Dean Baker's Blog, page 71

November 19, 2018

Maybe the Best Way to Help Left Behind Regions Is to Stop Having Policies that Give All the Money to Rich Regions

In the wake of Amazon's decision to locate its new headquarters in two prosperous metro areas, a NYT Upshot piece by Neil Irwin raised the question of what can be done to help the regions that have been left behind. He then turns to various policy proposals intended to help workers in the areas that are not doing well in the current economy.

An alternative approach is to stop pursuing policies that transfer money from the left behind regions to the rich ones. The top of this list would be pat...

Robert Samuelson Is Denying Inequality, Again

Yes, there is an insatiable market for writings claiming there has been no rise in inequality in the United States, with Robert Samuelson being one of the main actors in this group. His latest column reports on new data on income distribution from the Congressional Budget Office (CBO).

Samuelson gives us the good news:

"The poorest fifth of Americans (a fifth is known as a “quintile”) enjoyed a roughly 80 percent post-tax income increase since 1979. The richest quintile — those just bel...

November 18, 2018

NYT Understates Income in China by a Third

In an article pointing out that China has more income mobility than the United States, The New York Times seriously understated China's per capita income. The article told readers:

"Today, the economic output per capita in China is $12,000, compared with $3,500 a decade ago. The number is far higher in the United States, $53,000."

Actually, using a purchasing power parity measure of income (which applies a common set of prices to all goods and services, regardless of the country), China has...

November 17, 2018

Is Nicholas Kristof Prohibited from Mentioning IP Violations as Tool for China In Its Trade War?

You really have to wonder if there is a ban on columnists and reporters mentioning wanton violation of the copyrights and patents of U.S. companies as a potential weapon for China in its trade war with the United States. Incredibly, as aspects of the trade war get highlighted and debated, wholesale violations of copyrights and patents held by U.S. companies never gets mentioned.

The latest conspicuous ignorer is Nicholas Kristof. In a column that warns Trump of all the non-trade measures...

What's $2.8 Trillion Between Friends? Can We Try to Make These Numbers Meaningful?

Jeff Stein's Wonkblog piece told Post readers the good news that the vast majority of Senator Kamala Harris' proposed $2.8 trillion tax cut would go to the non-rich, according to an analysis from the Tax Policy Center. What the piece did not do is give readers any sense of how much money is involved.

I will go out on a limb here and suggest that the vast majority of Post readers really don't have much idea of how much money $2.8 trillion is over the decade from 2019 to 2028. It is not that di...

November 16, 2018

Will Progressives Ever Think About How We Structure Markets, Instead of Accepting them as Given?

(I originally posted this piece on my Patreon page.)

The right would like us to believe that the inequality we see in the United States, and increasingly in other countries, is a natural outcome of market processes. Unfortunately, many on the left seem to largely share this view, with the proviso that they would like the government to alter market outcomes, either with tax and transfer policy, or with interventions like a higher minimum wage.

While redistributive tax and transfer policies are...

Corporate Debt Will Not be the Basis for Another Financial Crisis/Great Recession

The folks who remain determinedly ignorant about the financial crisis and Great Recession continue to look for another crisis where it isn't. Much of the latest effort focuses on corporate debt. There are four big reasons why corporate debt does not pose anything like the same sort of problem that mortgage debt did during the housing bubble years.

First, many companies took on large amounts of debt for a simple reason, it was very cheap. The debt was not a necessity for them, but the opportun...

November 15, 2018

Mortgage Applications Keep Falling, and No One Seems to Care

Mortgage applications have been falling all through the fall, they are now down 22 percent from year-ago levels, with purchase applications down 3 percent. This matters because if people aren't taking out mortgages they are not buying homes. Residential construction has been a drag on GDP in the last three quarters. Also, when people buy a new home they typically buy appliances and other items associated with moving. This means less consumption spending as well.

The decline in refinancing wil...

If You Can’t Beat Them, Bilk Them: The Market for Caravan Insurance

(I wrote this as a column for an outlet that chose not to use it, so I am sharing it here.)

While the Democrats won an impressive victory this month, it is still distressing so that many people were willing to vote for openly racist xenophobic Republicans. Furthermore, Donald Trump’s bizarre stunt of hyping a “caravan” of asylum seekers walking up through Mexico from Central America apparently worked. Millions of people rushed to the polls to vote Republican, thinking that Donald Trump was th...

November 12, 2018

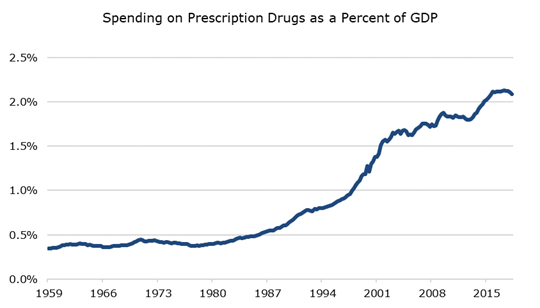

US Drug Prices Started to Explode in the 1980s, Contrary to What the NYT Tells You

Austin Frakt had an interesting Upshot piece in the NYT saying that drug spending in the US began to sharply diverge from other countries in the 1990s. This actually is not very clear, since the comparison group dating back to the 1980s is small. I am actually more struck by the explosion in spending in the 1980s, with it nearly doubling as a share of GDP over the course of the decade. Note that drug spending had not been increasing at all as a share of GDP over the prior two decades.

Dean Baker's Blog

- Dean Baker's profile

- 2 followers