J. Bradford DeLong's Blog, page 180

May 16, 2019

Comment of the Day: JEC: "I'd just add a note to lament t...

Comment of the Day: JEC: "I'd just add a note to lament the five decades of empirical research into the actual formation and behavioral consequences of expectations that didn't happen, thanks to the Rational Expectations Revolution in macro. We'll never get those squandered years back...

#commentoftheday

Comment of the Day: JEC: "Against my better judgment, I f...

Comment of the Day: JEC: "Against my better judgment, I find that I must demand, in the strongest possible terms, that you kids withdraw forthwith from my lawn. More specifically, this is correct: 'The concept was developed by the economist Joan Robinson in her 1933 book The Economics of Imperfect Competition to describe the labor market equivalent of a monopoly, where workers only have the option to work at one employer, so their wages will be set less than the value they create+ since they have no outside options'...

...But this is bollocks: "But work pioneered by economist Alan Manning at the London School of Economics in his book Monopsony in Motion broadens the definition of monopsony to include labor market dynamics where workers do not respond to changes in wages as would be predicted by a competitive model." Why in the world would anyone think it was a good idea to take a technical term denoting a specific market failure and turn it into a generic label for any and all market failures? O tempora o mores!

+Errr��� correct-ish. "The value they create" is not an accurate rendering of "the marginal product of labor." But that's a separate rant...

#commentoftheday

A nice instantiation of our WCEG's monthly summary of JOL...

A nice instantiation of our WCEG's monthly summary of JOLTS. I would, however, quibble with the authors' claim that workers are now "confident". Yes, they are quitting at a much higher rate than they dared to do in the early years of this decade. But I remember 1998-2000: That was a confident labor market! How old were these authors in 1999, anyway? :-): Kate Bahn and Will McGrew: JOLTS Day Graphs: March 2019 Report Edition - Equitable Growth: "The quits rate held steady at 2.3% for the 10th month in a row, reflecting a steady labor market where workers are confident leaving their jobs to find new opportunities...

#noted #worthyreads

"Attempts to Make Sense Out of Right Wing Austrian Economics Can Never Amount to Anything"���rootless_e: Hoisted From the Archives

rootless_e is correct: Ludwig von Miese is not: Hoisted from the Archives: Quote of the Day: November 12, 2011: "Attempts to carry out economic reforms from the monetary side can never amount to anything but an artificial stimulation of economic activity by an expansion of the circulation, and this, as must constantly be emphasized, must necessarily lead to crisis and depression. Recurring economic crises are nothing but the consequence of attempts, despite all the teachings of experience and all the warnings of the economists, to stimulate economic activity by means of additional credit"���Ludwig von Mises, The Theory of Money and Credit...

"Attempts to make sense out of right wing Austrian economics can never amount to anything."���rootless_e...

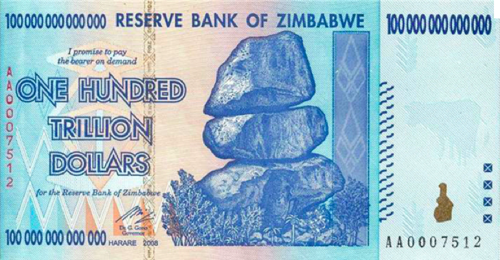

"Fictitious" Wealth and Ludwig von Mises: Nevertheless, like a moth to a flame���or like a dog to vomit, or like a dog to something worse���I find myself under a mysterious but inexorable and irresistible compulsion to waste what would otherwise be productive work time trying to make some kind of sense of it���to at least understand wherein lies the error, and how somebody trying very hard to understand the economy (never mind that he is a big fan of the political leadership of Benito Mussolini) can go so pathetically wrong. It is, of course, not the case that every expansion of the circulation is an "artificial" (and unnatural) "stimulation of economic activity" that must "necessarily lead to crisis and depression". So why does Ludwig von Mises think that it must? Here is my current guess as to where von Mises is coming from:

Let us start out with a world of publicly-known technology and constant returns to scale in everything. People happily make things and trade them. And everything sells at its resource cost.

One of the things people make is little disks of gold, usually decorated with pictures of bearded men on one side and allegorical female figures on the other, with lettering saying things like: "Fecund Augustae" or "Concordia Militum" or "Fides Exercituum" on them. These little gold disks trade���like everything else���at their cost of production: the cost of digging the ore out of the ground, extracting the metal from the ore, and stamping the disk into the right shape.

Then somebody has a bright idea: Because these little metal disks are valuable and easy to carry, they are subject to theft. I will offer to perform a service: I will keep everybody's little metal disks in my stronghouse, and let's write out signed declarations that people have little metal disks in my stronghouse and they can trade those rather than the disks directly.

And���as long as the circulating medium is backed by gold���everything goes on as before, with everything selling for its cost of production.

Then somebody else has a bright idea: They write out a whole bunch of signed declarations that they have little metal disks in the stronghouse even though they actually do not have any such. They then buy things with these pieces of the circulating medium that they have written out.

These people, Ludwig von Mises says, are thieves pure and simple. They have bought useful things. They have claimed that they have done so by trading valuable little metal disks for useful commodities. But they have lied: they did not have any valuable little metal disks for trade.

And, Ludwig von Mises would say, these lying thieves are governments that print dollar bills without having 100% gold bullion backing for them in Fort Knox. These lying thieves are banks that issue bank notes or allow you to write checks in amounts that exceed the specie reserves they have in their vaults.

The problem, I think Ludwig von Mises would say, is that a certain amount of work has gone into creating the commodities���the food, the clothing, the houses, the little gold disks���and yet people think that there is more wealth in society than their actually is. People count the food as wealth, the housing as wealth, the clothing as wealth, the little gold disks as wealth, the fiat money as wealth, and the bank credit as wealth���and the last two of these aren't wealth at all. They are fictions: false promises that there is somewhere some valuable gold that you have title to.

And, Ludwig von Mises would say, the larger the unbacked circulating medium the bigger the lie and the theft. And it is all guaranteed to end in tears, because if society thinks that it is richer than it is then plans will be inconsistent and unattainable. When that unattainability becomes manifest, that will trigger the crash and the depression.

That is, I think, where he is coming from.

And, of course, this is wrong���so so so so so so so so so unbelievably wrong. It is simply not the case that we can cheaply and easily buy things with money because it is valuable. It is, instead, the case that money is valuable because we can cheaply and easily buy things with it.

One way into the tangle of understanding why it is wrong is to ask each of us why we are happy accepting money in exchange when we sell useful commodities.

Hint: it's not because we are looking forward to going down to the bank, exchanging our bank notes for the little disks of gold usually decorated with pictures of bearded men on one side and allegorical female figures on the other with lettering saying things like "Fecund Augustae" or "Concordia Militum" or "Fides Exercituum" on them, taking our little disks home, and feeling happy looking at them.

That's not why we accept money.

We accept money because if we don't have any money we have to buy commodities with other commodities, and when we do so we are unlikely to receive the cost of production for what we sell. Have you ever tried to buy a latte at Peets with a copy of Ludwig von Mises's Money and Credit? It does not go well.

The fact is that your wealth is only worth its cost of production if you are liquid���if you can wait to sell until somebody willing to pay full cost of production comes along, which is not every minute. The use value of money is that it allows you to time your other transactions so that you can realize the full exchange value of what you sell, rather than having to sell it at a discount.

Thus there is no paradox: no sense in which the existence of fiat money creates a situation in which society must necessarily think that it is richer than it is, with claims to total wealth valued at more than the value of total wealth itself. You think���correctly���that your fiat money has value, and that value is just equal to the discount from its cost of production that your other wealth incurs because it is illiquid.

But what if the government prints more fiat money than the illiquidity gap in your other death? Well, then people will say: "I don't need to hold all this extra money. I would be liquid enough with less." Everybody will try to run down their money balances, and so the price level will rise until the real money stock is just what people think covers the illiquidity gap between their other wealth and its cost of production.

And what von Mises misses completely is that the size of this illiquidity gap can and does change suddenly and drastically���and it is the business of the central bank and of the government to alter the quantity of money to keep such changes from disrupting the real economy.

#hoistedfromthearchibves #economicsgonewrong #fascism #highlighted

May 14, 2019

Comment of the Day: Howard: "As a white male who graduate...

Comment of the Day: Howard: "As a white male who graduated high school in Allentown, PA in 1970, I have often noted that while I went to college and forged a reasonably well paid career as a consultant, the white males like me who didn't go to college expected to find life-long work and reasonable pay at Bethlehem Steel, Mack Truck, or the Western Electric Plant. All those jobs are long, long gone. While the area has been lucky enough to have seen big growth in healthcare, my high school classmates have had little but struggle, and I wouldn't be surprised if some good number of them were now Trumpists. That all said, i'm not sure baby boomers were scarred by the inflation monster: i think fed economists were scarred by the inflation monster, which is what produced years and years of pretending that a hard ceiling was merely a target...

#noted

Chris Lee: Photons Dance Along A Line Of Superconducting ...

Chris Lee: Photons Dance Along A Line Of Superconducting Qubits: "Computation relies on more than just having and preserving qubits; you also need to control their interactions.... Nature beat us to it Perhaps the most interesting part of random walk quantum computers is that they already exist, and we would not exist if it didn't work.... Photosynthesis works because light creates a quantum particle called an exciton that has to travel to a reaction center before it decays away to nothing. The only way that it can do this is by traveling all possible paths simultaneously. Through the power of constructive interference (or, if you prefer, quantum computing), the exciton survives about a 1,000 times longer than it would otherwise be expected to, allowing it to reach the reaction center. Since photosynthesis takes place at room temperature, it gives me hope that, eventually, the quantum computer will move out of the helium dilution fridge...

#noted

John Authers: Federal Reserve Interest-Rate Cut Odds Drop...

John Authers: Federal Reserve Interest-Rate Cut Odds Drop: "Male employment is clearly lower.... The recovery... has still left male unemployment worse than at any point post-war before the Great Recession. So yes, the macro-data do indeed suggest that there are many men who are less productive than their fathers, and have reason to feel angry. That said, women have reason for unhappiness as well.... Women are still putting up with [non-]employment rates 10 points higher than for men. And so it does indeed seem possible, from my extremely swift look at the top-down data, that gender dynamics help explain why improving employment is not making many Americans happier...

#noted

Trump's policies are not boosting economic growth. So the...

Trump's policies are not boosting economic growth. So the Trumpists���paid, and those who hope to cash in���are preparing the battlespace by arguing that economic growth isn't a good thing anyway���just as we have shifted from "no collusion!" to "collusion isn't illegal!" To his honor, Michael Strain pushes back:

Michael Strain: Right-Wing Populists Are Wrong About Economic Growth - Bloomberg: "Oren Cass... the Manhattan Institute... argues that the results from decades of policies designed to encourage GDP growth are 'embarrassing' and have 'steered the nation off course'. Michael Anton... Claremont... questioning the presumption that technological and economic progress is desirable and that innovation is 'per se good.... [But] growth doesn���t just help low-income and working-class households in the short term. Over longer periods, seemingly small changes in the growth rate have large consequences.... A rising tide does not lift all boats equally, and it doesn���t lift them instantaneously. But over time, all boats do rise considerably...

...Populists are of course correct that we also need to be talking about targeted programs designed to help the working class���even if funding these endeavors can slow growth.... But populists need to be reminded that it is precisely a growing economy that creates the financial and political space for these types of programs. Undervaluing growth will lead us to make imprudent choices, forgetting the true cost of programs. Among the populists on the left and right, downplaying growth makes it easier to attack free trade and immigration... Imagine the world in the year 1900. There was no air travel, no antibiotics, no iPhone, no Amazon Prime, no modern high school and no air conditioning. Compared with today, people were starved for knowledge and leisure. Anyone who played down growth a century ago wouldn���t have known they were arguing against any of these things, because none of these growth-enabled features of modern life had been invented yet. But they would have been putting the existence of all these at risk by stifling, even marginally, the economic engine that allowed for their creation...

#shouldread

On the one hand, apparently permanent low interest rates ...

On the one hand, apparently permanent low interest rates do produce a lot of reaching for yield���which means a lot of people taking risks they do not understand for low expected returns, and a lot of people figuring out how to take advantage of the cognitive biases of those who take risks they do not understand. On the other hand, as long as the bills are paid and as long as the investors are risking money they can stand to lose, the Fyre Festival Economy does push us closer to full employment. Thus I find myself genuinely perplexed here:

Izabella Kaminska: GMO's Montier on the Rise of the Dual Economy: "This week's installment of The entire economy is Fyre Festival (TEEIFF).... To recap... we made the argument that the rise of mystic job titles like 'chief vision officer'... was indicative of corporates having lost their purpose... to make or provide stuff people wanted so much they were prepared to pay for it.... In the modern corporate sphere the desire to make profits, however, has been replaced with the desire to achieve growth at any cost... [because] products and services are so visionary and forward thinking that we the customers can't yet understand... [yet[ one day in the future... we will eventually be prepared to pay top dollar for them. The second justification is that if you hook enough customers to your brand you will eventually be able to sell them something they will be prepared to pay for. What that thing is doesn't necessarily have to be determined yet, and may or may not be determined in countless corporate pivots that follow onwards. This is why the mystic vision officer is so important. Establishing a vision of what tomorrow's needs may be, rather than what today's needs actually are, is essential to keeping the investment case alive.... And it's all very believable because this is exactly how a selection of today's most profitable technology stocks have made it...

#noted

Nice to finally see the red-meat throwing Republican sena...

Nice to finally see the red-meat throwing Republican senators admit that those of their Democratic colleagues who voted for ObamaCare created something that has, on balance, been a good thing for America. May their consciences weigh on them every morning when they ask themselves why they didn't do this ten year ago: Tony Leys: "Grassley, who opposed Obamacare, isn���t now pressing to replace it. 'Quite obviously, more people have health insurance than would otherwise have it, so you got to look at it as positive', he says. via @pw_cunningham...

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers