Chris Hedges's Blog, page 291

April 2, 2019

WWF Sounds Alarm After 48 Pounds of Plastic Found in Dead Whale

MILAN—An 8-meter (26-foot) sperm whale was found dead off Sardinia with 22 kilograms (48.5 pounds) of plastic in its belly, prompting the World Wildlife Foundation to sound an alarm over the dangers of plastic waste in the Mediterranean Sea.

The environmental group said Monday the garbage recovered from the sperm whale’s stomach included a corrugated tube for electrical works, plastic plates, shopping bags, tangled fishing lines and a washing detergent package with its bar code still legible.

The female whale beached off the northern coast of Sardinia last week, within the vast Pelagos marine sanctuary that was created as a haven for dolphins, whales and other sea life.

“It is the first time we have been confronted with an animal with such a huge quantity of garbage,” Cinzia Centelegghe, a biologist with the University of Padova, told the Turin daily La Stampa.

The exam also determined that the whale was carrying a fetus that had died and was in an advanced state of decomposition. Experts said the mother whale had been unable to digest calamari due to the huge amount of plastic it had ingested, filling two-thirds of its stomach.

WWF said plastic is one of the greatest threats to marine life and has killed at least five other whales that had ingested large amounts of it over the last two years from Europe to Asia.

Another sperm whale died off the Italian island of Ischia, near Naples, last December with plastic bags and a thick nylon thread in its stomach, but plastic was not the cause of death.

The World Wildlife Foundation said between 150,000 and 500,000 tons of plastic objects and 70,000 to 130,000 tons of micro-plastics wind up in Europe’s seas each year.

To combat the phenomenon, the European Parliament last week approved a new law banning a wide range of single-use plastic products, including plates and straws, starting in 2021.

Italy’s environment minister, Sergio Costa, lamented the whale’s death and said he planned to propose a new law this week to limit the use of plastics.

The law will permit fishermen to bring plastics recovered at sea to land for proper disposal, which they currently are barred from doing. Costa also pledged Italy would be one of the first countries to enact the European single-use plastics ban and appealed to the mayors of Italian cities and coastal towns to adopt the ordinances in advance of the 2021 law.

“We have been using disposable plastics in a carefree way in these years, and now we are paying the price,” he said. “The war on disposable plastics has started. And we won’t stop here.”

April 1, 2019

Trump Team Overruled 25 Security Clearance Denials, Worker Alleges

WASHINGTON—A career official in the White House security office says dozens of people in President Donald Trump’s administration were granted security clearances despite “disqualifying issues” in their backgrounds, including concerns about foreign influence, drug use and criminal conduct.

Tricia Newbold, an 18-year government employee who oversaw the issuance of clearances for some senior White House aides, says she compiled a list of at least 25 officials who were initially denied security clearances last year but then had those denials overruled by senior administration officials.

The allegations were detailed in a letter and memo released Monday by Rep. Elijah Cummings of Maryland, chairman of the House Oversight and Reform Committee. The documents, which are based on Newbold’s March 23 private committee interview, don’t identify the officials on the list but say they include “two current senior White House officials, as well as contractors and individuals” in different parts of the Executive Office of the President.

“According to Ms. Newbold, these individuals had a wide range of serious disqualifying issues involving foreign influence, conflicts of interest, concerning personal conduct, financial problems, drug use and criminal conduct,” the memo says.

The release of the documents sets the stage for another fight between the White House and the Democratic-controlled House, and immediately drew criticism from House Republicans who called the allegations overblown and “cherry-picked.”

Cummings’ panel has been investigating security clearances issued to senior officials including Trump son-in-law Jared Kushner, former national security adviser Michael Flynn and former White House aide Rob Porter. That probe has picked up steam after The New York Times reported that Trump ordered officials to grant Kushner a clearance over the objections of national security officials, and after Newbold spoke out to NBC News and other news outlets about her concerns.

On Monday, Cummings said he will move this week to authorize his first subpoena in the probe. The subpoena will be for the deposition of Carl Kline, who served as the White House personnel security director and supervised Newbold. He has since left the White House for the Defense Department.

The White House did not immediately respond to a request for comment Monday.

Rep. Jim Jordan, the committee’s ranking Republican, said in a statement that Cummings’ probe is a “partisan attack” and an “excuse to go fishing” through personnel files. He also said that one person on Newbold’s list is a GSA custodian.

Also, in a response memo circulated to Republican members, Jordan’s staff cast Newbold as a disgruntled employee who had only limited knowledge of the reasons security clearances were granted. The Republican document also suggests Newbold’s concerns were “overblown,” saying that four or five of the clearance denials for “very serious reasons” were a small fraction of about 5,000 employees who work in the Executive Office of the President.

According to Democrat Cummings’ memo, though, Newbold considered the decisions to be part of a “systematic” problem within her office where the decisions of security clearance reviewers were “continuously” overridden.

Newbold said she raised her concerns up the chain of command in the White House to no avail. Instead, she said, the White House retaliated, suspending her in January for 14 days without pay for not following a new policy requiring that documents be scanned as separate PDF files rather than one single PDF file.

Newbold said that when she returned to work in February, she was cut out of the security clearance process. The office also announced a plan to “restructure” that would remove her from a supervisory role, she said.

In response to Newbold’s interview, Cummings is asking the White House to turn over the list she created as well as documents related to the handling of security clearances for several senior officials including Flynn, Kushner and Porter.

Flynn maintained his clearance even after the White House learned that he lied to the FBI about his conversations with Russia’s ambassador and that he was under investigation by the Justice Department for his previous foreign work.

Kushner failed to initially disclose numerous foreign meetings on security clearance forms, and, according to the Times, career officials recommended against granting him a clearance before Trump personally overruled them.

Porter had high-level access with an interim security clearance even though the FBI repeatedly told the White House of past allegations of domestic violence lodged against him by two ex-wives.

Porter resigned after the allegations becoming public.

___

Associated Press writer Zeke Miller contributed to this report.

___

Read the documents: http://apne.ws/NuF4iSJ

Multiple Senators Back Proposals to Abolish the Electoral College

After two presidential races in the last five in which the victor won the Electoral College but not the popular vote, Americans are reconsidering how they choose their presidents. According to a 2018 survey by the Pew Charitable Trusts, 55% of voters believe the president should be chosen by popular vote. Reflecting that desire, Sen. Brian Schatz, D-Hawaii, is set to announce a constitutional amendment to abolish the Electoral College, The Daily Beast reported Monday.

The bill is co-sponsored by Sens. Kirsten Gillibrand, D-N.Y., Dianne Feinstein, D-Calif., and Dick Durbin, D-Ill., a Schatz aide told Daily Beast writer Sam Stein.

Schatz’s proposal comes just days after fellow Democratic Sen. Jeff Merkley of Oregon announced he was introducing legislation to abolish the Electoral College, part of a broader package of electoral form bills, The Hill reported Friday.

“It’s time to end the undemocratic Electoral College and to ensure a pathway to full voting representation for all American citizens,” Merkley said in a statement.

The Hill reports that Merkley “also wants to establish a ‘We the People’ commission to develop a proposal to provide voting representation for D.C., Puerto Rico, and the territories of Guam, the U.S. Virgin Islands, American Samoa and the Northern Mariana Islands.”

Merkley and Schatz’s proposals have not been merged but, as Stein writes, they “reflect a growing appetite within the Democratic Party to change the fundamental structure of America’s electoral system.

Other Democratic presidential hopefuls, including Sen. Elizabeth Warren, D-Mass., and Pete Buttigieg, mayor of South Bend, Ind., have also said they want to end the Electoral College.

Momentum for electing presidents by popular vote has been building at the state level since at least 2006, according to the National Conference of State Legislatures. Thirteen states and Washington, D.C., have signed the National Popular Vote Interstate Compact, in which signatory states agree to give their electoral votes to the popular-vote winner. That agreement will only take effect if states representing 270 votes sign on; the votes of the compact’s 14 signatories to date represent 184.

Proposals to end the Electoral College still have tough odds of being enacted. As Chelsea Janes writes in The Washington Post, Republicans “say the [Electoral College] rightly preserves the influence of small states.” That these and similar proposals to overhaul campaign finance, gerrymandering and other electoral reforms are even being considered, Janes says, “speaks volumes about the state of the Democratic Party in the age of Trump, reflecting a sentiment in the party that the system has stopped working fairly—a grievance once voiced more often by conservatives, including President Trump.”

Buttigieg emphasized that these proposals are part of a long-term strategy. “When we’re talking about things that might entail constitutional reform, it’s a very long game,” he told the Post, adding, “but I think you do it out of the gate, if only to remind people of the level of ambition we have. … We’ve sometimes underestimated how much America can handle.”

Why Is the Fed Paying So Much Interest to Banks?

“If you invest your tuppence wisely in the bank, safe and sound,

Soon that tuppence safely invested in the bank will compound,

And you’ll achieve that sense of conquest as your affluence expands

In the hands of the directors who invest as propriety demands.”

— “Mary Poppins,” 1964

When “Mary Poppins” was made into a movie in 1964, Mr. Banks’ advice to his son was sound. The banks were then paying more than 5% interest on deposits, enough to double young Michael’s investment every 14 years.

Now, however, the average savings account pays only 0.10% annually—that’s one-tenth of 1%—and many of the country’s biggest banks pay less than that. If you were to put $5,000 in a regular Bank of America savings account (paying 0.01%) today, in a year you would have collected only 50 cents in interest.

That’s true for most of us, but banks themselves are earning 2.4% on their deposits at the Federal Reserve. These deposits, called “excess reserves,” include the reserves the banks got from our deposits, and on which they are paying almost nothing; and unlike with our deposits, there is no $250,000 cap on the sums banks can stash at the Fed amassing interest. A whopping $1.5 trillion in reserves are now sitting in Fed reserve accounts. The Fed rebates its profits to the government after deducting its costs, and interest paid to banks is one of those costs. That means we, the taxpayers, are paying $36 billion annually to private banks for the privilege of parking their excess reserves at one of the most secure banks in the world—parking them, rather than lending them out.

The banks are getting these outsize returns while taking absolutely no risk, because the Fed, as “lender of last resort,” cannot go bankrupt. This is not true for other depositors, including large institutions such as the pension funds that hold our retirement money. As Matt Levine notes on Bloomberg:

[I]f you are a large institutional cash investor—a money-market fund, a foreign central bank, things like that—then in some sense you have no way to keep your money perfectly safe. … The closest that big non-banks normally get is “overnight general collateral repo”: You give your money to a bank, and the bank gives you back a Treasury security as collateral, and you can get your money back the next day.

This arrangement is reasonably safe for the institutional investor, which can withdraw its money on a day’s notice; and the investor gets interest that is close to 2.4%. But the bank is using the investor’s money to run its business, and the bank is leveraged. The money it gets from repo-ing Treasuries is used to buy other things and to trade in stocks, bonds, derivatives and the like. This makes the repo business highly risky for the market as a whole, as was seen when a run on the repo market triggered the credit crisis of 2008-09. As Jennifer Taub explained the problem in a New York Times article titled “Time to Reduce Repo Run Risk”:

An overnight repo would be like you having a car loan that is due in full every morning and if the lender does not renew your loan that day, you need to find a new one, each and every day or they take your car away.When trust is strong and cash plentiful, repos are rolled over. When trust reasonably erodes, or there is a panic, cash is demanded from the repo borrowers who might have to sell the collateral or relinquish it. This leads to fire sales by the borrower and others with similar securities and downward asset price spirals. Indeed, the Federal Reserve Bank of New York has repeatedly warned of the repo “fire sale” risk.

Taub cited Federal Deposit Insurance Corp. (FDIC) officials Thomas Hoenig and Sheila Bair, who warned that the banks remain dangerously interconnected and vulnerable to sudden runs due to their dependence on short-term—often overnight—borrowing through the multitrillion-dollar repo market.

The Narrow Bank

One proposed alternative for large institutional investors is something called “The Narrow Bank” (TNB). TNB would take large-depositor money and park it at the Fed, and that’s all the bank would do. The Fed would pay 2.4%, TNB would take a small cut and the rest would be passed to the depositors. Because TNB would be only a pass-through for Fed accounts—it would not engage in trading, derivatives, mortgages, business loans or even Treasuries—it would be arguably the safest possible place for large institutional investors to keep their money while earning a good return.

The Fed, however, has refused to open an account for this sort of “Pass-through Investment Entity” (PTIE), and in a recent notice of proposed rule-making, it explained why. As Levine puts it:

[T]he Fed worries that having too safe a bank would be bad for financial stability: In times of stress, everyone will flee from the regular banks to the super-safe narrow banks, which will have the effect of bringing down the regular banks.

Besides impairing its ability to target interest rates, the Fed is worried that narrow banks would take funding away from regular banks, making it harder for those banks to trade stocks and bonds (a business largely funded by repo) as well as jeopardizing their lending business:

PTIE deposits could be seen as more attractive than Treasury bills, because they would provide instantaneous liquidity, could be available in very large quantities, and would earn interest at an administered rate that would not necessarily fall as demand surges. As a result, in times of stress, investors that would otherwise provide short-term funding to nonfinancial firms, financial institutions, and state and local governments could rapidly withdraw that funding from those borrowers and instead deposit those funds at PTIEs. The sudden withdrawal of funding from these borrowers could greatly amplify systemic stress.

The Fed, while declaring its “independence,” is obviously not a neutral arbiter. It is working for the banks. Says Levine:

The Fed just gets to decide who gets to compete in the banking business, and how that competition will work, and what their business models can be, by virtue of its control of access to reserve accounts. … There is no modern banking that is independent of the sovereign’s power to control money, and the question is just who the sovereign shares that power with.

The European Approach: Negative Interest Rates

While U.S. banks are being paid an unprecedented 2.4% for leaving their reserves at the Fed, the European Central Bank is taking the opposite tack: It is charging banks a negative interest rate of 0.4% for holding its reserves. The goal is to get banks to move the reserves off their books by making new loans. If they lend money on to the real economy, and particularly to companies, this interest payment may be rebated to the banks, under a facility called “targeted longer-term refinancing operations” or TLTROs. In 2016 and 2017, the ECB returned a total of 739 billion euros to banks through TLTROs, and it is expected to renew that program, in an effort to avoid an even greater economic downturn than Europe is suffering now.

Negative interest rates were supposed to be a temporary emergency measure, but in comments on Saturday, ECB President Mario Draghi hinted that they could be around for a long time, if not permanently. The “new normal” is evidently a chronically abnormal state of emergency in which central banks can experiment with the formerly unthinkable and get away with it.

All of which suggests some interesting possibilities.

A Public Option for the Rest of Us

Even if large depositors were allowed to participate in the perks of Fed accounts through PTIEs, small depositors and small businesses would still be left with a meager one-tenth of 1% annually on their deposits. But some interesting proposals are on the table for opening the Fed’s deposit window to everyone, allowing us all to collect 2.4% on our deposits.

One such plan was presented in a June 2018 policy paper, titled “Central Banking for All: A Public Option for Bank Accounts,” by a trio of law professors and former Treasury advisers headed by Morgan Ricks. They suggested that for the physical infrastructure to handle so many accounts, the Fed could use the post offices peppered across the country.

Postal banking has been popular for two centuries in Europe and was offered in U.S. post offices from 1911 to 1967. Postal banks were in their heyday in the 1930s, when private banks were going bankrupt and were vulnerable to crushing bank runs. The postal banks were government-backed, paid 2% interest on deposits, and were very safe. Congress could have expanded that system into a national public utility that safely and efficiently served the banking needs of local communities. But instead, it chose to back the private banking system with federal deposit insurance, guaranteeing private bank deposits with taxpayer funds—again showing how the winners and losers are picked by government officials, depending on whose lobbyists have the most clout.

To prevent public banks from competing with private banks, Congress capped the amount of interest postal banks could pay and strictly limited their lending. As a result, in 1967, the postal banking system was shut down as being no longer competitive or necessary. But efforts are now underway to revive it. Last April, New York Sen. Kirsten Gillibrand introduced legislation that would require every U.S. post office to provide basic banking services.

A movement is also afoot to establish state- and city-owned banks that would have the ability to lend for infrastructure and other local needs. Local governments cannot get a risk-free 2.4% rate from the Fed for their demand deposits, but city- or state-owned banks could. Combining postal banks with a network of local public banks having affordable access to the Fed’s deep pocket could provide a safe and efficient public banking option for individuals, businesses and local governments.

Israeli Watchdog Says Network of Bots Is Stumping for Netanyahu

JERUSALEM — An Israeli watchdog group said Monday that it found a network of social media bots disseminating messages in support of Prime Minister Benjamin Netanyahu ahead of next week’s elections.

Noam Rotem and Yuval Adam, two researchers operating the Big Bots Project, said in a report that they uncovered hundreds of fake accounts spreading messages in support of Netanyahu’s Likud party and smearing his opponents. Likud denied the allegations.

Adam said his project discovered a network that included a number of real people, along with hundreds of Twitter accounts that appeared to be fake or duplicate.

“One person might be operating tens or hundreds of accounts at the same time,” he told The Associated Press. “All these accounts are pushing their political agenda, not only that but also inciting hate speech, attacking very specific people who are opposed to their political agenda.”

He said this appeared to be a violation of Twitter’s terms of use. He said the findings had been forwarded to Twitter in hopes of deactivating the fake accounts. Twitter declined comment.

Adam said the Big Bots Project was financed through a crowdfunding program. The project also includes researchers from Ben Gurion University’s Cyber Research Center and Tel Aviv University.

Israelis head to the polls in eight days in a close race between Netanyahu and his main rival, former army chief of staff Benny Gantz. Netanyahu is seeking a fifth term in office under the shadow of corruption charges.

The campaign has focused largely on personal attacks between the two front-runners, with Gantz taking aim at Netanyahu’s alleged ethical lapses, and Netanyahu painting Gantz as a weak “leftist.” The prime minister’s Likud Party has also tried to portray Gantz as being mentally unstable.

Rotem and Adam said they found no direct link between the network and Netanyahu or Likud. But Netanyahu’s son Yair, who has run into trouble in the past for controversial social media activity, has frequently liked posts by the network’s accounts.

They said it was unclear who was operating the network. The report said the network had relayed tens of thousands of tweets and garnered over 2.5 million engagements.

Many of the accounts in the network were largely inactive before elections were announced in December. Since then, these users have tweeted frequently and exclusively about the Likud party and against its opponents, Adam said.

The report found a huge spike in activity during the first few months of the year compared to the same period in 2018; for example, March 2019 had 13.2 times more average activity than in the same month last year.

One of the most active Twitter accounts mentioned in the report became private shortly after the 34-page document was published, Adam said.

At a press conference convened to address the issue, Netanyahu dismissed the report sarcastically as an April Fool’s Day prank. He called it a “false libel” by the media based on a “fake investigation.”

“Almost all of the examples, perhaps all of them, turned out to be real people. They have a name, they have a face, they have families, and the worst thing: they have opinions of their own. Independent people,” Netanyahu said. “Not one of them is fake.”

One Twitter user named in the report, Ziv Knobler, said in an interview with Israel’s Army Radio that “there is nothing organized. We are a group of people who believe in the way of Benjamin Netanyahu.”

“We expressed personal opinions, not on behalf of an organization,” Knobler said. “We have absolutely no connection to the Likud party.”

After the Big Bots Project’s report headlined Monday’s edition of Hebrew daily Yedioth Ahronoth, Gantz’s Blue and White party wrote on Twitter that “Netanyahu is trying to steal the elections” and called for a police investigation to determine the network’s funding.

Last month, news broke that Gantz’s personal telephone was infiltrated by Iranian hackers. While Gantz contends no sensitive information was compromised, Netanyahu leveraged the breach to argue that Gantz was unprepared to lead the country.

Massive Lawsuit Targets Authors of America’s Opioid Epidemic

A lawsuit filed by more than 500 cities, counties, and Native American tribes accuses the Sackler family, owners of the company that makes the opioid painkiller OxyContin, of playing a role in creating “the worst drug crisis in American history.”

While other lawsuits have targeted Purdue Pharma, which is wholly owned by the Sacklers, and eight family members have been recently added to some of those lawsuits, this is the first time Sackler family members have been sued as individuals on such a massive scale.

The lawsuit, filed on March 18 in federal court in the Southern District of New York, accuses family members of knowingly breaking the law in their bid to get rich off sales of OxyContin, which helped generate the current opioid crisis with its release and intensive marketing in the late 1990s. Hundreds of thousands of Americans have died of opioid overdoses since the rollout of OxyContin in 1996.

“Eight people in a single family made the choices that caused much of the opioid epidemic,” the lawsuit charges. “This nation is facing an unprecedented opioid addiction epidemic that was initiated and perpetuated by the Sackler defendants for their own financial gain, to the detriment of each of the plaintiffs and their residents.

“The ‘Sackler defendants’ include Richard Sackler, Beverly Sackler, David Sackler, Ilene Sackler Lefcourt, Jonathan Sackler, Kathe Sackler, Mortimer D.A. Sackler, and Theresa Sackler,” the lawsuit states.

Richard and Jonathan Sackler are sons of the late Raymond Sackler, one of Purdue Pharma’s founding brothers. Beverly is Raymond’s widow and David his grandson. Ilene, Kathe, and Mortimer David Alfons are children of the late Mortimer Sackler, another of the founding brothers of Purdue, and Theresa is his widow.

Court documents filed in relation to the lawsuit accuse the eight of purposefully downplaying the dangers of OxyContin, which is multiple times more potent than either heroin or morphine. Purdue Pharma marketed the drug as non-addictive and abuse-proof, but neither claim was true. The company and the Sacklers are also accused of over-the-top marketing and sales techniques that led to over-prescribing and the prescribing of ever-stronger doses for many patients who didn’t need them.

“The defendants’ actions caused and continue to cause the public health epidemic,” the court documents charge. Their activity “caused deaths, serious injuries, and a severe disruption to public peace, order and safety, it is ongoing and it is producing permanent and long-lasting damage.”

The charges aren’t new—many of them are contained in a similar lawsuit against Purdue Pharma and the Sackler eight filed earlier in Massachusetts, as well as in court documents from yet another case against pharmaceutical companies including Purdue filed in federal court in Cleveland. That lawsuit, filed by more than 1,200 cities and counties, does not name Sackler family members individually.

The Sackler eight are the public face of a family that has sought to cement its place in high society through massive philanthropy (it helps to have billions in opioid sales profits). The Sacklers have given heavily to nationally known arts institutions, such as the Guggenheim and Metropolitan museums in New York City, a move that has sparked recent protests against taking the tainted money. Earlier this month, in the face of mounting criticism, Britain’s National Portrait Gallery announced it was foregoing a million-pound gift from the Sacklers.

The Sacklers have also donated to educational institutions, such as Columbia, MIT, Tufts, Yale, and other universities in both the U.S. and the United Kingdom. Columbia University and the University of Washington, which also took Sackler money, have both announced they will accept no more gifts from the family.

The Sacklers and Purdue Pharma reject any claims of wrongdoing.

“This complaint is part of a continuing effort by contingency-fee counsel to single out Purdue, blame it for the entire opioid crisis in the United States, and try the case in the court of public opinion rather than the justice system,’’ a Purdue spokesman said in an emailed statement to the Bloomberg news agency.

“These baseless allegations place blame where it does not belong for a complex public health crisis, and we deny them,” the Mortimer and Raymond Sackler families said in a statement, adding that OxyContin sales “represented a tiny portion of the opioid market.”

Facing numerous lawsuits over the way it has done business, as well as having admitted to misbranding OxyContin in a 2007 criminal case, Purdue Pharma has considered filing for bankruptcy, but has also suggested it does not have the kind of cash reserves to pay out a massive settlement or fines in the cases against it. But if the plaintiffs in this lawsuit are victorious, it wouldn’t just be Purdue Pharma funds but Sackler family fortunes at risk.

This article was produced by Drug Reporter, a project of the Independent Media Institute.

Kamala Harris’ Calls for Reform at Odds With Past as Prosecutor

WASHINGTON — When Kamala Harris made her much-heralded arrival in Washington as California’s first black U.S. senator, she made a curious early decision.

Within months of her swearing-in, she sponsored a bill urging states to eliminate cash bail, denouncing the system as a scourge on the poor and communities of color.

That position would become a key part of her criminal justice reform platform. But her choice surprised some bail reform advocates back in California. In her seven years as a district attorney, and then six as attorney general, Harris was absent on the issue, they say. In fact, less than a year earlier, her office defended the cash bail system in a pair of federal court cases, shifting course only weeks before she entered the Senate.

“For her entire career she used some of the highest money bail amounts in the country to keep people in jail cells and saddle poor families with financial debt,” said Alec Karakatsanis, an attorney who has brought several legal challenges to California’s bail system, “and as soon as she had no influence on that issue practically, she announces she has a different view on it.”

Now a presidential candidate , Harris is casting herself as a progressive who consistently leveraged her power in the justice system to further civil rights causes and advocate for the disadvantaged. She has pledged a wholesale overhaul of the country’s fractured criminal justice system, arguing for marijuana legalization, bail reform and a moratorium on the death penalty.

But when she had a chance to take a bold stand on these issues as a top law enforcement officer, Harris often opted for a careful approach or defended the status quo. Observers of her career note some of her key positions, like her opposition to cash bail, came at politically opportune moments, after public views had shifted on race, inequality and bias in the justice system.

“I never had a sense she was forward thinking or reforming,” said John Raphling, a bail reform advocate and senior researcher at Human Rights Watch who faced off against Harris’s state Justice Department as a criminal defense attorney. “Bail reform is a trendy issue, and a lot of politicians are jumping on it and saying this is unfair. I don’t have any evidence that Harris was seeing that unfairness back when she was attorney general — but to her credit, we evolve, we learn, we see things.”

Harris’ supporters say as a prosecutor she was tasked with upholding the law and, as attorney general, defending the state, not making policy. She had limited ability to effect change within the rigid structure of the courts, they argue.

“Everyone who has experienced the criminal justice system knows it’s broken,” said Lateefah Simon, a civil rights activist who worked for Harris in San Francisco. “She would say, ‘we’re confined by the rules of the law, and in the areas where we have discretion, we are going to work to try to move justice.’”

“I deeply know her convictions about what could be possible and what we needed to do, but also what the boundaries and limitations were,” she said.

Simon said Harris worked to hire more people of color as prosecutors. In her first year as San Francisco district attorney, she launched a re-entry program designed to keep low-level drug offenders from returning to prison. That same year she refused to seek the death penalty for a man who killed a police officer, infuriating the Bay Area political establishment and creating friction with the law enforcement community.

But in many cases throughout her career Harris embraced the traditional role of prosecutor.

Her office defended wrongful convictions, fighting to keep behind bars those who judges determined should go free. She refused to take a position on a pair of sentencing reform ballot measures, arguing she must remain neutral because her office was responsible for preparing ballot text. She defended the death penalty in court, setting aside her personal opposition to capital punishment.

In response to critics who’ve pushed her to use her power in the courts to usher in change, she told The New York Times in 2016, “I have a client, I don’t get to choose my client.”

Harris says she would call for a federal moratorium on the death penalty if elected president.

Harris’ law enforcement approach has at times put her out of step with California’s activist community. When she pushed a controversial policy that criminalized truancy, threatening to jail parents of children who missed too much school, even Harris’ staff “winced at the plan,” she wrote in her first book released just in time for her campaign for attorney general in 2010.

The program has since become a source of tension with criminal justice advocates, who see it as sign of Harris’ outdated approach to dealing with problems that stem from poverty.

In a recent NPR interview, Harris said her truancy initiative was not designed to punish vulnerable families, but “put a spotlight” on the problem and direct resources to needy families. Her campaign hails the effort as a success, and supporters have lauded Harris for prioritizing a child’s education.

“As a result of our initiative, which never resulted in any parent going to jail — never — because that was never the goal,” Harris said.

But Harris’s legacy remains on the state’s books: She authored a state-wide truancy law modeled after her San Francisco program. It has resulted in hundreds of parents in often less affluent and less politically liberal California counties being prosecuted.

Harris’ approach at the time was considered smart politics for a politician seeking to run statewide. Throughout her career, Harris worked to win over powerful police unions. She refused to support a bill requiring her office to investigate shootings involving law enforcement officers. In 2015, she declined to back statewide standards for body cameras, arguing that individual departments should decide how to use the technology.

“If you offend all the police chiefs and sheriffs of California, you’re probably not going to get re-elected as the attorney general of California, and if you’re not elected, how do you engage in any of the reforms you want to do?” said Jim Bueermann, a former California police chief who worked on Harris’ transition to the attorney general’s office.

As Harris transitioned from law enforcement to legislating, the politics of criminal justice issues were changing fast.

The deaths of unarmed black men at the hands of police in 2014 and 2015 prompted outcry and spawned the Black Lives Matter movement. Democrats began rethinking their tough-on-crime strategies, focusing more on inequality and abuse in the system. Prosecutors and police came under increasing scrutiny for their roles.

Harris’ views appear to have been changing, too.

In 2014, she was opposed to legalizing recreational marijuana, and when she ran against a Republican challenger for re-election as attorney general she took the more conservative view: He wanted to legalize. Harris laughed at the idea in a local television interview.

But Harris’s public tone changed as speculation grew about her running for president in 2020. Last year, Harris endorsed Democratic Rep. Cory Booker’s bill for federal legalization of marijuana. She argued on Twitter that “making marijuana legal at the federal level is the smart thing to do and it’s the right thing to do.” She released a video declaring that “marijuana laws are not applied and enforced in the same way for all people.”

Last month, she went as far as acknowledging to a pair of morning radio hosts that she’s used recreational marijuana: “I have, and I did inhale; that was a long time ago.”

For Ron Gold, the Republican who ran against her in 2014 and who supported recreational legalization when she did not, Harris’ stance on marijuana is indicative of her tendency to take a position “that’s popular, but not necessarily held strongly by the candidate, it’s a position that curries favor with a segment of the population,” he said.

Some see a similar pattern when it comes to the call for bail reform.

Shortly after announcing her presidential bid in January, Harris declared on Twitter: “It’s long past time to address bail reform across the country.”

“This is a serious injustice,” she wrote.

Three years earlier, Harris’s office was defending cash bail in a federal case.

“Neither the bail law nor the bail schedule discriminate on the basis of wealth, poverty, or economic status of any kind,” she wrote. In response to the notion that money bail schemes unfairly punish low-income defendants, Harris wrote, “the state is not constitutionally required to remove obstacles not of its own creation.”

Harris appears to have shifted her stance 10 months later. In December of 2016, Harris filed a motion in a case challenging the application of California’s money bail laws saying the system is deserving “of intense scrutiny.” She pledged not to defend any bail scheme that fails to take into account a defendant’s ability to pay. Three weeks later she was sworn in to the Senate.

Still, she asked the judge to toss the case, arguing that the laws were constitutional even if the way some counties implemented those laws was not.

“The bail system at issue here does not categorically deny bail to any group of individuals,” she wrote.

The move perplexed bail reform advocates who say she could have used her position of power to do more as the top law enforcement official in the state, overseeing thousands of prosecutors who each day requested cash bail for those they charged with crimes.

“I’m glad she’s come to the right position now, but it’s too late for tens of thousands of Californians, real human beings who have been detained in jail every day in California throughout the whole state, that the attorney general could have stopped,” said Phil Telfeyan, one of the plaintiff’s attorneys in the bail cases.

Harris’ campaign declined to answer questions about when and why Harris’ views on marijuana and bail reform shifted.

Campaign spokesman Ian Sams noted the political arena, not the courtroom, is the appropriate place to address policy problems.

“As senator,” he said, “she has aggressively confronted the policy question by proposing a bipartisan federal law to end cash bail.”

Simon, the civil rights advocate who worked with Harris, said she often say Harris spoke, privately, in frustration about cash bail and other elements of the criminal justice system while she was a prosecutor. But still, Harris had to work within its confines, Simon said.

“Prosecutors and lawmakers are different,” she said, “as a lawmaker, you actually get to make laws. As a prosecutor, you must follow them.”

Advocates say they’re cautiously optimistic about Harris’ legislative efforts, and are glad to see the issue in the political spotlight. But they note her bill, which she co-wrote with Republican Sen. Rand Paul, endorsed the use of controversial risk-assessment tools to determine who should be released from jail and who should remain behind bars.

Raphling said Harris’ office has been receptive to feedback. Still, he said she never indicated a progressive stance on the issue before and her commitment remains to be seen.

“I give her credit for wanting to tackle bail reform, and people are listening,” Raphling said. “The question is, and this is an open question, what kind of reform is she going to push?”

The Green New Deal Could Eradicate Poverty

If you haven’t yet heard of the Green New Deal, chances are that you soon will. To its growing band of supporters, it looks like an idea whose time has come.

Just suppose we could see a way to transform the global economy, society and even the environment so that they met real needs, and promised to go on doing so far into the future. Well, we can. And it’s growing simpler all the time, futurologists say.

The bad news? Inertia and resistance. Too few of us think we really need a transformation. Too many are actively trying to prevent one. No change there then − except that the balance may be starting to shift, thanks largely to science and money − and ordinary people who are refusing to go on as we are.

Supporters of the Green New Deal say we don’t have to look very far ahead for results − no further than about mid-century.

By then, some of them told The New Yorker magazine, much of the world should be able to achieve the goal of zero carbon emissions, a goal for which they say the world already has about 90-95% of the technology it needs.

Technological Gallop

One problem often raised is the need to store the power produced by wind and solar power, which may be inconveniently unavailable just when it’s needed. But even here there are hopeful signs that the galloping pace of technological advance may soon have an answer in the form of greatly improved batteries.

The Deal’s supporters are not the first to claim we’re most of the way towards a carbon-free future in 30 years, and possibly well before that. But this Deal, itself a reminder of US President Franklin D Roosevelt’s 1933 New Deal, explores more ambitious territory still, with the prospect of also ensuring a living wage job for everyone who wants one and reducing racial, regional and gender-based inequalities in income and wealth.

To make any headway the new Deal will need strong political backing. Here it’s had a stroke of luck, being identified with the arrival in Washington DC of the politician Alexandria Ocasio-Cortez, the youngest woman ever elected to the US Congress.

There are signs across the Atlantic of mounting involvement in the ideas spelt out in the Green New Deal, incorporating lessons learned from France, for instance, and the experience of Germany.

In Britain a rising star of the parliamentary opposition, Clive Lewis, the shadow sustainable economy minister, told a recent meeting: “The green economy will simply be ‘the economy’ under the next Labour government”.

The British economist Ann Pettifor, a fellow of the New Economics Foundation, describes the Green New Deal as “incredibly ambitious . . . a huge advance for green campaigners and, hopefully, for our threatened species.” Pettifor was co-author of the original Green New Deal Report, published in the UK in 2008, which in many ways prefigured the present US initiative.

Her fellow co-author was Andrew Simms, now co-ordinator of the Rapid Transition Alliance (RTA), an enthusiastic backer of Ocasio-Cortez’ vision.

The RTA says: “Like the UK proposal, [the Deal] seeks to tackle the climate and economic crisis simultaneously and looks at job creation, decarbonising electricity, renovating buildings for energy efficiency and much more.

Affordable

“A Green New Deal today would cost no more than [Roosevelt’s] New Deal, less than the 2008 bailouts, and see off the worst effects of the climate crisis.”

Simms told the Climate News Network: “What does it actually look like to start transforming our economies to prevent climate breakdown and meet the internationally agreed climate targets?

“Practically it looks like a Green New Deal − a programme that meets our economic, social and environmental needs at the same time − a ‘win, win, win’ package of measures.

“Any Green New Deal worthy of the name creates millions of ‘green collar’ jobs by building the low-carbon infrastructures which respect environmental limits and are vital to modern economies − renewable energy, zero carbon homes, efficient and clean mass transport systems delivered by switching investments from old, dirty ways of doing things and with innovative financial mechanisms. The opportunities are immediate, needed and everywhere.”

Obstacles Remain

Perhaps an idea which puts the environment, the economy and social justice together can hope to mobilise mass support in a way the three distinct groups have so far not managed to achieve − especially when it exploits the potential of new technology and falling costs. But there’s still political inertia to reckon with, and financial self-interest.

Even there, change may be afoot. A British group of scientists, activists and one former archbishop of Canterbury, ExtinctionRebellion, has been staging audacious public protests in the UK for four months now, and started a spring uprising on 16 March, giving no sign yet of succumbing to inertia.

And resistance to the very idea that the world needs an energy transformation? A brief online search for the way parts of the fossil fuel industry continue to challenge and decry climate science suggests change could be coming there too. One example from the US site Inside Climate News shows the deniers are facing challenges of their own.

Change on the scale envisaged by the Green New Deal is certainly demanding, but it will be far less so than refusing to change.

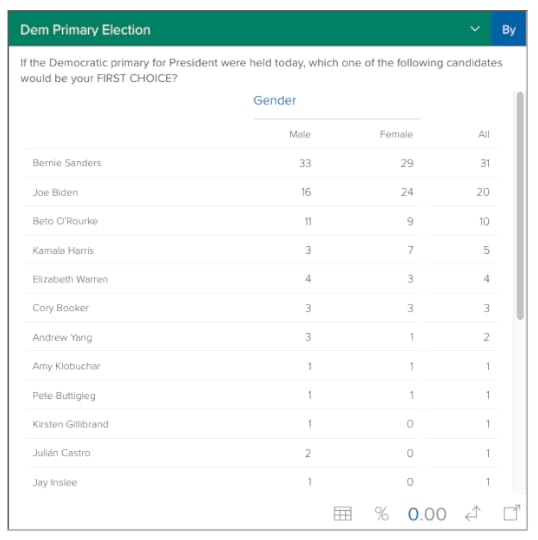

Poll Shows Sanders With Double-Digit Lead Among Young Democrats

A new national poll of young Democratic voters released Monday shows Sen. Bernie Sanders leading the crowded 2020 field with a double-digit lead over the second most popular candidate, Joe Biden.

According to the survey by the Institute of Politics (IOP) at the Harvard Kennedy School, the U.S. senator from Vermont is preferred by 31 percent of likely Democratic primary voters between the ages of 18 and 29 years old.

While Biden came in second place with 20 percent and Beto O’Rourke of Texas nabbed the third spot with 10 percent, none of the other candidates garnered more than single digits in the poll. After O’Rourke, IOP noted the following support for the remaining candidates:

Sen. Kamala Harris (5%), Sen. Elizabeth Warren (4%), Sen. Cory Booker (3%), Andrew Yang (2%), Mayor Pete Buttigieg (1%), former Sec. Julian Castro (1%), Rep. Tulsi Gabbard (1%), Sen. Kirsten Gillibrand (1%), Gov. Jay Inslee (1%) and Sen. Amy Klobuchar (1%). Several other candidates polled at less than one percent at this early stage.

While some political commentators have noted that Sanders’ age—the candidates is now 77 years old and 79 come election day in 2020—could be a factor in the campaign, the poll suggests that young Democratic voters may not be the ones driving that argument.

“Proving that young voters see more than age, it’s notable that the candidates with the most experience in government service are leading a diverse field at this early stage in the process,” said John Della Volpe, IOP’s director of polling.

“Compared to this point in the last presidential cycle,” he added, “young Democratic voters are more engaged and likely to have an even greater impact in choosing their party’s nominee.”

The IOP poll is part of a series conducted by the group that goes back to the year 2000. Broken down by gender, ethnicity, and level of education, the survey found:

BY GENDER

Among young males in the sample who say they will definitely vote in the primary, Sanders (33%) leads Biden (16%) by 17 points, with O’Rourke at 11 percent, and Harris at 3 percent. Among young women, Sanders’ lead narrows to 5 points (29% Sanders – 24% Biden), with O’Rourke in third with 9 percent, followed by Harris with 7 percent.

BY RACE AND ETHNICITY

Sen. Sanders leads former Vice President Biden by 11 points among whites (31%-20%), by 19 points among Hispanics (38%-19%), but is in a statistical tie with young African-American voters, trailing by one point (25% Biden – 24% Sanders). There is no statistical difference in support for O’Rourke.

BY EDUCATION

The race is statistically tied among college students with 25 percent supporting Sanders, 23 percent for Biden, and 25 percent who remain undecided. No other candidate receives more than 8 percent of the share.

In contrast, likely Democratic voters who are not enrolled in a four-year college or university and do not have a degree, favor Sanders by 25 points. The Vermont Senator polls at 41 percent to Biden’s 16 percent. O’Rourkepolls at 12 percent with this cohort, with no one else receiving more than 4 percent.

Over 3,000 people within the age range were surveyed in the poll that was conducted between March 8 and 20, with a margin error for the total sample noted at +/- 2.64 percentage points.

We’re Heading Toward a Rural Health Care Emergency

We’ve got a rural health care emergency on the horizon.

Rural hospitals are closing or teetering on the brink of closure at an alarming rate. More than a hundred have closed since 2005 and hundreds more are on life support. Long-term care facilities are vanishing across rural America or being bought up by large corporations who care about profit, not the care of our loved ones.

Most rural hospitals have even stopped delivering babies — you’ll need to go to the city for that, so plan ahead.

I know firsthand. I’m a registered nurse and lifelong Iowan from the country. I’ve kept a close eye on where we’ve been with health care, and where it appears we’re headed. It’s not looking too good for my community and others if we stay on our current failed path.

Medicaid expansion was supposed to help here in Iowa. It sure didn’t — because we handed the program over to private, for-profit “managed care organizations.” What we got in return was less care — and more services denied, facilities shuttered, and lives lost to corporate greed.

Hospitals that were already struggling now have to submit and re-submit claims to these private companies and wait months, if not years, to get paid. Even without privatized Medicaid, we’d still be facing an impending rural healthcare emergency. Privatization merely hastened what was already happening.

Americans spend about twice as much on health care than any other developed country, but we live shorter lives — even as we create “health care billionaires” that get profiles in magazines like Forbes.

The for-profit healthcare system is an extractive industry, helping to suck the wealth and life out of communities, especially in rural areas. We’re being left behind because the for-profit insurance industry doesn’t see us as worth their time.

Rural hospitals, local nursing homes, and care facilities are the lifeblood of our small towns across the heartland. We’re watching our farms and small towns wither away as the countryside empties out and our health declines.

But it doesn’t have to be this way. A system that puts the wellbeing of our community ahead of the bottom line of a select few can and will deliver the care we need, where and when we need it, and keep our rural communities alive and vibrant.

Which brings us to the Medicare for All Act of 2019 introduced by Rep. Pramila Jayapal of Washington state. Instead of allowing private corporations to decide who pays for health care and how much, we would put our financing back into public hands — and our health care decisions back into the hands of patients and their care provider.

Under Medicare for All, virtually all aspects of our health care will be covered. This includes, but isn’t limited to, medical, dental, vision, hearing, prescription drugs, mental health, addiction treatment, and much more.

Medicare for All also covers long-term and in-home care as well. What a gift to our families, especially those that often go unseen by an industry dominated by profit: the elderly and people with disabilities. Long-term and in-home care allows people to stay near their families or in their homes, rooted in the communities we call home.

Perhaps most importantly for Iowa and other rural communities, Jayapal’s bill includes a special projects budget for capital expenditures and staffing needs of providers in rural or medically underserved areas.

Will this cost money? Of course it will. But we’ll actually spend less overall than we’re currently spending in our broken health care system, and we’ll get better and more comprehensive coverage.

For all these reasons, Medicare for All is the prescription America and our rural communities need.

Chris Hedges's Blog

- Chris Hedges's profile

- 1922 followers