J. Bradford DeLong's Blog, page 268

December 12, 2018

Fairly Recently: Must- and Should-Reads, and Writings... (December 12, 2018)

Two Differences Between a Clinton Administration and a Trump Administration...: Overwhelmingy, those writing opeds and releasing studies boosting last year's Trump-McConnell-Ryan corporate tax cut knew that the forecasts they made last year were overwhelmingly likely to be wrong. So they are not surprised when they turn out to be wrong. And they do not even think it worthwhile to go through the motions of pretending to be surprised that the investment share of national income and product in 2012 dollars is 18% and not 22%. So I say to Binyamin Applebaum, and to other reporters who wrote up���much less critically then they should have���what the administration was saying and what corporate tax cut-boosting economists from Barro to Taylor and company were saying last year: remember: "fool me once, shame on you; fool me twice, shame on me"...

Hoisted from the Archives: Matthew Yglesias: The Lies, The Lies of Andrew Sullivan

Fall 2018 Econ 101b Exam: U.C. Berkeley

Note to Self: Watching Niskanen Center Live Stream: "Starting Over: The Center-Right After Trump...

Cosma Shalizi (1998): Psychoceramics: "Psychoceramics could... play a... role... analogous to that of lesion studies in neuropsychology. A working intellectual discipline, like probability theory or Sanskrit philology, has mechanisms which keep it from going off the rails, and keep cranks from taking over; most of the time and on balance, they produce reliable knowledge. This is manifestly not the case outside the bounds of such disciplines... #orangehairedbaboons #publicsphere #cognitive

Ezra Klein: Political Tribalism in Trump���s America: What Andrew Sullivan Gets Wrong: "I knew when we launched Vox that there would be criticisms I didn���t anticipate, but I���ll admit, I never foresaw one of them being that writing explainers doesn���t satisfyingly replace the role of religion in people���s lives. Yet here we are.... That���s Andrew Sullivan writing in New York magazine, and while the column caught my attention for that line, which I will now have needlepointed on a pillow, the broader piece is wrong in more important, less amusing, ways... #shouldread #orangehairedbaboons #journamalism

Always remember that Andrew Sullivan glories in misleading the public by telling them lies: "The Krugmans and the Chaits will shortly have a cow, if not a whole herd of them.... To which my response is: Hoorah.... Commentators... get steamed because Bush has... claimed his tax cut will cost less than it actually will... is using Medicare surplus money today that will be needed tomorrow and beyond.... The fact that Bush has to obfuscate his real goals of reducing spending with the smoke screen of 'compassionate conservatism' shows how uphill the struggle is." When somebody tells you he is an evil, deceptive f---, believe him: HOLLYzoy: Besides @ezraklein 's Point About Andrew Sullivan, a Few Others: "'But the banality of the god of progress, the idea that the best life is writing explainers for Vox in order to make the world a better place, never quite slakes the thirst for something deeper'. I think that sneering at this impulse makes sense only if you don't ask the people involved what 'making the world better' means. Suppose you thought: democracy is the best political system. But it requires a reasonably informed citizenry to work. It's always hard for people to be adequately informed (they have lives.) But doubly so now, when entire networks etc. are actively trying to mislead them. Then those of us who have a knack for it should try to step up, and make it easier. How is this shallow or banal? If done right, it is a way of supporting democracy, and of empowering our fellow citizens. It also helps them to spot demagogues and charlatans. If you think that democracy is an inspiring ideal (I do), then this is an inspiring thing to do... #orangehairedbaboons #journamalism #publicsphere

Philo: On the Cherubim: "Is my mind my own private possession? It is a creator of lies, a founder of wandering, of paranoia...

How did Evangelicals miss the memo that God saves you later only if you save the image of God in your neighbor today?: "Lord, when saw we thee an hungred, or a thirst, or a stranger, or naked, or sick, or in prison, and did not minister unto thee?": Ronald Brownstein: Trump's Coalition Is Cracking: "Evangelical Christians this year comprised fully 45% of all white voters without a college degree, a substantial portion of the total electorate. By contrast, evangelicals represented only one-fourth of college-educated white voters. (In 2016, the exit polls found that evangelicals constituted slightly larger shares of each group.) In all of the southern states where the question was asked this year, evangelicals represented a majority of working-class white voters, including fully two-thirds in Georgia and Tennessee. Evangelicals were also a majority of white working class voters in West Virginia and Indiana and exactly half in Missouri... #orangehairedbaboons

Principles of Neoliberalism: .Neoliberalism is many things...

Allin Cottrell (2003): Word Processors: Stupid and Inefficient

Kieran Healy: The Plain Person���s Guide to Plain Text Social Science

Daniel Donner: Requiem for a California Dream: "It is especially delicious, then, to watch the real-time collapse of the Republican Dream in California���and specifically Orange County���as the state party���s power shrivels into a desiccated lump of greenish oatmeal. Meanwhile, California as a whole enjoys its status as one of the most diverse and dynamic states in the country, with a thriving combination of culture and��creativity���and, yes, taco stands on many corners, if not every one���making it one of the most desired regions in the world in which to live, work, or play... #politics #california #orangehairedbaboons

Paul Krugman: Botching the Great Recession: "The acute phase of the financial crisis... was relatively brief... scary and did immense damage���America lost 6 �� million jobs in the year after Lehman fell. But... measures of financial stress fell off rapidly in 2009, and were more or less back to normal by the summer. Rapid financial recovery did not, however, produce rapid recovery for the economy as a whole. As the same figure shows, unemployment stayed high for many years...

TV Tropes: [Literature/Badass Creed(https://tvtropes.org/pmwiki/pmwiki.ph...): "The millennia-old messenger golem Anghammarad remembers a badass version of the A-M Post Office motto from the dawn of time: 'Neither Deluge Nor Ice Storm Nor The Black Silence Of The Netherhells Shall Stay These Messengers About Their Sacred Business. Do Not Ask Us About Sabre-Tooth Tigers, Tar Pits, Big Green Things With Teeth Or The Goddess Czol.' Inevitable question: The Goddess Czol? Anghammarad: Do Not Ask...

The first occurrence of "Be still my heart!": Homer: The Odyssey: "Ulysses lay wakefully brooding upon the way in which he should kill the suitors; and by and by, the women who had been in the habit of misconducting themselves with them, left the house giggling and laughing with one another.... His heart growled within him... But he beat his breast and said, 'Heart, be still, you had worse than this to bear on the day when the terrible Cyclops ate your brave companions; yet you bore it in silence till your cunning got you safe out of the cave...'

Noah Smith: Trump's Embrace of Tariffs Hurts U.S. Consumers More Than China: "Trump���s goal of making the U.S. more competitive isn���t bad, but he needs to stop using bad tools. Tariffs... raise costs for American manufacturers and prices for American consumers. Tariff Man needs to cool his jets...

Noah Smith: Trump's Embrace of Tariffs Hurts U.S. Consume...

Noah Smith: Trump's Embrace of Tariffs Hurts U.S. Consumers More Than China: "Trump���s goal of making the U.S. more competitive isn���t bad, but he needs to stop using bad tools. Tariffs... raise costs for American manufacturers and prices for American consumers. Tariff Man needs to cool his jets...

#shouldread

Paul Krugman: Botching the Great Recession: "The acute ph...

Paul Krugman: Botching the Great Recession: "The acute phase of the financial crisis... was relatively brief... scary and did immense damage���America lost 6 �� million jobs in the year after Lehman fell. But... measures of financial stress fell off rapidly in 2009, and were more or less back to normal by the summer. Rapid financial recovery did not, however, produce rapid recovery for the economy as a whole. As the same figure shows, unemployment stayed high for many years...

...Why didn���t financial stability bring a rapid bounceback? Because financial disruption wasn���t at the heart of the slump. The really big factor was the bursting of the housing bubble���of which the banking crisis was a symptom.... The housing bust led directly to a dramatic drop in residential investment, enough in itself to produce a deep recession, and recovery was both slow and incomplete.... What should we have done to produce a faster recovery? Private spending was depressed; monetary policy was ineffective because we were at the zero lower bound on interest rates. So we needed fiscal expansion, some combination of spending and tax cuts. And we did, of course, get the ARRA���the Obama stimulus. But it was too small and, even more important, faded out much too quickly....

Why, then, didn���t we get the fiscal policy we should have had? There were, I���d say, multiple villains.... First, we can argue whether the Obama administration could have gotten more; that���s a debate we���ll never see resolved. What is clear, however, is that at least some key Obama figures were actively opposed to giving the economy the support it needed. ���Stimulus is sugar,��� snapped Tim Geithner at Christina Romer.... Very Serious People pivoted very early from concern about the unemployed���hey, they probably lacked the necessary skills���to hysteria over deficits. By 2011, unemployment was still over 9 percent, but all the Beltway crowd wanted to talk about was the menace of the debt. Finally, Republicans blocked attempts to rescue the economy... claimed that this was because they cared about fiscal responsibility���but it was obvious to anyone paying attention (which unfortunately didn���t include almost anyone in the news media) that this was an insincere, bad-faith argument..... The end result was that policy moved quickly and fairly effectively to rescue banks, then turned its back on mass unemployment. It���s a story that���s both sad and nasty. And there���s every reason to believe that if we have another crisis, it will happen all over again...

#shouldread

Daniel Donner: Requiem for a California Dream: "It is esp...

Daniel Donner: Requiem for a California Dream: "It is especially delicious, then, to watch the real-time collapse of the Republican Dream in California���and specifically Orange County���as the state party���s power shrivels into a desiccated lump of greenish oatmeal. Meanwhile, California as a whole enjoys its status as one of the most diverse and dynamic states in the country, with a thriving combination of culture and��creativity���and, yes, taco stands on many corners, if not every one���making it one of the most desired regions in the world in which to live, work, or play...

...In the state���s House delegation, the collapse is especially stunning. The high point for the California GOP came with the re-election of Pete ���I Am Not A Racist��� Wilson as governor as he campaigned��for the indisputably racist Proposition 187, in 1994, the year of the Angry White Male (oh, hindsight). Prop 187 coincided with a shift in the political preferences of Latinos even more toward��Democrats, and an increase in Latino political participation; while causation is difficult to prove, alternate explanations are hard to come by.

Since then, there has been neither a will nor a way for California Republicans to reverse course to any meaningful extent. Addicted to their hateful rhetoric, they have effectively sent themselves into a death spiral as the demographics of the electorate have changed.

Which brings us to this year. In January there will be fewer House Republicans from California than there were in the 1920s, when California only had 11 representatives total. Orange County, the conservative paradise, has been wiped clean of House Republicans. A brief survey of recent writings about the GOP���s fate in California yields the terms ���wipeout,��� ���irrelevance,����� ���dead,��� ���toxic,��� ���debacle,��� ���annihilation,��� and ���devastation���...

#shouldread #politics #california #orangehairedbaboons

Fall 2018 Econ 101b Exam: U.C. Berkeley

We expect that this will take you 90 minutes���but we will not kick you out after that time span... Open book, open devices, open internet���everything except conversing interactively with another Turing-Class entity... Do your work in your bluebook... Be calm: from your performance in the course so far, we are confident that you have (largely) got this...

Good luck!

Write your name, your section number, and your section leader on the front and at the top of the first page of your bluebook.

Make the first page of your bluebook an answer page for parts A and B so that we can quickly grade the exam���on that page write "A1:", "A2:", "A3:...", etc., and "B1:", "B2:", "B3:", etc., on successive rows of the page, and then write the answer you pick or the quantity you calculate next to each label...

Solow Growth Model

We have the Solow Growth Model (SGM) system of equations:

$ \frac{d\left(L_t\right)}{dt} = nL_t $ :: labor-force growth equation

$ \frac{d\left(E_t\right)}{dt} = gE_t $ :: efficiency-of-labor growth equation

$ \frac{d\left(K_t\right)}{dt} = sY_t - \delta{K_t} $ :: capital-stock growth equation

$ Y_t = \left(K_t\right)^{\alpha}\left(L_tE_t\right)^{1-\alpha} $ :: production function

Business Cycle Models

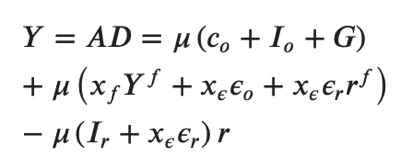

The key filing system and checklist to use in understanding how an economy subject to business cycle shocks behaves in both the flexible-price and sticky-price models is our IS Curve equation:

Where:

$ Y^* $ is the level of potential output

$ Y $ is the level of national income and product

$ \mu $ is the so-called Keynesian multiplier

$ c_o $ is our measure of consumer confidence

$ I_o $ is our measure of corporate investment committe optimism���of business "animal spirits"

$ G $ is the level of government purchases

$x_f $ is the responsiveness of exports to a change in foreigners' incomes

$ Y^f $ is national income and product abroad

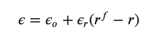

$ x_{\epsilon} $ is the responsiveness of exports to a shift in the exchange rate

$ {\epsilon}_o $ is foreign exchange speculators' assessment of the long-term fundamental value of the exchange rate $ \epsilon $

$ {\epsilon}_r $ is the responsiveness of the exchange rate to the differential between foreign and domestic interest rates

$ r^f $ is the foreign interest rate

$ I_r $ is the responsiveness of investment to the domestic real interest rate $ r $

$ r $ is the long-term risky real domestic interest rate

$ c_y $ is the marginal propensity to consume

$ t $ is the marginal tax rate on income

$ im_y $ is the marginal propensity to import

Plus the other equations and variables of the business-cycle model:

$ \mu = \frac{1}{1-c_y(1-t)+im_y} $ is the Keynesian multiplier

$ r = i - \pi + \rho $ is the interest-rate determination equation

$ C = c_o + c_y(1-t)Y $ is the consumption function

$ I = I_o - I_{r}r $ is the level of investment

$ IM = im_y{Y} $ is the level of imports

$ GX = x_fY^f + x_{\epsilon}{\epsilon} $ is the level of gross exports

�� = ��o + ��r(r - rf) is the exchange rate

$ Y = C + I + G + (GX - IM) $ is national income and product circular-flow

$ i $ is the short-term safe nominal interest rate that the central bank controls

$ �� $ is the inflation rate

$ \rho $ is the risk and term premium financial markets charge for lending long to risky businesses rather than lending short to a stable government possessing exorbitant privilege

Recall that the key difference between the flexprice and the sticky-price versions of our business-cycle model is that:

in the flexprice version national income and product Y is always in equilibrium equal to potential output Y*: the real wage quickly adjusts to make production equal to potential; the price level quickly adjusts to make aggregate demand and spending equal to production; the real interest rate quickly adjusts to balance the flow-of-funds through financial markets.

in the sticky-price version none of these three prices move quickly and substantially enough to play a significant role in pushing the economy to its short-run equilibrium. Instead, rising or falling inventories induce firms to fire or hire people which decreases or increases production and incomes until inventories are stable and aggregate demand equals national income and product. Potential output is nowheresville in the sticky-price version.

Part A: Multiple Choice Questions

2 mins each

1. Long-Run Capital-Worker Ratio

If the model parameters s, n, g, ��, and �� remain constant at their initial time-0 values, toward what path is output-per-worker $ K_t/L_t $ converging in the long run? Write "A1:" followed by the letter of the correct answer in your bluebook:

A $ \lim\limits_{t\to\infty}\left(\frac{K_t}{L_t}\right) = \left(\frac{s}{n+g+\delta}\right)\left(E_0{e^{gt}}\right) $

B $ \lim\limits_{t\to\infty}\left(\frac{K_t}{L_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{1}{1-\alpha}}\left(E_0{e^{gt}}\right) $

C $ \lim\limits_{t\to\infty}\left(\frac{K_t}{L_t}\right) = \left(\frac{s}{n+g+\delta}\right)^{\frac{\alpha}{1-\alpha}}\left(E_0{e^{gt}}\right) $

D $ \lim\limits_{t\to\infty}\left(\frac{K_t}{L_t}\right) = \left(\frac{s{\alpha}}{n+g+\delta}\right)\left(E_0{e^{gt}}\right) $

E none of the above/cannot be determined from the information given

2. An Increase in Population Growth and Savings

If, in a SGM economy, the savings rate s and the population growth rate n both increase by the same proportional amount, the steady-state balanced-growth path values of capital per worker will:

A. increase

B. decrease

C. stay the same

D. increase unless both (a) capital is completely durable and does not depreciate and (b) the efficiency-of-labor is absolutely constant

E. none of the above/cannot be determined from the information given

3. An Increase in the Production Function Parameter $ \alpha $

Comparing two SGM economies with otherwise-identical parameter values, the one with a higher value of the production function parameter $ \alpha $ will have:

A. faster convergence to its steady-state balanced-growth path and a higher level of output per worker along its steady-state balanced-growth path

B. faster convergence to its steady-state balanced-growth path and a lower level of output per worker along its steady-state balanced-growth path

C. the same speed of convergence to its steady-state balanced-growth path and a higher level of output per worker along its steady-state balanced-growth path

D. slower convergence to its steady-state balanced-growth path and a lower level of output per worker along its steady-state balanced-growth path

E. none of the above/cannot be determined from the information given

4. Malthusian Economies: $ \alpha $

Comparing two Malthusian economies that are both on their steady-state balanced-growth paths and that otherwise have identical parameter values and identical initial values of the efficiency-of-labor at time zero Eo, the one with a higher level of the parameter h describing how rapidly productive ideas are generated will:

A. have a faster-growing population but the same level of output-per-worker than the other

B. have a faster-growing population and a faster growing level of output-per worker than the other

C. have a faster-growing population and a slightly-higher level of output-per-worker than the other

D. have a faster-growing population and a much higher level of output-per-worker than the other

E. none of the above/cannot be determined from the information given

5. Malthusian Economies

The failure of all the useful and productive ideas developed by humanity over the course of the long Agrarian Age���from 5000 BC to 1800 AD���to produce any significant boost to the standard of living of the typical human is primarily due to:

A. the failure of legal systems to provide sufficient protection for patents and copyrights

B. the strong positive relationship between standards of living and population growth

C. wars that kept the capital stock from growing sufficiently rapidly

D. the fact that it was much more rewarding for smart and aggressive people with resources to focus their energy on the win-lose struggle to make domination more effective than on the win-win task of making production more efficient

E. none of the above/cannot be determined from the information given

6. Malthusian Economies

In a Malthusian economy in which the ideas stock H grows at a proportional rate h, in which the natural-resource stock N is constant, and in which the efficiency-of-labor E is given by:

$ E_t = \left(H_t\right)^\left(\frac{\gamma}{1+\gamma}\right)\left(\frac{N_t}{L_t}\right)^\left(\frac{1}{1+\gamma}\right) $

Suppose the economy is initially on its steady-state balanced-growth path, and then the rate of generation of ideas parameter h undergoes a sudden, immediate, discontinuous, and permanent upward jump. After this jump, along this economy's balanced-growth path:

A. the population growth rate n will be less than $ \gamma $ times the growth rate h of the ideas stock

B. the population growth rate n will be the same as $ \gamma $ times the growth rate h of the ideas stock

C. the population growth rate n will be more than $ \gamma $ times the growth rate h of the ideas stock

D. the population growth rate n will be greater than the growth rate h of the ideas stock if $ \gamma > 1 $, and the population growth rate n will be less than the growth rate h of the ideas stock if $ \gamma < 1 $

E. none of the above/cannot be determined from the information given

7. Divergence

Suppose that we are trying to account for the 49-to-1 divergence in productivity levels and living standards across the globe today using the SGM, and assuming that economies are on their steady-state balanced-growth paths. Assume also that divergence across economies in capital-output ratios is perfectly correlated with divergence in efficiency-of-labor levels, and that all countries now are equal in their labor force growth, efficiency-of-labor growth, and depreciation rates. If the capital share parameter in the production function $ \alpha = 1/3 $ and if the divergence in efficiency-of-labor levels across countries is 7-to-1, how large a divergence in savings rates would be needed to account for observed global cross-country inequality?

A. 7-to-1

B. 49-to-1

C. $ \sqrt{7}$-to-1

D. none: the divergence in efficiency of labor levels does the job

E. none of the above/cannot be determined from the information given

8. Divergence

Suppose again that we are trying to account for the 49-to-1 divergence in productivity levels and living standards across the globe today using the SGM, and assuming that economies are on their steady-state balanced-growth paths. Assume also that divergence across economies in capital-output ratios is perfectly correlated with divergence in efficiency of labor levels, and that all countries now are equal in their labor force growth, efficiency of labor growth, and depreciation rates. If the capital share parameter in the production function $ \alpha = 2/3 $ and if the divergence in capital-output levels across countries is 7-to-1, how large a divergence in efficiency-of-labor levels would be needed to account for observed global cross-country inequality?

A. 7-to-1

B. 49-to-1

C. $ \sqrt{7}$-to-1

D. none: the divergence in capital-output levels does the job

E. none of the above/cannot be determined from the information given

9. Divergence...

What economist Richard Baldwin calls the "Ancient Seven" economies���China; what are now India and Pakistan and Bangladesh; what are now Iraq and Syria; Iran; what is now Turkey; what are now Italy and Greece; and Egypt���dominated the pre-Industrial Revolution world in terms of their shares of total world product predominantly because:

A. they had uniquely advantageous positions located on major world trade routes, so they had higher levels of the efficiency-of-labor

B. they had more and more fertile agricultural land���much more ample stocks of natural resources���than anywhere else

C. their high civilizations were more sophisticated and generated more ideas useful for production than anyplace else, so they had higher levels of the efficiency-of-labor

D. all of the above are not implausible possible scenarios

E. none of the above/cannot be determined from the information given

10. An Adverse Supply Shock

Suppose, in the flexible-price business cycle model, an adverse supply shock reduces potential output by an amount $ {\Delta}Y^* $. Suppose nothing else in the economic environment changes. Suppose that there are no changes in fiscal policy to government purchases or the tax rate.

Which of the following happens to the economy?

A. Consumption spending goes down by $ {\Delta}C = (c_y - im_y){\Delta}Y^* $

B. Investment spending goes down by $ {\Delta}I = $

$ -\frac{I_r}{I_r + x_{\epsilon}{\epsilon}_r}{\Delta}Y^* $

and the interest rate goes up by:

$ {\Delta}r = \frac{{\Delta}Y^*}{I_r + x_{\epsilon}{\epsilon}_r} $

C. The fall in national income forces a reduction in government purchases of $ {\Delta}G = - {\Delta}Y^* $

D. The interest rate goes up by $ {\Delta}r = \frac{{\Delta}Y^*}{\mu(I_r + x_{\epsilon}{\epsilon}_r)} $

E. none of the above/cannot be determined from the information given

11. A Decline in Business Animal Spirits

In the flexprice IS Curve equation:

with the Keynesian multiplier:

$ \mu = \frac{1}{1 - (1-t)c_y + im_y} $

holding other things equal, a decrease in investor "animal spirits"���a fall in the parameter $ I_o $ in the equation determining the level of business investment spending���will cause:

A. a fall in investment spending I, no change in the domestic interest rate, no change in exports or government purchases, but a fall in imports and consumption spending

B. a fall in investment spending I, a rise in the domestic interest rate r to generate the fall in investment spending, a fall in the value of the dollar���the home currency���a rise in exports, and no change in government purchases, imports, or consumption spending

C. a fall in investment spending I, a fall in the domestic interest rate r, a fall in the value of the dollar���the home currency���a rise in exports, and no change in government purchases, imports, or consumption spending

D. a fall in investment spending I, a rise in the domestic interest rate r to generate the fall in investment spending, a rise in the value of the dollar���the home currency���a fall in exports, and no change in government purchases, imports, or consumption spending

E. none of the above/cannot be determined from the information given

12. The "Neutral" Rate of Interest

As Federal Reserve Bank of New York President John Williams defines it, the "neutral" rate of interest is the rate of interest at which total spending���aggregate demand���is equal to potential output. It is thus the same as the equilibrium interest rate in the flexible price model. Which of the following statements about influences on the neutral interest rate is correct?

A. a rise in animal spirits, a rise in foreign interest rates, and a rise in confidence in the long-run fundamental value of the domestic currency���the dollar���will all raise the neutral interest rate

B. a rise in animal spirits, a rise in foreign interest rates, and a rise in the value of the exchange rate defined as the value of foreign currency $ \epsilon $ will all raise the neutral interest rate

C. a rise in animal spirits, a rise in foreign interest rates, and a rise in confidence in the long-run fundamental value of the domestic currency���the dollar���will all lower the neutral interest rate

D. a rise in animal spirits, a rise in foreign interest rates, and a rise in the value of the exchange rate $ \epsilon $ will all lower the neutral interest rate

E. none of the above/cannot be determined from the information given

13. Offsetting Fiscal Contraction

In one of his early weekly lunches in 1993 with Federal Reserve Chair Alan Greenspan, the newly installed Treasury Secretary, Lloyd Bentsen, expressed concern that the 2% of GDP fiscal contraction planned by President Clinton in order to try to to balance the budget might send the economy into recession.

Greenspan expressed a willingness to keep interest rates lower than he would have done in the baseline, no-deficit reduction scenario in order to avoid this risk.

Suppose we model this as a reduction in G by an amount $ {\Delta}G = - 2 $ (% of GDP). Suppose that the Keynesian multiplier $ \mu = 3 $, and that the parameters are:

$ I_r = \frac{2}{3}, $

$ {\epsilon}_r = \frac{1}{3}, $

$ x_{\epsilon} = 1 $.

By how much would Alan Greenspan have had to take steps to lower r below its baseline path in order to have kept his promise?

A. $ \frac{2}{3} $%-points

B. 6%-points

C. 2%-points

D. 3%-points

E. none of the above/cannot be determined from the information given

14. Foreign Monetary Policy

If foreign governments reduce their interest rates and by so doing induce a boom abroad that raises total incomes abroad, the consequence for the domestic economy in the sticky-price model is likely to be:

A. a decrease in the value of the dollar and an increase in exports, consumption spending, and national product

B. an increase in the value of the dollar and a reduction in exports, but an increase in investment spending and no change in the level of consumption spneding and national product

C. an increase in the value of the dollar and a reduction in exports, consumption spending, and national product

D. a decrease in the value of the dollar and an increase in exports, but a decrease in investment spending and no change in the level of consumption spneding and national product

E. none of the above/cannot be determined from the information given

15. Phillips Curve

In an economy described by the so-called Phillips Curve equation:

$ {\pi_t} = {\pi_t}^e - \beta\left(u_t - u^*\right) $

where inflation expectations are adaptive:

$ {\pi_t}^e = \pi_{t-1} $

a central bank that pushes or lets the unemployment rate rise and stay above its NAIRU for a long period of time will probably:

A. see a higher rate of inflation at the end of the period than at the start

B. see a lower rate of inflation at the end of the period than at the start

C. see about the same rate of inflation at the end of the period than at the start

D. none of the above/cannot be determined from the information given

Part B: Short Calculation Questions

Five minutes each

1. Long-Run Capital-Output Ratio

Suppose that in a Solow growth model economy the values of s, n, g, ��, and �� are 0.18, 0.01, 0.02, 0.5, and 0.03 and remain constant, and suppose further that in year 0 $ E_o = 1, L_o = 1, K_o = 9 $. What is the value of the capital-output ratio $ K_t/Y_t $ in year 100? Write "B1:" and then the correct value in your bluebook.

2. An Increase in Savings

Suppose that in a SGM economy the production function parameter $ \alpha = 0.25 $. If the savings rate s quadruples, by what factor will the level of output per worker along the steady-state balanced-growth path be? Write "B2:" and then the correct value in your bluebook.

3. Sticky-Price Monetary Offset

Suppose that in a sticky-price economy the multiplier is two, a one-percentage point increase in the domestic long-term risky real interest rate discourages 200 billion of annual investment, and that foreigners raise and lower their interest rates in tandem with the domestic central bank. Suppose that the President and the Congress raise annual government purchases by 400 billion dollars. By what amount would the central bank have to change the long-term risky real interest rate to keep that expansion of government purchases from changing the level of national income and product? Write "B3:" and then the correct value in your bluebook.

4. Sticky-Price Financial Crisis

Between the start of 2007 and the end of 2008 the wedge between the policy interest rate the Federal Reserve controls and the long-term risky real interest rate that matters in the IS equation rose by 15 percentage points. Suppose that similar effects were happening abroad so that the interest rate differential between home and abroad did not change. Suppose further that a 1%-point rise in the interest rate discourages 100 billion of annual investment, that a 1%-point shift in the domestic-foreign interest rate differential causes a 5% shift in the value of foreign currency, and that a 1% increase in the value of foreign currency raises annual exports by 30 billion. Suppose that the multiplier was 2.5.

If the U.S. government had reacted to 2007-8 the way it reacted to 1929-1933���that is, had it done nothing���what would have been the effect, in billions, on annual national income and product?

Part C: Model Applications and Extensions

10 minutes each

1. A "Strong Dollar"

My boss's boss back in 1995, Clinton Administration Treasury Secretary Robert E. Rubin liked to say "a 'strong dollar' is in America's interest". In our business-cycle framework, a strong dollar is a low value of the exchange-rate-value-of-foreign-currency parameter $\epsilon $, which is itself determined by:

A "strong dollar" can thus be generated by any of:

A low value of $ {\epsilon}_o $, when foreign exchange speculators are confident about the fundamental value of the home currency

A low level of $ r^f $, interest rates abroad

A high level of $ r $, interest rates at home

(a) In the flexprice model, what are the consequences of a "strong dollar" generated through channel (1) or channel (2) on the economy? Use the symbols for parameters (i.e., $ I_r $), to specify what are the effects on economic variables of interest of a dollar stronger via a $ {\Delta}{\epsilon}_o = - 0.1 $ and via a $ {\Delta}r^f = - 0.02 $. (Recall that in the flexible price model, r is not something that can vary except as a result of some other change in the economic environment or in the fiscal-policy variables G and t.)

(b) In the sticky-price model, what are the consequences of a "strong dollar" generated through channel (1), (2), or (3) on the economy? Use the symbols for parameters (i.e., $ I_r $), to specify what are the effects on economic variables of interest of a dollar stronger via a $ {\Delta}{\epsilon}_o = - 0.1 $, via a $ {\Delta}r^f = - 0.02 $, or via a $ {\Delta}r = +0.02 $.

(c) Finally, what adjustments/additions/corrections to the models of this course occur to you that might make Bob Rubin's "strong dollar" mantra a more correct belief than your analyses in (a) and (b) suggest?

2: Solow Growth Model

In 1977 China's level of real national product per capita was 909 dollars per person a year. Forty years later, in 2017, it was 15200 dollars per person a year.

By what factor was China's level of output per capita greater in 2017 than it had been in 1977?

If the production function parameter $ \alpha = 1/3 $ happened to be true for China over this period, how much of a multiplicative increase in the capital output ratio would have been needed to drive such growth?

If the production function parameter $ \alpha = 1/2 $ happened to be true for China over this period, how much of a multiplicative increase in the capital output ratio would have been needed to drive such growth?

If the production function parameter $ \alpha = 2/3 $ happened to be true for China over this period, how much of a multiplicative increase in the capital output ratio would have been needed to drive such growth?

In fact, China's capital output ratio doubled between 1977 and 2017. If the production function parameter $ \alpha = 2/3 $ happened to be true for China over this period, how fast did the efficiency of labor grow on average in China from 1977 to 2017?

Suppose you believe that China will no longer be able to raise its capital-output ratio, but that it will still be able to increase its efficiency of labor as rapidly as it has over the past forty years. What would you forecast for the growth rate of output per capita in China over the next generation?

Suppose you believe that China will no longer be able to raise its capital-output ratio, and that���because China is now a middle income country���it will only be able to exceed the 1.6% per year growth rate of the efficiency of labor in the global north by half as much in the future as it has over the past forty years. What would you forecast for the growth rate of output per capita in China over the next generation?

Can you think of something to say about this that it is important for Xi Jinping to either learn (if he does not know it already) or keep constantly in the front of his mind (if he does know it already)?

Part D: Essays

10 minutes each; 150 words maximum each

1. The Current American Macroeconomy

Suppose you are Kevin Hassett, Chair of the President's Council of Economic Advisers. President Donald Trump comes to you and asks if you think he should fire Federal Reserve Chair Jay Powell because interest rates are going up, the value of foreign currencies like the renminbi, the yen, the euro, and the pound are falling, and the trade deficit is increasing. Using the ideas you have learned in this course, write what you would say to him to try to guide him to an accurate understanding of the current state of the American macroeconomy. We take the word limit seriously. So think, write that many words, and then stop.

2. Italy Today

Earlier this week, the extremely sharp Adam Tooze wrote:

More than 32 percent of Italy���s young people are unemployed. The gloom, disappointment and frustration are undeniable. For the commission to declare that this is a time for austerity flies in the face of a reality that for many Italians is closer to a personal and national emergency.... The Bank of Italy and the Peterson Institute of International Economics, warn that Italy is caught in a trap: Anxieties about debt sustainability mean that any stimulus has the perverse effect of driving up interest rates, squeezing bank lending and reducing growth...

Think in terms of our sticky-price model. What do you believe would have to be true about the interrelationships of the economic variables in the model for the BoI and the PIIE's worries to be correct?

We take the word limit seriously. So think, write that many words, and then stop.

#highlighted #berkerley #economicgrowth #macroeconomics

December 11, 2018

How did Evangelicals miss the memo that God saves you lat...

How did Evangelicals miss the memo that God saves you later only if you save the image of God in your neighbor today?: "Lord, when saw we thee an hungred, or a thirst, or a stranger, or naked, or sick, or in prison, and did not minister unto thee?": Ronald Brownstein: Trump's Coalition Is Cracking: "Evangelical Christians this year comprised fully 45% of all white voters without a college degree, a substantial portion of the total electorate. By contrast, evangelicals represented only one-fourth of college-educated white voters. (In 2016, the exit polls found that evangelicals constituted slightly larger shares of each group.) In all of the southern states where the question was asked this year, evangelicals represented a majority of working-class white voters, including fully two-thirds in Georgia and Tennessee. Evangelicals were also a majority of white working class voters in West Virginia and Indiana and exactly half in Missouri...

It's not the white working class who have been totally grifted by Trump���it's those who call themselves Evangelicals:

#shouldread #orangehairedbaboons

"Lord, When Saw We Thee an Hungred, or A Thirst, or a Stranger, or Naked, or Sick, or in Prison, and Did Not Minister Unto Thee?"

How did Evangelicals miss the memo that God saves you later only if you save the image of God in your neighbor today?: "Lord, when saw we thee an hungred, or a thirst, or a stranger, or naked, or sick, or in prison, and did not minister unto thee?": Ronald Brownstein: Trump's Coalition Is Cracking: "Evangelical Christians this year comprised fully 45% of all white voters without a college degree, a substantial portion of the total electorate. By contrast, evangelicals represented only one-fourth of college-educated white voters. (In 2016, the exit polls found that evangelicals constituted slightly larger shares of each group.) In all of the southern states where the question was asked this year, evangelicals represented a majority of working-class white voters, including fully two-thirds in Georgia and Tennessee. Evangelicals were also a majority of white working class voters in West Virginia and Indiana and exactly half in Missouri...

It's not the white working class who have been totally grifted by Trump���it's those who call themselves Evangelicals:

#shouldread #orangehairedbaboons

Matthew Yglesias: The Lies, The Lies of Andrew Sullivan: Hoisted from the Archives

Hoisted from the Archives: Matthew Yglesias: The Lies, The Lies: "Andrew Sullivan has been a pretty consistent proponent of the view that Paul Krugman is some sort of liar... [because of his] repeated insistences that George W. Bush's economic policy is founded on a tissue of lies. Krugman is, of course, entirely correct about this. The unnoted irony here is that in his May 14, 2001 column 'Downsize', Sullivan conceded Krugman's point: 'Ah, but the details. The Krugmans and the Chaits will shortly have a cow, if not a whole herd of them. The Times will weigh in again with yet another barrage of articles, editorials, and op-eds opposing any tax relief that would actually benefit those who pay most of the taxes. And, to be fair to these liberal critics, they're right...

...about one thing. One of the tax cut's effects will surely be that the United States won't be able to afford a vastly expanded Medicare drug benefit. And the archaic sinkhole known as Social Security won't be shored up either. And Medicare, may the gods preserve us, may even have to grow at a slightly slower rate. In fact, many of the spending programs that some still believe solve most human problems will encounter the only political resistance that matters in budgetary matters: insolvency.

To which my response is: Hoorah. We don't need these expansions of the welfare state. We need to privatize Social Security if we want to provide for our retirement in ways slightly more up-to-date than those based on economics and life-expectancy figures devised in the 1930s. We don't need to add yet another entitlement for the most pampered generation--our current seniors.

And if there is one thing we have learned in the past 20 years, it's that controlling government spending is simply impossible without deficits. Look back at the last decade. A huge part of Bill Clinton's economic success was his remarkable grip on public finances. He deserves credit for this, although the Republican Congresses from 1994 to 1998 were mainly responsible, and Ross Perot made deficit-cutting hot. But from 1998 on, all hell broke loose. Last year, discretionary spending increased by a whopping 8 percent--under the Republicans. The minute deficits became surpluses, in other words, the politicians started bribing the voters with their own money. The only relevant question is: Why do Dennis Hastert, Trent Lott, Dick Gephardt, and Tom Daschle know better than taxpayers how to allocate their own resources?...

Some commentators--at this magazine and elsewhere--get steamed because Bush has obscured this figure or claimed his tax cut will cost less than it actually will, or because he is using Medicare surplus money today that will be needed tomorrow and beyond. Many of these arguments have merit--but they miss the deeper point. The fact that Bush has to obfuscate his real goals of reducing spending with the smoke screen of "compassionate conservatism" shows how uphill the struggle is.

Yes, some of the time he is full of it on his economic policies. But a certain amount of B.S. is necessary for any vaguely successful retrenchment of government power in an insatiable entitlement state. Conservatives learned that lesson twice. They learned it when Ronald Reagan's deficits proved to be an effective drag on federal spending (Stockman was right!)--in fact the only effective drag human beings have ever found. And they learned it when they tried to be honest about taking on the federal leviathan in 1994 and got creamed by Democrats striking the fear of God into every senior, child, and parent in America. Bush and Karl Rove are no dummies. They have rightly judged that, in a culture of ineluctable government expansion, where every new plateau of public spending is simply the baseline for the next expansion, a rhetorical smoke screen is sometimes necessary. I just hope the smoke doesn't clear before the spenders get their hands on our wallets again.

Now needless to say, Sullivan differs from Krugman in thinking that this is a good thing, while Krugman thinks it's a bad thing. But that's really all there is to it. Bush was lying. As Sullivan correctly points out, the lies were integral to securing public tolerance for Bush's agenda. Krugman has tried to expose the lies in hopes of denying Bush's agenda public support. It's very hard to see how Krugman can be held culpable in this scenario.

#shouldread #hoisted #journamalism #fiscalpolicy #orangehairedbaboons

Always remember that Andrew Sullivan glories in misleadin...

Always remember that Andrew Sullivan glories in misleading the public by telling them lies: "The Krugmans and the Chaits will shortly have a cow, if not a whole herd of them.... To which my response is: Hoorah.... Commentators... get steamed because Bush has... claimed his tax cut will cost less than it actually will... is using Medicare surplus money today that will be needed tomorrow and beyond.... The fact that Bush has to obfuscate his real goals of reducing spending with the smoke screen of 'compassionate conservatism' shows how uphill the struggle is." When somebody tells you he is an evil, deceptive f---, believe him: HOLLYzoy: Besides @ezraklein 's Point About Andrew Sullivan, a Few Others: "'But the banality of the god of progress, the idea that the best life is writing explainers for Vox in order to make the world a better place, never quite slakes the thirst for something deeper'. I think that sneering at this impulse makes sense only if you don't ask the people involved what 'making the world better' means. Suppose you thought: democracy is the best political system. But it requires a reasonably informed citizenry to work. It's always hard for people to be adequately informed (they have lives.) But doubly so now, when entire networks etc. are actively trying to mislead them. Then those of us who have a knack for it should try to step up, and make it easier. How is this shallow or banal? If done right, it is a way of supporting democracy, and of empowering our fellow citizens. It also helps them to spot demagogues and charlatans. If you think that democracy is an inspiring ideal (I do), then this is an inspiring thing to do...

#shouldread #orangehairedbaboons #journamalism #publicsphere

Ezra Klein: Political Tribalism in Trump���s America: Wha...

Ezra Klein: Political Tribalism in Trump���s America: What Andrew Sullivan Gets Wrong: "I knew when we launched Vox that there would be criticisms I didn���t anticipate, but I���ll admit, I never foresaw one of them being that writing explainers doesn���t satisfyingly replace the role of religion in people���s lives. Yet here we are.... That���s Andrew Sullivan writing in New York magazine, and while the column caught my attention for that line, which I will now have needlepointed on a pillow, the broader piece is wrong in more important, less amusing, ways...

...Sullivan offers a nostalgic analysis of our current problems that has become popular among a certain class of pundits... but that doesn���t hold up to the slightest scrutiny, and in fact displays the very biases it laments.... Absent the calming effects of Christianity, he... [says], Americans look to politics to find their meaning, and that escalates the stakes of political conflict. Politics ceases to be procedural and becomes fundamental. Boundaries must be drawn and tribal membership policed. This is Sullivan���s diagnosis of our current divisions. He writes:

Now look at our politics. We have the cult of Trump on the right, a demigod who, among his worshippers, can do no wrong. And we have the cult of social justice on the left, a religion whose followers show the same zeal as any born-again Evangelical. They are filling the void that Christianity once owned, without any of the wisdom and culture and restraint that Christianity once provided...

This is a relentlessly ahistorical read of American politics. America���s political past was not more procedural and restrained than its present, and religion does not, in general, calm political divides. What Sullivan is missing in these sections is precisely the perspective of the groups he���s dismissing. But if Sullivan���s essay fails as historical analysis, it succeeds as a metaphor for our times. What he has done is come up with a tribal explanation for political tribalism: The problem is not enough people like him, too many people unlike him.... Even as Sullivan decries political tribalism, here is his theory of it: A decline in people practicing his form of Christian faith has led to a rise in ���political cultists��� who find their ultimate meaning in politics, who will stop at nothing to achieve their political goals, and who cannot be reasoned or compromised with. This is not an analysis of the thinking deepening our political divides, but a demonstration of it...

#shouldread #orangehairedbaboons #journamalism

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers