J. Bradford DeLong's Blog, page 165

June 14, 2019

June 14, 2019: Weekly Forecasting Update

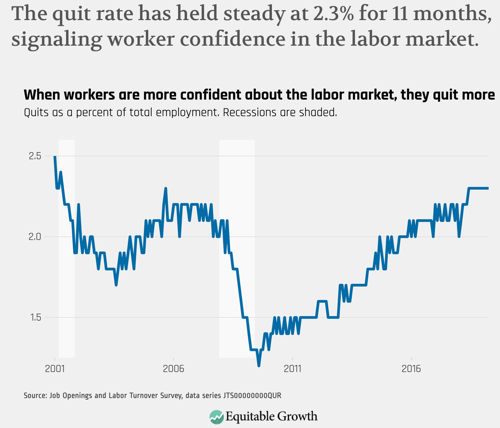

The right response to almost all economic data releases is: Next to nothing has changed with respect to the forecast���your view of the economic forecast today is different from what it was last week, last month, or three months ago in only minor ways. About the only news is that over the past month we have seen an 0.8%-point decrease in our estimate in what production will be over April-June, largely driven by reductions in durable goods orders, capacity utilization, net exports, and this morning employment. This might be an impact of Trump's attempt to fight a trade war with China, plus Trump's attempts to add a trade war with Mexico to the mix.

Federal Reserve Bank of New York: Jun 14, 2019: Nowcast: "1.4% for 2019:Q2 and 1.7% for 2019:Q3. News from this week's data releases increased the nowcast for both 2019:Q2 and 2019:Q3 by 0.4 percentage point. Positive surprises from retail sales, capacity utilization, and industrial production...

Key Points:

Specifically, it is still the case that:

The Trump-McConnell-Ryan tax cut has been a complete failure at boosting the American economy through increased investment in America.

But it has been a success in making the rich richer and thus America more unequal.

And it delivered a short-term demand-side Kerynesian fiscal stimulus to growth that has now ebbed.

U.S. potential economic growth continues to be around 2%/year.

There are still no signs the U.S. has entered that phase of the recovery in which inflation is accelerating.

There are still no signs of interest rate normalization: secular stagnation continues to reign.

There are still no signs the the U.S. is at "overfull employment" in any meaningful sense.

A change from 1 week ago: Slightly good news about retail sales, capacity utilization, and industrial production...

A change from 1 month ago: An 0.8%-point decrease in our estimate of what production will be over April-June. This might well be an impact of Trump's attempt to fight a trade war with China, plus Trump's attempts to add a trade war with Mexico to the mix.

A change from 3 months ago: The U.S. grew at 3.2%/year in the first quarter of 2019���1.6%-points higher than had been nowcast���but the growth number you want to put in your head in assessing the strength of the economy is the 1.6%/year number that had been nowcast. The falling-apart of Trump's trade negotiating strategy with China will harm Americans and may disrupt value chains, and the might be becoming visible in the data flow.

A change from 6 months ago: Stunning dysfunctionality in the British Conservative Party has put a destructive, hard, no-deal Brexit on the scenario list...

#macro #forecasting #highlighted

This File: https://www.bradford-delong.com/2019/06/june-7-2019-weekly-forecasting-update-tickler.html#more

Edit This File: https://www.typepad.com/site/blogs/6a00e551f08003883400e551f080068834/post/6a00e551f0800388340240a4af782b200b/edit

Forecasting: http://www.bradford-delong.com/forecasting.html

For the Weekend: Pam Jakiela: Taking Preferences Seriously, Not Literally

Pam Jakiela: Taking Preferences Seriously, Not Literally:

#fortheweekend #economicdevelopment #economicgrowth #behavioral

That the Conservative Party appears to want a no-deal Bre...

That the Conservative Party appears to want a no-deal Brexit is as bad and destructive as the Republican Party wanting Donald Trump for president: Martin Wolf: No-Deal Brexit Would Be a Lunacy Wrapped Up in a Stupidity: "AThe cost to Britain���s economy and its standing in the world would be immense.... It will be disruptive. Nobody knows quite how disruptive.... EU co-operation... would be limited.... The jump from being a full EU member to this very different status is sure to be disorderly. This is why standard trade agreements have long transition periods.... The long-run costs of being without any deal with the EU would be substantial.... For such reasons, no deal could not possibly be the end of negotiations, but a shift to new ones from a far weaker position.... The EU knows that no deal would weigh more heavily on the UK.... Leaving the EU without a deal would impair the UK���s credibility as a partner for everybody...

#noted

June 13, 2019

The Intergenerational Burden of the Debt: Nick Rowe Tempts Fate Weblogging: Hoisted from the Archives

Until secular stagnation ends���until the yield on U.S. government debt exceeds the growth rate of the economy���worry about reducing of even stabilizing the debt-to-GDP ratio of a country like the U.S. that has assume running room via financial repression to stabilize demand for its debt is premature. Thus the takeaway is this: It would be much more productive right now to worry about how do we maintain normal levels of net investment in a high government debt post-interest rate normalization environment than to propose sending the economy back into recession in order to reduce government debt accumulation. Recession and high unemployment in the short- and medium-run are problems. Low investment in the medium- and long-run are problems. Government debt is a tool to avoid the first and a source of risk of the second. But it is better to keep your mind focused on the things that are real problems

Hoisted from the Archives: The Intergenerational Burden of the Debt: Nick Rowe Tempts Fate Weblogging...: Nick Rowe:

Worthwhile Canadian Initiative: The burden of the (bad monetary policy) on future generations: You can try to kill zombie ideas. Or you can try to reframe them. I'm fed up with killing the "The national debt is not a burden on future generations because they will inherit (sic) the bonds as well as the debt so they will owe it to themselves" zombie. I already killed it a year ago���. [I]f you don't believe in Ricardian Equivalence, and you think the old generation sells the bonds to the next generation, and then consumes the proceeds from that sale, then don't say that the next generation "inherits" the bonds. They don't inherit the bonds, they damned well pay for them. And if they pay for them, and at the same time pay taxes to pay interest and/or principal on the bonds they have already paid for, then that next generation is paying twice.

Oh God, I don't want to have to argue this all over again! Can I just use the argument from authority? Please? My authority is Brad DeLong. Brad DeLong knows his macro. The very fact that Brad DeLong did not jump all over me last year when I said that Paul Krugman was wrong about the burden of the debt proves that Brad DeLong knows I am right. There is just no way he could have managed to stay silent if he had thought I was wrong!���

Well that is certainly tempting fate! Especially because I have to do something on the plane from London to Tokyo, and watching "Prometheus" doesn't seem attractive somehow���<!���more���>

Let's move into an overlapping-generations model. It is true that the next generation has to buy the debt from the current generation, but the next generation also gets to sell the debt to the generation two generations forward. Thus the real wealth of any generation will be equal to (a) its Haig-Simons income, plus (b) any difference between the value of the real capital stock it buys and inherits from its predecessor and the value of the real capital stock it sells and bequeaths to its successor.

If we hold constant the value of the real capital stock the next generation sells and bequeaths to its successor���and I see no reason why we should not���then incurring a larger national debt in this generation will burden the next generation only if it means (a) a less productive economy���lower Haig-Simons income���in the next generation, or (b) a smaller real capital stock bequeathed and sold to the next generation. Assume���and I see no reason why we should not���that the influence of the present on future productivity comes through the capital stock, and we are reduced to one factor: the way the present burdens the future is by transferring a smaller real apical stock to it.

That is where Dean Baker is coming from. And that is a perfectly fine place to come from. So why doesn't Nick Rowe appear to come from there?

I think he really does. In Nick Rowe's world the next generation's taxpayers are taxed to pay off the debt���and so they are losers. And in Nick Rowe's world the next generation's debt-holders are not gainers. They spend the debt-service payments they receive because bought the debt from the current generation. If they had not bought the debt they would have bought real capital instead, and would have financed their spending via dissaving. Thus the next generation's taxpayers are losers, and the next generation's debt-holders are not winners.

But, Dean Baker would correctly say, the reason that the next generation's debt-holders are not winners is because they acquire debt instead of rather than in addition to real capital���that the current generation invests less in building up the capital stock. What causes the burden is not that government debt is issued, but rather that the issuance of government debt crowds out the formation of useful capital.

No crowding-out of investment, no burden of the debt on the future.

Thus the argument that issuing debt burdens future generations is really an argument that issuing debt right now crowds-out investment by shifting resources from forming capital to working for the government, or that holding debt in the near future crowds-out investment by making people feel wealthier and shifting resources from forming capital to producing consumption goods and services.

Those are fine arguments to make, and they have a lot of validity.

But, still, if you want to argue that issuing debt in a time of deficient aggregate demand burdens the future, you need to make that argument that there is crowding-out of investment���and you need to recognize that both forms of crowding out, both crowding out via expanded government purchases and crowding out via expanded consumption driven by wealth effects, are smaller and perhaps much smaller than at full employment.

Thus when Nick Rowe writes:

But what I really want to do in this post is reframe the question. Because, deep inside every zombie, there is something that wants to stay alive. If monetary policy were doing its job right, and getting Aggregate Demand where it ought to be, nobody would be arguing for bigger deficits to increase Aggregate Demand. Obviously���. [N]obody would have to argue for imposing a debt burden on future generations just to increase Aggregate Demand now. Which means that ultimately it's bad monetary policy that is responsible for that burden of debt on future generations.

And the longer monetary policy stays bad, and the bigger the debt gets, the more worried I get about that future burden. With nominal interest rates near zero, and real interest rates sometimes negative, there is nothing to be worried about right now. But recovery will mean a rise in nominal and real interest rates. If recovery gets postponed much longer, I'm going to start to worry whether (e.g. Japan's) fiscal authorities will be able to afford a recovery.

He should be writing something different: he should be writing: "bad monetary policy that leads to either government purchases or consumption crowding out of capital formation."

Seems to me it would be much more productive right now to worry about how do we maintain normal levels of net investment in a high government debt post-interest rate normalization environment than to propose sending the economy back into recession in order to reduce government debt accumulation. Recession and high unemployment in the short- and medium-run are problems. Low investment in the medium- and long-run are problems. Government debt is a tool to avoid the first and a source of risk of the second. But it is better to keep your mind focused on the things that are real problems....

#hoistedfromthearchives #secularstagnation #fiscalpolicy #macro #highlighted

Edit This File: https://www.typepad.com/site/blogs/6a00e551f08003883400e551f080068834/post/6a00e551f0800388340240a4b341c0200b/edit

Uncertainty���fear that Brexit will be badly handled���is...

Uncertainty���fear that Brexit will be badly handled���is "killing investment and market sentiment toward the U.K", says Marcus Ashworth. Therefore, says Marcus Ashworth, let's choose a Prime inister���Boris Johnson���guaranteed to handle Brexit as badly as possible. And Ashworth is one of the smartest, most reasonable, and most coherent of the Brexziteers. And he's an incoherent, unreasonable, and rather dim nutter:

Marcus Ashworth: Boris Johnson Is Underpriced By the Financial Markets: "Sterling could well get a lift if the former Mayor of London becomes prime minister.... The fact that several of the candidates to replace her are seemingly happy to let Britain crash out of the European Union without an agreement (with bookies��� favorite Boris Johnson foremost among them) has spooked foreign exchange traders. But plenty of people would welcome some kind of clarity.... It���s the uncertainty that���s killing investment and market sentiment toward the U.K. The flipside of this is the sense that people just want to get Brexit done...

#noted

Bloomberg: U.K. Tory Prime Minister Candidates Unprepared...

Bloomberg: U.K. Tory Prime Minister Candidates Unprepared for Brexit Reality: "Irresponsible tax and spending promises predominated. Implausible approaches to Brexit were aired, along with nonchalant talk of defaulting on public debts. Cocaine proved unexpectedly salient. One thing nearly all the candidates had in common was a refusal to accept the precarious position the next party leader will be in.... A chaotic no-deal exit on Halloween. Alarmingly, most of the candidates��have suggested that they���d be okay with that last option. In doing so, they seem to be following May���s playbook of keeping the worst-case scenario on the table for negotiating purposes. If that tactic ever made sense, it���s now doubly wrongheaded. For starters... imposing the most damaging version of a policy that about half the country already despises, and one that Parliament has already explicitly rejected.... If the Tory candidates recognize the urgency of confronting hard truths, they���re showing few signs of it...

#noted

When "Prince of Whales: suddenly shows up in my timeline,...

When "Prince of Whales: suddenly shows up in my timeline, only one thing can possibly be gong on: Darth: "���� u know it wasn���t even a typo: he really thinks it is prince of whales:

#noted

China Digital Space: Grass-Mud Horse: "Mascot of Chinese ...

China Digital Space: Grass-Mud Horse: "Mascot of Chinese netizens fighting for free expression, symbolizing defiance of Internet censorship. The grass-mud horse, whose name sounds nearly the same as "f--- your mother" (c��o n�� m�� ���������), was originally created to skirt government censorship.... The Communist Party is often described as the 'mother' of the people, so saying 'f--- your mother' also suggests 'f--- the Party'...

#noted

Economists Think of Most Lawyers Like Cats Think of Small Birds: Hoisted from the Archives

Hoisted from the Archives: Economists Think of Most Lawyers the Way Cats Think of Small Birds: June 13, 2002: I find that right-wingers Glenn Reynolds, Tom Maguire, and company have elevated me to the high and mighty rank of Democratic Party Hack. Alas! The real ideological partisans scorn me: I have too great a tendency to think about what I should say and then say what I think, rather than to simply jerk my knee and line up in my assigned place on some ideology- or patronage-based team.... Reynolds and company want very badly to say something critical about... Paul Krugman. Unfortunately for them, Krugman's recent column has nothing to take exception to.... So since they can't argue substance, they decide to try to argue procedure.

I can imagine what they thought: "Paul Krugman quotes Brad DeLong! And he doesn't say that DeLong was Deputy Assistant Secretary of the Treasury in the Clinton administration!! That's 'material nondisclosure'!!! Krugman has done a bad thing!!!!" Never you mind that this isn't an issue on which there is any partisan dispute, and thus that 'disclosure' of the partisan allegiance of one's sources is not relevant. To an economist like me this style of���let's be polite, and call it "lawyerlike"���discourse is sad.... Try your best to make the listener forget what the big issue is (in this case, is Krugman right?)--and, instead, argue that there is something wrong with your adversary's procedure. This is, I think, the reason that we economists regard most lawyers like cats regard small birds: Flighty things. Unable to keep their minds focused on what matters. And our lawful prey.

#hoistedfromthearchvies #publicsphere #orangehairedbaboons

Larry Summers: The Economist Who Helped Me Find My Callin...

Larry Summers: The Economist Who Helped Me Find My Calling: "Working for [Feldstein], I saw what I had not seen in the classroom: that rigorous and close statistical analysis of data can provide better answers to economic questions, and possibly better lives for millions of people. A doctor can treat a patient. An economist, through research or policy advice, can improve life for a population. Marty was appointed president of the NBER in 1977���a position he held for more than 30 years. The NBER became my professional home and occasionally my literal home as I slept near its computer terminals.... Marty was a magnet for talent.... Marty cared about people���s economic analysis, not their political affiliation. That is why he mentored stars like Jeffrey Sachs and Raj Chetty, who disagreed with him on many questions...

#noted

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers