Gennaro Cuofano's Blog, page 61

July 17, 2025

Netflix Strategic Inflection Point

Netflix’s Q2 2025 results reveal a company at a critical strategic inflection point. The 34.1% operating margin—up nearly 7 percentage points year-over-year—signals the successful execution of a fundamental business model transformation. This isn’t just operational excellence; it’s strategic repositioning from a growth-at-all-costs disruptor to a value-extraction machine.

The Three-Pillar Revenue ArchitecturePillar 1: Dynamic Pricing OptimizationThe 15% revenue growth in U.S./Canada (versus 9% in Q1) demonstrates Netflix’s pricing power has reached a new level. This isn’t simple price increases—it’s sophisticated yield management.

Strategic Insight: Netflix has discovered its demand curve is far more inelastic than previously thought. The minimal churn from recent price hikes suggests Netflix has achieved what strategists call “utility status”—becoming so essential to daily life that price sensitivity diminishes.

The Pricing Ladder Strategy:

Basic with ads: $7.99 (capturing price-sensitive segments)Standard: $18 (the profitable middle)Premium: $25 (extracting maximum value from power users)This tiered architecture allows Netflix to capture consumer surplus at every price point while using the ad tier as a retention mechanism for price-sensitive users who might otherwise churn.

Pillar 2: The Advertising TransformationThe goal to double advertising revenue in 2025 represents more than incremental revenue—it’s a fundamental business model expansion. With ad-tier signups representing over 50% of new acquisitions, Netflix is essentially building a second company within the first.

Strategic Implications:

Data Monetization: 260+ million households generate viewing data worth billions to advertisersInventory Control: Unlike YouTube or social platforms, Netflix controls premium, brand-safe inventoryPricing Power Multiplication: Ads allow Netflix to raise subscription prices while offering a lower-priced alternativeThe advertising business transforms Netflix’s unit economics. A subscriber paying $7.99 plus generating $8-10 in monthly ad revenue is more valuable than a $15.49 standard subscriber.

Pillar 3: The Emerging Commerce LayerWhile not explicitly detailed in earnings, Netflix’s experiments with gaming, merchandise, and live experiences suggest a third pillar emerging: commerce and experiences.

The strategic logic is compelling:

IP Monetization: Extending successful content into games, products, and experiencesEngagement Deepening: Creating ecosystem lock-in beyond video consumptionMargin Expansion: Digital goods and licensing carry minimal marginal costsThe Operational Leverage FlywheelNetflix’s business model now exhibits powerful operational leverage across three dimensions:

Content LeverageThe shift from licensed to original content fundamentally changed Netflix’s cost structure. Original content is a fixed cost that scales infinitely—whether 10 million or 100 million people watch “Stranger Things,” the production cost remains constant.

Key Strategic Advantages:

Global Amortization: Content costs spread across 190+ countriesPerpetual Library Value: Owned content appreciates rather than requires renewalData-Driven Efficiency: AI/ML reduces content failure ratesTechnology LeverageNetflix’s technology infrastructure represents a massive fixed cost that becomes marginally cheaper with scale:

CDN Efficiency: Netflix’s Open Connect delivers content at fraction of competitor costsPersonalization at Scale: Recommendation algorithms improve with more dataPlatform Extensibility: Same infrastructure supports video, gaming, live eventsMarketing LeverageThe most underappreciated aspect of Netflix’s model is marketing efficiency. With 260+ million households, Netflix has achieved:

Organic Content Discovery: Users market to each other via social sharingCultural Moments: Hit shows create free media coverage worth billionsRetention vs. Acquisition: Marketing spend shifts from expensive acquisition to cheap retentionStrategic Moats: Beyond ScaleThe Data MoatNetflix possesses the most comprehensive global entertainment consumption dataset:

600+ billion hours of viewing dataMicro-behavioral insights: pause points, rewatch patterns, abandonment ratesCross-cultural preferences: understanding what translates across marketsThis data advantage compounds—better data leads to better content decisions, which generate more engagement, creating more data.

The Talent MoatNetflix’s financial strength creates a virtuous cycle with creative talent:

Upfront Payments: Creators get paid regardless of performanceGlobal Distribution: Instant access to 190+ countriesCreative Freedom: Less interference than traditional studiosData Insights: Creators see detailed performance metricsThe Attention MoatNetflix has achieved what strategists call “default status”—becoming the reflexive choice for entertainment. This attention moat manifests in:

Habitual Usage: Average 2+ hours daily viewingUI Dominance: Netflix button on remotes worldwidePassword Sharing: Even “freeloaders” strengthen the moat by creating habitsThe Hidden Strategy: Optionality ValueNetflix’s strongest strategic asset may be its optionality—the ability to enter adjacent markets with existing capabilities:

Live ProgrammingThe infrastructure for streaming allows Netflix to enter live sports/events with marginal investment, while linear broadcasters face existential threats.

Gaming PlatformWith 260+ million authenticated users and payment relationships, Netflix could become a major gaming platform without traditional console/PC barriers.

Social FeaturesThe viewing data and user base position Netflix to add social features that would make switching costs prohibitive.

Commerce PlatformDirect relationships with consumers enable Netflix to bypass traditional retail for merchandise, experiences, and digital goods.

Strategic Vulnerabilities and MitigationThe Innovation ParadoxSuccess breeds conservatism. As Netflix optimizes for profitability, it may lose the experimental edge that created its moat. The company must balance:

Margin expansion vs. content investmentGlobal efficiency vs. local relevancePlatform stability vs. feature innovationThe Regulatory ReckoningNetflix’s dominance invites regulatory scrutiny across:

Content Quotas: Countries mandating local content investmentTax Optimization: Pressure on international revenue recognitionData Privacy: Restrictions on behavioral tracking and targetingThe Talent Inflation TrapAs the primary buyer of global content, Netflix faces the monopolist’s dilemma—its willingness to pay inflates the entire market, raising costs for everyone, including itself.

Strategic Implications for Different StakeholdersFor Competitors: The Consolidation ImperativeNetflix’s economics make standalone streaming unviable for most. Strategic options:

Merge or Perish: Combine subscale services to approach Netflix’s leverageNiche Specialization: Focus on specific demographics/genres Netflix underservesBundle Strategies: Hide streaming losses within broader offeringsFor Traditional Media: The Extinction EventLinear TV faces strategic obsolescence. Netflix’s margin profile while paying for content reveals the inefficiency of the traditional model:

60-70% of revenue going to distribution (cable/satellite) vs. Netflix’s direct modelFixed programming schedules vs. on-demand consumptionGeographic restrictions vs. global reachFor Big Tech: The Streaming Reality CheckDespite superior technology and resources, Big Tech streaming efforts face strategic disadvantages:

Lack of Content DNA: Tech companies struggle with creative decisionsDivided Attention: Streaming is strategic for Netflix, tactical for othersCulture Clash: Engineering culture conflicts with entertainment cultureThe Next Strategic HorizonNetflix’s Q2 results suggest three strategic priorities for the next phase:

1. The Engagement EconomyMoving beyond time watched to engagement depth:

Interactive Content: Choose-your-own-adventure scalingSocial Viewing: Synchronized watching with friendsCreator Tools: User-generated content within Netflix IP2. The AI TransformationLeveraging AI for step-function improvements:

Content Creation: AI-assisted production reducing costs 50-90%Hyper-Personalization: Individual episode edits based on preferencesPredictive Greenlighting: Near-perfect content success prediction3. The Platform EvolutionTransforming from app to platform:

Netflix OS: Becoming the operating system for TVDeveloper Ecosystem: Third-party apps within NetflixHardware Integration: Deeper integration with TV manufacturersConclusion: The Compounding AdvantageNetflix’s Q2 2025 results reveal a business model with extraordinary compounding characteristics. Each strategic advantage reinforces others, creating a flywheel that accelerates with scale.

The genius of Netflix’s strategy isn’t any single element—it’s the interconnected system where:

Scale enables investmentInvestment creates differentiationDifferentiation drives pricing powerPricing power funds scaleThis virtuous cycle, now generating 34% operating margins with 16% growth, suggests Netflix hasn’t peaked—it’s just beginning to extract value from its strategic position.

The ultimate strategic insight: Netflix has transformed streaming from a product into a platform, from a service into a utility, and from a disruptor into the new establishment. The question isn’t whether this model is sustainable—it’s whether any competitor can build an alternative before Netflix’s advantages become insurmountable.

The post Netflix Strategic Inflection Point appeared first on FourWeekMBA.

ChatGPT Agent: The Autonomous AI Revolution and Its Seismic Industry Implications

OpenAI’s launch of ChatGPT Agent today marks a significant milestone in the history of computing. This isn’t just another feature update—it’s the moment AI transitions from answering questions to completing work. The new agent combines the web browsing capabilities of Operator, the synthesis powers of Deep Research, and the conversational intelligence of ChatGPT into a unified system that operates its own virtual computer.

For the first time, mainstream users can delegate complex, multi-step tasks to an AI that will navigate websites, run code, analyze data, and complete transactions autonomously. The implications ripple far beyond OpenAI’s valuation—this launch redefines the nature of work itself.

The Architecture of Autonomy: How ChatGPT Agent WorksThe Unified System BreakthroughChatGPT Agent represents a technical achievement that seemed impossible just months ago. By merging three previously separate capabilities, OpenAI has created something greater than the sum of its parts:

Operator’s Web Mastery provides the ability to click, scroll, and navigate any website—essentially giving AI hands to interact with the digital world. Deep Research’s Synthesis Engine can process information from dozens of sources simultaneously, creating comprehensive reports that would take humans hours or days. ChatGPT’s Intelligence Core orchestrates everything, understanding context, making decisions, and maintaining conversational flow throughout complex tasks.

The genius lies in the integration. When you ask ChatGPT Agent to “prepare for a client meeting,” it doesn’t just give you advice—it checks your calendar, researches the client’s recent news, prepares briefing documents, and even drafts follow-up emails. All while you watch through its virtual computer window, maintaining control but freed from the tedium.

Performance That Changes the GameThe numbers tell a compelling story. ChatGPT Agent achieves 41.6% on Humanity’s Last Exam, a benchmark so difficult it’s designed to test the limits of AI reasoning. More impressively, it scores 68.9% on BrowseComp—17.4 percentage points higher than Deep Research alone. These aren’t incremental improvements; they represent a leap in capability that enables entirely new use cases.

But the real proof comes from practical applications. In internal benchmarks measuring investment banking analyst tasks—building financial models, creating leveraged buyout analyses—ChatGPT Agent significantly outperforms previous systems. This isn’t about replacing junior analysts; it’s about giving every professional analyst-level support.

The Immediate Industry DisruptionProfessional Services: The First DominoLaw firms, consulting companies, and financial services face immediate disruption. ChatGPT Agent can conduct due diligence, prepare market analyses, and draft complex documents. McKinsey charges $500,000 for what ChatGPT Agent could draft in hours. While human expertise remains essential for strategy and judgment, the economics of professional services are about to be rewritten.

The disruption isn’t destruction—it’s transformation. A single consultant armed with ChatGPT Agent can deliver what previously required a team. Small firms can compete with giants. Individual experts can scale their impact exponentially.

E-commerce and Digital Marketing RevolutionChatGPT Agent doesn’t just browse websites—it completes purchases, compares prices, and manages transactions. This capability transforms e-commerce from a human-driven to an agent-driven economy. Imagine millions of AI agents shopping simultaneously, comparing every option, negotiating prices, and optimizing purchases.

For marketers, this means rethinking everything. SEO becomes “AEO”—Agent Engine Optimization. Websites must be designed not just for human eyes but for AI comprehension. The companies that adapt fastest will capture the agent economy; those that don’t will watch their traffic evaporate.

Software Development’s Recursive AccelerationWhile Anthropic predicts AI will write 90% of code soon, ChatGPT Agent takes a different approach—it doesn’t just write code; it deploys, tests, and iterates autonomously. A developer can describe a feature and watch as ChatGPT Agent codes it, sets up the development environment, runs tests, and even submits pull requests.

This creates a recursive improvement loop. As ChatGPT Agent helps build better AI tools, those tools make ChatGPT Agent more capable. We’re witnessing the beginning of exponential capability growth that makes Moore’s Law look linear.

The Hidden Dangers and Systemic RisksThe Security Nightmare ScenarioWith great autonomy comes great vulnerability. ChatGPT Agent operates with user credentials, accesses sensitive data, and can execute financial transactions. Every capability that makes it useful also makes it dangerous. OpenAI has implemented safeguards—requiring permission for “actions of consequence,” monitoring for prompt injection attacks—but the attack surface is vast.

Consider the implications: Malicious actors could potentially hijack thousands of agents simultaneously. Hidden instructions on websites could redirect agent behavior. The same tool that automates productivity could automate cybercrime at unprecedented scale.

The Concentration of Power ProblemAs capable as ChatGPT Agent is, it’s controlled by a single company. OpenAI now holds the keys to productivity for millions of users. This concentration of power exceeds anything we’ve seen from previous tech monopolies. Google controlled information discovery; OpenAI could control information action.

The pricing structure—400 queries per month for Pro users, just 40 for Plus users—reveals the scarcity of this resource. Those who can afford unlimited agent access will have superhuman productivity; those who can’t will fall further behind. The digital divide becomes an capability chasm.

The Employment Disruption AccelerantSam Altman’s warning that ChatGPT Agent is “experimental” and not ready for “high-stakes uses” rings hollow when millions of jobs involve exactly the tasks it automates. Administrative assistants, research analysts, and data entry workers face immediate displacement. Unlike previous automation waves that took decades, this one could happen in months.

The optimistic view sees new jobs created—agent supervisors, AI prompt engineers, human-AI collaboration specialists. The pessimistic view sees massive unemployment as AI agents handle increasingly complex tasks. The reality will likely be both: unprecedented opportunity for some, devastating disruption for others.

Strategic Implications for Every IndustryFor Enterprises: Adapt or PerishCompanies must immediately begin agent-proofing their operations. This means:

Reimagining workflows around human-agent collaboration rather than human-only processes. The companies that figure out how to amplify their workforce with agents will outcompete those clinging to traditional methods.

Securing agent-ready infrastructure becomes critical. Your systems must be secure enough to grant agent access yet flexible enough to enable productivity. The CIO’s role transforms from managing IT to orchestrating human-agent symphonies.

Rethinking competitive advantage in an agent-enabled world. When every company has access to superhuman productivity, what differentiates you? The answer lies in uniquely human capabilities: creativity, empathy, strategic thinking, and ethical judgment.

For Startups: The Great EqualizerChatGPT Agent democratizes capabilities previously reserved for well-funded companies. A solo founder can now operate like a full team. Market research, competitive analysis, customer outreach, and even basic product development can be delegated to agents.

But this democratization cuts both ways. When everyone has superhuman capabilities, execution speed and decision quality become the only differentiators. The barriers to entry collapse, but the barriers to success rise. Markets will move at AI speed—measured in hours, not months.

For Investors: Recalibrating EverythingTraditional valuation models assume human-constrained growth rates. ChatGPT Agent breaks those constraints. Companies might achieve in months what previously took years. Due diligence must account for agent-amplified execution. Portfolio companies need agent strategies, not just AI strategies.

The investment implications are staggering. Companies selling human labor become less valuable overnight. Companies selling agent-amplified services see exponential growth potential. The entire venture capital model—built on 10-year funds and gradual scaling—may need complete reimagination.

The New Rules of the Agent EconomyRule 1: Speed Compounds ExponentiallyIn the agent economy, first movers don’t just get advantages—they get compound advantages. Each task automated frees humans for higher-value work. Each process optimized creates time for more optimization. Companies using agents pull further ahead each day.

Rule 2: Data Becomes DestinyAgents need data to function effectively. Companies with clean, accessible, agent-ready data will thrive. Those with messy, siloed, human-only systems will struggle. The technical debt of poor data architecture becomes existential debt in the agent era.

Rule 3: Trust Scales EverythingAs agents handle more sensitive tasks, trust becomes the ultimate currency. Users must trust OpenAI with their data, their credentials, and their digital lives. One major breach or misuse could crash the entire agent economy. Trust, once lost, may prove impossible to rebuild.

Rule 4: Human Skills Invert in ValueSkills that were valuable—like data entry, basic research, and routine analysis—become worthless. Skills that seemed soft—like emotional intelligence, creative problem-solving, and ethical reasoning—become the only skills that matter. The job market inverts: poets might outrank programmers.

The Path Forward: Navigating the Agent RevolutionFor Individuals: Become IrreplaceableThe key to thriving in the agent economy is focusing on what agents can’t do. Build deep relationships. Develop creative insights. Make ethical judgments. Tell compelling stories. These uniquely human capabilities become more valuable as routine tasks get automated.

Learn to work with agents, not against them. The most valuable professionals will be those who can orchestrate multiple agents toward complex goals. Think of yourself as a conductor, not a player—your value lies in coordination, not execution.

For Organizations: Build Agent-Native CulturesCreating an agent-native organization requires more than buying ChatGPT licenses. It demands fundamental cultural change. Employees must feel secure enough to embrace agents without fearing replacement. Processes must be redesigned around human-agent collaboration. Success metrics must value outcomes over hours worked.

The organizations that thrive will be those that see agents as amplifiers, not replacements. They’ll use the productivity gains to pursue ambitious goals previously thought impossible, not just to cut costs.

For Society: Prepare for AccelerationWe’re entering an era of unprecedented change velocity. Social systems designed for human-speed adaptation—education, regulation, social safety nets—must evolve for agent-speed disruption. This isn’t optional; it’s existential.

The choices we make now about agent governance, access equality, and ethical boundaries will shape society for generations. Do we create an agent aristocracy where only the wealthy have superhuman capabilities? Or do we democratize access and share the productivity gains broadly?

The Bottom Line: This Changes EverythingChatGPT Agent’s launch on July 17, 2025, will be remembered as the day AI became a colleague rather than a tool. Despite current limitations—usage caps, experimental status, safety constraints—the trajectory is clear and irreversible.

We’re not watching the evolution of technology; we’re witnessing the birth of a new form of intelligence that can act in the world. The companies, individuals, and societies that recognize this shift and adapt quickly will shape the future. Those that don’t will become its casualties.

The agent revolution isn’t coming—it’s here. The question isn’t whether to participate but how quickly you can adapt. Because in the agent economy, the pace of change isn’t just fast—it’s exponential, compounding, and accelerating every day.

Welcome to Day One of the autonomous age. By Day 1,000, the world will be unrecognizable.

The post ChatGPT Agent: The Autonomous AI Revolution and Its Seismic Industry Implications appeared first on FourWeekMBA.

Lovable’s Lightning Growth: How AI Startups Are Rewriting the SaaS Playbook

Swedish AI startup Lovable has shattered conventional startup timelines, achieving unicorn status in just eight months—a feat that typically takes SaaS companies 7-10 years. The company has raised a $200M Series A at a $1.8B valuation, reaching $75M in annual recurring revenue within seven months and attracting 2.3 million active users with over 180,000 paying subscribers.

This isn’t just fast growth—it’s a fundamental shift in how software companies can scale.

The AI Acceleration Phenomenon: Why AI Startups Grow 10x FasterInstant Value RealizationThe traditional SaaS model requires 3-6 month implementation cycles, extensive onboarding, and gradual ROI realization. AI startups deliver immediate utility from day one—users see value within minutes, not months.

Lovable exemplifies this perfectly. Users can build a functional web application in their first session, compared to traditional no-code tools requiring weeks of learning. The “time to wow” has compressed from months to minutes.

Zero Integration FrictionTraditional SaaS demands complex API integrations, data migration, and organizational change management. AI startups eliminate these barriers entirely through natural language interfaces. Lovable’s approach—”describe what you want in plain English”—removes the entire technical onboarding phase that plagues enterprise SaaS adoption.

Viral Product-Led Growth on SteroidsWhere traditional SaaS companies celebrate 2-5% monthly growth through product-led strategies, AI startups are achieving 50-100% monthly growth through viral demonstrations. Every Lovable creation becomes a demonstration piece. When non-technical users build impressive applications, it creates a powerful “if they can do it, I can do it” viral loop that traditional SaaS rarely achieves.

The New Physics of Software AdoptionNetwork Effects at HyperspeedTraditional network effects required years to build critical mass. AI products create immediate network value through knowledge accumulation—every user interaction improves the product. Successful creations become templates for others, and the social proof of non-technical users becoming builders is inherently shareable content.

The Democratization PremiumLovable’s targeting of non-developers isn’t just market expansion—it’s market creation. By enabling the 99% who can’t code, they’re not competing for existing budget but creating entirely new budget categories.

Traditional SaaS calculates TAM as the number of developers multiplied by average spend. AI-enabled TAM equals the number of people with ideas multiplied by the value of those ideas realized. This represents a 100x expansion in addressable market.

The Compound Advantages of AI-First StartupsDevelopment VelocityAI startups can ship features 10x faster using their own tools. Lovable likely uses Lovable to build Lovable—a recursive acceleration loop that traditional companies can’t match. A CRM company can’t use their CRM to build their CRM faster, but an AI development platform becomes more powerful as it builds itself.

Margin Structure RevolutionTraditional SaaS companies consider 70-80% gross margins excellent. Despite model costs, AI startups can achieve 60%+ margins with 10x the revenue per employee. Lovable’s lean team structure means they can reach $75M ARR with likely fewer than 100 employees, versus 300-500 for traditional SaaS at similar revenue levels.

Customer Acquisition Cost DisruptionTraditional enterprise SaaS faces CAC of $10,000-50,000 per deal. AI startups achieve near-zero CAC for viral acquisition and sub-$100 CAC for paid channels. The self-serve nature and immediate value proposition compress sales cycles from months to minutes.

Strategic Implications for the IndustryFor InvestorsThe Lovable phenomenon reveals that traditional SaaS valuation models are obsolete for AI companies. Growth persistence changes dramatically—AI companies can maintain 300-500% growth rates far longer than SaaS predecessors. Markets expand 10-100x when technical barriers disappear, and network effects in AI create more powerful winner-take-most dynamics than traditional software ever achieved.

For IncumbentsTraditional software companies face an innovator’s dilemma on steroids. They can’t match AI-native architectures without complete rebuilds, can’t match pricing without destroying existing revenue models, and can’t match user experience without abandoning complex feature sets. The very strengths that made them successful—comprehensive features, enterprise integration, professional services—become anchors in the AI era.

For EntrepreneursThe Lovable playbook reveals new success factors. Target the 99% who couldn’t use previous solutions, not the 1% who could. Build products that demonstrate value in the first session, not the first quarter. Create viral loops through user success, not just user referrals. Most importantly, use AI to build AI—the recursive advantage is real and compounds daily.

The Broader ImplicationsLovable’s trajectory isn’t an anomaly—it’s the new normal for AI-first companies. The combination of instant value delivery, viral growth mechanics, and democratized access creates a fundamentally different growth curve than anything we’ve seen in software.

Traditional SaaS took a decade to disrupt on-premise software. AI is disrupting SaaS in under two years. The acceleration isn’t just in adoption rates but in the entire cycle of innovation, distribution, and value creation.

For Lovable specifically, the challenge now becomes maintaining quality at scale while preserving the simplicity that drove initial adoption. But their 8-month sprint to unicorn status has already rewritten the playbook for everyone else. The question isn’t whether AI startups will grow faster than SaaS companies—it’s whether any non-AI software company can survive the pace of change.

The post Lovable’s Lightning Growth: How AI Startups Are Rewriting the SaaS Playbook appeared first on FourWeekMBA.

Daily Roundup: Major Shifts in Valuation, Talent, and Market Structure

In a surprising reversal, two leaders of Anthropic’s coding product who joined rival Anysphere two weeks ago have returned to Anthropic. Boris Cherny and Cat Wu, who had been instrumental in developing Claude Code, departed for more senior positions at Cursor developer Anysphere before quickly returning to their original employer.

This rapid reversal suggests potential complications in the AI talent market, where aggressive recruiting and counter-offers have become commonplace. The brief departure and return may indicate either successful retention efforts by Anthropic or challenges in integrating key personnel into competing organizations.

Lovable Achieves Record-Breaking Unicorn StatusSwedish AI startup Lovable has secured a $200 million Series A funding round at a $1.8 billion valuation, marking one of the fastest paths to unicorn status in European tech history. Only eight months since its launch, the startup has raised a $200 million Series A round led by Accel at a $1.8 billion valuation Lovable becomes a unicorn with $200M Series A just 8 months after launch | TechCrunch.

The company’s metrics reveal extraordinary growth:

2.3 million active usersOver 180,000 paying subscribers$75 million in annual recurring revenue within seven monthsLovable’s trajectory demonstrates the market’s appetite for AI-powered development tools that democratize software creation. Unlike competitors targeting professional developers, Lovable focuses on enabling non-technical users to build applications through natural language, potentially expanding the addressable market for software development tools exponentially.

Anthropic Valuation Surge Signals Continued AI Investment FrenzyOpenAI rival Anthropic is in the early stages of planning another investment round that could value the company at more than $100 billion Anthropic Draws Investor Interest at More Than $100 Billion Valuation – Bloomberg. This represents a dramatic increase from its $61.5 billion valuation achieved just four months prior.

The valuation discussions are supported by exceptional revenue growth. The discussions come as Anthropic’s annual revenue has reached $4 billion, a stunning quadrupling from $1 billion in December 2024 Anthropic in Talks for $100 Billion Valuation as Revenue Hits $4 Billion – FourWeekMBA. This 300% revenue growth in seven months suggests strong enterprise adoption of Claude and related services.

Market Implications:

The proposed $100 billion valuation would place Anthropic among the world’s most valuable private companiesInvestors appear willing to assign forward revenue multiples exceeding 25xThe valuation gap with OpenAI (reportedly at $300 billion) remains substantial but is narrowingScale AI Restructuring Following Meta Investment Reveals Industry TensionsOne month after Meta’s $14.3B investment sparked a client exodus over neutrality fears, data-labeling firm Scale AI is laying off 14% of its staff Scale AI Lays Off 14% of Workforce in Fallout from Meta’s $14.3B Investment – WinBuzzer. The company is eliminating 200 full-time positions and terminating relationships with 500 contractors.

In light of Meta’s investment, several of Scale AI’s largest data customers cut ties with the startup Scale AI lays off 14% of staff, largely in data-labeling business | TechCrunch. This client defection highlights a critical challenge in the AI infrastructure market: maintaining neutrality while accepting strategic investments from potential competitors of your customers.

The restructuring follows Meta’s hiring of Scale AI founder Alexandr Wang to lead its Meta Superintelligence Labs, effectively acquiring both leadership and a significant equity stake. Interim CEO Jason Droege attributed the cuts to over-expansion in the company’s core data-labeling business.

Strategic Analysis: The Evolving AI LandscapeThese developments reveal several critical trends reshaping the AI industry:

1. Talent Wars Intensifying The Anthropic executive boomerang and Meta’s acquisition of Scale AI leadership demonstrate that human capital remains the scarcest resource in AI development. Companies are willing to pay extraordinary premiums—whether through equity, compensation, or strategic investments—to secure top talent.

2. Valuation Disconnect from Traditional Metrics Anthropic’s potential $100 billion valuation on $4 billion in revenue and Lovable’s $1.8 billion valuation after eight months of operation suggest investors are pricing in exponential growth expectations. This mirrors the early internet boom but with companies demonstrating actual revenue traction.

3. Infrastructure Dependencies Creating Conflicts Scale AI’s post-Meta challenges illustrate how the AI ecosystem’s interconnected nature creates strategic vulnerabilities. Companies providing critical infrastructure (data labeling, compute, tools) face difficult choices between growth capital and maintaining neutrality for their customer base.

4. Democratization Accelerating Lovable’s success in targeting non-technical users represents a broader trend toward AI accessibility. As these tools mature, the distinction between technical and non-technical users may become irrelevant, potentially disrupting traditional software development economics.

Looking ForwardThe industry appears to be entering a consolidation phase where well-funded players are accumulating talent, technology, and market share. The Scale AI situation may presage similar challenges for other “neutral” infrastructure providers as major tech companies seek to control their AI supply chains.

For enterprises, these developments suggest both opportunity and risk. While AI capabilities are advancing rapidly and becoming more accessible, the concentration of power among a few large players raises questions about dependency, pricing power, and long-term strategic flexibility.

The sustained investor enthusiasm, evidenced by Anthropic’s valuation trajectory and Lovable’s rapid fundraising, indicates confidence in AI’s transformative potential. However, the Scale AI layoffs serve as a reminder that even in a booming market, strategic missteps can have immediate consequences.

The post Daily Roundup: Major Shifts in Valuation, Talent, and Market Structure appeared first on FourWeekMBA.

July 16, 2025

xAI’s Saudi Data Center Play: Geopolitical Chess in the AI Arms Race

Elon Musk’s xAI is in early-stage discussions to lease massive data center capacity in Saudi Arabia, marking a bold geopolitical gambit in the global AI infrastructure race. The talks involve two potential partners, revealing the complex dynamics of AI power consumption, sovereign wealth, and technological sovereignty.

The Two-Track Negotiation

The Two-Track NegotiationTrack 1: The Humain Mega-Deal

Partner: Humain, a Saudi PIF-backed AI firmProposed capacity: Several gigawatts (potentially one of the world’s largest)Timeline: Years away – infrastructure not yet builtReality check: Ambitious but distant, no ground broken yetTrack 2: The Immediate Option

Partner: Unnamed company (already under construction)Capacity: 200 megawattsTimeline: Near-term availabilityStatus: More realistic short-term solutionThe Power Game: Why Saudi Arabia?The Energy EconomicsThe move to Saudi Arabia isn’t just about oil money—it’s about the intersection of cheap energy and political goodwill. As Kathryn Huff, former Energy Department nuclear office administrator, notes: “As power demand goes way up, you’re going to need to see some balance between the cost of running these data centers with the cost of powering them.”

To put this in perspective:

A 1-gigawatt facility consumes energy equivalent to 900,000 homes annuallyAI training requires massive, continuous power supplySaudi Arabia offers some of the world’s cheapest energy costsThe kingdom is investing heavily in renewable energy (130 GW target by 2030)The Geopolitical CalculusWhy Now? The timing reveals multiple strategic pressures converging:

US Regulatory Tensions: Despite Musk’s advisory role to President Trump, he faces ongoing clashes with US lawmakers and regulatorsInfrastructure Constraints: US power grid struggles to meet AI’s voracious energy demandsCapital Abundance: Saudi’s sovereign wealth seeks AI dominanceChip Access: Saudi Arabia’s potential access to specialized AI chips makes it attractiveThe Money Trail: Following the BillionsxAI’s Soaring ValuationCurrent fundraising target: $170-200 billion valuationPrevious valuation (May 2024): $18 billion10x increase in less than a yearSaudi PIF’s role: Expected major participant in new funding roundThe Saudi ConnectionKingdom Holdings: Already invested $800 million in xAIPrince Alwaleed bin Talal: Deepening ties with Musk’s venturesStrategic alignment: Part of Saudi Vision 2030’s tech diversificationThe Players and Their MotivationsInside HumainTechnical lead: Jeff Thomas (infrastructure development)Commercial lead: Saeed Al-Dobas (negotiations)Backing: Saudi Public Investment FundChallenge: Translating promises into actual infrastructurexAI’s Global Chess GameThe Saudi talks are part of a broader infrastructure strategy:

Other considerations:

UAE: Discussions with G42 in Abu DhabiAfrica: Exploring countries with cheap energy accessMemphis: Existing Colossus supercomputer facilitySecond Memphis facility: Already teased by MuskThe Competitive LandscapeThe AI Infrastructure Arms RacexAI isn’t alone in this scramble for compute power:

OpenAI: Building massive training clustersMeta: Investing billions in data centersGoogle: Expanding global AI infrastructureAnthropic: Securing compute partnershipsWhat makes xAI’s Saudi move unique is the combination of sovereign wealth backing and energy abundance at a scale few other locations can match.

Critical Analysis: The Risks and RewardsStrategic AdvantagesEnergy Cost Arbitrage: Dramatic reduction in operational expensesCapital Access: Tap into one of world’s largest sovereign wealth fundsRegulatory Freedom: Escape US regulatory constraintsSpeed to Market: Faster deployment without US bureaucracyGeopolitical Hedge: Diversification beyond Western infrastructureSignificant RisksGeopolitical Backlash: Potential US government concerns about technology transferData Sovereignty: Questions about AI training data locationReputational Impact: Association with Saudi Arabia’s human rights recordTechnical Challenges: Remote management of critical infrastructureDependency Risk: Reliance on foreign government for core operationsThe Bigger Picture: AI’s New GeographyThe Shift from Silicon ValleyxAI’s Saudi negotiations signal a fundamental shift in AI development geography. The traditional Silicon Valley-centric model is giving way to a multipolar landscape where:

Energy abundance trumps proximity to talentSovereign wealth competes with venture capitalGeopolitical alignment becomes a business strategyInfrastructure becomes the ultimate differentiatorThe Middle East’s AI AmbitionsSaudi Arabia and the UAE are aggressively positioning themselves as AI powerhouses:

Massive infrastructure investmentsPartnerships with global AI leadersSovereign AI initiativesEnergy advantage exploitationImplications for the IndustryShort-term ImpactPrecedent Setting: Other AI companies may follow xAI’s leadInfrastructure Rush: Acceleration of global data center developmentPricing Pressure: Competition for limited high-end GPU capacityTalent Migration: AI expertise flowing to new geographic centersLong-term ConsequencesDecentralized AI Development: End of US/China duopolyNew Power Brokers: Middle Eastern influence in AI governanceEnergy-AI Nexus: Countries with cheap energy become AI hubsRegulatory Fragmentation: Different rules in different jurisdictionsThe Technical Reality CheckWhat “Several Gigawatts” Really MeansIf Humain delivers on its promise, we’re talking about:

Unprecedented scale: Among the largest AI facilities globallyPower consumption: Equivalent to a major cityCooling requirements: Massive infrastructure needs in desert climateNetwork capacity: Requires significant bandwidth infrastructureTimeline reality: Years of construction aheadThe 200MW AlternativeThe unnamed partner’s facility represents:

Immediate capacity: Ready for near-term deploymentProven execution: Already under constructionLower risk: More manageable scaleStepping stone: Potential precursor to larger investmentsExpert PerspectivesThe move has drawn mixed reactions from industry observers:

The Pragmatists: See this as inevitable given AI’s energy demands The Skeptics: Question the wisdom of critical infrastructure in Saudi Arabia The Geopoliticians: Frame this as part of broader US-Saudi-China dynamics

What This Means for Musk’s EmpirePortfolio SynergiesTesla: Potential EV and energy storage opportunities in SaudiSpaceX: Launch facilities and satellite ground stationsNeuralink: Medical AI compute requirementsX (Twitter): Content moderation AI infrastructureThe Musk-Saudi RelationshipThis isn’t Musk’s first dance with Saudi capital:

Previous Tesla privatization sagaOngoing investment discussionsShared vision of post-oil economyMutual benefit arrangementConclusion: A New Chapter in AI DevelopmentxAI’s Saudi data center negotiations represent more than just an infrastructure deal—they signal a fundamental realignment of the global AI landscape. As the race for artificial general intelligence intensifies, we’re witnessing the emergence of new power centers beyond traditional tech hubs.

The success or failure of this venture will likely influence how other AI companies approach the critical challenge of securing massive, affordable compute power. In the high-stakes game of AI development, geography, energy, and geopolitics are becoming as important as algorithms and data.

Whether this proves to be a masterstroke or a miscalculation, one thing is certain: the AI arms race is going global, and the rules are being rewritten in real-time. The kingdom that once powered the world with oil may soon power the AI revolution with its data centers—if it can deliver on its ambitious promises.

For Musk and xAI, this represents both an enormous opportunity and a significant gamble. In the race to build AGI, they’re betting that Saudi’s energy and capital advantages outweigh the geopolitical risks. Time will tell if this bet pays off, but it’s already reshaping how we think about AI infrastructure and international technology partnerships.

The AI future may well be written in the desert sands of Saudi Arabia—powered by petrodollars and cooled by ambitious dreams of technological supremacy.

The post xAI’s Saudi Data Center Play: Geopolitical Chess in the AI Arms Race appeared first on FourWeekMBA.

How AI is Flattening Organizations

We are witnessing the most significant transformation in organizational structure since the Industrial Revolution.

Artificial intelligence is not just changing how work gets done; it’s fundamentally reshaping who does the job and how companies organize themselves.

The traditional corporate pyramid is collapsing, middle management is disappearing, and individual contributors are becoming organizational powerhouses.

The Great Flattening: What the Data Shows The Middle Management Extinction Event

The Middle Management Extinction EventThe numbers are stark and accelerating. Gartner predicts that through 2026, 20% of organizations will use AI to flatten their organizational structure, eliminating more than half of current middle management positions.

This isn’t a gradual transition; it’s a rapid restructuring happening right now.

Amazon CEO Andy Jassy’s recent mandate exemplifies this shift: each organization must increase “the ratio of individual contributors to managers by at least 15%” by the end of Q1 2025.

According to Jassy, this will remove layers and flatten organizations while increasing teams’ “ability to move fast, clarify and invigorate their sense of ownership, drive decision-making closer to the front lines.”

The trend extends beyond tech giants. Companies like Microsoft, Meta, Google, and Amazon collectively eliminated tens of thousands of middle-management positions in 2024, primarily targeting middle-skill roles that once served as reliable pathways to economic stability.

The post How AI is Flattening Organizations appeared first on FourWeekMBA.

Google’s AI Search Revolution: The Existential Threat to Publishing

Google’s transformation of search through AI isn’t just another tech update—it’s a fundamental rewiring of how humanity accesses information. As AI Overviews, AI Mode, and Deep Search roll out globally, we’re witnessing the potential collapse of the publishing ecosystem that has powered the free internet for decades.

The stakes couldn’t be higher: journalism as we know it faces extinction.

The AI Arsenal Reshaping SearchAI Overviews: The Gateway Drug

The AI Arsenal Reshaping SearchAI Overviews: The Gateway DrugLaunched in May 2024, AI Overviews now reach over 1 billion users monthly across 200+ countries. These AI-generated summaries sit atop search results, delivering instant answers that make clicking through feel antiquated. Google calls it progress. Publishers call it piracy.

AI Mode: The Publisher KillerOn May 20, 2025, Google unleashed AI Mode on all US users—a conversational search interface that makes traditional blue links obsolete. Using its “query fan-out” technique, AI Mode issues hundreds of simultaneous searches, digesting entire swaths of the web to deliver comprehensive answers without a single click required.

The technology is seductive: ask follow-up questions, get multimodal responses, experience search as conversation rather than exploration. For users, it’s magical. For publishers, it’s a death knell.

Deep Search: The Nuclear OptionAvailable to Google AI Pro and Ultra subscribers ($19.99-39.99/month), Deep Search represents the weaponization of research itself. It can issue hundreds of searches simultaneously, reasoning across disparate sources to create comprehensive, fully-cited reports in minutes. What once required hours of human investigation now happens instantly—without visiting a single website.

Agentic Features: The Final EvolutionGoogle’s latest innovation? AI that makes phone calls on your behalf. Need pet grooming prices? Restaurant reservations? The AI handles it all, bypassing not just websites but human interaction entirely. Partners like Ticketmaster and StubHub are already onboard, trading direct customer relationships for Google’s distribution power.

The Carnage: Publishing’s Brutal RealityThe Numbers Tell a Massacre StoryThe data reads like a casualty report from a one-sided war:

34.5% average click loss when AI Overviews appear—and they’re appearing everywhere. Some publishers report losses up to 70% of their traffic. The New York Times saw organic search traffic plummet from 44% to 36.5% in just three years. Business Insider? Down 55%.

But the real killer statistic? Zero-click searches surged from 56% to 69% between May 2024 and May 2025. Nearly seven out of ten searches now end without a single website visit.

The Financial ApocalypseRaptive estimates the industry faces $2 billion in annual ad revenue losses. A Tollbit report reveals an even grimmer reality: AI search bots send 95.7% less referral traffic than traditional Google search.

This isn’t disruption—it’s demolition.

Case Studies in DestructionEmma’s Gardening Blog: Ranked top 3 for “how to grow tomatoes indoors,” generating 5,000 monthly visits. Post-AI Mode? Traffic crashed 60% to just 2,000 visits. Her content still appears—summarized, sanitized, and stolen.

Italian Publishing: General information sites experienced 30-40% traffic declines after AI Overviews launched. Specialized content fared slightly better, but the trajectory is clear: adapt or die.

The Mechanics of DestructionHow Google Learned to Stop Worrying and Love Zero ClicksThe genius—or evil, depending on your perspective—lies in the execution. Google doesn’t just answer questions; it anticipates, extrapolates, and eliminates the need for exploration.

When users search “What happened at Met Gala 2025,” they no longer browse multiple perspectives from fashion critics, gossip columnists, and cultural commentators. Instead, they receive a sanitized summary that flattens nuance into bullet points.

The “Query Fan-Out” Technique: Death by a Thousand SearchesThis seemingly innocuous technical innovation represents the industrialization of content theft. By breaking complex questions into subtopics and searching simultaneously, Google can digest dozens of articles instantly, extracting value while destroying the economic model that created that value.

Intent Over Keywords: The Philosophical ShiftThe move from keyword-based to intent-based search sounds progressive until you realize its implications. Google no longer connects users with content; it interprets, synthesizes, and replaces it. Publishers aren’t partners anymore—they’re raw material.

The Resistance: Fighting for SurvivalLegal Warfare Erupts GloballyBrazil leads the charge: Major media organizations filed antitrust complaints, with Fenaj’s president Samira de Castro calling Google’s practices “self-preferencing” that “requires urgent regulation.”

Europe joins the battle: Independent publishers filed complaints with the EU Commission and UK’s Competition and Markets Authority, demanding compensation for content use.

The US awakens: News Media Alliance CEO Danielle Coffey doesn’t mince words: “Links were the last redeeming quality of search that gave publishers traffic and revenue. Now Google just takes content by force and uses it with no return, the definition of theft.”

Publishers’ Desperate Pivot StrategiesThe survivors are those who recognize this isn’t a temporary disruption but a permanent shift in the information economy. Their strategies reveal the desperation:

Experience-first content: If AI can’t live it, it can’t steal it. Publishers pivot to first-person narratives, exclusive access, and human experiences that resist summarization.

Hyper-specialization: General information is dead. The future belongs to deep expertise that AI struggles to synthesize accurately.

Direct relationships: Email lists, apps, and subscriptions become lifelines as search traffic evaporates.

AI licensing deals: Some publishers surrender, signing deals with OpenAI and others. The New York Times’ $250 million deal with OpenAI shows the price of survival—or capitulation.

Google’s Defense: Gaslighting at ScaleGoogle executives maintain a stunning disconnect from reality. VP of Search Nick Fox claims “from our point of view the web is thriving,” citing growth in crawlable pages while ignoring that more content with less traffic equals widespread creator poverty.

CEO Sundar Pichai insists AI features send “higher-quality referral traffic” but provides no data. The message is clear: trust us, even as your business burns.

Google’s most insidious claim? That AI Overviews “increase searches by 10%” for relevant queries. Even if true, more searches generating fewer clicks represents a fundamental breaking of the search economy’s social contract.

The Philosophical ReckoningThe Web as Database, Not DestinationPichai’s revelation that Google views “the web as a series of databases” with “a UI on top for all of us to consume” exposes the endgame. Publishers aren’t partners in an ecosystem—they’re data sources to be mined.

The Faustian BargainPublishers face an impossible choice: opt out of AI features and disappear from search entirely, or participate in their own demise. Google eliminated the middle ground, forcing acceptance of AI scraping as the price of visibility.

The Innovation ParadoxGoogle argues AI search represents progress, delivering better user experiences. But what happens when the sources of that information disappear? AI models trained on quality journalism can’t function without journalists creating new content. Google is burning the forest to harvest the trees.

The Future: Dystopia or Renaissance?The Pessimistic ScenarioPublishing enters a death spiral. Quality journalism becomes unsustainable. The web devolves into AI-generated content creating more AI-generated content—a snake eating its own tail until information itself becomes meaningless.

Local news disappears first, then specialized publications, until only the largest players with diversified revenue streams survive. The democratic promise of the internet—anyone can publish, anyone can be heard—dies quietly.

The Optimistic RebirthCrisis forces innovation. Publishers who survive develop new models that bypass search entirely. Direct reader relationships strengthen. Quality becomes a differentiator as audiences tire of AI summaries lacking depth or perspective.

Regulation forces Google to share revenue or limit AI features. New platforms emerge that respect creator rights. The publishing industry, bloodied but not broken, emerges leaner and more focused on unique value humans provide.

The Call to ArmsThis isn’t just about publishers losing traffic—it’s about the future of human knowledge and creativity. When Google CEO Sundar Pichai envisions the web as merely “databases” with “UI on top,” he’s describing a world where human expression becomes raw material for machine consumption.

The question isn’t whether Google can do this—they’re already doing it. The question is whether we’ll accept a future where the largest repository of human knowledge becomes a walled garden, accessible only through Google’s interpretation.

Publishers, regulators, and users must recognize this moment for what it is: not the evolution of search, but a fundamental restructuring of information power. The battle isn’t just for traffic or revenue—it’s for the soul of the internet itself.

The revolution has begun. Which side of history will you choose?

The post Google’s AI Search Revolution: The Existential Threat to Publishing appeared first on FourWeekMBA.

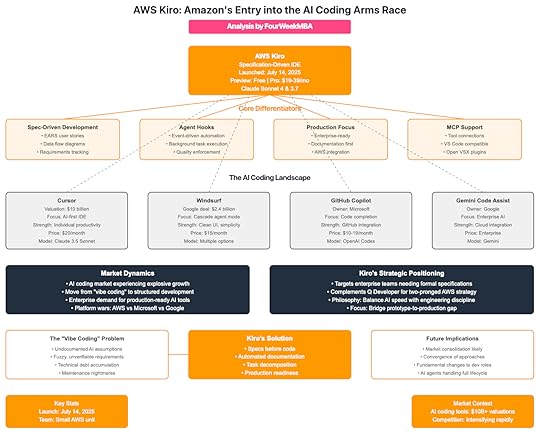

AWS Kiro: Amazon’s Strategic Entry into the AI Coding Arms Race

Amazon Web Services launched Kiro on July 14, 2025, marking the tech giant’s ambitious entry into the competitive AI-powered integrated development environment (IDE) market. Unlike traditional AI coding assistants, Kiro introduces a specification-driven development approach that aims to bridge the gap between rapid AI prototyping and production-ready software, directly challenging established players like Cursor, Windsurf, and GitHub Copilot.

What is AWS Kiro?Core FeaturesSpecification-Driven Development: Kiro transforms developer prompts into structured specifications, design documents, and task lists before generating codeAgent Hooks: Event-driven automations that execute tasks when files are saved, created, or deletedBuilt on Code OSS: Maintains compatibility with VS Code settings and Open VSX pluginsModel Support: Uses Claude Sonnet 4 as default, with Sonnet 3.7 as an option; more models coming soonMCP Integration: Supports Model Context Protocol for connecting specialized toolsPricing Structure (Post-Preview)Free Tier: 50 agentic interactions per monthPro: $19/month for 1,000 interactionsPro+: $39/month for 3,000 interactionsThe “Vibe Coding” Problem Kiro Aims to Solve

What is AWS Kiro?Core FeaturesSpecification-Driven Development: Kiro transforms developer prompts into structured specifications, design documents, and task lists before generating codeAgent Hooks: Event-driven automations that execute tasks when files are saved, created, or deletedBuilt on Code OSS: Maintains compatibility with VS Code settings and Open VSX pluginsModel Support: Uses Claude Sonnet 4 as default, with Sonnet 3.7 as an option; more models coming soonMCP Integration: Supports Model Context Protocol for connecting specialized toolsPricing Structure (Post-Preview)Free Tier: 50 agentic interactions per monthPro: $19/month for 1,000 interactionsPro+: $39/month for 3,000 interactionsThe “Vibe Coding” Problem Kiro Aims to Solve“Sometimes it’s better to take a step back, think through decisions, and you’ll end up with a better application that you can easily maintain,” explains the Kiro team. The tool addresses what Amazon calls “vibe coding chaos” – the practice of rapidly generating code through AI prompts without proper documentation, testing, or architectural planning.

Key issues with current AI coding approaches:

Undocumented assumptions made by AI modelsFuzzy requirements that are difficult to verifyLack of clear system design documentationTechnical debt accumulationDifficulty in maintaining AI-generated codebasesHow Kiro Differentiates Itself1. Specification-First ApproachUnlike competitors that focus on immediate code generation, Kiro:

Generates user stories using EARS (Easy Approach to Requirements Syntax)Creates data flow diagrams, TypeScript interfaces, and database schemasProduces comprehensive task lists with dependenciesLinks each task to requirements to ensure nothing is missed2. Autonomous Agent CapabilitiesKiro’s agents can:

Automatically update test files when components changeRefresh documentation when API endpoints are modifiedScan for security vulnerabilities before commitsGenerate infrastructure code with IaC toolsRun comprehensive QA checks3. Enterprise-Ready Focus“Kiro brings planning, design, QA, and infra together in a single, AI-supported loop,” making it particularly suitable for:

Long-lived production applicationsTeams requiring formal specificationsAWS-centric development environmentsProjects needing comprehensive documentationMarket Context and CompetitionThe AI Coding LandscapeThe launch comes amid intense competition:

Cursor: Valued at $10 billion, known for its AI-first IDE approachWindsurf: Recently avoided OpenAI acquisition; Google licensed its technology for $2.4 billionGitHub Copilot: Microsoft’s established player with agent modeGoogle Gemini Code Assist: Google’s answer to the AI coding revolutionStrategic ImplicationsAmazon’s Positioning: By launching Kiro separately from Amazon Q Developer, AWS signals a two-pronged strategy:Q Developer for traditional code completion and chat assistanceKiro for autonomous, specification-driven developmentMarket Timing: The launch follows several key events:Google’s $2.4 billion Windsurf licensing dealCursor’s rumored $10 billion valuationGrowing enterprise demand for AI coding toolsUnique Value Proposition: While competitors focus on speed and code generation, Kiro emphasizes structure, documentation, and production readinessTechnical AnalysisStrengthsComprehensive Workflow: From ideation to deployment in a single environmentQuality Enforcement: Built-in hooks ensure consistent code qualityAWS Integration: Seamless deployment to AWS infrastructureOpen Standards: MCP support enables extensive tool integrationLimitationsLearning Curve: Requires adapting to specification-driven workflowLanguage Support: Currently optimized for TypeScript/JavaScript, Python, and Java.NET Challenges: Limited support due to Open VSX registry restrictionsIDE Lock-in: No CLI version available (though potentially coming)Industry Expert PerspectivesConstellation Research analyst Holger Mueller: “The challenge is to find the right balance between in the background vs. in the face – to establish the coveted ‘vibe’ setup. We will see in a few weeks if Kiro got that right.”

AWS’s Srini Iragavarapu: “We are providing options to developers. The way Kiro differentiates itself is through spec-driven development, advanced agent hooks, and agent steering, all from ideation to deployment.”

The New Stack’s analysis: “AWS is among the first to make [specification-driven development] a core part of the overall experience — and one that more closely aligns with how code is written in an enterprise environment.”

Implications for the AI Coding Race1. Enterprise vs. Individual Developer FocusWhile Cursor and Windsurf optimize for individual developer productivity, Kiro targets enterprise teams needing:

Formal specificationsComprehensive testingOngoing documentationProduction-ready systems2. The Death of “Move Fast and Break Things”Kiro represents a philosophical shift from rapid prototyping to structured development, suggesting that as AI coding matures, the industry is recognizing the need for more disciplined approaches.

3. Platform Wars IntensifyWith all major cloud providers now offering AI coding tools:

AWS: Kiro + Q DeveloperMicrosoft: GitHub Copilot + Azure AIGoogle: Gemini Code Assist + Cloud AIThe battle extends beyond features to ecosystem lock-in and cloud service integration.

4. Consolidation LikelyThe market’s rapid growth and high valuations suggest consolidation is coming:

OpenAI’s interest in acquiring Windsurf/CursorGoogle’s $2.4 billion Windsurf licensing dealPotential for further M&A activityKey InsightAWS Kiro represents more than just another AI coding tool – it’s a bet that the future of software development requires balancing AI’s creative capabilities with traditional engineering discipline. By focusing on specifications, documentation, and production readiness, Amazon is targeting enterprises that need more than just fast code generation.

As Andy Jassy noted, Kiro “has a chance to transform how developers build software.” Whether developers embrace this more structured approach or prefer the flexibility of competitors like Cursor and Windsurf will determine not just Kiro’s success, but potentially the direction of AI-assisted software development itself.

The launch signals that the AI coding arms race is far from over, with each major player pursuing different philosophies about how humans and AI should collaborate to build software. For developers and enterprises, this competition promises rapid innovation – but also difficult choices about which approach best fits their needs.

The post AWS Kiro: Amazon’s Strategic Entry into the AI Coding Arms Race appeared first on FourWeekMBA.

The Meta Superintelligence Labs Explained

Meta has launched Meta Superintelligence Labs (MSL), a new AI division aimed at developing artificial general intelligence and superintelligence. Led by former Scale AI CEO Alexandr Wang and former GitHub CEO Nat Friedman, the lab has recruited at least 20 top AI researchers from competitors including OpenAI, Google DeepMind, and Anthropic, offering unprecedented compensation packages reportedly ranging from $100 million to $450 million over four years.

Leadership StructureTop LeadershipAlexandr Wang – Chief AI Officer, overall lead of MSL28-year-old former CEO and co-founder of Scale AIMeta invested $14.3 billion for 49% stake in Scale AI as part of his recruitmentDescribed by Zuckerberg as “the most impressive founder of his generation”Nat Friedman – Co-lead, heading AI products and applied researchFormer GitHub CEO (Microsoft)Previously ran one of the leading AI investment firmsServed on Meta Advisory Group for a year before joiningDaniel Gross – AI ProductsFormer CEO of Safe Superintelligence (co-founded with Ilya Sutskever)Business partner of Nat FriedmanJoined after Meta’s failed attempt to acquire Safe SuperintelligenceComplete List of Confirmed HiresFrom OpenAI (11 researchers)Trapit Bansal – Pioneered RL on chain of thought and co-creator of o-series modelsShuchao Bi – Co-creator of GPT-4o voice mode and o4-mini; led multimodal post-trainingHuiwen Chang – Co-creator of GPT-4o’s image generation; invented MaskGIT and Muse architecturesJi Lin – Helped build o3/o4-mini, GPT-4o, GPT-4.1, GPT-4.5, 4o-imagegen, and Operator reasoning stackHongyu Ren – Co-creator of GPT-4o, 4o-mini, o1-mini, o3-mini, o3 and o4-mini; led post-training groupJiahui Yu – Co-creator of o3, o4-mini, GPT-4.1 and GPT-4o; led perception team at OpenAIShengjia Zhao – Co-creator of ChatGPT, GPT-4, all mini models; led synthetic data at OpenAILucas Beyer – From OpenAI Zurich office (previously Google DeepMind)Alexander Kolesnikov – From OpenAI Zurich office (previously Google DeepMind)Xiaohua Zhai – From OpenAI Zurich office (previously Google DeepMind)Additional unnamed researcherFrom Google/DeepMind (3 researchers)Jack Rae – Pre-training tech lead for Gemini and reasoning for Gemini 2.5; led Gopher and ChinchillaPei Sun – Post-training, coding, and reasoning for Gemini; created last two generations of Waymo’s perception modelsAdditional researcher (not yet publicly named)From Anthropic (2 researchers)Joel Pobar – Worked on inference at Anthropic; previously at Meta for 11 yearsShengjia Zhao – Also counted in OpenAI alumni (moved from OpenAI to Anthropic to Meta)From Other CompaniesJohan Schalkwyk – Former Google Fellow, early contributor to Sesame, technical lead for MayaOrganizational StructureMeta Superintelligence Labs (MSL) encompasses:Foundation Models TeamsLlama model development teamsTeams working on Llama 4.1 and 4.2Infrastructure supporting over 1 billion monthly active usersFAIR (Fundamental AI Research)Meta’s long-standing AI research divisionNow consolidated under MSL umbrellaAI Products TeamsMeta AI assistant developmentIntegration with WhatsApp, Facebook, InstagramAR/VR AI integration (Ray-Ban glasses, etc.)New Frontier LabFocused on developing next-generation modelsSmall, talent-dense team working on achieving AGI/superintelligenceParallel research track to existing Llama developmentTechnical Focus Areas

Leadership StructureTop LeadershipAlexandr Wang – Chief AI Officer, overall lead of MSL28-year-old former CEO and co-founder of Scale AIMeta invested $14.3 billion for 49% stake in Scale AI as part of his recruitmentDescribed by Zuckerberg as “the most impressive founder of his generation”Nat Friedman – Co-lead, heading AI products and applied researchFormer GitHub CEO (Microsoft)Previously ran one of the leading AI investment firmsServed on Meta Advisory Group for a year before joiningDaniel Gross – AI ProductsFormer CEO of Safe Superintelligence (co-founded with Ilya Sutskever)Business partner of Nat FriedmanJoined after Meta’s failed attempt to acquire Safe SuperintelligenceComplete List of Confirmed HiresFrom OpenAI (11 researchers)Trapit Bansal – Pioneered RL on chain of thought and co-creator of o-series modelsShuchao Bi – Co-creator of GPT-4o voice mode and o4-mini; led multimodal post-trainingHuiwen Chang – Co-creator of GPT-4o’s image generation; invented MaskGIT and Muse architecturesJi Lin – Helped build o3/o4-mini, GPT-4o, GPT-4.1, GPT-4.5, 4o-imagegen, and Operator reasoning stackHongyu Ren – Co-creator of GPT-4o, 4o-mini, o1-mini, o3-mini, o3 and o4-mini; led post-training groupJiahui Yu – Co-creator of o3, o4-mini, GPT-4.1 and GPT-4o; led perception team at OpenAIShengjia Zhao – Co-creator of ChatGPT, GPT-4, all mini models; led synthetic data at OpenAILucas Beyer – From OpenAI Zurich office (previously Google DeepMind)Alexander Kolesnikov – From OpenAI Zurich office (previously Google DeepMind)Xiaohua Zhai – From OpenAI Zurich office (previously Google DeepMind)Additional unnamed researcherFrom Google/DeepMind (3 researchers)Jack Rae – Pre-training tech lead for Gemini and reasoning for Gemini 2.5; led Gopher and ChinchillaPei Sun – Post-training, coding, and reasoning for Gemini; created last two generations of Waymo’s perception modelsAdditional researcher (not yet publicly named)From Anthropic (2 researchers)Joel Pobar – Worked on inference at Anthropic; previously at Meta for 11 yearsShengjia Zhao – Also counted in OpenAI alumni (moved from OpenAI to Anthropic to Meta)From Other CompaniesJohan Schalkwyk – Former Google Fellow, early contributor to Sesame, technical lead for MayaOrganizational StructureMeta Superintelligence Labs (MSL) encompasses:Foundation Models TeamsLlama model development teamsTeams working on Llama 4.1 and 4.2Infrastructure supporting over 1 billion monthly active usersFAIR (Fundamental AI Research)Meta’s long-standing AI research divisionNow consolidated under MSL umbrellaAI Products TeamsMeta AI assistant developmentIntegration with WhatsApp, Facebook, InstagramAR/VR AI integration (Ray-Ban glasses, etc.)New Frontier LabFocused on developing next-generation modelsSmall, talent-dense team working on achieving AGI/superintelligenceParallel research track to existing Llama developmentTechnical Focus AreasBased on the expertise of hired researchers, MSL is focusing on:

Reasoning and Chain-of-Thought ModelsMultiple hires specialized in o-series models from OpenAIFocus on competing with OpenAI’s o1, Google’s Gemini reasoning capabilitiesMultimodal AIVoice, image, and video understandingSeveral hires with GPT-4o multimodal experienceSynthetic Data GenerationCritical for training next-generation modelsLed by former OpenAI synthetic data leadPerception and Computer VisionIntegration with Meta’s AR/VR initiativesWaymo perception model expertise brought inInference OptimizationMaking models faster and more efficientCritical for widespread deploymentCompensation and Recruitment StrategySigning Bonuses: Reportedly up to $100 millionTotal Packages: Some researchers offered up to $450 million over 4 yearsTypical Offer: Around $200 million over 4 years for top talentRecruitment Method: Zuckerberg personally involved, meeting candidates at his homes in Lake Tahoe and Palo Alto“The List”: Zuckerberg compiled a list of most-cited AI researchers to targetPhysical OrganizationLocation: Meta’s Menlo Park headquartersSeating: Reorganized so new superintelligence team members sit near ZuckerbergSize: Approximately 50-person core team, with plans to expandStrategic GoalsPersonal Superintelligence for Everyone: Deliver AI assistants that exceed human capabilities across Meta’s platformsCompute Advantage: Leverage Meta’s massive infrastructure investment (up to $65 billion in 2025)Product Integration: Deep integration across Meta’s 3+ billion user ecosystemOpen Philosophy: Continue open-source approach with Llama while pursuing AGITimeline and MilestonesJune 2025: Initial recruitment begins, Zuckerberg starts personal outreachJune 30, 2025: Official announcement of Meta Superintelligence LabsJuly 1, 2025: Alexandr Wang officially joins as Chief AI OfficerComing weeks: Additional hires to be announcedNext 12-18 months: Target to reach AI frontier with next-generation modelsCompetitive ContextMeta’s MSL represents a significant escalation in the AI arms race, directly challenging:

OpenAI’s lead in reasoning modelsGoogle DeepMind’s research capabilitiesAnthropic’s safety-focused approachGrowing competition from Chinese labs like DeepSeekThe formation of MSL signals Meta’s transformation from a social media company with AI features to a dedicated AI research powerhouse competing for superintelligence leadership.

Notable ObservationsChinese Talent: 7 of 11 publicly named technical hires are graduates of prestigious Chinese universities (Tsinghua, Peking University, etc.)OpenAI Dominance: The majority of hires (11) came from OpenAI, suggesting targeted poachingFailed Acquisitions: Meta attempted to acquire Safe Superintelligence but was rebuffed by Ilya SutskeverCultural Concerns: OpenAI leadership has expressed that Meta’s approach could create “deep cultural problems”This comprehensive restructuring and aggressive hiring campaign represents one of the most significant organizational shifts in the AI industry, with implications for the development and deployment of artificial general intelligence in the coming years.

The post The Meta Superintelligence Labs Explained appeared first on FourWeekMBA.

Competitive Moating in Agentic AI

A few months back, I wrote about competitive moating in AI, and since every year in AI is worth ten years in the real world, not surprisingly, a lot of things have changed, and I thought to update this piece with a focus on Agentic AI, what makes an agentic AI company thick?

In the rapidly evolving landscape of agentic AI, the difference between market leaders and forgotten startups won’t be determined by who has access to the best foundation models.

The winners will be those who understand that sustainable competitive advantage requires building multiple layers of defense, each reinforcing the others in a carefully orchestrated system of moats.

This strategic framework reveals how the most successful agentic AI companies will construct their competitive fortresses, not through a single breakthrough or feature, but through the patient accumulation of interlocking advantages that become exponentially harder to replicate over time.

The Architecture of Competitive Advantage for The Agentic AI Player

The competitive moat in agentic AI isn’t a single barrier—it’s a sophisticated system of concentric defenses, each layer building upon the previous one.

Like a medieval castle with multiple walls, successful AI companies must construct their defenses from the inside out, starting with technical foundations and expanding to strategic positions that dominate entire ecosystems.

The framework identifies eight critical pillars organized across three defensive layers, each with distinct characteristics, timelines, and strategic importance.

Understanding this architecture is essential for any company seeking to build lasting competitive advantages in the age of commoditized AI.

Layer 1: Technical Excellence (The Foundation)

The post Competitive Moating in Agentic AI appeared first on FourWeekMBA.