The Sick Economist's Blog, page 13

July 16, 2020

CLASH OF THE TITANS: A CORONA COMPETITION

Although this new vaccination sector can create opportunities for lower-cap companies, the industry has recently been dominated by two “fighting titans,” Eli Lilly and Regeneron, with a combined market share of +200 Billion. The two companies are currently the leaders within the competition to find a vaccine and are well equipped with billions in cash to fuel their endeavors regarding Covid-19.

by John Coughlin

Titan #1 Eli Lilly

Aside from many Biotech companies founded in the late 20th century, Eli Lilly finds its origins in the late 19th century, in the year 1876. Founded by Colonel Eli Lilly, the company states its founder was “committed to creating high-quality medicines that met real needs in an era of unreliable elixirs peddled by questionable characters.” Although Eli Lilly does not compete with questionable characters anymore, it does compete to create a vaccination in a “questionable” time.

Currently, the company produces and distributes medications and drugs, such as the well-known Taltz and Trulicity. Eli Lilly is a well-trusted company within the medication field, which has seen sustained growth for the past decade and will continue to succeed in the future.

Titan #2 Regeneron

The other titan and direct competitor to Eli Lilly are Regeneron, a leading biotechnology company that studies and produces medicines. Dissimilar to Eli Lilly, Regeneron was founded in 1988 by Leonard Schleifer and Eric Manvers Shooter. Since their founding, Eli Lilly has seen tremendous growth over those thirty years, growing to a $60 billion valuation. This tremendous growth can be attributed to their “science to medicine” method, which has resulted in “seven FDA-approved treatments and numerous product candidates in development.” Although Regeneron is ⅓ of the company of Eli Lilly, their advancing technologies allow the company to compete in creating medicines and, more importantly, a vaccine for Covid-19.

Eli Lilly Covid-19 Efforts

From the start of the severe spread of Covid-19 in the United States, Eli Lilly has ramped up their laboratory work output and overall efforts in finding a vaccine. In their COVID Fact Sheet, published on May 26th, the company reported that they have “Repurposed labs at Lilly Corporate Center” and “Tested over 60,000 samples, a combination of samples from a drive-through and Indiana State Department of Health’s testing efforts.” These early company efforts prepared the company to launch “the world’s first study of potential Covid-19 antibody treatment in humans.” On June 1st, the company announced their “First patients had been dosed in a Phase 1 study of LY-CoV555.” Eli Lilly later suggested, “Should Phase 1 results show the antibody can be safely administered, Lilly will initiate a Phase 2 proof of concept study to assess efficacy in vulnerable populations”.

Along with their Phase 1 trials with LY-CoV555, Eli Lilly later announced the “first healthy volunteer had been dosed in a Phase 1 study of JS016, the lead antibody from Lilly’s collaboration with Junshi Biosciences.” With two trials underway, Eli Lilly is well suited to find a possible vaccination, as two is always greater than one.

Regeneron Covid-19 Efforts

Regeneron, like their founding, has come late to the game, but in a timely fashion. Since the beginning of the year, Regeneron has continued its efforts to create medicines, such as their most recent FDA approval of a Dupixent® in both adult and children use for severe Dermatitis. Although these efforts do now correlate directly with Covid-19, it does suggest Regeneron’s efficient “science to medicine” method, regarding antibody drugs.

On June 11th, the company announced the beginning of their “first clinical trials of anti-viral antibody cocktail REGN-COV2 for the treatment and prevention of Covid-19. This announcement of REGN-COV2 came eleven days later than Eli Lilly’s announcement of their first trials, which shows that the race is neck and neck. Currently, REGN-COV2 is in “two Phase 2/3 clinical trials for the treatment of COVID-19 and in a Phase 3 trial for the prevention of COVID-19 infection.”

In a significant move by Regeneron on July 7th, the company announced “the Biomedical Advanced Research and Development Authority (BARDA)” and “the Department of Defense Joint Program Executive Office for Chemical, Biological, Radiological and Nuclear Defense have awarded Regeneron a $450 million contract to manufacture and supply REGN-COV2.” This deal by Regeneron shows the potential value of a vaccine for Covid-19 and overall confidence in REGN-COV2. Although Regeneron may be a smaller company than Eli Lilly, it is making big moves and is advancing through trials with ease.

Who will win the Battle?

It is currently unknown to definitively answer who will find a possible vaccination for Covid-19 first, but an inference can be made when looking at which company is most financially capable of supporting vaccine trials.

Looking at Eli Lilly’s “Consolidated Balance sheet,” found in the company’s investor section, the cash and cash equivalents section is essential for their company longevity. Currently, the company has burned through $600 million of its cash and cash equivalents, from $2.3 Billion in Q4 2019 to $1.7 billion in Q1 2020. More important information will be provided in the company’s Q2 balance sheet regarding current company performance, but this Q1 report shows the early action of Eli Lilly in laboratory efforts regarding testing possible treatments and eventually, a vaccine.

Although Regeneron may be significantly smaller than Eli Lilly, the company is growing fast. Regeneron saw “First quarter 2020 revenues increase 33% to $1.83 billion versus first quarter 2019,”and “a net sales increase of 9% to $1.17 billion versus first quarter 2019.” Along with their growth in revenue and net income, Regeneron also had a $800 million increase in cash and marketable securities from $6.4 billion to 7.2 billion. This newly gained cash will be beneficial to the company for current and future trials and will allow Regeneron to move at a faster rate of production and delivery.

Looking Forward….

The struggle to find a vaccine is nothing less of a stressing and fast-paced process. With both Eli Lilly and Regeneron currently participating in trials, the battle is going to be hard fought. Although Eli Lilly is a larger company, Regeneron is moving at a faster pace both financially and scientifically.As I suggested earlier in this article, the company has grown to a $60 billion valuation in just thirty years. This smaller, yet powerful biotech company, will compete against the bigger titan, Eli Lilly, in The Battle for Covid Cash.

To follow Analyst John Coughlin, go to:

TikTok: Street Signs

Instagram: Stockmarketsigns

The post CLASH OF THE TITANS: A CORONA COMPETITION appeared first on Sick Economics.

July 15, 2020

THREE STOCKS THAT WILL BENEFIT FROM COVID-19

By Juliet Duguid, Biotech Analyst

Gilead Sciences ($GILD)

Gilead Sciences is an American pharmaceutical company located in Foster City, California. Primarily, the company deals with the development of antiviral drugs for the treatment of HIV, hepatitis B, and hepatitis C. Recently, the company came to national attention because it is on track to make a profit with the advent of its therapeutic COVID-19 drug, remdesivir. Remdesivir is a nucleotide analog with broad spectrum antiviral activity, tested both in vitro and in vivo in animals against a myriad of viral pathogens. As a result of this development, the stock price has surged upwards by 17.5%, while the S&P 500 only went up 2% in the same time frame. Although the FDA hasn’t approved the drug, due to the extenuating circumstances, the FDA has issued an Emergency Use Authorization, or an EUA, to expedite its ability to reach consumers that need it the most. In mid-June, the company began enrollment for a single arm, open label, phase II/III clinical trial that will evaluate the safety and efficacy of the drug in treating Covid-19 within the pediatric patient population, which is part of their ultimate goal to continue to conduct research on the drug to make it as useful as possible for hospitalized patients globally.

According to a press release, the US Department of Health and Human Services has secured more than 500,000 courses of the drug for hospitals all over America. This would last through September, totaling around $1.9 billion in remdesivir sales for the company for the year. Analyst Geoffrey Porges at SVB Leerink estimates that the drug will be priced at $5000 a course in the United States, $4000 a course in Europe, and $2000 a course in other areas of the world. Although skeptical at first, Porges changed his rating on the drug from ‘market perform’ to ‘outperform’, and believes that the drug’s sales could total $7.7 billion by 2022. According to Gilead’s first quarter Earnings Press Release, the company’s total sales this year were $5.5 billion, up from $5.2 billion in the same period 2019. There was an estimated increase of $200 million due to “increased customer buying patterns and patient prescription trends, primarily in the United States, due to the coronavirus disease (COVID-19) pandemic”. Ultimately, as the coronavirus continues to affect the population, Gilead will continue to profit off it.

Roche ($RHHBY)

Roche is a multinational healthcare company based in Switzerland. Its worldwide operations encompass two divisions–Pharmaceuticals and Diagnostics. Roche has been working on developing a Covid-19 antibody test, which, according to the company, was granted Emergency Use Authorization status by the FDA in early May. The test, named Elecsys Anti-SARS-CoV-2, is an immunoassay for in-vitro detection of SARS-CoV-2 antibodies. The serology test has a 99.8% specificity and 100% sensitivity, which are both vitally important to ensure that there is no cross reactivity with other, similar forms of coronavirus. Although it has not been proven whether or not the presence of antibodies in one’s body necessarily corresponds with immunity, this level of accuracy is important for determining the exact number of people who have been exposed to the virus so proper measures can be taken to mitigate its spread within the population.

In addition to this, Roche received Emergency Use Authorization status for their diagnostic test, which has the primary purpose of creating expedited medical testing to meet the urgent need for more proficient technologies. The cobas SARS-CoV-2 test was designed to qualitatively detect the presence of the virus via nasopharyngeal and oropharyngeal swab samples, especially on those who meet clinical and/or epidemiological criteria for Covid-19 testing. In addition to the diagnostic tool, Roche also released the cobas 6800 and 8000 systems, which enable hospitals and laboratories to run tests and get results on the spot. The test is also available in areas and regions that accept the CE Marking (mainly European nations), enabling these tools to reach a larger population, which is crucial at a time like this. CEO of Roche Diagnostics Thomas Schinecker said “Providing quality, high-volume testing capabilities will allow us to respond effectively…CE Mark certification and the FDA’s granting of EUA supports our commitment to to give more patients access to more reliable diagnostics which are crucial to combat this serious disease”.

In late March, Roche was investigating its rheumatoid arthritis drug Actemra, an IL-6 inhibitor for the treatment of pneumonia in patients with Covid-19. The test allegedly showed evidence that the drug did not make a difference in the condition of patients with severe pneumonia. According to an Italian study, “The study showed no benefit in treated patients neither in terms of aggravation…nor in terms of survival”. However, Roche went ahead and continued with the phase III trial of the drug, partnering with Gilead Sciences to evaluate the drug’s efficacy in conjunction with remdesivir. Results of these studies are pending, but look promising.

In late March, Roche was investigating its rheumatoid arthritis drug Actemra, an IL-6 inhibitor for the treatment of pneumonia in patients with Covid-19. The test allegedly showed evidence that the drug did not make a difference in the condition of patients with severe pneumonia. According to an Italian study, “The study showed no benefit in treated patients neither in terms of aggravation…nor in terms of survival”. However, Roche went ahead and continued with the phase III trial of the drug, partnering with Gilead Sciences to evaluate the drug’s efficacy in conjunction with remdesivir. Results of these studies are pending, but look promising.

Roche appears to have one of the fastest growing research and development budgets in the industry–their expenditures went from 8.073 million Swiss francs (roughly $8.58 million dollars) to 11.696 million Swiss francs (roughly $12.43 million). This is one of the most important indicators of a company’s profitability–the more they invest in developing new drugs, therapies, and technologies, the more likely they are to continue to be profitable as a result of the increase in innovation. Furthermore, Roche shareholders are paid a dividend of 2.6%, and although this number hasn’t seen too much of an increase in recent years, if still quite a large dividend nonetheless.

Abbott Laboratories ($ABT)

It is a hardly disputed fact that testing devices, at their current level of production, are inadequate and unsustainable in the long run. Headquartered in Abbott Park, Illinois, Abbott Laboratories seems to be tackling this issue head on. The multinational healthcare company focuses on the discovery, development, and production of a wide variety of medical devices. As far as their coronavirus ventures, the company recently received Emergency Use Authorization status from the FDA for Alinity m, a fully integrated and automated molecular lab test for the detection of Covid-19. Alinity m previously received official FDA approval for Abbott’s HCV assay in March. The aim of the device is to allow laboratories to run through more tests in less amounts of time, thus improving efficiency–in fact, Alinity m allows 1080 tests to be processed in the span of 24 hours. Current laboratory testing procedures operate at much slower levels, and especially at a time like this, speed and flexibility are as crucial as ever.

Abbott Laboratories has also been working on the development of antibody tests, just like Roche. In late April, it released a serology test, a chemiluminescent microparticle immunoassay intended for the qualitative detection of the IgG antibody in patients who have had SARS-CoV-2. According to an independent study conducted by the University of Washington School of Medicine, “SARS-CoV-2 IgG lab-based serology blood test had 99.9% specificity and 100% sensitivity for detecting the IgG antibody in patients 17 days or more after symptoms began”. These are very promising results, and it seems the company is positioned to profit from the exceptionally large specificity of the test.

In addition to increasing efficiency across laboratories, Abbott Laboratories is experimenting with point of care testing, which is testing done as near to the patient as possible (eliminating the need to send samples to a laboratory and having to wait prolonged periods of time for a result). Abbott’s ID NOW test is a portable, reliable testing device that can give you results within 12 minutes or less. Tests that have the ability to give results to patients rapidly will be vitally important to identify the virus in patients at the earliest possible stages, and slow down the spread of the virus considerably. As of July 1st, ID NOW has been shipped to physicians’ offices and urgent care clinics in all 50 states. In early May, however, there was controversy surrounding this testing method–allegedly, an NYU study had found that the tests were way less accurate than the company claimed, but after Abbott contacted the researchers, NYU admitted to the possibility of there being limitations in the study design. Still, this controversy took a slight toll on the stock price, but this minor setback must ultimately be taken in context–the company has 5 other coronavirus related devices in the works. The stock also offers a 1.6% dividend, which they have been raising for 48 consecutive years.

The post THREE STOCKS THAT WILL BENEFIT FROM COVID-19 appeared first on Sick Economics.

July 14, 2020

LARGE VS. SMALL BIOTECH IPOS: IS THERE A SWEET SPOT FOR BIOTECH INVESTING?

By: Matthew Rojas, Biotech Financial Analyst

Range of IPO Offerings:

When companies IPO, they are grouped into categories according to the value of their market capitalizations. Nano-caps, a.k.a. “penny stocks”, have market caps of below $50 million and are generally considered the riskiest. Next up are micro-caps, which have market caps between $50 and $300 million; these companies are generally less risky than nano-caps but still exhibit a high degree of volatility. Then, there are small caps or companies with market caps between $300 million and $2 billion that have room for growth opportunities. After small caps are mid-caps, which are companies with market caps between $2 billion and $10 billion that are known for having more stability. Following mid-caps, large caps are companies with market caps of over $10 billion and represent the majority of the U.S. equity market. Lastly are the mega- caps: companies with market caps over $200 billion such as Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), and Facebook (NASDAQ: FB). For the remainder of this article, when referring to “smaller” biotech IPOs, what I mean are the nano-caps, micro-caps, and small caps that do not exceed $500 million. On the other hand, when referring to “larger” biotech IPOs, I am talking about mid-caps with market caps above $500 million and large caps. Since there has never been a biotech IPO considered a mega-cap, they will be excluded from this discussion.

The Small IPO Theory:

Just as many people claim that “bigger is better”, several individuals counter that belief with one of their own: “smaller is better”. The logic behind the latter theory is that smaller biotech IPOs potentially have more room for growth than larger biotech IPOs. Increasingly, many smaller biotech companies IPO without FDA approved product candidates. If people were to invest in these companies when they IPO and, in the future, one or more of their product candidates receives approval, investors’ earnings per share can skyrocket. Larger biotech IPOs also have room for growth; however, many believe that their growth is not as pronounced compared to smaller biotech IPOs. We will examine the large vs. small biotech IPO debate by examining how $100 investments in multiple IPOs over the last five years either grow or depreciate.

The Graph:

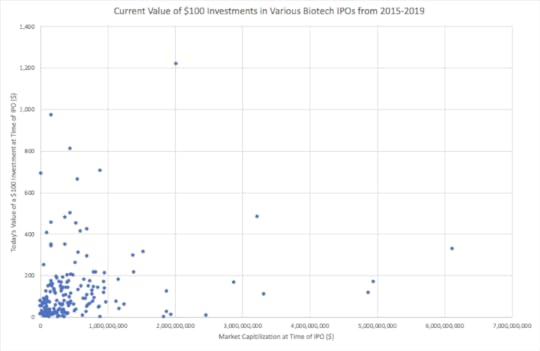

Each point on the scatter plot above represents a biotech company that IPOed within the last 5 years, 2014-2019, on either the NASDAQ or NYSE stock exchanges. There are a total of 175 companies on the graph gathered from the NASDAQ IPO database. The companies are arranged according to their market capitalizations on the date of IPO, listed on the x-axis, and today’s value of a hypothetical $100 investment in the company on the IPO date, listed on the y-axis. The IPO market capitalizations were obtained from the YCharts database, and the current values of the $100 investments in the various companies were derived using the percent change in share price from the date of IPO to the present. The reason for arranging the companies in this specific way is to discern if larger (>$500 million) or smaller (

Potential Sources of Error:

Of the 175 biotech IPOs on the scatter plot, 117 or 67% of the companies have market caps below $500 million, and 58 or 33% of the companies have market caps above $500 million; therefore, smaller biotech IPOs are overrepresented in this data set. If more $100 investments grow in value for smaller companies compared to larger companies, this may be due to the larger sample size. Additionally, it is important to note that the IPO market cap is not the sole determinant of future success. Many factors play into a company’s success including but not limited to deals, FDA approval for product candidates, and mergers/acquisitions. Furthermore, if the market cap is found to be a significant factor in determining share price growth, it should be used as a data point among many others before an investment decision is made. Lastly, some of the IPOs, particularly those that IPOed in the beginning of the five year period, may have increased in value more because the $100 investments in those companies had more time to mature.

Findings:

Of the 117 companies that IPOed with market caps below $500 million, 42 or about 36% of them realized growth in the $100 investment at the time of IPO. On the other hand, of the 58 companies that IPOed with market caps above $500 million, 36 or 62% of them experienced growth in the $100 investment at the time of IPO. Even though the sample size of companies that IPOed with market caps above $500 million was smaller, this group performed much better in terms of return on investment compared to companies that IPOed with market caps below $500 million.

Having established that larger IPOs have outperformed the smaller ones over the last five years, it’s time to break down the larger IPOs into categories to see if we can find the sweet spot. There were 22 companies that IPOed with market caps between $500 and $750 million, and 13 or about 60% of them realized an increase in the $100 investments. Next, 17 companies had market caps between $750 million and $1 billion, and in 10 or about 59% of them, the $100 investment grew. Then, there were 11 companies that IPOed with market caps between $1 and $2 billion, and 5 or 45% of them saw the $100 investment increase. Lastly, there were 8 companies with IPO market caps between $2 and $7 billion, and 7 or about 88% saw the $100 investment increase — this appears to be the sweet spot. In all of these market cap categories besides the biotechs with IPO market caps between $1 and $2 billion, investors were more than 50% likely to receive a positive return on their investment.

Now, we are going to see how the groups within the smaller biotech IPOs, nano-caps, micro-caps, and some small caps, performed in terms of growth in the $100 investment. Of the 10 companies that IPOed with market caps below $50 million, 10% or one company experienced growth in the $100 investment. There were 65 companies that IPOed with market caps between $50 and $300 million, and of those companies, 20 or 30% of them realized growth in the $100 investment. Lastly, there were 42 companies with IPO market caps between $300 and $500 million, and 12 or about 29% of them experienced gains in the $100 investment. From this data, I would recommend steering clear of nano-caps because nearly all of them within the last five years decreased in value when looking at the $100 investment. When it comes to investing in micro-caps and small caps with market caps less than $500 million, some of them do have growth opportunities; I would just recommend researching the companies extensively before investing because they are significantly riskier than larger IPOs.

What to Look for in Smaller Companies:

There is room for opportunity when investing in smaller companies, you just have to know what to look for to find a successful candidate. The first thing to look for when researching is the company’s clinical pipeline. How far along are their clinical trials? Do they have multiple clinical trials or just one or two? If a smaller company only has two product candidates in pre-clinical trials, it could be years before they receive FDA approval; hence, these companies are very risky and one should stay away from investing. On the other hand, if the company has 5 product candidates and two of them are in phase 3 clinical trials, then this company is more likely to grow your investment.

Next, investors should examine the company’s recent news, deals, and current partnerships. Many companies have a “press release” section on their website where they post their most current news. It is always a good idea to scan that page for clinical trial updates and to see if they have made any deals with other leading biotech companies. If they have, then the company is more likely to be successful.

The last thing I recommend looking at is the company’s S-1 document, which every company has to file to the SEC to be listed on a public stock exchange. In this document, the company that wants to IPO addresses its risk factors, competitors, and even some consolidated financial statements. You don’t have to read the entire document, just search for individual words and phrases like “debt”, “risks”, and “competitive advantage”.

In Summary:

Today, I said we would answer the question, “Is bigger really better”? According to the data from 175 biotech IPOs over the last five years, the answer to that question is yes. Statistically, the initial $100 was more likely to grow when invested in the larger IPOs than the smaller ones. And, when looking at the $2 to $7 billion market cap range, investors were 88% likely to increase their earnings — this is the sweet spot. Does this mean you should blindly invest your money in any large biotech IPOs? No. It is always critical to research any company before investing, carefully looking at their pipeline, press releases, and S-1. Do our findings mean that you should steer clear of smaller biotech IPOs? Also no. There is still a lot of money to be made investing in smaller biotech IPOs; however, researching the company extensively before shelling out cash is essential. Overall, the biotech IPO space is filled with opportunity — definitely pay attention to the big players, but don’t forget about the smaller ones too.

The post LARGE VS. SMALL BIOTECH IPOS: IS THERE A SWEET SPOT FOR BIOTECH INVESTING? appeared first on Sick Economics.

July 13, 2020

THREE STOCKS HURT BY THE CORONAVIRUS PANDEMIC

By Lee Rivers, Biotech Analyst

Tenet Healthcare

Tenet Healthcare operates 65 hospitals and about 500 other healthcare facilities, including outpatient surgery centers. The lockdown caused by the pandemic resulted in visits of patients to hospitals declining significantly in the second half of March, and many patients have deferred elective care. Tenet said that its overall surgery count fell 55% from the prior year. At the end of the first quarter this year (March 31st), there was a 5% drop in same hospital admissions, portraying the decline in patient volume that began in mid-March. Consequently, Tenet furloughed approximately 10% of its workforce.

The decline in patient volume directly also led to a decrease in net income of $0.69 per share. However, Tenet Healthcare still reported a profit from continuing operations of $1.28, which beat analysts’ estimates by $0.32 per share. The earnings beat was primarily because of an $0.81 tax benefit linked to the Coronavirus Relief and Economic Security (CARES) Act. The company’s net income attributable to Tenet shareholders in the first quarter of 2020 was $93 million or $0.81 per share, compared to the first quarter of 2019’s loss of $12 million, or $0.11 per share. Operating revenue fell to $4.52 billion from $4.55 billion over the same period.

In the first half of June, Tenet reported that its admissions to hospitals had reached 90% of pre-crisis levels. Moreover, surgery counts were at 95% of pre-crisis levels. Hospital departments that were previously closed are reopening, and vital elective procedures are resuming, but the acceleration of the second wave of COVID-19 cases may pose a danger, as Texas (Tenet is based in Dallas) has paused its reopening plans. This second wave will likely disrupt Tenet’s operations again as patient volume decreases and elective procedures continue to get deferred. One significant difference in the first and second waves, however, is that the average age has declined considerably, resulting in shorter average hospital stays in this second wave.

DBV Technologies (DBVT)

DBV Technologies is a biopharmaceutical company that develops products and immunotherapies for diagnosing and treating food allergies, such as milk and peanuts. The firm is currently developing Viaskin Peanut, an immunotherapy for peanut allergies that is in Phase III trials for ages 4-11 and 1-3, and the treatment for adolescents and adults is in Phase II trials. It also has several other ongoing immunotherapy programs, such as Viaskin Milk, in Phase II trials, Viaskin Egg, in the preclinical stage, and a diagnostic for cow’s milk allergy in infants that is in Phase II trials.

DBVT’s Viaskin Peanut immunotherapy had a set target date of approval in August. The Food and Drug Administration (FDA), however, is currently focused on the coronavirus pandemic, thus impacting the timelines for reviews of drugs and medical treatments. A minimum of 1,100 clinical trials in both the U.S. and Europe have either decelerated or stopped. The company reports that it provided the FDA with answers and data regarding questions it had in March, but the FDA is still reviewing the data. Nevertheless, the FDA maintained the target approval date of August 5th.

Consequently, DBVT plans to implement a restructuring plan to provide more flexibility to the firm. This restructuring plan, according to DBVT, is intended to put DBVT in the best position possible for the possibility of a delay in the review process for Viaskin Peanut’s FDA approval. The company will focus on continuing the BLA review process for Viaskin Peanut, preparing to bring Viaskin Peanuts to patients, and preserving an abundance of cash to achieve the above.

This restructuring plan will diminish the firm’s other clinical and preclinical programs and spending to reserve capital. DBVT anticipates that its current holdings of cash and cash equivalents of €262.4 million will be able to fund operations substantially beyond the prior guidance of the first quarter of 2021 under the new plan. Despite the firm’s ability to restructure and pivot to focus on preserving cash, DBVT will still be impaired by scaling down its other programs under development, particularly when coupled with the present difficulties of finding enrollment for studies. It is unclear what the ultimate results of the restructuring will be for DBVT over the long-term, but, indubitably, the timelines for nearly all the programs outside of Viaskin Peanut will be delayed substantially.

Ventas, Inc.

Ventas, Inc. is a Chicago-based healthcare real estate investment trust that acquires and possesses senior housing, research and innovation, and healthcare properties. Ventas leases the properties to unaffiliated tenets or operates them through third-party managers. The company also makes secured and non-mortgaged loans relating to senior housing and healthcare properties or operators.

The coronavirus pandemic caused a tremendous shrinkage in demand for senior care, with occupancy of senior living and housing properties currently at 80.7%, compared to 85.5% in April. Some primary drivers of the decrease in occupancy are the limited admissions and visitations at many senior living facilities, as well as the headlines regarding infection rates. At the end of June, approximately 30% of Ventas’s communities were closed to new admissions. Additionally, senior living facilities have also experienced increased costs because of the pandemic, as its residents are the most at-risk, thus requiring extensive safety precautions, in addition to the obligation of hazard pay for employees drawing substantial funding.

The combination of increased costs and decreasing demand is certain to harm Ventas’s profitability, and occupancy declines are expected to continue. Ventas is preparing for this, as its quarterly dividend has been reduced by 43% compared to the prior quarter. Other senior care facilities have done the same, with WellTower decreasing its dividend by 30%. Ventas is expecting a 1% sequential average monthly occupancy loss, or a $2-$3 million decline in revenue each month. Senior living is an essential business, however, and occupancy rates are unquestioned to accelerate with the inevitable aging of the more senior U.S. population.

Conclusion: Essential Services?

The coronavirus pandemic has impacted many companies within the healthcare industry. Tenet Healthcare, DBV Technologies, and Ventas, Inc. are three stocks that will markedly be affected by the pandemic, particularly as cases of coronavirus continue to rise again. With reopening plans ceasing in some regions of the country, there is a likelihood of a potential second lockdown that could further detriment these companies.

Nevertheless, these companies are in an industry that is essential and will likely rebound in demand as the coronavirus pandemic subsides. In the short-term, the epidemic will undoubtedly affect them negatively from a business and financial standpoint. These companies hence have the potential to become undervalued investments, as a result. DBV Technologies is potentially the riskiest of the three stocks, as it is dependent on the approval of the FDA and the successful commercialization of its Viaskin Peanut treatment. Tenet Healthcare will likely experience a rebound in revenue as deferred elective procedures are performed after the pandemic dissipates, but will need to manage the rising costs caused by the pandemic. Moreover, Ventas, Inc. will likely rebound as well once the pandemic subsides, as new admissions will resume and the potential for health risks in senior living facilities minimized. Each of the firms will have to find efficient ways to reduce costs to achieve profitability and will be exceptional value investments if they can attain that aim despite the challenges posed by the current pandemic.

The post THREE STOCKS HURT BY THE CORONAVIRUS PANDEMIC appeared first on Sick Economics.

July 9, 2020

ZENTALIS PHARMACEUTICALS: A BIOTECH IPO FOR BREAST CANCER

By John Coughlin, Biotech Analyst

What is Zentalis Pharmaceuticals?

Zentalis Pharmaceuticals specializes in cancer treatment, and more specifically, “Developing small molecule therapies.” Within their “about us” section on their website, Zentalis Pharmaceuticals states, “We are dedicated to the discovery and development of small molecule therapeutics targeting fundamental biological pathways of cancer.”

Along with their dedication to discovery, the company has an impressive track record, which consists of accelerated pipelines fueled by their investors’ cash. According to Zentalis Pharmaceuticals, the company has “cleared three INDs and submitted a fourth to the FDA in five years” due to their “capital efficient” pipelines. To accompany their efficient pipelines, Zentalis Pharmaceuticals is well equipped with an “experienced team,” “composed of industry leaders with proven track records in the discovery, clinical development, and commercialization of innovative cancer therapies.”

Zentalis Pharmaceuticals Lead Candidate

Looking to add to their resume of INDs, Zentalis Pharmaceuticals has, for the past year, been advancing in their studies of their new treatment, ZN-c5. As stated by the company, ZN-c5 is a “treatment of ER+/HER2- advanced or metastatic breast cancer.” The treatment is currently in a Phase 1/2 study, with an intent to be a monotherapy or alone treatment, and also combined with Ibrance®, marketed by Pfizer. This collaboration with Pfizer shows the progress of ZN-c5 and Zentalis Pharmaceuticals’ credibility by working with a Biotech leader.

Along with their advancing studies in ZN-c5, the company recently raised $85 Million to “Accelerate Internally-Developed Clinical-Stage Oncology Pipeline.” This newly raised cash shows great investor sentiment towards this treatment and further accelerates the approval process.

If ZN-c5 can be approved and further used widely for metastatic breast cancer, the treatment could become one of the top streams of revenue for the company. This approval could further legitimize the company and increase investor confidence regarding the company’s pipelines.

Financials

Since Zentalis Pharmaceuticals is a recent IPO, the company has only published one quarterly report from Q1 of 2020. In their Q1 earnings report, Zentalis Pharmaceuticals reported a net loss of $16 million, compared to a loss of $8.7 million in the previous quarter. Other than the company’s net loss, other financials such as assets and liabilities have remained stable.

Although Zentalis Pharmaceuticals is operating at a loss, it is in the early stages of becoming a profitable company through their new treatments. Most of the company’s expenses are found in “Research and Development,” which produced an operating expense of $13 million, compared to $7 million in the previous quarter. Although these expenses may be growing, they also show the growing progress and cash input into their studies, such as ZN-c5.

Stock Performance

Zentalis Pharmaceuticals, under the ticker symbol ($ZNTL), opened to the stock market on April 3rd, 2020. Over the course of two months, Zentalis Pharmaceuticals nearly doubled in stock price. Currently, the stock sits at $44 and is considerably off its all-time high of $59.32.

It does not take a genius to recognize the considerable price movement of Zentalis Pharmaceuticals. With no significant news or revenue increase within the company, the stock rose over 100%. At its current price, the stock is overbought and subsequently dropped 25% in just seven trading days. If ($ZNTL) continues to fall further, a key area of support is found in the high $30s.

With a volatile stock like ($ZNTL), value investors may need to look elsewhere. Although, for investors who are familiar with speculation, Zentalis Pharmaceuticals could represent a buy, with its promising pipelines. The best place to enter a position within ($ZNTL) would be in a consolidation phase, with low volume, since the stock has “cooled off.” IPO stocks can be risky, but if one manages their risk and plans for the future, significant gains can be realized, with Zentalis Pharmaceuticals being no exception.

Future Outlook

A good analogy for Zentalis Pharmaceuticals is like a seed equipped with sunlight, water for nourishment, and a promising environment. Instead of the plant necessities, Zentalis is equipped with good investor sentiment, growing cash, and a speculative, yet promising business.

According to Businesswire, since its inception in 2014, Zentalis Pharmaceuticals “has raised a total of $147 million in gross proceeds from private financings.” Within just six years, the company has raised more money than most Biotech companies do in decades. With Zentalis Pharmaceuticals showing promising results for the future, their investors, such as Matrix Capital, Viking Global Investors, Redmile Group, Farallon Capital, and others, will likely continue to provide cash as the company grows.

Currently, Zentalis Pharmaceuticals has four active pipelines, which could show promising results. Their potential treatments cover a broad range of cancers, which target lung cancer and solid tumors, and are both in Phases 1/2. With their newly raised cash, the company can expand its studies and accelerate its four pipelines, all of which can be promising revenue makers.

Closing and Rating

When an investor buys Zentalis Pharmaceuticals, they are buying into what the company has today and what the company may hold tomorrow. The IPO market, paired with the cancer treatment field, can result in a highly speculative company. Zentalis Pharmaceuticals is no exception to this idea but presents many factors, such as future cash flow, that new start-up companies do not have.

Investors, especially highly speculative ones, should take the effort to invest in Zentalis Pharmaceuticals but at a fair price for the future. With all of this information being said, ($ZNTL) is a strong buy, especially at lower prices.

To follow Analyst John Coughlin, go to:

TikTok: Street Signs

Instagram: Stockmarketsigns

The post ZENTALIS PHARMACEUTICALS: A BIOTECH IPO FOR BREAST CANCER appeared first on Sick Economics.

July 8, 2020

LISTEN UP! AKOUOS, INC IS A HOT IPO

By Lee Rivers, Biotech Analyst

Akouos Inc. is a biotechnology company that is developing therapies aimed to restore and preserve hearing in populations with particular sets of genetics. The company utilizes adeno-associated viral (AAV) vector-based gene therapies to treat a range of forms of hearing loss, from a single genetic mutation to ototoxic drug exposure, in addition to the aging process. Akouos hopes to facilitate the healthcare industry’s ability to treat sensorineural hearing loss efficiently. Akouos had its initial public offering (IPO) on June 29, 2020, raising $212.5 million.

Competition

Akouos, Greek for “to hear,” benefits from limited competition due to the high research and development costs associated with rare gene therapies. However, there are several competitors in this space, and many of them have a similar strategy of expanding to more common causes of hearing loss, making competition among them inevitable. The primary potential competitors include Decibel Therapeutics, Applied Genetic Technologies Corp., Sensorion SA, and Frequency Therapeutics.

Decibel Therapeutics is a private company that is in the drug discovery phase for the treatment DB-OTO, curing congenital otoferlin (OTOF) deficiency in infants. Akouous’s main treatment program under development, AK-OTOF, also treats OTOF-mediated hearing loss, but for all age groups, and is already in the preclinical phase. Akouos also presumably has more direct funding available to move along with its clinical trials and further research, since it recently had a successful IPO. However, Decibel has partnered with Regeneron Pharmaceuticals for a strategic collaboration involving one of its two potential products.

Applied Genetic Technologies Corp (AGTC) and Otonomy, Inc. (OTIC) have also reached a collaboration to co-develop and commercialize an AAV-based gene therapy that is in the preclinical development stage. The gene therapy treats non-syndromic, sensorineural hearing loss resulting from a deleterious mutation of the GJB2 gene. Akouos is also developing a gene therapy for the mutation of the GJB2 gene, and both companies are in the preclinical development stage.

Sensorion SA is a French biotechnology company developing an AAV vector-based gene therapies for the inner ear, including OTOF deficiency, Usher Syndrome, and sudden sensorineural hearing loss. The two former treatments are in preclinical development, while the latter is in phase I/II trials. Sensorion, however, has limited funding available. Its total assets are only about €38 million, and its market capitalization is $52.2 million, yet it lost a staggering €13 million in 2019. The firm also has a collaboration with Institut Pasteur to develop its gene therapies.

Lastly, Frequency Therapeutics (FREQ) is developing an AAV gene therapy for sensorineural hearing loss (SNHL), the most common form of hearing loss, that is the result of damage to hair cells in the inner ear or problems with nerve pathways. These hair cells can be damaged through chronic noise exposure, aging, viral infections, or drugs that are toxic to the ear.

The current treatment option for severe hearing loss is a CI, or a surgical hearing device, as hearing aids are not effective for severe to profound hearing loss. CIs require a two to four-hour surgery that may be incompatible with future biologic therapies. Furthermore, CIs are also not as effective as the potential restoration of normal hearing, as the auditory content they transmit are complex and often of poor quality. Furthermore, they require extensive maintenance and can result in many negative consequences from anatomical movement.

Potential Pipeline

Akouos’s lead product candidate is AK-OTOF, a gene therapy treatment for otoferlin-mediated hearing loss that is in the preclinical development stage. The company expects to have a potential market size of about 7,000 patients. Sensorion and Decibel Therapeutics are also developing a similar gene therapy for the same hearing loss, and all of them are in the preclinical development stage. Akouos plans to submit an investigational new drug application (IND) for AK-OTOF for OTOF-mediated hearing loss to the FDA in 2021, and they expect to report preliminary clinical date in 2022. Phase 1 trials are expected to also begin in 2021.

The company also has a preclinical development program for the mutation of the CLRN1 gene, which results in Usher syndrome type 3A, a disorder that results in the progressive loss of hearing and vision. Usher syndrome type 3a affects nearly 2,000 in the U.S. and Europe. Akouos believes other hereditary deaf-blind disorders will be able to be treated with the AAV vector containing the functional version of the CLRN1 gene. The company expects to identify a candidate for the program in 2020.

Akouos has a third preclinical development program targeting the treatment of monogenic deafness caused by a mutation in the gap of the GJB2 gene. This is one of the most common forms of monogenic deafness. The potential market size is estimated at 200,000 patients in Europe and the United States. Preclinical studies are currently ongoing A candidate for this program is expected to be announced in 2021.

Furthermore, the company has a preclinical AK-antiVEGF program that targets vestibular schwannomas, the most common intracranial tumor. Over 3,000 vestibular schwannoma cases are diagnosed per year in the United States. These tumors cause numerous symptoms and are currently removed through surgical removal or radiation, both of which typically cause lost hearing and may be associated with morbidity. Akouos believes that systemic anti-VEGF therapy involving the AAV vector containing a gene that encodes a secreted anti-VEGF protein potentially could reduce schwannoma volume and improve hearing. The firm recently concluded a pilot non-human primate tolerability study and will be requesting a pre-IND meeting with the FDA in the second half of 2020.

Akouos also has two programs in the discovery stage of development. One program is for autosomal dominant hearing disorder, with the program target expected to be announced in 2021. The other program focuses on the regeneration of hair cells to restore hearing. The World Health Organization estimates that recreation noise exposure puts approximately 1.1 billion children and adults ages 12 to 35 years at risk of hearing loss. This program is also expected to have a target announcement in 2021. As shown by the overlap in the programs of Akouos and its competitors’, the firms are destined to crowd the market in the long-term but Akouos may be able to receive patent protection and leverage its expertise in its main product candidate to reach first-to-market standing.

Financials

Akouos initially aimed to raise $100 million in the IPO, selling 8.33 million shares at $14, but ultimately raised $212.5 million with 12.5 million shares at $17. The firm’s cash and cash equivalents in March 2020 were $120 million, so its current cash and cash equivalents are about $300 million. The firm also had total liabilities of only $21.7 million in March 2020. The proceeds from the IPO will be used to advance the clinical development of AK-OTOF, initiate the development of additional product candidates for ANTI-VEGF, CLRN1, and GJB2, continue preclinical development of other product candidates and development programs, establish internal manufacturing capabilities, and establishing working capital.

The company’s IPO price is slightly greater than its competitors’. Frequency Therapeutics had its IPO in October of 2019 at $13.49, but it is currently trading at $23.25. Applied Genetics Technologies Corp. had its IPO in April of 2014 at $14.55.

Is Akouos a Good Investment for You?

Akouos, Inc. has noteworthy potential if it can receive FDA approval for AK-OTOF as well as a patent on the AAV gene therapy. One profitable gene therapy company has a current price of nearly $75. Akouos plans to apply for expedited regulatory pathways, such as the orphan drug designation, which would allow it to achieve faster approval and funding for its research and development. Nonetheless, Akouos’s competitors have the potential to receive FDA approval of their OTOF therapy earlier, which would limit the Akouos’s potential profits and funding. Consequently, Akouos is an excellent buy for the investor willing to take a significant amount of risk holding this stock for several years with potential for a substantial return, but it is not a stock for the risk-averse. The company’s potential will become increasingly clear as more news becomes available regarding it and its competitors’ preclinical trials.

The post LISTEN UP! AKOUOS, INC IS A HOT IPO appeared first on Sick Economics.

July 7, 2020

INNOVATION IN THEIR BLOOD: FORMA THERAPEUTICS IPO

By Juliette Duguid, Biotech Strategist

Forma Therapeutics Holdings Inc. ($FMTX), founded in 2007 in Watertown, Massachusetts, is a clinical stage biopharmaceutical company that focuses on developing novel therapeutics for those with rare hematologic diseases and cancers. Currently, the company has 3 clinical-stage programs in the works designed to improve patient outcomes, specifically in cohorts that have an otherwise largely unmet need. FT-4202, oral small molecule agonist which is being developed for the treatment of hemolytic anemias, is currently undergoing a Phase 1 trial, during which the safety, tolerability and pharmacokinetics/pharmacodynamics will be evaluated in both healthy volunteers and sickle cell disease patients. In April, FT-4202 was granted Orphan Drug designation by the FDA, which is among two other designations the drug previously received, including Fast Track and Rare Pediatric Disease designation. The title comes with several perks that will ultimately translate to larger profits in the future–for example, 50% tax credit off the clinical drug testing cost and eligibility for market exclusivity for 7 years after approval. If testing proves to be a success and the right to market exclusivity is ultimately granted, the large reduction in competition would be a huge benefit as the drug is marketed to consumers. Additionally, the company is currently developing olutasidenib, otherwise known as FT-2102, a drug designed for the treatment of Acute Myeloid Leukemia (AML). It is a small molecule whose purpose is to bind to and inhibit mutated IDH1 genes. Olutasidenib is currently in the midst of a registrational phase 2 trial (a trial which is initiated with the purpose of providing a basis for Regulatory Authorization of the product), during which its safety and efficacy will be evaluated as a solo agent as well as in conjunction with azacitidine (a form of chemotherapy), specifically in patients with specific requirements, among which are contraindication for standard treatments. In addition, olutasidenib is currently undergoing an exploratory phase 1 trial to test its effectiveness at combating glioma.

The goal of the IPO was to focus on developing more funds for these ventures. Their shares went public on the Nasdaq Global Market on June 19th. In their proposed IPO pricing, the company detailed plans to offer 13,882,352 shares at $20.00 a piece. Apparently, the company had initially only planned to release just under 12 million shares in the $16 to $18 price range. Ultimately, the company ended up raising $278 million during the offering, the lead managers of which were Jefferies, SVB Leerink and Credit Suisse.

As always, it is useful to see what the future of the markets Forma Therapeutics is seeking to attract hold. Take, for example, the sickle cell anemia drug and therapy market, which is projected to grow $1.85 billion from the 2019 to 2023 period, with a CAGR of 11%. According to studies, the sickle cell trait is expected to appear more frequently in the population, disproportionately targeting African Americans, which, although very unfortunate, will produce an increase in demand for sickle cell treatments and therapies, thus allowing the market to grow as predicted. Sickle cell anemia is only one of a range of hemolytic anemias that Forma Therapeutics could treat.

That being said, although Forma Therapeutics seems to be positioned for large growth in the coming years, there are several obstacles they could run into that stunt their ability to thrive. For one, virtually all of the company’s drugs and therapies are still in the clinical phase stages, meaning none have had the opportunity to become FDA approved. That is not to say that this is something that won’t happen in the future, but it would make sense that investors exercise a certain amount of caution in such scenarios. Additionally, there are several other companies that Forma Therapeutics is in competition with to produce drugs similar to FT-4202. Take, for example, IImara, a company that also recently went public in an effort to raise money to advance research on their investigational molecule. Others are searching to find therapeutic alternatives and gene editing fixes for the disease.

Furthermore, the company’s prospectus says that investing in the company “involves a high degree of risk”. It goes on to detail what exactly those risks entail. For one, the company has actually never turned a profit from drug sales due to large operating expenses and suspects it may not become profitable in the foreseeable future. Due to their relatively short operation history, it is impossible to predict with certainty their future successes, and as they progress from a company that has drugs in the clinical development stages to late development and production stages, they may not have the means to support this transition. The document also goes on to explain that the company has mainly financed their ventures through license and collaboration agreements, as well as money from outside investors. The company has been profitable in recent years, but due to the increase in expenses that came with the development of more drug candidates and moving further along with existing ones, (not to mention increasing general and administrative costs associated with maintaining the business) their profits started going negative. This took a severe toll on their shareholders’ equity and will potentially have adverse effects on their working capital for the next several years. If their efforts to raise money prove to be unsuccessful, they may be forced to delay, scale back, or discontinue the development and commercialization of certain drug candidates. The money raised from the public offering certainly helped move the company in the right direction, but they will likely need additional support at this time in order to turn a profit.

The bottom line is, if you’re looking to make quick money from Forma Therapeutics, that won’t happen any time soon. That being said, this seems like a rut they more than likely will be able to escape–they seem to have several promising drug candidates in the works, and the fact that they are targeting a rare disease whose drug market will grow considerably in the coming years is a big plus. Needless to say, however, investors should proceed with caution when it comes to Forma Therapeutics.

The post INNOVATION IN THEIR BLOOD: FORMA THERAPEUTICS IPO appeared first on Sick Economics.

July 6, 2020

POSEIDA THERAPEUTICS: ANOTHER GO AT AN IPO

By: Matthew Rojas, Biotech Financial Analyst

Poseida Therapeutics:

Among the list of companies that plan to go public shortly is Poseida Therapeutics, an up and coming biopharmaceutical company based out of San Diego, California that utilizes genetic engineering technologies to create life-saving cell therapeutics. Genetic engineering is accomplished with the use of recombinant DNA (rDNA) technology that directly alters the genetic makeup of an organism. Presently, the company has several patented technology platforms for gene insertion, gene editing, and gene delivery.

With the use of their genetic engineering technologies, Poseida Therapeutics has developed a range of cell therapies that are currently in its clinical pipeline. Its farthest along candidate is its CAR-T cell therapy, P-BCMA-101, for multiple myeloma; the drug is currently in a potentially registrational phase II clinical trial. CAR-T cell therapy is a form of immunotherapy that uses modified T cells, essential parts of the immune system, to fight cancer. The first step of the modification process is taking samples of patients’ T cells from their blood. The T-cells are then genetically modified using various technologies, creating structures called chimeric antigen receptors (CARs) on their surfaces. When these CAR-T cells are infused into the patients, the CARs enable them to attach to certain antigens on the patients’ tumor cells and kill them.

In May of 2019, the FDA granted P-BCMA-101 orphan drug status, meaning that the company is entitled to financial incentives from the government because it will never profit from a drug for a rare disease like multiple myeloma. With orphan drug status, Poseida Therapeutics has exclusive marketing and development rights, along with other benefits, like tax credits for qualified clinical testing, to help recover the high costs of research and development. This designation is great news for the company because it allows them to continue developing and commercializing the drug knowing that there will be a financial incentive for them and their investors if it is approved.

Beyond P-BCMA-101, Poseida Therapeutics has additional CAR-T therapies for other cancers and gene therapies for rare diseases. For example, its CAR-T therapy for prostate cancer, P-PSMA-101, is currently in phase I clinical trials. Its other CAR-T therapies have investigational new drug applications (INDs) in process or are in pre-clinical trials. On the gene therapy side, the company has two candidates in preclinical studies for ornithine transcarbamylase deficiency (OTC) and methylmalonic acidemia (MMA), two genetic liver diseases.

First Attempt:

In April of 2019, Poseida Therapeutics terminated its plans to IPO and instead settled for $142 million from its Series C funding round, more than half of that money coming from pharmaceutical giant, Novartis. The reason for discontinuing the IPO was because of the government shutdown in early 2019, which caused federal agencies to cease operations. For IPOs, there are usually multiple funding rounds when outside investors have the opportunity to shell out cash in exchange for equity or a partial stake in the company. The seed round of funding is when people such as founders, friends, family, venture capital investors, and others invest their money to help grow the company. Next, once a business has proven itself through key performance indicators such as consistent revenue figures, it may engage in another round of funding called series A funding. After series A funding, series B funding is designed to take the company past the development stage because it has demonstrated its potential for long-term success. Finally, Series C funding is so that companies can further develop new products and scale the company even more. If necessary, some companies may even opt for series D and E funding rounds, and others may need only the seed round and a series A funding round: there is a high degree of variation when it comes to IPO funding.

Second Attempt:

Poseida Therapeutics filed another S-1 document to the SEC on June 19, 2020, indicating that the company is, once again, ready to IPO on the NASDAQ stock exchange under the ticker symbol PSTX. The underwriters of the IPO are Bank of America Securities, Piper Sandler, and William Blair, all well-known and respected investment banks. In the document, it states that the company is looking to raise $115 million by selling shares to the public. About a week after filing for the S-1, Poseida Therapeutics announced that it received $110 million in a series D funding round to continue its CAR-T cell therapy programs. Raising a large amount of money that quickly is a sign that many investors have confidence in Poseida Therapeutics’ future performance in the public space. The question is… just how far in the future are we talking about?

Financial Statements:

Poseida Therapeutics is a growing company incurring high research and development costs, and its financials reflect this reality. According to its balance sheet for the quarter ended March 31, 2020, the company has about $103 million in cash and cash equivalents, which is an 18% decrease from the fourth quarter of 2019 but about a 240% increase from the fourth quarter of 2018. In their S-1, Poseida Therapeutics stated that they were operating at a net losses of $44.4 million and $86.5 million for the years ended December 31, 2018 and 2019, respectively. They also said that their net losses were $13.3 million and $28.8 million for the quarters ended March 31, 2019 and 2020, respectively. The company announced in the S-1, “We expect our expenses and losses to increase substantially for the foreseeable future as we continue our development of, and seek regulatory approvals for, our product candidates”. Given the COVID-19 pandemic, Poseida Therapeutics also admitted that it would be hard to secure additional sources of funding, which they have been relying on, such as debt financings. Overall, the company still has a significant amount of work to do, and their financials will remain on the weaker side until they achieve regulatory approval from the FDA for one of their product candidates.

Competition:

There are currently many companies involved in producing CAR-T therapies and gene therapies including but not limited to Adaptaminne Therapeutics, Astellas Pharma, Merck, Pfizer, and AstraZeneca. Poseida Therapeutics acknowledges that many of its competitors “have substantially greater financial, technical and other resources, such as larger research and development staff”. However, the company may have a competitive advantage when it comes to its dual CAR-T allogeneic program candidates. Their technology platform, piggyBac, allows for two or more CAR molecules in a T-cell, which may be more effective than other companies’ approaches. The company also has promising preclinical data for its liver-directed gene therapy, and this may provide a significant competitive advantage over earlier generation gene therapies. Overall, the competitive advantages that Poseida Therapeutics has are speculative because all of their product candidates are in pre-clinical or early stages of clinical trials besides P-BCMA-101.

Final Recommendation:

Poseida Therapeutics is a perfect example of a company that is still heavily involved in the research and development stage of its various product candidates. Their CAR-T cell therapy, P-BCMA-101, has shown promising results in the phase I clinical trial, and the phase II clinical trial will be underway shortly. Regardless, they are entering a market that is crowded with competitors and, unfortunately, they do not have the finances nor the manpower to keep up. That is not to say that the company will never be successful — they have a multitude of product candidates in their clinical pipeline and, in the distant future, some of them may pan out. However, when the company IPOs in the coming months, I would personally advise holding off on investing until some of their clinical trials are further along.

The post POSEIDA THERAPEUTICS: ANOTHER GO AT AN IPO appeared first on Sick Economics.

July 2, 2020

IMMUNOGEN: A HIDDEN ROSE FOR YOUR BIOTECH GARDEN?

By John Coughlin

Company Overview

ImmunoGen ($IMGN) has stood the test of time within the Biotech industry. Founded in 1981, the company specializes in creating antibody drugs that help fight the spread of cancer. ImmunoGen’s antibody-drug conjugates (ADCs), is stated to “improve outcomes for cancer patients.”

With striving to fight the spread of cancer, ImmunoGen has created the motto of “targeting a better now.” This “better now” can best be seen with the company’s commitment to “A therapy that targets cancer cells where they live, not where you live. This drive to fight the spread of cancer within the human body has put the company at the forefront of cancer treatments and will continue to do so in the future.

Financials

The story of ImmunoGen can best be seen within the company’s past three-year performance, especially in its 2018 financial year. ImmunoGen’s worst year, regarding financials, was 2018, in which the company was operating at a net loss of $168 million. Although this number was near devastating to the company, ImmunoGen bounced back within the 2019 financial year and only incurred a $104 million loss. From 2018 to 2019, the company has seen a nearly $30 million jump in revenue, which has continued into 2020. In ImmunoGen’s most recent quarterly report, the company reported a $5 million increase in revenue, and a $14 million improvement in their net loss, from ($43 million) to ($29 million) within Q1 of 2020. If ImmunoGen continues to report revenue improvements, such as the ones seen before, the company could turn a profit within the following years.

Along with the company’s revenue, ImmunoGen’s cash and cash equivalents, which were $176.2 million as of December 31, 2019, has risen to $247.3 within the first quarter of 2020. This increase was due to ImmunoGen selling “24.5 million shares of its common stock.” With this newly acquired cash, the company can easily weather the storm of Covid-19 and pursue further expansion and studies, as seen in Mark Enyedy, CEO of ImmunoGen, statement: “We are in a strong financial position with our anticipated cash runway extended well into 2022.”

Financials, Including Covid-19

The story of 2020, regarding financial markets, is how Covid-19 has affected the economy and what it means for individual companies. Regarding ImmunoGen, the company has continued to perform at its highest level, regardless of the pandemic. Within the company’s Q1 earnings report, Mark Enyedy, ImmunoGen’s President and Chief Executive Officer, remarked they are “adapting to meet the evolving challenges of the COVID-19 pandemic.”

The company is also continuing to improve their trials, SORAYA, a new single-arm study in platinum-resistant ovarian cancer for women. ImmunoGen, in their anticipated events, stated they are continuing to enroll patients in their pivotal SORAYA trials, which is an excellent sign that the pandemic is not interfering in their advancing treatments.

Stock Performance

The company’s stock price has remained stagnant over the past two years. Before 2019, the company was sitting at $10 per share but drastically fell to a low of $2 due the Covid-19 market crash and the company’s trial of mirvetuximab, which failed in early 2019. Although the company’s stock price may look bleak from an outsider’s perspective, ImmunoGen represents a great buy opportunity, roughly pertaining to the future of the company’s revenue.

As I have mentioned in the previous financial section, ImmunoGen is continuing to increase its revenue year over year. Although the company may be improving regarding financials, its stock performance has not resembled their company performance. Year to date, ($IMGN) is down 10%, even though the company has seen a tremendous quarterly report.

If ImmunoGen can continue to increase its revenue year over year, which is likely to occur, then ($IMGN) may be able to return to a price over the $10 mark, representing a 150% price increase.

Mirvetuximab Soravtansine Trials and Studies

Mirvetuximab Soravtansine is, as suggested by ImmunoGen, “a potential new treatment for patients with folate receptor alpha (FRα)-positive cancer.” In the years prior, the company had been advancing in Phase 3 FORWARD I trial and other trials. Still, the treatment fell short of its desired destination, as quoted to “not result in a progression-free survival improvement” Subsequently, ImmunoGen’s stock price fell dramatically, as mirvetuximab is a central treatment to the company.

Although ImmunoGen fell short of their desired treatment with mirvetuximab, SORAYA, their new study, is on the fast track for approval. This new study, which has acquired many patients, may provide a gateway into a new journey for mirvetuximab and further profitable quarters for ImmunoGen.

Company Outlook

ImmunoGen’s future remains bright. In the past years, SORAYA, a new study for women with ovarian cancer, has gained traction and is at the company’s forefront of their agenda. SORAYA is accelerating the approval process for mirvetuximab, a treatment for ovarian cancer, which had initially failed in early 2019. If the company can get mirvetuximab approved in the upcoming years, ImmunoGen’s revenue will skyrocket, as the treatment is their leading study.

With the advancing technology that ImmunoGen is creating, the company is full of potential. From a study and financial perspective, the company is loaded with $247.3 in cash and cash equivalents to push forward their trial agenda and grow as a company.

Rating

ImmunoGen, with its treatment mirvetuximab, provides an investor with a sense of confidence within the Biotech investing atmosphere. With the company having potential in its financials and potential treatments, ImmunoGen is considered a STRONG BUY. ImmunoGen is finally gaining its needed sunlight to flourish within the Biotech garden.

To follow Analyst John Coughlin, go to:

TikTok: Street Signs

Instagram: Stockmarketsigns

The post IMMUNOGEN: A HIDDEN ROSE FOR YOUR BIOTECH GARDEN? appeared first on Sick Economics.

July 1, 2020

SEATTLE GENETICS, INC: TRAILBLAZING A PATH TOWARDS PROFITS

By Juliette Duguid, Biotech Strategist

Seattle Genetics currently has two phase 1 trials in progress. If the trials are successful and therapies are approved to move on to the next step, this could potentially be very promising news for the company and investors alike. On June 18th, 2020, the company announced “…dosing of the first patient in a phase 1 clinical trial evaluating investigational agent SEA-TGT…”. The testing will involve approximately 111 individuals, and will focus on both the safety and anti-tumor efficacy of the agent in “…advanced solid tumors and lymphomas, including non-small cell lung cancer, gastric carcinoma, Hodgkin, and selected non-Hodgkin lymphomas”. The other phase 1 trial is for SGN-B6A, which is an ADC (otherwise known as anti drug conjugate, which refers to a class of biopharmaceutical drugs designed for cancer therapy treatment) that targets integrin beta 6 to deliver the previously clinically validated payload monomethyl auristatin E (MMAE). This study is expected to enroll 235 participants and explore the effects of SGN-B6A on solid tumors such as those found in breast, esophageal, ovarian, bladder, and cervical cancers, among others. The company is hopeful that these therapeutic agents will prove to be both safe and effective, but a number of things could potentially stand in their way, such as trial results that prove to be virtually inconclusive, as well as regulatory actions that may get in the way of further testing.

Adcetris, a drug that stops the growth of cancer cells in the body, was virtually the only product Seattle Genetics was producing last year. Now, that it has introduced other drugs and therapies into the market, profitability have grown considerably–in fact, market shares are reportedly up 14.6% since the company’s last earnings report, outperforming the S&P 500 in the same time frame. Earlier this year, another Seattle Genetics drug became FDA approved–an antibody drug conjugate known as Padcev. According to an American Cancer Society report, Padcev can treat patients with advanced urothelial carcinoma if past experiences with standard chemotherapy and immunotherapy treatments proved to be unsuccessful. The approval of the drug was based on a clinical trial of 125 advanced urothelial carcinoma patients who had already received platinum chemotherapy treatment. This is great news for the company, as Padcev is the first drug meant for this patient group to become FDA approved. Furthermore, in April, shares went up 1% when the FDA approved Tukysa, which is a drug meant for those with HER2-positive breast cancer that has metastasized to areas of the body such as the brain, or that cannot be surgically removed.

Adcetris generated net sales of around $164.1 million, which is up 22% year to year. Padcev, in the first quarter since its release, has generated $34.5 million in revenue. Seattle Genetics has many Anti Drug Conjugate (ADC) license agreements with companies such as AbbVie, Astellas, Bayer, Genentech, GlaxoSmithKline, and Progenics, which lead to collaboration and license agreement revenues of $15.6 million, which was up 65% year over year.

As always, with any biotech company, it’s important to look into the way Seattle Genetics approaches research and development to evaluate how much emphasis they place on creating and improving. According to a statement on the company’s website, they “…conduct rigorous research and development in areas of serious unmet medical need…” , which is a strong indication of the fact that they will continue to be profitable and competitive. Companies that have successfully done what has seldom been accomplished before (i.e., creating drugs and therapies targeted at an often overlooked cohort of the population) have the wherewithal to grow bigger, no matter the setbacks they experience. For Seattle Genetics, this year’s research and development expenses were approximately $195.2 million, up 23.3% year over year. Overall, projections for revenue in 2020 are in the $675 to $700 million dollar range.

The reason why Seattle Genetics is such a good choice for any investor is because the company is targeting a very large population of people–those with cancer, seeking treatment. Take, for example, the lymphoma treatment market, which has a value of $11.7 billion in 2018, and is expected to grow at a compound annual growth rate of 9.5% over the forecast period. The breast cancer drug market has similar projections–in 2017, it was valued at $16.98 billion in the United States and is expected to have a CAGR of 10.7% over the forecast period. In fact, you’ll recall that Seattle Genetics had recently gotten an FDA stamp of approval for a HER2 type breast cancer treatment–turns out, due to growing number of cases, HER2 is regarded as the most lucrative segment of the overall breast cancer market. As grim as it sounds, markets for all types of cancers will continue to provide many effective treatments in lieu of an actual cure–it is economically feasible for them to continue to do so. Biotech companies are motivated to come up with the best medicines so their patients live longer and thus, spend more money on drugs and treatments they need to survive. Seattle Genetics managed to experience a tremendous amount of growth by simply capitalizing on this market –according to Nasdaq’s historical data, the stock closing price on June 24th, 2019 was $70.11, and on June 24th, 2020, the closing price was $164.80, which indicates an increase of 135%. Now, they have several other treatment therapies in the works, and there really is no telling how big they can get in the coming years.

The post SEATTLE GENETICS, INC: TRAILBLAZING A PATH TOWARDS PROFITS appeared first on Sick Economics.