Dean Baker's Blog, page 479

May 7, 2012

Robert Samuelson Gets Serious About Inflation

Robert Samuelson had a serious discussion of Paul Krugman's idea (and in his professor days, Ben Bernanke's) that the Fed could boost demand by deliberately targeting a higher rate of inflation. The idea is that this would lead to a lower real interest rate.

If businesses expected inflation to be 4.0 percent over the next five years, rather than 2.0 percent, it would give them more incentive to invest. They would be able to sell everything for 20 percent more money in five years. Higher infla...

May 6, 2012

The World Needs More of the United States Leadership on Global Warming, or You Can Say Absolutely Anything in the Washington Post

Just when you thought that the Washington Post could not go any further in bringing its readers off the wall statements from self-imagined great thinkers, it rises to the occasion. Today we have Ian Bremmer, the president of the Eurasia Group, giving us "five myths about America's decline."

This short piece contains heaping doses of silliness. For example, Bremmer thinks China will be suffering because:

"the ratio of Chinese workers to retirees is around 6 to 1 today, but by 2040, that number...

May 5, 2012

Stop the Obamapologists Before They Kill the Data

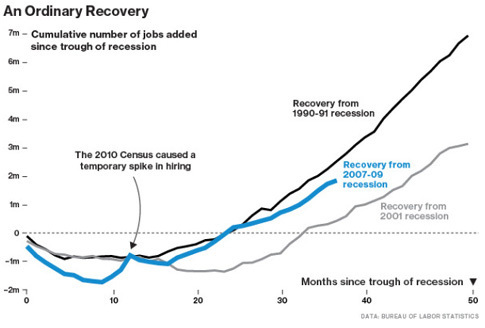

Peter Coy is ordinarily a pretty good reporter, but he really misses the boat with this chart, with the comment, "this jobs recovery is weak, all right, but right in line with the past two recoveries."

When you evaluate the strength of a recovery, you also have to consider the depth of the downturn that preceded it. In the 1990-91 recession we lost 1.5 million jobs, in the 2001 recession we lost 1.6 million jobs. In the 2007-2009 recession we lost 7.5 million jobs.

The job loss in the downtu...

May 4, 2012

It Was the Housing Bubble, Stupid

I really don't like to beat up on Ben Bernanke. I don't know him personally, but everyone I know who does says that he's a really nice guy. And, there is no doubt he is a very smart economist. But he shares the blame for the downturn with his former boss, Alan Greenspan. Even worse, he still seems resistant to getting the story right.

He gave a speech last month in which he forgives himself and others in policy positions for being surprised by the dangers posed by the collapse of the housing...

NPR Gets It Wrong, Overspending Did Not Get Spain Into Its Crisis

Morning Edition gave a Spanish economist, Pedro Videla, an opportunity to mislead listeners when he dismissed the idea of more public spending as a way out of the crisis by saying "overspending is what got Spaniards into this mess in the first place."

This is wrong. Spain's public sector was not overspending. In fact, Spain's government was running large budget surpluses. NPR should try to find Spanish eocnomists who are more familiar with Spain's economy.

May 3, 2012

Robert Samuelson Doesn't Want Us to Think Speculation Affects Oil Prices

Not All Economists Expect Spain's Recession to Bring About Deflation

In reference to the high unemployment rate in Spain the Post told readers:

"The recession also is expected to force down wages and prices and, over time, make Spanish exports more competitive and the country more attractive to investors and tourists."

Actually there are few, if any, examples of countries where high unemployment led to this process of falling wages and prices that in turn restored competitiveness. Wages tend to be very sticky downward, which is why prices in countries across t...

The Fault for a Trade Deficit is by Definition the Value of the Currency

Eduardo Porter told readers in his Economic Scene column that because China's trade surplus overall has fallen, Treasury Secretary Timothy Geithner:

"will have a harder time making the case that America’s trade deficit is somehow China’s fault."

Actually, he will have no problem at all making the case that the U.S. trade deficit is the result of an over-valued dollar, which China helps to sustain by buying hundreds of billions of dollars of government bonds.

In a system of floating exchange r...

May 2, 2012

Collateral Damage: Thoughts from Mitt Romney's Partner In Crime

Adam Davidson has a piece in the Sunday NYT magazine on Mitt Romney's former business partner, Edward Conrad and his new book, Unintended Consequences. At one point, the piece cites me as saying that for each dollar earned by investors (corporations), the rest of society gets five dollars.

This should not sound surprising. This is simply the division of national income between capital and labor. The after-tax capital share of corporate income is roughly one-sixth of total income. This means t...

Splurging Ain't What It Used to Be

Outsourced to Mark Weisbrot.

The Economist’s editorial opinion on the second round of the French election is a bit unsubtle. The title “The rather dangerous Monsieur Hollande” and sub-head “The Socialist who is likely to be the next French president would be bad for his country and Europe” tell you all you might need to know about how the editors of this dull magazine really feel about the prospect of a left-of-center government in France.

To scare the readers, the editorial notes of this...

Dean Baker's Blog

- Dean Baker's profile

- 2 followers