J. Bradford DeLong's Blog, page 2240

August 1, 2010

Yes, the Odds Are That Structural Unemployment in the U.S. Has Started to Rise

Live at The Economist:

Q: Is America facing an increase in structural unemployment?

A: Yes, but there is still time to prevent a big rise: David Altig of the Federal Reserve Bank of Atlanta has just convinced me that the answer to this question is "yes": given the large recent increase in vacancies in the past two quarters, the US unemployment rate ought to have started to fall. It did not.

That means that the chances are now very high that our cyclical unemployment is starting to...

Ed Luce Quotes Larry Katz on Wealth, Poverty, and Inequality

Ed Luce:

The crisis of middle-class America: Statistics only capture one slice of the problem. But it is the renowned Harvard economist, Larry Katz, who offers the most compelling analogy:

Think of the American economy as a large apartment block,” says the softly spoken professor. “A century ago – even 30 years ago – it was the object of envy. But in the last generation its character has changed. The penthouses at the top keep getting larger and larger. The apartments in the...

Why Oh Why Can't We Have a Better Press Corps? Tom Zeller of the New York Times Should Go Do a Job He Could Do Well Edition

Tom Zeller sticks the lead of his story in paragraph sixteen, and calls it a "caveat"--albeit a "not insignificant" one.

Tom if it is a significant part of the story, doesn't it belong a lot higher in the article than paragraph fourteen?

Is It Hot in Here? Must Be Global Warming: There is a not-insignificant caveat: Those pointing to hot weather as evidence of global warming are, in the broadest sense, more likely to be right. Scientists at the National Center for Atmospheric Research...

Liveblogging World War II: August 1, 1940

July 31, 2010

links for 2010-07-31

Edward Niedermeyer: The Volt - G.M.'s Electric Lemon

Paul Krugman: Clockwise Spirals

Mike Konczal: Chris Hayes, guest hosting the Rachel Maddow Show, covers the failure of HAMP

Laura Bassett: Dwindling Retirement Savings 'Undiscussed Explosive Bomb' Of Recession

...

Excellent Article by Ed Luce

Friends Let Friends Read the Wall Street Journal Editorial Page Only If They Promise to Immediately Trade Against It

Paul Krugman observes that the Wall Street Journal editorial page has one use: the fact that there are poor fools--whom we pity--who believe it opens up profitable trading opportunities for the rest of us:

Krugman:

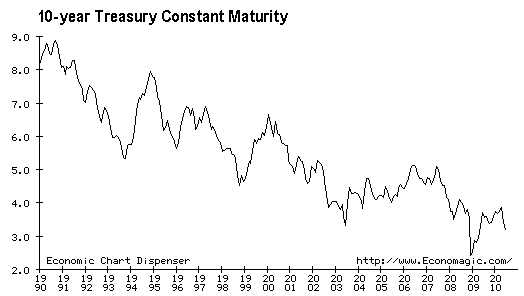

Two Point Nine One: Remember this? May 29, 2009:

They’re back. We refer to the global investors once known as the bond vigilantes, who demanded higher Treasury bond yields from the late 1970s through the 1990s whenever inflation fears popped up, and as a result...

Menzie Chinn: What the Data Tell Us About the Shape of the Recession

A fine job of intellectual garbage collection by Menzie Chinn:

Econbrowser: The 10Q2 Advance GDP Release: Cautionary Notes from Revisions: The release was accompanied by an annual revision of data extending back to data for 2007Q1. This revision alters our understanding (or lack of understanding in the cases of certain people) of the evolution of this recession. Here are the points I gleaned.... First, it is generally unwise to make definitive statements such as Donald Luskin's...

DeLong Smackdown Watch: Structural Unemployment Edition

Robert Waldmann is not alarmed:

This is really getting extreme. All this discussion of the shift of the Beveridge curve is discussion of 1 (one) data point 2010Q2. Earlier points are above the non-Beveridge line, but, you know it is (and always has been) a curve. It is also not exactly the cutting edge approach to presenting data on vacancies and unemployment. That would be the matching function. Discussions of the vacancy rate and unemployment rate in 2010Q2 do not discuss gross...

Doug Henwood Questions the CBO's Long-Term Economic Forecast

From Left Business Observer:

The CBO’s deep, unappreciated gloom: Seven decades is a really long time to do forecasting over, since the economics profession isn’t really all that good at forecasting next year. But you do have to think about these things, if only to do some half-rational planning. People who worry about pools of red ink say that countries face the risk of debt crisis when their total debt reaches somewhere around 100% of their GDP. There’s nothing magical about this, but...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers