Arthur Shapiro's Blog, page 4

October 14, 2018

Tom Jago: The Passing of an Industry Icon

This is from The Last Drop Distillers, a company that Tom co-founded:

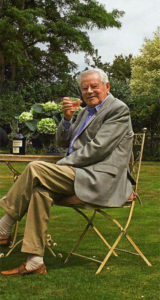

It is with profound and heartfelt sadness that we announce the death of our co-founder and inspirational president, Tom Jago, aged 93. Beloved by us all, we give thanks for his brilliance, his incisive humour and, above all, his deep affection for the team and the industry he so loved. Rest in peace, Tom.

Tom Jago. 21st July 1925 – 12th October 2018

There is no one I have met in my booze business journey that I respected more than Tom. He was a true gentleman, a creative genius, and a warm, fun, person. I wrote his story in this blog and in my book and I thought it would be worth re-telling as my personal tribute to a terrific man and friend.

There is no one I have met in my booze business journey that I respected more than Tom. He was a true gentleman, a creative genius, and a warm, fun, person. I wrote his story in this blog and in my book and I thought it would be worth re-telling as my personal tribute to a terrific man and friend.

# # #

I first met Tom Jago in the early 1990s when he was part of James Espey’s scotch and cognac team at Seagram. My immediate reaction was, here is a man who is gifted in product development and marketing. He’s also affable and fun to be with. I’m not sure he’s really British.

Over the years he taught me a great deal about the spirits business, above all, how to choose and enjoy good Claret (Bordeaux).

Together with Dr. Espey and Mr. Peter Fleck, he is a principal in the Last Drop Distillers Ltd. (The full story of the company is here.)

Here’s how their website describes Tom:

From a village school in the remote countryside, via a scholarship to Oxford and service in the Royal Navy during WWII, Tom Jago found his niche in the wine and spirits trade. He led the team that developed new ideas on old themes, like Croft Original Pale Cream Sherry and Le Piat D’Or brands, which revolutionised British drinking habits forever. He cooperated with the ‘gang of three’ in the invention of Bailey’s Irish Cream and Malibu.

But wait, there’s more. Tom was instrumental (as in the driving force) in such brands as Johnnie Walker Blue Label, Hennessy, Chivas Regal 18 Year Old, Martell, The Classic Malts and many others.

If that’s not enough, while at Seagram, Tom helped in the creation of Imperial Blue and Royal Stag, now an important part of Pernod India.

In preparation for this article, I’ve spent some time talking and emailing with Tom on a range of topics and his thoughts on the industry.

Tom’s Career

After the war, Tom “slipped accidentally into advertising.” He applied for a job as a photographer but was mistaken for someone else and got a job as a copywriter. He later became an account director at an ad agency that ultimately became Ogilvy & Mather. Among his accounts was a small company that hired him, called Gilbeys. Through mergers and acquisitions, Gilbeys became IDV and finally Diageo.

Next came four years at Moet-Hennessy, followed by United Distillers (with James) and later Seagram.

The area of focus throughout his career was innovation and new products. As Tom puts it, “I was not very good at being a marketing director (at Gilbeys) so they gave me a small budget, an office and secretary and said try and think of some new drinks we might profitably sell.” The string of successes mentioned earlier, attest to the accomplishments.

Product Development Philosophy

Tom Jago’s focus over the years has been simple, and straightforward, guiding principles.

First, “Make the drink agreeable to the palate, the eye and the nose. Baileys and Malibu are good examples of this.”

The other principle was to develop products that inherently persuade drinkers that there is virtue in drinking them and in learning to appreciate their quality. Interestingly, it’s the same motivations of palate, eyes and nose but applied to whisky, cognac and even tequila.

But above all, Tom has a powerful way of looking at the acceptance and growth of a brand – patience.

“It is clear to me that the motivation to drink alcohol is very deeply buried in the human subconscious… therefore, attempts to market distilled spirits must be subtle too. A spirits brand is bound to be slow growing, so promotions must be long, steady and consistent.”

In my experience, new products and brands often fail because the companies behind them, particularly the global ones, lack the fortitude to see them through to fruition. That’s why the successes in the US (e.g., Grey Goose, Tito’s, and Patron) have come from entrepreneurs.

Another interesting and worthwhile notion from Tom is not to let drinker research get in the way. “It is of course useful, but in the specific case of alcohol drinks, not to be relied on, given the essential illogical responses of people to alcohol,” says Tom. He goes on to say, “No one will tell you the truth about their feelings regarding drinks – mainly because they don’t know what they are themselves.”

I tend to put it another way. Consumer research is like a lamppost, some people lean on it while others are illuminated by it.

Whisky

Despite the drink inventions that favor light, sweet and palatable drinks, Tom is an unabashed devotee of Malts.

“These are, I must confess, my favourite of all the alcoholic drinks… I admire them partly because of their enormous variety of nose and taste (cognac, no matter how fine, all tastes much the same – compared with the vast difference between a malt from Islay and one from the Spey). Much of their appeal, of course, lies in their relative rarity – the amateur can ‘discover’ them for himself, so he feels that he owns a part of the brand. It is interesting that when a malt gets as big (in volume sales) as for instance Glenfiddich or the Glenlivet, people stop thinking of it as a malt, rather as just another Scotch brand.

His focus on whisky over the years has been extraordinary. Johnnie Walker Blue Label was created in 1987 to reassert the perceived value of the Johnnie Walker brand in Asia, where grey market discounting had damaged it. He also developed Classic Malts, a collection of outstanding products from individual malt distilleries, which became brands.

At his current venture, Last Drop Distillers Ltd, he and his partners are using 70 single malts in their blend. Some are from distilleries long since closed. It’s truly an amazing venture and you might want to look it up. (Today, The Last Drop Distillers is owned by Sazerac Limited.)

Throughout his career, Tom helped to define and advance product quality. While at Hennessy, for example, he learned about the sophisticated use of oak in spirit maturation. No one in the scotch business knew about this at the time and one can only imagine the battles that ensued between this young upstart and the tough and crusty old timers who ran the whisky production.

Perhaps based on these battles or just plain good common sense, Tom taught me to be wary of production managers.

“A word of caution concerning those splendid fellows…Don’t let them ruin a great luxury brand by economy measures unrelated to the essential perceived value of the pack; I have seen a production man try to save less than a penny by spoiling the closure of Johnnie Walker Blue Label – this on a brand that sells for £100.”

India

In the late nineties, while at Seagram, Tom was called to Seagram India to help with new product development. One of the chemists, had the idea of making a good admix whisky by using both imported scotch malt and local grain spirit. The resulting products were successful and have stood the test of time – Royal Stag and Imperial Blue. As Tom puts its it, a number of factors accounted for the success – branding, packaging, price (above the competition) and the unique use of TV advertising outside of India.

# # #

Tom Jago was indeed a man for all seasons and the most extraordinary spirits marketer I’ve ever met.

Industry executives, both young and old, can learn a great deal from his business strengths and skills – innovation and outside the box thinking; patience and tenacity; an understanding of people; how to build brands and the price/value relationship in marketing. Above all, Tom has a skill set all executives need, but not all have – a sense of humor.

Side Bar

What I love about the spirits and wine business is that it’s an industry of people, relationships and stories. No one I’ve met has better industry tales than Tom Jago.

Vodka

Real change began in 1949 when a Mr. Kunett, a Russian émigré in the USA, sold his tiny Smirnoff distillery to Heublein. At the time he was making about 5,000 cases a year. He and Heublein began seriously to promote vodka as the spirit with negligible taste, which mixed with fruit juice, tomato juice, or even ginger beer, to give a drink that was actually NICE. So vodka drinking spread to the civilised world (in Russia, it was never that civilised, the vodka was always sold in 50cl bottles with an aluminum capsule – non-reclosable!)

I was closely involved in this period of change. From 1957 I had been helping an old drinks merchant called Gilbeys with their advertising.

Gilbeys had been smart enough to get the rights to Smirnoff vodka for a large part of the world, so we were engaged in promoting vodka – which was entirely unknown in Britain. We began to understand the revolution that was taking place, although research produced some unexpected results: we used an ad showing young men in their digs preparing for a party. One of them was cleaning his teeth; the advertisement was badly understood, and it emerged after a few enquiries that only some 12% of young English males owned a toothbrush!

And when we claimed that Smirnoff doesn’t give you a hangover, we got the response “What’s the point of having a drink if you don’t get a hangover?” Binge drinking is nothing new, it seems.

About Gilbeys:

There was lots of fun to be had at Gilbeys. In the first place they owned a beautiful chateau in the Medoc (Chateau Loudenne), which I used as a cool place to plot things with co-workers. The cellar had first growths from 1875 on.

And board meeting were delightful on occasion. Walter Gilbey said one day, “Tom, I just got a lift back on Hennessy’s little jet – ever so nice. Do you think we might get one?” I said I thought it unlikely but would search and report back. Next week I said “we can’t afford it; costs £2m and that’s about our overdraft. And anyway, you would have two pilots to feed and clothe.”

“Oh,” said young Walter, “Couldn’t Hawkins learn to drive it?”

The joy of this was that Hawkins, an old family retainer, was 56, a serious drunk, and only worked one day a year when he drove the Gilbeys to Royal Ascot race meeting in the coach and four.

Product Placement in Films:

James Bond was in part my baby. I was with Gilbeys in the ‘60s and they had the franchise for Smirnoff in what used to be the British Empire. When Cubby Broccoli (Albert Broccoli, the producer of the Bond films) was rounding up funds for Dr. No he approached Gilbeys and got a flea in his ear; they were broke, in fact. But one of them told me and I persuaded them to let me give him two cases (one blue label 100 proof, the other red, 37.5) I said I hoped that they could include both in the film, and they agreed, with the great scene where Bond rejects the red and makes his martini with the stronger vodka. When I asked for a few more cases for their wind-up party to which I was told to get lost – no more money. So we lost the chance to be in all the Bond films. No money changed hands. Times change, huh?

And when I was down at Pinewood negotiating this, I lunched in the canteen with Terence Young (director); at the next table was Ava Gardner. She took a mouthful of steak and salad, drew deeply on her Camel, and started chewing. Never forgot that.

September 27, 2018

A National Drink is Born

The US has Bourbon, Mexico has Tequila and Mezcal, Scotland has Scotch, Brazil has Cachaça, and the list goes on and on. But what about India? It’s among the top five alcohol consuming countries in the world and there is a robust spirits/whisky manufacturing industry. Colonial India invented the gin and tonic, but has had no serious candidate for national liquor, until now.

This is the story of the emergence of a national drink, led by one man’s innovativeness and tenacity. An alcohol product with a long history and exclusively Indian heritage, surrounded by legends, and spanning centuries. A historic product from the many tribes in the Central Indian Forest belt.

The products (there are two) are called DJ Mahua and DJ Mahua Liqueur. The man is Desmond Nazareth and we have met him before in this blog. (You will find them here, , and here.)

Desmond Nazareth, Founder and Managing Director, Agave India.

Desmond Nazareth, Founder and Managing Director, Agave India.The Product

Mahua (pr. Ma-hu-a) is a flower that Indian tribes have been fermenting, distilling, and drinking. The Mahua tree has been considered sacred for centuries. Desmond and his Agave India Company have begun marketing the product under the DJ (DesmondJi) brand in liquor and liqueur formats and selling these products as Indian Made Liquor (IML) since June of this year. But his real challenge is to get the widespread liquor authorities to recognize Mahua as an official, potentially national drink.

Here’s how he describes Mahua:

“Mahua is a nectar rich flower of the Madhuca longifolia tree, which grows in the Central Indian Forest belt, historically inhabited by indigenous people of India, so called ‘Adivasis’, or ‘Tribals’. The nectar rich flowers mature and drop for a month or so in the Mar-April-May timeframe. These edible sundried flowers retain a significant part of their sugars, with a pleasant, complex taste akin to a hybrid of sun-dried raisin, fig and date… For centuries, Central Indian tribes have been collecting and storing Mahua flowers, and consuming single distilled Mahua spirit made from the flowers in traditional clay, wood-fired potstills.”

He depicts the products as “forest-to-bottle” and both are 40% Alcohol by Volume (AbV). The DJ Mahua liqueur is blended with honey and spices and there are plans for a DJ sparkling product. I’ve tried both the liquor and liqueur and found them to be very enjoyable products, with unique and pleasant tastes. The DJ Mahua Liqueur product in particular, was most enjoyable both straight and in cocktails.

Desmond describes Mahua as “the only spirit in the world that is fermented and distilled from naturally sweet flowers.” ‘What about St Germain?” I asked. According to Desmond, St Germain is made by macerating and steeping Elder Flower in alcohol; DJ Mahua is naturally fermented and distilled directly.

The Mahua Mystique

Mahua Tree

Mahua TreeWhat fascinates me about Mahua is its colorful history. Spend a few minutes here and you’ll see what I mean.

As legend has it, Mahua is “An indigenous drink rumored to be the elixir of the Gods and the weakness of deities, the tribals tell tales of how it is coveted by deer, birds, and humans alike.”

According to Desmond, Mahua is more than a drink, it’s a reflection of India’s colorful tribal history. The legends and stories abound with tales of hard-working villagers saved from the messengers of death by Mahua; of animals cavorting while tipsy on the flowers. Desmond writes:

“From bark to fruit, leaf to root, every part of the Madhuca Longifolia (botanical name) earmarks our heritage in a way few other elements of our long cultural history do.”

A well-respected English anthropologist working with tribes in Central India named Felix Padel, a descendent of Charles Darwin, tasted Mahua and was surprised that the government did not develop it as an industry. He is quoted as saying, “I wonder why people in India would prefer French wine and English scotch when something fresh and rejuvenating like Mahua is available.”

And that leads us to Desmond Nazareth’s journey to make Mahua the Indian national drink.

The Challenges and Obstacles

Mahua is currently made in over a third of India’s 29 states and getting Mahua recognized all over India is a daunting task, particularly when you’re a niche, craft distiller with limited resources.

The Indian alcohol market is very complex and, to me at least, somewhat confusing. As I mentioned, its alcohol volume consumption is among the highest in the world but its per capita consumption is low. There is a love-hate relationship with alcohol, dating back to Gandhi’s aversion to it and at least four states and one territory practice prohibition. Yet, Indians love to drink and the worldwide cocktail enthusiasm is alive and well in the major cities.

Indian Made Liquor (IML) consists of two types. One is Indian Made Foreign Liquor (IMFL) and is the official term used by governments, businesses and media in India to refer to all types of liquor manufactured in the country other than indigenous alcoholic beverages. The other type is Country products such as Feni and Mahua.

Desmond is trying to get a new Excise category established countrywide. It would be known as Heritage alcohol products and strictly governed by international standards. It would be taxed lower than ‘IMFL/IML’ and higher than ‘Country’. He feels that this would encourage entrepreneurs to explore and exploit the huge treasure trove of Indian alcoholic beverages.

To get Mahua recognized as a national drink means a state by state campaign since there is no central national regulatory body equivalent to the USA’s TTB. “It is a crying shame that there currently is no simple Excise/ Revenue/ Customs mechanism for proudly made in India alcoholic beverages to be placed in Travel Retail (Duty Free) outlets in India,” says Desmond.

Nevertheless, an important step forward has emerged, thanks to Desmond’s efforts so far. The Food Safety and Standards Authority of India (FSSAI) is roughly equivalent to the USA’s FDA and is working to standardized the manufacture of Mahua and the use of its ingredients.

What’s Next?

As you read this, know that Desmond is hard at work on a number of levels. The manufacture and sale of DJ Mahua and DJ Mahua Liqueur in his home state of Goa and elsewhere in India; working on a sparkling Mahua product; and pushing for recognition as a national drink.

My own view of this situation is that it represents a unique and powerful opportunity for a global player to enter the fray. The “size of prize” of the Indian market and overcoming the obstacles for global brands, suggests that the Diageos, Pernods, and others might want to take a close look at Mahua. I think it represents a real opportunity to participate in the development of a new national brand with Indian and global potential. (If I were still at Seagram, I’d be doing just that.)

For a brand to succeed on the global stage, it needs to be good tasting, backed by an entrepreneurial effort, and a have compelling story. DJ Mahua and its variants has all that and more.

It’s time for the product to come out of the woods and reflect its heritage the same way as bourbon, scotch, tequila, and all the other national drinks. I hope that the Indian authorities would grant a type of AOC (protected designation of origin) or Geographic Indication (GI) for Mahua along the same lines as those for cognac, tequila, champagne, and others.

DJ Mahua Liqueur

DJ Mahua Liqueur DJ Mahua

DJ Mahua

August 20, 2018

Alcohol vs. Cannabis Marketing

I have followed Seth Godin for many years and have found him to be among the most insightful marketers I know. Here’s a bit about him — he’s an author (18 bestselling books), an entrepreneur (founded two companies, one of which was sold to Yahoo), a speaker/teacher, and a member of both the Direct Marketing Hall of Fame and the Marketing Hall of Fame (probably the only person to be in both). Above all, his views and ideas on effective marketing have inspired, motivated, and changed people and ways of looking at things.

One of his blog posts last week dealt with the differences between marijuana and alcohol marketing. Considering the close scrutiny of the pot business by the booze industry, I asked and received his permission to share most of his blog post with you.

Let’s look at Seth’s views followed by my comments.

(By the way, as I write this, it was just announced that Constellation Brands has increased its investment in a Canadian cannabis company by $4 billion.)

US prohibition ended in 1933. After that, there was a gold rush that led to the creation of dozens of billion dollar brands.

80 years later, the prohibition against pot is ending in various places throughout North America and then, probably, worldwide.

The question some professional marketers are asking is: Will there be worldwide profitable brands for pot that are similar to Bacardi, Johnnie Walker and Smirnoff for alcohol?

Both industries are regulated. Both have products that are sold in specialty stores. Both use non-proprietary manufacturing techniques.

Here’s the big difference:

When alcohol marketing became legal, it coincided with the glory days of magazines, radio and then TV. The mass marketing phenomenon happened at exactly the same time as these brands were being rolled out—and along with cigarettes, alcohol brands were major advertisers, particularly in magazines (liquor) and TV (beer). The ads supported the media in a fundamental way (and vice versa–Rick’s Cafe anyone?).

But when cannabis marketing arrives, it’s the internet that’s dominant. And the internet isn’t a mass medium.

It seems like one. It’s used by billions of people.

But it’s a micro medium. A direct marketing medium. There are 3 billion people online, but they’re busy looking at 3,000,000 web pages (that’s only a thousand a page).

The other difference is that there’s a thousand-year tradition of the pub and the bar. And those facilities offer status games, word of mouth and significant margins that created another marketing engine for alcohol that won’t exist for cannabis.

Sure, it’s possible that the huge demand and profit margins will fund a winner-take-all advertising movement for pot. But it’s more likely to be more like local espresso or high-end chocolate or whiskey (word of mouth) and less like vodka.

* * *

My Comments and Observations

Seth is obviously on target; the overall world of marketing has steadily been moving from macro to micro — away from mass media toward direct to consumer media. To a large extent this is happening in the booze business today. Brand building and communication has left mass approaches (print as well as broadcast) in favor of word-of-mouth, bartender influence, publicity and event marketing.

Let’s not forget that currently, the cannabis industry is totally on a state by state basis. There are no national brands and there will not be until such time as the federal government approves its sale. Marketing, therefore, is regional, at best.

The notion that the absence of bars and restaurants for cannabis will inhibit marketing is true now but will it be in the future? In many of the legal recreation use states, weed cafes are springing up and it’s a topic that will grow in the future. Think Bulldog Café in Amsterdam.

As to branding, that too is emerging. Consider this:

For many cannabis consumers, the content and type are surrogates for brands. They talk about Indica vs. Sativa. For others, it’s the amount of CBD vs THC that becomes the brand.

For those introduced to weed medicinally, they think of the brand the same way as branding in prescription drugs — by function.

In this regard, recreational users have the function/purpose of the cannabis as an identifier, such as “sleep,” “arouse,” “harmony,” “awake,” etc. These are clearly labeled and provide a kind of branding function.

There are brands like Dompen, LuxLyte and others. But the function/purpose is the main factor.

At this stage, it’s the retailer that becomes the brand. Check out the list of retailers in Colorado. A company I wrote about recently, MedMen, has stores all over the country, both dispensing medicinal cannabis as well as recreational. The dispensary is the source of quality and other reassurances.

Interestingly, the beer folks are getting into alcohol infused cannabis, partly leveraging their own brand’s influence. There’s even a brand of wine made with THC.

# # #

As of June, of this year, 30 states have legalized medical marijuana and 9 have approved recreational use. New Jersey and New York are expected to legalize recreational use soon. So, clearly, legalization of cannabis is here to stay and will grow in acceptance.

The key marketing issue will be, as Seth points out, the difficulty in mimicking branding (and reach) of the alcohol world. Perhaps that means that no one brand will predominate; perhaps the function/purpose will be the brand; or the retailer. But, it’s still earlier days for the fledgling legal business.

He’s also correct that the marketing of cannabis, despite other similarities with booze, will have its own model and pattern.

Like the man says, more like whisk(e)y and less like vodka.

July 31, 2018

The Seagram Heiress and the Company Plane

From the NY Times, July 25th

Clare Bronfman, an heiress to the Seagram’s liquor fortune, pleaded not guilty on Tuesday in federal court in Brooklyn after her arrest on conspiracy and racketeering charges in connection with her role at Nxivm, (pronounced Nex-e-um) a self-help group that prosecutors call a pyramid scheme and former members say is a cult.

The article concluded with:

The hearing for Ms. Bronfman revealed few new details about Nxivm’s inner workings, but gave a glimpse of her considerable wealth. Ms. Necheles (her lawyer) said Ms. Bronfman was worth around $200 million, with about half tied up in trusts supervised by Goldman Sachs, and the remainder in real estate in New York, California and Fiji, where she bought an island for $47 million.

She was charged with identity theft and was released on a $100 million bail bond. It is part of an ongoing investigation of the group which, according to the indictment, was allegedly engaged in money laundering, extortion, obstruction of justice, forced labor, sex trafficking, identity theft and more.

Ms. Bronfman and her sister Sara are children of Rita Webb, also known as Georgiana, who was the daughter of an English pub owner. After their parents’ divorce (they were divorced twice), she and her sister lived in England. Keep that in mind, when we get to the second part of the story.

I didn’t know her but knew how much her father Edgar M. Bronfman (Edgar Sr) cared about her. I recall a phone call from his office with the instruction for us to sponsor equestrian events inasmuch as she was a world class rider and competitor. Believe me, there weren’t any brands for whom this made any sense at all. So, with a stretch of the strategy and an intense desire to keep my job, Crown Royal was selected.

The Company Airplane

Gulfstream IV (Haute Living photo)

Gulfstream IV (Haute Living photo)The days surrounding the news brought a deluge of emails from ex-Seagram friends with questions and observations. But none were as interesting as the one from Tony Rodriguez. Tony joined Seagram in the early 1980s and held a number of important senior positions in business strategy and finance. He related the following story.

Edgar traveled often to and from London in the mid 80s to visit his daughters. The presence of Seagram employees was often desired in order to qualify for a tax-deductible trip. Of course, the Bronfmans flew on the Gulfstream IV whenever they chose but wanted traveling employees when possible.

Here’s how Tony began his story:

“One of my first business trips around 1985, as Budget Dept. bean counter, was to Seagram’s European HQ in London (where I would eventually work as CFO for 3 years). On one particular trip and at the last minute, they (Seagram Travel Department) cancelled my Pan Am flight reservations because Mr. Edgar wanted a “mule” to be his excuse for a company-paid corporate jet flight with his family, including wife and two daughters, to London. What ensued was a very uncomfortable cross-Atlantic flight…”

As you might imagine the flight was operated with aviation fuel for the airplane and lots of alcohol fuel for the passengers. That’s when the fun began.

Allow me to interject a thought or two at this point. While the trip on the Gulfstream was a wonderful way to fly, it was not without its own special peril. Especially when traveling with Edgar Sr, one was often cautioned to control the alcohol intake and to avoid career ending conversations when Mr. Bronfman had been, ahem, over-served. Unfortunately, the plane only held a dozen or so people and there was no place to hide.

Nevertheless, on this trip, the booze flowed, especially the Sanderman’s Port. Tony was invited to join the meal aboard the plane and to join in the booze and conversation.

There were seven passengers on the flight — Edgar Sr, Georgiana, a British friend of Edgar’s, the Seagram doctor, Tony, and the daughters. They all had lunch (except for the children) and fit nicely around a table on the plane.

Gulfstream IV interior. (Libertyjet.com)

Gulfstream IV interior. (Libertyjet.com)The Seagram Doctor

Yes, that’s right, Seagram had a full-fledged and fully equipped medical office in the NYC headquarters with a full-time doctor and a few nurses. The physician was quite a character — part pedophile and part poster child for #MeToo, but his interest was men. Let’s call him Dr. G, since many of us referred to him as Dr. Goldfinger. One Seagram friend told me recently that if he went to the medical office for a Band-Aid for a paper cut, the doc would tell him to drop his pants.

Anyway, Tony, in his late 20s at the time, found himself in a very uncomfortable trans-Atlantic flight sitting next to Dr. G who kept trying to stroke his thigh during the meal.

Knowing what was happening, Edgar engaged Tony in conversation, including his upper crust British crony. The topic was shooting grouse and the conversation went something like this:

British Crony: Your name is Rodriguez, where is your family from?

Tony: Spain.

British Crony: Ah, I love Spain… I often go grouse hunting on the Costa Del Sol. Have you ever been there? Did your family ever shoot grouse?

Tony: No sir. My family were peasant farmers and didn’t partake in such activities.

Edgar Sr: Have you ever gone grouse hunting when you were growing up? Where did you grow up, anyway?

Tony: No sir, I never went grouse hunting. I grew up in Newark… there were no grouse. But, there were lots of pigeons we shot with BB guns.

British Crony: Well then, tell me, us — what sports did you play in New Ark?

Tony: Street games…

British Crony: Such as…?

Tony: Well, stickball for one. It’s like baseball except, among other things, for a bat we used our mother’s cut off broom.

Edgar: That’s hysterical. Tell me Nigel, have you ever played with your mother’s broom?

British Crony: I can’t say that I have.

Tony went on to tell me that he was sure that neither of them ever saw their mothers use a broom, or even knew if they had one.

He ended his email to me with the following:

“So now we fast forward some 30+ years later to hear that Edgar’s cute little girl is involved in an international sexual trafficking ring. I’m glad my family is much more boring even if none of us own an island in Fiji.”

* * *

Thank you, Tony.

For more stories about the Seagram plane see elsewhere on my blog such as here. Also, you might enjoy this one from my book:

Where to sit?

The protocol on where to sit on the company plane was well known. The owner, either Edgar Sr. or Edgar Jr., had the last seat on the right as you faced the rear of the plane (aft). If they weren’t on it, the most senior executive had that seat. Other plush seats were taken by rank, and the couches (we’re talking Gulfstream jets), were left to the more junior or lower ranking execs.

As the story goes, while waiting for one of the Bronfmans to board the plane, a company president was talking to a colleague while seated in the Bronfman seat, when suddenly Bronfman appeared. Startled, the executive shot up, moved away, and said, “Sorry Mr. Bronfman, here’s your seat.” To which the Bronfman in question replied, “They’re all my seats.”

July 11, 2018

Seagram’s 7 Crown: Then and Now

Seagram’s 7 Crown launched an interesting event last week — the first official National Dive Bar Day. No surprise that the launch date was 7/7. So, there’s lots to tell about the brand and this event. Let’s start with the event.

Dive Bars

Here’s how the folks at Diageo described this brand promotion:

“The Dive Bar is an American institution: where long-lasting memories are created, where people-watching is imperative, and where the greatest stories and a come-as-you-are attitude, live. Seagram’s 7 Crown will raise a glass to these historic hidden gems found across America, marking the first official National Dive Bar Day, fittingly taking place on July 7th, 2018 – in celebration of the quintessential Dive Bar drink, the 7&7.”

There are lots of definitions of a Dive Bar, some negative like this one in the Urban Dictionary: “A well-worn, unglamorous bar, often serving a cheap, simple selection of drinks to a regular clientele.” Whew, that’s mean.

The one that comes closest to what I think, is from my friend, Gaz Regan:

“Dive bars …. are bare bones joints where guests are treated equally whether they arrived wearing greasy overalls, or tuxedos … when the guest wants a quick shot and a beer before heading out to some swank affair. These places are great equalizers. The filing clerk can tell the CEO how to run the company better in a dive bar. And in a real dive, the CEO will actually listen.”

Linking Seagram’s 7 and Dive Bars makes sense on many levels. First, the brand is an icon and an important part of America’s drinking history. It’s a natural link and since the purpose of Dive Bar Day is to support these places through the National Trust for Historic Preservation, it makes sense.

In addition, Dive Bars suggest fun, camaraderie, and good times. According to Jason Sorley, Diageo Brand Director for Seagram’s 7, both the brand and Dive Bars have a storied past and have been an important part of the American drinking culture. (Here’s a list of the best dive bars in every state from Thrillist.)

Seagram’s 7 Crown

As I was doing my homework for this article, I walked into my favorite neighborhood package store and asked for a bottle. (Yeah, it’s been a long time since I bought one.) The owner, who’s a friend, looked at me as though I had lost my mind. “Seriously?” he said, “You come in for all kinds of fancy shmantzy whiskies and gins and now you want Seagram’s 7? I don’t carry that. I remember it but who drinks that these days?”

I grumbled something about how any store can fail to stock an American liquor icon and one that millions of folks remember as their drinking “training wheels.” In fact, for decades, the 7&7 (Seagram’s 7 and 7 Up) was the drink of choice for entry level drinkers. It tastes great and is easy to drink. But, alas, many other booze products have usurped that esteemed rite of drinking passage.

So, I for one am delighted that Diageo is working to bring that brand back.

Let’s Look at Some Numbers

One of the things that I’ve learned about the booze business is that it’s hard, if not impossible, to kill a brand based on its sales. Sure, a manufacturer can end the life of a brand, but, the marketplace itself will rarely if ever kill a brand.

According to the ex-Seagram people I spoke with who worked on the brand, at its peak, Seagram 7 Crown reached well over 8 million (9-litre) cases in the late 1970s. Even by 1990, when whiskies were losing dramatically to vodka, the brand sold close to 4 million cases. As to my retailer friend’s view that the brand is dead, guess what? Today Seagram’s 7 still sells in the 2 million case range. In fact, according to Shanken’s Impact, the brand is in the top 30 leading spirit brands in the US. So there, Mr. Retailer!

The Brand’s History

To stay with the numbers for a moment…

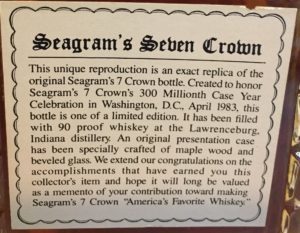

Seagram’s 7 was the 1st brand ever to reach 1 million cases. The 1st to sell 100 million cases. And, over the years sold over 300 million cases in 1983. (See close up photo below.) We’re talking a multi-billion-dollar brand, boys and girls.

The back label of the commemorative bottle from the 300 million case celebration

The back label of the commemorative bottle from the 300 million case celebrationAs the story goes, after prohibition and before WWII, Seagram introduced two blended American Whiskies — Seagram 5 Crown and 7 Crown. Why the name Seagram 7? The apocryphal story is that Sam Bronfman (the Seagram patriarch, known as Mr. Sam) was presented with a range of candidate products for a blended whiskey and ended up choosing the one he liked — the 7th one presented to him.

Whatever happened to Seagram’s 5? During the Second World War the government asked distillers to cut back on alcohol production to aid the war effort. Seagram’s 5 was not doing as well as 7, so it was discontinued. Also, Seagram’s 5 was higher in alcohol at 86.8 proof.

How did the 7&7 come to be? (Another apocryphal story.) Well, those were the days when distributor sales reps tried to build brands rather than just fill orders. So, an aggressive sales rep thought it would be clever to link the 7 in 7up with Seagram’s 7. Much to his surprise it was great and the 7&7 was born.

Here’s What Else I Can Tell You

At Seagram and since then, I’ve heard it referred to differently. Internally, we referred to the brand as 7 Crown. Among consumers and generally outside of Seagram it was called Seagram 7 or just plain ‘7.’

The event linking the brand to Dive Bar Day was organized and run by Greg Leonard and his company Proof Media Mix. Greg is a former Seagram and Diageo PR and activation executive and, for my money, the best in the business at making ideas and events come alive,

Did you know that Seagram’s 7 — a blended American Whiskey contains a large percentage of grain neutral spirits? Check the packaging, right on the front label it says “75 per cent Grain Neutral Spirits.” Even back in the day, GNS was a significant proportion of Seagram’s 7. In fact, the US regulations for blended whiskey allows a blend of straight whiskies and up to 80 percent neutral spirits.

I’ve often heard it said that brands have a life cycle — from creation to maturity to decline, and ultimately gone. Maybe. Here’s a brand that had its heyday in the 1960s and 70s and is still alive and kicking. Like I said, manufacturers kill brands, consumers don’t.

* * *

I wish to thank the following people whose thoughts and experiences helped shape this article… Rob Warren, Greg Leonard, and John Hartrey. Special thanks to John for sharing his collection of Seagram memorabilia and photos. In fact, John has the dubious distinction of being the last Seagram’s 7 brand director at Seagram.

Diageo activation at the 2018 Firefly Music Festival (Photo by Jack Dempsey)

Diageo activation at the 2018 Firefly Music Festival (Photo by Jack Dempsey)

June 21, 2018

Amazon, Malfy Gin, and Building a Brand

Last Friday, Wine and Spirits Daily reported that Mark Teasdale, CEO of Proximo Spirits is leaving to join Biggar & Leith, the company Founded by Elwyn Gladstone that markets Malfy Gin and Spytail Rum. Mark and Elwyn have previously worked together at Proximo and William Grant and collaborated on such new brands as Kraken Rum and Hendrick’s Gin, among many others.

I learned of this development after I wrote this article and it adds immensely to the story. Both these folks are top of the game spirits industry players. And, as you will see, Elwyn has already been doing amazing things with Malfy. So, this change builds on success and gives the company an even more important presence in the industry.

Leveraging the Power of Amazon and Direct-to-Consumer Sales

Malfy Con Limone Gin (the original product) is made in Italy from the luscious lemons of the Amalfi coast under the marketing and sales guidance of Elwyn, whose background includes senior positions at large spirits companies. (The original story on Elwyn and Malfy can be found here.)

I was wondering how Elwyn, with his large company experience, was making out with his fledging startup brand. So, last month, I checked in with him. He is, after all, one of the most creative and smart marketers I know. Could he transfer his skills honed at large spirits companies to a startup? In particular, I wanted to know how the brand was received by distributors. Would he get the same attention with Malfy as he got with Hendrick’s?

Little did I know when I reached out to Elwyn, that this journey is most unusual and a case study on how to beat the system and build a brand despite obstacles.

How is Malfy Doing?

After only just a few years in the market, the brand is on track to do over 185,000 6-pack cases in the US and around the world — the UK, other European markets, South and Central America, South Africa and elsewhere. He has lots of room to grow geographically and his re-order rates are impressive.

In the US, the brand is among the top 10 Super-Premium Gin in Nielsen (brands that cost more than $25 per bottle) growing at over 300% and on track to hit a top 5 position. The brand is distributed by Infinium Spirits in the US, and based on the aforementioned, I’d say they are paying attention to the brand.

He has also introduced a range of gin products. The US has the first launched Con Limone, and recently introduced Originale, a traditional gin. Outside the US, the Malfy Gin line also includes Gin Rosa, a Sicilian pink grapefruit gin, and Con Arancia, gin made with Sicilian blood oranges. He and Infinium Spirits will introduce these other gin line extensions in July.

That’s only part of the story—enter Amazon

It is fairly common for a new brand to look to the rest of the world (especially Europe) as a way to build a brand and generate sales, while waiting for the US market to wake up. What happens is that an importer is contacted, who probably has a stable of brands, and the wait for growth traction overseas becomes another frustration.

But not for Elwyn and Malfy Gin. I asked him, “How come you’re doing so well in the UK?”

The answer? Amazon and direct-to-consumer sales.

According to Elwyn, “The absence of a mandatory 3-tier system coupled with a robust purchase and delivery system creates a strong platform for direct to drinker sales. But, more important, Amazon provides the opportunity for the brand owner to use all sorts of marketing efforts and truly remain the guardian of their brand.”

In the UK and Germany, he is selling over 1,000 bottles per month and growing.

Let’s take a closer look at Amazon and liquor sales.

But, first, let’s cover a few noteworthy things about Amazon and spirits:

As I’m sure you known (but for those who don’t) Amazon does not sell direct to consumers in the US. They tried to with wine but that ended when they acquired Whole Foods.

Outside the US, it is the importer who sells to Amazon, but in Elwyn’s case, he has been the driving force influencing importers to use Amazon.

The markets where Amazon is currently selling booze are limited to the UK, Germany, Spain and Italy. But they are rapidly opening other markets.

Amazon — distributor and retailer

If you talk to US distributors about Amazon, you’ll hear two views, a public and private one.

The expected and public view is, “Nobody ever built a brand on Amazon.” That’s currently true but, certainly, brand building overall in the US has changed and, for fledgling brands, the growth comes from the consumer themselves, more than the trade. That’s why privately, many distributors express concern about direct sales in general and Amazon in particular.

Recommendations from bartenders and store people are important but so is word-of-mouth among drinkers themselves. As to Amazon’s role here, Elwyn suggests,

“Think of Amazon’s product page as the world’s most efficient shelf-talker and neck-tag information booklet… including reviews from hundreds of consumers, press and PR, recipes, photos, and more. And, let’s not forget the simple star ratings based on thousands of people.”

Clearly, Elwyn has spent quite a bit of time trying to understand Amazon and its power to build and sell spirits brands so I asked him to further share his marketing and sales thoughts. After all, Malfy has become a top 10 best-selling gin, surpassing many household name brands including Hendrick’s.

Here is what he has learned about the power of Amazon and the role of the internet in general:

The brand owner is in control. Once establishing your ownership with Amazon, you can appoint people who can manage the site/sales, but the brand is firmly in your hands.

Brand sales drivers. Of course, product credentials (brand name, packaging, etc.) are important but Amazon also allows an owner to:

Put up consumer reviews, so that the more frequent and better the review, the higher the brand appears in searches.

Use key words, that also drive how well a brand does in searches on Amazon.

Advertise via sponsored ads.

The use of brand photos, which is a huge driver and there are ways to test which photographs work best.

Sales data. Amazon in the UK provides easily accessible data on brand sales ranking for all brands within a given category.

A level playing field. This is ideal for smaller brands inasmuch as the big boys cannot muscle them out as they can in stores with multiple facings, optimum shelf space and, well, plain old clout.

More effective promotions. Amazon provides quicker and easier ways to manage and measure the impact of promotional activities.

Tastings are more cost effective. The current approach at retail can easily cost $200 per session and the reach is limited. Amazon offers the opportunity to purchase sample boxes so consumers can buy a bunch of miniatures. It’s also a better use of the brand owner’s time than standing around a retail store doing tastings.

Enhanced recommendations and word of mouth. According to Elwyn, the Amazon approach may just surpass a recommendation from a bartender or store-keeper. (See the earlier comment about the Amazon page strengths.)

Making it easier to reach the on-premise trade. Those of you involved in the bar trade can relate what a nuisance it is to order a new brand from a startup. Amazon provides the ability to order any brand listed, including a single bottle

* * *

In sum, the Amazon — non-USA — platform is a powerful brand building and sales device. The brand owner stays in complete control, the tools available can provide an effective means for reaching a very wide audience, all efforts and expenditures are easily tracked and effectiveness measured, and, it is amazingly cost effective.

It is, of course, interesting to speculate whether the US will eventually go this way and create the same opportunities for the small producer as in Europe. My answer is NO, we have a 3-tier system, which is unlikely to go away, and direct-to-consumer transactions remain difficult if not impossible.

Elwyn Gladstone’s approach to building his overall and global brand business is incredibly sound both strategically and tactically. While he overcomes obstacles and patiently waits for the US business to take hold, he is leveraging the available resources outside the US to provide the wherewithal to help and to build his brand in the rest of the world.

I told you he was smart.

* * *

Elwyn Gladstone

Elwyn GladstoneMy thanks to Elwyn Gladstone for taking the time to share his efforts and thinking with me for this article.

I’d love to hear your thoughts in the comments section at the very end of this article or in an email to arthur@boozebusiness.com

May 10, 2018

Black Fig Vodka: A Star is Born

Black Fig is a vodka infused with figs, but far from a flavored vodka. Actually, it’s a Distilled Spirit Specialty whereby actual California figs (roughly a pound per bottle) are naturally infused in a neutral grain spirit (NGS) without added sugar or additives.

From what I can tell, this is a home run and has everything going for it right out of the gate—a great tasting product, a unique concept, an incredible cocktail addition, and a passionate owner who knows what he’s doing.

Consider this:

Michael Davidson, the owner and CEO of Black Infusions, walks into a top restaurant and approaches the F&B manager, who promptly tells him he has no time to speak to him. Michael’s combined chutzpah and Boston charm convinces the manager to give him 10 seconds and “just taste this.” He does and the next thing you know they’re talking for half an hour about cocktails, using Black Fig in food recipes, and a large order for the product is placed.

He gets into one of the Total Wine & More stores and conducts a tasting and quickly sells out the three cases he brought—18 bottles in 45 minutes.

At ABC Kitchen in NYC, a distributor sales rep (MS Walker) pitches the brand, does a tasting, and the Food & Beverage Manager falls in love with it. The next thing Michael knows, Black Fig Martini is on the cocktail menu. They sell 25 to 30 (6-pack) cases a month.

I can go on but I think you get the picture. One sip of this product and you’re hooked. So, let’s take a closer look. (By the way, the brand won Double Gold at the 2017 San Francisco Spirits Competition.)

About the owner

Michael Davidson is a born and bred Bostonian who left his successful family business to follow his dream to launch a spirit brand he came across. He was at a Mediterranean restaurant owned by a friend who served a homemade drink consisting of dried figs soaked in vodka. “That’s vodka? This tastes like liquid fig,” said Michael.

A light bulb went on and, after more than two years in development, the product was ready for market. Over the course of that time, a formula/recipe was developed, a contract bottler was engaged, legal issues were addressed, distributors were found, drink recipes created—and, a brand was born.

Michael is a unique kind of guy. I’ve met scores of startup entrepreneurs but he has most of them beat with his thirst for knowledge and information about the booze business; his willingness to make a difficult decision and still change gears when necessary; and, his understanding that without marketing and sales, a product cannot succeed. Above all, I’m very impressed with his passion for the brand and the business.

I’ve met with Michael a number of times in restaurants and he’s fun to watch as he gently but effectively pitches Black Fig. He listens, a trait many wannabe spirit entrepreneurs need to learn.

He’s gotten the brand into 12 markets with a number of distributors, most notably M.S. Walker, and some top on-premise accounts (ABC Kitchen, Bobby Van’s, Mistral, and more) and off-premise accounts, (Wegman’s, Total Wine & More, Whole Foods to name a few). The brand is currently available in the northeast, mainly New England and parts of the mid-Atlantic.

The product

In a word—amazing. As soon as you open the bottle, the aroma of the figs comes pleasantly through. It’s great straight and on the rocks, and you won’t believe what it does to a cocktail. But let’s start with the basics.

Black Fig is an artisanal product distilled with neutral grain spirit and naturally infused with California figs (about a pound per bottle) in small batches. It is 60 proof (30 AbV) and made without artificial sugars, flavors or colors. And, since the NGS (vodka) is made from corn, it is gluten-free and Kosher if that interests you. The product sells for around $30 per 750ml, depending on where you live.

Ah, but the real joy of this product is it’s mixability and versatility—it plays nicely with other ingredients and enhances your favorite cocktail like a Black Fig Martini, a Fig Mojito, Mediterranean Mule, or a Black Fig Old Fashioned. Michael also has quite a number of drinks that he invented like the Fig Flower, the Black Dragon and many more that you’ll find on his recipe page.

Black Fig martini

Black Fig martiniThe Future and Challenges

Michael “gets it,” and knows that as a small startup he has to work night and day to increase traction and break through the clutter. One of his favorite expressions is, “Sometimes I feel like I’m screaming from the bottom of the Grand Canyon and trying to get heard.”

But by far, his greatest challenge is being a one-man show. To succeed and grow, he will need to get some sales help, focus his time and energy on things that have the greatest return on the investment of his time, and probably both.

He literally does everything but has some marketing help (conventional and digital) from a very sharp woman named Kalen Junda. Kalen is an entrepreneur in her own right and runs a small marketing company called the Tobe Agency. In my view she is also a rising star.

Among the things I admire about Michael is that he’s not falling into the “startup trap” of expanding markets before he’s ready and thereby spreading his financial and other resources very thin. But that doesn’t mean he’s not thinking about the future.

Down the road, he would like to move into southern and western markets. Hey, come on, a Black Fig product made with California figs? He’s got to be in the Golden State.

He is also thinking about what comes next and has decided on a line extension that he’s not yet ready to reveal publicly. He’s told me about it, sworn me to secrecy, and I know it will also be a home run. I guess I’ll just have to keep following and writing about him and see where this journey takes him.

I’ll just sum it up by quoting another favorite expression from Michael, which he got from VinoTapa restaurant’s drink menu— “Go fig or go home.”

March 22, 2018

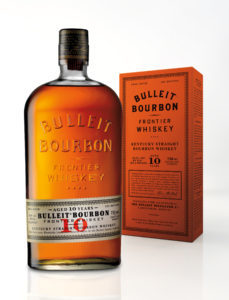

Bulleit Bourbon: The Birth of a Brand

I’ve known Tom Bulleit since the 1990s and it was under my watch at Seagram that Bulleit Bourbon was developed and launched. Tom is a terrific guy, a real gentleman, and a smart businessman.

I saw some Impact Databank sales information the other day and among the top 10 super-premium bourbon brands, Bulleit is second only to Maker’s Mark in case sales at 1.2 million 9-liter cases (Maker’s is at 1.5 million), but Bulleit’s growth from 2016 to 2017 was 12.7% compared to maker’s 4.7%.

What’s even more impressive is that in 2000 Bulleit sold 180,000 cases while Maker’s Mark sold 1.4 million. At this rate of growth, it is likely that Bulleit Bourbon will surpass Maker’s as the leading selling brand.

So, the brand’s remarkable achievement has been the result of Diageo’s and Tom Bulleit’s efforts. Its launch and positioning in the bourbon market was due to the folks at Seagram.

Its start has always been an enigma to me and I set out recently to get the full story and to refresh my memory.

Let’s go Down Seagram Memory Lane

If you’ve read my book (forgive the shameless self-promotion), you know that Seagram was a whisk(e)y company in a world of vodka, tequila and other non-whiskey products. Starting in the early to mid 90s, the company acquired the distribution rights to Absolut, and at the same time, Captain Morgan and Crown Royal were growing by double digits each month. By the mid to late 1990s Seagram had consolidated its whisk(e)y portfolio to Canadian Whiskies (Crown Royal, VO and its line extension), Seagram 7 Crown, and Scotch brands (Chivas Regal, The Glenlivet, and other single malt whiskies).

All other whiskey brands were sold or let out to pasture. This Included such terrific brands as Weller, Benchmark and my current favorite, Eagle Rare. The sole exception that comes to mind is Four Roses, which was doing very well as a bourbon brand in Japan but languished as a blended American whiskey in the US.

The puzzle to me as I look back on it is, with the portfolio changing and growing and many whiskies being sold, why did Seagram want a fledgling bourbon with a pretty awful package (at the time)?

The old Bulleit bottle

The old Bulleit bottleThere’s another piece of the equation that may partially shed some light on this.

In 1995, Seagram bought 80 percent of the shares in entertainment conglomerate MCA Inc. for $8 billion. The company was now in a new business and Edgar Bronfman Jr. focused his attention there. As a result, the owner “overwatch” returned to Edgar M. Bronfman (the Chairman) assisted by John Bernbach, a long time Edgar Jr. friend, an advertising and media executive, and a Bronfman/Seagram advisor.

How Bulleit Came to Seagram

John played a crucial role. At dinner one night with an attorney friend from a prominent NYC law firm, John was told about Tom and the brand. He naturally assumed that since Seagram did not have a bourbon, Bulleit would make a strong addition to the overall portfolio. He brought the idea to both Edgar Jr. and the Chairman.

Both Bronfmans were said to have some reservations. The younger Bronfman was not happy with the packaging (see photo) while the Chairman had some reservations about the taste. But, both liked the idea of a bourbon in the House of Seagram.

But why? Bourbons had been removed from the fold, Crown Royal was on fire, Glenlivet and other single malts were doing nicely, and the company’s focus was on Absolut and the commitments to the Swedish owners.

There are lots of conjectures as to the answer. Perhaps Edgar Jr. was prescient and saw bourbon’s return as an opportunity. Maybe he wanted to show investors and the company that, despite the entertainment industry involvement, the spirits business was still top of mind. Conceivably the Chairman, now returned to the forefront of the booze business, was excited by the idea of a bourbon product that was outstanding.

My guess is that when John brought in his team (copywriter and art director), he showed the Bronfmans what the brand could become. Edgar Jr. in particular loved the work of these two gents.

Bulleit 10 year old bourbon

Bulleit 10 year old bourbonChuck Cowdery—writer, blogger, historian, marketer, and arguably the most knowledgeable bourbon maven on the planet—has written more than anyone about Bulleit. So, I’ll let him provide a brief history as reported on his blog:

Bulleit bourbon was launched in 1995, the brainchild of Tom Bulleit, a Kentucky lawyer who, through his legal work, learned a lot about the growing international market for American whiskey. He contracted with the Buffalo Trace Distillery in Frankfort, Kentucky, to make it. A few years later, he moved his operation over to Seagram. They created the current bottle and reformulated the product, moving its production to the Four Roses Distillery in Lawrenceburg, Kentucky.

Tom Bulleit

From the moment Tom walked through the door, and up to the closing of the Seagram door, Tom was a key player in the development of the brand. He worked with the production folks on the recipe, with the agency on the brand’s positioning, and with marketing/packaging on the look and message of Bulleit.

To me, this was a bit unusual. While Seagram often welcomed brand acquisitions, with the exception of Absolut, the attitude was often (to paraphrase) “thanks, we love your brand, here’s your check, we’ll take it from here, and here’s the door…” But, all of us from the Bronfman’s on down, welcomed Tom’s involvement.

There’s probably a couple of reasons for that, mainly due to Tom’s personality and approach—he’s smart, has the brand in his DNA, a team player, and overall terrific person to work with. Neil Gallo, who ran the day-to-day development of the brand, told to me recently that Tom would often say to Seagram folks something like, “here’s my suggestion, use it or not as you see fit.” His ideas were almost always accepted.

From my standpoint, I loved Tom’s “outsider” views and the way he interacted with our people.

Tom Bulleit

Tom BulleitThe Bulleit Product

Whether there was a Bulleit Bourbon product on the market or otherwise available to be bought in the 19th Century, was irrelevant to us. Tom’s proposition was 1) the brand traced its origin to Augustus Bulleit (great-great-grandfather of Tom) and 2) with strong brand credentials, the brand could be a winner. We totally agreed.

The production folks were energized by the fact that they would be working on a new whiskey (a bourbon no less) and would be able to use the outstanding bourbon stocks they had. According to Art Peterson, who was VP of Quality Assurance and Technical Services, the team presented samples from mingling bond stocks from inventory. These went to Tom and the master distiller for approval. Ultimately, as was the case with all Seagram products, the final approval of the liquid came from the Chairman.

Tom, for his part, had his ancestors recipe in mind—a high rye content bourbon. What was produced was two-thirds corn and one-third rye. (The bourbon corn requirement is 51%). Today the brand’s recipe is very similar—68% corn, 28% rye, and 4% malted barley.

Here’s how the Bulleit website describes the product:

Inspired by his great-great-grandfather Augustus Bulleit, who made a high-rye whiskey between 1830-1860…

The Concept and the Packaging

John’s Bernbach’s team (with Tom and Neil’s involvement), came up with a simple yet powerful message. This isn’t just a bourbon, this is a Frontier Whiskey. A powerful slogan followed— “When men were men and whiskey was bourbon.” I loved it, approved it immediately then brought it to Edgar Jr. for his final okay.

The slogan is gone but the Frontier Whiskey is still prominent in the current Bulleit packaging.

To me, the Bulleit packaging that was developed by Sandstrom Partners in Portland Oregon captured the concept perfectly. All the elements were there—a flask shaped, apothecary-like bottle, embossed branding, cork closure and, a minimal wraparound label that is slightly askew as though it was hand applied.

About that label… It was put on deliberately misaligned because it fit the imagery and positioning of the brand. It is part of the brand’s personality. However, in almost all operating committee meetings someone from production would invariably say something like this: “Great news Arthur, we fixed the label. It’s now perfectly straight.” This “great news” was always met with a groan and a request to leave it alone.

The Reactions

Not everyone in the organization loved or cared about Bulleit. Most of those in sales welcomed the brand since it had the backing of the owners or because they saw an opportunity in the bourbon business. At the same time, there were many who felt that Bulleit detracted focus and attention from the phenomenal growth of Crown Royal—a known winner vs. an upstart. Besides, there were other brands in need of focus such as Absolut and Captain Morgan, both recognized winners.

The brand limped along from the mid-1990s until the end of the decade. Then the lights went out as Seagram was sold to Pernod-Ricard and Diageo. The brands were split up and Diageo acquired Bulleit Bourbon.

The situation for the brand changed appreciably. According to data I’ve seen, the returning growth of bourbon began in the mid-2000s. Unlike Seagram, Diageo, while strong in scotch, did not have much going for it in American whiskies, particularly bourbon. Dickel and Rebel Yell hardly fit the bill to compete with the rapidly growing brands. As a result, Diageo had nothing to lose and much to gain by pushing Bulleit and its unique package and positioning. I’m told that Diageo’s sales folks loved the brand and strongly focused on it.

Today

In 2017, to meet the demand of Bulleit, Diageo built a distillery in Shelbyville, Kentucky which will produce 1.8 million proof gallons annually, with the opportunity to expand further over time. It’s on a 300-acre campus with barrel houses at a cost $115 million.

At the current rate of growth of the brand, I wouldn’t be surprised if the expansion were to happen very soon.

* * *

Lessons Learned

1. The role of focus

Seagram had strong and rapidly growing brands requiring concerted and sustained effort. Bulleit would have had to push itself to the forefront of the portfolio at the company. Even if Seagram had survived, I have my doubts as to whether Bulleit would be where it is today.

2. Managing a portfolio of brands

Diageo, seeing the emergence of a return to bourbon, had the good sense to back Bulleit at the expense of George Dickel (a Tennessee whiskey) and Rebel Yell (which was ultimately sold to Luxco in 1999). In short, Seagram’s roster of brands had no real room for Bulleit while Diageo did.

3. Hey marketing folks—don’t overthink it

I think there is a temptation among marketers to show relevance and authenticity by claiming a brand’s recipe dates back to 1830. It was smart to go a different route—just being inspired by Augustus Bulleit is sufficient. As a consumer, I care less about a brand’s history and background and more about what it is today.

* * *

I’d like to thank the following people who helped refresh my memory or otherwise corrected my recollection in writing this article. These included Neil Gallo, Rob Warren, John Bernbach, Greg Leonard, Sam Ellias, Art Peterson, and, of course, Tom Bulleit.

The Bulleit portfolio of brands

The Bulleit portfolio of brands

February 13, 2018

Marijuana: A Store Visit

At the end of January, I visited some folks in LA and, since the sale of recreational marijuana is legal in that state, I thought I would visit one of the stores and check it out.

A friend who lives there and had purchased medical marijuana in the past, agreed to go with me and serve as a guide—a ganja guide.

Before I get into the fascinating and (dare I say) fun shopping spree, let’s take a look at the current marijuana situation in the US.

MedMen Venice store. Courtesy of MedMen

MedMen Venice store. Courtesy of MedMenSome Facts and Figures

As of 2018 there will be eight states that have legalized marijuana for recreational use. Over twenty other states allow marijuana for medical use. And, both lists keep growing.

It shouldn’t come as a surprise considering the following polling results on the subject from the Gallup people:

64% of Americans support legalization and this represents the highest number recorded since Gallup started asking the question in 1969. (Jan 4, 2018)

45% report having tried marijuana, also the highest since 1969, and 12% claim to currently use it. (July 19, 2017)

In a study on its use by DIG Insights (a global research firm) few people are concerned about harmful effects (16%) and a majority believe consumption can be beneficial (51%). (April 14, 2017)

What About the Effect on Alcohol Sales?

Well, here the data is currently less clear, but signs point to more impact on beer than wine and spirits.

But it seems to me that just as there is “share of stomach” that beer, wine and spirits compete for, the advent of widespread availability of marijuana has to create a fight for “share of buzz.”

A Cowen Insight report (via Mark Brown’s Industry News Update on Jan 15, 2018) indicated that a study using scanner data showed, “that counties located in states that legalized medical marijuana saw a reduction in alcohol sales of 13%.” Further, the Cannabiz Consumer Group (C2G) predicted in March, 2017: “Legal marijuana will take away 7.1% of revenues from the existing retail beer industry.

With this information in mind, I set out with my friend to visit a store, see what the shopping experience was like, get an understanding of who the customers are, and learn first-hand about this product and its future.

MedMen Enterprises

The store we went to is owned by MedMen Enterprises, who currently own 18 facilities in 3 states and has over 700 employees. Unlike other retailers/dispensaries, MedMen is vertically integrated and has licenses to own cultivation facilities, retail stores, and distribution. (In the cannabis industry, distribution involves a “watch dog” and oversight function whereby quality, record keeping, compliance, and related matters are scrutinized.)

The store we went to is owned by MedMen Enterprises, who currently own 18 facilities in 3 states and has over 700 employees. Unlike other retailers/dispensaries, MedMen is vertically integrated and has licenses to own cultivation facilities, retail stores, and distribution. (In the cannabis industry, distribution involves a “watch dog” and oversight function whereby quality, record keeping, compliance, and related matters are scrutinized.)

The company both owns and manages various aspects of the marijuana trade. It will be listed on the Canadian Securities Exchange in the second quarter of this year. (By the way, here is the list of marijuana companies on the CSE—around 60. You might also find this of interest.)

This is how MedMen describes themselves:

MedMen is writing the book on the modern cannabis industry, from how facilities are designed and constructed to setting the bar on quality and excellence. We are also helping shape the laws that make this industry viable.

These are true professionals with a serious set of business criteria and mission:

MedMen operates scalable, highly-efficient growing facilities using the latest in agronomic technology and sustainable techniques, and our manufacturing facilities use standards comparable to those in the biotech and pharmaceutical industries.

They are not the first company to enter this emerging business, but from what I witnessed by talking to their management and visiting a store, I think they’re top of the game and will grow.

Sun Valley cultivation workers

Sun Valley cultivation workersCourtesy of MedMen

Plants

PlantsCourtesy of MedMen

The Shopping Spree

We went to their Venice store on Lincoln Blvd. It was at 1:00 on a weekday and the place was mobbed. I was told that it’s always busy and fairly common to see people waiting to come in. The Venice store is small (perhaps 700 square feet of selling space) with shelves of products and showcases on the floor.

To enter, you must stop at a registration area and show proof of age (driver’s license or passport) and register, which allows you to buy. They sell cannabis in different formats including—cannabis buds, of course (various strains and potencies), edibles such as gummies and other sweets (chocolate, cookies, etc.). There is even medicated cannabis rubs (salves) meant to help with aching joints, uh, body joints.

There is a limit to the amount of product you can buy on any one visit.

What really struck me was the caliber and knowledgeability of the sales people. My friend described them as akin to the sales people at the Apple store and Daniel Yi, the Medmen spokesperson, told me that many customers come to the same analogy. These folks were friendly, happy to answer questions and serve as a cannabis escort—what you might be interested in, how much to use, etc.

I learned, for example, the difference between THC and CBD and their role in health matters as well as in “mood change.” Also, the difference between Sativa, Indica and Hybrid strains. I was kind of envious of their retail skills and how the booze business might benefit from similar selling approaches—low key on sales persuasion and primarily focused on educating and guiding the customer.

What about the customers? Good question. It was everyone—young and old; men and women; from all walks of life; all socioeconomic levels. I couldn’t help but ask some of the shoppers about the comparison between alcohol and marijuana. One person said they were just looking for something different from alcohol. Another told me that sometimes they like a drink and sometimes a joint. Still another told me that they preferred cannabis because alcohol was chemical and marijuana was botanical. Ouch.

Here’s the interesting kicker that can serve as a predictor of marijuana legalization and potential growth—taxes.

The Tax Situation

My friend spent $517 that day. Of that amount, $411 was for various products and $62 was for state excise tax (15%) and $45 was for local sales tax (11%). That’s over 25% in taxes. The tax revenue from marijuana sales are attractive to State governments and taxpayers as well, for that matter.

Here’s an interesting article on the California tax situation. It points out that the sales tax on alcohol and marijuana are fairly similar (7.5 to 9.5 percent) but the state excise tax for cannabis is 15%, while wine is 0.25% on average and beer is 1.5%.

But it’s not totally a rosy picture. From my understanding, people in California are skeptical as to how these taxes will be used and whether they will go to where it was intended. A few states can’t seem to figure out how to proceed despite the vote for legalization. And, of course, the federal government repealed an Obama-era policy of leaving law-abiding marijuana businesses alone in those states that have legalized it.

Those of us in the booze business know firsthand that prohibition doesn’t work and that the single most important reason for the end of the “noble experiment” was the absence of taxes from booze.

Further Thoughts and the Future

As to what the alcohol industry should be doing, I found it very interesting that Constellation Brands made a play in the marijuana business last year, investing $191 million in a Canadian company. At the recent Wine and Spirits Daily Annual Summit at which COO Bill Newlands spoke, he said they believe marijuana is an emerging trend that they need to tap into because it’s going to be a big business.

A recent article from Rolling Stone had some interesting predictions for 2018 and what to expect from the marijuana situation in the US.

Let’s start with this quote: “State-legal pot markets seem poised to match or exceed the value of black market pot by 2020.” The friendly, neighborhood dealer could soon be looking for work.

They also predict that there will be legal marijuana lounges in some places, probably Las Vegas for starters and Canada will continue to benefit financially and otherwise from their role in the business.

But the most interesting of all is that the possibility of legalization of recreational marijuana in New Jersey will mean increased pressure on New York—where medical marijuana is legal—to do the same. You can get to Jersey City from Manhattan in 15 minutes or less. Also, let’s not forget that much of New England has approved medical and/or recreational sales already.

* * *

My takeaway is that the marijuana industry will have growing pains but, in the long run, it is here to stay and will flourish. The question for us, dear readers, is how the alcohol industry can or will adapt.

January 8, 2018

Move over, Tequila and Mezcal

Back in 2014, I wrote a number of articles about Desmond Nazareth and his Agave India products, as well as how agave made its way to India. (See articles and here.) Recently, I learned that Desmond has joined forces with Martin Grassl, the founder of Porfidio tequila.

is how their joint venture is described on Old Town Liquor’s website.

The joint venture was created out of the mutual respect of two entrepreneurs of disparate backgrounds but with similar creative minds. They shared a profound admiration for a botanical wonder, the “tree of marvels” as the Spanish Conquistadors called the agave when they encountered it in Mexico.

The product is called SINGLE AGAVE® 100% AGAVE AMERICANA EDITION (Code Name: S3xA). It’s not made in Mexico but in southern India— the Deccan Plateau, a geographical area where the agaves grow. As the story goes… the agave was transplanted from Mexico to India by Queen Victoria for fencing off the railways of the Raj to stop Holy Cows from being crushed by trains. The Agave Americana is the producer’s way of celebrating that 100-year-old event by distilling the wild plants.

I spoke with Desmond Nazareth or DesmondJi, as his brand is called, and here are excerpts from the interview.

BB: How did your relationship with Martin Grassl and Porfidio come about? How did you and he meet?

DN: The relationship was born out of respect for each other’s achievements and each other’s product quality. Martin noticed articles about Indian agave spirits appearing around 2012 in the Mexican press and contacted me.

It was both Martin’s and my opinion that agave spirits— be it tequila, mezcal or other— are unique precisely because of the botanical uniqueness of the agave plant (“the inulin factor”), the true and only star of the equation, not because they are Mexican-made.

The idea, of course, is not new, as it simply mimics what Baron Rothschild did for the world of wines 50 years ago by creating the first non-French wines in Chile and Napa. It was revolutionary idea at the time.

Both Martin and I strongly feel that Indian agave spirits, made in our craft distillery (India’s first), should be viewed in the same league as Mexican agave spirits like mezcal, by nature of being made from naturally grown and foraged agave plants, as opposed to plantation-grown agave plants. The fact that my products are made from 100% Agave Americana, rather than 100% Blue Agave, takes our premium products intentionally beyond tequila, along the lines of Mexico’s finest mezcals.

BB: This is a special edition product, how is it different from your other Agave brands?

DN: It differs in terms of product formulation from our other agave spirits products. Certain adjustments were made to the hydrolysis, fermentation and distillation process to create a product which is more attuned towards international taste profile preferences, rather than India’s domestic preferences. For this first special edition, a traditional process of heat hydrolysis has been used, the oven cooking method.