Gennaro Cuofano's Blog, page 249

October 23, 2018

Why Google Success Was The Fruit Of Its Business Distribution Strategy

When we think of Google, that’s easy to think of it as the most significant tech success of the last decades. Yet, Google isn’t only that. Google is the most significant tech, distribution and commercial success of the previous decades. Indeed, the company managed to conquer the web and build an over a hundred billion a year turnover based on digital advertising alone based on a brilliant distribution strategy, built one deal at the time!

Considering it was a late mover, I believe that part of the secret for its success was the deals it managed to close, which allowed it to gain traction and traffic for years to come. As I pointed out in another article, the traffic acquisition cost strategy that Google put up over the years, allowed the company to create a sustainable business model that keeps making money today.

Thus, it is worth exploring some of the deals that made Google the success it is today!

Netscape deal: the first massive deal

MOUNTAIN VIEW, Calif. – October 4, 2000 – Google Inc., developer of the award-winning Google search engine, and Netscape Communications, a subsidiary of America Online, Inc., (NYSE: AOL), today announced that they have renewed their partnership under which Google will continue to provide the fall-through search technology to complement Netscape’s award-winning Open Directory Project (www.netscape.com). Netscape will also continue to feature Google as a Premier Search Provider as part of its popular Net Search Program, which helps Netscape users choose from a variety of different search tools available on the Web.

This is how Google announced the news back then.

What was the deal about?

First, it is worth to remember that Netscape at the time was the most successful and trafficked browser on the web. That might have been the period in which Netscape was the web. Indeed, most of the browser market was in its hands. It is important to notice that Google at the time had proved a reliable service for Netscape users, which made it easier to close that deal. Therefore, the product or service is always a key ingredient in a business deal success.

As pointed out at the time “Netscape was the first to realize the potential of Google’s cutting-edge search technology, and we are pleased to continue our relationship, which underscores our commitment to providing the best possible search tools to navigate the Web.“

Google deal with Mozilla to keep getting search market shares

Google understood that if it wanted to have a sustainable business model, it needed a continuous stream of traffic so that it could monetize that traffic on its main asset, its search results pages. Yet back in the 2000s Google was still far from having its web browser, Chrome, which would be launched in 2008. In the meanwhile, if it wanted to dominate the market, it had to secure deals across the board of the browser market.

Mozilla was one critical piece of the puzzle and Google made it a good deal for them. Back then of the $61 million in royalties most came from Google’s deal:

[image error]

Source: Mozilla Independent Auditor’s Report

As pointed out on TechCrunch back then:

Mozilla,the organization behind the popularFirefoxweb browser, has extended its search deal withGooglefor another three years. In return for setting Google as the default search engine on Firefox, Google pays Mozilla a substantial sum – in 2006 the total amounted to around $57 million, or 85% of the company’s total revenue. The deal was originally going to expire in 2006, but was later extended to 2008 and will now run through 2011.

Guarantee the proper distribution to your product or service is a commercial war. Thus, you need to have a compelling offer. Google managed to secure the deal for years, thanks to its offer, which made up most of Mozilla revenues for years!

When Microsoft tried to steal AOL deal, Google went all in!

As we’ve seen one of the key deals that allowed Google a proper distribution success was Netscape. Yet, Netscape was acquired by AOL in 1998 for a staggering $4.2 billion. Back when AOL was the most popular portal on the web. Being there for Google was critical. Microsoft understood that, and it offered AOL a compelling deal:

Google has been the search engine on AOL for several years, but rival Microsoft Corp. made a bid to take its place, offering AOL hundreds of millions in cash annually if it dumped Google for MSN Search. But Thursday night in New York, Google presented Richard D. Parsons, chief executive of AOL parent Time Warner Inc., with a more lucrative proposal that gave AOL numerous ways to grow along with rapidly expanding online ad spending.

As reported on the Washington Post of the time battle between Microsoft and Google was quite fierce. Google relaunched the Microsoft offer with a deal that would be hard to refuse.

As pointed out by the Washington Post “Under the agreement, Google will remain the search engine on the AOL service for five years, and Google will give AOL millions of dollars of free advertising on the search engine to promote its network of Web sites.“

Also, “AOL also will get the exclusive right to sell online banner ads for Google. AOL will keep about 20 percent of the proceeds from those ad sales, while Google will get about 80 percent.“

To give you a bit of context of how critical this deal was, AOL at the time had 20 million subscribers and 110 million unique visitors per month. As part of the deal, Google also bought 5% of the company for a billion dollar.

As pointed out on Google financials for 2006:

We rely on our Google Network members for a significant portion of our revenues, and we benefit from our association with them. The loss of these members could adversely affect our business.

To understand the importance of AOL for Google distribution success, “advertising and other revenues generated from America Online, Inc. (“AOL”) accounted for 12%, 9% and 7% of revenues, primarily through our AdSense program, in 2004, 2005 and 2006.“

A single deal, AOL, accounted for more than 10% of Google revenues in 2004. And this traffic wasn’t inexpensive neither. Indeed, throughout 2003-06 there was an increase in traffic acquisition costs ($135.5 million) primarily driven by advertiser fees generated through the Google AdSense program.

[image error]

Google needed to become independent and start building up its distribution channel via its browser. While its toolbar was already available beginning in 2000, Google Chrome was yet to come. In the meanwhile, Google wanted to get more distribution capability to dominate the market!

Google deal with the once mighty Ask.com

In 2007 Google secured another essential deal with a search engine that at the time was quite popular, Ask.com. As pointed out on SEJ:

Yesterday Google and IAC (the parent company of Ask.com) extended their sponsored search and advertising agreement in a move which is worth an estimated $3.5 Billion to IAC over the next 5 years.

Microsoft stole AOL deal to Google when it was too late

Over the years Microsoft had tried to take several deals from Google, unsuccessfully. Finally, in 2016 Microsoft managed to secure a deal with AOL, for its search engine, Bing. At that point, the deal couldn’t do any harm to Google dominance over the search market!

Yet the fight for the conquest of distribution on the web isn’t over.

The battle over mobile traffic acquisition starts with the Safari deal

As users’ behaviors and habits of content consumption change, also the distribution strategy has to adapt. An effective distribution strategy built a decade before won’t work today. As reported by Fortune, “Google will reportedly pay Apple $9 billion in 2018 and $12 billion in 2019 to remain as Safari’s default search engine.”

Why does Google spend so much money to be Safari default search engine, when Google Chrome is the dominant player now?

[image error]

Source: gs.statcounter

The reason is Chrome is the dominant player on the desktop, not so on mobile. Today, though mobile is the most significant distribution opportunity and it has the highest potential!

Handpicked related articles:

What Is a Business Model? 26 Successful Types of Business Models You Need to Know

What Is Business Development? The Complete Guide To Business Development

Who Owns Google? Under The Hood Of The Tech Giant That Conquered The Web

The Power of Google Business Model in a Nutshell

How Does Google Make Money? It’s Not Just Advertising!

Ok Google, Are You In Search Of A Business Model For Voice?

The Future of Google: The Curse of Engineers Become Advertisers

When The AI Meets Users’ Intent, Google Takes A Cut On Every Sale On Earth

Baidu Vs. Google: The Twins Of Search Compared

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

What Is The Most Profitable Business Model?

The post Why Google Success Was The Fruit Of Its Business Distribution Strategy appeared first on Four-Week MBA.

October 22, 2018

Why Traffic Acquisition Cost Is The Key Metric To Understand Google Success

The traffic acquisition cost represents the expenses incurred by an internet company, like Google, to gain qualified traffic on its pages for monetization. Over the years Google has been able to reduce its traffic acquisition costs and in any case to keep it stable. In 2017 Google spent 22.7% of its total advertising revenues (over $21 billion) to guarantee its traffic on several desktop and mobile devices across the web.

Why traffic has been a critical driver for Google’s success all along

As of the time of this writing Google is the most popular website on earth. It is important to remember that. Indeed, as a search engine, we often forget that Google is also a website, a place on the web where people go voluntarily to find information of any time. As a website, Google needs to make sure to have a constant stream of traffic on its search results pages.

To attract traffic Google has developed several strategies throughout the years. While its ability to index the entire web and show by time to time results based on users searches. Ordered by relevance and authoritativeness (its ranking system) has proved a critical weapon to its success. However, were users not going back to Google over and over again, its search engine would not have improved. Thus, it would not have been able to succeed at the level it did today.

Indeed, users’ data is critical for Google experimentation and change, thus improvements. Between 2017-18 of over 200,000 experiments Google made over 2,400 changes to its search algorithm.

Google business model starts by finding the sweet spot between traffic and monetization

Since its first distribution deals, Google understood right away that monetizing its pages was the key to its success. Many search engines and websites back then drove traffic which was not qualified enough to be monetized or at least to be monetized at the point of creating a successful and sustainable business.

Yet Google once found the right traction channel (be it AOL, Netscape or any other deal that would come afterward) it managed to find the sweet spot which allowed it to monetize its pages enough to be extremely profitable.

Therefore, a key metric to look at to understand Google success is its traffic acquisition cost.

What does the traffic acquisition cost stand for?

The traffic acquisition costs represent the expenses of an internet company, like Google, has to incur to generate enough revenues to sustain the business. When the revenues run faster compared to the traffic acquisition cost that is when the internet business becomes sustainable.

Keeping the traffic acquisition costs at a stable level over the years is the key to make sure the company remains sustainable and financially successful. This implies a set of initiatives to create a network of partners, distributors, and any other way that allows the company to attract qualified traffic that converts into revenues for the business.

What does the Google traffic acquisition cost comprise?

Cost of revenues consists of TAC which are paid to Google Network Members primarily for ads displayed on their properties and amounts paid to our distribution partners who make available our search access points and services. Our distribution partners include browser providers, mobile carriers, original equipment manufacturers, and software developers.

As specified in its annual report for 2017, Google traffic acquisition costs (TAC) comprise the payout to Google partners, which take part to program like AdSense. It also comprises browser providers, mobile carriers and any other distribution channel.

Many give for granted Google success. Yet from its first days Google managed to close massive deals that guaranteed it enough distribution and traction to grow substantially over the years. Netscape, AOL, Safari and many other channels guarantee to Google an enormous amount of traffic each year. That traffic also has a cost.

Why Google traffic acquisition cost is more expensive for AdSense?

The cost of revenues related to revenues generated from ads placed on Google Network Members’ properties are significantly higher than the costs of revenues related to revenues generated from ads placed on Google properties because most of the advertiser revenues from ads served on Google Network Members’ properties are paid as TAC to our Google Network Members.

The traffic that comes from Google main properties (like its main search pages) is less expansive than the traffic coming from the sites part of AdSense. The reason is pretty simple; Google has to give most of the revenues coming from AdSense to the websites part of the network. The AdSense network has been critical to Google success to allow it to serve organic results, besides it paid results. Even though the traffic cost is higher, so far AdSense has played an essential role in the overall Google business model.

Breakdown of the Google traffic acquisition costs

[image error]

Of the total cost of revenues, traffic acquisition costs represented a good chunk of it. For instance, in 2017 Google spent 22.7% of its total advertising revenues in traffic acquisition costs.

As specified in its annual report for 2017:

Cost of revenues increased $10,445 million from 2016 to 2017. The increase was due to an increase in TAC of $4,879 million. The increase in TAC to distribution partners was a result of an increase in Google properties revenues and the associated TAC rate. The increase in TAC to Google Network Members was a result of an increase in Google Network Members’ properties revenues and the associated TAC rate.

What factors affect Google traffic acquisition costs?

Traffic acquisition costs is a critical factor of Google past and future success. It is also a significant business risk. In fact, as users’ ways to consume content change over the years, this makes it harder for Google to keep up with its traffic acquisition costs.

For instance, as we’ve been moving from desktop to mobile, the traffic cost for Google has proved higher, however also easier to monetize. Thus, even if it grew, Google managed to have its revenues to grow faster than its costs.

As listed in the Google annual report some of the causes of increased traffic acquisition costs are:

Google Network Members TAC rates are affected by the continued underlying shift in advertising buying from traditional network business to programmatic advertising buying

Google properties TAC rates are influenced by device mix between mobile, desktop, and tablet, partner mix, partner agreement terms such as revenue share arrangements, and the percentage of queries channeled through paid access points

Growth rates of expenses associated with the data center and other operations, content acquisition costs, as well as Google hardware inventory and related costs

Increased proportion of non-advertising revenues, whose costs are generally higher about its advertising revenues

Relative revenue growth rates of Google properties and Google Network Members’ properties

Traffic acquisition costs over the years

Summary and conclusions

It’s easy to give for granted Google success in terms of traffic; Yet Google is a website, which needs a continuous flow of qualified traffic that makes it able for the company to generate enough revenues to create a sustainable and profitable business. Since its first deals, Google has been able to drive massive amounts of traffic to its search pages.

At the same time, AdWords and AdSense allowed the company to generate enough revenue to make it one of the most profitable internet companies ever existed.

The traffic acquisition cost is a crucial metric that explains Google past success but also Google future success. In 2017 Google spent over $21 billion in traffic acquisition costs, which represented 22.7% of its total advertising revenues. Over the years Google has been able to keep reducing its traffic acquisition cost, which made it quite profitable!

Handpicked related articles:

What Is a Business Model? 26 Successful Types of Business Models You Need to Know

Who Owns Google? Under The Hood Of The Tech Giant That Conquered The Web

The Power of Google Business Model in a Nutshell

How Does Google Make Money? It’s Not Just Advertising!

Ok Google, Are You In Search Of A Business Model For Voice?

The Future of Google: The Curse of Engineers Become Advertisers

When The AI Meets Users’ Intent, Google Takes A Cut On Every Sale On Earth

Baidu Vs. Google: The Twins Of Search Compared

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

What Is The Most Profitable Business Model?

References for this article:

2000-04 financials

2005-07 financials

2008-10 financials

2011-13 financials

2014-17 financials

The post Why Traffic Acquisition Cost Is The Key Metric To Understand Google Success appeared first on Four-Week MBA.

October 21, 2018

The History Of Google Business Model From Its First Billion

We’re in an era of great inspiration and possibility, but with this opportunity comes the need for tremendous thoughtfulness and responsibility as technology is deeply and irrevocably interwoven into our societies.

This is what Sergey Brin said in the 2017 Alphabet founders' letter.

When search seemed to be a solved problem PageRank showed they had just scratched the surface

When Page and Brin managed to create a search engine that was 10x better than competing engines, it made clear that search was all but a solved issue. At the end of 1990s Page came out with its algorithm, PageRank, which managed to rank the entire web based on relevance and authoritativeness of the web pages it indexed.

It took off right away! It was at that point that many of Google's competitors understood that search was just at the embryonic stage. It was by then that Google had already taken over the search market, yet revenue was still far away.

When Page and Brin saw advertising as the worst business model for search

[image error]

Bacn in the days, Brin and Page didn't hide their resentment toward the advertising business model, which was the prevalent model for search. Indeed, in a paper "The Anatomy of a Large-Scale Hypertextual Web Search Engine" where Page and Brin presented their first prototype of Google. With a full text and hyperlink database of at least 24 million pages, in a paragraph dedicated to advertising, they explained: "We expect that advertising funded search engines will be inherently biased towards the advertisers and away from the needs of the consumers."

The main issue they had toward advertising was the fact that it was biased and it caused a lot of spam in search results. Indeed, when they met Bill Gross, founder of GoTo, which would later become Overture, the encounter might not have been among the most cordial. That's because Bill Gross had figured the market for advertising had massive potential, as he introduced an auction-based system for bidding businesses, based on performance and clicks.

However, this was still back when Page and Brin were two academics completing their Ph.D. at Stanford University. The transition to becoming businessmen would take soon to arrive. Indeed, as venture money was soon to be over a plan B was needed.

In addition, as Google managed to rank advertising based on relevance (for instance, by ranking higher those ads that got more clicks) advertising became a possible option. As Larry Page pointed out in the first Google letter to shareholders:

Advertising is our principal source of revenue, and the ads we provide are relevant and useful rather than intrusive and annoying.

Google revenues start to take off, yet the company would take a few years to become a "unicorn"

By 2000 Google was already a key player in the search industry. However, it wasn't yet in the safe zone at a financial level. Indeed, in 2000 Google made $20 million in revenues. Even though it had launched its AdWords network, which would allow it to speed up growth Google business model was still transitioning.

Some pieces of the puzzle were still missing. However, the first massive deal came into the door.

Google deal with AOL as the first traction phase

By 2002, Overture was still a valid competitor for Google, yet, it was losing ground. Overture had managed to grow thanks to a series of deals. One of the leading deals was with - at the time - one of the most successful portals, AOL. However, in May 2002 the agreement between AOL and Overture was to expire.

It was time for a battle, which would finally allow Google to have its chance for the second stage of massive growth, both regarding users acquisitions, then revenues. As reported in the book "Googled: The End of the World As We Know It" Page escorted his head of business development and sales, Mr. Kordestani, "I want us to bid to win." Whether or not this story is apocryphal, there is no doubt that the AOL deal played a crucial role in Google's future growth.

The missing piece for Google business model: the launch of AdSense (Google network websites)

Back in 2003, Google acquired Applied Semantics, which as reported at the time on Google blog:

Applied Semantics’ products are based on its patented CIRCA technology, which understands, organizes, and extracts knowledge from websites and information repositories in a way that mimics human thought and enables more effective information retrieval. A key application of the CIRCA technology is Applied Semantics’ AdSense product that enables web publishers to understand the key themes on web pages to deliver highly relevant and targeted advertisements.

Google was primarily targeting technology from Applied Semantics called AdSense. It was the missing piece of the puzzle. In fact, with AdSense, Google could finally offer targeted ads within websites of partners that joined the program. In short, Google would provide businesses with the chance to show their banners on the estate of those blogs which had become the heart of the web back in the 2000s. It would also allow those blogs to jump from being amateurs to make some money via advertising. It was all tracked and based on the context of the page.

The AdSense value proposition was quite compelling. As pointed out on a 2004 financial report Google would "generate revenue by delivering relevant, cost-effective online advertising. Businesses use AdWords program to promote their products and services with targeted advertising. Also, the thousands of third-party websites that comprise our Google Network use our Google AdSense program to deliver relevant ads that generate revenue and enhance the user experience."

AdSense would become a critical part of the business.

Google embraced the whole web with its business model

At that stage, Google was ready to take off. I pointed out time and time again that when all the pieces of a business model are in place, that's when the company is ready to take off for years to come. Back in 2003 when Google had finally fine-tuned its business model, it had three primary constituencies:

Users: Google provided users with products and services that enabled them to find any information, quickly

Advertisers: Google AdWords program, the auction-based advertising program allowed businesses to deliver ads both to customers on Google sites (for instance, the search page) and through the Google Network (any blog or site part of the AdSense program)

Websites: Google free products, Google AdWords and Google AdSense embraced the whole web. While users get information for free and quickly. Businesses could make money by sponsoring their products on Google and via Google network. Publishers could also quickly monetize their content

Google gains traction, and it goes from less than a billion to over ten billion in revenues in three years

Once the business model had all the pieces, needed growth became the norm. If at all, Page and Brin had to make sure not to have Google implode for hypergrowth. Thus, the hardest challenge might have been managing hypergrowth that would continue for over two decades.

Google has become Alphabet

In 2014 Google restructured the company as Alphabet, with Google as a subsidiary. Beyond Search, today Alphabet offers services like YouTube, Maps, Play, Gmail, Android, and Chrome to billion of people worldwide.

Where does Google stand today?

The Google business model is way more diversified today than it was back in 2000. In 2017 Advertising still represented 86% of its revenues. Google - now Alphabet - also devoted part of its revenues in investing in bets which might become its next cash cow. Today those bets only represent over 1% of the total Google turnover.

Google and the rise of AI

As reported in the 2017 founders' letter Google now uses AI for several aspects comprised of its products:

understand images in Google Photos;

enable Waymo cars to recognize and distinguish objects safely;

significantly improve sound and camera quality in hardware;

understand and produce speech for Google Home;

translate over 100 languages in Google Translate;

caption over a billion videos in 10 languages on YouTube;

improve the efficiency of data centers;

suggest short replies to emails;

help doctors diagnose diseases, such as diabetic retinopathy;

discover new planetary systems;

create better neural networks (AutoML);

... and much more.

The rise of voice search and the battle ahead

The next major battle for Google will be in voice search. As Google has become smarter, it has also managed to understand more and more users intent. Will Google manage to be the dominant player in this rising industry?

Read next: How Does Google Make Money? It’s Not Just Advertising!

Handpicked related articles:

What Is a Business Model? 26 Successful Types of Business Models You Need to Know

Who Owns Google? Under The Hood Of The Tech Giant That Conquered The Web

The Power of Google Business Model in a Nutshell

How Does Google Make Money? It’s Not Just Advertising!

Ok Google, Are You In Search Of A Business Model For Voice?

The Future of Google: The Curse of Engineers Become Advertisers

When The AI Meets Users’ Intent, Google Takes A Cut On Every Sale On Earth

Baidu Vs. Google: The Twins Of Search Compared

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

What Is The Most Profitable Business Model?

References for this article:

2000-04 financials

2005-07 financials

2008-10 financials

2011-13 financials

2014-17 financials

The post The History Of Google Business Model From Its First Billion appeared first on FourWeekMBA.

How Amazon Revenue Model Changed In Four Years

Amazon is the largest online store in the world. Started out as an online bookstore, now Amazon embraces any product you can ever imagine. Jeff Bezos, as one of the wealthiest and most influential people in business on earth, has managed to survive the dot-com bubble while building a company that would stay for years to come. On this blog, we covered the Amazon business model from several perspectives. From how its prime membership segment was growing and how Amazon has been shifting from a core commerce company to a company that offers a complete experience to its members.

While the revenues from products, in 2014 represented about 77% of its revenues it then became about 61% in 2017. Indeed, other segments like AWS, subscription services, and third-party seller services has become a massive business, given Amazon scale.

Indeed, I pointed out how Amazon has been in part "swallowing the fish" as it was moving more and more to a subscription-based business model. However, even there Amazon strategy is relentless toward growth. When more people become prime members, they also spend more on the platform. Amazon makes more money. The company also runs on tight profit margins on its product sales, as it leverages on the cash conversion cycle to generate a massive short-liquidity for the business, used to expand quickly and take over several industries.

Handpicked related content:

How Amazon Makes Money: Amazon Business Model in a Nutshell

What Is the Receivables Turnover Ratio? How Amazon Receivables Management Helps Its Explosive Growth

Amazon Case Study: Why from Product to Subscription You Need to “Swallow the Fish”

What Is Cash Conversion Cycle? Amazon Cash Machine Business Model Explained

Other handpicked related business models:

How Does PayPal Make Money? The PayPal Mafia Business Model Explained

How Does WhatsApp Make Money? WhatsApp Business Model Explained

How Does Google Make Money? It’s Not Just Advertising!

How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

Marketing vs. Sales: How to Use Sales Processes to Grow Your Business

The Google of China: Baidu Business Model In A Nutshell

Accenture Business Model In A Nutshell

Salesforce: The Multi-Billion Dollar Subscription-Based CRM

How Does Twitter Make Money? Twitter Business Model In A Nutshell

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

The post How Amazon Revenue Model Changed In Four Years appeared first on FourWeekMBA.

October 19, 2018

How To Improve Emotional Intelligence

Emotional intelligence can be defined as the ability to recognize emotions that arise from within to be able to handle them for better decision making. Also, the ability to identify others’ people emotions to be able to handle complex situations in the best possible way.

Origin story

One question that always puzzled me is: “How to determine whether a person is intelligent?”

I have to confess that I did not know the answer to that question, until recently.

But that inquiry brings us to a deeper one: “how can we measure intelligence?”

The most common metric (IQ) has been a cause of frustration and discomfort for many who found out not to be as smart as they thought. But how reliable is IQ in measuring overall intelligence?

Is it fair to say that a person with a low IQ would get condemned to a useless life?

It leads us to the source of all misunderstandings: Can intelligence and therefore success get relegated to a standardized test such as the IQ?

Two brilliant guys

Let me tell you the story of two very “smart” guys: Jeffrey and Kenneth.

Jeffrey was born in 1953, in Pittsburg, Pennsylvania. Second, of four kids, since childhood hour he showed to be smarter than other youngsters.

It became evident when Jeffrey got was finally admitted to the Southern Methodist University in Dallas where he received a full scholarship and eventually studied business.

After graduation and working for a while with a Houston bank, Jeffrey was sent to Harvard Business School graduating in the top 5% of his class (Bio).

Kenneth was born in 1942, in Tyrone, a small town in Missouri, as the only child. As the child, Kenneth showed to be very smart as well.

He worked his tail off by delivering newspapers and mowing lawns. Subsequently, he earned a degree in economics from the University of Missouri and not satisfied yet; he received a Ph.D. in economics from the University of Houston in 1970 (Bio).

What did they have in common?

They were both brilliant, successful and wanted to make a lot of money. Their paths crossed when Kenneth hired Jeffrey as the consultant (while working at Mckinsey and Co).

Kenneth’s company operated in the utility industry, and it was one of the biggest and most successful corporations in the US.

Kenneth was impressed by Jeffrey’s performance, and eventually, he hired him as CEO of the Capital & Trade Resources of the organization (the primary division of the company).

Jeffrey’s career was so successful that (by 1997) he was nominated CEO of the whole business. Only Kenneth retained a more influential role within the organization.

It would have been great if the story ended there, but let’s see what happened next!

The story unraveled

Kenneth and Jeffrey were two brilliant individuals, with MBAs and PhDs, and very high IQs, therefore, destined to succeed. Jeffrey and Kenneth were not the only smart guys in the company.

Ever since Jeffrey became CEO, top graduates were hired to run the business’ operations. The company became so successful that Kenneth and Jeffrey were everywhere: from business magazines to finance newspapers.

Their reputation in Wall Street snowballed. How did the company grow so fast?

Jeffrey had the brilliant idea to use the market to market accounting. It means that the firm was valuing its assets at market value instead of historical cost.

For example, when the company invested in new plants, they could already show its future estimated profits on the balance sheet.

And if the acquired plant did not produce any benefit in the future, the company created ad hoc off-balance sheet financial vehicles to hide the losses.

Therefore the company balance-sheet was always kept “clean” from losses. Those complex operations allowed the company to maintain a high rating, while not risking a dime. Were all those activities legal?

As it turned out, they were not. Indeed, when the operations became too complicated, the company could not hide them anymore, and the financial situation became unbearable.

When voices spread that the firm had billions lost in those operations, it became one of the greatest scandals in American history. The company was Enron, and the two protagonists of the story were: Jeff Skilling and Kenneth Lay.

They were “the smartest guys in the room.” In 2006 both Jeff and Kenneth were convicted of fraud and became the most obvious case of how smart people can do stupid things.

Does a Nobel Prize keep you away from troubles?

Let me tell you the story of LTCM (Long-term Capital Management), a hedge fund which eventually collapsed by taking too much risk. LTCM was founded by Robert C. Merton in 1993 and had on its board, Myron S. Scholes.

Who are they? Both Merton and Scholes were Nobel Prizes, awarded in 1997, just one year before LTCM collapsed.

You might think “why is this relevant to our story?” Well, the LTCM firm got founded on the idea that a formula (they won the Nobel Prize thanks to this method), could succeed in all financial circumstances.

That formula worked for a couple of years, until 1997. During that year the firm lost a staggering $4.4bln and had to be bailed out by other institutions (When Genius Failed – The Rise and Fall of Long-Term Capital Management)

Is it possible that two Nobel Prizes, among the smartest persons on the planet, were not able to foresee the risk involved in their operations? Maybe they did understand the risk rationally but not emotionally.

But if that is the case can we still define those people intelligent? Of course, they are among the people with the highest IQ in the world. What is the other aspect of intelligence that goes beyond IQ? Emotions. Indeed, emotions can hijack the intelligence of an individual.

Daniel Goleman calls it “EI” or “Emotional Intelligence.” Although the term “Emotional Intelligence” got used for the first time by psychologists John Mayer and Peter Salovey, Goleman was the one who formulated a systematic approach to EI.

Who is Daniel Goleman?

Daniel Goleman is an international psychologist who eventually became famous through the book “Emotional Intelligence.” He was born in Stockton, California, in 1946.

After getting a scholarship to Harvard, he studied clinical psychology. After that, Goleman continued his education in India and Sri-Lanka where he started to investigate the implications of meditation practices on stress reduction.

He then joined the New York Times in 1984, but soon he realized that the topic of emotional intelligence required his attention until the book on the subject came about and sold more than 5 million copies worldwide.

What is Emotional Intelligence (EI)?

How many times do you find yourself doing something you promised it wouldn’t happen again?

Saying something in public, you were not supposed to say, falling still into an old bad habit that you were trying to abandon. In all those cases the reason we fall back into the trap is that we lack Emotional Intelligence, or “the capacity to assert self-control, persistence and most of all to motivate oneself.”

Why is it so difficult to change our bad habits or behaviors? Try to stop and think for a few seconds how many times you burst into anger and treated people around you poorly.

Then, a just half-hour later you regret what you did. Why don’t we stop such behaviors when they are happening?

Well, because we lack Emotional Intelligence, or the ability to understand what we are feeling at a particular moment.

In other words, if you are having a dispute with your family and suddenly you are about to “lose your mind” how you can avoid that?

While you talk or listen, try to analyze your internal mental state, assess your body sensations and if you detect some feelings of discomfort get out of the dispute for the half-hour.

This time will give you the chance to make your mind and let the cortisol (a hormone released during stressful situations) to be absorbed by the organism; therefore making you more relaxed.

Of course, this is just one situation you may face in life, but the point is that EI requires a lot of mindfulness and the ability to see oneself from the outside.

It is almost like you are inside your head while you react to something and on the other hand, you are someone else, looking at yourself from the outside! Does it sound crazy?

I know it seems overwhelming and It is not easy since a lot of practice is required. Thereby the next natural question is: why would I waste my time doing so when I could be studying technical staff? Let me answer.

Correlation between IQ and career success

Of course, you can spend your whole life studying hard and acquiring technical skills that will make you more successful when it comes to your career advancement.

But will they? As shown in many types of research IQ scores have a weak correlation with professional success. Instead, cognitive ability (EI) resulted from a much more reliable predictor of job performance (IQ correlation with success). In few words, the IQ without the EI does not get you anywhere.

And the reason is pretty simple: do you remember the stories at the beginning of the article? Enron and LTCM are just extreme examples of lack of Emotional Intelligence.

If you compare two individuals, one with a higher IQ and lower EI and another with a more moderate IQ but high EI should not surprise you if the second person will become more successful in life.

Why? Intelligence in standard terms (IQ) gets completely wiped out by emotions. Unless EI gets developed.

Why do we feel emotions such as anger and fear?

Evolutionary speaking those emotions make perfect sense. Imagine a homo sapiens two hundred thousand years ago, in a jungle. The Sapiens is about to be attacked by an old tiger weighing around 150kgs.

Fear strikes, his body freezes (to allow hiding) so that the body will be in a state of max alert and he gets ready for the fight or flight response.

Think of all the times you heard a noise in the middle of the night; something fell, your heart rate increased, you froze. On the other hand, your brain started to scan all the possible scenarios: is it a bird? Is it a thief?

In other words, emotions are a defensive mechanism used by our organism to face dangerous situations.

Indeed, for example, when anger strikes your heart rate increases, the blood is pumped faster and toward areas of the body such as our hands. In turn, this gives you the chance to defend yourself by allowing the energies to flow where needed the most.

If this makes sense when it comes to situations of real danger, it can become counterproductive when it comes to social conditions.

Think of an argument with a co-worker where your anger mounts to the point that you almost physically attack him/her. What just happened to you? Why could you not control that reaction?

Another example: last time you spoke in public your hands sweated, and you could barely open your mouth or move your tongue to articulate a word. How to control that?

To answer, we have to dig deeper and ask: Why do emotions are triggered faster than thoughts? But to respond to this question, we must understand how our brain works.

Our brain is an evolutionary machine

In our head, we have an evolutionary device. What does it mean? Think of when you bought an I-phone for the first time. In the package, you found the phone ready to be used.

The software got installed, and all I-phones come with the same configuration. On the other hand, to make it work properly, you need to install apps.

The apps make your I-phone more functional. Therefore, what will differentiate one I-phone to the next are the apps installed on it.

For example, one I-phone will have ten apps, another twenty and of course, the one with more apps has higher functionality.

I know it may sound very simplistic, but the point is that when humans come to life, they have all the same “package”: our brain (software).

Then later in life, we start to learn many things such as how to talk, walk and so on (apps).

Once reached the mature stage we can learn several languages or play several musical instruments. Those “upgrades” are similar to an I-phone with more apps on it.

Keep in mind though that to preserve the functioning of your I-Phone you must update the software first otherwise, all the apps installed will be worthless.

The same applies to our brain. You can learn all the skills you want, but to be very useful you must learn how to control your emotions first (upgrade your software).

Then it will make more sense to go on and learn ten languages or to play ten musical instruments (apps).

The next thing to figure out is how our brain evolved. It turns out that our mind grew gradually; in other words, it developed one layer at the time.

The new brain has three primary layers or systems: reptilian, limbic and neocortex. The reptilian brain is the oldest. Therefore, it evolved before the other layers.

Indeed, that part of the brain controls vital functions such as breathing, body temperature, heart rate, and balance. The limbic system evolved subsequently, and it is the part related to emotions and memory.

The neocortex, the last to develop played a key role in thoughts, consciousness processes, language and so on.

Keep in mind this is only an (over)simplification of our brain, which is way more complicated than that.

What triggers emotions?

The limbic system is the part that plays a vital role when it comes to emotions. And evolutionary speaking emotions are essential for survival.

Also, emotions are crucial because they allow us to form memory. In the limbic system, there are two main parts: the amygdala and the hippocampus.

Those parts are linked, and the activation of the amygdala becomes crucial to allow the hippocampus to form memories to be stored in our brain.

Also, the amygdala is like a “human alarm.”Indeed, it signals all the situations that may be “relevant” to the hippocampus, which in turn stores those memories for future purposes. The issue is that the amygdala continuously scans the surroundings.

Therefore, if it gets over-activated, it may become dysfunctional. Think of a paranoid person that sees danger anywhere. Well, this person’s amygdala is over-stimulated.

Think of your car’s alarm that is too sensitive and gets armed all the time someone passes a few feet away from the vehicle.

How to control emotions? One way to manage your feelings is to tame the amygdala. In other words to make sure you do not get hijacked by it. How to do so?

It comes very handily our neo-cortex area: in particular the left pre-frontal cortex. That is the part related to consciousness, thought, and language.

Many types of research showed that increased activity in this area of the brain inhibits the amygdala; therefore it keeps it under control.

Taming the amygdala is not that easy at first, and the reason stands in the fact that the signals that arrive from the outside world, such as sounds, vision and so on may be acknowledged first by the amygdala, then by other areas of the brain.

Stop victimizing yourself: it is counterproductive!

One way to develop Emotional Intelligence is to learn how to use productive self-talk. How many times you did something wrong, and you ended up saying “I always make the same mistakes” “I am a failure” or “It is always my fault.” If you do use such kind of self-talk is time to STOP.

It is the kind of self-talk that allows the amygdala to dominate within your brain, reinforcing itself from time to time until the other parts of the brain become numb.

One key to change self-talk is to modify the perception of things. Anyone knows that if you take two persons looking at a glass of water half empty and half full, the optimist will see the entire half and the pessimist the empty half.

In reality, none of them is right or wrong; their perception is different. To change your opinion of things, you must be aware and conscious throughout your day.

Think of how many times you get caught in thoughts entirely unrelated to the situations you are facing.

For example, you see an object, such as a pen that for some reason reminds you of a person that few days before mistreated you. You get swept by that thought that leads to another view and so on until you become so angry and nervous, although you were having a , day. That train of ideas must be stopped if you want to keep a positive mood throughout the day. But to do that you must be aware, or be able to “think about your thoughts and keep them on track.”

Indeed, the emotional brain, unfortunately, is indiscriminate; it creates links between memories that are not rational or controlled. If you let your emotional mind run undisturbed, this will bring most of the time to unpleasant emotions and feelings.

How to stop it? Use your consciousness and understand what is happening in the background. In other words ask yourself: is it rational what I am thinking? Is this thought useful to the situation I am facing now? Those questions will help to activate the prefrontal cortex while inhibiting the amygdala.

Three advises from Daniel Goleman

Daniel Goleman through his writings suggest us to be very careful about many aspects of our personalities such as self-awareness, personal decision-making, managing feeling, handling stress, empathy and so on. Also, he would remind us of three elements that are crucial:

Know thyself

Start to become aware of your thought processes. In any moment of your day, from the smallest errand to the critical meeting try to keep track of your thoughts.

For example, if your boss is mad at you and you start sensing a feeling of fear that kicks in start to tell yourself “I am sensing fear,” such an exercise can be beneficial to detach you from the actual situation and train your left prefrontal cortex to act. Do not let the amygdala dictate your life!

Master thyself:

Once you become good at understanding your feelings start to work on your impulses. In other words, if there is any wrong habit that is making you a slave, try to become aware of it, and gradually develop “the capacity to resist that impulse to act” instinctively.

Temperament is not destiny

Keep in mind that you choose. Of course, your emotional troubles are coming from a long time ago, most probably when you were just a kid. On the other hand, that does not imply that your personality determines your destiny. Quite the opposite, choose the qualities you would like to have and start to implement them now! (see Warren Buffet on How to develop a character )

Start practicing Emotional Intelligence

If you are one of those people who think they cannot control their emotions, I hope you changed your mind. In Daniel Goleman’s book: “Emotional Intelligence” you will find useful information that will help you to reduce stress, to reduce impulses and to create more self-awareness.

It is your turn to dedicate some time of your day to nurture the intellectual side of your brain. The most important takeaway from this article is that “you can choose.” Don’t get me wrong, not all emotions are bad! It is amazing to experience positive emotions such as love, compassion, and joy.

On the other hand, if you let yourself get swept by negative emotions such as hatred, envy, and anger you are limiting your life.

In today’s world where social media are intended to make us look perfect and happy, people post beautiful pictures, funny moments, and exotic trips.

It seems almost like unhappiness does not exist. If you dig deeper, you see how things are. Repeat yourself this mantra “I am not alone. I am not different; I am like any other human being, I am facing the same problems other people are facing or that others are already faced”. Once you recite this mantra, your perspective will shift.

You will no longer see yourself as the “victim, ” and suddenly a new world will open to your eyes. Therefore, to be successful in life and business:

Stop personalizing, victimizing and blaming yourself or others. Take charge for your life now:

The biases you need to be aware of to be more conscious

Biases are built in perceptions about things that in many cases help us survive in many others might bring us toward making wrong decisions. Knowing what some of those biases are might be a great starting point.

Intuition Index

Do you know that your intuitive machine works better when in a good mood? Daniel Kahneman in some of his experiments showed that people who were put in a good mood doubled their inherent ability. The opposite is true as well. Many mistakes made by speculators happen either when in an exuberant mood or a terrible mood.

The Illusion of linear Patterns

Ever since Greek Philosophers (Plato and Aristotle more than anyone) thought us about purpose. Everything in nature must have a goal and therefore be connected by a cause-effect relationship.cause-effect Relationship. Our tendency to look for patterns is in part built-in and partly inherited from ancient philosophy. We love order, it makes us feel safe, and it gives us a sense of self-confidence. The problem is that we go too far with our tendency to look for order. We see patterns where they are non-existent. The investor falls in the same cognitive bias often. In many circumstances, he attributes the rise or fall of stocks to the next market news.

Anchoring Effect

When someone gives us a certain number (not necessarily related to the transaction) for some reason, we stick to that figure (or we don’t go too far from it). For example, if I were to ask you the age when a person died, and before the question, you were shown a small number (say 25) chances are you will say the person died at a young age. The investor falls into the same trap when dealing with stock price. For such reason, stocks, which tend to be overpriced by the market, are also the most desired. The opposite is true as well.

Outcome Bias

Success is a matter of results, isn’t it? We often tend to listen to “successful people,” almost like the outcome of their success is mainly due to their ability to make good decisions. If this can be true in some cases, it can also be incredibly wrong in many other cases. On the other hand, we are inclined to accuse those, which sound decisions didn’t turn out to be also the right ones because of the outcome. The speculator often associates a winning strategy based on its results. The problem lies in the fact that the strategy may have worked out of pure lack. Therefore, once the speculator gets convinced of how sounding the strategy is that is when disasters happen.

Theory-induced blindness

“This is just an idea! It isn’t real!” How do you feel about this statement? Although your System 2 may rationally agree, your System 1 seems not to grasp this concept. Indeed, we treat ideas like belongings. We own them, we breathe them, and we would perish or murder for them. Wouldn’t we?

How otherwise can we explain wars fought for religion, power and so on? Wasn’t Descartes who once said, “Cogito Ergo Sum” (I think therefore I am)? We feel alive when we theorize and make sense of the world around us. This isn’t negative in itself. What is negative is the fact that we get devoted to those theories. Many times the investors, which fall in love with their ideas, are the ones who wind up losing money.

A different example of that is investor George Soros. Soros can change opinion very quickly. In other words, if changing view can be seen poorly in politics or any other field, this does not apply to investments. The screwed investor has to be ready to change “idea” very quickly.

Loss Aversion

“Losses loom larger than gains. The “loss aversion ratio” has been estimated in several experiments and is usually in the range of 1.5 to 2.5,” says psychologist Daniel Kahneman. The speculator often falls into the trap of opening positions, to recoup the losses or to wait too long before liquidating a losing position, because of the deceiving thought of waiting for the stock to rise again.

Domain Dependence

Formulated by Nicholas Nassim Taleb in “Antifragile,” this is a fascinating concept. It consists on the inability of individuals to transfer the knowledge they have in one field to another area. For instance, investors, often make decisions about market moves based on mere superstition. Although, they are “experts” and as such should be able to transfer their financial knowledge to the financial markets, often they are not able to do so.

Learn emotional intelligence from the most successful modern investor

Warren Buffet is one of the few men in the Universe who does not need any introduction. Currently, among the wealthiest persons in the globe, Warren Buffet is one of the most sought businessmen alive.

Many love to define him as the “Oracle of Omaha” due to his mythological Midas touch (although he prefers to invest in stocks rather than gold). In one of many speeches, he affirmed to have won the “Ovarian Lottery” because he was born at the right time and place. Besides his modesty Buffet is a wise man before then a wise investor.

For such reasons we deemed compulsory to account here some of the advises that he publicly gave about life and investments. Also, Warren Buffet’s official biography, “The Snowball” by Alice Schroeder is a detailed account of all the principles that served as a guide throughout his life. However the chances to become as wealthy as Warren Buffet are extremely low (maybe you have better chances of winning the lottery);

On the other hand, Buffet’s advice is meant to be a starting point to build a successful career in business. Therefore take these six guidelines as a catalyst to your success:

The future is not the past

For how petty this point may seem, it is actually very important in Warren Buffet’s world. One of the hardest things to comprehend when dealing with stocks is that we cannot derive from the past future’s stock results.

For such reason Buffet never wasted his time trying to predict financial markets, or how they will react to the next Federal Reserve move. This concept may even be harder to get for those who received formal training in finance. Too often business schools teach how to derive the “future value” of a stock based on the projections of its recent past performance (3-5 years).

The consequence is that the model itself is stunning (excel-psychos make the tool become the end rather than the mean) although worthless.

Beware of the Noise

Newspapers, TV Shows, second by second charts are all engineered to produce a great deal of noise. That sensational clamor is what the wise investor knows how to avoid. The reason to avoid noise is not only psychological but also physiological.

Indeed, not only noise makes us more vulnerable to rumors, but it also makes us more apprehensive and stressed. Our brain is not wired for losses; Cognitive psychologists showed that we perceive losses extremely more than gains.

Consequently, it is wise to reduce the frequency to which we are updated about our portfolio’s performance.

Circle of Competence

This idea is simple but very powerful. Warren Buffet built his life around this concept. To become a successful one must learn how to avoid screw-ups. Many of those come from our tendency to fall into the “mimicry trap.”

In other words, we feel we have to start a venture or invest in the stock just because our neighbor did so. It is essential to draw a line and determine what the things we truly understand are.

For example, as reported in “The Snowball” by Alice Schroeder, Warren Buffet recognized himself as an expert on money, business, and his own life. That is one of the reasons Buffet did not get involved in the dot.com bubble.

He did not necessarily think there weren’t companies worth investing (Buffet is Bill Gates’ good friend); but he did not understand those businesses, and therefore he avoided them because they fell outside his circle of competence.

Don’t go into debt

Buffet learned this principle very early in his life. As reported in “The Snowball” by Alice Schroeder “spend less than you make” and “don’t go into debt” represented Buffet’s Family dictum.

While this principle is easy to understand rationally, it is tough to implement practically. When you contract debt and spend more than you earn, for instance, you will stop accumulating and compounding your wealth.

This was the practical reason for which Buffet implemented this principle throughout his life. If many so-called “gurus” do not practice what they preach, conversely Buffet has always done the contrary. For instance, Buffet still pays himself $100,000 per year, a pretty meager salary compared to Wall Street multi-millionaire bonuses.

The main reason for that is not only symbolical but also practical. If management is paid too “generously,” this would divert resources away from the company which to be successful has to keep its compounding growth.

Not in the Game for money

One may argue that Buffet is a billionaire and as such of course he loves money. But this isn’t the case. What Buffet loves is “how to make money” but not money itself. Not by accident, the Oracle of Omaha donated over $21bn to charities (Buffet’s Donations to Charity), and it is likely that this amount will considerably grow in the next years. Buffet learned this principle from his mentor, and (super)intelligent investor Benjamin Graham.

Work-Smart not hard

Ever since childhood, Warren Buffet disliked manual labor but understood that financial freedom was what he wanted in life. Therefore, he started from early experience to create a system to become financially independent. For instance, the system he used already existed, and it was the financial market.

On the other hand, this principle applies to any other aspect of life. This leads to the difference between scalable and not scalable jobs. Although this concept matured from “The Black Swan” by Taleb, it interestingly applies here as well. There are two categories of jobs. The non-scalable, which strictly depend on some hours you put in.

If you are an accountant you will earn per hour, therefore the more you work, the more you make money. And the scalable ones, where there is not the correlation between hard-work and earnings. If you are a writer or an investor the success of the book or investment does not necessarily depend on some hours invested in it. In the non-scalable spectrum, to become rich, you have to work extremely hard.

Also, the level of income is strictly tied to the amount of work. This implies that you will never be free from your job. In other words, your income is your job, but your job is yourself. Therefore you are your income!

As soon as you stop working your income stops as well. On the scalable spectrum, instead, you are not your income. In other words, you depersonalized your job, by creating a system that works for you.

When you stop working, no longer your income will halt. This principle seems to have been instilled in Buffet’s mind at a very early age.

The post How To Improve Emotional Intelligence appeared first on FourWeekMBA.

What Is The Most Profitable Business Model?

The hidden revenue generation model is among the most profitable patterns for business models built on advertising. In fact, businesses like Google and Facebook have managed to gain more than $130 billion in 2017 from advertising on their platform, even though many users might not be aware of the mechanisms that drive those platforms.

The hidden revenue generation model in a nutshell

[image error]

On this blog, I analyzed dozens of business models. From tech to luxury, retail, and many others. I found that the most profitable business models are those able to "hide" its revenue generation strategies from the people that use those services.

This is particularly true for the tech industry. In short, the mechanism is the following: the company creates a compelling service, it makes it free so that it can start gathering users data. That data becomes a massive repository that the company uses to study and understand what users might be looking for. It then matches that information with an existing business so that it can get paid for visibility to those businesses or for a cut of the revenues.

This hidden revenues generation pattern is something that tech companies like Google and Facebook have mastered. This digital advertising duopoly has produced more than $130 billion in 2017 from digital advertising!

Other companies like Amazon are joining in to start selling advertising on their platform and compete to the hidden revenues generation economy.

This kind of model doesn't seem so different from the traditional media model, or is it?

Why hidden revenue generation plus technology makes it so powerful

[image error]

Companies have become a massive collector of data. While though in the past the data collected might not have been useful at all. That dada has instead become the most critical asset. As companies like Google and Facebook develop powerful algorithms powered by massive amounts of data and driven by AI and machine learning, those algorithms can tap into our intentions, desires, pain points, to make us become a cash machine.

Each time that I search for something on Google, the search engine knows what's my commercial intent. In other words, it tries to read between the lines of what I am searching to understand whether I need just information or whether I might be looking for a product or service to buy. In many cases, if my intent can be satisfied via additional information, Google might be sending the user on a website that is part of its organic listing (sites that don't pay to be featured on Google for certain key terms).

On the other hand, if Google understands I might have commercial intent. In that exact instant will serve a sponsored content that shows on top of all the others, which is a paid result. That result is there because it might be the one who gets more clicks and offers more money for that key phrase.

In short, imagine the case I'm searching "car insurance." This has a clear commercial intent. Google shows an ad right away:

[image error]

In other cases, If I search "what's the weather tomorrow," rather than showing me advertising, Google will give me a direct answer:

[image error]

In other words, at the exact moment, we're typing something on Google, its algorithm is already predicting what we're looking for and what is my intent!

When a company can tap into users intents with such a powerful mechanism, it becomes easy for the company itself to give its users what they want, without ever having them ask, "what's in it for you?"

This is the crucial ingredient of the hidden revenue generation model.

How do you build a hidden revenue generation business?

If you're the only aim is to build a profitable business, the hidden revenue generation mechanism might be the most effective way to build up a high margin business that can become a cash machine for years to come. In this context, you need several pieces to make this happen:

Make the service/product at least 10x better than anyone available

Make it free and frictionless

Use gamification to make users come back

The critical ingredient is the variable reward you give to users

Find a partner that can finance your business for a few years so that you can experiment on monetization without impacting the user experience

Build a solid brand

And keep improving your algorithms to make your service or product more and more relevant to your users

When those steps/ingredients are in place, you might be on the right track to building a profitable business that follows the hidden revenue generation pattern!

How to get started with your business:

What Is a Business Model? 26 Successful Types of Business Models You Need to Know

What Is The Best Business Model For A Small Business?

What Is a Business Model Canvas? Business Model Canvas Explained

Business Model Tools for Small Businesses and Startups

What Is a Value Proposition? Value Proposition Canvas Explained

What Is a Lean Startup Canvas? Lean Startup Canvas Explained

What Is the Minimum Viable Product? Why Use the Exceptional Viable Product Instead

How To Build A Business Model Based On The Market Leader Weakness

The Marketing Lessons Learned from Rand Fishkin

The post What Is The Most Profitable Business Model? appeared first on FourWeekMBA.

October 17, 2018

What’s The Business Of Quora? It’s About Asking The Right Question

Many believe that Quora main asset is the repository of answers the platform offers. However, the real deal is the repository of questions Quora has been able to gather. That repository of questions is critical not only to hook its users but also to its business model. Were Quora fail to have people ask the right questions the whole company would be in jeopardy.

The answers merchants

If I were to compare Quora advertising network, I'd instead compare it to Google than Facebook. Quora, just like Google tries to organize information. They do it in different ways. Google allows you to search for anything and find a perfect match with existing paid content (ads) and organic content (any site it can crawl, index and rank) through a massive algorithm comprised of many parts, which also leverages on human quality raters.

Quora instead tries to match information, in the form of questions with humans that are willing to answer to those questions. While it is a Q&A system, Quora also leverages on a search to retrieve the massive amount of questions stored in its database.

The similarity here is that both Google and Quora tries to answer as many questions as possible. Indeed, Google is more and more skewed toward giving direct answers to users in the form of featured snippets:

[image error]

Example of a Google featured snippet that offers a direct answer on a search "DuckDuckGo business model."

In other words, Google "decides" when it makes sense to provide direct answers based on specific keywords. The advantage of Google right now is that it has become a powerful semantic engine able to provide a vast array of answers. As shown by MozCast (based on a set of 10k searches) those direct answers are showing up at least half of the time people search for something:

[image error]

Source: MozCast

On a collection of 10k searches, Mox shows how featured snippets and knowledge panels (two features of Google which aim is to provide direct answers) provide an answer half of the time

On its hand, Quora also tries to provide as many answers on any topic. In short, the web is moving from a place where you could find the content of any kind, to a place where you can find in most cases answers to any question you might have.

While Google and Quora look for answers to users, they do it in a completely different way. Google doesn't have an issue in terms of questions the user can ask. It is all the way around. As Google is the largest repository of people searches, it is now fine-tuning its search algorithm to make it able to provide an answer to any question or keyword that where an answer would fit well.

Quora instead, while it has humans answering to any questions and it uses its algorithms to match a question to a person that might be able to provide an answer it has to make sure that people keep asking interesting questions, but interesting for whom?

Quora attempts to fine-tune its business model

As Quora business model is skewed toward user-generated content, it is vital for Quora to keep producing content which is relevant. However, there is another critical piece of the puzzle: advertising.

In terms of monetization Quora’s business model is based on two main foundations:

Investors, looking for ROI through exit or IPO

And publishers/online businesses looking for ROI through advertising

Since Quora has launched its advertising program, there is no doubt the company is doubling down on that:

[image error]

The mechanism is simple. You set up your account, your copy, chose your audience and you only pay if people click on that advertising!

The logic is not far from Google AdWords. Yet as I highlighted several times on this blog a business model is way more complicated than a monetization strategy. Therefore, for Quora business model to success, it needs to bring several moving parts together to make its business model finally sustainable.

Google become successful when it managed to create a balance between paid results and organic answers. This was achieved via two main networks, AdWords and AdSense. Quora is now truing to find the same balance but from a different angle.

You might think that the central issue of Quora is to keep having people answer questions on the platform. In this context though what matters the most to Quora is to make sure people keep asking questions that can generate ads revenues. Indeed, what keeps the platform alive and viable from the commercial standpoint is its ability to address questions that people find interesting. Thus, it is not a matter of answering any quest but rather to ask the right question instead!

But how do you make sure people ask the right questions?

The questions merchant: Quora partners program and why it might be critical to its business model success

Questions are compensated based on a proportion of the advertising revenue they generate. This is a result of how well-answered they are and how many people find them interesting. After you ask a question, you will earn money on it for 1 year.

This is what Quora specifies on its partner program page. In other words, Quora wants to leverage monetization and economic incentives to have people write compelling questions. Thus, the company is making a good point: the value (both commercial and not) is in the questions users pose.

As specified by Quora "The program is invite-only at this time, but we intend to open it up to more people as time goes on."

As specified in its announcement:

Good question pages are fundamental to making Quora a great place for writers and for anyone who wants to better understand the world. Today, we're excited to share a new program that will help ensure that Quora always offers the most interesting and useful questions. The Quora Partner Program will compensate participants for adding good questions that many people in the world may have.

This might sound quite counterintuitive, and it might disappoint people that spend much effort in producing content on Quora, but the reality is, asking right questions is the first propeller of Quora business model. Would people keep asking silly questions, no matter how philosophical, and in-depth it is the answer none will bother reading (just like a book with a bad cover or wrong title doesn't sell).

Will this program turn out to be a critical piece in the puzzle of Quora business model?

Handpicked related content:

How Does Quora Make Money? Quora Business Model Explained

What Is a Business Model? 26 Successful Types of Business Models You Need to Know

How Does PayPal Make Money? The PayPal Mafia Business Model Explained

How Does WhatsApp Make Money? WhatsApp Business Model Explained

How Does Google Make Money? It’s Not Just Advertising!

How Does Facebook Make Money? Facebook Hidden Revenue Business Model Explained

The Google of China: Baidu Business Model In A Nutshell

How Does Twitter Make Money? Twitter Business Model In A Nutshell

How Does DuckDuckGo Make Money? DuckDuckGo Business Model Explained

How Amazon Makes Money: Amazon Business Model in a Nutshell

How Does Netflix Make Money? Netflix Business Model Explained

How Does Microsoft Make Money? Microsoft Business Model In A Nutshell

The Trillion Dollar Company: Apple Business Model In A Nutshell

Quick Snapshot of Alibaba Business Model

The post What’s The Business Of Quora? It’s About Asking The Right Question appeared first on FourWeekMBA.

October 16, 2018

Can DuckDuckGo Be A Threat To Google Business Model?

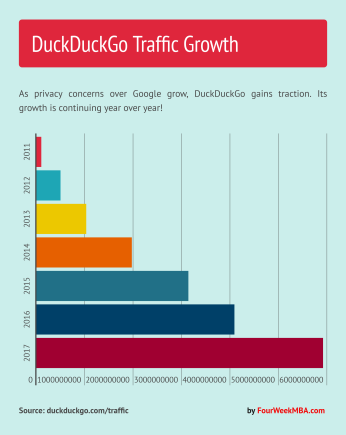

It’s hard to know right now how big the “online privacy" market will be. As I pointed out on “How To Build A Business Model Based On The Market Leader Weakness” DuckDuckGo (DDG) is leveraging on a Google weakness to build up momentum (it is essential to clarify that since 2009 DDG has grown pretty fast).

Thus, as of now DuckDuckGo, value proposition "we don't track you, we don't collect, neither share your data" is quite powerful, and it is working as a propeller for its growth.

Yet, when it comes to DDG business model, it still makes money via Advertising and Affiliate Marketing. Advertising is shown based on the keywords typed into the search box. Affiliate revenues come from Amazon and eBay affiliate programs. When users buy after getting on those sites through DuckDuckGo the company collects a small commission.

Can DDG still grow? It can and it probably will; as privacy concerns grow, especially over Google and Facebook monopolies, the “online privacy” market might keep growing quite quickly.

In short, the paradox is that as those multi-billion dollar digital advertisers can’t live without your data, the more privacy will become a concern, thus a business opportunity. On the other hand, a business model is made of many moving parts.

Therefore, even though DDG might continue to gain traction and it might do so via the existing monetization strategy and other rounds of financing, it will need a viable business model (to compete against a tech giant like Google) any time soon.

Also, as search is moving toward mobile, voice and other kinds of online discoveries; traditional search might become secondary. True, the Lindy Effect tells us that something unperishable - like search technology - that lived for 20 years might live for at least other 20 years. However, it might not tell us much about the adoption rate.

Indeed, it might be true that the search market will still be a technology that will exist for the next twenty years at least. Yet it might be that the rate of adoption will be way lower than it is today. Imagine the scenario where you are given several ways to consume content, and traditional search is just one of them. How many chances there are that people will still keep using it?

Google itself is using its cash cow (the advertising network comprising AdWords and AdSense) to reinvest massively in voice search, and as other tech giants like Apple (with Cortana) and Amazon (with Alexa) are also investing massive resources on that, the way we consume content might completely change in a few years. And once again search might still exist but as a niche of a much broader market that offers many other ways of consuming content.

In that context, DDG might make a great niche search engine and alternative to Google but nothing more; yet if DDG can grow faster, find a sustainable business model (for such intended both profitable and able to allow DDG to scale up) and move also to voice (assuming you can enable voice search based on the privacy of its users) then we might see the birth of another tech giant, one the founded its success on privacy!

Handpicked business models: