Simon Weiner's Blog, page 30

December 1, 2015

How do you Create a Daily Ritual ? [Supercharge Your Business]

Excerpt from Supercharge Your Business by Simon Weiner

General InformationTo maintain an overall view of the company and to identify value-added opportunities, it’s important to create and keep time available for reviewing the business activities and determining why things are done in a certain way and how they could be done differently.As I mentioned at the beginning of this book, the business person is probably too busy working on operational issues and, therefore, lack of time is a real limitation. However, without this extra time for the process I will describe, nothing will change. The business person has to make that important step and organize his or her schedule so he or she can identify those value-added business ideas.So let’s get to the core of this chapter.Stepping back only requires the business person to allocate a meaningful time to review (say half an hour per day in the morning to ensure he or she is still fresh and not preoccupied by current operational activities). That time should ONLY be used to focus on developing value in the organization by reviewing the material areas in the company (rather than thinking about day-to-day operational matters) and putting a plan together on how to realise the internal business value-added opportunities. Naturally, it would make sense, if a small team of people were involved, as “two heads are better than one,” and I propose creating a short-term value-added team. It is worth noting, though, that having such a team may also be problematical because its meetings involve discussing changes as well as questioning assumptions that may have existed over a longer time and may have become very personal. But as long as the team members are open to new ideas, quick wins will demonstrate that this is the way forward. Additionally, one team member needs to play the “advisor,” very much like the king’s jester at court, to ensure potentially lucrative opportunities are not overlooked by the old and conventional ways of doing things. What we are simply trying to do here is brainstorm value-added internal business ideas for further discussion. No idea should be too outrageous at this point, as an even better one might occur. Also criticism may reduce active participation because people will be worried about looking foolish. The CEO must clarify that this is a learning exercise and not an opportunity to criticise existing practices; otherwise, the whole process could lead to bitterness and recriminations. Team members can bring up a problem as long as they have an idea that might solve it. There also needs to be company social recognition for the team’s efforts and fair financial rewarding for members contributions when appropriate.Having a value-added team during the discussions also means it should be easier to sell the ideas of changes to the management and staff, making implementation so much easier.Ideally, the meetings should be in a conference room or similar place, away from the normal working environments, to avoid any interference like emails, text messages, phone calls, etc.

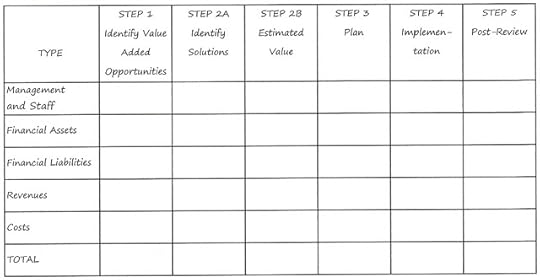

The DetailsOnce the 30 minutes a day have been set aside and the team has been chosen and motivated, the members can start focusing on working through the following five steps:1. Identify some value-added opportunities (1-2 weeks maximum). 2. Identify best possible solutions through financial analysis, based on 80/20 rule, with estimated value of solution (3 weeks maximum).3. Plan on how to implement the best possible solutions (1 week maximum).4. Implementation (this will take several months, but the relevant project manager will report separately to the CEO and not to the team).5. Post-implementation review to determine whether the expected results have been realised or not. (The implementation review itself takes 2 weeks maximum; however, since it takes several months or years to see the full value-added benefits, the review will happen over an extensive period for the different value-added projects.)Clearly—as can be seen from the above—the whole process of identifying value-added opportunities worth execution really does not take that much time. What does take time is implementation, and the period required is obviously dependent on its complexity. However, as we are talking about simple solutions here, the implementation period should really be less than 6 months.I have mentioned the 80/20 rule in the 5 steps, and it is especially important when people’s time is constrained. The 80/20 rule is based on the fact that 80% of the benefits can be achieved with 20% of the total effort, meaning in our case any business can benefit from the majority of the value added without too much effort. For detailed explanation on the 80/20 rule, please refer to the back of the book.It would make sense for the 5 steps to be included on a physical board, so they stand out during the meeting. This board should otherwise be locked away temporarily as the information could be sensitive.

Please see a possible example of physical board below:

There may be a number of management and staff opportunities and then there would be a line for each. This chart must be completed and kept up to date. It is essential that best estimated values are given to each opportunity, as this board will be used to determine which ones to tap and which ones not to pursue because they are insignificant or will take a disproportionate amount of time.

Therefore, the daily ritual will involve identifying opportunities, finding solutions, planning, implementing and reviewing the material value-added internal business opportunities until the 80/20 rule indicates this is no longer worthwhile. The next chapter will show how exactly this is done, but it also will bring you closer to discovering that golden nugget.

Excerpt from Supercharge Your Business by Simon Weiner

General InformationTo maintain an overall view of the company and to identify value-added opportunities, it’s important to create and keep time available for reviewing the business activities and determining why things are done in a certain way and how they could be done differently.As I mentioned at the beginning of this book, the business person is probably too busy working on operational issues and, therefore, lack of time is a real limitation. However, without this extra time for the process I will describe, nothing will change. The business person has to make that important step and organize his or her schedule so he or she can identify those value-added business ideas.So let’s get to the core of this chapter.Stepping back only requires the business person to allocate a meaningful time to review (say half an hour per day in the morning to ensure he or she is still fresh and not preoccupied by current operational activities). That time should ONLY be used to focus on developing value in the organization by reviewing the material areas in the company (rather than thinking about day-to-day operational matters) and putting a plan together on how to realise the internal business value-added opportunities. Naturally, it would make sense, if a small team of people were involved, as “two heads are better than one,” and I propose creating a short-term value-added team. It is worth noting, though, that having such a team may also be problematical because its meetings involve discussing changes as well as questioning assumptions that may have existed over a longer time and may have become very personal. But as long as the team members are open to new ideas, quick wins will demonstrate that this is the way forward. Additionally, one team member needs to play the “advisor,” very much like the king’s jester at court, to ensure potentially lucrative opportunities are not overlooked by the old and conventional ways of doing things. What we are simply trying to do here is brainstorm value-added internal business ideas for further discussion. No idea should be too outrageous at this point, as an even better one might occur. Also criticism may reduce active participation because people will be worried about looking foolish. The CEO must clarify that this is a learning exercise and not an opportunity to criticise existing practices; otherwise, the whole process could lead to bitterness and recriminations. Team members can bring up a problem as long as they have an idea that might solve it. There also needs to be company social recognition for the team’s efforts and fair financial rewarding for members contributions when appropriate.Having a value-added team during the discussions also means it should be easier to sell the ideas of changes to the management and staff, making implementation so much easier.Ideally, the meetings should be in a conference room or similar place, away from the normal working environments, to avoid any interference like emails, text messages, phone calls, etc.

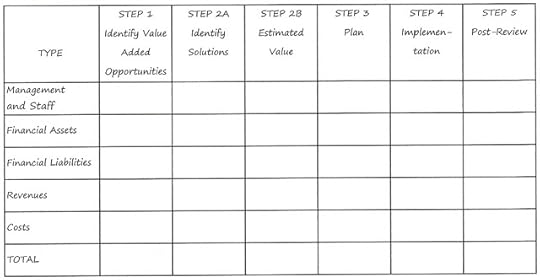

The DetailsOnce the 30 minutes a day have been set aside and the team has been chosen and motivated, the members can start focusing on working through the following five steps:1. Identify some value-added opportunities (1-2 weeks maximum). 2. Identify best possible solutions through financial analysis, based on 80/20 rule, with estimated value of solution (3 weeks maximum).3. Plan on how to implement the best possible solutions (1 week maximum).4. Implementation (this will take several months, but the relevant project manager will report separately to the CEO and not to the team).5. Post-implementation review to determine whether the expected results have been realised or not. (The implementation review itself takes 2 weeks maximum; however, since it takes several months or years to see the full value-added benefits, the review will happen over an extensive period for the different value-added projects.)Clearly—as can be seen from the above—the whole process of identifying value-added opportunities worth execution really does not take that much time. What does take time is implementation, and the period required is obviously dependent on its complexity. However, as we are talking about simple solutions here, the implementation period should really be less than 6 months.I have mentioned the 80/20 rule in the 5 steps, and it is especially important when people’s time is constrained. The 80/20 rule is based on the fact that 80% of the benefits can be achieved with 20% of the total effort, meaning in our case any business can benefit from the majority of the value added without too much effort. For detailed explanation on the 80/20 rule, please refer to the back of the book.It would make sense for the 5 steps to be included on a physical board, so they stand out during the meeting. This board should otherwise be locked away temporarily as the information could be sensitive.

Why not Supercharge Your Business & Never Worry about Money Again? RT https://t.co/hZW71TRjqu #smallbiz #business— Simon Weiner CGMA (@simondweiner) November 26, 2015

Please see a possible example of physical board below:

There may be a number of management and staff opportunities and then there would be a line for each. This chart must be completed and kept up to date. It is essential that best estimated values are given to each opportunity, as this board will be used to determine which ones to tap and which ones not to pursue because they are insignificant or will take a disproportionate amount of time.

Therefore, the daily ritual will involve identifying opportunities, finding solutions, planning, implementing and reviewing the material value-added internal business opportunities until the 80/20 rule indicates this is no longer worthwhile. The next chapter will show how exactly this is done, but it also will bring you closer to discovering that golden nugget.

Excerpt from Supercharge Your Business by Simon Weiner

Published on December 01, 2015 01:05

November 30, 2015

What is Profit and Value Added ? [Supercharge Your Business]

Excerpt from Supercharge Your Business by Simon Weiner

As this book focuses on internally generated value added, it is important to understand the concepts and to differentiate between profit and value added, especially since business people and accountants in small- to medium-sized companiestend to concentrate on profit without addressing value added, which can be far greater (more on this subject will be explained later in this book). For relevant definitions of technical accounting terms, please refer to a Glossary of Terms at the back of this book. Profit is generally known and, for the purpose of this book, it is the difference between revenues and costs. Also for the purpose of the book, value added is the increase in value of an asset that has gone through a process, and it also includes profits. The concept of value added is well understood in large companies and it’s not clear why it has taken so long to trickle down to smaller organizations. Hopefully, this book will do its small part to change this. The fundamental differences between profit and value added can be seen in two areas: realization and the final beneficiary. Profit is realized in the short term (say within 1 year maximum), while value added includes the whole time spectrum. Additionally, the final beneficiary of the value-added exercise can be the business or owners in terms of increased profits or increase in the market value of the business. Thus, owners of businesses should be most interested in value added, since, with a few steps, they may be able to turn their companies into a gold mine. Here are some examples to make this subject clearer.

ProfitExample 4.1:If you sell a product at 100, the cost of it is 70, and overheads are 25, the profit you made on it is 5.

Value addedExample 4.2: A company adds a mezzanine floor to its warehouse, doubling capacity, and rents the additional space created to a third party. In this case, the total profit for the business on the extra floor space is the total value of the rent less the cost of the mezzanine floor. In addition by doubling the warehouse capacity, then, you conceivably double the value of the building, as warehouses are generally valued at x amount per square meter of usable space, and this increase in value is defined here as value added . If the business were to sell the warehouse at some point in the future, the beneficiary of the added value would be the business. However, if the warehouse were kept till the company was sold at some point, then the beneficiary of the added value would be the owner. You can see from this example that profit as well as value added for the business and for the owner may all happen at different times in the course of the business’s lifetime but they are all, nevertheless, important.This book is focused on increasing value added rather than just profits because assets don’t necessarily create short-term profits, but they can create a huge amount of value added. Business people need to take both of them into account when they look at their company’s performance and exploit their business assets to make this happen. Moreover, value added can far exceed profits, as those who have invested in property in the past can confirm when they compare rents (aka profits) with the capital gains (aka value added) on the properties.

By now, the idea of golden nugget hidden somewhere within value-added opportunities may have dawned on you. I will clarify this in more detail in later chapters where I will explain how to look for and find these opportunities.

As this book focuses on internally generated value added, it is important to understand the concepts and to differentiate between profit and value added, especially since business people and accountants in small- to medium-sized companiestend to concentrate on profit without addressing value added, which can be far greater (more on this subject will be explained later in this book). For relevant definitions of technical accounting terms, please refer to a Glossary of Terms at the back of this book. Profit is generally known and, for the purpose of this book, it is the difference between revenues and costs. Also for the purpose of the book, value added is the increase in value of an asset that has gone through a process, and it also includes profits. The concept of value added is well understood in large companies and it’s not clear why it has taken so long to trickle down to smaller organizations. Hopefully, this book will do its small part to change this. The fundamental differences between profit and value added can be seen in two areas: realization and the final beneficiary. Profit is realized in the short term (say within 1 year maximum), while value added includes the whole time spectrum. Additionally, the final beneficiary of the value-added exercise can be the business or owners in terms of increased profits or increase in the market value of the business. Thus, owners of businesses should be most interested in value added, since, with a few steps, they may be able to turn their companies into a gold mine. Here are some examples to make this subject clearer.

Why not Supercharge Your Business & Never Worry about Money Again? RT https://t.co/hZW71TRjqu #smallbiz #business— Simon Weiner CGMA (@simondweiner) November 26, 2015

ProfitExample 4.1:If you sell a product at 100, the cost of it is 70, and overheads are 25, the profit you made on it is 5.

Value addedExample 4.2: A company adds a mezzanine floor to its warehouse, doubling capacity, and rents the additional space created to a third party. In this case, the total profit for the business on the extra floor space is the total value of the rent less the cost of the mezzanine floor. In addition by doubling the warehouse capacity, then, you conceivably double the value of the building, as warehouses are generally valued at x amount per square meter of usable space, and this increase in value is defined here as value added . If the business were to sell the warehouse at some point in the future, the beneficiary of the added value would be the business. However, if the warehouse were kept till the company was sold at some point, then the beneficiary of the added value would be the owner. You can see from this example that profit as well as value added for the business and for the owner may all happen at different times in the course of the business’s lifetime but they are all, nevertheless, important.This book is focused on increasing value added rather than just profits because assets don’t necessarily create short-term profits, but they can create a huge amount of value added. Business people need to take both of them into account when they look at their company’s performance and exploit their business assets to make this happen. Moreover, value added can far exceed profits, as those who have invested in property in the past can confirm when they compare rents (aka profits) with the capital gains (aka value added) on the properties.

By now, the idea of golden nugget hidden somewhere within value-added opportunities may have dawned on you. I will clarify this in more detail in later chapters where I will explain how to look for and find these opportunities.

Published on November 30, 2015 00:58

November 29, 2015

What is the Vision for the Business? [Supercharge Your Business]

Excerpt from Supercharge Your Business by Simon Weiner

The question may be asked now why the vision (and this chapter) are so critical. They are critical because business decisions based on internal value-added opportunities have to complement the vision; otherwise, taking advantage of them may not make sense. For instance, taking advantage of extra storage space to realise a value-added opportunity may not make sense if the vision is to move to a new building within the next year. But what is value added really about? In the next chapter, I will explain this concept and compare it with profit.

The question may be asked now why the vision (and this chapter) are so critical. They are critical because business decisions based on internal value-added opportunities have to complement the vision; otherwise, taking advantage of them may not make sense. For instance, taking advantage of extra storage space to realise a value-added opportunity may not make sense if the vision is to move to a new building within the next year. But what is value added really about? In the next chapter, I will explain this concept and compare it with profit.

Published on November 29, 2015 00:03

November 27, 2015

Why are some Business People Self Destructive? [Supercharge Your Business]

Excerpt from Supercharge Your Business by Simon WeinerBusiness Person A He is a good example of somebody who, to the world outside, looked like a very happy and positive person, sort of “everything is great” guy. So, he and his family led their lives as if everything were going great: nice holidays, expensive finishing for their house, etc. But he knew there was a problem in his business; he just didn’t know what it was exactly. As a result, when he was by himself, he worried a lot. He worried about the business itself but also about his own family, who soon might no longer be able to live the lives they were now accustomed to.Business Person A didn’t know if or how much profit his company was making because there simply were no up-to-date accounting records. He started noticing something wasn’t right when there was no cash to pay either his expenses, or suppliers’ invoices, but when money from his customers occasionally arrived, the problem was temporarily solved. This situation carried on for some time until it was discovered his company owed so much money to his main supplier that there was a high risk the supplier would end their relation, which would signify the end of his business. So when I met business Person A, he was looking for me to wave a magic wand to make all his problems vanish.

Business Person BHe was a very calm and unruffled person, hardly showing any emotions to the outside world. He had worked hard on his business for about 40 years, transforming it from a tiny operation to a company employing 50-60 people. He liked having everything under control, and he was still involved in all areas of his business, just like at the beginning when there were only a few people working for him. After all these years, Business Person B decided to sell his company, and this was when he realised his business wasn’t in as good condition as he thought. As a result, he was unable to sleep and started having some health problems, since he feared everything was collapsing around him just at the wrong time. But he still was checking every tiny aspect of the business instead of focusing on the bigger strategic picture of preparing the company for sale. This meant the management and decision making were grinding to a halt and seriously affecting the already weakened business. When he asked for me to come on board and help, he didn’t really know what the problem was, he simply wanted it to be fixed before the company (and possibly him) would collapse.

Business Person C He was very devoted to the company he created. He knew how and when everything should be done, and, since he knew it best, he didn’t think anybody else could do it better and, therefore, ended up performing at least three roles. This obviously resulted in him being so exhausted and irritated that, after a while, he just wanted to sell his business and retire.Business Person C knew his company was achieving huge profits, so he was really surprised and couldn’t understand why there was hardly any interest in his great business by prospective purchasers. Frustrated even more, he started looking for help but wasn’t willing to pay for expensive professional advice and, instead, was getting cheap or free advice that was of little use. In his mad rush, Business Person C wasn’t able to notice that he was the business and that he was generating the profit: he was performing all the important roles, so, without him, the company wouldn’t continue. The market value of his business, at that point, was almost zero, as, not surprisingly, there were no buyers.

Business Person D He was a highly emotional, kind of black-or-white person. Whoever was not with him was against him, straightaway becoming his worst enemy. He was under tremendous stress and strain caused by his personal and business life; therefore, when matters didn’t work his way, he would get angry and, sometimes, even aggressive. Business Person D was full of contradictions. On the one hand, he was committed to his business and so desperate for it to be successful that he was even willing todeceive people to achieve the end objective. But, on the other hand, whenever there was any money in the company, he would use it for his personal expenses and not for developing his organization. Additionally, although he knew he needed help with his company, he still often acted as if he were the only person who knew how his business could be rejuvenated, and he didn’t take notice of any advice. That’s why many bad decisions caused the company to be in an even worse financial condition, and nobody was interested in supporting his business with new finance.Some business people are simply on a destructive path and this blinds them to the opportunities.They are negative. They are close-minded. They don’t listen. They carry on doing what they always do because that’s what they’re comfortable with. They don’t think beyond today. They think about themselves more than their business, risking the life of the business itself.It’s important that there are changes to the business person’s attitude and behaviours as well as to his company because the business person is the conductor of the business, and, if he does a poor job, the organization will suffer accordingly. So the business person must become positive and see the light at the end of the tunnel. He must be willing to listen to and accept new ideas. He must be willing to change those parts of his behaviour that are negatively impacting the organization. He must have a long-term vision of his company and stop focusing on today. He must nurture the business so that it grows strong and healthy and then, in return, the business will be able to look after his needs.With this change in the business person, there is a good chance that value-added parts of the company can not only be identified but also realised.However, this cannot be achieved without defining a vision for a business, the principles of which I am going to explain next.So are YOU ready now for this adventure? There is a golden nugget waiting for you along the way.

Business Person BHe was a very calm and unruffled person, hardly showing any emotions to the outside world. He had worked hard on his business for about 40 years, transforming it from a tiny operation to a company employing 50-60 people. He liked having everything under control, and he was still involved in all areas of his business, just like at the beginning when there were only a few people working for him. After all these years, Business Person B decided to sell his company, and this was when he realised his business wasn’t in as good condition as he thought. As a result, he was unable to sleep and started having some health problems, since he feared everything was collapsing around him just at the wrong time. But he still was checking every tiny aspect of the business instead of focusing on the bigger strategic picture of preparing the company for sale. This meant the management and decision making were grinding to a halt and seriously affecting the already weakened business. When he asked for me to come on board and help, he didn’t really know what the problem was, he simply wanted it to be fixed before the company (and possibly him) would collapse.

Why not Supercharge Your Business & Never Worry about Money Again? RT https://t.co/hZW71TRjqu #smallbiz #business— Simon Weiner CGMA (@simondweiner) November 26, 2015

Business Person C He was very devoted to the company he created. He knew how and when everything should be done, and, since he knew it best, he didn’t think anybody else could do it better and, therefore, ended up performing at least three roles. This obviously resulted in him being so exhausted and irritated that, after a while, he just wanted to sell his business and retire.Business Person C knew his company was achieving huge profits, so he was really surprised and couldn’t understand why there was hardly any interest in his great business by prospective purchasers. Frustrated even more, he started looking for help but wasn’t willing to pay for expensive professional advice and, instead, was getting cheap or free advice that was of little use. In his mad rush, Business Person C wasn’t able to notice that he was the business and that he was generating the profit: he was performing all the important roles, so, without him, the company wouldn’t continue. The market value of his business, at that point, was almost zero, as, not surprisingly, there were no buyers.

Business Person D He was a highly emotional, kind of black-or-white person. Whoever was not with him was against him, straightaway becoming his worst enemy. He was under tremendous stress and strain caused by his personal and business life; therefore, when matters didn’t work his way, he would get angry and, sometimes, even aggressive. Business Person D was full of contradictions. On the one hand, he was committed to his business and so desperate for it to be successful that he was even willing todeceive people to achieve the end objective. But, on the other hand, whenever there was any money in the company, he would use it for his personal expenses and not for developing his organization. Additionally, although he knew he needed help with his company, he still often acted as if he were the only person who knew how his business could be rejuvenated, and he didn’t take notice of any advice. That’s why many bad decisions caused the company to be in an even worse financial condition, and nobody was interested in supporting his business with new finance.Some business people are simply on a destructive path and this blinds them to the opportunities.They are negative. They are close-minded. They don’t listen. They carry on doing what they always do because that’s what they’re comfortable with. They don’t think beyond today. They think about themselves more than their business, risking the life of the business itself.It’s important that there are changes to the business person’s attitude and behaviours as well as to his company because the business person is the conductor of the business, and, if he does a poor job, the organization will suffer accordingly. So the business person must become positive and see the light at the end of the tunnel. He must be willing to listen to and accept new ideas. He must be willing to change those parts of his behaviour that are negatively impacting the organization. He must have a long-term vision of his company and stop focusing on today. He must nurture the business so that it grows strong and healthy and then, in return, the business will be able to look after his needs.With this change in the business person, there is a good chance that value-added parts of the company can not only be identified but also realised.However, this cannot be achieved without defining a vision for a business, the principles of which I am going to explain next.So are YOU ready now for this adventure? There is a golden nugget waiting for you along the way.

Published on November 27, 2015 20:49

November 26, 2015

What is Tyranny of the Urgent? [Supercharge Your Business]

Excerpt from Supercharge Your Business by Simon Weiner

Example:A company simply could not finance its business, as it had an appalling payment reputation and, therefore, was unable to negotiate substantial trade credit, just at the point where lack of finance was stopping it from expanding in a fast-growing market. The simple solution was to pay an exorbitant 10,000 in interest over 3 months on a 300,000 short-term pound loan (amounting to interest of over 10%) so that it could pay its major trade debts on time for the first time ever. This short-term loan allowed it to dramatically improve its financial risk profile and provided it with an opportunity to negotiate an extra 1.25 million of free trade credit. This extra free credit allowed the company to dramatically develop its business from 6 to 20 million annually within a 2-year period. How many business people wouldn’t like to invest 10,000 to get the same extra 1.25 million in free credit, allowing their sales to grow by a factor of 3?My simple solutions are just that. Really quite simple. And I won’t pretend otherwise. The problem with being so busy on urgent operational matters is that you sometimes can’t see the wood for the trees and, thus, you miss these simple solutions. This book basically points them out to YOU again and urges you to take action.I cannot tell you whether your internal business value will increase by a factor of 2 or 10, as this depends on how you implement these solutions, but what I can promise you is that your company will certainly benefit from the suggestions included in this book. I can also promise that if you need help with your organization, buying this book will be the best decision you will make as the benefits could outweigh the insignificant costs of this book by a factor of 1,000,000.So don’t wait any longer because you think you know your company in detail and these value-added opportunities to develop your business simply don’t exist. Don’t be the person who misses out on opportunities because you are so busy working on everyday issues and don’t have time to look at the bigger picture. Be open-minded. Give yourself the time to read about the solutions that are quite simple to understand and implement. And once you have implemented them, you will probably look back and say, “I knew that.” And with hindsight, you do. The question will be why you had to wait so long to notice and implement them?So if YOU want to realize the full potential value of your business, please read on.

*This book may also be pertinent to larger brick-and-mortar businesses, but they tend to employ more management and more professionals focusing on strategic and tactical matters who should, in the main, deal with opportunities I discuss in this book. **This book only deals with brick-and-mortar companies and not web-based ones, as web-based businesses benefit from less assets and efficiencies and, therefore, the opportunities to create value from these assets and efficiencies are hugely reduced.

***This book deliberately does not look at external business opportunities, as first, this is a much bigger subject (possibly the subject of the next book) and second, these external business opportunities are NOT under the business person’s control. Internal opportunities, on the other hand, are, and they are most easily won if the business person so wishes and makes them happen.

Author presenting a paper at the Warsaw Stock Exchange November 2014 on the impact of the new CGMA accounting principles on small- and medium-sized businesses. Source: Used with permission from CIMA (Chartered Institute of Certified Accountants), Poland

Why not Supercharge Your Business & Never Worry about Money Again? RT https://t.co/hZW71TRjqu #smallbiz #business— Simon Weiner CGMA (@simondweiner) November 26, 2015

Example:A company simply could not finance its business, as it had an appalling payment reputation and, therefore, was unable to negotiate substantial trade credit, just at the point where lack of finance was stopping it from expanding in a fast-growing market. The simple solution was to pay an exorbitant 10,000 in interest over 3 months on a 300,000 short-term pound loan (amounting to interest of over 10%) so that it could pay its major trade debts on time for the first time ever. This short-term loan allowed it to dramatically improve its financial risk profile and provided it with an opportunity to negotiate an extra 1.25 million of free trade credit. This extra free credit allowed the company to dramatically develop its business from 6 to 20 million annually within a 2-year period. How many business people wouldn’t like to invest 10,000 to get the same extra 1.25 million in free credit, allowing their sales to grow by a factor of 3?My simple solutions are just that. Really quite simple. And I won’t pretend otherwise. The problem with being so busy on urgent operational matters is that you sometimes can’t see the wood for the trees and, thus, you miss these simple solutions. This book basically points them out to YOU again and urges you to take action.I cannot tell you whether your internal business value will increase by a factor of 2 or 10, as this depends on how you implement these solutions, but what I can promise you is that your company will certainly benefit from the suggestions included in this book. I can also promise that if you need help with your organization, buying this book will be the best decision you will make as the benefits could outweigh the insignificant costs of this book by a factor of 1,000,000.So don’t wait any longer because you think you know your company in detail and these value-added opportunities to develop your business simply don’t exist. Don’t be the person who misses out on opportunities because you are so busy working on everyday issues and don’t have time to look at the bigger picture. Be open-minded. Give yourself the time to read about the solutions that are quite simple to understand and implement. And once you have implemented them, you will probably look back and say, “I knew that.” And with hindsight, you do. The question will be why you had to wait so long to notice and implement them?So if YOU want to realize the full potential value of your business, please read on.

*This book may also be pertinent to larger brick-and-mortar businesses, but they tend to employ more management and more professionals focusing on strategic and tactical matters who should, in the main, deal with opportunities I discuss in this book. **This book only deals with brick-and-mortar companies and not web-based ones, as web-based businesses benefit from less assets and efficiencies and, therefore, the opportunities to create value from these assets and efficiencies are hugely reduced.

***This book deliberately does not look at external business opportunities, as first, this is a much bigger subject (possibly the subject of the next book) and second, these external business opportunities are NOT under the business person’s control. Internal opportunities, on the other hand, are, and they are most easily won if the business person so wishes and makes them happen.

Author presenting a paper at the Warsaw Stock Exchange November 2014 on the impact of the new CGMA accounting principles on small- and medium-sized businesses. Source: Used with permission from CIMA (Chartered Institute of Certified Accountants), Poland

Published on November 26, 2015 21:48

Are you going for GOLD or will just Bronze do? [Supercharge Your Business]

Excerpt from 'Supercharge Your Business' by Simon Weiner

Just imagine for a moment that your company was training for the Business Olympics and the objective was nothing less than to win Gold. The company was a bit overweight and not quite fit. You brought in a coach to help your company perform better and you started to train. The coach checked your company’s performance and advised you were doing okay, but there were areas that still needed work: the equivalent of reducing weight, building muscles, improving flexibility, and training hard. Your company took a note of all the coach’s advice and slowly but surely dealt with the issues the coach raised. Finally the Business Olympics has arrived and the company is prepared. And it wins Gold. How would that feel?

Just imagine for a moment that your company was training for the Business Olympics and the objective was nothing less than to win Gold. The company was a bit overweight and not quite fit. You brought in a coach to help your company perform better and you started to train. The coach checked your company’s performance and advised you were doing okay, but there were areas that still needed work: the equivalent of reducing weight, building muscles, improving flexibility, and training hard. Your company took a note of all the coach’s advice and slowly but surely dealt with the issues the coach raised. Finally the Business Olympics has arrived and the company is prepared. And it wins Gold. How would that feel?

Why not Supercharge Your Business & Never Worry about Money Again? RT https://t.co/hZW71TRjqu #smallbiz #business— Simon Weiner CGMA (@simondweiner) November 26, 2015

Why I wrote 'Supercharge Your Business'

Posted by Simon Weiner on Tuesday, 17 November 2015

Published on November 26, 2015 00:16

November 24, 2015

Do you want Your FREE download of Supercharge Your Business?

Supercharge Your Business e-book is now launched and #1 Bestseller (in 3 categories) on Amazon.

This ebook is now FREE to download on Amazon.com until end 25th November when the price will go up to 9.99 USD.

Grab your FREE copy now on http://amzn.com/B017INW3HY

- Simon Weiner

This ebook is now FREE to download on Amazon.com until end 25th November when the price will go up to 9.99 USD.

Grab your FREE copy now on http://amzn.com/B017INW3HY

- Simon Weiner

Published on November 24, 2015 05:18

November 22, 2015

November 20, 2015

Why 'Supercharge Your Business' ?

Published on November 20, 2015 22:22