Dean Baker's Blog, page 147

May 14, 2017

No, People Staying in Their Home Is Not Bad for the Economy

This is more of the which way is up problem in economics. Right now we have lots of economists debating how best to reform the tax code. Most of them see increasing the incentive to save (which means not spending money) as an important goal.

Of course, more saving is not a good idea if we think the economy doesn't have enough demand to fully employ the workforce. I put myself in the group of economists who hold this view, but we are the minority these days. Most economists think that the econ...

May 13, 2017

Economists' Record On Assessing the Economy's Potential Is Awful

Binyamin Appelbaum had a good piece in the NYT presenting how mainstream economists assess the prospects for boosting growth with the sort of tax cuts proposed by the Trump administration. While the piece accurately conveys the range of views among the mainstream of the profession about the extent to which it is possible to boost GDP growth, it is worth noting that the mainstream of the profession has an absolutely horrible track record in this area.

The piece tells us that the Federal...

May 12, 2017

What Happens to the Economy With a President In Crisis? Lessons from Watergate Days

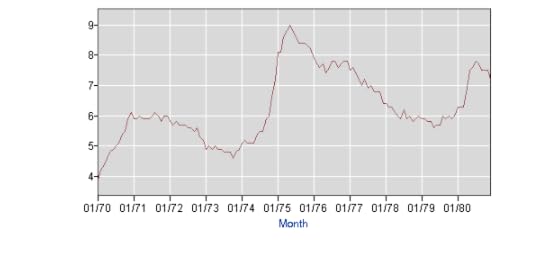

I've had people ask me, so I went back to refresh my memory. Yes, it was very bad news as the Watergate scandal unfolded and Nixon was eventually forced to resign. The economy slipped into a recession beginning in November of 1973, with the unemployment rate rising from a low of 4.6 percent in October of 1973 to an eventual peak of 9.0 percent in May of 1975.

Unemployment Rate: 1970 to 1980

Source: Bureau of Labor Statistics.

Having put these numbers on the table, I'm not sure how much of th...

More Evidence of Inflation Spiraling Out of Control: Core Without Shelter at 0.8 Percent

The betting still seems to be that the Fed will raise rates in June, but it doesn't seem like the inflation data could be the reason. The numbers were again quite tame in April, with the overall CPI increasing by 0.2 percent in the month and the core by 0.1 percent. The year over year increase in the overall CPI is 2.2 percent, and 1.9 percent in the core. This puts inflation well below the 2.0 percent average rate (for the PCE deflator) being targeted by the Fed.

However, the weakness of inf...

May 11, 2017

Trump on Trade with China: Beef and Goldman Sachs

In his presidential campaign, Donald Trump made a big point of beating up on China for its "currency manipulation." He said that China was ripping off the United States because of its large trade surplus with the U.S., which had cost us millions of manufacturing jobs.

Trump said the trade deficit was due to the fact that our "stupid" trade negotiators allowed China to get away with depressing the value of the yuan against the dollar. This makes Chinese goods relatively cheaper in world market...

Robots and the Which Way Is Up Problem in China

As I like to point out, debates on economic policy suffer badly from the "which way is up problem." At the same time we are constantly hearing concerns about aging baby boomers and large budget deficits (too little supply and too much demand) we also hear stories about robots displacing workers and creating mass unemployment (too much supply and too little demand).

Either of these stories could, in principle, be true, but they can't possibly both be true at the same time. It speaks volumes fo...

Thomas Friedman Shows Yet Again the Economy Still Has Good Paying Jobs for People Without Skills

The people who run the economy have really screwed it up over the last four decades from the standpoint of ordinary workers. This is a bipartisan issue, so it's not a blame Reagan, Bush I, Bush II, and Trump story. Clinton and Obama were also willing to support a bloated financial sector and trade policies that redistributed upward by subjecting ordinary workers to low-wage competition while protecting doctors, dentists, and other highly paid professionals. This policy was made worse by the h...

May 10, 2017

Where's the Productivity Growth? The Bureau of Labor Statistics Can't Find the Robots!

We hear endless stories in the media about how the robots are taking all the jobs. There was a new rush of such stories after the release of a study by Daron Acemoglu and Pascual Restrepo, which found that robots were responsible for a substantial share of the job loss in manufacturing in the last decade. (For example, this Bloomberg piece by Mira Rojanasakul and Peter Coy.)

However, there remains a very basic problem in the robot story, it is not showing up in the productivity data. To step...

May 8, 2017

Financial Transactions Taxes: Job Killing Robots for the Wall Street Hedge Fund Crew

Last week, Representative Peter DeFazio reintroduced his financial transactions tax (FTT) proposal. The bill would impose a tax 0.03 percent on trades of stock, bonds, options, and other derivative instruments. (That's 3 cents on $100 of trades.) This can be thought of as the equivalent of a sales tax imposed on financial transactions, which are now largely untaxed.

According to the Joint Tax Committee, this tax would raise roughly $400 billion over a 10-year budget horizon. This translates i...

May 7, 2017

Do We Need Jobs In Health Care to Keep People From Being Unemployed?

The NYT had a piece discussing some of the potential economic ramifications of the repeal of the Affordable Care Act (ACA). The article points out that the health care sector has been a major source of job growth in recent decades. If we cut back spending on health care, then presumable employment growth in the sector would slow.

There are few points to be made here. First, job growth in health care is only desirable insofar as it is improving people's health. More people who directly provide...

Dean Baker's Blog

- Dean Baker's profile

- 2 followers