Chris Shayan's Blog, page 2

August 31, 2025

The Other Side of AI

The excitement around AI (whatever it means lately) is undeniable. From optimizing supply chains to personalizing customer experiences, the potential for AI to drive business value is constantly in the spotlight.

However, amid the hype, a crucial conversation is missing: the true cost of AI.

It’s not just about the initial software and talent expenses; it’s about the significant, often invisible, financial and environmental burdens that come with AI adoption.

The Environmental Footprint of AIWe oft...

August 25, 2025

Financial Well Being AI Coach

One of the things I enjoy about business trips is the uninterrupted time they provide for reading. The longer the trip, the better. On my last one, I read Peter Godfrey-Smith’s Other Minds. It challenges the human-centric view of what it means to be conscious and opens up a new world of possibilities.

His masterful blend of biology, philosophy, and personal observation makes a compelling case for a distributed and embodied form of consciousness. I was particularly drawn to “Conscious Experience,”...

August 13, 2025

DevEx Ambient Agent with Advanced Knowledge Graph

You can find the code in https://github.com/chrisshayan/devex-agent

As developers, we all face friction points throughout the day — from repetitive tasks to sifting through documentation or getting stuck on a challenging bug. The Agentic DevEx Assistant was built to help with these challenges by acting as a developer’s co-pilot. Instead of just generating code, this tool works alongside you, proactively offering contextual assistance, automating common tasks, and helping you navigate your team’s ...

July 24, 2025

Predictions with Ensemble Learning in Agentic Treasury

UNC Bands | Wind Ensemble, Symphonic Band, Concert Band, Marching Band

UNC Bands | Wind Ensemble, Symphonic Band, Concert Band, Marching BandIn my Agentic Treasury and Liquidity Management (TLM), I shared about my latest open source Agentic TLM on GitHub. In this post, I like to talk about the ML technique that was used in Cash Flow Forecasting Agent (CFFA) — “The Oracle” agent.

Ensemble learning is a machine learning paradigm where multiple models, often referred to as “weak learners,” are trained to solve the same problem and then combined to achieve better perfor...

July 20, 2025

My Journey into Digital Biology: Building an Agentic Worm with OpenWorm and LangGraph

Hello everyone! Today, I’m genuinely excited (and a little nervous!) to share a project that’s been fueled by my deep curiosity about digital biology and the incredible potential of AI: Agentic Worm. You can find the repository now on GitHub at https://github.com/chrisshayan/agentic-worm.

For a while now, I’ve been fascinated by the idea of bridging the gap between biological simulation and artificial intelligence. How does something as seemingly simple as a worm move, react, and even “decide”? T...

July 6, 2025

Agentic Treasury and Liquidity Management (TLM)

What is Treasury and Liquidity Management (TLM)?

What is Treasury and Liquidity Management (TLM)?Treasury and Liquidity Management (TLM) is the strategic backbone of a bank’s financial health. At its core, TLM is about optimizing the flow and availability of cash (liquidity), managing financial risks, and ensuring the bank can meet its obligations at all times, both short-term and long-term.

It’s critical for banks because it directly underpins their financial stability and solvency, especially in volatile markets, by ensuring there’s always en...

June 29, 2025

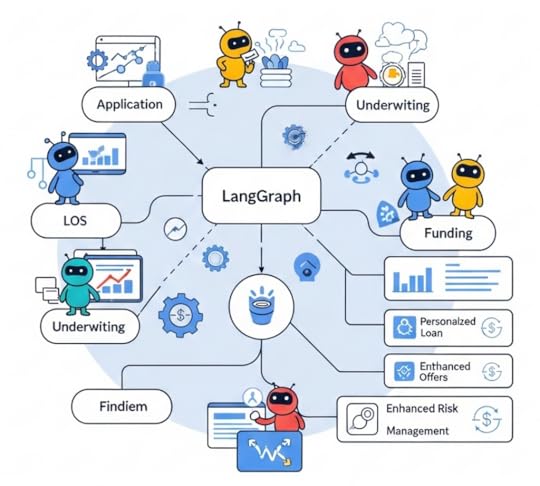

An Agentic LOS for Business Banking

Part 1: Reimagining Lending with LangGraph-Powered LOS

Project Structure

Source code: You can find the source code of this LOS in here: https://github.com/chrisshayan/agentic-los

Key Directories:

src/: Core loan origination system with multi-agent architectureenhancements/: Advanced AI capabilities for enterprise featuresrules/: Bank-specific underwriting guidelines and policiestests/: Comprehensive testing framework for quality assurancedocker/: Production-ready containerization and orchestrationWh...June 17, 2025

Data Contracts in Action

Todd McLellan

Todd McLellanIn the world of data, we often talk about “data products” and “data as a service.” Sounds great, right? But here’s the dirty little secret: too often, data isn’t reliable. It’s like building a beautiful house on a shaky foundation.

Imagine you’re a data consumer — perhaps a business analyst creating a critical report, or a machine learning engineer building a predictive model. You pull data from a source, only for the schema to unexpectedly change, a column to go missing, or the data...

June 2, 2025

Reimagining Lending with LangGraph-Powered LOS

by author using self-build ai service

by author using self-build ai serviceIntegrating LangGraph into a modern Loan Origination System (LOS) represents a profound architectural shift, moving from rigid, monolithic processes to dynamic, intelligent, and adaptable workflows. The most critical architectural considerations revolve around leveraging LangGraph’s graph-based state management and orchestration capabilities to create a truly data-driven, efficient, and developer-friendly lending ecosystem.

Why Agentic?Event-DrivenMoving away ...

May 15, 2025

Know Your Data

In this post:

Zero-Party Data — The Voice of the CustomerFirst-Party Data — Your Direct Customer InteractionsSecond-Party Data — Partnering for InsightsThird-Party Data — Reaching Wider AudiencesCombining Data Types for Maximum ImpactThe Importance of Data Governance and Privacy

In today’s dynamic digital ecosystem, businesses are awash in a torrent of data. Yet, the true power lies not merely in the volume of information collected, but in the understanding derived from it. Knowing your customer —...