J. Bradford DeLong's Blog, page 370

April 29, 2018

Jason Rhode: What tech calls ���AI��� isn���t really AI: ...

Jason Rhode: What tech calls ���AI��� isn���t really AI: "We're in the dark ages of neuroscience and neuroanatomy, to say nothing of the philosophical riddles...

...[And] apart from the issues of human bias and engineering, how will we be able to tell AI is, well, AI?... What is more likely to happen first: that human beings are able to create an artificial mind, or that humans build clever programs that can fool most of us into thinking they're thinking?... Where human beings are concerned, the power of illusion usually arrives first.... When the talking heads and tech journalists and silicon bros discuss "AI assistants" like Siri or Alexa, they don't actually mean AI. They're not talking about virtual minds.... Machines that adopt human mannerisms or echo human behaviors are not artificially intelligent. If aping mankind equaled AI, then there are some really nifty American Girl Doll collections that Elon Musk should look into. At present, sci-fi AI does not exist. Large spreadsheets exist. Predictive text exists. Pattern-seeking algorithms exist. But these are not minds. When I see how easily the public and industry titans project mind-ness on these digital card-tricks, I grow skeptical about our capacity for Turing-style discernment...

#shouldread

Tyler Feder: I've never had so many people: " accuse me o...

Tyler Feder: I've never had so many people: "

accuse me of spying on them before hahaha:

I've never had so many people accuse me of spying on them before hahaha

— tyler feder (@roaringsoftly) April 28, 2018

������ ���Which 'work from home' look matches you? �������https://t.co/kreK1bZtKY pic.twitter.com/wxsOCD50Ea

#shouldread

American Economic History: Slides for Wrap-Up Lecture...

Each time I do this I think there must be a way to do it better. But each time I fail to think of one...

Good ideas very welcome...

Here we are https://www.icloud.com/keynote/0AuVq4veo1M_lK-EXXK3kQUwg:

J. Bradford Delong

http://bradford-delong.com

brad.delong@gmail.com

@delong

2018-04-30

https://www.icloud.com/keynote/0AuVq4veo1M_lK-EXXK3kQUwg

Big Ideas: Review

Narrative

Varieties of nationalism

The furnace where the future is being forged

Slavery and its echoes

Large but unequally-distributed liberty

Built on immigrants

Used to deliver high opportunity

Has delivered high prosperity

Growth-oriented industrial policy

Well being-oriented industrial and social welfare policy

The Gilded Ages

The Age of Social Democracy as the apogee

Structural transformation

Regions and cultures

Narrative

We tell stories; we learn by listening to stories; we think by means of narrative

Hence historical narratives have extra-special salience in our brains

Easier to remember stories than theories or checklists

And what can theories be but crystallized historical episodes?

Need the history to understand whether the theory is any good���

Opened with a story:

The story of Leon Trotsky

And his view that America was ���the furnace where the future is being forged���

Did this to arrest you

Did it work?

Varieties of Nationalism

Threefold:

(Utopian) New England

(Libertarian) Virginia

(Blood-and-soil) Kentucky

These threads we have seen throughout the course over and over again���

For ex., both slavery and abolitionism���

And the failure of socialism to take hold���

Plus ���war to end war" and ���crusade in Europe���

The furnace where the future is being forged

The leading nation in terms of technology and prosperity over 1850-2016

Thus the first to try to grapple with its opportunities and dilemmas

Plus: frequently engaged in crusades to make the world better (New England nationalism)

Slavery

Plantation-based chattel slavery producing staples for the market not the most evil piece of human history

But it is way up there���

Familial vs. industrial slavery

Jim Crow

Echoes down to today

���Everybody gets to become white, except for Blacks���

Does that still hold?

Plus Ten MOAR Big, But Lesser, Ideas...

Review: The Making of Our World

The Post-WWII Boom: Thirty Glorious Years���Ending in the 1970s

The Great Depression and World War II together ended the idea of laissez faire: the idea became guilty until proven innocent.

The idea of laissez faire had in fact been dying for a while���

And yet it survived���

Survival and Return of the Hard Laissez Faire Right

Continued to argue that government beyond the ���night watchman��� would succumb to iron laws of power that would push it to totalitarianism���

Even argued that the Great Depression showed not the bankruptcy of laissez faire but the bankruptcy of government interference���

The return of the hard laissez faire right in the neoliberal era

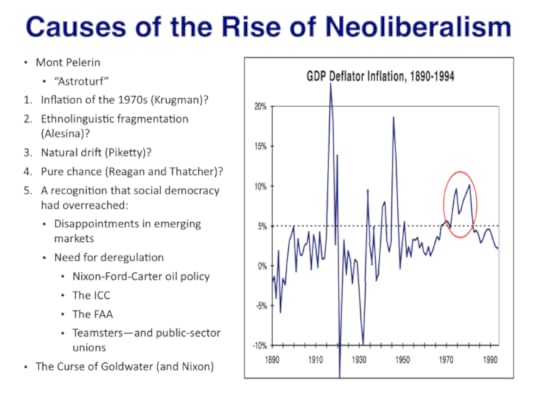

Causes of the Rise of Neoliberalism

Inflation of the 1970s (Krugman)?

Ethnic (Alesina)?

The Curse of Goldwater (and Nixon)

Natural drift (Piketty)?

Pure chance (Reagan and Thatcher)?

Mont Pelerin (���Astroturf���)

Social democracy overreach?

Hard Neoliberalism: Mitt Romney

���47 percent��� with [Obama]��� dependent��� believe that they are victims��� that government has a responsibility to care for them��� that they are entitled��� people who pay no income tax���.

���My job is not to worry about those people���I'll never convince them that they should take personal responsibility and care for their lives������

A Nation of Takers?: Ann Romney

���Not easy years��� basement apartment���. didn���t have money to carpet the floor��� remnants, samples, so I glued them together, all different colors���.

���Mitt had enough of an investment from stock that we could sell off a little at a time���.

���Mitt and I walked to class together, shared housekeeping, had a lot of pasta and tuna fish and learned hard lessons������

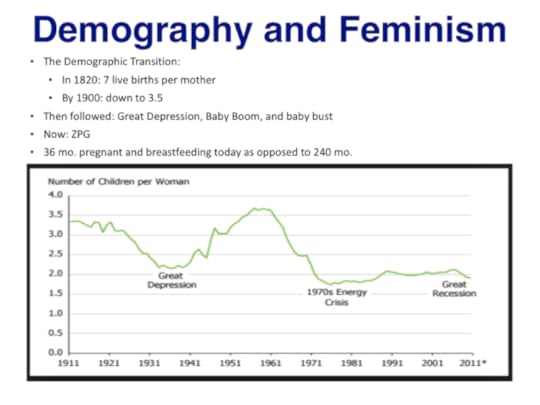

Demography and Feminism

The Demographic Transition:

In 1820: 7 live births per mother

By 1900: down to 3.5

Then followed: Great Depression, Baby Boom, and baby bust

Now: ZPG

36 mo. pregnant and breastfeeding today as opposed to 240 mo.

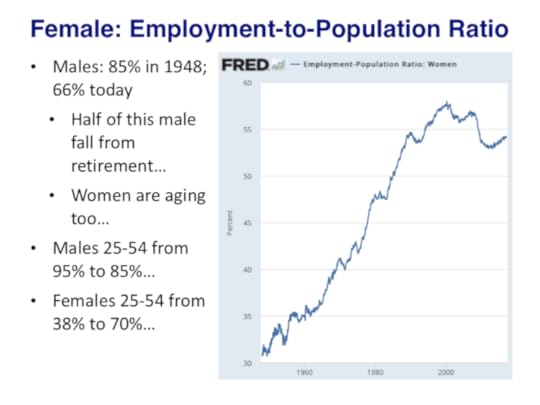

Female: Employment-to-Population Ratio

Males: 85% in 1948; 66% today

Half of this male fall from retirement���

Women are aging too���

Males 25-54 from 95% to 85%���

Females 25-54 from 38% to 70%���

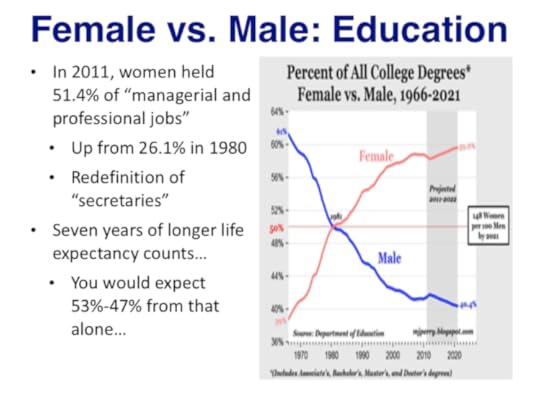

Female vs. Male: Education

In 2011, women held 51.4% of ���managerial and professional jobs���

Up from 26.1% in 1980

Redefinition of ���secretaries���

Seven years of longer life expectancy counts���

You would expect 53%-47% from that alone, but not 62%���

Sheryl Sandberg at Barnard

���Women��� like us except for the circumstances into which they were born, [lack] basic human rights���.

���We [here] are lucky.... We are equals under the law. But the promise of equality is not equality....

���We are nowhere close to 50% of the jobs at the top. That means that when the big decisions are made, the decisions that affect all of our worlds, we do not have an equal voice at that table.

���So today, we turn to you.....

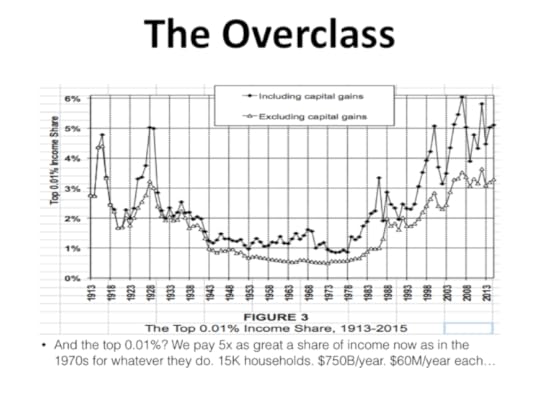

The Overclass

And the top 0.01%? We pay 5x as great a share of income now as in the 1970s for whatever they do. 15K households. $750B/year. $60M/year each���

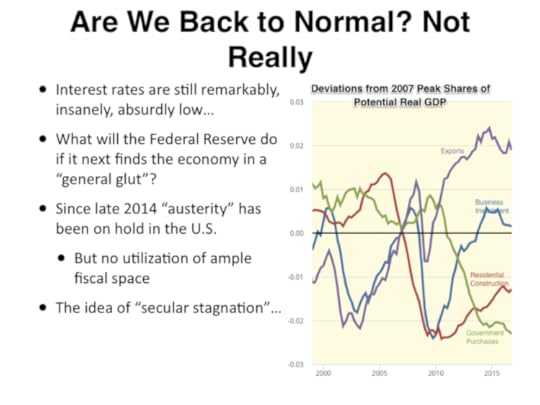

Are We Back to Normal After the Great Recession? Not Really

Interest rates are still remarkably, insanely, absurdly low���

What will the Federal Reserve do if it next finds the economy in a ���general glut���?

Since late 2014 ���austerity��� has been on hold in the U.S.

But no utilization of ample fiscal space

The idea of ���secular stagnation���������

Our Present Through a Polanyian Lens

Stagflation

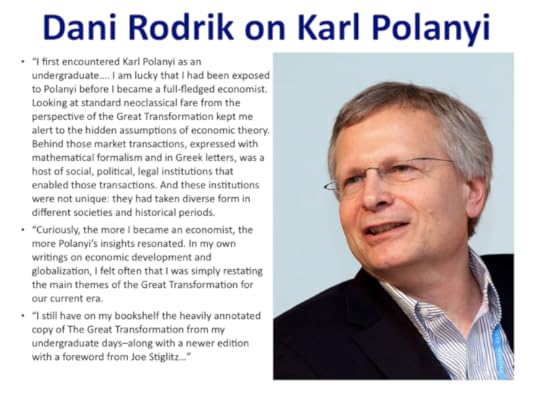

Dani Rodrik on Karl Polanyi

���The hidden assumptions of economic theory. Behind those market transactions, expressed with mathematical formalism and in Greek letters, was a host of social, political, legal institutions that enabled those transactions���.

���The more I became an economist, the more Polanyi���s insights resonated���. I was simply restating the main themes of the Great Transformation for our current era������

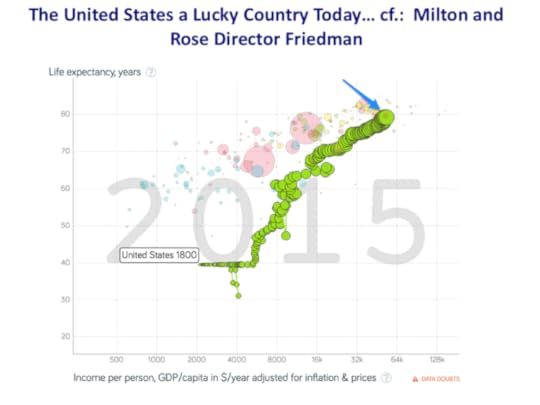

The United States a Lucky Country Today��� cf.: Milton and Rose Director Friedman

But Are We Feeling Lucky?

The Three ���Fictitious��� Commodities

Land���your community

Labor���your standard of living

Finance���your occupation/firm

All determined by a sociological logic of ���desert������in the sense of ���deserve���

The rebellion of ���society��� against the ���market���

But It���s Not a Rebellion Against the ���Market���, Really���

Polanyi���s error���

Joseph Bailey could have told him better���

Against ���rootless cosmopolites���

For: restricted community

In the U.S.

Mitt Romney (2012)���

Lyndon Johnson (1964)���

Sam Rayburn (1940)���

Joseph Bailey (1914)���

Breaking of the Populists/Populists (1892-96)

Your Mission, Should You Choose to Accept It���

April 28, 2018

Intermediate Macroeconomics: Econ 101b: Spring 2018: U.C. Berkeley: Sample Final (DRAFT)

In a sense, closed book exams have been obsolete since 1500. You could argue before 1500 that people would often find themselves in situations in which they had to produce documents and write answer is calling on nothing but what they had currently running on their own wetware. Books, after all, were very expensive. At five pages an hour, figure it would take a month to produce one copy of a book, and that is only the direct, skilled labor required.

After 1500, however closed book exams made no sense���at least not without a theory of why acting like a medieval monk would in fact teach habits of mind and thought that would help us think and write in a world where people were surrounded almost always by their notes and their libraries.

And now, of course, the young ones are never without their smartphones.

So it is time for us professors to start writing exams that test and teach habits of thought relevant for a world in which you have rapid broadband access to the entire online library of humanity at nearly every instant.

Therefore this exam is open note, open book, and open smartphone���or whatever other device you wish to bring...

Only one form of information access is prohibited: direct two-way interaction with other Turing class entities). In case you are uncertain, here are examples of five examples of Turing class entities:

But, you say, don't then exams become too easy? If we professors cannot write an exam in which you can score high by using information technology to help you think while still being unable to use information to learn on the fly enough for you to fake it, then I think we are in the wrong business...

Version "A"

Multiple Choice Questions

A.1: Solow Growth Model

We have the Solow Growth Model (SGM) system of equations:

$ \frac{d\left(L_t\right)}{dt} = nL_t $ :: labor force growth equation

$ \frac{d\left(E_t\right)}{dt} = gE_t $ :: efficiency of labor growth equation

$ \frac{d\left(K_t\right)}{dt} = sY_t - \delta{K_t} $ :: capital stock growth equation

$ Y_t = \left(K_t\right)^{\alpha}\left(L_tE_t\right)^{1-\alpha} $ :: production function

A.1.1: Long-Run Capital-Output Ratio

If s, n, g, ��, and �� remain constant at their initial values, toward what value is the capital-output ratio $ K_t/Y_t $ converging in the long run? Set the value of the variable in the code cell immediately below to the number of the correct answer:

$ \lim\limits_{t\to\infty}\left(\frac{K_t}{Y_t}\right) = \frac{s}{n+g+\delta} $

$ \lim\limits_{t\to\infty}\left(\frac{K_t}{Y_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{1}{1-\alpha}}

$

$ \lim\limits_{t\to\infty}\left(\frac{K_t}{Y_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{\alpha}{1-\alpha}} $

none of the above

A.1.2: Long-Run Output-per-Worker Path

If s, n, g, ��, and �� remain constant at their initial values, toward what path is the output-per-worker ratio $ Y_t/L_t $ converging in the long run? Set the value of the variable in the code cell immediately below to the number of the correct answer:

$ \lim\limits_{t\to\infty}\left(\frac{Y_t}{L_t}\right) = \frac{s}{n+g+\delta} \left(E_0{e^{gt}}\right) $

$ \lim\limits_{t\to\infty}\left(\frac{Y_t}{L_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{1}{1-\alpha}} \left(E_0{e^{gt}}\right) $

$ \lim\limits_{t\to\infty}\left(\frac{Y_t}{L_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{\alpha}{1-\alpha}} \left(E_0{e^{gt}}\right) $

none of the above

A.1.3: Long-Run Capital-per-Worker Path

If s, n, g, ��, and �� remain constant at their initial values, toward what path is the capital-per-worker ratio $ K_t/L_t $ converging in the long run? Set the value of the variable in the code cell immediately below to the number of the correct answer:

$ \lim\limits_{t\to\infty}\left(\frac{K_t}{L_t}\right) = \frac{s}{n+g+\delta} \left(E_0{e^{gt}}\right) $

$ \lim\limits_{t\to\infty}\left(\frac{K_t}{L_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{1}{1-\alpha}} \left(E_0{e^{gt}}\right) $

$ \lim\limits_{t\to\infty}\left(\frac{K_t}{L_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{\alpha}{1-\alpha}} \left(E_0{e^{gt}}\right) $

none of the above

A.1.4: An Increase in Savings: Output

If the savings rate s in a SGM economy doubles, then the level of output per worker along the economy's steady-state growth path will:

double

halve

increase by an amount that will be more than a doubling if the production function parameter $ \alpha > \frac{1}{2} $, but increase by an amount that will be less than a doubling if the production function parameter $ \alpha < \frac{1}{2} $.

none of the above

A.1.5: An Increase in Savings: Capital

If the savings rate s in a SGM economy doubles, then the level of the capital-output ratio along the economy's steady-state growth path will:

double

halve

increase by an amount that will be more than a doubling if the production function parameter $ \alpha > \frac{1}{2} $, but increase by an amount that will be less than a doubling if the production function parameter $ \alpha < \frac{1}{2} $.

none of the above

A.1.6: An Increase in the Production Function Parameter $ \alpha $

Comparing two SGM economies, the one with the higher value of the production function parameter $ \alpha $ will have:

faster convergence to its steady-state balanced-growth path

slower convergence to its steady-state balanced-growth path

the same speed of convergence to its steady-state balanced-growth path

none of the above

A.1.7: An Increase in the Production Function Parameter $ \alpha $

Comparing two SGM economies, the one with the higher value of the production function parameter $ \alpha $ will have:

a larger difference in output per worker levels along their steady-state balanced-growth paths

a smaller difference in output per worker levels along their steady-state balanced-growth paths

there is not enough information to determine what will be the difference in output per worker levels along their steady-state balanced-growth paths

none of the above

A.1.8: An Increase in the Production Function Parameter $ \alpha $

Comparing two SGM economies, the one with the higher value of the production function parameter $ \alpha $ will have:

a larger difference in capital per worker levels along their steady-state balanced-growth paths

a smaller difference in capital per worker levels along their steady-state balanced-growth paths

there is not enough information to determine what will be the difference in capital per worker levels along their steady-state balanced-growth paths

none of the above

A.1.9: Malthusian Economies

The slow pace of increase of average output per capita in the world economy over the long Agrarian Age���from 5000 BC to 1800���is best accounted for by:

the absence of intellectual property institutions that allowed inventors to profit mightily from their inventions

population growth that generated increasing resource scarcity that offset what would otherwise have been the positive effects of inventions and innovations on the efficiency of labor E

wars that kept the capital stock from growing rapidly

none of the above

A.1.10: Post-Malthusian Economies

The rapid pace of increase of average output per capita in the world economy since the end of the long Agrarian Age���since about 1800���is best accounted for by:

the presence of intellectual property institutions that allowed inventors to profit mightily from their inventions

population growth that has been slower than before and thus did not generate resource scarcity to offset what would otherwise have been the positive effects of inventions and innovations on the efficiency of labor E

the absence of wars and thus the ability of the capital stock to grow rapidly

none of the above

A.1.11: Divergence

Since 1800 the global distribution of income and wealth has become:

much more unequal as imperialism and capitalism have absolutely impoverished the global south

much more equal as the knowledge gained since the start of the Industrial Revolution diffuses around the world in a heartbeat due to our advanced information and communication technologies

much more unequal as productive use of knowledge about modern machine technologies has required effective communities of engineering practice, and those have proven difficult to construct outside of the global north

none of the above

A.1.12: Convergence

Since 1970 the global distribution of income and wealth has become:

somewhat more equal as China (and to a lesser extent India) have had two miraculously good generations of growth

somewhat more unequal as the end of the age of colonialism has been followed by an age of neocolonialism

somewhat more unequal as the growth of global value chains have allowed the global north to increase the rate of exploitation in the global south

none of the above

A.1.13: In the Future...

We are likely to see the global distribution of income and wealth:

remain the same as corruption and other forms of rent extraction hobble attempts at development in the global south

become much more equal as the knowledge gained since the start of the Industrial Revolution diffuses around the world in a heartbeat due to our advanced information and communication technologies

become more unequal as further technological progress competes withe and reduces the value of the "unskilled" human brain while the concentration of physical capital and intellectual property wealth increases

any of the above is not an implausible scenario���and their are other plausible scenarios too

A.1.14: Long Run Growth

The most important determinant of the long-run rate of growth of an economy is:

the presence of intellectual property institutions that allowed inventors to profit mightily from their inventions

its rate of growth of the efficiency of labor E

its steady-state balanced-growth capital-output ratio (K/Y)*

none of the above

A.1.15: Demographic Transition

The principal reason that the world is now closing in on zero population growth and a stable population of about 10 billion rather than seeing population double every generation or two is:

that with greatly reduced child mortality families no longer believe they need to have as many children as possible in the hope that at least one will outlive them, and the power of literate and relatively prosperous women to control their own fertility

that resource scarcity in the form of limited farmland makes large families unaffordable in the global south, and resource scarcity in the form of a very high price of education makes large families unaffordable in the global north

the development of Social Security and other government-sponsored social insurance schemes has greatly lessened the perceived need people see to have children who will outlive them

none of the above

A.1: Business Cycle Models

A.1.16: IS Curve

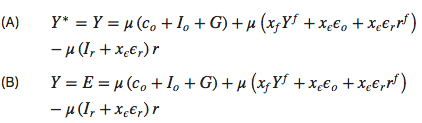

Shifting gears from long-run growth to short-run business cycles, a key tool in both the flexible-price and the stick-price models is the so-called IS Curve equation, in its two forms:

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

Of these two forms, (A) and (B):

the sticky-price model uses form (A) and the flexible-price model uses form (B)

the flexible-price model uses form (A), but (B) is not the form used in the sticky-price model

the sticky-price model uses form (B) and the flexible-price model uses form (A)

none of the above

A.1.17: Exchange Rate

In the so-called IS Curve equation:

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

an increase in the value of the dollar���of the home currency���that makes home-produced goods less attractive to foreigners and so discourages exports is modeled by:

an increase in the value of the exchange rate variable $ \epsilon $

a decrease in the value of the exchange rate variable $ \epsilon $

a decrease in the value not of the exchange rate variable $ \epsilon $ but of the parameter $ {\epsilon}_o $

none of the above

A.1.18: Determinants of the Multiplier

In the so-called IS Curve equation:

&nb<

img src="http://delong.typepad.com/.a/6a00e551..." alt="JupyterLab" title="JupyterLab.png" border="0" width="395" height="62" />sp;

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

comparing two otherwise identical sticky-price economies, the one with the higher value of the marginal propensity to consume c_y will have a:

higher value of the Keynesian multiplier $ \mu $ and thus a larger positive impact on the level of real national income and product of an increase $ {\Delta}G $ government purchases

lower value of the Keynesian multiplier $ \mu $ and thus a larger positive impact on the level of real national income and product of an increase $ {\Delta}G $ government purchases

higher value of the Keynesian multiplier $ \mu $ and thus a smaller positive impact on the level of real national income and product of an increase $ {\Delta}G $ government purchases

none of the above

A.1.19: Determinants of the Multiplier

In the so-called IS Curve equation:

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

an increase in the share of income that households spend on imports���an increase in the parameter $ im_y $ is associated with a:

higher value of the Keynesian multiplier $ \mu $ and thus a larger positive impact on the level of real national income and product of an increase $ {\Delta}G $ government purchases

lower value of the Keynesian multiplier $ \mu $ and thus a larger positive impact on the level of real national income and product of an increase $ {\Delta}G $ government purchases

lower value of the Keynesian multiplier $ \mu $ and thus a smaller positive impact on the level of real national income and product of an increase $ {\Delta}G $ government purchases

none of the above

A.1.20: Investment and Interest Rates

In the so-called IS Curve equation:

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

in the flexible-price model, holding other things equal, a decrease in investor "animal spirits"���a fall in the parameter $ I_o $ in the equation determining the level of business investment spending���will cause:

a rise in the domestic long-term risky real interest rate r

a decline in the domestic long-term risky real interest rate r

a rise in the value of the foreign long-term risky real interest rate $ r^f $

none of the above

A.1.21: Investment and Interest Rates

In the so-called IS Curve equation:

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

in the sticky-price model, holding other things equal, a decrease in investor "animal spirits"���a fall in the parameter $ I_o $ in the equation determining the level of business investment spending���will cause:

a decline in the domestic long-term risky real interest rate r

a decline in the level of national income and product Y

a rise in the value of the foreign long-term risky real interest rate $ r^f $

none of the above

A.1.22: Investment and Interest Rates

In the so-called IS Curve equation:

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

in the sticky-price model, holding other things equal, a decrease in investor "animal spirits"���a fall in the parameter $ I_o $ in the equation determining the level of business investment spending���will induce a central bank that is trying to keep national income and product Y from changing either up or down to:

take steps to boost the short-term safe nominal policy interest rate i it controls, and so induce a rise in the domestic long-term risky real interest rate r

take steps to cut the short-term safe nominal policy interest rate i it controls, and so induce a fall in the domestic long-term risky real interest rate r

take steps to boost the short-term safe nominal policy interest rate i it controls, and so induce foreign central banks to react and thus trigger a rise in the value of the foreign long-term risky real interest rate $ r^f $

none of the above

A.1.23: Phillips Curve

In an economy described by the so-called Phillips Curve equation:

$ {\pi_t} = {\pi_t}^e - \beta\left(u_t - u^*\right) $

where inflation expectations are adaptive:

$ {\pi_t}^e = \pi_{t-1} $

a central bank that pushes or lets the unemployment rate fall and stay below its NAIRU for a long period of time will probably:

see a higher rate of inflation at the end of the period than at the start

see a lower rate of inflation at the end of the period than at the start

see about the same rate of inflation at the end of the period than at the start

none of the above

A.1.24: Phillips Curve

In an economy described by the so-called Phillips Curve equation:

$ {\pi_t} = {\pi_t}^e - \beta\left(u_t - u^*\right) $

where inflation expectations are rational:

$ {\pi_t}^e = \pi_t $

a central bank that attempts to push or lets the unemployment rate fall and stay below its NAIRU for a long period of time will probably:

see a higher rate of inflation at the end of the period than at the start

see a lower rate of inflation at the end of the period than at the start

see about the same rate of inflation at the end of the period than at the start

none of the above

A.1.25: Phillips Curve

In an economy described by the so-called Phillips Curve equation:

$ {\pi_t} = {\pi_t}^e - \beta\left(u_t - u^*\right) $

where inflation expectations are adaptive:

$ {\pi_t}^e = \pi_{t-1} $

you can derive the following equation for how inflation evolves over time:

$ {\pi_t} = \pi_{t-1} - \beta\left(u_t - u^*\right) $

$ {\pi_t} = \pi^* - \beta\left(u_t - u^*\right) $

$ {\pi_t} = \pi_{t} - \beta\left(u_t - u^*\right) $

none of the above

A.1.26: Phillips Curve

In an economy described by the so-called Phillips Curve equation:

$ {\pi_t} = {\pi_t}^e - \beta\left(u_t - u^*\right) $

where inflation expectations are a hybrid of static and adaptive:

$ {\pi_t}^e = \lambda\pi^* + (1 - \lambda)\pi_{t-1} $

you can derive the following equation for how inflation evolves over time:

$ {\pi_t} = \pi_{t-1} - \frac{\beta\left(u_t - u^*\right)}{1-\lambda} $

$ {\pi_t} = (1 - \lambda)\pi_{t-1} - \beta\left(u_t - u^*\right) $

$ {\pi_t} = \pi_{t} - \frac{\beta\left(u_t - u^*\right)}{1-\lambda} $

none of the above

A.1.27: Monetary Policy

Consider an economy where the long-term risky real interest rate r is equal to the short-term safe nominal policy rate i controled by the central bank, minus the inflation rate $ �� $, plus the spread $ \rho $ between the interest rate at which businesses can borrow long-term and the interest rate at which the government can borrow short term. If there is thought to be only a negligible chance that the central bank will ever wish that it could lower its policy rate i below zero, a prudent central bank should probably:

focus on keeping inflation at a moderate level so that it can reduce r to negative values on occasion

focus on keeping inflation low and stable so as not to make economic calculation more unpredictable

ignore inflation and focus on keeping unemployment from rising above the natural rate

none of the above

A.1.28: Monetary Policy

Consider an economy where the long-term risky real interest rate r is equal to the short-term safe nominal policy rate i controlled by the central bank, minus the inflation rate $ �� $, plus the spread $ \rho $ between the interest rate at which businesses can borrow long-term and the interest rate at which the government can borrow short term. If there is thought to be a substantial chance that the central bank will ever wish that it could lower its policy rate i below zero, a prudent central bank should probably:

focus on keeping inflation at a moderate level so that it can reduce r to negative values on occasion

focus on keeping inflation low and stable so as not to make economic calculation more unpredictable

ignore inflation and focus on keeping unemployment from rising above the natural rate

none of the above

A.1.29: Monetary Policy

The principal reason that then-Federal Reserve Chair Alan Greenspan was largely unworried about speculation in housing and the rise in housing prices in the mid-2000s was probably:

he believed the Federal Reserve had the tools to prevent even a large financial crisis in housing finance from having large effects raising the interest rate spread $ \rho $ and lowering business "animal spirits" $ I_o $

he believed that a large financial crisis in housing finance having large effects raising the interest rate spread $ \rho $ and lowering business "animal spirits" $ I_o $ would be ultimately beneficial because it would see irrational speculators with bad judgment replaced by prudent managers, and their would be long-term gain for short-run pain

he believed that there were very large benefits from a large expansion of America's housing stock, even if those who financed that expansion wound up bankrupt

none of the above

A.1.30: Monetary Policy

From 1979 to 1982 the principal reason that then-Federal Reserve Chair Paul Volcker raised interest rates high and kept them high was probably because:

he believed that inflation expectations were rational and thus that he could reduce inflation without seeing a significant or long lasting rise in unemployment

he believed that inflation of between 5% and 10% per year had a serious effect reducing investment and thus slowing long run growth

he believed it was very important to make inflation expectations a hybrid of static and adaptive rather than see them become a hybrid of adaptive and rational because the second would produce a very unstable economy

none of the above

A.2: Calculations

A.2.1: Solow Growth Model

On December 19, 2017, economist Robert Barro of Harvard University wrote https://tinyurl.com/dl20180428d that the effects on economic growth of Donald Trump and the Republicans' TCJA would raise real GDP Y in the long run by 7% and over ten years by 2.8% because:

[with] a capital share of income of 40%, the convergence rate in the neoclassical growth model would be around 5% per year... [with] the long-run 7% change... after ten years, the level of real per capita GDP is higher by 2.8%.

Let's suppose that we have a SGM economy with a savings share of 24%, an efficiency of labor growth rate of 1.5% per year, a population growth rate of 1% per year, and a depreciation rate of 3.5% per year. With a capital share production function parameter $ \alpha $ of 40%, what is the rate of annual convergence to the steady-state balanced-growth path in the SGM? How high would the sum of the efficiency of labor growth rate of 1.5% per year, the population growth rate of 1% per year, and the depreciation rate have to be to generate a rate of annual convergence of 5% per year? What does Barro's claim of a 7% long run boost to output per worker along the steady-state balanced-growth path require for the steady-state balanced-growth path capital-output ratio? How big a jump in the savings rate s would that require?

In the code cell below, set the variables:

convergence_rate

required_sum

required_KoverY

required_savings

to the answers to these four corresponding questions.

Relevant equations from the SGM framework are:

$ \left(\frac{K}{Y}\right)^* = \frac{s}{n+g+\delta} $

:: steady-state balanced-growth capital-output ratio

$ \frac{Y_t}{L_t} = \left(\frac{K_t}{Y_t}\right)^\left(\frac{\alpha}{1-\alpha}\right)\left({E_o}e^{gt}\right) $ :: output per worker as a function of the capital-output ratio

$ \frac{K_t}{Y_t} = \left(1- e^{-(1-\alpha)(n+g+\delta)t}\right)\left(\frac{K}{Y}\right)^* + \left(e^{-(1-\alpha)(n+g+\delta)t}\right)\left(\frac{K_o}{Y_o}\right) $

:: convergence to the steady-state balanced-growth capital-output ratio

A.2.2: Greece

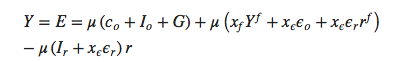

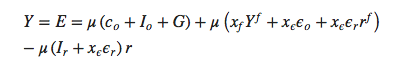

Countries sometimes choose to use monetary policy to fix their exchange rate at some value $ \epsilon^* $. in the case of Greece in this millennium, it has chosen to be part of the eurozone and so has given up all independent freedom of action to alter the long-term real risky interest rate r in Greece's IS Curve equation:

Instead of choosing r, the requirement that the exchange rate be $ \epsilon^* $ forces the interest rate to be:

$r = r^f - \frac{\epsilon^* - \epsilon_o}{\epsilon_r} $

The higher are foreign interest rates $ r^f $, the higher the domestic interest rate has to be; the higher are foreign exchange rate speculators' beliefs $ \epsilon_o $ about the fundamental value of foreign currency, the igher the domestic interest rate has to be; and the higher is the value of foreign currency that the country has set its currency peg to, the lower can the domestic interest rate r be. If you substitute this exchange peg maintaing value of r into the IS Curve equation, you get:

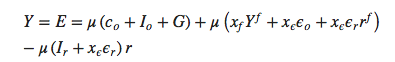

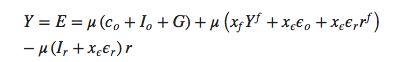

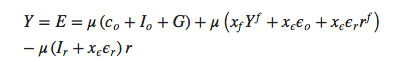

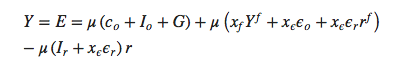

$ Y = E = \mu\left(c_o + I_o + G\right) + {\mu}x_f{Y^f} + {\mu}\left(x_{\epsilon} + \frac{I_r}{\epsilon_r}\right){\epsilon}^* - \frac{{\mu}{I_r}{\epsilon_o}}{\epsilon_r} - {\mu}I_r{r^f}$

The first half of this equation���through the $ {\mu}x_f{Y^f} $ term���is the same as the IS Curve equation. But the second half of the equation tells us that:

The more valuable is the domestic currency at the peg���the lower is $ \epsilon^* $���the lower is national income and product Y. Why? Because a higher value of domestic currency at the peg discourages exports directly, and also requires a higher domestic real interest rate to balance supply and demand for foreign exchange at that peg, and that higher rate discourages investment.

The less confident are foreign exchange speculators in the domestic currency���the higher is $ \epsilon_o $���the lower is Y. Why? Because foreign exchange speculators less confident about the peg also requires a higher domestic real interest rate to balance supply and demand for foreign exchange at that peg, and that higher rate discourages investment.

The higher are interest rates abroad $ r^f $, the lower is Y. Why? Because the domestic interest rate must rise and fall with foreign interest rates in order to maintain the currency peg, and so a higher value of interest rates abroad requires a higher domestic real interest rate to balance supply and demand for foreign exchange at that peg, and that higher rate discourages investment.

Why did Greece not expand government purchases���not raise G���when the second wave of the financial crisis hit it in 2010? Because���accurate���beliefs that Greek fiscal policy was unsustainable led foreign exchange speculators to tie their beliefs about $ \epsilon_o $ to the level of government purchases and taxes. Let's write down an equation for these beliefs:

$ \epsilon_o = \gamma_o - \gamma_GG $

If $ I_r =10 $ and if $ \epsilon_r = 4 $, what is the value of the parameter $ \gamma_G $ at which Greece would have been correct not to increase government purchases���at which increases in Greek government purchases in 2010 and after would have not increased Y, and above which increases in government purchases would have reduced Greek national income and product Y? Set the variable

PS13A22-critical_gamma_g

in the code cell below equal to that value.

(All this, of course, assumes that Greece is going to���for whatever reason���stay in the eurozone and thus maintain its currency peg. Which it did.)

A.3: Essay

A.3.1: U.S. Policy Dilemmas Today

The major question in American macroeconomic policy today is whether the United States should raise its inflation target above 2%. What do you think about this issue? Use material taught in this course to buttress your argument where appropriate. Alternatively, attack material taught in this course as unhelpful or misleading in terms of thinking about this problem.

We will read at most 400 words. So think, write that many, and then stop.

April 26, 2018

Your Own Private Intellectual Elysium: Delong Morning Coffee Podcast

By judiciously muting and blocking people you can create a truly useful individual Internet feed. The problem is that that does nothing to produce a truly useful functioning intellectual community. And that is what we really need...

Your Own Private Intellectual Elysium

Thx to Wavelength and the very interesting micro.blog http://delong.micro.blog/2018/04/21/your-own-private.html

Text: http://www.bradford-delong.com/2018/03/creating-your-own-private-internet-intellectual-elysium.html

Every country has its depressed regions, dominated by cul...

Every country has its depressed regions, dominated by cultures that cling to habits of thought and cultural patterns that no longer take advantage of local resources and global markets and so deprive them of opportunity, wealth, and happiness: its mezzogiorno, its Ostmark, its Appalachia. Yet only in America today does it seem to amount to half a country, and have a plutocratic poiltical party fighting hard to enlarge it: Noah Smith: Zero-Sum Thinking Makes Our Fights Much Nastier: "Universities, meanwhile, continue to be the engine of American technological dominance...

...But they are increasingly under attack from conservatives who worry they serve as engines of liberal indoctrination, causing Republicans to threaten to cut their funding. Strangling the world���s best university system might make the U.S. a bit less liberal, but it would certainly make the country significantly poorer. In all of these cases, zero-sum thinking is replacing the win-win thinking that prevailed throughout much of the 20th century. In a world of slow growth, inequality and reduced opportunity, there���s a seductive tendency to think that one can only be enriched if one���s neighbor is beggared. The danger is that policy becomes something like war was for our ancestors���a struggle of interest group against interest group that ends up harming all the groups at once. Our ancestors spent millennia trapped in a self-destructive cycle of constant warfare. Let���s try not to get trapped in a cycle of bitter zero-sum policy battles. In such a world, there are no real winners...

#shouldread

Republicans purge every thinker who was correct. Republic...

Republicans purge every thinker who was correct. Republican economists who were right about 2007-2012 are now, as best as I can see, all ex-Republican economists. And the same dynamic has long been working in the national security space: Gene Healy (2015): Think Tanks and the Iraq War: "It would be even better if the GOP���s 2016 contenders weren���t still, 12 years later, so eager to seek foreign policy advice from people who got the Iraq War Question spectacularly wrong...

...You might suspect that there���s just no accountability for GOP foreign policy advisers; but that isn���t so. The Wall Street Journal��recently reported that ���Elbridge Colby, a fellow at the Center for a New American Security, was being seriously considered for a job as foreign policy director in Mr. Bush���s expanding organization, [but] according to a person familiar with the campaign���s internal deliberations, Mr. Bush���s political operation raised concerns about Mr. Colby���s published views on Iran.��Mr. Colby has prominently��advocated against a military strike on Iran��and has called for the Republican Party to move closer to its roots of pragmatism and containment.��� So he���s out. You can���t expect to retain your political and professional credibility after a screw-up like that...

#shouldread #hoisted #mondaysmackdown

Economic history becomes BIG DATA: Ran Abramitzky, Roy Mi...

Economic history becomes BIG DATA: Ran Abramitzky, Roy Mill, and Santiago P��rez: Linking Individuals Across Historical Sources: a Fully Automated Approach: "Linking individuals across historical datasets relies on information such as name and age that is both non-unique and prone to enumeration and transcription errors...

...These errors make it impossible to find the correct match with certainty. We suggest a fully automated method for linking historical datasets that enables researchers to create samples that minimize type I (false positives) and type II (false negatives) errors. The first step of the method uses the Expectation-Maximization (EM) algorithm, a standard tool in statistics, to compute the probability that each two observations correspond to the same individual. The second step uses these estimated probabilities to determine which records to use in the analysis. We provide codes to implement this method...

#shouldread

Never forget how pig-ignorant stupid the High Priests of ...

Never forget how pig-ignorant stupid the High Priests of Liquidationist Chicago were in 2009: Paul Krugman (2009): The lost generation: "Matthew Yglesias catches Eugene Fama making a strange assertion...

...Beginning in the early 1980s, the developed world and some big players in the developing world experienced a period of extraordinary growth. It���s reasonable to argue that in facilitating the flow of world savings to productive uses around the world, financial markets and financial institutions played a big role in this growth.

The assertion about developed countries is, of course, entirely wrong.... And as Matt points out, the giant success story in the developing world was China, where the driver was the end of Communism���not modern finance. Actually, it���s even more absurd to give finance the credit than Matt realizes: China has not been experiencing net inflows of capital, partly because it has maintained capital controls, effectively insulating itself from the whole finance thing.

So why does Fama believe that something wonderful happened around 1980? Part of it, I suspect, is that in his milieu the politically correct thing is to pretend that nothing good happened until Reagan came along. And this has a truly weird effect in the American context: the best quarter-century of growth America has ever experienced, the postwar generation���which happens to be the era during which many of the founders of neoconservatism came of age!���has gone down the memory hole. After all, it���s impossible that living standards would double under a regime of high marginal tax rates, generous minimum wages, and strong unions. So it just didn���t happen...

#mondaysmackdown #shouldread #hoisted #darkageofeconomics

This phenomenon is truly deplorable, on many levels: Gill...

This phenomenon is truly deplorable, on many levels: Gillian Tett: True believers: why US evangelicals support Trump: "80 per cent of white evangelicals voted for him in the 2016 election...

...a higher proportion than backed Ronald Reagan or George W Bush (a self-styled evangelical).... Some 75 per cent of white evangelicals approve of Trump, compared with 42 per cent among the wider population. Moreover, that approval rate has risen over the past year.... Some evangelicals also seem willing to overlook Trump���s personal behaviour in the hope that he will deliver the goods for them on policy.... Tripodi found that evangelicals were reading the ���news��� very diligently and seriously.... Evangelicals... consumed... Trump���s speeches, videos and tweets, and then discussed and interpreted them.... The challenge with America today is not just that different people are watching different types of news; it���s that they are interpreting it in different ways.... Don���t presume that Trump will lose fans just because of the endless stories playing on (some) television channels about Stormy Daniels or Russian scandals.

#shouldread

A question: if "other religious measures had no direct effect on how likely someone was to vote for Trump" once one had accounted for whether somebody believed "The federal government should declare the United States a Christian nation", why call this a religious belief, rather than deplorable as simply pro-white���anti-Muslim anti-Jewish anti-Hindu���and anti-Black and anti-Hispanic as well?: Andrew L. Whitehead, Joseph O. Baker and Samuel L. Perry: Despite porn stars and Playboy models, white evangelicals aren���t rejecting Trump. This is why: "Why are religious individuals and groups that previously decried sexual impropriety among political leaders suddenly willing to give Trump a 'mulligan' on his infidelity?...

...Voters��� religious tenets aren���t what��is behind Trump support; rather, it���s Christian nationalism���their view of the United States as a fundamentally Christian nation.... To measure Christian nationalism, we combined responses to six separate questions that ask whether respondents agree or disagree with these statements: ���The federal government should declare the United States a Christian nation���.... The more someone believed the United States is���and should be���a Christian nation, the more likely they were to vote for Trump.... Americans��� religious beliefs, behaviors and affiliation did not directly influence voting for Trump. In fact, once Christian nationalism was taken into account, other religious measures had no direct effect on how likely someone was to vote for Trump. These measures of religion mattered only if they made someone more likely to see the United States as a Christian nation....

Many white Christians believe Trump may be an effective instrument in God���s plan for America, even if he is not particularly religious himself. In the upcoming midterm elections, Trump and other politicians will keep emphasizing Christian nationalism. After all, it works. White Christian America is unquestionably in demographic decline. But one of its primary cultural creations���Christian nationalism���will continue influencing��U.S. politics and society for decades to come, particularly in response to waning demographic and social dominance. It���s a worldview that can���t be undermined, even by porn stars and Playboy models.

#shouldread

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers