J. Bradford DeLong's Blog, page 1176

July 16, 2014

Noted for Your Morning Procrastination for July 16, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Evening Must-Read: Joe Romm: Hottest March-June On Record Globally | Washington Center for Equitable Growth

Lunchtime Must-Read: Mark Blyth: Europe’s Goldilocks Dilemma | Washington Center for Equitable Growth

Lunchtime Must-Read: Chang-Tai Hsieh and Enrico Moretti: Growth in Cities and Countries | Washington Center for Equitable Growth

Morning Must-Read: Chris Blattman Links to Reviews of James Scott's "Seeing Like a State" | Washington Center for Equitable Growth

The importance of CBO’s new interest rate projections | Washington Center for Equitable Growth

Plus:

Things to Read on the Morning of July 16, 2014 | Washington Center for Equitable Growth

And:

Wednesday Book Reviews: Over at Equitable Growth: Chris Blattman Links to Reviews of James Scott's "Seeing Like a State" (Brad DeLong's Grasping Reality...)

The Need for Medicaid Expansion in Missouri: Live from the Roasterie CCXIX: July 16, 2014 (Brad DeLong's Grasping Reality...)

Liveblogging World War I: July 16, 1914: The Schlieffen Plan (Brad DeLong's Grasping Reality...)

Should-Reads:

Paul Krugman: On the Neo-paleo-Keynesian Phillips Curve: "I mentioned...in passing that recent data actually look like an old-fashioned pre-accelerationist Phillips curve--that is, unemployment determines the inflation rate, not the rate of change of the inflation rate.... There seems to be one of these funny situations right now where people who don’t work on such issues consider this a wild and crazy, or maybe just silly assertion, while those actually doing serious empirical work treat it as a matter of course.... Is that just me? No. Consider two recent studies on unemployment and inflation.... Michael Kiley... had the very good idea of adding power by estimating the relationship across a number of metropolitan areas... his Phillips curve is non-accelerationist for the past 15 years.... Klitgaard and Peck at Liberty Street... does a similar exercise for eurozone countries. Their results... [are] a relationship between the change in unemployment and the change in inflation, equivalent to a relationship between the level of unemployment and the level of inflation--i.e., an old-fashioned Phillips curve.... All I’m saying is that people trying to fit recent data keep finding something that looks like the old-fashioned relationship. You can offer various explanations--downward wage rigidity, anchored expectations, or maybe it just isn’t worth adjusting price-setting to match fairly small variations in expected inflation. But anyway, that’s what the data look like."

Tim Duy: Yellen Testimony: "Her choice of words is important here. Note that she does not say 'If the labor market improves more quickly'. Yellen says 'continues to improve more quickly' which means that the economy is already converging towards the Fed's objective more quickly than anticipated by current forecasts.... It brings into question whether or not the Fed should maintain its 'considerable period' language: 'The Committee continues to anticipate, based on its assessment of these factors, that it likely will be appropriate to maintain the current target range for the federal funds rate for a considerable time after the asset purchase program ends...'. There will be resistance... the Fed will want to ensure that any change is interpreted as the result of a change in the outlook rather than a change in the reaction function. But the hawks will argue that the communications challenge is best handled by dropping the language sooner than later.... Bottom Line: A generally dovish performance by Yellen today consistent with current expectations..."

Should Be Aware of:

Harold Pollack: Tobacco is still America’s top health threat. But Washington doesn’t treat it that way

Jason Millman: Even with Obamacare, shopping for health insurance isn’t as easy as buying a plane ticket

Sudeep Reddy: Live Blog: Federal Reserve Chairwoman Janet Yellen’s Semi-Annual Testimony

Janet Yellen: Semiannual Monetary Policy Report to the Congress

And:

Zack Beauchamp: Why Hamas' military wing scuttled a ceasefire with Israel: "Just hours after Israel accepted an Egyptian-brokered cease fire agreement on Tuesday morning, the calm collapsed. Hamas continued to fire rockets into Israel, and its militant wing announced 'We will continue to bombard until out conditions are met'.... After six hours of holding its fire, Israel resumed bombing the Gaza Strip--and it's not clear, now, when the fighting is going to stop.... No one's quite sure what Hamas thinks about the cease fire agreement. That may sound bizarre, given that they've clearly violated its terms and never accepted it, but the group has not yet issued any official statement on the deal. The New York Times, CNN, and leading Israeli newspaper Ha'aretz all reported that Hamas' cabinet was still considering the proposal as rockets were falling. What this suggests is that there may be a real division between Hamas' military wing, the Izz ad-Dim al-Qassam Brigades, and its political leadership. Nominally, the military wing reports to the political wing, but it's not clear that the political wing has total control over rocket fire. Notably, an al-Qassam statement, not a Hamas political spokesman, claimed responsibility for the rocket attacks that continues after the ceasefire. And just after the proposal was announced, a military wing statement said the ceasefire agreement 'is not worth the ink that wrote it'..."

Nate Cohn and Derek Willis: More Evidence That Thad Cochran Owes Runoff Win to Black Voters: "The precinct-level results for... Mississippi... all but prove that Senator Thad Cochran defeated Chris McDaniel, a Tea Party-backed state senator, through a surge in black, Democratic turnout.... Cochran won by 7,682 votes in the state’s 286 most Democratic precincts, where President Obama won a combined 93 percent of the vote in 2012. That tally slightly exceeds Mr. Cochran’s... margin of... 7,667.... He won 92 percent of the vote in the state’s most uniformly Democratic precincts, where Mr. Obama won 99 percent of the vote. These precincts voted for Mr. Cochran by 3,889 votes, or more than half of his statewide margin of victory..."

Zeynep Tufekci: Engineering the public: Big data, surveillance and computational politics: "Digital technologies have given rise to a new combination of big data and computational practices which allow for massive, latent data collection and sophisticated computational modeling, increasing the capacity of those with resources and access to use these tools to carry out highly effective, opaque and unaccountable campaigns of persuasion and social engineering in political, civic and commercial spheres. I examine six intertwined dynamics that pertain to the rise of computational politics: the rise of big data, the shift away from demographics to individualized targeting, the opacity and power of computational modeling, the use of persuasive behavioral science, digital media enabling dynamic real-time experimentation, and the growth of new power brokers who own the data or social media environments. I then examine the consequences of these new mechanisms on the public sphere and political campaigns..."

John Holbo: Dreams and Plagiarism: "In other news: Zizek isn’t looking like an especially responsible scholar. I find the explanation that ‘a friend’ sent him a long passage cribbed from a white supremacist book review and told him ‘he could use it freely’, in addition to being insufficient, rather incredible. With ‘friends’ who trick you into plagiarizing white supremacists, who needs enemies?..."

Already-Noted Must-Reads:

Chris Blattman: Links to Reviews of James Scott's "Seeing Like a State": "Daron Acemoglu and James Robinson discuss the work of Jim Scott in a (so far) three-part series: here, here and here.... Brad Delong on Seeing Like a State. Also, Paul Seabright’s review in the LRB.

Chang-Tai Hsieh and Enrico Moretti: Growth in Cities and Countries: "We use a Rosen-Roback model of urban growth to show that a summary statistic for the aggregate effect of local growth (decline) is whether it shows up as an increase (decrease) in local employment or as an increase (decrease) in the nominal wage relative to other cities. Differences in the nominal wage across cities reflect differences in the marginal product of labor across cities which, ceteris paribus, lower aggregate output. We show that the dispersion of the average nominal wage across US cities increased from 1964 to 2009 and may be responsible for a 13% decline in aggregate output. Changes in amenities appear to account for only a small fraction of this output loss, with most of the loss likely caused by increased constraints to housing supply in highly productive cities. We conclude that welfare gains from spatial reallocation of the US labor force are likely to be substantial..."

Mark Blyth: Europe’s Goldilocks Dilemma: "The policy of austerity has twin goals: reducing growth in public debt and boosting investor confidence. On both counts, the eurozone's attempts have been an unmitigated failure.... The confidence-inspiring powers of what was curiously called 'expansionary fiscal contraction', the idea that budget cuts today make people spend more since they will have lower taxes in the future, haven't been any better. European consumer confidence dropped precipitously during the crisis and has yet to return to positive territory. Investment expectations, as measured by business confidence surveys, similarly fell as austerity took its toll and are now barely positive. Growth rates track these declines but with a North-South twist: Germany is pulling ahead, France is flat-lining, Italy is stagnating, and the periphery remains in negative territory. Unemployment rates (outside the export-driven North) are stuck at levels last seen on the eve of World War II. Given all this, you would think a halt to such self-defeating policies would be a good idea. And indeed, it is. But that doesn't mean that Brussels and Berlin can actually stop austerity..."

Joe Romm: Hottest March-June On Record Globally, Reports Japan Meteorological Agency: "The JMA reported Monday that last month was the hottest June in more than 120 years of record-keeping..."

Joe Romm: Hottest March-June On Record Globally, Reports Japan Meteorological Agency: "The JMA reported Monday that last month was the hottest June in more than 120 years of record-keeping..."

Wednesday Book Reviews: Over at Equitable Growth: Chris Blattman Links to Reviews of James Scott's "Seeing Like a State"

Over at Equitable Growth: Chris Blattman: Links to Reviews of James Scott's "Seeing Like a State": "Daron Acemoglu and James Robinson...

...discuss the work of Jim Scott in a (so far) three-part series: here, here and here.... Brad Delong on Seeing Like a State. Also, Paul Seabright’s review in the LRB.

The Need for Medicaid Expansion in Missouri: Live from the Roasterie CCXIX: July 16, 2014

HEALTH CARE FOR WORKING FAMILIES

HEALTH CARE FOR WORKING FAMILIES

REFORMING MEDICAID THE MISSOURI WAY:

“It is up to us to make the right choice - the human choice - and live in a place where working Missourians get a fair shake. A place where someone who works two jobs can afford to see a doctor when they are sick. A place where everyone lives longer, healthier, fuller lives...” – Governor Jay Nixon

What is Medicaid?

Medicaid provides health care services to low-income Missourians, their children and people with disabilities. About 829,000 Missourians receive Medicaid services, including 503,000 children; 158,000 people with disabilities; 75,000 seniors; 72,000 low income adults; and 21,000 pregnant women.

Currently, Medicaid is funded through a combination of 63% federal funds and 37% state funds.

Expanding Medicaid would close the Coverage Gap

Medicaid Expansion would raise Missouri’s income limit to 138% of the federal poverty level. Under the new limit, Medicaid would provide health care to an estimated 300,000 low-income adults, closing the Coverage Gap.

What is the Coverage Gap?

People who make too much to qualify for Medicaid under the current law, but not enough to qualify for other health subsidies are in the ‘Coverage Gap.’ According to the Kaiser Health Foundation: “Most people without health coverage are in working families and have low incomes.”[1][1]

To qualify for Medicaid under Missouri’s current law, a person must make less than 19% of the federal poverty level, which is $3,760 a year for a family of three. Under the Affordable Care Act, individuals start qualifying for subsidies to buy health insurance if they make 100% of the federal poverty level, which is $19,790 a year for a family of three.

What would expanding Medicaid cost the state?

The services provided under expansion would be paid mainly through federal revenue. For 2014, 2015 and 2016, federal funds would pay 100% of the cost. Even after 2021, federal funds would pay 90% of the cost.

By expanding and reforming Medicaid, any new costs to the state would be offset by savings in other areas. As a result, expanding and reforming Medicaid will actually save the state money.

How would expanding Medicaid save the state money?

Expanding and reforming Medicaid results in savings to the state in three ways:

Higher federal match rate

Improved patient outcomes

Increased economic activity

Saving the state money - Higher federal match rate

Currently, Medicaid is funded by 63% federal funds. Under Medicaid expansion, federal funds will pay:

100% through calendar year 2016

95% for 2017

94% for 2018

93% for 2019

90% for 2020 and all future calendar years.

Missouri currently pays as much as 100% of the cost of health care for some people who are not currently eligible for Medicaid. With expansion, some costs that are currently covered with state funds will be switched to federal funding. This will save the state money. For example:

The Department of Mental Health provides services to over 40,000 individuals with behavioral health issues with 100% state funds. With Medicaid expansion, many of these costs would be paid for by the federal government.

100,000 individuals including pregnant women with income up to 185% of the federal poverty level. Currently, federal funds only pay 63% of these costs. With Medicaid expansion, many of these women would have their health care costs paid with 90% - 100% federal funds, regardless of whether or not they are pregnant.

Saving the state money – Improved patient outcomes

Missouri will achieve savings through several reforms that will improve patient outcomes.

Right now, many Missourians – especially those in rural areas – have trouble getting access to primary and mental health care services. To address this challenge, Gov. Nixon is proposing expanding incentives that encourage health professionals to practice in underserved areas and increasing reimbursement rates for Medicaid providers to levels comparable to private insurance.

Saving the state money – Increased economic activity:

By expanding Medicaid, an additional $2 billion in federal funds will be pumped into Missouri’s health care system each year. The 300,000 Missourians who will have access to health care will seek the services of doctors, nurses, psychiatrists, therapists, hospitals and pharmacies. Increased health care services will drive the need to hire more health care professionals as well as ancillary staff. This will increase employment, payroll and sales taxes to the state.

A very conservative estimate is that the state will gain about $40 million per year in increased revenue due to this economic activity. A study by the Missouri Department of Economic Development estimates an increase of about 24,000 jobs as a result of Medicaid expansion.

The Missouri Hospital Association has estimated that passing up this opportunity to strengthen Medicaid will cost the state 9,000 jobs, increase uncompensated care costs by $11.1 billion, and hike health insurance premiums for families and businesses by more than $1 billion.

What are other states doing?

A majority of states are actively moving forward with Medicaid expansion for their citizens, including Missouri’s neighbors - Arkansas, Kentucky, Iowa and Illinois. Many of these states are using Medicaid expansion as an opportunity to get additional flexibility to make reforms.

[1]: http://kaiserfamilyfoundation.files.w...

Liveblogging World War I: July 16, 1914: The Schlieffen Plan

Gerhard Ritter: The Schlieffen Plan: Critique of a Myth:

Gerhard Ritter: The Schlieffen Plan: Critique of a Myth:

Discussion of the Schlieffen Plan up to date has... always tried to discover a formula for success in the one-sided massing of attacking forces on the right wing—-a rather primitive formula in view of the restricted deployment area on the upper Meuse, the destruction of the Belgian railway network and the consequent enormous marches needed to outflank the enemy front line! The great Schlieffen Plan was... an over-daring gamble whose success depended on many lucky accidents. A formula for victory needs a surplus of reasonable chances of success if it is to inspire confidence—-a surplus which tends quickly to be used up by "frictions" in the day-to-day conduct of war. The Schlieffen Plan showed an obvious deficit in these chances: it was, in Schlieffen's own words, "an enterprise for which we are too weak." True, he wanted to cure this weakness by improvising at least eight Ersatz corps. But he could neither say how such improvised corps were to be made militarily efficient and provided with equipment, nor show how they were to be brought to the decisive point of the front in time.... Thus the Reichsarchiv (I, 55) referred to the Schlieffen Plan as "at the same time a programme for the further enlargement of the army and for its mobilisation."

Well, if it was a programme, it remained ineffective as such: a strictly guarded secret in the safes of the Great General Staff. The request to the War Ministry does not alter the fact that during his fifteen years in office as Chief of the General Staff, Schlieffen did very httle to expand the German Army to the figure needed for the fulfilment of his plans. Nor did his successor do anything.... There remains a strange disproportion between the high aims of the German General Staff and the forces available to them in practice. For active defence, as the elder Moltke envisaged it, the existing forces would have sufficed.... But for what Schlieffen had in mind, a quick, total annihilation of the enemy, Germany's strength was simply not adequate, particularly when, after the French, the mighty Russian Army was to be "annihilated" too!...

Schlieffen had not the least use for the German Navy either, though its development reached a new and decisive stage in 1906. It was to be used neither as an offensive weapon to support the Western front, nor in the Baltic, where its superiority was already unquestioned and where one might have thought its task was to secure sea lanes and enable the German Army to operate in the Baltic coastal provinces—perhaps even to force Russian harbours....

The extent of Schlieffen's uncertainty as to whether there would really be enough troops to inundate and occupy so many areas, and to invest so many fortified positions, is shown by bis suggestion that the Germans should resort to terror measures if necessary... giving the Belgian Government the choice of "a bombardment of its fortified towns, particularly Liege, as well as a considerable levy—-or of handing over all fortresses, railways and troops." To be able to carry out the bombardment if necessary, and also to force French towns like Lille or Nancy to capitulate quickly, the heavy artillery is to be suitably equipped.

When the long-expected crisis broke in July 1914, Germany had prepared nothing diplomatically, not even the ultimatum to Belgium. She had nothing but a plan for a military offensive, whose rigid time-table robbed her diplomacy of all freedom of manoeuvre.... There can be no doubt that the Chief of the General Staff kept the Government informed from the beginning of his plan to march through Belgium in case of war—-of course, only confidentially... for it was, after all, a military secret of the first order. But this did not preclude confidential discussions.... Count Hutten-Czapski, who at the time played the role of confidential adviser and "private secretary" to Prince Hohenlohe, records that in May 1900 the Chiet of the General Staff... asked... if he would agree to sound Holstein and the Chancellor confidentially on the following matter:

After long and conscientious reflection he had become convinced that in the event of a two-front war, success might possibly depend on Germany's not allowing international agreements to restrain her strategic operations. It would mean a great deal to him if Holstein could give him his personal point of view...

The whole conversation lasted only a few minutes. The name of the country to which Schlieffen referred was never mentioned, but Count Hutten immediately thought of Belgium.

July 15, 2014

Noted for Your Morning Procrastination for July 15, 2014

Over at Equitable Growth--The Equitablog

Over at Equitable Growth--The Equitablog

Nick Bunker: The changing calculus of labor market churn | Washington Center for Equitable Growth

Morning Must-Read: Simon Wren-Lewis: Macroeconomists, Not Bankers, Should Set Interest Rates | Washington Center for Equitable Growth

How to Understand the BIS View as an Analytical Position Rather than a Rhetorical Attitude?: Tuesday Focus for July 15, 2014 | Washington Center for Equitable Growth

Plus:

Things to Read on the Morning of July 15, 2014 | Washington Center for Equitable Growth

And:

World War I Reading List: Late Summer 2014 (Brad DeLong's Grasping Reality...)

Liveblogging World War II: July 15, 1944: Attrition, Rommel, Kluge (Brad DeLong's Grasping Reality...)

Over at Equitable Growth: How to Understand the BIS View as an Analytical Position Rather than a Rhetorical Attitude? (Brad DeLong's Grasping Reality...)

In Which Kansas Congressman Tim Huelskamp Edits His Own Wikipedia Page: Live from the Roasterie CCXVIII: July 15, 2014 (Brad DeLong's Grasping Reality...)

Down the Mississippi: Cochrane vs. McDaniel: Live from the Roasterie CCXVII: July 14, 2014 (Brad DeLong's Grasping Reality...)

Liveblogging World War II: July 14, 2014 (Brad DeLong's Grasping Reality...)

Liveblogging World War I: July 13, 1914: Austrian Investigation Concludes (Brad DeLong's Grasping Reality...)

Weekend Reading: Claudio Borio (2012): The Financial Cycle and Macroeconomics: What Have We Learnt? (Brad DeLong's Grasping Reality...)

Should-Reads:

David F. Hendry and Grayham E. Mizon: Why standard macro models fail in crises: "Many central banks rely on dynamic stochastic general equilibrium models. The models’ mathematical basis fails when crises shift the underlying distributions of shocks. Specifically, the linchpin ‘law of iterated expectations’ fails, so economic analyses involving conditional expectations and inter-temporal derivations also fail. Like a fire station that automatically burns down whenever a big fire starts, DSGEs become unreliable when they are most needed..."

John Aziz: Rube Goldbergnomics, or how I learned to stop worrying and love fiscal stimulus: "It is strange, to say the least, to witness the logical machinations of those who believe that austerity is the answer to a depressed economy.... It is an inherently reactionary position. That is it originates not so much as in being an idea designed to solve a problem, but an idea designed to justify a political position. More specifically, the political position that greater government is never the solution, and that government spending just sucks money out of the productive economy. And that, I think, is why so few austerians have updated their priors against austerity as a remedy to a depression, and continue to clutch at straws to justify their position.... Here's the key thing: cutting government spending is contractionary by definition. Cutting spending is cutting spending. The net effect will not always be contractionary, of course, because sometimes it will lead to a confidence boost (particularly, I think, if the cut spending was particuarly wasteful). But that confidence boost... depends on a pretty nebulous mechanism: that businesses will see a government policy, interpret the policy in a certain way and choose to respond in a certain manner. It is a Rube Goldberg mechanism: action A needs to lead to action B, needs to lead to action C.... There is no guarantee that this stream of events will occur.... What isn't Goldbergian? Boosting government spending is expansionary by definition..."

Emma Sandoe: Medicaid is the Best: Part 1: "Medicaid is my personal favorite federal (more accurately federal-state partnership, but you get what I mean) program. If you read this blog regularly I will attempt to convince you of that fact and you too will love Medicaid. Soon, we all will be on Team Medicaid and I will finally have a purpose for these hundreds of t-shirts I ordered. Today: Medicaid as an innovator..."

Should Be Aware of:

Moses Finley: The Ancestral Constitution

Justin Vaisse (2010): Why Neoconservatism Still Matters

Barry Ritholtz: Pro Forecasters Stink, You're Worse

Robert Frost: North of Boston

Claudio Borio (2012): The Financial Cycle and Macroeconomics: What Have We Learnt?

Koleman Strumpf: The Effect of File-Sharing on Box-Office Revenue

Ashutosh Jogalekar: Richard Feynman, sexism and changing perceptions of a scientific icon

And:

Robert Waldmann: Comment on Del Negro, Giannoni & Schorfheide (2014): "1) I have just skimmed the paper. I didn’t work through the equations. 2) I am very hostile to the whole discorso (roughly literature or research program). 3) I am more favorably impressed than I would like to be.... Del Negro et al contest the claim that some special nominal rigidity at zero change is needed to fit the data.... In effect the story of the 70s and 80s is one of the bold Volcker regime shift which caused a dramatic change in inflation by causing a dramatic change in expected future inflation. Here there are implications for variables other than inflation--in the 70s and 80s explicit forecasts of inflation from surveys, and in this millennium TIPS spreads as well. These implications are not tested.... Risk premia are central to Del Negro et als (and DeLong’s) explanation.... The paper does not confront the risk premia forecast by the model for 2008-2014 with the time series of actual risk premia.... I have an even crankier complaint about the financial frictions. They are modelled as the effect on risk premia of exogenous and otherwise unobserved variation in the variance in skill across entrepreneurs.... Since this variable appears only as a shifter in the risk premium... the microfoundations add nothing and subtract nothing.... The only implication of the microfounded model is that risk premia can vary for unexplained reasons and risk premia affect investment. My objection is that, since in practice all deviations between microfounded models and an ad hoc aggregate models are bugs not features, what possible use could there ever be in micro founding models?"

Hussein Ibish: What Israel and Hamas are really trying to accomplish in Gaza: "Hamas has been desperately trying to get out of this morass that it's found itself in.... They tried to foment trouble in the West Bank, and it didn't succeed. They didn't get anything out of the unity agreement, so it's falling back on what it knows sometimes gets results--which is rocket attacks. What they are hoping for, this time, is concessions not from Ramallah or from Tel Aviv, but from Cairo.... What Hamas can get can only come from Egypt. From Israel, they're demanding the release of prisoners that were part of the shahid squad [a Hamas military group] that was arrested when Israel was pretending they didn't know the teenagers were dead. Israel tracked them down and dealt Hamas a serious blow. Which is why Netanyahu isn't so interested in getting into an artillery/aerial exchange with Hamas--the Israelis frontloaded their retribution. It was all done in the West Bank, before the bodies were found..."

Gregg Carlstrom: Is This Hamas’ Last War?: "Sisi’s military-backed [Egyptian] regime... has declared Hamas a terrorist organization, and destroyed most of the smuggling tunnels into Gaza on which the group relied for weapons and tax revenue. The tunnel closures have brought Hamas to a point of diplomatic and financial isolation, which compelled it to announce a reconciliation deal with Fatah in April.... Hamas agreed to a 'national consensus' government that contained no members of the group. The deal had already begun to flounder before the Israeli military campaign, with both sides arguing over who should control Gaza, and the kidnapping pushed the Hamas-Fatah relationship again to the point of collapse."

Already-Noted Must-Reads:

Noah Smith: Should the Fed crash the economy now to prevent a crash later?: "To many, the implication is clear: The Fed needs to raise interest rates in order to prevent a destabilizing market crash. That isn't a good idea.... Higher asset prices due to lower safe interest rates aren't some kind of nefarious plot--this is just Finance 101.... That’s rational price appreciation, not a bubble.... When practically everyone is convinced that asset prices are relatively high, like now, it’s pretty obvious that there aren’t many greater fools out there. If you look at past bubbles, such as the late-'90s tech bubble or the mid-2000s housing bubble, you see that there was always a large contingent of society that thought it wasn’t a bubble at all.... Who nowadays thinks that there’s some special Big New Thing that’s going to push stocks and bonds and commodities all to stratospheric heights forever?.... I say we hold off on our calls for anti-bubble rate hikes.

Nick Rowe: Some simple arithmetic for mistakes with Taylor Rules: "If you see your neighbour thinking of doing something daft apparently unaware of one of the problems, you ought to speak up. Especially if it will affect you too, because you do a lot of trade with your neighbour. A fixed Taylor Rule... makes the danger of hitting the ZLB bigger than you think it is. And Taylor Rules don't work at the ZLB.... What happens if you are wrong about the natural rate of interest, or wrong about potential output?... If actual potential output is one percentage higher than you think it is, that makes you set the nominal rate 0.5 percentage points too high, and so inflation would need to be 0.33 percentage points too low on average to have a big enough offsetting effect to cancel out your mistake.... For a normal central bank, that is a problem, but it is not a big problem.... They fix mistakes in their Taylor Rule as they go along.... That's probably the main reason why we always observe a lagged interest rate in the equation when we estimate a central bank's reaction function.... But if the parameter values of the Taylor Rule are fixed by law, central banks are not allowed to learn from their mistakes.... If you really really want to legislate a Taylor Rule, OK. But there's a price you must pay, if you want to maintain the same margin of safety against hitting the ZLB. That price is a higher average rate of inflation built right into that legislated Taylor Rule. Your choice: legislated Taylor Rules; hitting the ZLB more frequently; a higher rate of inflation. Pick any two..."

Simon Wren-Lewis: Why macroeconomists, not bankers, should set interest rates: "[The] interest rate... which closes the output gap [maintains] the level of output and unemployment that will keep underlying inflation constant... [is] the Wicksellian natural rate.... But, respond[s]... the BIS... monetary policy cannot afford to ignore the financial sector, and the risk of excessive lending and bubbles.... The implication is that a financial crisis only happens because interest rates are set at the wrong level.... The... deregulation of the financial sector in the decades before?--not an issue. The widespread misselling of subprime mortgages?--these things happen. All the other examples of misselling and fraud?--boys will be boys. An industry that profits from a massive implicit public subsidy?--we see no subsidy. Classifying subprime products as AAA? Massive increases in bank leverage in the 00s?--all the result of keeping interest rates too low. When those putting the BIS case tell you that macroprudential controls (a.k.a. financial regulations) are ‘untested’ and ‘uncertain in their impact’, what they are really saying is that the financial system cannot be regulated to make it safe when interest rates are low....

"I like to praise the current UK government when I can. In setting up a Financial Policy Committee that is separate from the Monetary Policy Committee they did exactly the right thing. This formalises an assignment: macro prudential policy to control financial sector excess, and interest rates to control demand and inflation. Most macroeconomists know this makes sense. But the financial sector has a pecuniary interest in pretending otherwise. Those that get too close to that sector should be kept well away from setting interest rates."

Tuesday Reading: Late Summer 2014 World War I Reading List

World War I Reading List: Late Summer 2014:

World War I Reading List: Late Summer 2014:

Liaquat Ahamad: Lords of Finance

Norman Angell: The Great Illusion: A Study of the Relation of Military Power to National Advantage

Friedrich von Bernhardi: Germany and the Next War

Pitt Buttar: Collision of Empires: The War on the Eastern Front in 1914

Winston S. Churchill: The World Crisis I , II ), III , IV

Christopher Clark: Iron Kingdom

Christopher Clark: The Sleepwalkers

Charles Emmerson: 1913: In Search of the World Before the Great War

Andrew Gordon: The Rules of the Game: Jutland and British Naval Command

John Maynard Keynes: The Economic Consequences of the Peace

Robert Massie: Castles of Steel: Britain, Germany, and the Winning of the Great War at Sea

Thomas Otte: July Crisis: The World's Descent into War, July 1914

Dennis Showalter: Tannenberg: Clash of Empires, 1914

A.J.P. Taylor: War by Timetable: How the First World War Began

Adam Tooze: The Deluge: The Great War and the Remaking of Global Order, 1916-1931

Richard Toye: Churchill's Empire: The World that Mad Him and the World He Made

Barbara Tuchman: The Guns of August: The Outbreak of World War I

Geoffrey Wawro: A Mad Catastrophe: The Outbreak of World War I and the Collapse of the Habsburg Empire

Liveblogging World War II: July 15, 1944: Attrition, Rommel, Kluge

Richard Atkinson: The Guns at Last Light:

Richard Atkinson: The Guns at Last Light:

On any given day now, Army Group B might suffer as many losses as Rommel’s Afrika Korps had in the entire summer of 1942. Only 10,000 replacements had arrived to compensate for 100,000 German casualties in Normandy over the past six weeks. A British cannonade of 80,000 artillery rounds at Caen on July 10 had been answered with 4,500 German shells, all that were available. Rommel had seen a battalion commander riding horseback for want of a car or of fuel. “The divisions are bleeding white,” his war diary recorded. Berlin anticipated 1.6 million German casualties on all fronts from June through October, far more than the Fatherland could sustain.

Rommel’s disaffection grew day by day. Hitler “will fight without the least regard for the German people until there isn’t a house left standing in Germany,” he told his confidant Admiral Ruge. The field marshal was aware of talk, dangerous talk, of a separate peace on the Western Front, and perhaps a coup; he opposed making Hitler a martyr but would consider taking command of the armed forces if necessary.

In early July, Rundstedt had been removed as commander in the west, ostensibly after pleading age and infirmity, but in fact because he had advised Berlin to “make an end to the whole war.” Hitler gave him a medal and a 250,000-mark gratuity to go take the cure at Bad Tölz. “I will be next,” Rommel predicted.

Rundstedt’s successor, Field Marshal Günther von Kluge, known as Cunning Hans, had commanded an army group in the east for two years and brought to France a reputation as a fearless and tenacious innovator. In their first meeting at La Roche–Guyon, he accused Rommel of “obstinate self-will,” but within a week concurred that “the situation couldn’t be grimmer.” On July 15, Rommel composed a three-page report for the high command, in which he wrote: “The situation on the Normandy front is growing worse every day and is now approaching a grave crisis. The unequal struggle is approaching its end.” Kluge endorsed the assessment in a cover note to Berlin...

July 14, 2014

Over at Equitable Growth: How to Understand the BIS View as an Analytical Position Rather than a Rhetorical Attitude?

Over at Equitable Growth: Paul Krugman admonishes me for thinking I should try to work out what model underlies the Bank for International Settlements' 84th Annual Report. It is, he says, not so much a macroeconomic model or an analytical framework. Rather, he says, it is a mood: the rhetorical stance of austerity a outrance:

Over at Equitable Growth: Paul Krugman admonishes me for thinking I should try to work out what model underlies the Bank for International Settlements' 84th Annual Report. It is, he says, not so much a macroeconomic model or an analytical framework. Rather, he says, it is a mood: the rhetorical stance of austerity a outrance:

Paul Krugman: Liquidationism in the 21st Century: "The BIS position... [is] that of 1930s liquidationists like Schumpeter...

...who warned against any 'artificial stimulus' that might leave the 'work of depressions undone'. And in 2010-2011 it had an intellectually coherent--actually wrong, but coherent--story... that mass unemployment was the result of structural mismatch... [and] easy money would lead to a rapid rise in inflation.... it didn’t happen. So... it... look[ed] for new justifications for the same [policy] prescriptions... playing up the supposed damage low rates do to financial stability.... That over-indebtedness on the part of part of the private sector is exerting a persistent drag on the economy... is a reasonable story.... But the BIS... doesn’t understand that model... as if they were equivalent to... real structural problems... [which] makes a compelling case for... fiscal deficits to support demand while the private sector gets its balance sheets in order, for monetary policy to support the fiscal policy, for a rise in inflation targets both to encourage whoever isn’t debt-constrained to spend more and to erode the real value of the debt. The BIS, however, wants governments as well as households to retrench... and--in a clear sign that it isn’t being coherent--it includes a box declaring that deflation isn’t so bad, after all. Irving Fisher wept....

Are the BIS’s methods unsound? I don’t see any method at all. Instead, I see an attitude, looking for justification... READ MOAR

And Simon Wren-Lewis has an equally difficult time finding an analytical method here:

Simon Wren-Lewis: Why macroeconomists, not bankers, should set interest rates: "Notice what is going on here...

...The implication is that a financial crisis only happens because interest rates are set at the wrong level. The Great Recession was all the fault of the Fed, who kept interest rates too low after the 2001 recession. The gradual deregulation of the financial sector in the decades before?--not an issue. The widespread misselling of subprime mortgages?--these things happen. All the other examples of misselling and fraud?--boys will be boys. An industry that profits from a massive implicit public subsidy?--we see no subsidy. Classifying subprime products as AAA? Massive increases in bank leverage in the 00s?--all the result of keeping interest rates too low.

When those putting the BIS case tell you that macroprudential controls (a.k.a. financial regulations) are ‘untested’ and ‘uncertain in their impact’, what they are really saying is that the financial system cannot be regulated to make it safe when interest rates are low. There is no evidence for that proposition, and a lot of history that says otherwise.... But of course most working in the financial sector hate regulation. They have an interest in perpetuating different stories about the Great Recession. If you spend too much time around bankers, there is a danger that you come to believe these self-serving stories...

As does Noah Smith:

Noah Smith: Should the Fed crash the economy now to prevent a crash later?: "Asset prices, by historical measures, are high across the board.... Low risk-free rates, courtesy of the Federal Reserve, are driving investors... into risk assets. To many, the implication is clear: The Fed needs to raise interest rates in order to prevent a destabilizing market crash. That isn't a good idea.... First of all, higher asset prices due to lower safe interest rates... [are] rational price appreciation, not a bubble.

OK, but what if a bubble does occur?... Bubbles form when people think they can find some greater fool to sell to. But when practically everyone is convinced that asset prices are relatively high, like now, it’s pretty obvious that there aren’t many greater fools.... [In] past bubbles... there was always a large contingent of society that thought it wasn’t a bubble at all--that 'this time, it’s different'. Who nowadays thinks that there’s some special Big New Thing?... No one I know of. Paradoxically, the one time it’s hardest to have a bubble is when everyone and their dog is unhappy about asset prices and scared that there’s a bubble....

There’s laboratory evidence for bubbles.... It’s true that when you give traders in the lab more cash, you get more and bigger bubbles. Unfortunately, it’s also the case that raising interest rates doesn’t pop the bubbles, which tend to form whenever some people don’t understand fundamentals.... Basically, the people calling for Fed Chief Janet Yellen and the Fed to raise rates are demanding that the Fed crash asset prices in order to avoid an asset price crash....

There is also the idea that the rise in asset prices is simply unnatural or artificial. But the Fed has been regulating the monetary base for many decades, and for a lot of that time there were no big bubbles. Like it or not, the Fed is a natural part of the financial ecosystem.... It seems to me that 'naturalness' is a pretty weak justification for deliberate government action to crash the value of Americans’ retirement accounts.... The Fed isn’t yet worried enough... to use the blunt hammer of rate hikes. Its cautious, middle-of-the-road policy seems very at-odds with the extremism that a lot of people in the finance industry seem to attribute to it. I say we hold off on our calls for anti-bubble rate hikes.

I am not so sure. I do think that there is a chance that the BIPS view will turn out to be a live analytical position--if only I could figure out what it was. And let me say that the way the BIS phrases its case is not the way that I find helpful at all. But I--tentatively--conclude that it is a live position, albeit a weak one.

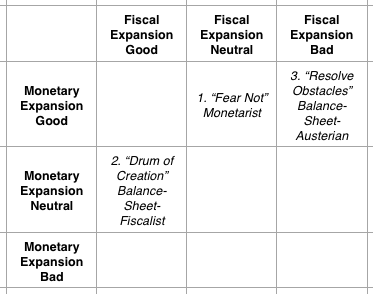

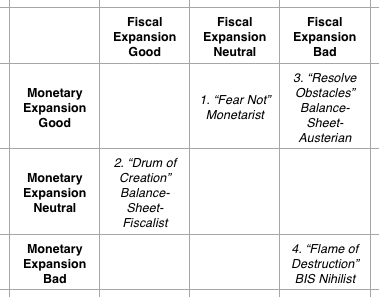

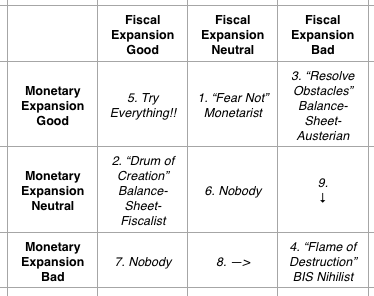

The three clearly live analytical positions--on the (1) fear-not, (2) drum-of-creation, and (3) remove-obstacles hands, respectively--are the monetarist, balance-sheet-fiscalist, and balance-sheet-austerian. The question is whether the BIS's position qualifies as a live analytical position on the (4) flame-of-destruction hand...

On the (1) fear-not hand, the monetarist position holds that central banks can successfully rebalance economies at full employment with low inflation by central banks' setting the short-term safe interest rates they control low enough and promising to credibly keep them low enough long enough to match Wicksellian planned investment to desired saving at full employment. The major critiques of the monetarist position are three: First, the question of how to manufacture sufficient credibility out of thin air--why should trying to summon the Inflation-Expectations Imp be any easier or more effective than trying to summon the Business-Confidence Fairy? Second, the zero lower bound means that the short-term safe real interest rate now is above its optimum value, and so getting the long-term safe interest rate now to its optimum value requires expected future state real interest rates below their optimum values: a reliance on monetary policy alone requires future expansionary monetary irresponsibility. Third, if (as I believe) the root problem is not a global savings month or investment shortfall but an absence of risk tolerance and a broken credit channel, expansionary policy that reduces all rather than just risky interest rates distorts the economy by incentivizing the creation of too-many long-duration assets. Fourth, very low long-term real interest rates amplify principal-agent problems because debtors no longer have to show their creditors the money via substantial positive cash flows.

On the (2) drum-of-creation hand, the balance-sheet-fiscalist position holds that the key problem is a broken credit channel and a lack of private-sector risk tolerance: savers no longer trust financial intermediaries to do the risk transformation and so to properly back financial assets of the degree of safety savers want to hold with appropriately-managed claims on the income from risky capital, and savers do not have the risk-tolerance to hold the financial assets that they do trust financial intermediaries to create. The solution is therefore to use the government to mobilize the risk-bearing capacity of the taxpayers, and to either guarantee loans in order to create the safe assets that savers want to hold or simply to create the safe assets savers want to hold directly: borrow money and buy stuff. The first critique is that we do not have great confidence that the government will get good-enough value either from its direct expenditures or from its loan guarantees. The second critique is the balance-sheet-austerian position.

On the (3) remove-obstacles hand, the balance-sheet-austerian position is that the problem is indeed a shortage of risk-tolerance and a credit channel that cannot fund enough risky investment projects to attain full employment, but that that is not the root problem: the root problem is excessive leverage. The solution is thus a painful-slog: we must wait for time, bankruptcy, rescheduling, and amortization to deleverage the economy until full employment is once again sustainable given saver tolerance for and intermediary ability to transform risk. The right policy is that government should do what little it can to hurry along the process of deleveraging, to the extent that it can. And this process can certainly be assisted by monetary expansion a outrance and (somewhat) higher inflation.

What this process cannot be assisted by, on the balance-sheet-austerian view, is fiscal expansion. Why not? Because expansionary fiscal and credit policies are very likely to crack the government's status as safe borrower. If expanded government debt means that the government also loses its status as a creator of safe assets, then we have not reduced but widened the gap between the (diminished) supply of safe assets from financial intermediaries (including the government) and the (enhanced) demand for safe assets from savers. We have thus worsened the problem by greatly amplifying the amount of deleveraging necessary, and so deepened and lengthened the depression.

I believe that all three of these positions--monetarist central-banks-can-do-it, balance-sheet-austerian painful-slog, and balance-sheet-fiscalist borrow-and-spend--are intellectually-coherent arguments that might be true here and now and are definitely true in some possible worlds (and, I would argue, in some past historical episodes). If we want to put them in a table depending on whether they judge monetary and fiscal expansion now to be helpful, neutral, or harmful, it looks like this:

The question is whether there is a fourth live analytical position--a coherent argument that both monetary and fiscal expansion are, here and now, bad, and whether as the BIS argues budget deficits need to be further slashed and interest rates raised RIGHT NOW!!:

I think the balance-sheet-fiscalist position is more correct. Not that more monetary expansion is unhelpful, mind you, just that it is not first-best and is likely to be insufficient. But it could work. And we should try it. And not that deleveraging is unhelpful, mind you, just that it is not first-best. Put me down as saying: (5) try everything. (And, parenthetically, note that there are four boxes left unfilled: I know of absolutely nobody even trying to take position (6)--both fiscal policy and monetary policy right now are practically perfect in every way--or position (7)--expansionary fiscal policy is good and expansionary monetary policy bad. And positions (8) and (9) that either monetary or fiscal expansion bad but the other neutral seem to slide rapidly into the BIS view...)

Why am I not in either the monetarist or the balance-sheet-austerian boxes? Because I buy the four critiques of the monetarist position, and I think that here and now the chances that additional fiscal expansion will crack the reserve-currency issuing governments' status as safe borrowers are very low, and that we will have plenty of advance warning should that process of the cracking of safe-asset-issuer status even begin.

So let us now try to dig into the mind of the BIS. The place to start is with Claudio Borio (2012): The Financial Cycle and Macroeconomics: What Have We Learnt?, for the BIS report is an implementation of that paper's theoretical framework. The paper summarizes its section on monetary policy during the post-balance-sheet-recession recovery thus:

What about monetary policy?... Extraordinarily aggressive and prolonged monetary policy easing can buy time but may actually delay, rather than promote, adjustment.... Monetary policy is likely to be less effective in stimulating aggregate demand.... There are at least four possible side-effects of extraordinarily accommodative and prolonged monetary easing. First, it can mask underlying balance sheet weakness.... Second, it can numb incentives to reduce excess capacity in the financial sector and even encourage betting-for-resurrection behaviour.... Third, over time, it can undermine the earnings capacity of financial intermediaries. Extraordinarily low short-term interest rates and a flat term structure, associated with commitments to keep policy rates low and with bond purchases, compress banks’ interest margins. And low long-term rates sap the strength of insurance companies and pension funds, in turn possibly weakening the balance sheets of non-financial corporations, households and the sovereign.... Finally, it can atrophy markets and mask market signals, as central banks take over larger portions of financial intermediation.... Over time, political economy considerations may add to the side-effects... [the] central bank’s autonomy and, eventually, credibility may come under threat....

The first point made is the standard critique of the monetary-policy-is-enough view: In a balance-sheet recession and especially at the zero lower bound, expansionary monetary policy has only limited traction. It must reduce expected future short-term safe interest rates by credibly promising future monetary policies that seem incredible. And beyond that it can only have traction on long-term real interest rates by summoning the Inflation-Expectations Imp. This is, of course, a very standard argument these days. It says that the benefits of expansionary monetary policy in a balance-sheet recession at or near the zero lower bound are low.

More problematic are the next five points: costs of expansionary monetary policy as it:

masks underlying balance sheet weakness.

numbs incentives to reduce excess financial-sector capacity and encourages betting-for-resurrection.

undermines the earnings capacity of financial intermediaries by compressing banks’ interest margins and sapping the strength of insurance companies and pension funds.

atrophying markets and masking market signals, as central banks take over larger portions of financial intermediation.

political economy considerations as the central bank’s autonomy and credibility come under threat.

It does not seem to me that (5) should be a consideration: it is the business of central banks to choose the right technocratic policy and to fight for the technocratic autonomy to do so. Economists do such central banks no good service when they curb their advice as to what is the technocratic first-best and so rob central banks of the ammunition that they need in their contest with political masters.

It also does not seem to me that (4) should be a consideration. We are in this mess in large part because the--deregulated--financial market could not produce the right price signals and had opened up markets in types of debt that really should not have existed, no? That the process of repairing the damage requires a somewhat larger public-sector role until the damage is fixed is regrettable, but not a reason not to do the job.

And it does not seem to me that (3) should be a consideration either. Organizations like pension funds and insurance companies have assets with a short and liabilities with a long duration. When circumstances have made the Wicksellian natural long-run safe real rate of interest very low, they are weak. Their strength has been sapped. The question is whether they should be given a special government subsidy by having the government keep the interest rate above its full-employment "natural" Wicksellian level. The answer, save for those who are stakeholders, lobbyists, or agents of influence of financial intermediaries, is no.

Thus we are left with (1) and (2): that the necessary process of deleveraging to fix the root problem underlying the balance-sheet recession would be slowed by monetary ease. And this, too, seems to me to be wrong. In an environment with substantial nominal liabilities, (moderate) inflation is an important tool for speeding deleveraging. And so here I side with Rogoff against Borio--monetary ease is a useful crutch, not a handicap, until normal is reattained.

But Borio is looking beyond the normal to the post-mid-cycle phase of the expansion:

Financial liberalisation weakens financing constraints, supporting the full self-reinforcing interplay between perceptions of value and risk, risk attitudes and funding conditions. A monetary policy regime narrowly focused on controlling near-term inflation removes the need to tighten policy when financial booms take hold.... Major positive supply side developments... provide plenty of fuel for financial booms.... Credit and asset price booms reinforce each other, as collateral values and leverage increase.... The financial boom...[does] not just precede the bust but cause it... sows the seeds of the subsequent bust, as a result of the vulnerabilities that build up.... The presence of debt and capital stock overhangs.... The weakening of financing constraints... leads to misallocation of resources, notably capital but also labour, typically masked by the veneer of a seemingly robust economy.... Too much capital in overgrown sectors holds back the recovery. And a heterogeneous labour pool adds to the adjustment costs. Financial crises are largely a symptom of the underlying stock problems and, in turn, tend to exacerbate them....

[Thus there is a] distinction between potential output as non-inflationary output and as sustainable output.... Current thinking... identifies potential output with what can be produced without leading to inflationary pressures.... Inflation is generally seen as the variable that conveys information about the difference between actual and potential output.... And yet, as the previous analysis indicates, it is quite possible for inflation to remain stable while output is on an unsustainable path, owing to the build-up of financial imbalances and the distortions they mask in the real economy.... Sustainable output and non-inflationary output need not coincide...

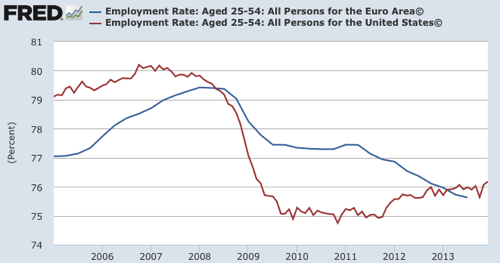

These are interesting claims: that output can be too high and "too much" labor can be employed without generating accelerating inflation because the only thing that creates the demand for the excess labor is the unrealistic expectations of savers and investors, and when savers' and investors' expectations return to normal they are unwilling to pay the excess workers the real wages that are required to get them to work. I do not think these are likely to be true because I do not believe that our current low levels of employment for 25-54 year olds in either the United States or the Eurozone qualify as in any sense equilibrium levels. Prime-age employment in the United States is now 4%-points below its mid-2000s peak. Prime-age employment in the Eurozone is also 4%-points below its mid-2000s peak--and is 2%-points below its level as of three years ago:

To the extent that this argument has bite, it seems to me to be a claim not that employment is "too high" during the--non-inflationary--boom, but rather that bad macroprudential regulation has meant that the full-employment level of aggregate demand is attained in an improper way that creates vulnerabilities. The policy response called for is thus not an easier monetary policy--not higher interest rates--but rather better and stricter macroprudential regulation. There seems to me at least to be an analytical error here. To reiterate:

Paul Krugman: Liquidationism in the 21st Century: "Throughout the annual report...

...balance-sheet problems are treated as if they were... real structural problems... a good reason to accept a protracted period of high unemployment as somehow natural, and to reject artificial stimulus that might alleviate the pain. That, however--as Irving Fisher could have told them!--is not at all the correct implication to draw from a balance-sheet view. On the contrary, what balance-sheet models tell us is that left to itself, the process of deleveraging produces huge, unnecessary costs: debtors are forced to cut back, but creditors have no comparable incentive to spend more, so there is a persistent shortfall of demand that leads to great pain and waste. Moreover, the depressed state of the economy can cripple the process of deleveraging itself...

The curious thing, however, is that, once we recognize that right now fiscal space is definitely not scarce for credit-worthy sovereigns who print reserve currencies, Borio (2012) appears to call for more aggressive policy both on the deleveraging and on the fiscal fronts:

Fiscal policy.... The challenge here is to use the typically scarce fiscal space effectively, so as to avoid the risk of a sovereign crisis.... If agents are overindebted, they may naturally give priority to the repayment of debt and not spend the additional income: in the extreme, the marginal propensity to consume would be zero. Moreover, if the banking system is not working smoothly in the background, it can actually dampen the second-round effects of the fiscal multiplier.... Importantly, the available empirical evidence that finds higher fiscal multipliers when the economy is weak does not condition on the type of recession (eg, IMF (2010)). And some preliminary new research that controls for such differences actually finds that fiscal policy is less effective than in normal recessions.... The objective would be to use the public sector balance sheet to support repair and strengthen the private sector’s balance sheet... [both] financial institutions... [and] households, including possibly through various forms of debt relief.... Importantly, this is not a passive strategy, but a very active one. It inevitably substitutes public sector debt for private sector debt. And it requires a forceful approach, in order to address the conflicts of interests between borrowers and lenders, between managers, shareholders and debt holders, and so on....

Whence then comes the BIS's calls for further fiscal austerity? It remains a mystery to me. But on financial deleveraging it seems to me that Borio has hit the nail on the head.

So how to sum up?

It seems to me that one way to make sense of this is to conclude that the BIS has not made the argument it really wants to make. What it really wants to argue for is (a) aggressive government promotion of deleveraging and recapitalization to solve the balance-sheet recession and (b) fiscal expansion by credit-worthy sovereigns that print reserve currencies. And, I think, it also wants to argue that effective macroprudential policies are impossible because of banking-sector capture of the regulators. And thus its arguments for monetary tightness are, I think, a counsel of despair: since the macroprudential tools cannot be used to manage and limit risk, higher interest rates once we pass the mid-cycle point are the only game in town.

3774 words

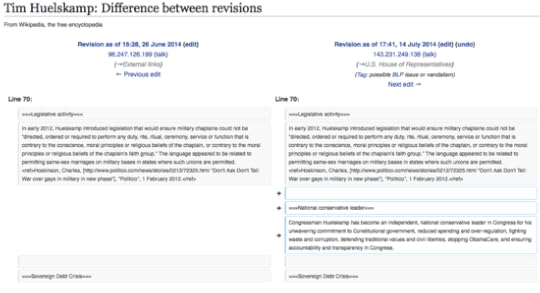

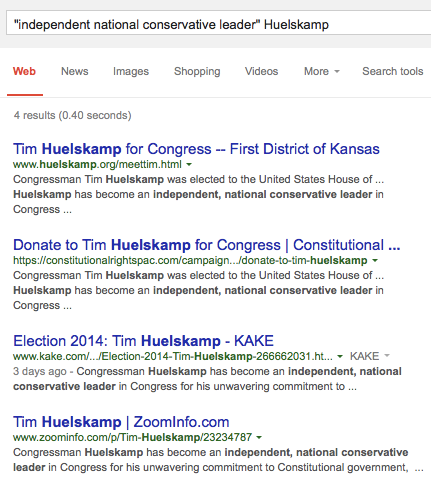

In Which Kansas Congressman Tim Huelskamp Edits His Own Wikipedia Page: Live from the Roasterie CCXVIII: July 15, 2014

Via Oliver Willis, @congressedits says:

Note that the only person on the internet who thinks or has every thought that Tim Huelskamp is an "independent national conservative leader" is Tim Huelskamp:

Classy...

Down the Mississippi: Cochrane vs. McDaniel: Live from the Roasterie CCXVII: July 14, 2014

Thad Cochrane: Update 3: 61 of 82 Counties: "The review of 61 of the 82 counties is now complete...

Thad Cochrane: Update 3: 61 of 82 Counties: "The review of 61 of the 82 counties is now complete...

...and the results continue to show extremely low numbers of questionable votes. As we noted in earlier updates, these are simply votes, including absentee and affidavit ballots, that are questioned, it does not mean they are definitively improperly cast votes. Because of secret ballot, of course, there is no way to determine for which candidate these votes were cast.

We have now moved into the third week of Chris McDaniel continuing to assert that a monstrous fraud was committed, yet he has supplied zero evidence for these allegations. It is extraordinarily irresponsible for an elected official to make such claims without providing proof. Our campaign continues to update our information in order to provide specifics. We also continue to urge the media to demand the same level of specificity from the McDaniel campaign and to question their assertions of "irregularities" while refusing to define what that means....

Alcorn Complete - 0 Amite Complete - 6 Attala Complete - 18 Benton Complete - 0 Bolivar Complete - 2 Calhoun Complete - 2 Carroll Complete - 1 Chickasaw Complete - 2 Choctaw Complete - 13....

Dennis G.: I beg to differ...: "I get that the White Walkers of the Tea Party...

...are upset that their candidate, Chris McDaniel, did not win the run-off election in Mississippi. An election going the other way is always a disappointment to any partisan left, right or extreme right. This time, the salt in their pain of defeat seems to be that Thad Cochran shamelessly appealed to black folks to vote in what should have been (in the Teatard view) a white’s only conservative primary–because beyond the officially sanctioned token minorities (who are known, named and on teevee), all Republicans conservatives are always assumed to be white.

The race betrayal of Cochran must have Nathan Bedford Forrest spinning in his grave. No wonder McDaniel and the Teatards are outraged and pumping up the rhetoric*:

“Let’s make it very clear today,” McDaniel said at July 5 “freedom rally.” “After what we saw the other night, which is clearly the most unethical election in the history of this state… and might… and might… very well be the most illegal election in the history of this state. We will let the word go forth from this time and place to friend and for alike. The people of this state will do anything to preserve the torch of liberty. We will bear any burden, fight any foe, to make sure that corruption is finally rooted out of the election process in this state.”

This was a ballsy statement. After all we are talking about Mississippi, a place where violent intimidation of voters was born. It was the Mississippi Plan of 1874 that the South used to end Reconstruction and strip Afirican-Americans of their rights for almost another hundred years. White terrorists murdered around 300 citizens as part of the 1874 elections and another 150 as part of the 1876 election. This model of White Terrorism was then exported throughout the South by motivational speakers and guidebooks.

I somehow think the Mississippi elections of 1874 and 1876 were–without question–the most unethical elections in the long and sad history of that perennially always failing state… and quite likely, the most illegal elections in the history of any fucking State. (For those who like to dig into original source material, this Senate testimony from 1877 as to denial of elective franchise in Mississippi during the elections of 1875 and 1876 might help to underscore the lie to the Teatardick worldview). And yet, because Negroes were involved, I’m sure the “free” citizens of Teatardickistan will disagree and think me mad.

J. Bradford DeLong's Blog

- J. Bradford DeLong's profile

- 90 followers