Mike Michalowicz's Blog, page 15

April 2, 2024

Why Risks Get Attention in Your Marketing

“Our own fear of standing out is the number one reason we don’t get noticed.”

In my book, Get Different, I talk a lot about the importance of standing out from the crowd and doing things differently. But here’s the thing: to truly succeed in marketing, you’ve got to be brave. You’ve got to be willing to take risks, push the boundaries, and step outside your comfort zone. So, how do you do it? How do you cultivate that bold mindset that’s essential for brave marketing?

Fail! – First and foremost, it’s all about embracing failure. Yep, you heard me right. Failure isn’t something to be feared; it’s something to be embraced. Because every failure is an opportunity to learn and grow. It’s a chance to course-correct, pivot, and come back stronger than ever. Don’t let the fear of failure hold you back. Learn from it, and use it to fuel your journey towards marketing greatness.

Take that risk – Next up, let’s talk about taking risks. Now, I get it – taking risks can be scary. But the biggest risks often yield the most attention and the biggest rewards. I encourage you to think outside the box, try new things, and shake things up. Whether it’s launching a bold new ad campaign, experimenting with a quirky marketing stunt, or completely rebranding your business, taking risks will get you seen in a crowded marketplace.

Still feeling unsure? Let’s back it up with some science.

Reticular formation is a region in the brain stem that is involved in multiple tasks such as regulating the sleep-wake cycle and filtering incoming stimuli to discriminate irrelevant background stimuli. It is essential for governing some of the basic functions of higher organisms and is one of the phylogenetically oldest portions of the brain.

Basically, reticular formation helps people weed out the things that are irrelevant and helps us ignore certain things that are going on in our lives. The cool thing is that it can jerk us out of a stupor when something unfamiliar happens. this is why you must get brave, take a chance, and do something novel that gets that reticular formation looking twice.

Brave marketing isn’t just about taking risks for the sake of it. It’s about taking calculated risks. It’s about doing your homework, gathering data, and making informed decisions. Because while being brave is important, being reckless isn’t. So before you dive headfirst into that daring new marketing strategy, take a step back, do your due diligence, and make sure you’re making the best possible decision for your business.

At the end of the day, brave marketing isn’t easy. It takes courage, determination, and a willingness to embrace the unknown. But trust me when I say this: the rewards are well worth it. So don’t be afraid to be bold, take risks, and stand out from the crowd. Because when you do, amazing things happen.

I know you’ve got this.

-Mike

Join me for a deep dive into your marketing and let’s get your business seen – The free Get Noticed Crash Course starts on April 22nd. Save your spot here now!

Last I saw there was a discount! Get Profit First for you or a friend at Amazon , Barnes & Noble , or any of your favorite booksellers.

The post Why Risks Get Attention in Your Marketing appeared first on Mike Michalowicz.

March 28, 2024

Marketing to Stop Their Scroll

Know what your marketing needs? It needs to pass the blink test.

“Ok, ok, Mike, what in the world is the blink test?” Picture this: You’re scrolling (and scrolling) through your social media feed, bombarded with ads left and right. In the blink of an eye, you decide whether to stop and engage with a post or keep on scrolling.

That, my friends, is the blink test in action.

You have one millisecond to make an impression. The blink test is inspired by the concept of the “blink” or “thin-slicing” phenomenon, where individuals make quick judgments or decisions based on limited information. It’s science.

The best example I’ve seen of this lately is on the Liquid Death water cans. Cans of water are starting to replace plastic bottles, so that grabs attention. Additionally, the labels have a skull, and different names like Mountain Water and Berry it Alive for the flavored waters. No other water is marketed like this.

Why you need to make a radical change to your marketing: To serve, you have to sell. To be profitable, you have to sell. To sell, you need to stand out – and I mean out. I’m not discounting that you may be the best in your industry. But, you must pass the blink test with flying colors. You can make a transformative change in your marketing with small steps. Here are a few strategies I’ve found to be particularly effective:

Keep it simple: Your message should be clear, concise, and easy to understand at a glance. Avoid jargon and complex language that might confuse or turn off your audience.

Be distinct: Stand out from the crowd with eye-catching visuals, catchy slogans, or unique branding elements. You want your business to be the one that sticks in people’s minds long after they’ve scrolled past.Know your audience: Tailor your marketing efforts to resonate with your target audience’s needs, interests, and preferences. The more you understand your audience, the better equipped you’ll be to grab their attention and hold onto it.Be authentic: People crave authenticity in today’s digital age. Be genuine, transparent, and true to your brand values in all of your marketing communications. Authenticity breeds trust, and trust leads to loyal customers.Test and iterate: Don’t be afraid to experiment with different marketing strategies and messages. Do some A/B testing to see what works and what doesn’t, and use that feedback to refine your approach over time.Remember, the blink test isn’t just about getting people to stop and notice your business – it’s about making a meaningful connection that leads to long-term loyal relationships. So the next time you’re crafting a marketing message, ask yourself, “Would it pass the blink test? Would I buy from me?”. If not, it might be time to go back to the drawing board.

Keep evolving. You’ve got this!

-Mike

PS – Last I saw there was a discount! You can grab a copy of Get Different for you or a friend at Amazon, Barnes & Noble, or any of your favorite booksellers.

Join me on the journey:

Instagram

LinkedIn

The post Marketing to Stop Their Scroll appeared first on Mike Michalowicz.

March 26, 2024

A Quick Marketing Strategy Guide – With a Twist

Ah, marketing, it’s that marketing has a very real trial-and-error aspect to it.

Yesterday I announced that it was launch day for my new romantic comedy, Love Between the Margins. Didn’t know I’m a fiction writer, now, did you?

When folks clicked on the link for the book, it brought them to an April Fool’s pop-up on my page for the Get Noticed Crash Course. Will this convert? So far so good.

I have two questions for you:

What was your best marketing idea?What was your worst?Business owners get these ideas (usually inconveniently in the middle of the night or in the shower) and think, “THIS is it! This will be the idea that my prospective clients and customers won’t be able to resist!”

Yet they do. Many of them do resist. And many of them never even noticed your marketing at all.

Ouch.

What happened? It was a great idea. You strategized. You didn’t go into it all willy-nilly. So what gives? I mean come on!

Invisibility in your marketplace is killing your business. Maybe slowly, maybe faster, but it’s obviously, well, sucky. Here are just a few simple reasons why you’re invisible and what you can do about it today.

Why they don’t see you

We are cave people: In Get Different I wrote about our innate caveman responses. I mean. Are we humans really made for this much input? I’d argue no, not at all. Think about the first men – they were in survival mode. This means they tuned out noise unless it was something to eat or run away from. Industrialized or not, we’re still wired in the same ways. Remember that your message has to make your prospects see, feel, and act. Lack of consistency and weak messaging: Consistency is key in marketing. If a company’s messaging is inconsistent across different channels or over time, it can confuse consumers and dilute the brand’s identity, making it harder for messages to break through the noise. And, if your marketing message is unclear, bland, or unmemorable, it’s less likely to grab the audience’s attention and make an impact. Poor targeting: Something you must audit in your marketing is your customer. Do you really know who they are, or do you just assume? And, where are your customers? Insert yourself into their worlds such as social media, masterminds, and speaking events.OK, now what?

Don’t be afraid to edit your marketing strategies and be different. Earlier I asked what your best and worst marketing strategies were. I’ll share mine:

My best marketing idea: One of the best marketing ideas I’ve had, truly, is being different and not being afraid to take a risk on a new tactic. I can’t give away all the secrets (that’s what the Crash Course is for), but one technique stands out. When I was launching my last book we had a lot of social proof. From readers’ testimonials to posts holding the book, it was an ideal way for other people to lend weight to the marketing effort.My worst marketing idea: When we were launching Fix This Next we wanted to draw attention to the book in a new and different way. So we created Drink This Next. I was so excited about it and I did a lot of investigation to try to figure out a hollowed-out book with a flask…and it was a dud.What to do.

Know your avatar: Make sure you know who your offering can serve. You may think you know, but take a closer look at what problem your service solves for your customers and clients – that should be your focus.Get personal and be relevant: If a marketing message doesn’t resonate with your target audience or address their specific needs and interests, it’s more likely to be ignored. Your prospective clients and customers are more likely to engage with content that is personally relevant to them.Messaging – be authentic: Strong, compelling messaging that communicates the unique value proposition of a product or service is key to standing out. Think of eye-catching visuals and buzzwords that make your prospect take notice immediately. And, while you’re doing that, maybe avoid the wacky waving inflatable that you see at car dealerships.I know. This is a bit to digest and takes some work. I think when many of us started our businesses we were so cash-flow driven that marketing took a back seat. Get that baby in the driver’s seat and make some noise so they can see you!

Wishing you success, health, and wealth.

-Mike

Join me on the journey:

Last I saw there was a discount! Get Get Different for you or a friend at Amazon , Barnes & Noble , or any of your favorite booksellers.

Are you on TikTok? I am! Meet me there.

The post A Quick Marketing Strategy Guide – With a Twist appeared first on Mike Michalowicz.

No One Sees You – A Quick Marketing Strategy Guide

Ah marketing. If there’s anything we learned from this video, it’s that marketing has a very real trial and error aspect to it (and, that even my butt flex at the end didn’t translate into sales!).

I have two questions for you:

What was your best marketing idea?What was your worst?Business owners get these ideas (usually inconveniently in the middle of the night or in the shower) and think, “THIS is it! This will be the idea that my prospective clients and customers won’t be able to resist!”

Yet they do. Many of them do resist. And many of them never even noticed your marketing at all.

Ouch.

What happened? It was a great idea. You strategized. You didn’t go into it all willy-nilly. So what gives? I mean come on!

Invisibility in your marketplace is killing your buysiness. Maybe slowly, maybe faster, but it’s obviously, well, sucky. Here are just a few simple reasons why you’re invisible and what you can do about it today.

Why they don’t see you

We are cave people: In Get Different I wrote about our innate caveman responses. I mean. Are we humans really made for this much input? I’d argue no, not at all. Think about the first men – they were in survival mode. This means they tuned out noise unless it was something to eat or run away from. Industrialized or not, we’re still wired in the same ways. Remember that your message has to make your prospects see, feel, and act. Lack of consistency and weak messaging: Consistency is key in marketing. If a company’s messaging is inconsistent across different channels or over time, it can confuse consumers and dilute the brand’s identity, making it harder for messages to break through the noise. And, if your marketing message is unclear, bland, or unmemorable, it’s less likely to grab the audience’s attention and make an impact. Poor targeting: Something you must audit in your marketing is your customer. Do you really know who they are, or do you just assume? And, where are your customers? Insert yourself into their worlds such as social media, masterminds, and speaking events.Ok, now what?

Don’t be afraid to edit your marketing strategies and be different. Earlier I asked what your best and worst marketing strategies were. I’ll share mine:

My best marketing idea: One of the best marketing ideas I’ve had, truly, is being different and not being afraid to take a risk on a new tactic. I can’t give away all the secrets (that’s what the Crash Course is for), but one technique stands out. When I was launching my last book we had a lot of social proof. From readers’ testimonials to posts holding the book, it was an ideal way for other people to lend weight to the marketing effort.My worst marketing idea: When we were launching Fix This Next we wanted to draw attention to the book in a new and different way. So we created Drink This Next. I was so excited about it and I did a lot of investigation to try to figure out a hollowed-out book with a flask…and it was a dud.What to do.

Know your avatar: Make sure you know who your offering can serve. You may think you know, but take a closer look at what problem your service solves for your customers and clients – that should be your focus.Get personal and be relevant: If a marketing message doesn’t resonate with your target audience or address their specific needs and interests, it’s more likely to be ignored. Your prospective clients and customers are more likely to engage with content that is personally relevant to them.Messaging – be authentic: Strong, compelling messaging that communicates the unique value proposition of a product or service is key to standing out. Think eye-catching visuals and buszzwords that make your prospect take notice immediately. And, while you’re doing that, maybe avoid the wacky waving inflatable that you see at car dealerships.I know. This is a bit to digest and takes some work. I think when many of us started our businesses we were so cash flow driven that marketing took a back seat. Get that baby in the driver seat and make some noise so they can see you!

Wishing you success, health, and wealth.

-Mike

Join me on the journey:

Last I saw there was a discount! Get Profit First for you or a friend at Amazon , Barnes & Noble , or any of your favorite booksellers.

Are you on TikTok? I am! Meet me there.

The post No One Sees You – A Quick Marketing Strategy Guide appeared first on Mike Michalowicz.

March 25, 2024

“Profit” Isn’t a Dirty Word – Why You Should Master Profit Distribution vs. Owner’s Compensation

Since writing Profit First, I’ve heard quite a few comments (and eye rolls) over the word, “profit”, itself. This always makes me curious. What’s so bad about making a profit?

Making a profit gets a bad rap. Here’s why:

Misconception about profit: Some individuals might associate profit with greed or exploitation, believing that it comes at the expense of others. This misconception overlooks the fact that profit is essential for the sustainability and growth of businesses.Negative corporate practices: Instances of unethical business practices, where profit is pursued at the expense of employees, customers, or the environment, can tarnish the reputation of profit-oriented initiatives. I do feel that today, there are more businesses with integrity and truly put good out into the world.Emphasis on social responsibility: In an era where corporate social responsibility and ethical business practices are increasingly valued, some people view profit-centric approaches as incompatible with broader societal well-being.Fear of exploitation: People may fear being taken advantage of by businesses solely focused on profit maximization, leading to skepticism or resistance towards profit-centric strategies.

I get it – and, another way of looking at profit is that it’s essential. You do have to recognize that profit, when earned ethically and responsibly, serves as a vital metric of your business success. It enables reinvestment in the business, job creation, innovation, and ultimately, the ability to make a positive impact on employees, customers, and communities.

Profit is a fundamental aspect of financial management aimed at ensuring the long-term viability and prosperity of your businesses.

Ok, now that’s out of the way. Let’s look at the difference between the owner’s comp and your profit.

Central to the Profit First methodology is the clear distinction between profit distribution and owner’s compensation, a concept that can significantly impact the financial health and longevity of your business.

Profit is non negotiable. It builds wealth for your business.

Profit distribution refers to setting aside a predetermined percentage of revenue for the business’s profit accounts. This allocation is separate from other accounts, such as operating expenses or taxes, and is intended to accumulate over time to build wealth for the business owner. By prioritizing profit distribution, you’ll create a sustainable financial foundation that enables long-term growth and stability.

Here’s the breakdown:

Profit distribution is all about strategically allocating your profits to ensure financial stability, growth, and prosperity for your business.

When you’ve mastered the management of your cash flow to this degree, you’ll not only sustain a thriving business that generates revenue but also prioritizes profit and personal well-being. And that? That allows you to put even more good into the world.

I am wishing you tremendous success!

-Mike

Join me on the journey: (Are you on TikTok? I am if you want to meet me there.)

Last I saw there was a discount! Get Profit First for you or a friend at Amazon, Barnes & Noble, or any of your favorite booksellers.

Instagram, LinkedIn

The post “Profit” Isn’t a Dirty Word – Why You Should Master Profit Distribution vs. Owner’s Compensation appeared first on Mike Michalowicz.

March 12, 2024

Mastering Profit First: Master Your Percentage Allocations

At its core, Profit First is all about flipping the script on traditional accounting and prioritizing profit from day one. One of the key pillars of Profit First is percentage allocation—the art and science of dividing your revenue into different buckets to ensure financial health and sustainability.

Let’s break it down step by step and explore how to allocate percentages using the Profit First method:

Profit (5-10%): First things first, let’s talk about profit—the lifeblood of your business. With Profit First, we flip the script and prioritize profit over expenses. Allocate a percentage of your revenue (ideally 5-10%) to your profit account right off the top. This ensures that you’re paying yourself first and building a financial cushion for the future.Owner’s Compensation (30-50%): Next up, let’s talk about owner’s compensation—the money you pay yourself for your hard work and dedication. Allocate a percentage of your revenue (typically 30-50%) to your owner’s compensation account. This ensures that you’re fairly compensated for your efforts and can enjoy the fruits of your labor.Operating Expenses (50-60%): Now, let’s turn our attention to operating expenses—the costs associated with running your business. Allocate a percentage of your revenue (typically 50-60%) to your operating expenses account. This covers everything from rent and utilities to payroll and supplies, ensuring that you have the funds needed to keep your business running smoothly.Tax (15-20%): Ah, taxes—the inevitable reality of business ownership. With Profit First, we take a proactive approach to taxes by allocating a percentage of our revenue (typically 15-20%) to our tax account. This ensures that you have the funds set aside to cover your tax obligations and avoid any nasty surprises come tax time.Profit First (5-10%): Last but not least, let’s circle back to profit. In addition to allocating a percentage of your revenue to your profit account upfront, consider implementing a Profit First allocation at regular intervals (e.g., quarterly or annually). This allows you to further bolster your profit reserves and celebrate your success along the way.By following the Profit First method and allocating percentages to your profit, owner’s compensation, operating expenses, tax, and profit first accounts, you can take control of your finances, prioritize profit, and build a financially sustainable business for the long haul.

The post Mastering Profit First: Master Your Percentage Allocations appeared first on Mike Michalowicz.

March 7, 2024

Interview with Kasey Compton, Author of In Search of You

Life’s journey can be complex – including our business journey. In Search Of You, by Kasey Compton, beautifully captures the essence of finding joy when the usual path falls short. It’s a captivating read that has the power to transform perspectives.

Kasey is a therapist, business owner, and author. In our interview, we talk about, well, a lot. From how we’ve evolved as people, business owners, and leaders to the realization that what our ideas of fulfillment were before we started our business have evolved too. And mostly, how to maintain joy in the journey.

One big takeaway for me from this interview is how much this interview served me in assessing my own mental health and wellness.

I’ve personally experienced the impact of In Search Of You, and it’s a breath of fresh air. Kasey’s insights are not only relatable but also inspiring. The book offers a roadmap to genuine and lasting joy, especially when the usual strategies seem to be missing the mark.

I highly recommend everyone pick up a copy of this book! I think you’ll be glad you did. You can grab it here.

Wishing you health and wealth always.

-Mike

The post Interview with Kasey Compton, Author of In Search of You appeared first on Mike Michalowicz.

March 5, 2024

The Profit First Formula Explained

Man, do I get hassled about the Profit First formula.

Let me be clear, I do believe following the GAAP (Generally Accepted Accounting Principles) is important so that when the time comes, you are prepared to submit taxes, financial statements for investors. However, using the GAAP as your primary accounting method is the wrong way to grow a hugely profitable business.

Replacing GAAP to track spending, enhance cash-flow management and assess the health of your company makes sense, you may just be afraid to go against what “everyone knows.”

Hot tip/reminder – Just because something appears to be true and “everyone” goes along with it, doesn’t mean it makes sense – and it doesn’t make it true.

The GAAP (Generally Accepted Accounting Principles) formula for determining a business’s profit is Sales – Expenses = Profit. It is simple, logical, and clear. While logically accurate, it doesn’t account for human behavior. In the GAAP formula profit is a leftover, something that is hopefully a nice surprise at the end of the year. Alas, the profit is rarely there and the business continues on its check-to-check survival.

With Profit First, you flip the formula to Sales – Profit = Expenses. Logically the math is the same, but from the standpoint of the entrepreneur’s behavior, it is radically different. With the Profit First formula, you take a predetermined percentage of profit from every sale first, and only the remainder is available for expenses.

Profit First encourages you to continue “bank balance accounting” by first allocating money to profit (and other accounts) so that the actual portion of deposits that are available for expenses and you automatically adjust spending accordingly.

This principle doesn’t try to change your habits (that is nearly impossible to do), Profit First works with your existing habits. By first allocating money to different accounts, and then removing the temptation to “borrow” from yourself, your business will become fiscally strong and you will benefit from regular profit distributions.

Let’s get into some details:

Profit First Allocation: In traditional GAAP accounting, profit is typically seen as what’s left over after all expenses are paid. But when revenue is allocated into different bank accounts based on predetermined percentages for profit, owner’s pay, taxes, and operating expenses, it ensures that profit is not an afterthought but a fundamental aspect of your financial management.Behavioral Approach: We’re human, and our habits determine our outcome. By setting up automatic allocations and creating clear boundaries for spending, Profit First helps you develop healthier financial habits.Simplicity and Clarity: GAAP accounting can be complex and overwhelming, especially for entrepreneurs without a background in finance. The Profit First methodology breaks down financial management into straightforward concepts and actionable steps, making it easier for business owners to implement and understand.Focus on Cash Flow: Prioritizes cash flow! When you ensure your business always has enough funds set aside for profit, taxes, and owner’s pay, it helps you avoid cash flow crises and maintain financial stability.Real-Time Monitoring: Traditional GAAP accounting often involves reviewing financial statements periodically, usually on a monthly or quarterly basis. Real-time monitoring of finances through regular check-ins with Profit First bank accounts. This provides you with up-to-date information on your financial health and enables you to make proactive decisions to stay on track with your financial goals.What are you waiting for? If you haven’t already, flip that accounting model and make profit a habit! Your company, employees, clients, heck your dog, will thank you!

Wishing you good health and wealth, always!

-Mike

Join me on the journey:

Last I saw there was a discount! Get Profit First for you or a friend at Amazon , Barnes & Noble , or any of your favorite booksellers.

Profit First works with your existing habits. By first allocating money to different accounts, and then removing the temptation to “borrow” from yourself, your business will become fiscally strong and you will benefit from regular profit distributions. – MM

The secret to financial success is to pay yourself first – MM

The post The Profit First Formula Explained appeared first on Mike Michalowicz.

The Profit First Formula

Man, do I get hassled about the Profit First formula.

Let me be clear, I do believe following the GAAP (Generally Accepted Accounting Principles) is important so that when the time comes, you are prepared to submit taxes, financial statements for investors. However, using the GAAP as your primary accounting method is the wrong way to grow a hugely profitable business.

Replacing GAAP to track spending, enhance cash-flow management and assess the health of your company makes sense, you may just be afraid to go against what “everyone knows.”

Hot tip/reminder – Just because something appears to be true and “everyone” goes along with it, doesn’t mean it makes sense – and it doesn’t make it true.

The GAAP (Generally Accepted Accounting Principles) formula for determining a business’s profit is Sales – Expenses = Profit. It is simple, logical, and clear. While logically accurate, it doesn’t account for human behavior. In the GAAP formula profit is a leftover, something that is hopefully a nice surprise at the end of the year. Alas, the profit is rarely there and the business continues on its check-to-check survival.

With Profit First, you flip the formula to Sales – Profit = Expenses. Logically the math is the same, but from the standpoint of the entrepreneur’s behavior, it is radically different. With the Profit First formula, you take a predetermined percentage of profit from every sale first, and only the remainder is available for expenses.

Profit First encourages you to continue “bank balance accounting” by first allocating money to profit (and other accounts) so that the actual portion of deposits that are available for expenses and you automatically adjust spending accordingly.

This principle doesn’t try to change your habits (that is nearly impossible to do), Profit First works with your existing habits. By first allocating money to different accounts, and then removing the temptation to “borrow” from yourself, your business will become fiscally strong and you will benefit from regular profit distributions.

Let’s get into some details:

Profit First Allocation: In traditional GAAP accounting, profit is typically seen as what’s left over after all expenses are paid. But when revenue is allocated into different bank accounts based on predetermined percentages for profit, owner’s pay, taxes, and operating expenses, it ensures that profit is not an afterthought but a fundamental aspect of your financial management.Behavioral Approach: We’re human, and our habits determine our outcome. By setting up automatic allocations and creating clear boundaries for spending, Profit First helps you develop healthier financial habits.Simplicity and Clarity: GAAP accounting can be complex and overwhelming, especially for entrepreneurs without a background in finance. The Profit First methodology breaks down financial management into straightforward concepts and actionable steps, making it easier for business owners to implement and understand.Focus on Cash Flow: Prioritizes cash flow! When you ensure your business always has enough funds set aside for profit, taxes, and owner’s pay, it helps you avoid cash flow crises and maintain financial stability.Real-Time Monitoring: Traditional GAAP accounting often involves reviewing financial statements periodically, usually on a monthly or quarterly basis. Real-time monitoring of finances through regular check-ins with Profit First bank accounts. This provides you with up-to-date information on your financial health and enables you to make proactive decisions to stay on track with your financial goals.What are you waiting for? If you haven’t already, flip that accounting model and make profit a habit! Your company, employees, clients, heck your dog, will thank you!

Wishing you good health and wealth, always!

-Mike

Join me on the journey:

Last I saw there was a discount! Get Profit First for you or a friend at Amazon , Barnes & Noble , or any of your favorite booksellers.

Profit First works with your existing habits. By first allocating money to different accounts, and then removing the temptation to “borrow” from yourself, your business will become fiscally strong and you will benefit from regular profit distributions. – MM

The secret to financial success is to pay yourself first – MM

The post The Profit First Formula appeared first on Mike Michalowicz.

February 28, 2024

Get Out of the Survival Trap – For Good

How many decisions did you make for your business last year? Decisions to solve a problem, fix a mistake, decide whether or not to take advantage of an opportunity, add a new product or service to your offerings, or try a new marketing strategy. No doubt you made a lot of decisions last year and put out a lot of fires. Phew.

Now, let me ask you this: Did any of those decisions move your business forward in a big way? Did your company see record growth? Were you able to step back from the grind of doing all the things and let your team run things? Did you make a significant impact in your clients’ lives? In your community? In your industry? If you answered yes, I’m stoked for you. If you answered no, welcome to the common experience of business ownership. Or what’s better known as the Survival Trap.

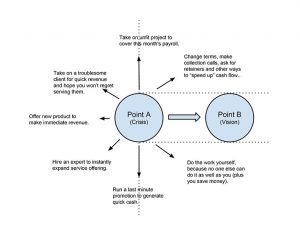

So, what exactly is this trap that so many of us find ourselves in? Well, picture this: you’re running your business day in and day out, but no matter how hard you work, it feels like you’re barely treading water. You’re just scraping by, living paycheck to paycheck, with little to show for it in terms of profit or financial stability. That, my friends, is the Survival Trap in action.

Let me break it down for you. The Survival Trap is a vicious cycle where businesses struggle to make ends meet, constantly playing catch-up with bills and expenses. It’s like running on a hamster wheel, working tirelessly just to stay in the same place. And trust me, I’ve been there myself.

What makes the Survival Trap so insidious is that it’s not just about the numbers on your balance sheet. It takes a toll on your mental and emotional well-being too. The stress, the worry, the constant uncertainty – it can all lead to burnout faster than you can say “profit margins.”

The Survival Trap is deceptive because it fools us into thinking we are at least inching toward our vision, as if our reactionary behavior is actually “smart” or evidence of our good instincts, and will eventually lead us to the promised land: financial freedom. When it comes to our business’s (lack of) cash flow, we often throw our few remaining dollars at the immediate problems and opportunities, hoping that profit will magically materialize.

When it comes to our time, we burn out ourselves and our people by working even longer hours, constantly putting out fires, and chasing arbitrary quarterly targets instead of building sustainable systems. And when it comes to fixing the business, we find ourselves patching up the obvious problems, only to wonder why they keep reoccurring over and over again.

The way out is through implementing the Profit First system. It offers a transformative solution to the Survival Trap by prioritizing profit through the allocation of revenue into separate accounts dedicated to profit, owner’s compensation, taxes, and operating expenses. Then, your profit will be a priority, not an afterthought.

This approach to financial management ensures that you won’t have to constantly chase money down and breaks the cycle of seeking cash to cover expenses. You’ll create a sustainable financial foundation that fuels growth and resilience for the long game.

Wishing you tremendous success!

-Mike

Last I saw there was a discount! Get Profit First for you or a friend at Amazon , Barnes & Noble , or any of your favorite booksellers.

Join me on the journey: Instagram LinkedInThe post Get Out of the Survival Trap – For Good appeared first on Mike Michalowicz.