed out on the February episodes of the Voice of FinTech podcast, here is the monthly summary! You can listen to all the episodes on the Episodes pages of this website or when you subscribe to your favorite podcast apps under Subscribe.

Finally getting rid of cash in 2021?

Will Graylin is a former US nuclear submarine officer, a serial entrepreneur with exits to Samsung, Oracle and others, former co-GM of Samsung Pay and Chairman and CEO of OVLoop, Inc., USA, his latest FinTech venture. Hosted by Rudolf Falat, founder of Voice of FinTech podcast.

We talk about:

How did Will get to do what he does today?

What has attracted Will to be an entrepreneur instead of being an employee? What were Will's favorite entrepreneurial moments?

What are the pros and cons of going more digital and how far can we go?

OV Loop - what’s the company about? What is the problem you are trying to solve? What does it mean, "everywhere commerce"?

Who are its key clients?

Digital payments are already a fairly crowded space. How are you better than your competitors? What’s your edge?

It seems that COVID loves e-commerce. Have you noticed a spike in demand driven by the pandemic? Where exactly?

Your favorite business book you have read recently?

Where can interested parties find out more about you?

Americas Series with David Yakobovitch: Socure - identity verification and security for financial transactions in a Digital First Society

David Yakobovitch discussed with Johnny Ayers, CEO and Founder of Socure, about the rise of identity verification and security for financial transactions in a Digital First Society. This episode featured a conversation on leading FinTech startups that are enabled by technology at Socure and similar exciting Finance ventures such as Public, Stash and Robinhood.

Topics included uncovering the powerful technology that Socure has built for identity fraud, anti-money laundering, and end-to-end predictive analytics. Notable startups discussed on the episode included Brigit, EarnIn, and Dave.com.

With its focus on binary classification and over 9 billion rows of weekly data, Socure has built three new, industry-changing solutions: Intelligent KYC, DocV and Sigma Synthetic Fraud.

Socure announced in the second half of 2020 a funding round of $35 million (here), and recently has entered the online gaming industry (here).

Socure is solving for the first ML model to verify 100% of good IDs and completely eliminate identity fraud on the Internet.

Johnny Ayers’ 2021 trend predictions on fraud include a part 1 and part 2.

Essentials of Entrepreneurial Finance

Jana Kovacovska, the founder at Tiny CFO, providing advisory services to start-ups focused on entrepreneurial finance in the tech, consumer, and media space. Ex-VC and McKinsey. An enthusiastic supporter of new-ish entrepreneurs and small businesses. Hosted by Rudolf Falat, founder of Voice of FinTech podcast.

Here is what we talked about:

Background on Tiny CFO and Jana

What made you start Tiny CFO?

What do you think founders need to focus on with regards to their finances from the start?

Is there a difference between a startup and a small business? Why does it matter?

Which issues do you witness in entrepreneurial finance?

Why not just leave all this to the accountant?

What do you think the best practice finance function for startups looks like?

Do you think forecasts still cannot be automated?

Can the founders do all of this – manage their whole finance function – on their own?

When should they hire a CFO and what to expect?

How do you collaborate with others in the ecosystem?

What's the best way to reach out?

Asia Pacific Series with Chia Jeng Yang 谢征阳: Banking for SMEs in India with Open's Vaibhav Garg

In this episode of Voice of FinTech: Asia Pacific Series, Chia Jeng Yang, Principal of Saison Capital based in Singapore, speaks to Vaibhav Garg, Head of Business Strategy for Open, an Indian SME focused neobanking platform. Vaibhav is the Head of Business Strategy at Open and was a founder of multiple companies (Boro, Zopper and IndieHaat), ex-Dalberg Global Advisors consultant and an Indian Institute of Technology (IIT) Bombay graduate.

Open is an SME-focused business banking platform, founded by serial entrepreneurs Anish Achuthan, Mabel Chacko and Ajeesh Achuthan, along with ex TaxiforSure CFO Deena Jacob.

Founded in 2017, Open is one of the world’s fastest-growing SME-focused business banking platforms with over 800,000 SMEs, processing over USD 24 billion in transaction processing volume annually and adding 50,000 new SMEs every month. Open is backed by leading global investors like Tiger Global, Speedinvest, Beenext, raising $37 million in funding, and was recently featured among the top 100 fintech companies globally in the 2019 Fintech 100 Report by KPMG and H2 Ventures.

We talk about:

Open and its founding story

Key events and nuances in the Indian fintech scene and how it compares to other FinTech markets

Opportunities in the SME open banking space

Regulatory oversight and its role in embedded finance

Overlooked factors for investing and building in India Fintech

The status and prospects of CBDCs and more with Ripple

James Wallis is Vice President RippleX, Central Bank Engagements and CBDCs at Ripple. Hosted by Rudolf Falat, founder of Voice of FinTech podcast. Here is what they talked about:

James, you have had a long and distinguished career at IBM. What drove you to the world of blockchain?

What are your predictions for blockchain and its use cases?

I know you focus on CBDCs – some countries are more supportive than others. Recently, the Swiss central bank representatives stated that they see no benefits of CBDCs over the currency as we know it today? What would be your answer to that?

What are the critical success factors that need to be fulfilled, so CBDCs take off?

What’s the interplay between CBDCs, Ripple and enterprise blockchain? What’s the problem you are solving?

Has your focus shifted as you have been building Ripple?

How does the world of blockchain look like now from Ripple’s perspective?

Who are your key clients?

What’s in store for you this year?

Ray Dalio from Bridgewater says governments will kill bitcoin. Is he right?

Your favorite business book you have read recently?

What’s the best way to reach out and find out more about Ripple?

Stacey Japhta, Head of Strategic FinTech Partnerships at Talent in the cloud, emerging markets FinTech executive search firm and host of Talking success podcast, talks to Buhle Goslar, Africa CEO at Jumo, a company providing financial services technologies to empower emerging market entrepreneurs, both based in South Africa.

Buhle learnt about being an entrepreneur at the age of 23 when she built the business division of a Travel Tech company in China from scratch. In this episode, Buhle touches on the steps to take to successfully build something from the ground up.

Her MBA paper dives into why we do not see the full benefits of financial inclusion in South Africa and how that ties into the emerging markets not creating innovative products. Buhle shares the reason for this and how we can solve the problem.

Then we chat about a controversial topic - focusing on gender diversity & pay equity. How do we move away from pay secrecy?

Get smarter about your life insurance

Michael Klien, co-founder of Safeside talks to Rudolf Falat, founder of the Voice of FinTech podcast about how to get life insurance more easily and intelligently.

More specifically, here is what they talked about:

Michael, how and why have you decided to start your own company?

What is SafeSide? How does it work? Why now?

What is your unique advantage? How are you different from comparison sites or brokers?

How do you make money?

Who are your target customers?

How have you started with your venture?

Where are you on your journey in terms of product development, geographic reach, funding, hiring? What’s the ultimate plan?

What are the next steps for you this year and beyond?

Michael's favorite business book: Pre-Suasion: A Revolutionary Way to Influence and Persuade

The best way to reach out

Asia Pacific Series with Angela Conroy: How to use your credit card even where you can't? Ask CardUp

In this episode of the Asia Pacific Series, Angela Conroy, co-founder and CEO at Notarum, an awesome RegTech based in Singapore, talks to Nicki Ramsey. Nicki is the founder and CEO of CardUp, also based in Singapore. CardUp is a credit card enablement platform that enables payment or collection of significant expenses using a credit card in places where cards are not accepted today.

Nicki and Angela talk about:

The 'great leap of faith' when moving from corporate to star-tup

The importance of a strong founding team

How non-tech founders can get comfortable with the tech world

Why finding the win-win is key to success

If you have suggestions for topics or guests on the show or have ideas about how to make this podcast better for you, please e-mail us at info@voiceoffintech.com. You can also leave feedback using a quick form here: https://www.voiceoffintech.com/feedback. Alternatively, you can also leave a voicemail here.

Keep safe!

Sincerely,

Resources RSSJanuary 29, 2021

January summary

Photo by Martin Shreder on Unsplash

In case you missed out on the January episodes of Voice of FinTech podcast, here is the monthly summary! You can listen to all the episodes on the Episodes pages of this website or when you subscribe to your favorite podcast apps under Subscribe.

2021 FinTech outlook and more with Innovate Finance

Janine Hirt, Innovate Finance, an independent, non-profit membership-based organization and industry body serving the United Kingdom's financial technology community. Hosted by Rudolf Falat, founder of Voice of FinTech podcast.

We talk about:

Janine's global citizen's journey to her role as a COO at Innovate Finance. Switzerland, USA, UK all featured!

Innovate Finance - mission and its objectives

How Innovate Finance and FinTech in the UK have evolved in the last six + years

Priority programs and initiatives: for example, FinTech for schools or Women in FinTec

Key FinTech industry verticals supported (18 altogether)!

Membership base: FinTech start-ups, incumbents and investors

What can one expect from Innovate Finance as a FinTech or an incumbent?

FinTech prospects in 2021