Dean Baker's Blog, page 507

January 14, 2012

The NYT Lectures France on How to Restore Its Aaa Rating

Arguably the main reason that France and the rest of the euro zone countries are facing recession and debt downgrades is the failure of the European Central Bank (ECB) to act as a lender of last resort and promise to back up the debt of its member states. This failure, coupled with its obsession to curb inflation even at the expense of growth, would seem to be the main source of the euro zone's economic problems at the moment.

However the NYT sees it otherwise. In an article on Standard ...

January 13, 2012

The Washington Post Has Not Heard About the Health Care Crisis

NPR Does Fluff Piece for Private Equity

A Morning Edition segment today told listeners (sorry, no link yet) that "there's no doubt that private equity firms create value," which it then justified by referring to the high returns earned by those who invest in private equity (PE) companies. This is WRONG!!!!!!!!!!!!

First, it is not at all clear that those who invest in PE funds (not the PE partners themselves) do beat the stock market when a full accounting is done. Recent research shows that net of fees, private equity investors...

January 12, 2012

How Is It Possible The Fed's Image Can Be Tarnished Further?

At this point it should be universally known that the Federal Reserve Board has been guilty of disastrous incompetence. It allowed an $8 trillion housing bubble to grow unchecked. The inevitable collapse of this bubble has produced the worst downturn since the Great Depression and ruined the lives of tens of millions of people across the country.

This is why it was striking to read a Washington Post headline for an article on newly released Fed transcripts that showed that Greenspan and the r...

Germany's Economy Shrank at a 1.0 Percent Rate, not 0.25 Percent

One of the simplest ways in which the media could improve their reporting is by reporting numbers in ways that make sense to their readers. When the Washington Post told readers that Germany's economy shrank by 0.25 percent in the 4th quarter, I would suspect that more 99 percent of readers thought this was an annual rate of decline, which is way numbers are always reported for the United States.

In fact, this is a quarterly rate of decline, which is the standard practice in Europe and much o...

Time to Panic! Unemployment Insurance Claims Jump to 399,000

It looks like unemployment is on the rise again, new claims for unemployment insurance jumped to 399,000 last week. That is 24,000 more than the consensus forecast and also 24,000 more than the prior week's number. So let's see some of those shrill talking heads getting scared -- real bad news for President Obama's re-election prospects.

Of course folks who know some economics remember that the December data showed a peculiar jump of 42,000 jobs in the courier industry in December. The same t...

January 11, 2012

Are Private Equity Firms Evil Doers? Washington Post Edition

No one reads Washington Post editorials for their astute economic analysis. The paper did not surprise readers with its balanced discussion of private equity today.

While the paper is right to point out that whether private equity firms directly increase or decrease employment is not a good measure of whether they are beneficial to the economy, it totally overlooked the main issues surrounding private equity and its impact on the economy. The question is whether the high profits earned by...

Are Private Equity Firms Evil Doers?

The NYT had an article discussing whether private equity firms are good or bad for the economy. The piece failed to focus on the real issues.

The focus of the piece is whether private equity increases or decreases the number of jobs in the firms it controls. This is not really a good measure of whether the industry is good or bad for the economy.

If private equity firms were successful in making companies more efficient and lowering prices to consumers, then it could lead to more jobs in the ...

When It Comes to China, Manufacturing Workers and Goldman Sachs Have Opposite Interests

This point would have been worth making in an NYT article on Treasury Secretary Timothy Geithner's trip to China. The article notes that Geithner will likely try to prod China to raise the value of its currency against the dollar. It also reports that:

"American corporations in industries like telecommunications and financial services have increasingly complained that China continues to restrict their access to domestic markets, despite pledges of openness when China joined the World Trade...

January 10, 2012

The Japan Story

Eamonn Fingleton started a debate on Japan's slump or lack thereof with a Sunday review piece in the NYT. This has since been joined by Paul Krugman and others. Since I have been asked by a number of people what I thought, I will weigh in with my own two cents.

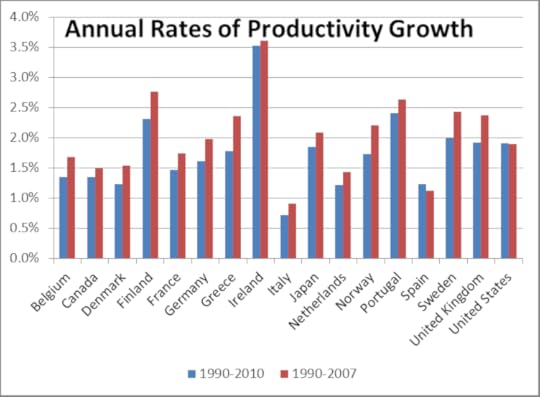

First I agree with Fingleton that the description of Japan as a basket case is way off the mark. While GDP growth has been weak, its productivity growth has been better than the average in the OECD.

...

Dean Baker's Blog

- Dean Baker's profile

- 2 followers