Geoff Noble's Blog, page 13

April 17, 2016

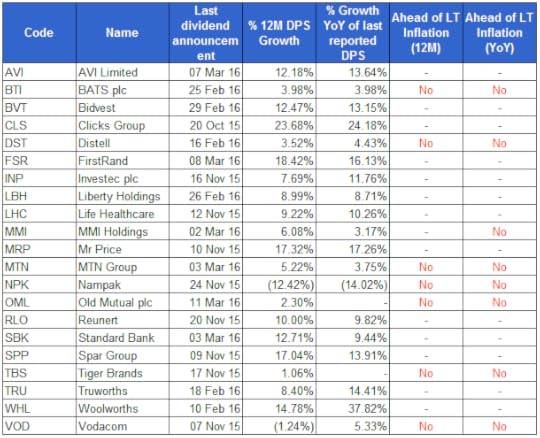

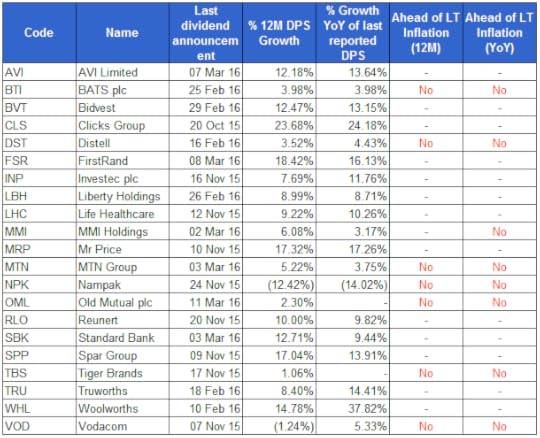

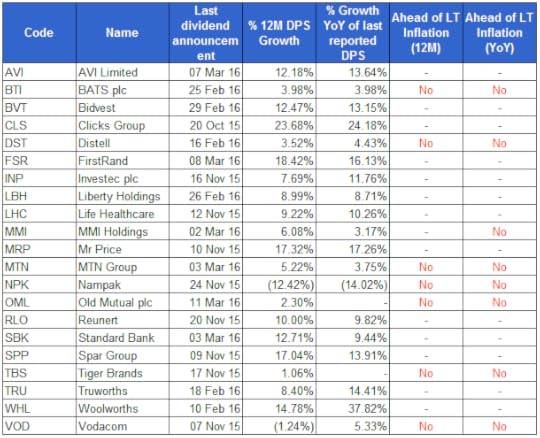

[Table] Weekly Dividend Update - 18 April 2016

Today, AVI is the only company in my universe to pay a dividend. The R1.50 per share paid is 13.6% ahead of last year. The forward yield of AVI is 4.2% (Using R3.68 DPS Broker Consensus for 30 June 2016 from AVI website). This means the total annual dividend for the year ended 30 June 2016 is expected to be 4.2% of the current AVI price of R87.94 (closing price on 15 April 2016).

Disclaimer: I have tried my best to ensure that the table above is accurate. It is based on factual data and does n...

Disclaimer: I have tried my best to ensure that the table above is accurate. It is based on factual data and does n...

Published on April 17, 2016 21:00

April 10, 2016

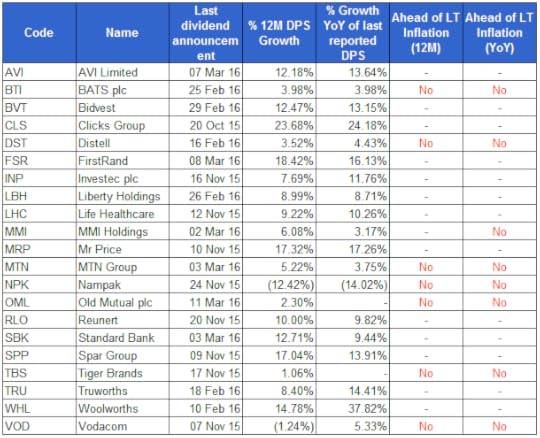

[Table] Weekly Dividend Update - 11 April 2016

No more final or interim results this week which means no changes. Two companies in my universe are paying a dividend today.

Bidvest (BVT):R4.83 per shareLiberty Holdings (LBH): R4.37 per share

Disclaimer: I have tried my best to ensure that the table above is accurate. It is based on factual data and does not contain any recommendations. Errors and Omissions are Excluded (E&OE).

Bidvest (BVT):R4.83 per shareLiberty Holdings (LBH): R4.37 per share

Disclaimer: I have tried my best to ensure that the table above is accurate. It is based on factual data and does not contain any recommendations. Errors and Omissions are Excluded (E&OE).

Published on April 10, 2016 20:00

April 7, 2016

[Article] How to spot a crooked financial advisor via Moneyweb

While "Forget the Noise" is aimed at the investor who wants to build their own share portfolio, some of you will have a financial advisor who looks after your unit trust investments if you have any. I read this article by Warren Ingram (a well-known financial advisor or IFA) on some of the signs that a financial advisor is dodgy or crooked. There are some good points in the article.

Click here to read the article on Moneyweb

[image error]

Click here to read the article on Moneyweb

[image error]

Published on April 07, 2016 06:43

April 4, 2016

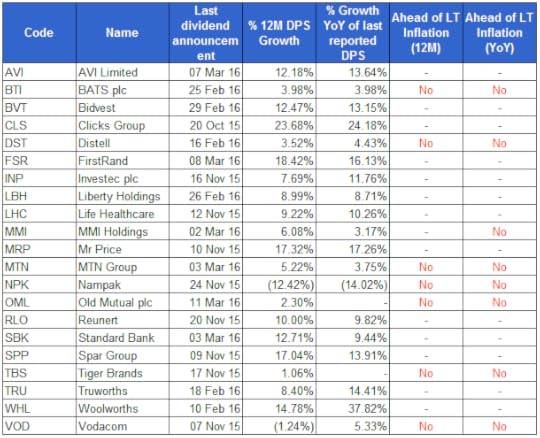

[Table] Weekly Dividend Update

Every Monday I will post my dividend growth table. There have been no updates since the last post.

The following companies in my universe paid their dividends today:

FirstRand (FSR): R1.08 per shareHyprop (HYP): R2.98 per share (not in the table, but REITs to be added soon)MMI: R0.65 per shareMTN: R8.30 per share

Disclaimer: I have tried my best to ensure that the table above is accurate. It is based on factual data and does not contain any recommendations. Errors and Omissions are Excluded (E&a...

The following companies in my universe paid their dividends today:

FirstRand (FSR): R1.08 per shareHyprop (HYP): R2.98 per share (not in the table, but REITs to be added soon)MMI: R0.65 per shareMTN: R8.30 per share

Disclaimer: I have tried my best to ensure that the table above is accurate. It is based on factual data and does not contain any recommendations. Errors and Omissions are Excluded (E&a...

Published on April 04, 2016 01:08

March 26, 2016

[Interview] Why active managers destroy value

A friend passed this article on to me. It is an interview with Charely Ellis by Robin Powell from the Evidence-Based Investor blog. Robin introduces Charley as follows:

For me, Charley Ellis is one of the investing world’s great consumer champions. In the mid-1970s, he became the first industry insider to acknowledge that most active fund managers fail to beat their benchmarks and that investors are far better off using low-cost index funds instead. His central argument was that the rarit...

Published on March 26, 2016 06:51

March 22, 2016

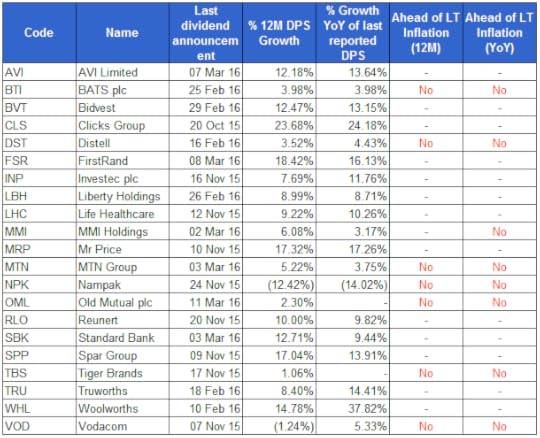

[Table] Dividends over last 12 months

This first post is a post to illustrate what is to come. I have created a table of equities I track. Each equity has dividend growth over the last 12 month period. There are two numbers.

The first number is the total 12 months growth in full-year dividends per share. (i.e. (Final DPS + Interim DPS) / (Last Year Final DPS + Last Year Interim DPS)).

The second number is the last declared DPS over the DPS declared 12 months ago. It could be (Final DPS / Last Year Final DPS) OR ...

The first number is the total 12 months growth in full-year dividends per share. (i.e. (Final DPS + Interim DPS) / (Last Year Final DPS + Last Year Interim DPS)).

The second number is the last declared DPS over the DPS declared 12 months ago. It could be (Final DPS / Last Year Final DPS) OR ...

Published on March 22, 2016 10:04

March 20, 2016

[1st Post] Welcome

Welcome to the Forget the Noise blog. I will write regularly about companies and investing. I will also provide updates on the book, Forget the Noise.

Please check back regularly for updates or click here to follow by email.

Please check back regularly for updates or click here to follow by email.

Published on March 20, 2016 13:04