J. Bradford DeLong's Blog, page 441

October 30, 2017

Should-Read: John Quiggin: The end of fossil fuels: "The ...

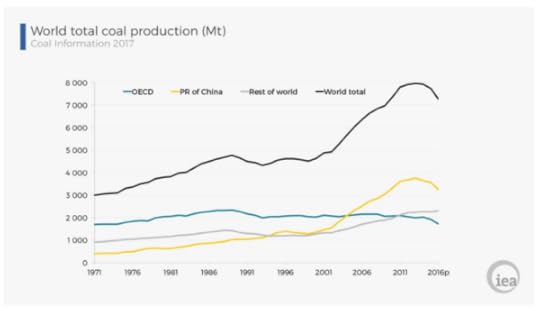

Should-Read: John Quiggin: The end of fossil fuels: "The International Energy Agency recently released data showing that world coal production fell sharply in 2016, mainly because of big cuts in China...

...Looking at the graph, it appears that the peak in production was around 2013. The price of coal has experienced a ���dead cat bounce��� over the last year or so, essentially because China has been closing coal mines faster than it���s been closing or cancelling coal-fired power stations, but the picture tells the story for the future.

Until relatively recently, the decline of coal was the result of competition with gas, while new renewables weren���t even enough to cover the growth in demand. But a quick calculation shows that renewables will soon be taking out a bigger bite. Global electricity generation is currently about 20000 terawatt-hours (TWh) a year, growing at around 1.5 per cent, or 300TWh a year. Installations of solar PV and wind (I haven���t checked on hydro and other renewables) for 2017 look set to come in around 150 gigawatts (GW). Assuming 2000 hours of operation per year, that���s just enough to offset demand growth. So, any future growth in renewables must come directly at the expense of existing fossil fuel generation which in practice will almost always mean coal...

Should-Read: The extremely sharp David Glasner is very si...

Should-Read: The extremely sharp David Glasner is very sick and tired of John Taylor's incoherences and evasions. In my experience, Glasner's net view of Taylor is about average of the private views of monetary economists worth respecting and listening to:

David Glasner: Larry Summers v. John Taylor: No Contest: "'If a Fed Funds rate higher than the rate set for the past three years would have led, as the Taylor rule implies, to lower inflation...

...than we experienced, following the Taylor rule would have meant disregarding the Fed���s own inflation target. How is that consistent with a rules-based policy?

This is such an obvious point���and I am hardly the only one to have made it���that Taylor���s continuing failure to respond to it is simply inexcusable. In his apologetics for the Taylor rule and for legislation introduced (no doubt with his blessing and active assistance) by various Republican critics of Fed policy... Taylor repeatedly insists that the point... is just to require the Fed to state a rule... [and] when deviating from its own stated rule, to provide Congress with a rationale.... But if Taylor wants the Fed to be more candid and transparent in defending its own decisions about monetary policy, it would be only fitting and proper for Taylor, as an aspiring Fed Chairman, to be more forthcoming than he has yet been about the obvious, and rather scary, implications of following the Taylor Rule during the period since 2003...

Seth Abramson (@SethAbramson) | Twitter

Live from the Orange-Haired Baboon Cage: Seth Abramson is super freaky on twitter today: Seth Abramson (@SethAbramson)...

Should-Read: Austin Clemens: Here���s why you should inte...

Should-Read: Austin Clemens: Here���s why you should interpret GDP growth estimates skeptically: "No single number can really tell us much of anything about our immensely complicated $19 trillion economy...

...But we have been conditioned to think about the health of the economy in terms of total output growth. We know these common refrains: ���A rising tide lifts all boats��� and ���growing the pie.��� Economic plans are based on GDP growth targets. So, it���s understandable that so many people treat this one number as somehow sacred. But reverence for GDP is harmful because GDP growth can be a deeply misleading way to think about the health of our economy...

Should-Read: Bridget Ansel: The gender gap in economics h...

Should-Read: Bridget Ansel: The gender gap in economics has ramifications far beyond the ivory tower: "The lack of women in economics���and their segregation into certain subfields���boast ramifications beyond individual women���s careers...

...Research establishes how economic policymakers��� life experiences affect the issues they elevate and the way they vote in the present. That makes the gender disparities within economics even more problematic because of the economics profession���s influence in determining public policy. There is statistical evidence that male and female economists think differently about many critical policy issues, even when controlling for age and type of employment. Unsurprisingly, that includes views on gender and equal opportunity, to cite one example, but the dissimilarities also extend to topics not explicitly about gender such as the minimum wage, labor standards, government regulation, and health insurance. Some female economists argue that large gender imbalances mean that the conventional wisdom on any given economic topic is likely to be biased...

Should-Read: Iris Marechal: Weekend reading: the ���fisca...

Should-Read: Iris Marechal: Weekend reading: the ���fiscal highlights��� edition: "Rex Nutting argues that the Trump-Ryan plan will actually encourage more corporate offshore tax avoidance...

...Larry Summers says the numbers don���t add up and other economists, including Jason Furman, pointed to the extreme optimism of the White House���s projections.... Richard Sutch has completed a review of Piketty���s evidence that he says shows Piketty���s data on 19th century wealth in America is unreliable.... The American Dream seems to have come to an end. Nowadays, only 50 percent of U.S. children will do better, economically speaking, compared to their parents. Stanford University���s Raj Chetty argues that chances of succeeding vary widely between zip codes and that���s why solutions to economic mobility have to be local....

Both the House and the Senate have now passed budgets that make tax reform possible. As Republican talked about a tax abatements on repatriated foreign income, Martin Sandbu argues that companies��� foreign profits are actually not trapped offshore. A recent working paper released by Amanda Bayer and David Wilcox addresses the unequal economic education distribution among U.S. college graduates...

Must-Read: Practically everything that the Democrats have...

Must-Read: Practically everything that the Democrats have been saying about the insanity of the Republicans (and that much of the media has been ignoring), said here by Republican ex-Speaker John Boehner:

Tim Alberta: John Boehner Unchained: "After railing against the defund strategy, however, Boehner surveyed his conference and realized...

...it was a fight many members wanted���and some needed. Yielding, he joined them in the trenches, abandoning his obligations of governance in hopes of strengthening his standing in the party. But the 17-day shutdown proved costly. Watching as Republicans got butchered in nationwide polling, the speaker finally called a meeting to inform members that they would vote to reopen the government and raise the debt ceiling. ���I get a standing ovation,��� Boehner says. ���I���m thinking, ���This place is irrational������...

October 29, 2017

Live from the MCP Bunker: Still looking for some kind of ...

Live from the MCP Bunker: Still looking for some kind of acknowledgement from any of Hendrik Hertzberg, Michael Kinsley, Andrew Sullivan���or, indeed, Marty Peretz���just how big of an asshole Leon Wieseltier they let rampage around their magazine, delighting in making women feel like pieces of meat...

Silence seems to be an acknowledgement that is is one of those: "my behavior was worse than you imagine, even though you know it was worse than you imagine..." moments...

Must-Read: I wish that the extremely sharp Alan Auerbach ...

Must-Read: I wish that the extremely sharp Alan Auerbach would turn his concern knob up a bit more���in fact, I wish he would turn it up to 11. He says: "change in the guise of [tax] reform has the capacity to make things worse, and the secretive, often chaotic nature of the current process provides ample opportunity to do so..." I wish he would say: "the secretive and constantly chaotic nature of the current tax reform process makes it inevitable that it will end up making things worse..." Nobody should have any illusions that Republican congressional leaders know what they are doing here���any more than they knew what they were doing with their health care fiasco:

Alan Auerbach: Five Questions for Congress on Tax Reform: "Congressional leaders say they���re working on a corporate tax reform...

...Yet... they���re keeping their plans under wraps until the last moment, with rumors and leaks serving as the main form of advance discussion.... A framework so we can quickly assess any proposals that emerge.... Does the plan have temporary provisions, and how are they justified?... The "big six" proposal... would allow companies to fully deduct short-lived capital investment... ���for at least five years���... presumably because a permanent tax break would look a lot more expensive.... This is worse than a mere budget trick: The temporary nature of the measure would also distort investment incentives and increase uncertainty. This week���s fiasco over reducing the limit on contributions to 401(k) retirement accounts was also about the timing of tax revenues... Roth 401(k) accounts... are taxed up front.... Does the plan pay for itself in the long run, using realistic forecasts?... How does the plan address the deductibility of interest?... A 2016 proposal from House Republicans offered a sensible... scrap the interest deduction, but allow companies to fully expense all capital investments.... The big six proposal, by contrast, calls for only a partial limitation on interest deductions for C corporations, with no details provided.... How would��the plan prevent companies from avoiding taxes by moving their operations or profits abroad?... There���s a simple and complete solution: Levy tax based on where a company���s products are services are used.... Unfortunately, the big six has already rejected this approach....

How��would the plan prevent people from using pass-through businesses to avoid personal income tax?... To prevent this from happening, any plan will have to include serious enforcement measures���such as taxing a certain share of reported business income as ordinary income.

The U.S. business tax system sorely needs reform, particularly in the way it deals with multinational corporations. But we must pay close attention to what Congress and the Trump administration propose. Change in the guise of reform has the capacity to make things worse, and the secretive, often chaotic nature of the current process provides ample opportunity to do so.

Live from the Right-Wing Economists' Self-Made Fresh Inci...

Live from the Right-Wing Economists' Self-Made Fresh Incidence Hell: One more time, morons: will you at least try to understand it if presented this way?

With a fixed required after-tax rate of return r...

A proportional tax t can either be administered as a fraction of factor cost or a fraction of market price...

When a proportional tax t is administered as a fraction of factor cost, so that the after-tax rate of return plus the tax rate times the after-tax rate of return equals market price, then:

(1) $ TR_{initial} = krt $

(2) $ ��TR_{static} = kr��t = TR_{initial}\left(\frac{��t}{t}\right) $

When a proportional tax t is administered as a fraction of market price, so that market price minus the tax rate times the pretax rate of return equals factor cost, then:

(3) $ TR_{initial} = \frac{krt}{1-t} $

(4) $ ��TR_{static} = \left(\frac{kr}{1-t} + \frac{krt}{(1-t)^2}\right)��t $

(5) $ ��TR_{static} = \frac{kr��t}{(1-t)^2} $

(6) $ ��TR_{static} = \left(\frac{1}{1-t}\right)TR_{initial}\left(\frac{��t}{t}\right) $

$ ��TR_{static} $ is transferred from taxes to wages. Mankiw calculates the change in tax revenue via (1)-(2) and the change in wages via (3)-(6). That is where his factor (1-t) comes from: that is how the static gain to wages can be bigger than the loss to tax revenue even though both are the exact same area in the static calculation: they are both (capital stock) x (change in tax wedge between pretax and after-tax returns).

Draw the diagram:

Calculate the area.

One does not simply find that production and preference parameters just drop out of incidence calculations:

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers