J. Bradford DeLong's Blog, page 2206

September 9, 2010

The Beveridge Curve and Structural Unemployment in the Great Depression--NOT!

Freshly back from the CEA staff and looking for a dissertation topic, Josh Hausman reports that there is no evidence of growing structural unemployment visible in an outward-shifting Beveridge curve during the Great Depression:

SEC v. Citigroup Documents

UNITED STATES DISTRICT COURT FOR THE DISTRICT OF COLUMBIA, SECURITIES AND EXCHANGE COMMISSION, v. CITIGROUP INC.: COMPLAINT OF PLAINTIFF SECURITIES AND EXCHANGE COMMISSION

During the October 15, 2007 conference call... Citigroup [Crittendon:] made the following prepared statement about the losses in the Securities and Banking business and the investment bank's sub-prime exposure:

$1.6 billion from writedowns in mortgage-backed securities which were warehoused for future CDO or...

Coordination Failure

September 8, 2010

links for 2010-09-08

@delong Fabulous Live Chat about the latest news on BP Oil Spill http://lz.ly/25Um Lovely

– Naomi Robinson (NaomiP2Robinson) http://twitter.com/NaomiP2Robinson/st...

(tags: from:NaomiP2Robinson)

Beware of Greeks Bearing Bonds | Business | Vanity Fair

Timeo Danaos et Debita Ferentes...

Liveblogging World War II: September 8, 1940

Jon Hilsenrath Brings Good News on the Beveridge Curve

Hoo Boy...

Duncan Black:

Eschaton: The View From The Mineapolis Fed: The problem is structural, nothing we can do, call us in a few years, naptime.

This estimate is based on a rather aggregative view of the labor market. It is important to dig deeper to get a better understanding of the problem, and there is a considerable amount of research under way exploring the quantitative importance of the various forms of mismatch. For example, the International Monetary Fund has recently...

Macroadvisers: Mind the Curve! Market Expectations and the Zero Bound

Macro Advisers tells us not to say "the yield curve is predicting a robust recovery":

Macroadvisers: Mind the Curve! Market Expectations and the Zero Bound: Mind the Curve! Market Expectations and the Zero Bound

Conventional wisdom would tell you that the yield curve is pricing in a robust recovery. Our term structure model says otherwise: Current yields are consistent with expectations of a very sluggish economy.

Indeed.

We are now looking--if nothing else is done--at a...

A Greco-Asiatic Horse...

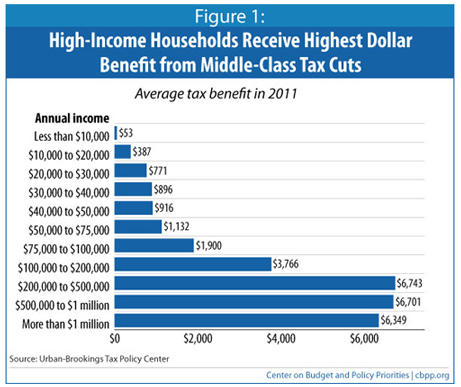

Chuck Marr and Gillian Brunet point out that Obama's "middle class" tax cut would give me $6,743 a year, and give a middle-class family making $60,000 a year $1,132 a yeqr:

Truthsayer Diane Lim Rogers on Fiscal Policy

Listen to Diane Lim Rogers:

Peter Orszag “Breaking Free” from the Bush/Obama Tax Cuts: [E:]ven temporary extension of even just the (generously-defined) “middle class” portions of the Bush tax cuts is only a second-best (at best) solution to both the need for more short-term stimulus as well as the need to get back to fiscal sustainability over the not-so-long-from-now longer term. They’re not the best solution for the short term because they have far from the biggest stimulative “bang...

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers